California Car Insurance Requirements in 2026 (See What CA Law Requires)

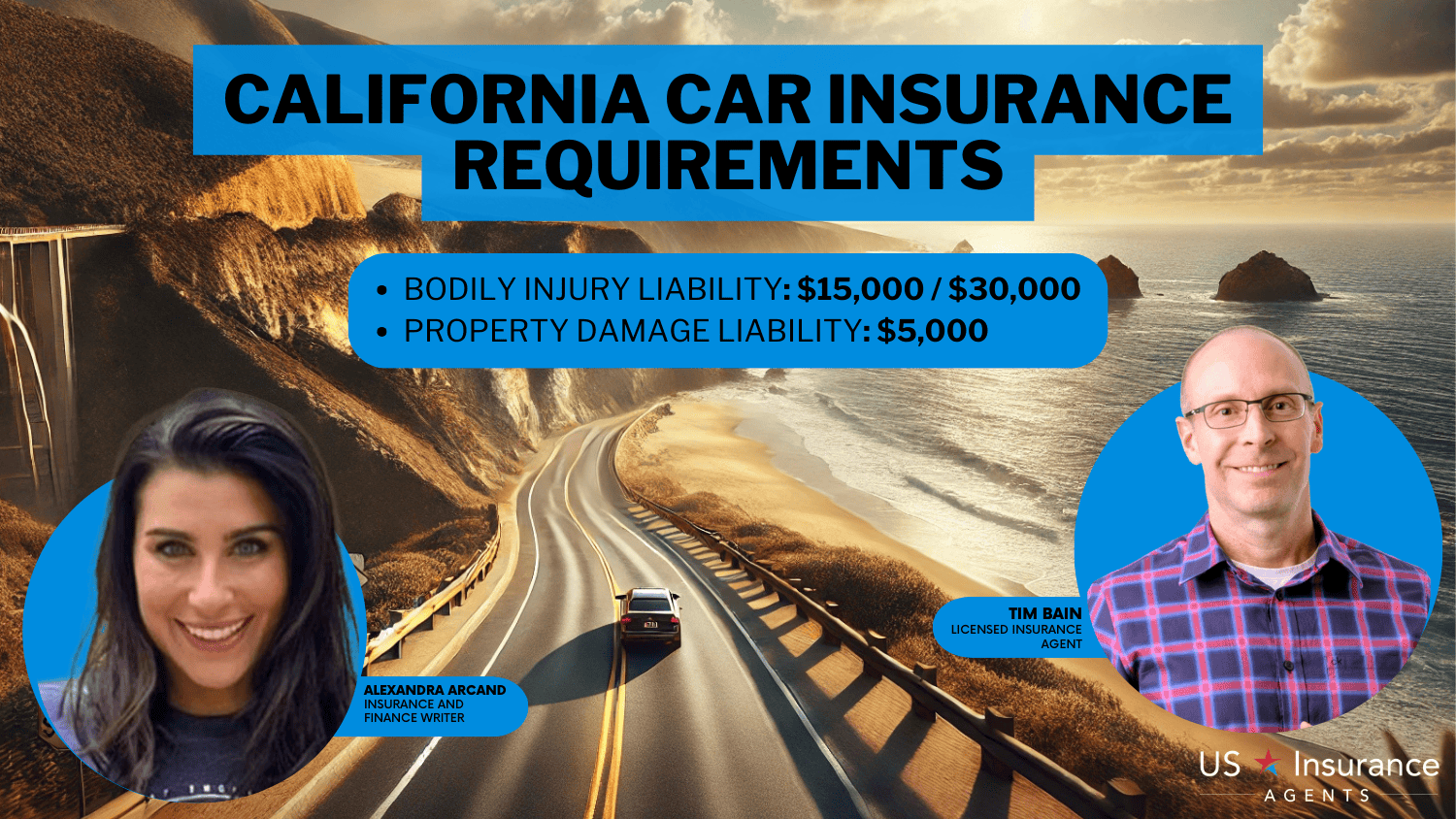

Discover California car insurance requirements where drivers must carry minimum liability coverage of 15/30/5, including $15,000 for injury per person, $30,000 per accident, and $5,000 for property damage. CA car insurance rates are as low as $24/mo, depending on your driving history, type of coverage, and insurer.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated December 2024

Understanding California car insurance requirements is essential for every driver in the state. California mandates minimum liability coverage of 15/30/5 to protect against injury and property damage, but additional options like uninsured motorist and comprehensive coverage can provide greater peace of mind.

With rates starting at just $24/month, top companies like USAA, State Farm, and Travelers provide affordable and dependable coverage for California drivers.

California Minimum Car Insurance Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $5,000 per accident |

Comparing these providers helps you meet state requirements, add extra protection, and find a policy that fits your needs and budget. Discover how to find the best rates and coverage in this comprehensive guide.

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool today.

- California car insurance requirements mandate 15/30/5 liability coverage

- USAA, State Farm, and Travelers offer affordable rates in CA starting at $24/mo

- Non-compliance in California results in fines, license suspension, and liability

California Car Insurance Requirements & What They Cover

Understanding California auto insurance requirements is essential for all drivers to stay compliant with state laws. All personal vehicles in California must meet the California car insurance minimum liability coverage of 15/30/5, which includes $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage.

For individuals who struggle to find insurance through standard channels, the California Automobile Assigned Risk Plan (CAARP) provides a solution by connecting them with insurers willing to offer coverage.

This ensures that all drivers, regardless of their situation, have access to the necessary protection for themselves and others on the road.

Read more: What does car insurance cover?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in California

You can find affordable car insurance in California with companies like USAA, State Farm, and Travelers. USAA has the lowest rates and great service, making it a top pick for military members and their families.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in California

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in California

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in California

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsState Farm is a strong contender, known for its competitive pricing and excellent discounts that benefit many drivers. Travelers rounds out the top three, offering affordable rates and customizable coverage options to meet diverse needs.

California Min. Coverage Car Insurance Monthly Rates by City

| City | Monthly Rates |

|---|---|

| Bakersfield | $53 |

| Chula Vista | $48 |

| Fresno | $54 |

| Los Angeles | $81 |

| Modesto | $60 |

| Oakland | $66 |

| Riverside | $60 |

| Sacramento | $64 |

| San Bernardino | $65 |

| San Diego | $53 |

| San Francisco | $69 |

| Santa Ana | $65 |

| Santa Barbara | $50 |

| Stockton | $61 |

Monthly rates vary by city, with affordable options such as $48 in Chula Vista, $53 in San Diego, and $60 in Riverside. Comparing these companies ensures you get the best deal while meeting California car insurance minimum requirements.

Read more: Best Car Insurance for Safe Drivers in California

Other Coverage Options to Consider in California

In addition to meeting California car insurance minimum requirements, drivers can enhance their protection with additional coverage options. These coverages provide greater financial security in situations where basic liability may fall short. Here are the key types of car insurance coverage to consider:

- Uninsured/Underinsured Motorist Coverage: Protects you, your passengers, and your vehicle if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured altogether. Uninsured/underinsured motorist coverage coverage also applies to hit-and-run incidents, ensuring you aren’t left with significant out-of-pocket expenses.

- Collision Coverage: Collision car insurance helps pay for repairs to your car after an accident, no matter who is at fault. It covers everything from single-car accidents to crashes with other vehicles, helping you handle repair costs.

- Comprehensive Coverage: Comprehensive insurance covers non-accident problems like theft, vandalism, or natural disasters. Since car theft is common in California, this coverage is a smart way to protect your car.

Adding this to your policy helps you deal with surprises, stay safe, and worry less.

Penalties for Driving Without Auto Insurance in California

Not following California car insurance rules can cause big problems. One of the main penalties is losing your vehicle registration. This can happen if you cancel your insurance and don’t get a new policy within 45 days, don’t give your insurance info to the DMV within 30 days of registering your car, or use fake insurance papers.

Penalties for Driving Without Car Insurance in California

| Penalty Type | Description | Potential Penalty |

|---|---|---|

| Fines | Pay fines for no insurance | $200 first offense; $500 for repeat offenses |

| Impoundment of Vehicle | Vehicle may be impounded | Towing and storage fees |

| License Suspension | License may be suspended | 4 years for non-compliance |

| SR-22 Requirement | Must file SR-22 proof | Maintain SR-22 for 3 years |

| Court Appearance | Court may be required | Additional fines or arrest for non-appearance |

| Increased Insurance Costs | Higher future premiums | Increased rates for several years |

Drivers who cannot provide proof of insurance during a traffic stop may face fines starting at $200 for a first offense and up to $500 for repeat violations. In some cases, tickets can exceed $1,000, making non-compliance a costly mistake. Additionally, uninsured drivers risk having their vehicles impounded, incurring towing and storage fees.

View this post on Instagram

More severe consequences include license suspension for up to four years, particularly if an uninsured driver causes an accident. Restoring driving privileges often requires filing an SR-22 form, which serves as proof of financial responsibility for three years. Moreover, driving without insurance can lead to personal liability for damages if you are at fault in an accident, potentially resulting in significant financial hardship.

Ty Stewart Licensed Insurance Agent

To avoid these penalties, ensure you have valid insurance coverage or establish financial responsibility through alternative methods, such as obtaining a DMV-issued self-insurance certificate, making a $35,000 cash deposit, or posting a surety bond.

You may need proper paperwork, like an insurance card or SR-22 form, when registering your car, renewing it, or after an accident. Following rules keeps you safe and out of trouble.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Securing the Right Car Insurance in California

Having car insurance in California isn’t just the law; it’s an important way to protect yourself and others. By learning about California car insurance requirements and looking into extra options like uninsured motorist, collision, and comprehensive coverage, you can create a plan that works for your needs and budget.

Top companies like USAA, State Farm, and Travelers offer affordable rates starting at just $24/month, ensuring reliable protection is accessible to all drivers. Remember, non-compliance can result in severe penalties, including fines, license suspension, and financial liability.

Take the time to compare insurance quotes online, understand your options, and secure the coverage you need to confidently drive in California. Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

Frequently Asked Questions

What is the required car insurance in California?

California requires a minimum liability insurance coverage of 15/30/5, which includes $15,000 for injury per person, $30,000 per accident, and $5,000 for property damage.

What is the new law for car insurance in California?

The new law in California adjusts requirements for uninsured motorist coverage and liability limits for certain scenarios, ensuring more comprehensive protection for drivers.

Do I need insurance before I buy a car in California?

Yes, you need insurance before driving the car off the lot. Most dealerships require proof of insurance before completing the purchase. Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

What happens if I don’t insure my car in California?

Driving without insurance can lead to fines, vehicle impoundment, license suspension, and personal liability for damages in an accident.

How much is car insurance in California per month?

On average, car insurance in California costs around $65 per month, but rates can start as low as $24, depending on the provider and coverage.

What is full coverage car insurance in California?

Full coverage includes liability, collision, and comprehensive insurance, protecting your vehicle and others in case of accidents or non-collision incidents.

Why is it hard to get car insurance in California?

Factors like high traffic density, theft rates, and frequent accidents contribute to challenges in finding affordable insurance in California.

What is the new car rule in California?

A recent rule requires all vehicles to maintain valid insurance to avoid registration suspension by the DMV.

How many days do I have to insure my car in California?

You must show proof of insurance to the DMV within 30 days of registering or purchasing a car.

Read more: What are the car registration fees by state?

How long do I have to get insurance after buying a car in California?

If you buy a car, you typically need insurance immediately to drive it. Some policies allow a grace period of up to 30 days to update coverage for a new vehicle.

Can I legally drive in California without insurance?

Who has the cheapest car insurance in California?

Why is car insurance so expensive in CA?

What is California minimum car insurance?

What is SR-22 insurance in California?

Do you need car insurance to get a driver’s license in California?

How long do you have to insure a car in California?

When did California require car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.