Ohio Car Insurance Requirements in 2026 (OH Minimum Coverage)

Ohio car insurance requirements include 25/50/25 of bodily injury and property damage liability. Failure to meet these Ohio requirements could result in the suspension of your license plates and vehicle registration. Monthly car insurance rates in Ohio start at only $16.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated August 2025

The liability coverage needed to meet the minimum requirements for auto insurance in Ohio is 25/50/25, with monthly rates starting at $16.

You can get a loss of driving privileges for a minimum of 90 days and a maximum of 2 years when you fail to show proof of insurance. Learn more about the different types of car insurance coverages below.

Ohio Auto Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

With this car insurance guide, you can compare rates and get the cheapest coverage for your vehicle needs. Enter your ZIP code to learn more and answer the question, “What is the minimum car insurance required in Ohio?”

- Ohio car law requires 25/50/25 in auto insurance coverage

- OH car insurance rates start at $16 monthly

- Driving without insurance in Ohio can lead to fines and license suspension

This car insurance guide will cover Ohio car insurance requirements and other coverage options drivers can choose from to save money on their insurance.

Ohio Auto Insurance Requirements & What They Cover

Ohio car insurance laws mandate minimum liability coverage for all personal vehicles. Drivers must carry bodily injury liability coverage of at least $12,500 per person and $25,000 per accident and property damage liability coverage with a minimum limit of $7,500.

The state sets these minimum car insurance requirements to ensure that the involved person will pay in the event of an accident. Find out what states require car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Car Insurance in Ohio

Various factors should be considered when seeking the cheapest car insurance in Ohio. You must consider comparing rates from different providers based on their location, demographics, and history.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Ohio

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage in Ohio

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsThis section highlights USAA as the cheapest provider, followed by American Family and Travelers. These monthly premiums can be affected by factors including your city.

Ohio Min. Coverage Car Insurance Monthly Rates by City

| City | Monthly Rates |

|---|---|

| Akron | $72 |

| Canton | $70 |

| Cincinnati | $85 |

| Cleveland | $88 |

| Columbus | $82 |

| Dayton | $78 |

| Dublin | $76 |

| Elyria | $67 |

| Euclid | $75 |

| Fairfield | $73 |

| Hamilton | $74 |

| Kettering | $69 |

| Lakewood | $77 |

| Lima | $66 |

| Lorain | $68 |

| Mansfield | $65 |

| Middletown | $71 |

| Newark | $64 |

| Parma | $79 |

| Springfield | $63 |

| Toledo | $80 |

| Westerville | $81 |

| Youngstown | $62 |

For instance, Elyria has the lowest average rate at $67 per month, while Cleveland drivers pay the highest at $88. These rates also fluctuate by age and gender; 17-year-old males typically pay the most, and 60-year-old females enjoy the lowest premiums.

Car Insurance Monthly Rates in Ohio by Provider, Age, and Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $489 | $515 | $161 | $172 | $138 | $145 | $121 | $125 | |

| $465 | $492 | $152 | $163 | $130 | $137 | $114 | $118 | |

| $470 | $498 | $155 | $166 | $132 | $139 | $116 | $120 | |

| $480 | $508 | $158 | $169 | $135 | $142 | $118 | $122 | |

| $450 | $475 | $150 | $160 | $128 | $135 | $112 | $116 | |

| $495 | $520 | $165 | $175 | $140 | $147 | $123 | $127 |

| $485 | $510 | $160 | $170 | $138 | $145 | $120 | $124 |

| $475 | $500 | $155 | $165 | $133 | $140 | $117 | $121 | |

| $460 | $485 | $150 | $160 | $130 | $137 | $115 | $119 | |

| $470 | $495 | $155 | $165 | $132 | $139 | $116 | $120 |

Driving records further influence insurance costs—drivers with clean records pay less, while those with DUIs or accidents face higher rates.

Car Insurance Monthly Rates in Ohio by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $220 | $220 | $356 | $243 | |

| $152 | $163 | $130 | $114 | |

| $155 | $166 | $132 | $116 | |

| $158 | $169 | $135 | $118 | |

| $69 | $69 | $80 | $79 | |

| $165 | $175 | $140 | $123 |

| $160 | $170 | $138 | $120 |

| $155 | $165 | $133 | $117 | |

| $98 | $98 | $107 | $107 | |

| $155 | $165 | $132 | $116 |

Minimum coverage in Ohio includes $25,000 and $50,000 for bodily injury and $10,000 for property damage coverage. Comparing providers and considering your profile is key to securing the best deal.

Read more: Does my car insurance cover damage caused by a falling object?

Penalties for Driving Without Insurance in Ohio

If you cannot show proof of insurance when requested, you may face several penalties in Ohio.

These can include the loss of driving privileges for 90 days and up to 2 years, suspension of your license and vehicle registration, reinstatement fees ranging from $75 to $600, and other potential additional costs.

Chris Abrams Licensed Insurance Agent

You may also be required to file an SR-22 or a bond for at least three and up to 5 years. In cases involving a financial responsibility (FR) suspension, your vehicle may be immobilized and your plates confiscated for 3 to 60 days.

Repeat offenses can lead to vehicle forfeiture and a registration suspension for up to 5 years.

Read more: Car Registration Fees by State

Additional Coverage Options in Ohio

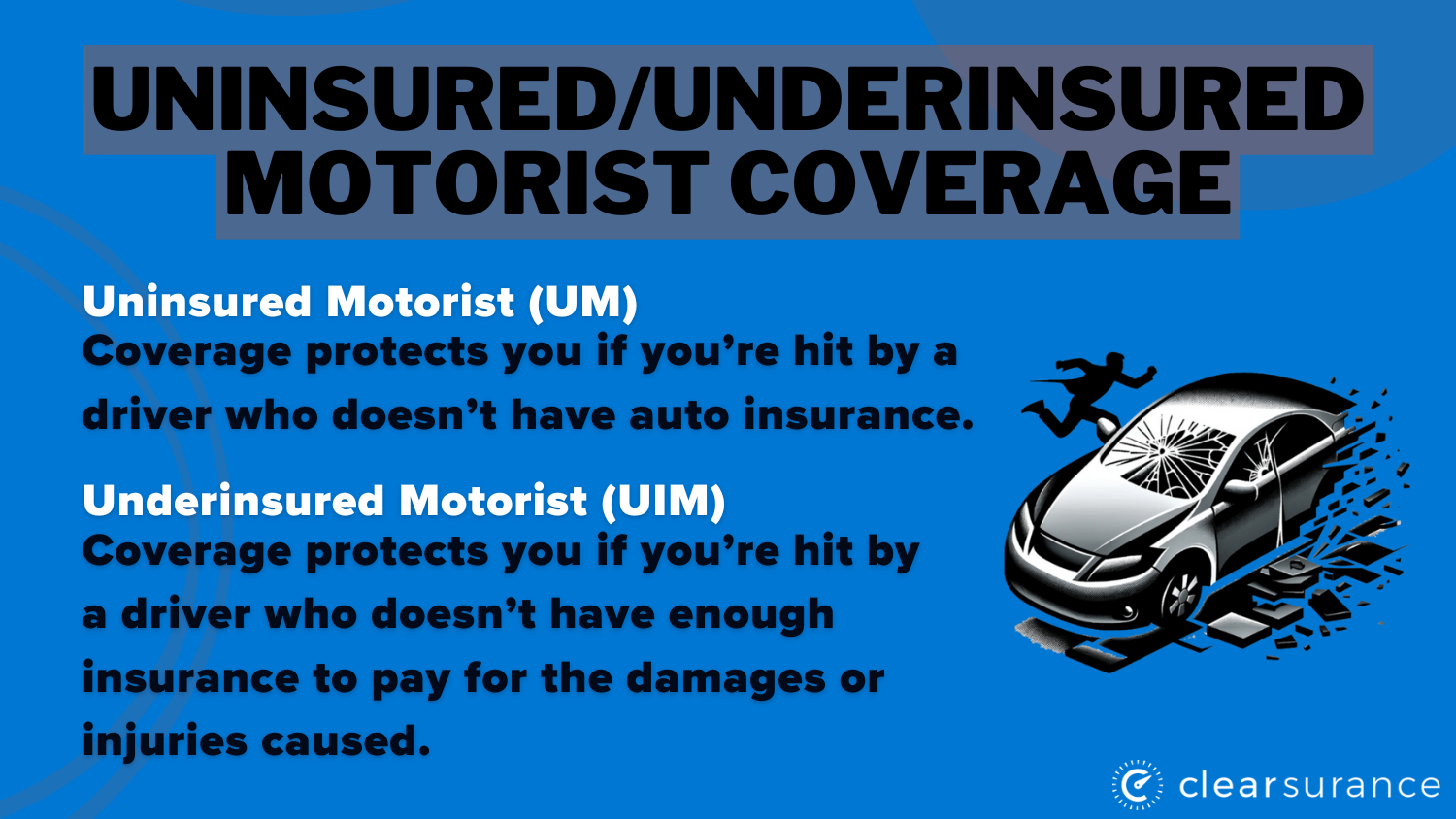

Uninsured/underinsured coverage helps pay for damages if you are in an accident with someone without adequate insurance or no coverage. It also will assist you in paying for damages if you are involved in a hit-and-run accident.

Collision and comprehensive coverage are optional coverages that can help provide additional security for you and your vehicle. Collision coverage will help cover car-related expenses if your vehicle has been involved in any type of collision, while comprehensive coverage covers expenses for non-collision-related incidents.

Non-collision incidents can include damage caused by a blizzard, a fire, or car theft. We have a list of the most stolen vehicles in Ohio. Even if your car isn’t listed, it doesn’t mean you should skimp on this coverage.

See other coverage options and learn how you can save on Ohio car insurance rates by entering your ZIP code.

Frequently Asked Questions

What does the 25/50/25 liability coverage in Ohio actually cover in the event of an accident?

25/50/25 coverage, part of the Ohio minimum auto insurance requirements, pays up to $25,000 for every injured person, $50,000 total per accident, and $25,000 for property damage you cause.

How does Ohio’s tort system affect who pays for damages after a car accident?

Under Ohio auto insurance laws, the at-fault driver is financially responsible for all damages resulting from an accident. Understand more the tort system by entering your ZIP code.

What are the exact consequences of failing to maintain car insurance in Ohio?

A first-time offender who doesn’t meet Ohio’s minimum auto insurance requirements can face license and registration suspension, reinstatement fees, and a minimum 90-day loss of driving privileges.

What is an SR-22?

An SR-22 may be required if you violate the minimum car insurance requirement in Ohio, such as driving without valid coverage.

Why might it be wise to purchase uninsured/underinsured motorist coverage?

Though not part of the Ohio state minimum car insurance requirements, uninsured/underinsured motorist coverage protects you if someone hits you.

How do age and gender impact car insurance premiums in Ohio?

According to the Ohio auto insurance guide, younger males pay higher premiums while older females usually get the lowest rates.

Read more: Best Car Insurance in your State

What are the benefits of adding comprehensive coverage in Ohio?

Comprehensive and collision coverage is part of Ohio’s complete coverage requirements and helps protect against damage from weather, theft, or accidents.

Which Ohio cities tend to have the highest and lowest average monthly car insurance rates?

Rates under the Ohio auto insurance requirements vary by city, with Elyria having lower costs and Cleveland having some of the highest. Compare car insurance rates in Ohio by entering your ZIP code.

How do insurance providers in Ohio typically assess risk when determining your monthly premium?

Premiums are based on several risk factors while complying with auto insurance requirements in Ohio, including age, location, and driving history.

Read more: Best Safe Driver Car Insurance Discount

What should a driver do immediately after losing proof of insurance during a traffic stop in Ohio?

If you’re pulled over without proof of insurance, you must provide it quickly to avoid penalties for not meeting the minimum car insurance Ohio standards.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.