New York Car Insurance Requirements for 2026 (Minimum Coverage in NY)

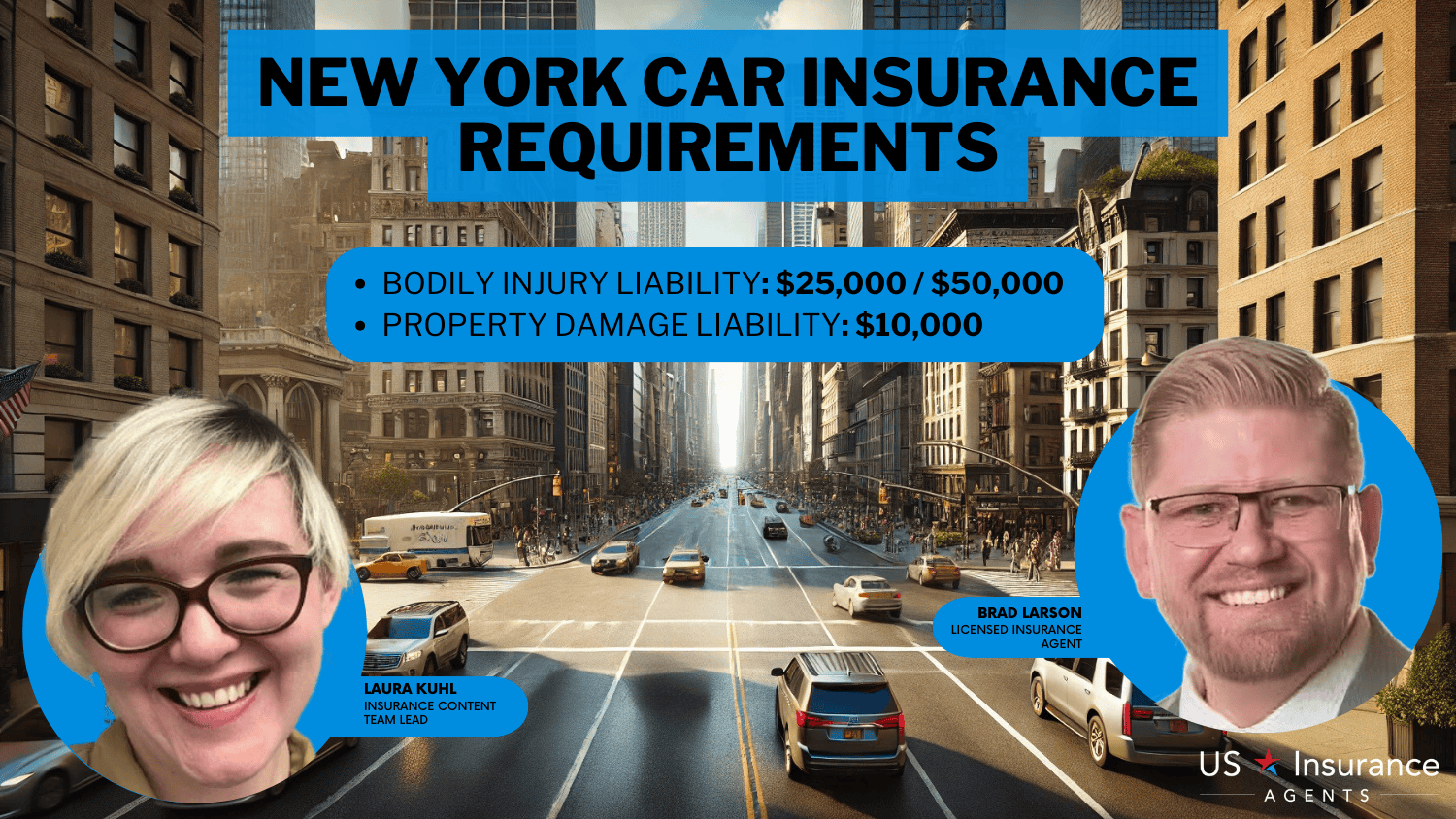

New York car insurance requirements mandate that all drivers carry a minimum coverage of 25/50/10. This includes $25,000 in bodily injury per person, $50,000 per accident, and $10,000 in property damage. New York's car insurance rates start as low as $44 per month, helping you stay compliant with state law.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

New York car insurance requirements mandate a minimum of 25/50/10 coverage, which includes $25,000 bodily injury liability per person, $50,000 per accident, and $10,000 for property damage.

Rates can start as low as $44 per month, with top providers like USAA, Progressive, and State Farm offering affordable options. This essential coverage not only keeps you compliant with state laws but also protects you financially in case of accidents.

New York Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $10,000 per accident |

Our guide breaks down these requirements and highlights the cheapest car insurance companies to help you find the best policy. Compare rates today to secure reliable coverage at the best price.

To find the best policy in NY, enter your ZIP code now and compare rates from the top insurance providers.

- New York car insurance requirements mandate 25/50/10 minimum coverage

- USAA offers affordable rates for NY drivers, starting as low as $44 per month

- Driving uninsured in NY results in fines, registration suspension, or license loss

New York Car Insurance Requirements & What They Cover

New York car insurance requirements mandate all personal vehicles to carry the state minimum coverage, including bodily injury liability of $25,000 per person and $50,000 per accident, along with $10,000 for property damage.

These NY auto insurance requirements ensure financial protection for all parties involved in an accident. Adhering to New York car insurance laws, every driver must meet these New York State minimum car insurance requirements to drive legally.

Understanding what type of car insurance is required by law helps avoid fines, license suspensions, or other penalties. For drivers wondering how to get car insurance in NY, comparison tools and a New York auto insurance guide are essential for finding the best coverage options.

Required Documentation

New York car insurance requirements mandate that drivers maintain proof of insurance, even though coverage is filed electronically with the DMV.

NY drivers must keep paper copies of their insurance ID cards, with insurance providers required to issue two. Proof of insurance must be presented when asked by a police officer, after an accident, during vehicle registration, or while operating a vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in New York

The cheapest car insurance in New York State is offered by USAA, with rates starting at $44 per month for the minimum car insurance in NY. Progressive follows as the second cheapest option at $50 per month, while State Farm offers coverage at $71 per month (Read more: State Farm Car Insurance Review & Ratings).

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in New York

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage in New York

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in New York

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThese affordable rates help drivers meet NY car insurance requirements without overspending. Comparing these options is essential for finding a policy that aligns with your needs and budget while adhering to New York auto insurance requirements.

New York Minimum Coverage Monthly Rates by City

| City | Rates |

|---|---|

| Albany | $85 |

| Binghamton | $79 |

| Buffalo | $87 |

| Elmira | $76 |

| Hempstead | $91 |

| Jamestown | $75 |

| Kingston | $80 |

| Long Beach | $86 |

| Mount Vernon | $88 |

| New York City | $105 |

| Niagara Falls | $77 |

| Poughkeepsie | $81 |

| Rochester | $84 |

| Saratoga Springs | $74 |

| Schenectady | $82 |

| Syracuse | $83 |

| Tarrytown | $73 |

| Watertown | $78 |

| White Plains | $92 |

| Yonkers | $90 |

Monthly rates for New York State car insurance vary by city, with the lowest in Jamestown at $75 and the highest in New York City at $105. For cities like Buffalo, Albany, and Long Beach, rates range between $85 and $87, reflecting regional differences in car insurance in New York State.

Understanding these variations can help you select the best provider for your location while ensuring compliance with New York car insurance minimum coverage laws.

Other Coverage Options to Consider in New York

Understanding the types of coverage available is essential for meeting NY state minimum car insurance and ensuring financial protection. Knowing what you need to get car insurance helps you stay compliant with auto insurance NY requirements and protect yourself on the road. Below are the key types of car insurance NY requirements you should consider:

- Liability Coverage: Meets NY liability insurance with $25,000 bodily injury per person, $50,000 per accident, and $10,000 property damage.

- Personal Injury Protection (PIP): Personal injury protection covers medical expenses, lost wages, and other costs regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist insurance coverage protects you if the at-fault driver lacks sufficient insurance.

- Collision Coverage: Collision car insurance pays for damages to your vehicle after a collision with another car or object.

- Comprehensive Coverage: Comprehensive coverage covers non-collision incidents like theft, vandalism, or weather-related damage.

By understanding these New York car insurance requirements, drivers can select coverage tailored to their needs and budget. Ensure you comply with car insurance NY requirements and protect your financial future by choosing the right coverage for your vehicle.

Penalties for Driving Without Auto Insurance in New York

Driving without insurance in New York comes with severe penalties, emphasizing the importance of complying with car insurance New York requirements.

Penalties for Driving Without Auto Insurance in New York

| Violation | Penalty Description |

|---|---|

| Fine | $150 - $1,500 depending on the offense and judge's discretion. |

| Suspension of Vehicle Registration | Registration can be suspended for a minimum of 1 year. |

| Driver’s License Suspension | Suspension of driver’s license until proof of valid insurance is provided. |

| Reinstatement Fees | Reinstatement fees of up to $750 may apply to reinstate registration and/or license. |

| Civil Penalty | $8 per day for the first 30 days of insurance lapse; up to $900 for 91+ days of lapse. |

| Vehicle Impoundment | Vehicle may be impounded until valid insurance proof is presented. |

| Criminal Charges | May face misdemeanor charges, depending on circumstances. |

Offenders may face fines ranging from $150 to $1,500, a suspension of their driver’s license and vehicle registration, and reinstatement fees up to $750. Civil penalties, such as $8 per day for insurance lapses, can add up to $900 for prolonged violations.

Scott W. Johnson Licensed Insurance Agent

In cases of accidents, the state will revoke both the license and registration for one year, regardless of fault. Additionally, vehicles may be impounded, and misdemeanor charges could apply, making it essential to maintain insurance for license protection and avoid these significant consequences.

Read more: Best Car Insurance for Drivers With Speeding Tickets in New York

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New York Car Insurance Regulations & Required Coverage

Complying with New York car insurance regulations is crucial to avoid severe penalties. NYS auto insurance laws require maintaining at least the minimum coverage. Otherwise, you must return your license plates to the DMV immediately.

Failure to do so results in registration suspension for the duration of your lapse, and if the lapse exceeds 90 days, your license will also be suspended. Reinstating your license comes with a $25 fee, while keeping your plates for up to 90 days incurs daily fees of $8 to $12, depending on the duration.

Note that you can only avoid registration suspension once every three years, making adherence to New York car insurance requirements essential for legal and financial protection. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Frequently Asked Questions

What is the minimum auto insurance coverage in New York?

New York requires a minimum coverage of 25/50/10, which includes $25,000 bodily injury liability per person, $50,000 per accident, and $10,000 property damage liability.

Read more: Types of Car Insurance Coverage

What happens if I don’t maintain car insurance in New York?

Failing to maintain car insurance can result in fines, license and registration suspension, and daily civil penalties. Prolonged lapses can also lead to vehicle impoundment and misdemeanor charges. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Can I drive legally without insurance in New York if I’m not at fault in an accident?

No, all drivers in New York must maintain at least the minimum coverage. Driving without insurance can result in license and registration revocation for up to a year, regardless of fault.

How much does car insurance cost in New York on average?

Car insurance rates vary by provider and city, but rates start as low as $44 per month with USAA for minimum coverage, while other providers like Progressive and State Farm offer competitive rates.

Read more: How much insurance coverage do I need?

What documents do I need to show proof of insurance in New York?

Drivers must carry paper copies of their insurance ID cards and present them when asked by a police officer, registering their vehicle, or after an accident.

Are personal injury protection (PIP) and uninsured motorist coverage required in New York?

Yes, New York requires PIP and uninsured motorist coverage as part of its no-fault insurance laws, providing additional financial protection for drivers.

Read more: What does car insurance cover?

What are the daily civil penalties for lapsing in insurance coverage in New York?

Daily penalties range from $8 for the first 30 days to $12 for lapses of 61–90 days. If the lapse exceeds 90 days, the state may suspend your license and registration.

How can I avoid penalties if my car insurance coverage lapses in New York?

Return your license plates to the DMV immediately to avoid registration suspension and additional fees. This must be done within 90 days of the lapse.

Read more: How to Find a Car Insurance Company Using the Policy Number

What are the consequences of driving uninsured in New York?

Consequences include fines of up to $1,500, reinstatement fees of up to $750, license suspension, and vehicle impoundment until valid insurance proof is provided. Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

How can I find affordable car insurance in New York?

Compare rates from providers like USAA, Progressive, and State Farm, which offer competitive rates for New York car insurance minimum coverage, starting as low as $44 per month.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.