Nationwide vs. New York Life Insurance in 2026 (Find Out Who’s Cheaper!)

Compare Nationwide and New York Life, with term policies from $27 and $30 per month, helping seniors and families secure financial protection. Nationwide vs. New York Life insurance highlights Nationwide’s CareMatters® for long-term care needs and New York Life’s NYL My Care for retirees.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated August 2025

3,071 reviews

3,071 reviewsCompany Facts

Term Policy

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviewsCompare Nationwide vs. New York Life insurance, featuring Nationwide’s CareMatters® hybrid policy and New York Life’s NYL My Care for long-term financial security.

Nationwide provides flexible universal and term life policies, while New York Life offers whole-life and investment-driven plans.

With distinct coverage benefits, policyholders can secure financial protection tailored to their needs. If you’re wondering how life insurance works, explore the basics and benefits here.

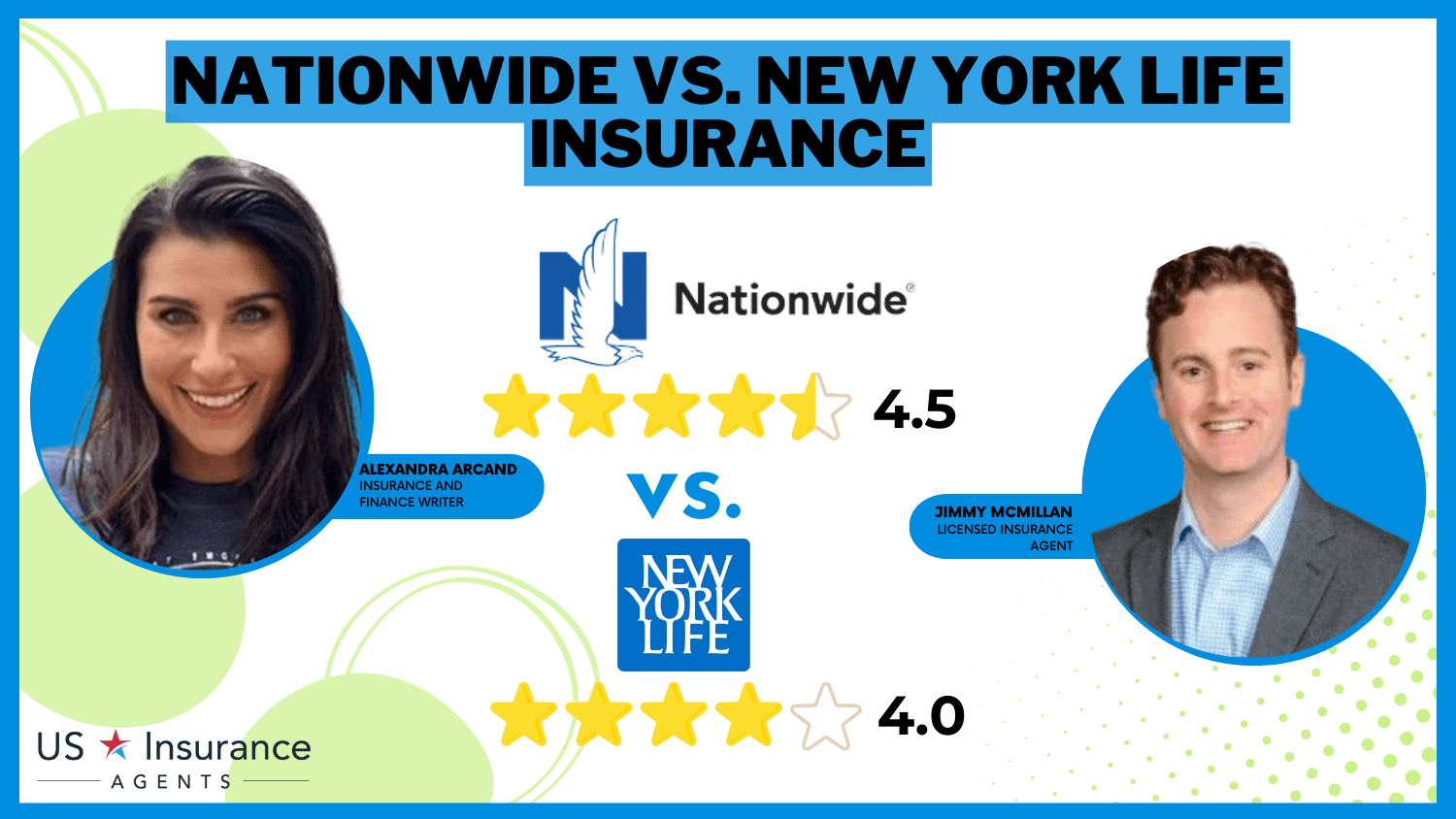

Nationwide vs. New York Life Life Insurance Rating

| Rating Criteria |  |  |

|---|---|---|

| Overall Score | 4.5 | 4.0 |

| Business Reviews | 4.5 | 4.2 |

| Claim Processing | 3.5 | 3.8 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.3 | 3.7 |

| Customer Satisfaction | 4.0 | 4.3 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 3.4 |

| Insurance Cost | 4.4 | 3.0 |

| Plan Personalization | 4.5 | 4.7 |

| Policy Options | 4.7 | 4.6 |

| Savings Potential | 4.6 | 3.2 |

| Nationwide Review | New York Life Review |

Explore which insurer aligns best with your goals. Save on Nationwide vs New York Life insurance by entering your ZIP code today.

- Nationwide vs. New York Life insurance policies compared

- Nationwide’s CareMatters® offers long-term care coverage

- New York Life’s NYL My Care provides flexible benefits

Nationwide vs. New York Life Insurance Coverage Cost Breakdown

The table below compares Nationwide vs. New York Life Insurance monthly rates by coverage type. Nationwide offers term policies starting at $27, while New York Life begins at $30.

Nationwide vs. New York Life Insurance Monthly Rates by Coverage Type & Provider

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $30 | $165 | |

| $35 | $180 |

| $33 | $175 | |

| $32 | $175 | |

| $29 | $145 | |

| $27 | $160 |

| $30 | $170 |

| $26 | $150 |

| $30 | $170 | |

| $28 | $155 |

Whole life policies show more variation, with Nationwide at $160 and New York Life at $170, placing them among mid-range competitors.

Nationwide vs. New York Life Whole Policy Life Insurance Monthly Rates by Age & Gender

| Age & Gender |  |  |

|---|---|---|

| Age: 16 Female | $30 | $28 |

| Age: 16 Male | $34 | $34 |

| Age: 30 Female | $64 | $62 |

| Age: 30 Male | $69 | $71 |

| Age: 45 Female | $91 | $99 |

| Age: 45 Male | $103 | $108 |

| Age: 60 Female | $149 | $156 |

| Age: 60 Male | $160 | $170 |

The table compares Nationwide vs. New York Life insurance’s whole life policy rates by age and gender (Read more: Types of Life Insurance).

Nationwide offers lower rates for most age groups, with 16-year-old females at $30 and males at $34. New York Life tends to be pricier for older applicants, with 60-year-old males at $170.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nationwide vs. New York Life: Life Insurance Coverage Options

Nationwide structures its coverage options to balance affordability, flexibility, and long-term financial stability.

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Indexed Universal Life Insurance

- Variable Universal Life Insurance

- CareMatters® Hybrid Policy

Whether policyholders seek term-based simplicity, lifelong cash accumulation, or market-driven growth, Nationwide offers tailored solutions designed to evolve with changing needs.

New York Life’s plan balances cost-effectiveness, investment potential, and lasting benefits. Use the information below to find a suitable option.

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Universal Life Insurance

- Custom Whole Life Insurance

- NYL My Care

Those with policies can select from numerous choices, whether looking for fixed-term insurance, stability throughout life, or market growth.

Read more: Understanding Life Insurance

Nationwide vs. New York Life Insurance: Ratings & Reviews

The table compares Nationwide vs. New York Life Insurance ratings across major industry agencies. See which cheapest car insurance companies offer the best value for your needs.

Insurance Business Ratings & Consumer Reviews: Nationwide vs. New York Life

| Agency |  |  |

|---|---|---|

| Score: 855 / 1,000 Above Avg. Satisfaction | Score: 805 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 80/100 Very Good Customer Feedback |

|

| Score: 0.78 Fewer Complaints | Score: 0.45 Below Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A+ Superior Financial Strength |

Nationwide scores higher in J.D. Power satisfaction (855/1000) and fewer complaints (0.78), while New York Life earns better consumer feedback (80/100) and a lower complaint index (0.45). Both insurers hold A+ financial strength ratings from A.M. Best.

This table compares Nationwide’s and New York Life Insurance’s market share to that of other providers. New York Life holds 5.0% of the market, surpassing Nationwide’s 3.0%, while other insurers dominate with 92.0%. Despite their smaller shares, both companies remain key players in the industry.

An Overview of New York Life Insurance

Starting in 1845, New York Life insurance has been giving financial safety insurance for more than 175 years. It stayed strong during tough times like the Great Depression and the financial crisis of 2008, keeping its steadiness and earning trust. The company also helps with charity work, focusing on honesty, kindness, and social duty as part of its longtime mission.

Types of Policies Offered by New York Life

New York Life provides term, whole, universal, and variable universal life insurance for many different needs. Term life is short-term coverage with a death benefit. It’s a good choice for families or mortgage safety. Compare the best whole life insurance providers for long-term stability.

Whole life insurance gives protection for your entire lifetime with cash value growth. Universal life insurance lets you pay flexible premiums. Variable universal life combines investment choices that can help your money grow, but it also involves risks.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

An Overview of Nationwide Life Insurance

Nationwide life insurance is a well-known company for insurance and financial services in America. Its very old history begins with a humble start in 1926. Initially started as a small mutual car insurer, Nationwide Life Insurance has grown its business and diversified its offerings to meet customers’ changing needs.

Nationwide is very committed to making customers happy. This strong focus has helped them become well-known for giving reliable and thorough life insurance coverage. Explore the types of whole life insurance and how they build cash value over time.

Types of Policies Offered by Nationwide

Nationwide life insurance offers term, whole, universal, and variable universal life insurance to satisfy different needs. Term life insurance is cheap and provides only temporary protection, while whole life assures coverage for your entire lifespan.

Universal life allows flexibility in premiums and coverage. Variable universal life also contains investment choices for the possible growth of cash value.

New York Life Insurance

Pros:

- Established Reputation: Having over 175 years of knowledge, New York Life is known as one of the most aged insurance companies in the United States.

- Economic Stability: New York Life has shown robustness during economic challenges. Read the New York Life insurance review & ratings to find out if it’s the right choice for you.

- Various Policy Options: New York Life offers various policies such as term life, whole life, universal life, and variable universal insurance.

Cons:

- Higher Premiums: You may have to pay higher premiums with New York Life because it has a very old history, strong financial status, and broad coverage options.

- Strict Application Process: The process might be stricter than other firms because they focus on underwriting and assessing risk.

Nationwide Life Insurance

Pros:

- Customer Satisfaction: Nationwide has a name for giving trustworthy life insurance. Explore the Nationwide insurance review & ratings to see how it ranks in affordability.

- Competitive Prices: Nationwide gives good rates, which means the price of life insurance coverage is not high.

- Digital Instruments: Nationwide offers advanced online tools and assistance for its policyholders.

Cons:

- Availability is Limited: Nationwide insurance may be restricted to some individuals since it may not be available in all states.

- Smaller Selection: Nationwide has limited life insurance policies than New York Life insurance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Nationwide and New York Life Insurance

When choosing between Nationwide and New York Life, it is important to look at main things like coverage, price, and service quality. Each company offers special benefits, so it is important to compare what each offers before choosing.

- Policy Choices: New York Life and Nationwide have many different policies, but New York Life gives more extra options and customizations for better flexibility.

- Price Comparison: Life insurance prices change based on age, health condition, and how much coverage you want. Comparing quotes from both companies ensures the most competitive pricing.

- Customer Service: Both companies prioritize making customers happy, but New York Life’s many years of good name might make people feel even more assured.

Choosing New York Life or Nationwide insurance depends on what coverage you need, how much money you want to spend, and what kind of service you like.

Jeff Root Licensed Insurance Agent

It is a good idea to look at quotes online to see which gives the best price for your situation (Discover more by reading our guide: How To Get Free Insurance Quotes Online).

Enter your ZIP code into our free quote comparison tool to get personalized rates for Nationwide vs. New York Life.

Frequently Asked Questions

Is Nationwide a good life insurance company?

Is Nationwide life insurance good? Yes, Nationwide is a reputable life insurance company known for its flexible term and whole-life policies. Discover ways to save with Nationwide car insurance discounts tailored for drivers.

What is Nationwide whole life insurance?

Nationwide whole life insurance provides lifetime coverage with guaranteed cash value accumulation and fixed premiums. Depending on your age and coverage, monthly rates start around $160.

Is Nationwide Insurance available in NY?

Yes, Nationwide Insurance is available in NY and offers coverage options tailored to residents’ needs, including affordable term life insurance. Discover affordable coverage options for Nationwide and New York Life Insurance by entering your ZIP code.

What are USAA Embrace pet insurance reviews like?

USAA Embrace pet insurance reviews highlight comprehensive coverage for accidents and illnesses. The company is often praised for customizable plans. Monthly rates typically depend on your pet’s age and breed.

What is New York Life term life insurance?

New York Life term life insurance offers affordable, temporary protection with fixed monthly premiums. Rates start at $30 and vary based on the policyholder’s age and term length. See how the best permanent life insurance policies can build cash value over time

What is Nationwide Mutual Insurance Company?

Nationwide Mutual Insurance Company is a major insurer offering life, auto, and property coverage. It’s known for affordable policies, including term life insurance.

What are New York Life career reviews?

New York Life career reviews often emphasize strong training programs and potential for career growth. Agents also benefit from performance-based incentives and competitive compensation.

How much does a New York Life agent make?

A New York Life agent’s earnings vary, with average annual income ranging from $50,000 to $80,000. For example, new agents may earn less, while experienced agents can make significantly more with commissions.

What should I consider when comparing Nationwide vs. Safeco?

Nationwide offers affordable term life policies, while Safeco focuses on auto and property insurance. Check Safeco insurance review & ratings to uncover its benefits and overall reliability.

How does AAA compare to Nationwide?

AAA excels in auto insurance with roadside assistance, while Nationwide provides diverse options, including life insurance.

Which is better, New York Life vs. Northwestern Mutual?

What are the differences between the 21st Century vs. Nationwide?

What is the difference between New York Life vs. National Life Group?

Should I choose Nationwide vs. Northwestern Mutual?

How does Nationwide compare to State Farm life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.