Wyoming Car Insurance Requirements for 2026 (WY Minimum Coverage Guide)

Unravel Wyoming car insurance requirements—the state minimum is 25/50/20, covering bodily injury and property damage liability. Stay compliant and protected with our A++ A.M. Best rating and USAA’s lowest rate at $13/month. You can also explore policies from Liberty Mutual and State Farm for added protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated August 2025

Welcome to our comprehensive guide on Wyoming car insurance regulations and required coverage. Understanding the ins and outs of car insurance in Wyoming is essential for all drivers, whether you’re a long-time resident or just passing through.

In this article, we will delve into the key topics that every Wyoming driver needs to know, including minimum coverage requirements, uninsured motorist coverage, and other important regulations.

- Minimum coverage refers to the legally required 25/50/20 liability limits

- Uninsured motorist coverage applies when the at-fault driver lacks sufficient insurance

- Optional add-ons provide extra protection

By the end, you’ll have a clear understanding of the necessary steps to ensure you’re adequately protected on the road.

Don’t miss out on the opportunity to save on your car insurance premiums. Enter your zip code now to compare rates from the best insurance providers and find the perfect coverage for your needs.

Minimum Coverage Requirements & What They Cover

The minimum car insurance in Wyoming is dictated by state law and applies to all drivers operating personal vehicles. The required liability limits are:

Wyoming Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

This basic Wyoming auto insurance covers damages you cause to others in an at-fault accident, whether it’s injuries or property damage. However, this minimum car insurance in Wyoming does not cover your vehicle or medical expenses.

If you have been involved in a serious accident, the financial damages could easily exceed these limits. That’s why many drivers choose to increase their liability limits or purchase additional coverage, like collision and comprehensive, to ensure they are fully protected.

Enhanced coverage can be valuable in cities like Laramie and Evanston because of their unpredictable weather conditions and traffic patterns. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Wyoming

Finding the best car insurance in Wyoming often means shopping around and comparing rates from multiple providers. Some of the cheapest car insurance companies in Gillette, Rock Springs, and statewide include:

- Geico: Affordable rates and various discounts.

- Progressive: Great online tools and flexible policy options.

- State Farm: Strong reputation for customer service and coverage.

- Farmers Insurance Evanston, Wyoming: Local agents with personalized service, especially helpful in rural areas.

- USAA: Excellent rates for military families (available only to current/former military members and their families).

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsCar insurance quotes in Gillette are among the most competitive in the state due to its relatively low claims frequency. Similarly, car insurance quotes in Rock Springs are often affordable, especially for safe drivers or those who bundle policies.

Wyoming Min. Coverage Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Casper | $59 |

| Cheyenne | $63 |

| Cody | $57 |

| Douglas | $60 |

| Evanston | $62 |

| Gillette | $61 |

| Green River | $56 |

| Jackson | $64 |

| Laramie | $57 |

| Powell | $56 |

| Rawlins | $55 |

| Riverton | $59 |

| Rock Springs | $60 |

| Sheridan | $58 |

| Torrington | $58 |

Your location in Wyoming can significantly impact your premiums, so it’s best if you compare localized rates. Always use multiple quote tools and check for discounts like safe driver, multi-policy, or good student programs.

Penalties for Driving Without Insurance

Driving without insurance is not only illegal in Wyoming, but it can also lead to serious financial consequences. As outlined in Wyoming car insurance laws, failure to maintain valid insurance can result in the following:

- First Offense: A fine between $250–$750 and/or up to 6 months in jail.

- Repeat Offenses: Fines up to $1,500, possible jail time, and vehicle registration suspension.

Additionally, your driving record will reflect the violation, which can lead to much higher Wyoming auto insurance premiums in the future. Reinstating your registration also involves fees and proof of continuous coverage.

You’re required to show proof of insurance:

- When stopped by a police officer

- When registering your vehicle

- After an accident

- Any time you’re operating a vehicle

Proof can include your insurance ID card, a certificate of deposit, or bond documentation on file with the state. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Other Coverage Options to Consider

While Wyoming auto insurance requirements only mandate liability coverage, several optional coverages can significantly enhance your protection:

- Uninsured/Underinsured Motorist Coverage: Protects if you’re hit by a driver with no insurance or insufficient coverage. Highly recommended given the national rate of uninsured drivers.

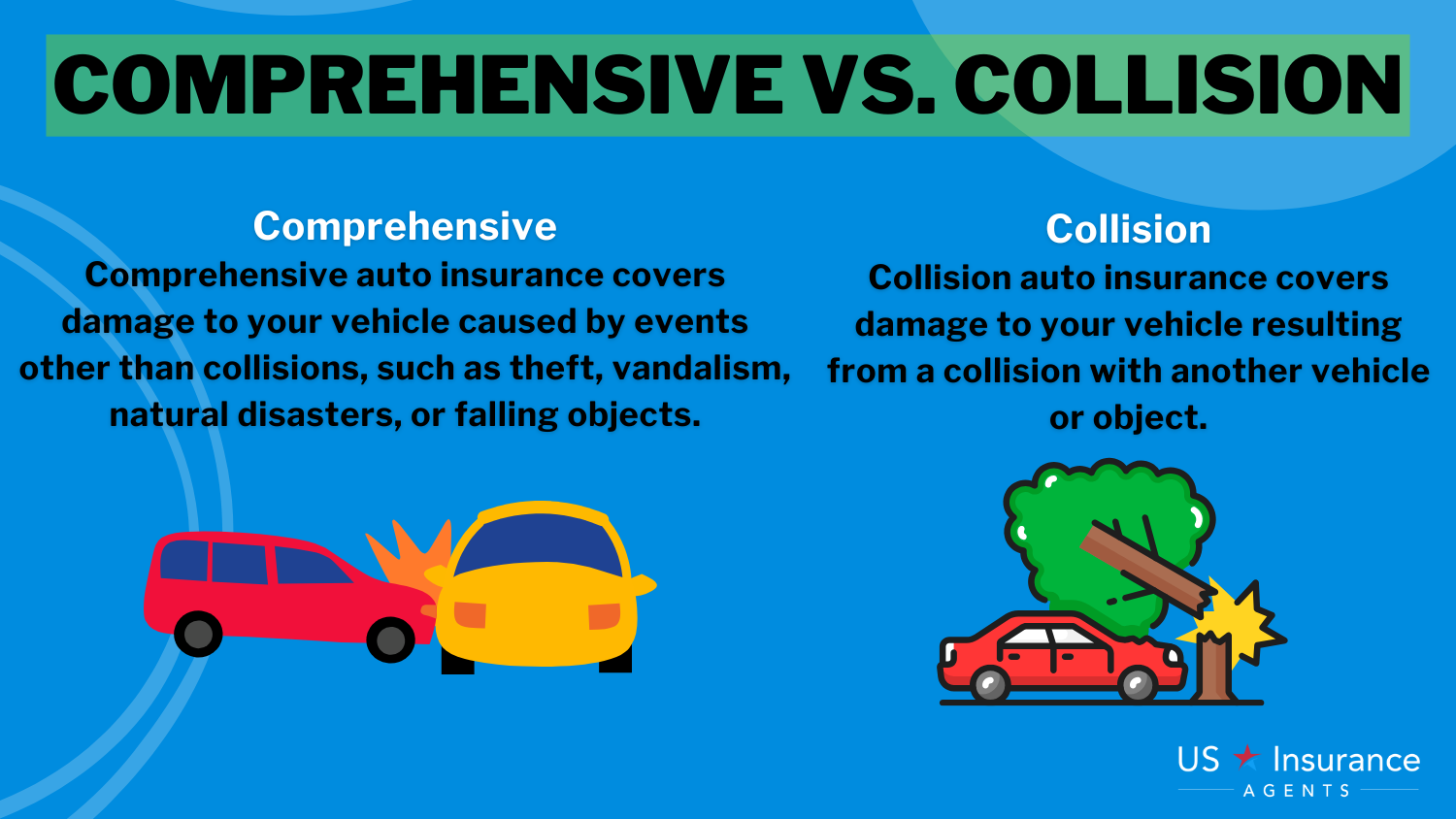

- Comprehensive Coverage: Covers non-collision damage such as theft, vandalism, hail, fire, or flooding. For residents in places like Laramie or Evanston, this is especially valuable due to seasonal storms and wildlife hazards.

- Collision Coverage: Pays for repairs to your vehicle after an at-fault accident. It’s essential for newer or financed cars.

- Towing and Labor: Helps cover roadside assistance, towing, and emergency services.

- Rental Reimbursement: Pays for a rental car while your vehicle is in the shop due to a covered loss or damage.

Wyoming auto insurance laws don’t require these add-ons, but considering the state’s unique driving conditions—from long rural highways to unpredictable weather—these optional coverages can be a smart investment.

In a serious accident, basic coverage may fall short—boosting liability limits or adding extra coverage can protect you from costly expenses.

Daniel Walker Licensed Insurance Agent

They not only help avoid out-of-pocket expenses but also provide vital financial protection and convenience when unexpected events occur.

Cheyenne Car Insurance | Casper Car Insurance | Gillette Car Insurance | Laramie Car Insurance | Rock Springs Car Insurance | Evanston Car Insurance |

Frequently Asked Questions

What is the minimum coverage required for car insurance in Wyoming?

Drivers in Wyoming must have a minimum of 25/50/20 liability coverage, which means $25,000 per person, $50,000 per accident, and $20,000 for property damage.

What additional coverage should I consider adding to my policy in Wyoming?

Uninsured and underinsured coverage, collision coverage, comprehensive coverage, towing coverage, and rental reimbursement coverage are some of the additional coverages you may consider.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code into our free comparison tool.

What is a tort system, and how does it work in Wyoming?

Wyoming follows a tort system, which means that someone is always found at fault in an accident, and the person, along with their insurance company, is held responsible for paying for the damages.

Read more: Cheyenne Car Insurance

What documents are needed to provide proof of insurance in Wyoming?

You can provide an insurance ID card, a copy of your policy, or a written statement from your insurance company to prove you have insurance in Wyoming.

What are the penalties for failing to maintain financial responsibility in Wyoming?

In Wyoming, failing to maintain financial responsibility can result in fines of $250-$750 and/or 6 months in prison for the first offense, with higher fines and suspension of registration for subsequent offenses.

Avoid overpaying for your car insurance by entering your ZIP code in our free comparison tool to find which company has the lowest rates.

What cities in Wyoming have car insurance agents?

Some cities in Wyoming with car insurance agents include Cheyenne, Casper, Gillette, Laramie, Rock Springs, and Evanston.

Read more: Casper Car Insurance

Is uninsured/underinsured motorist coverage required in Wyoming in 2025?

Yes, Wyoming car insurance requirements include offering uninsured/underinsured motorist (UM/UIM) coverage, but drivers can decline it in writing.

Can I get temporary car insurance that meets Wyoming car insurance requirements?

Yes, short-term policies are available and must meet at least the 25/50/20 liability limits required by Wyoming law. Explore your car insurance options by entering your ZIP code and finding which companies have the lowest rates.

How often do Wyoming car insurance requirements change?

Wyoming’s minimum car insurance limits are reviewed periodically by lawmakers but haven’t changed significantly in recent years, including in 2025.

Read more: Gillette Car Insurance

Where can I find the official Wyoming car insurance requirements for 2025?

You can verify the current minimum coverage laws through the Wyoming Department of Insurance or the Wyoming Department of Transportation (WYDOT).

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.