Delaware Car Insurance Requirements for 2026 (Everything DE Drivers Should Know)

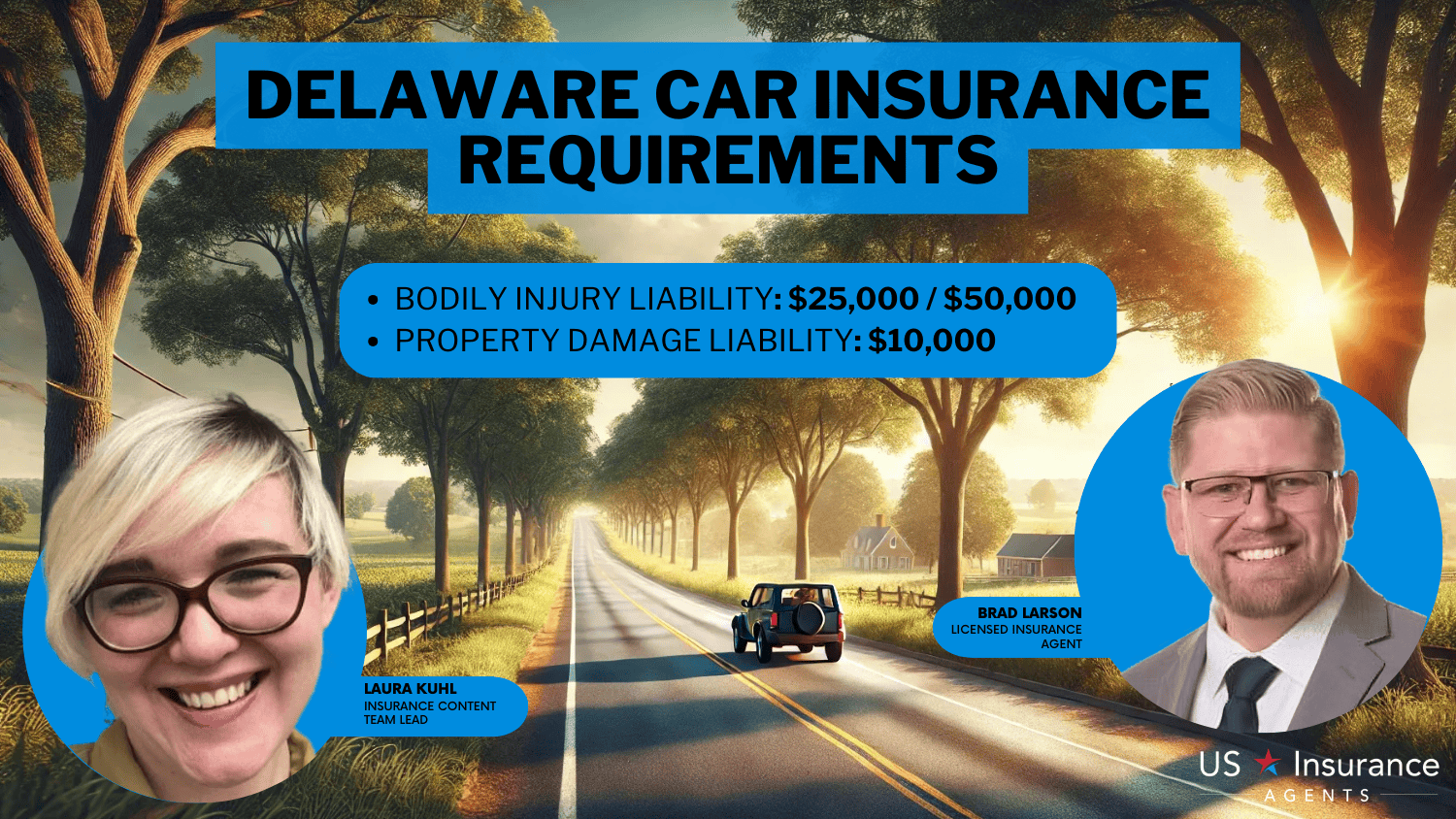

Delaware car insurance requirements mandate minimum coverage of $25,000 bodily injury liability per person, $50,000 per accident, and $10,000 property damage liability per accident. With Delaware car insurance rates starting as low as $23 per month, finding affordable coverage to meet legal requirements is easy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

Discover how Delaware car insurance requirements protect drivers with minimum 25/50/10 liability coverage, including $25,000 for bodily injury per person, $50,000 per accident, and $10,000 for property damage.

Mandatory Personal Injury Protection (PIP) adds up to $15,000 per person for medical expenses and $30,000 per accident. With rates starting as low as $23/month, factors like your driving record and vehicle type can influence premiums.

Delaware Minimum Car Insurance Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $10,000 per accident |

Additional options like collision and comprehensive coverage, as well as uninsured motorist coverage, provide enhanced protection.

Comparing quotes is the best way to find affordable rates while meeting state requirements. Get the best car insurance in DE, enter your ZIP code to shop for coverage from the top insurers.

- Delaware car insurance requirements mandate 25/50/10 of liability coverage

- USAA offers top-rated coverage with rates starting at just $23/mo for DE drivers

- Driving uninsured in Delaware can result in fines, license suspension, and penalties

Delaware Car Insurance Requirements & What They Cover

Delaware car insurance laws require all personal vehicles to meet specific liability coverage standards. The Delaware state minimum auto insurance mandates at least $25,000 in bodily injury liability per person, $50,000 per accident, and $10,000 for property damage liability.

These Delaware minimum car insurance requirements ensure financial protection for drivers and others on the road. Under Delaware auto insurance laws, drivers must also carry Personal Injury Protection (PIP) to cover medical expenses and lost wages.

Non-compliance with Delaware insurance laws, such as driving without insurance in Delaware, can result in severe penalties, including fines and license suspension. The Delaware auto insurance minimum requirements are designed to provide essential coverage while offering flexibility to add optional protections like collision or comprehensive coverage.

For guidance, a Delaware auto insurance guide can help you navigate options like temporary car insurance in Delaware or compare the best car insurance in Delaware. Meeting Delaware insurance requirements is crucial to avoid legal and financial consequences while maintaining peace of mind.

Read more: Best Delaware Car Insurance Discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Delaware

Finding affordable coverage that meets Delaware auto insurance requirements is essential for drivers. The cheapest car insurance in Delaware options includes USAA, starting at just $23/month, followed by Travelers at $43/month, and Progressive at $47/month.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Delaware

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage in Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsRates vary across cities due to factors like location and risk, with Delaware minimum auto insurance coverage in Lewes being the lowest at $69/month and New Castle the highest at $83/month. Meeting Delaware car insurance laws requires carrying at least 25/50/10 liability coverage, making it crucial to find affordable policies.

Delaware Min. Coverage Car Insurance Monthly Rates by City

| City | Monthly Rates |

|---|---|

| Camden | $77 |

| Claymont | $81 |

| Dover | $78 |

| Georgetown | $70 |

| Harrington | $73 |

| Laurel | $71 |

| Lewes | $69 |

| Middletown | $80 |

| Milford | $74 |

| New Castle | $83 |

| Newark | $82 |

| Rehoboth Beach | $75 |

| Seaford | $72 |

| Smyrna | $76 |

| Wilmington | $85 |

For drivers seeking to meet Delaware minimum insurance requirements, these providers offer competitive options that align with Delaware auto insurance limits. Local rates in cities like Dover at $78/month and Milford at $74/month demonstrate how location impacts costs.

To meet Delaware automobile insurance laws and save, comparing options is the key to finding the best Delaware auto insurance coverage for your needs.

Read more: Most Stolen Cars in Delaware

Additional Coverage Options to Consider in Delaware

When it comes to protecting yourself and your vehicle, meeting Delaware auto insurance requirements is just the beginning. While liability coverage is mandatory, adding optional coverages can provide enhanced financial security and peace of mind. Below are additional coverage options every Delaware driver should consider:

- Personal Injury Protection (PIP): Delaware is unique as one of the few tort law states requiring PIP coverage. Personal injury protection covers up to $15,000 per person for medical expenses and lost wages in a single accident, up to $30,000 per accident, and $5,000 for funeral expenses.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist insurance coverage pays for damages caused by a driver who either has no insurance or insufficient coverage to pay for all expenses, ensuring you’re protected even when others are not.

- Comprehensive Coverage: Comprehensive coverage provides financial protection for non-collision incidents such as theft, vandalism, hail, or fire damage, making it essential if your vehicle is at risk for such events.

- Collision Coverage: Collision car insurance pays for repairs or replacement of your vehicle regardless of fault in an accident, offering crucial support for high-value or frequently used vehicles.

- Towing and Labor Coverage: Covers costs related to towing and roadside assistance, offering help in emergencies such as breakdowns or accidents.

- Rental Reimbursement Coverage: Pays for a rental car or alternative transportation while your vehicle is being repaired or replaced, keeping you on the move after an accident.

By adding these coverages, you can go beyond the Delaware minimum auto insurance coverage to ensure greater financial security. Customizing your policy with these options allows you to meet both your unique needs and Delaware insurance laws while staying protected on the road.

Penalties for Driving Without Auto Insurance in Delaware

Failing to maintain active insurance coverage in Delaware can lead to severe penalties under Delaware car insurance laws. Drivers who cancel their policies without notifying the DMV face fines starting at $1,500 for a first offense and up to $3,000 for subsequent violations.

Penalties for Driving Without Auto Insurance in Delaware

| Penalty Type | Description |

|---|---|

| Fines | First offense: $3,000 |

| Subsequent offenses | $5,000 |

| License Suspension | License suspension up to six months |

| Vehicle Registration Suspension | Registration suspension, reinstatement fees required |

| Civil Penalties | Additional civil penalties, fees, and costs |

| SR-22 Requirement | Required for three years post-suspension |

| Jail Time | Jail possible for repeat offenders |

| Increased Insurance Rates | Higher premiums after reinstatement |

Additional consequences include a six-month license suspension and suspension of vehicle registration, with reinstatement fees required. Repeat offenders may face jail time and the requirement to carry SR-22 insurance for three years, which often leads to significantly higher premiums.

Jeffrey Manola Licensed Insurance Agent

Delaware auto insurance requirements mandate that proof of insurance, such as an insurance ID card or policy, must be presented upon request by law enforcement, during a DMV audit, after an accident, or anytime you operate a vehicle (Read more: DWI vs. DUI).

Adhering to Delaware insurance laws by securing a standard liability policy is crucial to avoiding these penalties and maintaining your financial and legal responsibilities.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting the Right Car Insurance in Delaware

Securing the right car insurance is essential to comply with Delaware car insurance laws and protect yourself financially. The minimum car insurance in Delaware requires 25/50/10 liability insurance coverage, which means $25,000 for bodily injury per person, $50,000 per accident, and $10,000 for property damage.

Whether you need only the minimum coverage or additional options like comprehensive or collision insurance, comparing policies is the key to finding affordable rates that meet your needs. Ensuring you meet Delaware auto insurance requirements not only keeps you legally compliant but also provides peace of mind in the event of an accident.

By exploring multiple providers and understanding your coverage options, you can select a policy that balances cost and protection, keeping you and your vehicle safe on the road. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Frequently Asked Questions

What are the minimum car insurance requirements in Delaware?

Delaware requires drivers to carry 25/50/10 liability coverage: $25,000 for bodily injury per person, $50,000 per accident, and $10,000 for property damage. Personal Injury Protection (PIP) is also mandatory (Read more: Types of Car Insurance Coverage).

What is Personal Injury Protection (PIP), and why is it required in Delaware?

PIP is required under Delaware car insurance laws and covers up to $15,000 for medical expenses per person, $30,000 per accident, and $5,000 for funeral expenses. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

What happens if I drive without insurance in Delaware?

Driving without insurance in Delaware can result in fines starting at $1,500 for the first offense, a six-month license suspension, and additional penalties like SR-22 requirements and higher insurance premiums.

Can I purchase more than the minimum car insurance in Delaware?

Yes, drivers can choose additional coverages like comprehensive, collision, uninsured/underinsured motorist, and towing or rental reimbursement for enhanced protection.

Read more: Best Car Insurance for Rental Reimbursement Coverage

Are there affordable options for meeting Delaware auto insurance requirements?

Yes, rates in Delaware start as low as $23/month with providers like USAA, making it possible to meet legal requirements affordably.

How do I prove I have car insurance in Delaware?

Proof of insurance can be shown with an insurance ID card, policy declaration page, or digital proof via an app. It must be presented when requested by law enforcement, during a DMV audit, or after an accident.

How does location affect car insurance rates in Delaware?

Car insurance rates vary by city due to factors like population density and risk. For example, rates are lower in Lewes ($69/month) compared to New Castle ($83/month).

Do I need uninsured/underinsured motorist coverage in Delaware?

Uninsured/underinsured motorist coverage is not required, but it is strongly recommended to protect against drivers who lack sufficient coverage.

Read more: What does car insurance cover?

What additional penalties might I face for driving without insurance in Delaware?

Beyond fines and suspensions, repeat offenders may face jail time and civil penalties, and they must maintain SR-22 insurance for three years. Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

How can I find the best car insurance in Delaware?

Compare car insurance quotes from multiple providers, consider optional coverages and factor in your driving history and vehicle type to find a policy that meets your needs and budget.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.