Vermont Car Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $10,000 per accident |

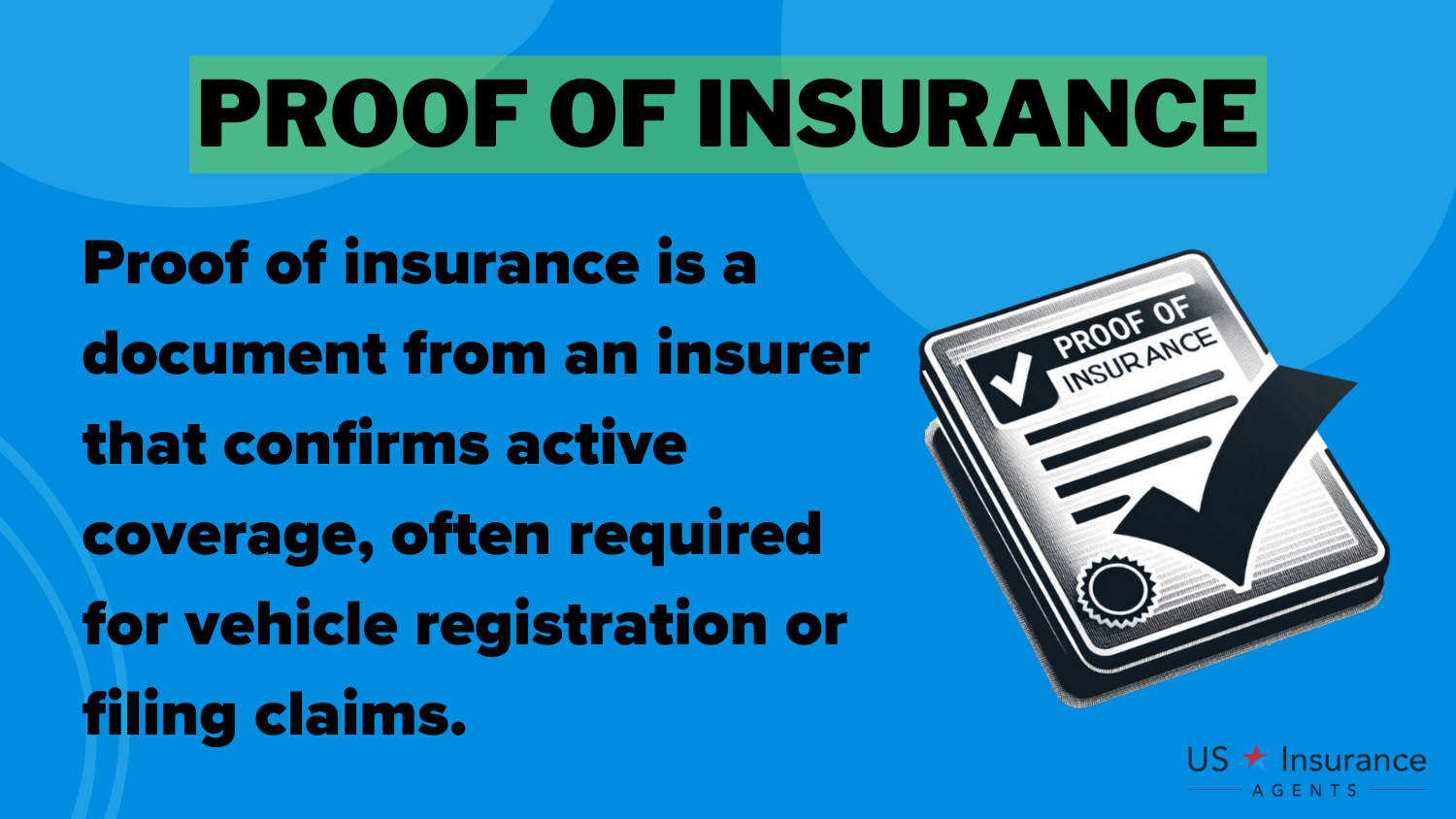

To comply with Vermont car insurance laws, you must show proof of insurance when registering a vehicle, after an accident, or during a traffic stop.

- Vermont requires 25/50/10 of liability coverage

- Proof of insurance must be shown at traffic stops, crashes, or registration

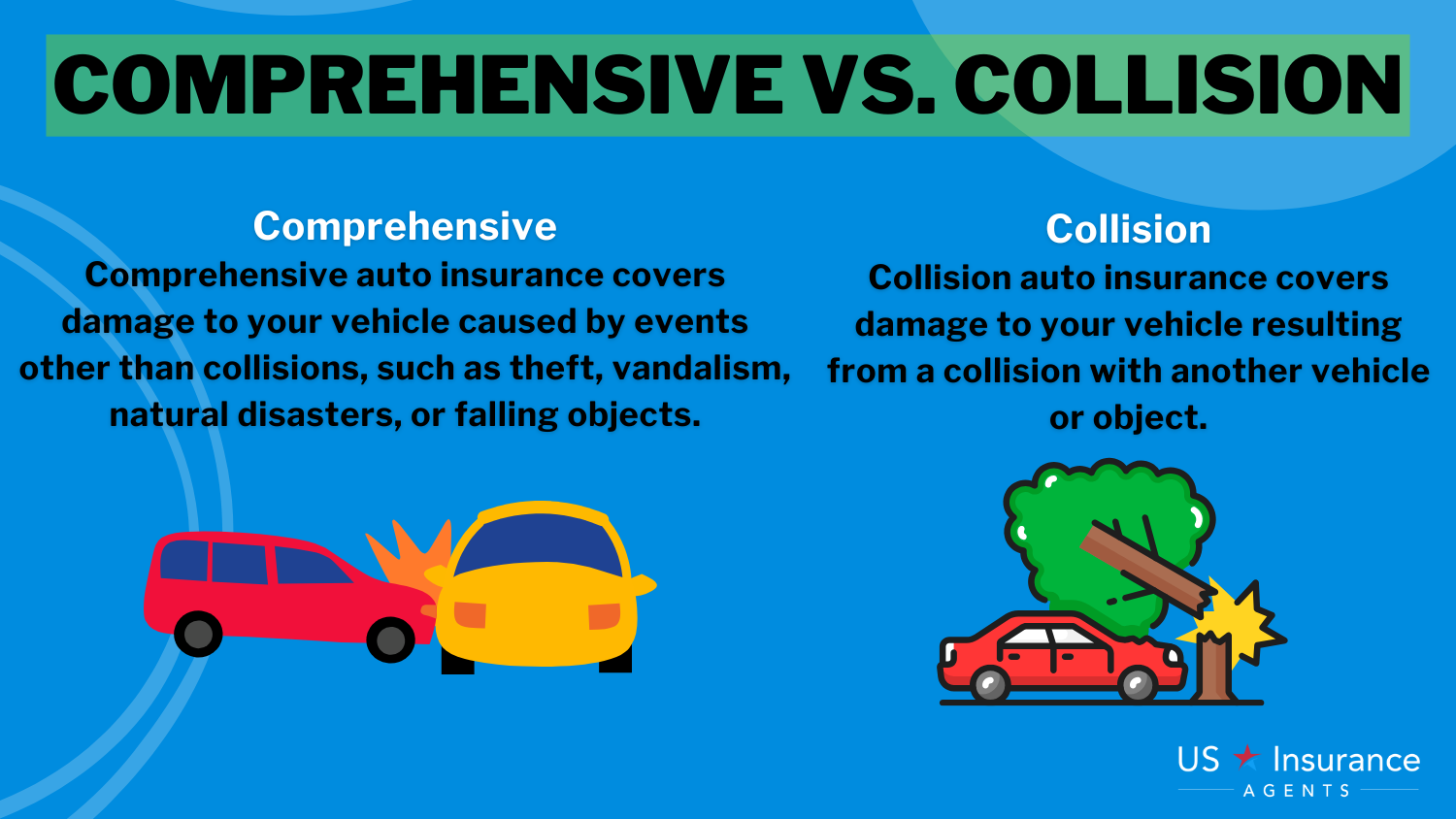

- Optional coverages include collision, comprehensive, and medical payments

Failure to meet financial responsibility laws may result in fines, license points, or the requirement to file an SR-22. Ready to find the best car insurance plan? Get instant insurance rates in our free comparison tool.