Montana Car Insurance Requirements in 2026 (MT Minimum Coverage Guide)

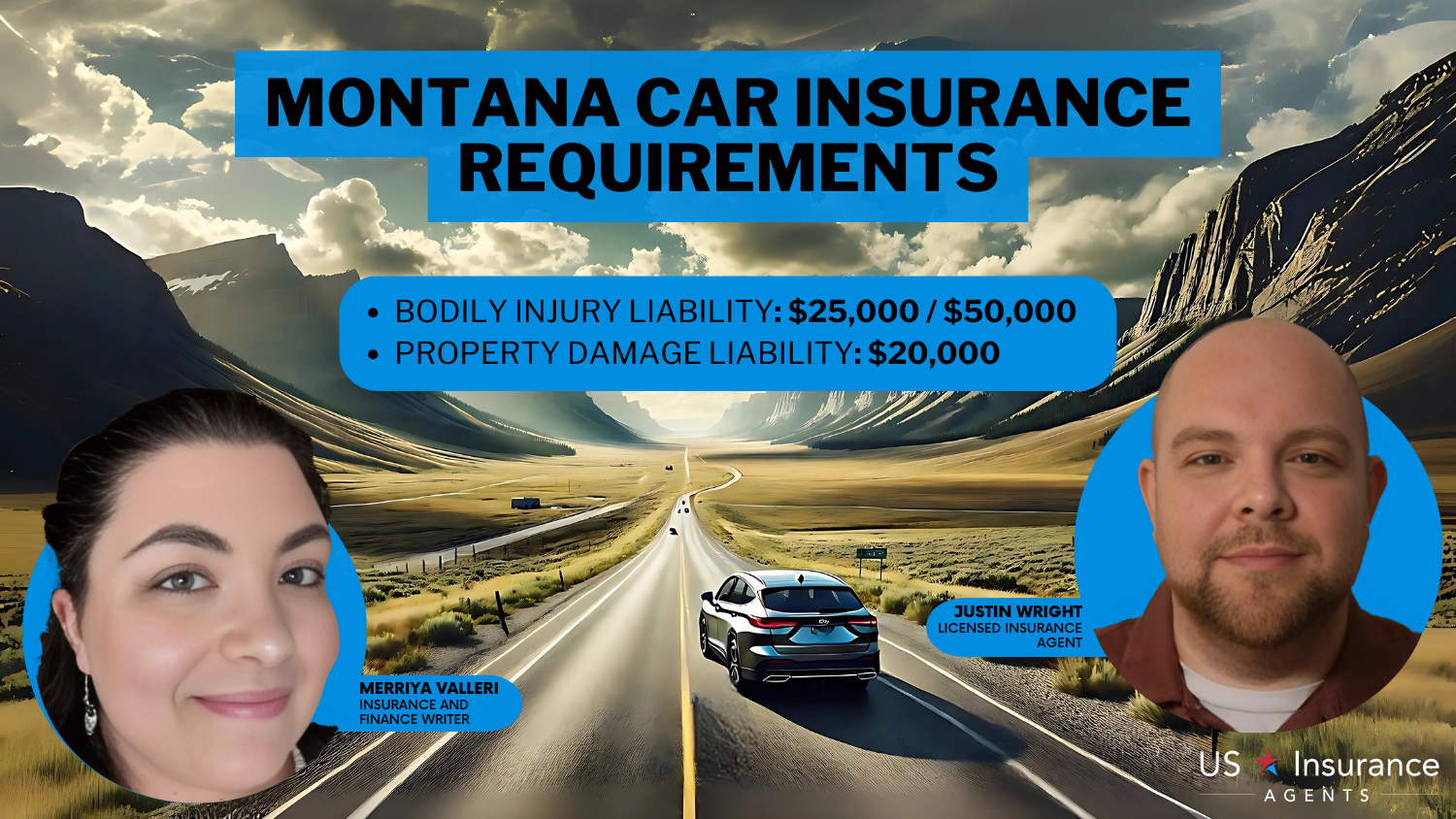

Montana car insurance requirements include 25/50/20 of bodily injury and property damage coverage. Your license can be discontinued if you fail to meet Montana car insurance laws. MT car insurance rates start at $14/mo. This guide will help you find the cheapest coverage that meets Montana car insurance requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated August 2025

To meet Montana car insurance requirements, you need liability coverage of 25/50/20. MT car insurance rates start as low as $14 per month.

Failure to show proof of insurance can result in fines of $250-$500 and/or up to 10 days in jail–even for a first offense. Read our guide to answer the question, “Does Montana require car insurance?

Montana Auto Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

Get the best auto insurance coverage by comparing rates with the help of our guide. Enter your ZIP code now to learn more about Montana car insurance requirements.

- Montana law requires 25/50/20 in auto insurance coverage

- Your license could be suspended for not meeting Montana car requirements

- MT car insurance rates start at at $14 monthly

This Montana car insurance guide will help you learn how to drive legally in Montana and avoid potential penalties, fines, and license or registration suspension.

Montana Auto Insurance Requirements & What They Cover

In Montana, all personal vehicles must have liability insurance, with a minimum coverage of $25,000 for each person, $50,000 for every accident involving bodily injury, and $10,000 for property damage.

This type of coverage helps pay for any property damage or injuries if the insured driver is at fault. While these are the state-required minimums, many drivers opt for higher limits or additional coverage for better protection.

Read more: What does car insurance cover?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Montana

If you’re looking for the cheapest car insurance companies in Montana, USAA consistently offers the lowest rates, followed by Liberty Mutual and State Farm. Monthly premiums vary depending on factors like city, age, gender, and driving record.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsFor example, drivers in Conrad and Cut Bank enjoy some of the lowest city rates at $69 and $68 per month, while cities like Billings can reach up to $90.

Montana Min. Coverage Monthly Rates by City

| City | Rates |

|---|---|

| Anaconda | $76 |

| Belgrade | $78 |

| Billings | $90 |

| Billings Heights | $76 |

| Bozeman | $88 |

| Butte | $79 |

| Conrad | $69 |

| Cut Bank | $68 |

| Frenchtown | $84 |

| Great Falls | $83 |

| Hamilton | $77 |

| Havre | $75 |

| Helena | $82 |

| Kalispell | $80 |

| Laurel | $72 |

| Lewistown | $74 |

| Livingston | $82 |

| Miles City | $71 |

| Missoula | $85 |

| Polson | $81 |

| Ronan | $70 |

| Sidney | $73 |

| Thompson Falls | $65 |

| Whitefish | $87 |

| Wolf Point | $67 |

Younger drivers, especially 17-year-old males, tend to pay the highest rates, while older drivers generally see lower premiums.

Car Insurance Monthly Rates In Montana By Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $620 | $670 | $230 | $250 | $190 | $200 | $175 | $185 | |

| $610 | $660 | $220 | $240 | $185 | $195 | $165 | $175 | |

| $590 | $640 | $220 | $240 | $185 | $195 | $165 | $175 | |

| $560 | $610 | $210 | $230 | $175 | $185 | $160 | $170 | |

| $650 | $700 | $240 | $260 | $200 | $210 | $180 | $190 |

| $600 | $650 | $225 | $245 | $195 | $205 | $170 | $180 |

| $580 | $630 | $215 | $235 | $180 | $190 | $160 | $170 | |

| $570 | $620 | $205 | $225 | $170 | $180 | $155 | $165 | |

| $600 | $650 | $215 | $235 | $180 | $190 | $160 | $170 | |

| $540 | $590 | $190 | $210 | $160 | $170 | $145 | $155 |

Among insurers, USAA stands out with the most affordable rates across most age groups and clean driving records—starting as low as $125 per month.

Car Insurance Monthly Rates in Montana by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $145 | $165 | $190 | $250 | |

| $140 | $160 | $185 | $240 | |

| $140 | $160 | $185 | $240 | |

| $135 | $155 | $180 | $235 | |

| $150 | $170 | $200 | $260 |

| $138 | $158 | $188 | $245 |

| $142 | $162 | $192 | $252 | |

| $130 | $150 | $175 | $230 | |

| $138 | $158 | $182 | $238 | |

| $125 | $145 | $170 | $220 |

However, your rates can increase significantly with a ticket, accident, or DUI, so maintaining a clean record or history is key to keeping your auto insurance costs low.

Penalties for Driving Without Insurance in MT

If you cannot show proof of insurance in Montana, you may face severe penalties. For a first offense, you could be fined between $250 and $500 and/or face up to 10 days in jail.

A second offense carries a fine of $350, up to 10 days in prison, and a 90-day suspension of your vehicle registration. A third or subsequent offense results in a minimum fine of $500, up to 6 months in jail, and a 180-day registration suspension.

Daniel Walker Licensed Insurance Agent

Your license will be suspended in addition to the previous penalties upon a fourth or subsequent offense. Reinstatement fees may apply to restore driving and registration privileges.

Read more: If you have an accident while driving with an expired license will insurance cover damages?

Additional Coverage Options in Montana

Comprehensive and collision insurance are optional but very useful. Collision will pay to fix your car after it’s been damaged in an accident, and comprehensive coverage covers other non-accident-related damages.

These non-accident incidents can include fire damage, flood damage, or even theft. We have compiled a list of the most stolen vehicles in Montana to show you whether your car is at risk.

Kristine Lee Licensed Insurance Agent

Uninsured and underinsured insurance protects you if someone without enough coverage involves you in an accident. If they are found to be at fault but aren’t covered, your insurance company will compensate you for the damages.

Enter your ZIP code to connect with Montana car insurance agents in Miles City to meet state standards.

Frequently Asked Questions

What is the minimum liability coverage required for car insurance in Montana?

The minimum auto insurance needed for Montana includes liability coverage of 25/50/20, the base requirement under Montana auto insurance requirements and enforced by Montana car insurance laws.

What are the legal penalties for a first-time offense of driving without insurance in Montana?

Under Montana auto insurance laws, failure to maintain coverage—such as not meeting minimum car insurance in Montana—can lead to a $250–$500 fine and up to 10 days in jail for a first offense. Enter your ZIP code to see other legal penalties.

Which insurance company consistently offers the cheapest car insurance rates in Montana?

According to the Montana auto insurance guide, the best car insurance in Montana for affordability is often from Montana car insurance companies like USAA, Liberty Mutual, and State Farm.

Read more: USAA Reviews & Ratings

How do car insurance rates in Montana differ by city, and which cities offer the lowest rates?

When comparing auto insurance quotes in Miles City, drivers appreciate some of the most affordable rates. Car insurance in Miles City costs less on average than in major cities like Billings.

Why might a driver choose to purchase more than the minimum required coverage in Montana?

Although the minimum auto insurance needed in Montana meets basic requirements, many drivers choose more robust policies for better protection. Enter your ZIP code now to better understand the minimum required coverage.

What optional insurance coverages are recommended for Montana drivers?

The Montana auto insurance guide suggests adding comprehensive, collision, and Montana uninsured motorist coverage for drivers seeking better coverage than just the minimum car insurance in Montana.

Is uninsured motorist coverage mandatory in Montana, and what are the rules surrounding it?

While Montana auto insurance laws do not mandate uninsured motorist coverage, Montana car insurance laws require all insurers to offer it as an option within Montana auto insurance policies.

How do age and gender affect car insurance premiums in Montana, especially for young drivers?

Rates for auto insurance in Miles City and across the state vary significantly by age and gender. Auto insurance Montana trends show that young male drivers pay the highest premiums. Enter your ZIP code to see how age and gender affect your premiums.

What are the consequences of a second or third offense for driving without car insurance?

Under Montana car insurance laws, a second offense for not carrying coverage that meets Montana auto insurance requirements includes a $350 fine, jail time, and a registration suspension—penalties enforced even in smaller towns like Miles City.

How does having a ticket, accident, or DUI impact your insurance rates?

Even if you have the best car insurance in Montana, providers like USAA and car insurance companies in Miles City will raise your premiums significantly after a DUI, ticket, or accident, making it critical to compare car insurance quotes in Miles City and maintain a clean driving record.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.