Best Defensive Driver Car Insurance Discounts in 2026

The best defensive driver car insurance discounts are from Geico, Allstate, and State Farm, offering up to 15% off your premiums. These companies stand out for their significant savings, rewarding safe driving habits with the highest discounts available. Discover how to maximize your savings with this discount.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated October 2024

The best defensive driver car insurance discounts come from Geico, Allstate, and State Farm, with Geico offering up to 15% savings. These top providers stand out for their competitive rates, wide availability, and excellent customer service.

Completing a state-approved defensive driving course can lead to significant savings on your premiums. Young drivers, seniors, and those with clean driving records benefit the most.

Our Top 10 Company Picks: Best Defensive Driver Car Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 15% | A++ | Drivers completing an approved course | |

| #2 | 10% | A+ | Certified defensive driving course completers | |

| #3 | 10% | B | Drivers with a defensive driving certificate | |

| #4 | 10% | A+ | Approved defensive driving course completers | |

| #5 | 10% | A | Drivers who complete a defensive driving course |

| #6 | 10% | A+ | Policyholders who pass a defensive driving course |

| #8 | 8% | A++ | Customers completing a defensive driving course | |

| #7 | 8% | A++ | Military families with defensive driving certification | |

| #9 | 8% | A | Certified defensive driving course completers | |

| #10 | 7% | A+ | Policyholders 50+ completing a defensive course |

Be sure to compare quotes to maximize your discounts. Understanding eligibility and combining discounts can lead to even greater savings.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code above into our free comparison tool to find the best defensive car insurance discount in your area.

- The best defensive driver car insurance discounts save you 15%

- State Farm offers competitive rates and top discounts for safe drivers

- Discounts apply to those who complete approved defensive driving courses

How to Qualify for a Defensive Driver Car Insurance Discount

Qualifying for a defensive driver car insurance discount typically involves meeting certain criteria set by your insurance provider. You’ll usually need to complete a recognized defensive driving course and provide proof of completion to your insurer.

Some insurers may also have additional requirements or offer varying discount percentages based on the course taken and your driving history. Here’s what you generally need to do:

Complete a State-Approved Defensive Driving Course

The first step is enrolling in and successfully completing a defensive driving course that is approved by your state. Defensive driving courses can lower your car insurance rates, and these courses are designed to teach safe driving techniques, which can often be taken online or in person.

Submit Proof of Course Completion

Once you’ve finished the course, you’ll need to provide your insurance company with a certificate of completion. This document verifies that you have completed the required training and are eligible for the discount.

Maintain a Clean Driving Record

A clean driving record is essential for qualifying for the discount. Insurance providers typically look for drivers with no recent traffic violations, accidents, or claims when offering defensive driving insurance discounts. Learn more information: Car Accidents: What to do in Worst Case Scenarios

Meet Age and Other Eligibility Requirements

Some insurance providers may have additional requirements based on your age, driving experience, or other factors. For example, seniors or young drivers might have specific guidelines to meet in order to qualify.

Completing these steps can lead to significant savings on your car insurance premiums. It’s essential to contact your insurance provider to understand their specific requirements and ensure you maximize your discount.

Additional Considerations

- Course Renewal: Some insurers may require you to renew the discount by taking a refresher course every few years.

- Policy Application: The discount typically applies to the specific driver who completed the course and may not extend to all drivers on your policy.

By understanding and meeting these requirements, you can take full advantage of the defensive driver discount, leading to lower insurance costs and safer driving habits.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Auto Insurance Rates Are Favorable to Defensive Drivers

Defensive driving not only enhances road safety but also results in significant savings on auto insurance premiums. Insurance companies often reward drivers who demonstrate caution and responsibility behind the wheel with lower rates, acknowledging the reduced risk these drivers pose.

For instance, a comparison of full coverage car insurance monthly rates before and after discounts for defensive drivers shows noticeable reductions across various companies. Geico, ranked #1, offers a reduced rate of $68 after the discount, down from $80.

Defensive Driver Savings: Full Coverage Car Insurance Monthly Rates With Discount

| Insurance Company | Rank | After Discount | Before Discount |

|---|---|---|---|

| #1 | $53 | $59 | |

| #2 | $68 | $80 | |

| #3 | $77 | $86 | |

| #4 | $91 | $99 | |

| #5 | $94 | $105 | |

| #6 | $103 | $115 |

| #8 | $105 | $113 |

| #7 | $128 | $139 | |

| #9 | $144 | $160 | |

| #10 | $157 | $174 |

Similarly, Allstate’s rate decreases from $160 to $144, while State Farm lowers its rate from $86 to $77. This trend is consistent across other insurers, illustrating how defensive driving can lead to substantial savings.

The benefits extend beyond full coverage policies; minimum coverage rates also see a decline with defensive driving discounts. For example, Geico’s rate drops from $30 to $26, and Allstate’s from $61 to $55, reinforcing the financial advantages of defensive driving.

Defensive Driver Savings: Min. Coverage Car Insurance Monthly Rates With Discount

| Insurance Company | Rank | After Discount | Before Discount |

|---|---|---|---|

| #1 | $20 | $22 | |

| #2 | $26 | $30 | |

| #3 | $30 | $33 | |

| #4 | $34 | $37 | |

| #5 | $35 | $39 | |

| #6 | $39 | $44 |

| #8 | $40 | $43 |

| #7 | $49 | $53 | |

| #9 | $55 | $61 | |

| #10 | $61 | $68 |

These reductions are reflective of the overall industry practice of rewarding safer drivers, underscoring the importance of defensive driving in achieving favorable insurance rates.

Moreover, when examining full coverage car insurance rates based on age and gender, it’s evident that defensive driving has a widespread impact across different demographics.

Full Coverage Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 25 Female | Age: 25 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male |

|---|---|---|---|---|---|---|

| $181 | $190 | $168 | $176 | $162 | $160 | |

| $172 | $180 | $160 | $167 | $139 | $139 | |

| $97 | $93 | $90 | $87 | $80 | $80 | |

| $187 | $215 | $174 | $200 | $171 | $174 |

| $136 | $150 | $124 | $136 | $113 | $115 |

| $141 | $146 | $131 | $136 | $112 | $105 | |

| $101 | $111 | $94 | $103 | $86 | $86 | |

| $135 | $143 | $126 | $133 | $115 | $113 |

| $107 | $116 | $99 | $108 | $98 | $99 | |

| $80 | $85 | $74 | $79 | $59 | $59 |

Younger drivers, typically viewed as higher risk, can particularly benefit from lower rates through defensive driving, with Geico offering the lowest rates for both males and females at various age levels. Delve more details on our “Best Car Insurance for High-Risk Drivers.”

This data further highlights how cultivating safe driving habits can lead to meaningful financial benefits, making defensive driving an essential consideration for anyone looking to reduce their auto insurance costs.

Best Companies for Defensive Driving Car Insurance Discount

When comparing defensive driver auto insurance rates by driving record and provider, it’s clear that premiums can fluctuate widely based on your driving history and the company you choose.

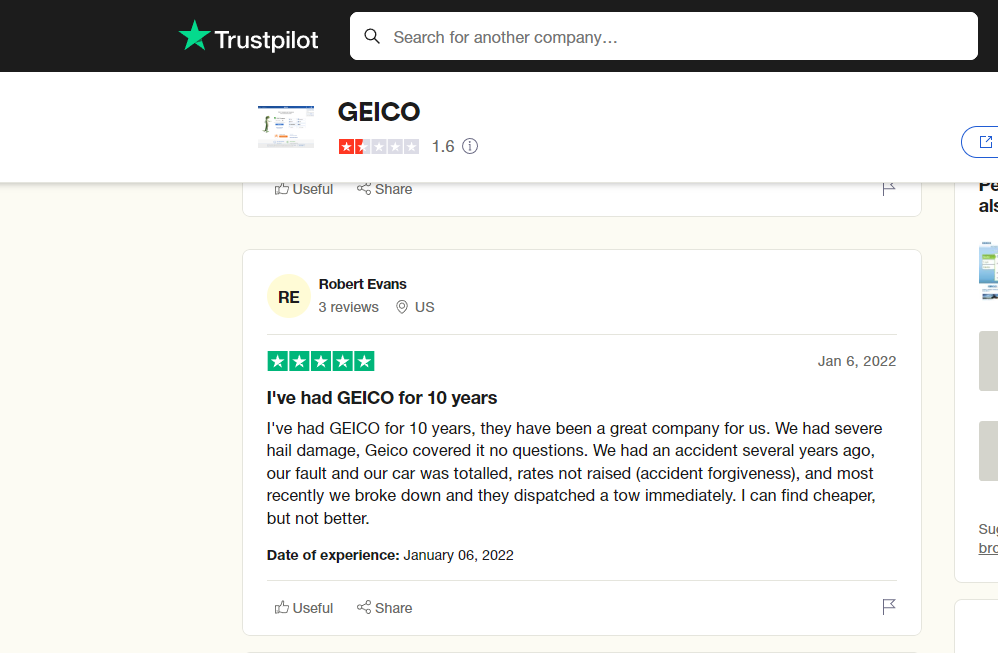

According to the review below, a long-term GEICO customer expressed satisfaction with the company’s handling of claims, including severe hail damage and an accident where the car was totaled.

GEICO’s accident forgiveness was praised, along with their prompt roadside assistance for breakdowns, demonstrating GEICO’s commitment to providing reliable service.

Companies like Geico and USAA offer particularly competitive rates for drivers with a clean record, while those with incidents like a DUI or accident may face significantly higher costs, especially with providers like Liberty Mutual.

Obtain more knowledge with this review guide: USAA Insurance Review & Ratings

The table underscores the value of maintaining a clean driving record and the importance of comparing rates to find the best deal.

Other Auto Insurance Discounts for Defensive Drivers

Defensive drivers may be eligible for a variety of additional car insurance discounts beyond the standard insurance discount for defensive driving courses. These discounts reward safe driving habits and responsible vehicle ownership, helping to further reduce your insurance premiums.

Safe Driver Discount

One of the most common discounts available to defensive drivers is the safe driver car insurance discount. This discount is typically offered to drivers who have maintained a clean driving record over a certain period, usually three to five years, without any accidents or traffic violations.

Insurance companies view these drivers as lower risk, resulting in substantial savings on premiums.

Multi-Policy Discount

Defensive drivers who bundle their auto insurance with other types of insurance, such as homeowners insurance or renters insurance, may qualify for a multi-policy car insurance discount. This discount not only simplifies your insurance management but also provides significant cost savings by consolidating your policies with one provider.

Low Mileage Discount

Drivers who do not frequently use their vehicles are often eligible for a low mileage car insurance discount. This discount is particularly beneficial for defensive drivers who primarily use their cars for short commutes or occasional travel. Insurance companies offer this discount because less time on the road typically correlates with a lower risk of accidents.

Anti-Theft Discount

Installing anti-theft devices in your vehicle can also lead to discounts on your auto insurance. Defensive drivers who take extra precautions to secure their vehicles demonstrate responsibility and lower the risk of theft, which insurance companies reward with reduced premiums.

In addition to the standard defensive driving course discount, there are several other discounts that defensive drivers can take advantage of to lower their auto insurance costs.

By maintaining a clean driving record, bundling policies, driving fewer miles, and enhancing vehicle security, you can maximize your savings. To find out which discounts you qualify for, it’s important to compare quotes from various insurance providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximizing Your Savings With Defensive Driving Discounts

Taking advantage of defensive driving discounts is an excellent way to reduce your car insurance premiums while promoting safer driving habits. By completing a state-approved defensive driving course, maintaining a clean driving record, and exploring additional discounts like multi-policy or low mileage, you can significantly lower your insurance costs.

Defensive driving is not just about safety; it's a direct path to substantial savings on your auto insurance. Insurance companies recognize and reward the reduced risk, offering significant discounts that can make a real difference in your monthly premiums.Justin Wright Licensed Insurance Agent

Companies like Geico, Allstate, and State Farm offer some of the best discounts, making it essential to compare rates and ensure you’re getting the most value. Remember, the effort you put into safe driving and smart insurance shopping can lead to substantial financial benefits over time.

Discover further details on our review guide: State Farm Insurance Review & Ratings

So, take the next step—complete that course, maintain your record, and start saving today. When you’re ready to see how much you can save with defensive car insurance discount, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

What kind of courses qualify for the discount?

Typically, courses must be approved by your insurance provider to qualify for the discount. Many providers accept online or in-person courses, and some may even offer their own defensive driving courses.

What is a defensive driver car insurance discount?

A defensive driver car insurance discount is a discount offered by some of the best car insurance companies to drivers who complete a defensive driving course.

Can new drivers qualify for the defensive driver car insurance discount?

Yes, new drivers can often qualify for the defensive driver car insurance discount. However, the eligibility requirements may vary depending on the insurance provider. Some insurance providers may require new drivers to have a certain number of years of driving experience before they can qualify for the discount.

What is a good driver discount and how can I qualify for it?

A good driver discount is a reduction in car insurance premiums offered to drivers with a clean driving record. To qualify for car insurance discounts for no tickets, you typically need to have no violations for three years and maintain a safe driving history. Safe driver discounts are offered by many insurance providers to reward responsible driving.

How do I get the California good driver discount?

To qualify for the California good driver discount, you must have a valid California driver’s license, a clean driving record, and no tickets in three years. This discount can significantly reduce your premiums on car insurance for good drivers in California.

What is the best car insurance for good drivers?

The best car insurance for good drivers typically offers a safe driving discount or a good driver discount. Providers like Geico, State Farm, and Allstate are known for offering good cheap drivers insurance with competitive rates for those who maintain a clean driving record.

Do safe driver insurance policies offer additional discounts?

Yes, safe driver insurance policies often include multiple discounts, such as the safe driving discount, making it one of the best car insurance discounts to ask for. These discounts are given to drivers with no tickets in three years and those who have completed defensive driving courses.

How can I find good cheap drivers insurance that rewards safe driving?

To find good cheap drivers insurance, compare quotes from providers that offer a good driver discount or safe driving discount. Many companies offer competitive rates on car insurance for good drivers who maintain a clean driving record.

Is there a difference between California good driver discount and good driver discount California?

There is no difference between the California good driver discount and good driver discount California. Both terms refer to the same program that offers discounts on car insurance for good drivers in California who meet the eligibility criteria, such as no tickets in three years.

Does defensive driving course lower insurance in SC?

Many insurance companies offer drivers discounts on auto insurance premiums if drivers complete a defensive driving course. However, not all do. Moreover, insurance companies vary in the nature and amount of the discount. Learn more insights on premium calculation with our guide “How does the insurance company determine my premium?”

What is the best insurance for good drivers with a clean record?

How often can you take a defensive driving course to remove points from your driving record?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.