Does car insurance follow the car or the driver? (2026 Coverage Rules)

Does car insurance follow the car or the driver? Most policies follow the car, meaning coverage applies to permitted drivers. Non-owner car insurance follows the driver and starts at just $32 per month, providing affordable liability protection for those who frequently rent or borrow vehicles.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Natasha McLachlan is a writer who currently lives in Southern California. She is an alumna of California College of the Arts, where she obtained her B.A. in Writing and Literature. Her current work revolves around insurance guides and informational articles. She truly enjoys helping others learn more about everyday, practical matters through her work.

Natasha McLachlan

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

Auto insurance can be tricky, especially when figuring out who’s covered. A common question is, “Does car insurance follow the car or the driver?” In most cases, it follows the car.

If you often borrow or rent vehicles, non-owner car insurance may be a smart choice from $32/month. Adding the best gap car insurance can enhance your protection.

- Most car insurance policies follow the car, covering permitted drivers

- Non-owner insurance follows the driver and starts at just $32 per month

- Knowing which policy applies helps avoid liability when lending or borrowing cars

Getting policy quotes is the key to finding the best possible rates. Enter your ZIP code into our free tool today to see what quotes might look like for you.

What it Means for Insurance to Follow the Car or Driver

When insurance follows the car, the vehicle’s policy typically covers any permitted driver. If insurance follows the driver, their personal policy may cover them when driving other cars. Knowing how your coverage applies helps you avoid unexpected costs and liability if an accident occurs.

Auto insurance can cover either the vehicle or the driver, depending on the types of car insurance coverage. If it follows the car, coverage applies regardless of who’s driving. If it follows the driver, their personal policy covers rentals or borrowed vehicles.

Jeffrey Manola Licensed Insurance Agent

Imagine your friend borrows your car and ends up causing an accident, whose insurance pays for the damages? Understanding whether insurance follows the car or the driver helps you avoid costly surprises. It determines who’s financially responsible when someone else gets behind the wheel of your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

When Car Insurance Follows the Car

Understanding how car insurance applies when someone else drives your vehicle starts with knowing the role of different coverages.

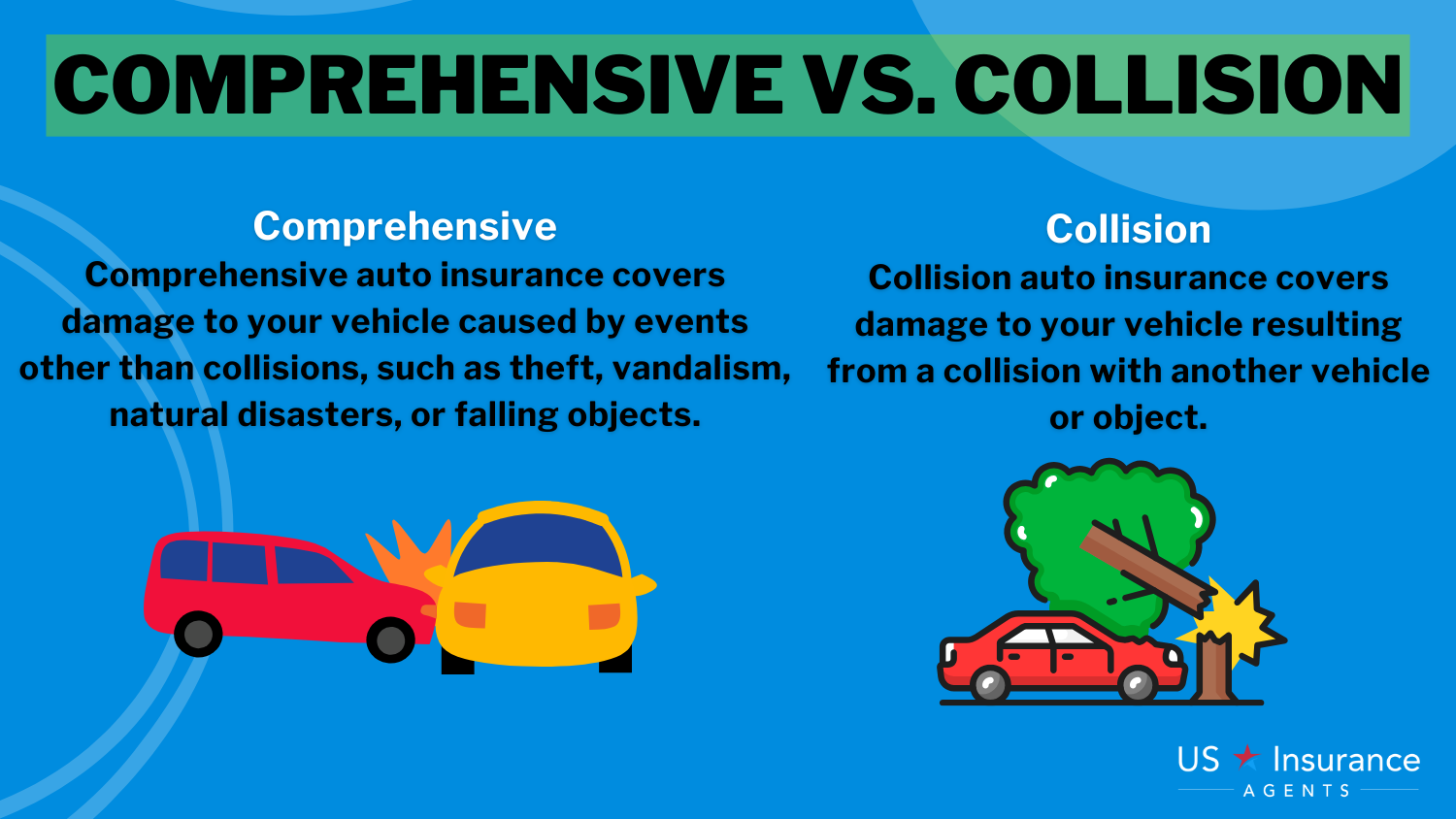

Liability, collision, and comprehensive coverage each serve a unique purpose and protect you in different scenarios. The examples below show how each type of coverage works in real life.

- Liability Coverage: Covers damage or injuries to others if you or a permitted driver causes an accident, including repairs and medical bills.

- Collision Coverage: Covers damage to your car in an accident, no matter who’s driving. If your cousin backs into a pole, this coverage helps pay for repairs.

- Comprehensive Coverage: Comprehensive insurance covers non-collision damage like theft, vandalism, or weather. If a tree branch falls on your car while a friend is driving it, this coverage applies.

Knowing how your coverage works helps you make smart choices before lending your car. Take time to review your policy so you understand what is covered in different situations.

Check out these real-life scenarios to learn how different types of car insurance coverage work when someone else is driving your car:

- Friend Hits Another Car: Your liability insurance coverage would help pay for the other driver’s vehicle repairs, medical bills, lost wages, and legal costs if a lawsuit arises.

- Friend Hits a Pole: Collision coverage helps pay to repair your car’s damage, including bodywork, structural repairs, or parts, after you pay your deductible. If the damage totals the vehicle, your insurer would reimburse you for its current market value.

- Friend Drives During Storms: A large tree branch falls on the car, damaging the roof and windshield. Comprehensive coverage helps pay for repairs or, if the car is totaled, reimburses you for its actual cash value, after you pay your deductible.

Whether it’s a collision, an accident involving another driver, or unexpected weather damage, knowing how liability, collision, and comprehensive coverage apply can help you feel more prepared.

These examples highlight why it’s important to review your policy before lending your car. Knowing your coverage helps you prepare for any accidents or unexpected events.

When Car Insurance Follows the Driver

When car insurance follows the driver, coverage comes from the driver’s own policy rather than the vehicle’s. This often happens with non-owner car insurance, which provides liability protection when driving a car you don’t own, such as a rental or borrowed vehicle.

Non-Owner Car Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $47 | $124 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Non-owner car insurance rates vary by company and coverage level. On average, minimum coverage ranges from around $32 to $96 per month, while full coverage can range from $84 to $248 per month. Companies like USAA and Geico tend to offer some of the most affordable options, while Liberty Mutual and Travelers are on the higher end for full coverage.

Rates decrease with age and are slightly lower for females. At 18, females pay $110 and males $130. By age 60, rates drop to $37 for females and $40 for males, reflecting reduced risk with age.

Comparing rates from the cheapest car insurance companies can help you find the best value. In permissive use, the owner’s insurance is primary and the driver’s is secondary, key to avoiding coverage gaps with rentals or work vehicles.

Insurance Coverage for Renting or Borrowing a Car

When renting a car, your personal auto insurance may extend liability, collision, and comprehensive coverage to the rental, and some credit cards also offer rental car protection if you pay with the card.

To avoid paying for duplicate coverage, review your personal insurance policy and credit card benefits before accepting the rental company’s coverage.

If you’re borrowing a car from a family member, their insurance typically provides primary coverage as long as you have permission to drive it. However, if their policy limits are exceeded, your own insurance may offer secondary coverage.

Without personal insurance, you could be responsible for any uncovered costs. Always check what coverage applies before driving a rental or borrowed car to avoid unexpected expenses.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Things to Consider if You Regularly Share Vehicles With Others

If you regularly share your car with family or friends, it’s important to consider key insurance factors to stay protected. Here are a few things to keep in mind.

- Understand Primary and Secondary Coverage: Know which policy applies first. The car owner’s insurance is usually primary, with the driver’s insurance providing secondary coverage if needed.

- Check Policy Requirements for Listed Drivers: If someone drives your car often, they may need to be listed on your policy. Otherwise, claims could be denied or your policy could be canceled.

- Verify Driver’s License and Insurance Status: Always confirm the driver is licensed and insured. Letting an unqualified driver use your car risks major financial and legal trouble.

- Be Aware of Coverage Limitations: Understand what your policy covers and excludes. Permissive use may not apply to commercial driving or frequent drivers not listed on the policy.

- Communicate Expectations Clearly: Discuss coverage, deductibles, and expectations with drivers to avoid misunderstandings and prepare for potential accidents.

Taking the time to understand how insurance works when you share your vehicle can help you avoid unexpected costs and legal issues.

Tonya Sisler Insurance Content Team Lead

Clear communication and a solid understanding of your policy will give you and anyone driving your car greater peace of mind.

How to Add a Driver to Your Car Insurance

If someone regularly drives your car, such as a family member, partner, or roommate, you’ll likely need to add them to your car insurance policy to ensure proper coverage. The process is usually simple and helps prevent coverage gaps or claim denials if they’re involved in an accident.

Start by contacting your insurance company to inform them that you’d like to add a driver. The insurer will typically ask for the driver’s full name, date of birth, driver’s license number, and driving history. They may also inquire about how often the person will be using the vehicle.

Once the driver is added, your premium may change based on their record. If they’re high-risk, consider the best car insurance for high-risk drivers to save on rates.

Car Insurance Monthly Rates: Before vs. After Adding a Driver

| Company | Before | After |

|---|---|---|

| $103 | $175 | |

| $94 | $160 | |

| $101 | $170 | |

| $82 | $142 | |

| $106 | $181 |

| $95 | $162 |

| $90 | $158 | |

| $87 | $151 | |

| $99 | $165 | |

| $76 | $134 |

Adding a driver to your car insurance usually increases your premium, with costs rising by about $50 to $75 per month. Rates vary by insurer, with USAA and Geico showing smaller increases and Liberty Mutual and Allstate showing larger ones. Comparing rates can help you find the best deal when updating your policy.

It’s important to be proactive when adding a driver. Failing to list someone who regularly uses your car can result in denied claims or even policy cancellation. Always keep your insurer updated if your household changes or if someone begins driving your car more frequently.

Car Insurance Coverage for Drivers and Vehicles

Does car insurance follow the car or the driver? Typically, it follows the car, so your policy covers anyone you permit to drive.

However, non-owner car insurance follows the driver and offers liability coverage for vehicles you don’t own. Starting at $32 per month, it’s ideal for frequent borrowers or renters. New car owners should also check the best car insurance discounts for new vehicles to save more.

Quit overpaying for your car insurance. Our free quote comparison tool helps you to shop around for quotes from leading providers in your area by entering your ZIP code now.

Frequently Asked Questions

What happens if someone else crashes your car?

If they had your permission, your insurance typically covers the damages, but you may still be responsible for the deductible and any premium increase, especially if the incident occurred during a paid car-sharing arrangement.

Can I drive my partner’s car if I’m not on their insurance?

Yes, if you’re a permissive driver, their policy may cover you, but it’s best to confirm with their insurer to avoid gaps, since coverage typically won’t extend to any excluded drivers listed on the policy.

Enter your ZIP code to get custom quotes for coverage to suit your needs and budget.

How does borrowing another person’s car impact auto insurance rates in an accident?

If you’re at fault, the car owner’s insurance typically covers the damages, but their rates may increase, especially if the claim is large or they don’t have accident forgiveness. It’s important to understand how to file a car insurance claim properly to ensure a smooth process and avoid unnecessary delays.

Will my insurance cover me if I drive someone else’s car?

It depends on your policy. Some auto insurance plans provide limited car vs. driver coverage, meaning they may only apply when you’re driving your own vehicle. However, if you’re operating a non-owned car with permission, your insurer might still extend some level of coverage, though it’s best to confirm the specifics with them directly.

What happens if someone else is driving my car and gets in an accident?

If the driver had your permission, your insurance typically serves as the primary coverage. However, if damages exceed your policy limits, the driver’s insurance may provide secondary coverage.

Will my insurance cover me if I drive someone else’s car with Progressive?

Yes, Progressive may offer coverage if you have permission to drive the car and the owner’s policy includes permissive use. However, their insurance is typically primary, and yours may act as secondary. See our Progressive insurance review & ratings for more information.

How do primary and secondary insurance work in case of an accident involving a borrowed car?

In most cases, the car owner’s insurance is primary and pays first; if damages exceed coverage limits, the driver’s own policy may act as secondary to cover the rest.

Can someone drive my car if they are not on my insurance?

Yes, in many cases, your insurance covers occasional drivers with your permission, but this depends on your policy’s permissive use clause.

Will my insurance go up if someone else crashes my car?

Yes, your insurance may go up if a permitted driver at fault crashes your car. Follow the tips for sharing vehicles to help prevent surprises. This is especially true in complex scenarios like determining fault in a multiple car accident, where shared or unclear liability can still impact your rates.

Does car insurance cover the car or the driver?

Car insurance typically covers the car, so if the permitted driver causes an accident, the vehicle owner’s policy usually pays first.

What happens if someone wrecks your car and they aren’t on your insurance?

What happens if an insured driver is driving an uninsured car?

Does my car insurance cover other drivers?

Does insurance follow the car or the driver?

What uninsured drivers should know?

Can my son drive my car if he is not insured?

Does auto insurance follow the car or driver?

Can an uninsured driver drive my car?

What is permissive vs. non-permissive use?

Does my car insurance cover other drivers who operate my vehicle?

Does my car insurance cover me when driving another vehicle?

When can someone else drive your car?

If someone borrows your car and gets in an accident, are you liable?

Does car insurance cover the car or driver?

What if you let an uninsured driver borrow your car?

Can you remove a driver from your car insurance policy?

Do I have to add my spouse to my car insurance policy?

What is an excluded driver on a car insurance policy?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.