Cheapest Car Insurance in Iowa

Understanding The Importance Of Car Insurance In Iowa Car insurance is a crucial aspect of owning a vehicle in Iowa. Whether you drive a car, truck, or motorcycle, having the right car insurance cover...

Secured with SHA-256 Encryption

Understanding The Importance Of Car Insurance In Iowa Car insurance is a crucial aspect of owning a vehicle in Iowa. Whether you drive a car, truck, or motorcycle, having the right car insurance cover...

Understanding Car Insurance Requirements In The District Of Columbia When it comes to driving in the District of Columbia, having adequate car insurance is not only a recommendation but also a legal r...

Where you live significantly affects how much you’ll pay for car insurance coverage. Your location is one of the factors car insurance companies consider when determining how much you’ll p...

Welcome to our essential guide about cheap car insurance in Florida. In this article, we provide valuable insights and tips to help you find affordable coverage without compromising on quality. We cov...

Post

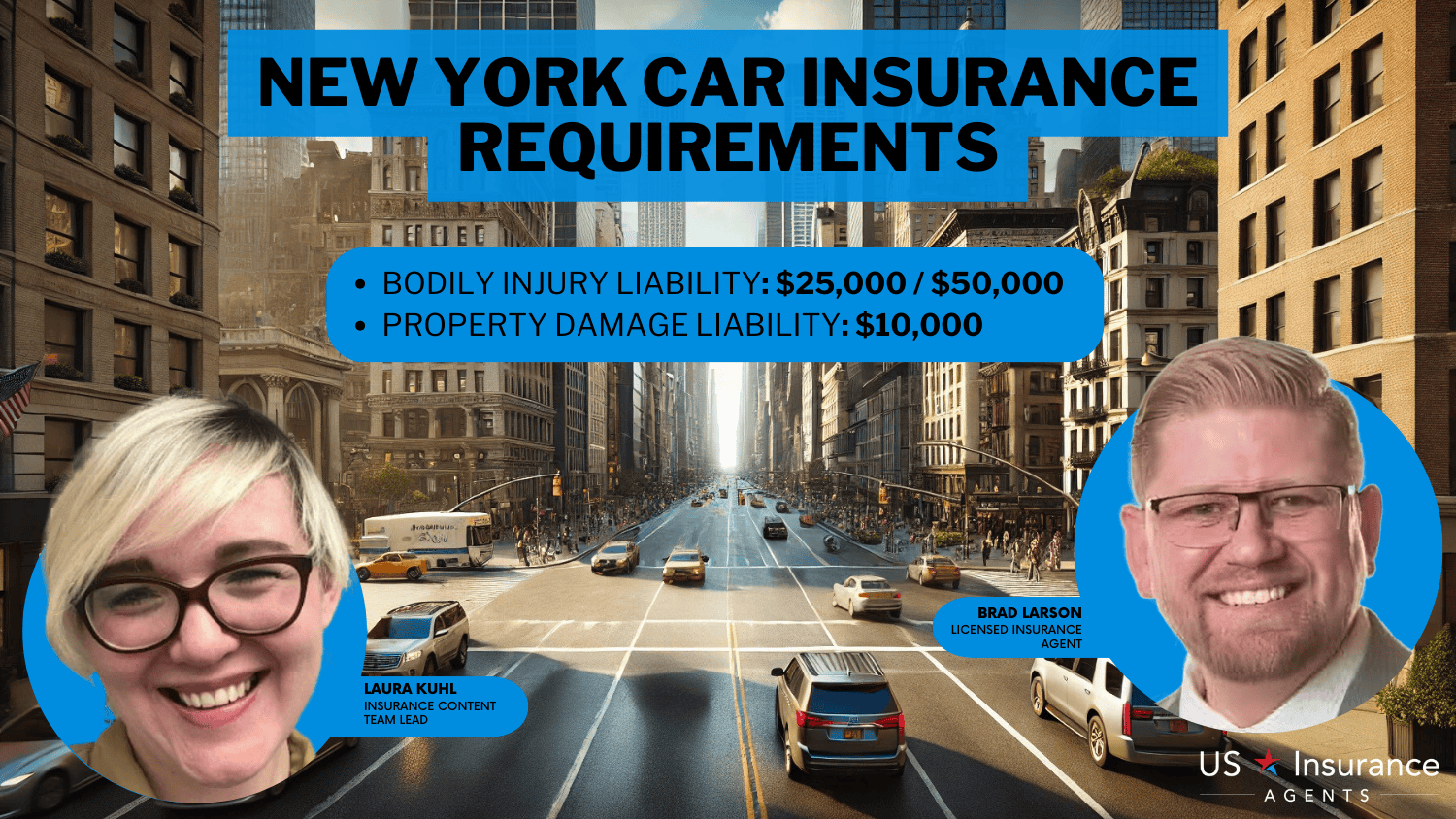

PostNew York requires all motorists to maintain insurance coverage and is a no fault state. This, along with the fact that it has a large population concentrated in the New York City area, cause insurance...

Post

PostNew Mexico requires drivers to maintain financial responsibility in the form of an insurance policy or posting cash or bond with the state treasury. Most often, people will opt for simply getting a ca...

Post

PostThe state of Nevada requires that all drivers maintain car insurance. There are a couple different ways to maintain financial responsibility but the most common is to obtain a standard car insurance p...

Post

PostDrivers in Wyoming are required to maintain proof of financial responsibility when operating a vehicle. The most common way to do this is by getting a car insurance policy. The specific insurance laws...

With so many ways to establish financial responsibility in Oklahoma, there is no reason why anyone should be driving without it. The most common way is to get a standard car insurance policy. Even hig...

Looking for reliable Los Angeles, California auto insurance? Look no further. In this article, we’ll explore the key aspects of auto insurance coverage in Los Angeles, California, including the ...

Welcome to our comprehensive guide on Chicago Auto Insurance. Whether you’re a resident of the Windy City or planning to visit, it’s crucial to have the right car insurance coverage to pro...

Welcome to our comprehensive guide on New York, NY Auto Insurance. Our extensive guide is designed to help you navigate the complexities of auto insurance providers and coverage options in the vibrant...

Welcome to our comprehensive guide on Houston, Texas auto insurance providers and coverage options. If you’re a vehicle owner in the bustling city of Houston, it’s crucial to have reliable...

Post

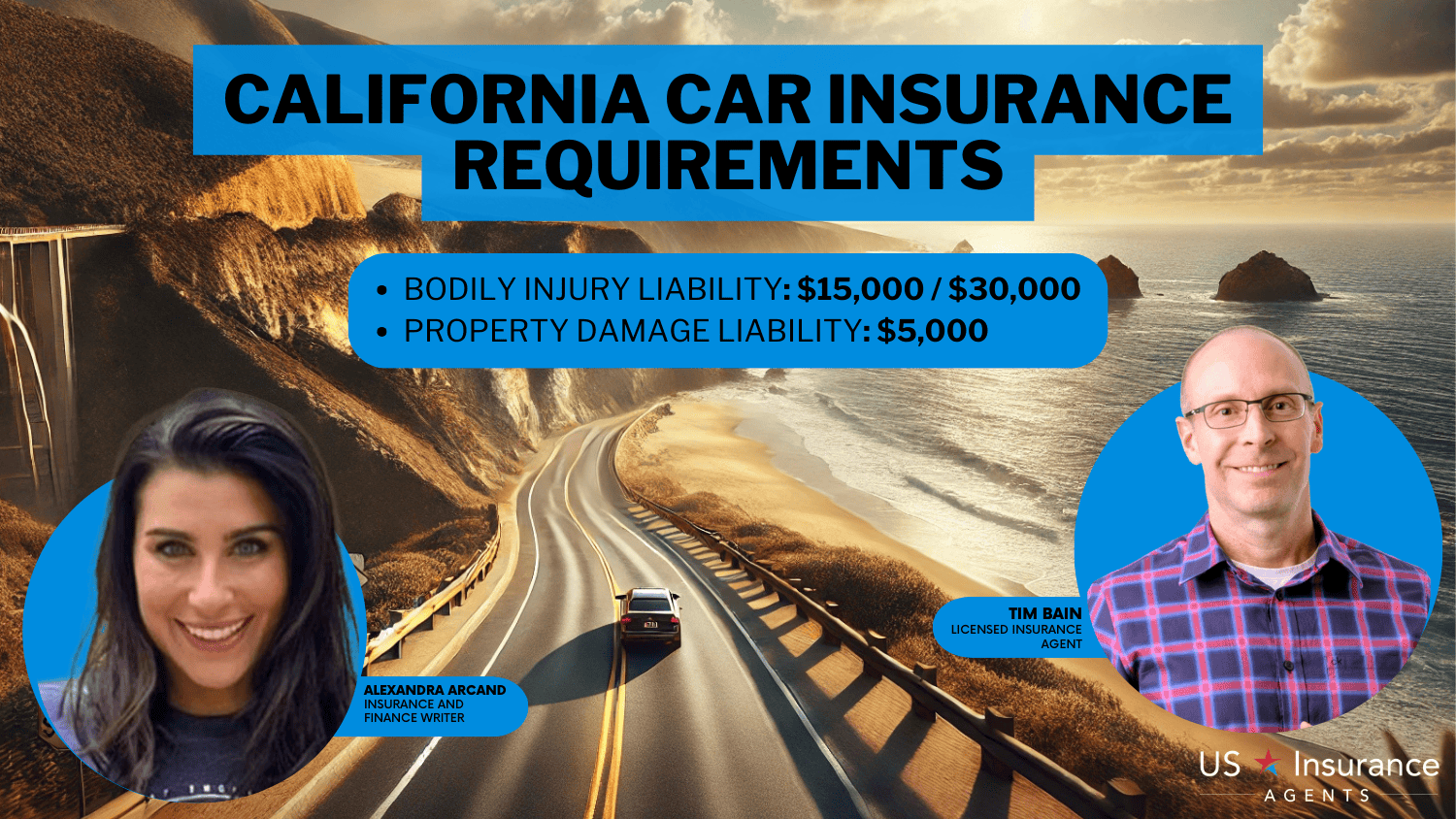

PostCar insurance is mandatory in California with minimum liability limits of 15/30/5. It is important to maintain the right insurance coverage to protect yourself in the event of an accident. The state...

Post

PostEach driver in Wisconsin is required to maintain car insurance coverage. Wisconsin has minimum liability limits of 50/100/15 and 100/300 Uninsured Motorist (UM) limits. Since the state follows a tort ...

Pennsylvania car insurance laws are governed by a tort system with limits of 15/30/5. There is also an additional First Party Benefits requirement that is unique to the state. Additional coverage is...

Post

PostAll drivers living in Vermont are required to maintain minimum liability insurance limits of 25/50/10 along with uninsured/underinsured bodily injury and property damage coverage. The state follows a...

Post

PostAll drivers living in Texas are required to maintain minimum liability insurance limits of 25/50/10 along with uninsured/underinsured bodily injury and property damage coverage. The state follows a to...

Post

PostCar insurance laws in Florida are a bit different than other states. They do not legally require drivers to maintain bodily injury liability coverage but it is highly recommended to do so and many ins...

Post

PostSouth Carolina law requires minimum insurance coverage of 25/50/25. If you do not maintain the minimum coverage requirements, you can face several penalties and fees. The insurance rules in South Caro...

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.