West Virginia Car Insurance Requirements in 2026 (WV Minimum Coverage Guide)

West Virginia car insurance requirements include 25/50/25 of bodily injury and property damage liability coverage. WV car insurance rates start at $25/mo. Failure to meet WV state minimum limits can result in a 30-day license suspension and a $100 fine.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated April 2025

West Virginia car insurance requirements require drivers to carry 25/50/25 liability coverage to legally drive. West Virginia car insurance rates can be as low as $25 per month.

If you fail to provide proof of car insurance, you may be fined $100 and have your license suspended for 30 days.

West Virginia Auto Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Read through our guide to learn how to compare car insurance quotes and understand the car insurance requirements in West Virginia.

- The required auto insurance coverage in West Virginia is 25/50/25

- Compare other coverage options in West Virginia for your vehicle needs

- Avoid these penalties and fines by reading through our West Virginia guide

Understand West Virginia car insurance requirements and find ways to save and avoid penalties and fines by entering your ZIP code in our quote comparison tool.

WV Auto Insurance Requirements & What They Cover

In West Virginia, drivers are required to carry several types of auto insurance coverage to stay legal on the road. This includes property damage liability with a minimum of $25,000 per accident, bodily injury liability of $25,000 per person, and $50,000 per accident.

In addition, coverage for uninsured motorists is mandatory, including $25,000 for property damage per accident, $25,000 per person, and $50,000 per accident for bodily injury.

Drivers must also carry underinsured motorist bodily injury coverage at the same limits—$25,000 per person and $50,000 per accident—to ensure protection if the at-fault driver’s insurance falls short. Learn more about minimum auto insurance coverage in West Virginia below.

Read more: What does car insurance cover?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in West Virginia

Suppose you’re looking for the most affordable car insurance options in West Virginia. In that case, USAA offers the lowest rates, followed by State Farm and Travelers, making them top picks for budget-conscious drivers.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in WV

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in WV

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in WV

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsRates vary by city, with Martinsburg offering the cheapest minimum coverage at just $47 per month, while towns like Dunbar have rates of up to $60 per month.

West Virginia Car Min. Coverage Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Beckley | $55 |

| Bluefield | $58 |

| Charleston | $56 |

| Clarksburg | $54 |

| Dunbar | $60 |

| Fairmont | $53 |

| Huntington | $54 |

| Martinsburg | $47 |

| Morgantown | $50 |

| Oak Hill | $56 |

| Parkersburg | $52 |

| Princeton | $57 |

| South Charleston | $59 |

| St. Albans | $55 |

| Weirton | $51 |

| Wheeling | $49 |

Age and driving history also play major roles—young drivers and those with violations pay significantly more, while clean records earn the most significant savings. For example, a 35-year-old with a clean record can get coverage from USAA for as low as $70 per month.

Car Insurance Monthly Rates in West Virginia by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $242 | $243 | $208 | $193 | $175 | $160 | $135 | $125 | |

| $150 | $177 | $136 | $138 | $130 | $125 | $115 | $110 | |

| $211 | $220 | $167 | $166 | $155 | $150 | $140 | $130 | |

| $126 | $137 | $105 | $100 | $95 | $90 | $85 | $80 | |

| $238 | $262 | $217 | $234 | $205 | $190 | $160 | $150 |

| $151 | $165 | $122 | $125 | $115 | $110 | $105 | $100 |

| $180 | $188 | $137 | $132 | $125 | $120 | $110 | $105 | |

| $119 | $94 | $95 | $95 | $90 | $85 | $80 | $75 | |

| $134 | $146 | $120 | $122 | $115 | $110 | $105 | $100 | |

| $114 | $122 | $81 | $80 | $75 | $70 | $65 | $60 |

If you’ve had a ticket, accident, or DUI, expect higher rates, especially from providers like Geico and Liberty Mutual, which have steep increases after infractions.

Car Insurance Monthly Rates in West Virginia by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $198 | $221 | $260 | $269 | |

| $141 | $164 | $212 | $233 | |

| $170 | $212 | $242 | $236 | |

| $102 | $113 | $216 | $414 | |

| $239 | $303 | $318 | $354 |

| $127 | $150 | $201 | $246 |

| $135 | $177 | $225 | $187 | |

| $97 | $105 | $113 | $105 | |

| $124 | $169 | $175 | $260 | |

| $82 | $94 | $98 | $148 |

Comparing quotes based on your city, age, and record helps ensure you’re getting cheap car insurance in West Virginia. Liability car insurance is the best coverage to meet state minimum limits.

Consequences of Driving Without Insurance in West Virginia

When you’re in an accident or stopped by the police, you must show proof of car insurance. You could face steep penalties if caught breaking the West Virginia car insurance laws.

First, you’ll face a driver’s license suspension. Your license is suspended for a month for the first offense and 90 days for subsequent violations within five years.

Kristine Lee Licensed Insurance Agent

In addition, you must pay a $50 reinstatement fee and show proof of insurance. Next, your vehicle registration is suspended, meaning no one can drive your car. You are also charged a $100 fine.

If the state picks up your license plates, there is an additional $50 fine. Failing to carry the minimum amount of auto insurance costs time and money. Therefore, you save more over time by having the proper insurance on your vehicle.

Read more: Best Insurance Companies

Additional Coverage Options for WV Drivers

Standard car insurance coverages offer a range of protections to help drivers manage the financial impact of accidents and other incidents. Liability insurance, which is required by law, covers property damage and bodily injuries you cause to others but does not pay for your own injuries or vehicle repairs.

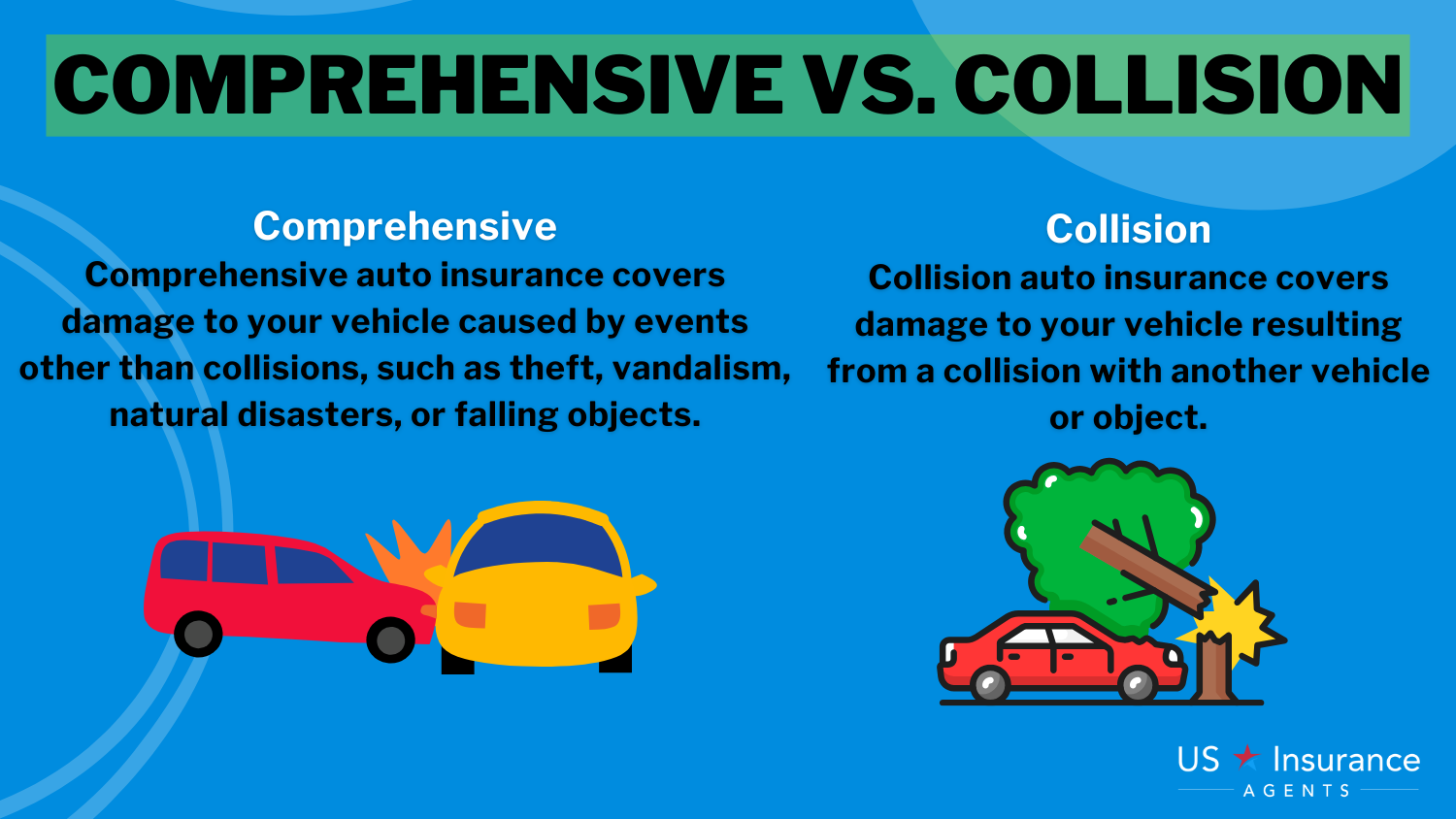

Collision coverage helps pay for damage to your car resulting from a crash with another vehicle or an object like a fence or tree. Comprehensive coverage protects against non-collision-related damage, including theft, vandalism, fire, and natural disasters like hailstorms.

Uninsured and underinsured motorist coverage steps in if you’re hit by a driver who has insufficient or no insurance. Medical payments (MedPay) helps cover medical expenses for you and your passengers, while personal injury protection (PIP) offers broader coverage that may also include lost wages and child care.

Rental car coverage pays for a temporary vehicle if yours is being repaired for a covered claim, and roadside assistance provides help for common emergencies like flat tires, dead batteries, or needing a tow. Enter your ZIP code to find out other coverage options for WV drivers.

Frequently Asked Questions

What are the minimum liability insurance requirements for drivers in West Virginia?

The West Virginia auto insurance requirements state that drivers must carry 25/50/25 liability coverage.

Is uninsured/underinsured motorist coverage mandatory in West Virginia?

According to Virginia car insurance laws, WV uninsured motorist coverage is mandatory. Understand how uninsured/underinsurance motorist coverage can help you meet auto insurance requirements in West Virginia by entering your ZIP code.

What penalties can drivers face if they are caught without car insurance in West Virginia?

Violating West Virginia auto insurance laws can lead to fines and suspension. That’s why all drivers must meet the minimum car insurance in West Virginia.

Read more: Types of Car Insurance Coverage

Which cities offer the cheapest West Virginia auto insurance rates for minimum coverage?

If you’re looking for cheap insurance in WV, Martinsburg has the lowest car insurance quotes in WV, while car insurance in Huntington, West Virginia, tends to be slightly higher.

How do age and driving record impact car insurance premiums in West Virginia?

Age and driving history significantly affect car insurance quotes in West Virginia, with cheaper insurance typically available to older, safer drivers. See other factors that impact your car insurance premiums by entering your ZIP code.

What optional coverage types are available beyond the WV state minimum car insurance?

Beyond the Virginia state minimum car insurance, West Virginia car insurance coverage can include collision, comprehensive, MedPay, and PIP. Read our West Virginia auto insurance guide for more details.

Which insurance providers offer the most affordable car insurance in West Virginia?

Top providers in West Virginia, such as USAA, Travelers, and State Farm, offer cheap insurance in West Virginia.

What happens to your license plates if you’re caught driving without insurance in West Virginia?

Under West Virginia auto laws, if drivers fail to show proof of insurance, their registration and plates can be suspended. See what other penalties and fines you can avoid by entering your ZIP code.

How does collision coverage differ from liability insurance?

While liability coverage is required under the WV auto laws, collision coverage protects your own car.

Is personal injury protection (PIP) required in West Virginia?

Although not required by WV car insurance laws, PIP can be added to enhance West Virginia car insurance coverage for drivers seeking more protection.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.