Cheapest Car Insurance for 23-Year-Old Drivers in 2026 (Save With These 10 Companies!)

Get the cheapest car insurance for 23-year-olds from the best companies like USAA, American Family, and State Farm. USAA car insurance price is around $60/mo for 23-year-olds but exclusive to military families only. Take a look at the cheapest car insurance for 23-year-old and young drivers below.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Company, Healthl...

Melissa Morris

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2025

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

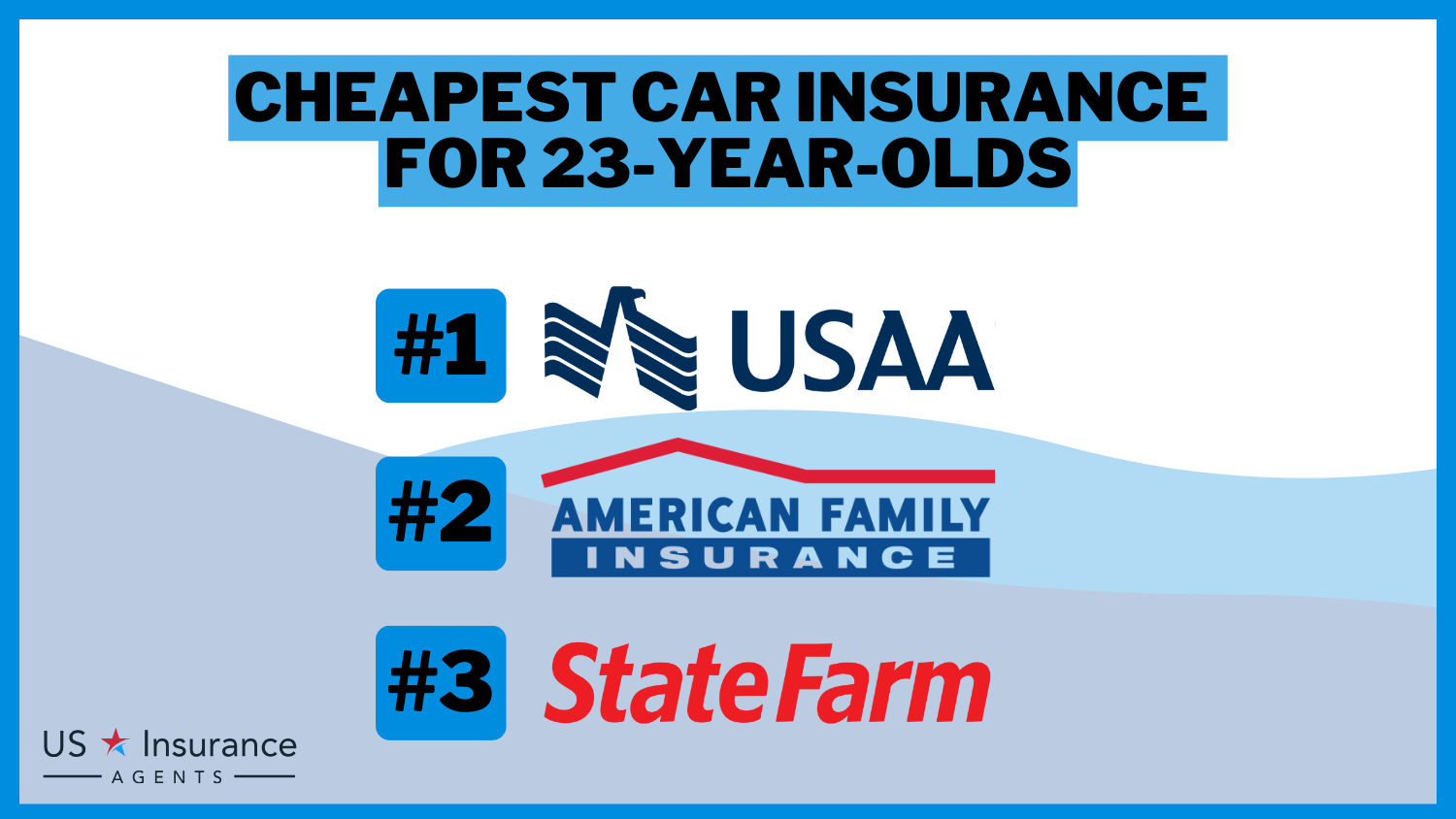

18,157 reviewsOur Top 10 Company Picks: Cheapest Car Insurance for 23-Year-Old Drivers

Our Top 10 Company Picks: Cheapest Car Insurance for 23-Year-Old Drivers| Company | Rank | Monthly Rates | Usage-Based Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $60 | 30% | Military Savings | USAA | |

| #2 | $70 | 30% | Cheap Rates | American Family | |

| #3 | $70 | 30% | High-Risk Savings | State Farm | |

| #4 | $72 | 25% | Many Discounts | Geico | |

| #5 | $75 | 40% | Usage Discount | Nationwide | |

| #6 | $80 | 30% | Student Savings | Travelers | |

| #7 | $80 | 40% | Pay-Per-Mile Savings | Allstate | |

| #8 | $85 | 30% | Bundling Policies | Farmers | |

| #9 | $85 | 30% | Alumni Discount | Liberty Mutual |

| #10 | $90 | 30% | Online Convenience | Progressive |

With USAA, 23-year-olds pay $175 monthly for full coverage car insurance and $60 for minimum coverage. However, you can find cheap car insurance for a 23-year-old by comparing costs from the best insurance companies.

- USAA is our top pick for the cheapest auto insurance for 23-year-olds

- 23-year-old drivers pay around $206 monthly for full coverage auto insurance

- Compare costs and discounts to find the best insurance for 23-year-olds

We’ll look at the cheapest car insurance for 23-year-olds, how much car insurance is for 23-year-olds per month, and the best car insurance coverage for new drivers. Enter your ZIP code to start comparing free car insurance quotes for 23-year-old drivers today.

How 23-Year-Olds Can Get Discounts to Save on Car Insurance

When searching for the cheapest car insurance for a 23-year-old driver, it’s crucial to explore the best car insurance discounts and savings. Many insurance companies offer discounts for young and new drivers. While cheaper car insurance when you turn 25 is common, 23-year-olds can still find affordable options.

Dani Best Licensed Insurance Producer

Companies that offer the lowest car insurance rates for new drivers have special programs for young adults.

Car insurance for 30-year-olds is usually cheaper but 23-year-olds can get many of the same discounts that make the best car insurance for 30-year-olds affordable. Look into these options and you can get the cheapest car insurance for 23-year-old drivers.

Read More:

- Best Drivers Education Car Insurance Discounts

- Safety Features Car Insurance Discount

- Good Driver Car Insurance Discount

- Good Student Car Insurance Discount

Bundle Policies to Maximize Savings on Car Insurance for 23-Year-Olds

Bundling car and home insurance discounts alongside other policies can be a game-changer in finding affordable car insurance at age 23. By bundling policies under the same insurer, you simplify your insurance management and enjoy significant savings.

This approach allows 23-year-old drivers to take advantage of the best multi policy car insurance discounts, making car insurance more affordable without compromising coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Impact Car Insurance Rates for 23-Year-Old and New Drivers

Insurance companies consider several factors when setting car insurance rates for 23-year-old drivers. Since 23-year-olds are inexperienced drivers compared to other ages, they get charged higher premiums. Check out this table to compare the average car insurance for a 23-year-old from the top car insurance providers:

23-Year-Olds Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$80 $210

$73 $195

$83 $215

$72 $180

$85 $220

$75 $200

$90 $230

$70 $190

$80 $210

$60 $175

Who has the cheapest car insurance? As you can see, USAA offers the cheapest 23-year-old insurance rates, starting at $60 monthly, but only drivers in military families qualify for coverage.

So make sure to check other cheap car insurance companies for new drivers that fits you best.

However, other factors also contribute to how much car insurance is for a 23-year-old per month, including driving record, vehicle type, and location.

Lowering Your Car Insurance Rates for 23-Year-Old Drivers by Credit Score

Your credit score can impact your car insurance premiums, even as a 23-year-old driver. Insurance companies often use credit scores to assess the riskiness of insuring an individual. Check out the table below to see how much 23-year-old drivers pay for car insurance based on credit:

23-Year-Olds Car Insurance Monthly Rates by Credit Score

Insurance Company Good Credit Fair Credit Bad Credit

$160 $185 $220

$150 $180 $210

$165 $190 $230

$145 $170 $200

$170 $200 $235

$155 $185 $215

$165 $190 $225

$150 $175 $205

$155 $180 $220

$140 $160 $190

Understanding how your credit score impacts car insurance is essential to building a good score and lowering rates. Achieve good credit by paying debts on time, keeping low credit utilization, and avoiding unnecessary credit inquiries.

Car insurance is the cheapest when you get good credit as this shows insurers you are financially responsible, so it’s a great way for 23-year-olds to lower car insurance rates.

How Deductible Amount Affects 23-Year-Old Car Insurance Rates

Choosing the right deductible for your car insurance as a 23-year-old is an important decision that affects your premium and out-of-pocket costs. A deductible is the amount you must pay before your insurance coverage kicks in. Check out how much 23-year-old drivers might pay for auto insurance by deductible amount:

23-Year-Olds Car Insurance Monthly Rates by Deductible Amount

Insurance Company $250 Deductible $500 Deductible $1,000 Deductible

$195 $175 $155

$190 $170 $150

$200 $180 $160

$185 $165 $145

$205 $185 $165

$192 $172 $152

$198 $178 $158

$187 $167 $147

$194 $174 $154

$180 $160 $140

As you can see, raising your deductible lowers premiums for 23-year-old drivers but results in higher out-of-pocket costs after an accident. When deciding on a deductible, consider your financial situation and how much you can pay if an accident occurs.

Finding the right balance between deductible amounts and monthly rates is critical to finding the best insurance for 23-year-olds.

Get the Best Insurance for 23-Year-Olds With a Good Driving Record

Your driving record also impacts car insurance rates for 23-year-olds, as insurance companies use it to evaluate your risk as a driver. Of course, if you have a history of DUIs, tickets, or accidents, insurers may view you as a higher risk.

On the other hand, a clean driving record can lead to lower insurance rates. The table below compares car insurance rates for 23-year-olds by driving record.

23-Year-Olds Car Insurance Monthly Rates by Driving Record

Insurance Company Clean Record One Ticket One Accident One DUI

$160 $185 $205 $290

$155 $180 $200 $280

$165 $190 $210 $295

$150 $175 $195 $275

$170 $195 $215 $300

$157 $182 $202 $282

$163 $188 $208 $288

$152 $177 $197 $277

$162 $187 $207 $287

$145 $170 $190 $270

As you can see, maintaining a safe driving record is essential for 23-year-old drivers to lower their auto insurance premiums and stay safe on the road.

How Location Affects 23-Year-Old Car Insurance Rates

Check out the map below to compare car insurance rates for 23-year-old drivers as well as knowing where’s the cheapest car insurance by state:

Where you live impacts your auto insurance premiums since each state has different levels of risk.

Read More: How does the insurance company determine my premium?

How Maintaining Continuous Coverage Impacts Auto Insurance Rates for 23-Year-Olds

Maintaining continuous car insurance coverage is critical for young drivers, including 23-year-olds. Letting your insurance coverage lapse can have serious consequences, including higher premiums, legal issues, and the need for high-risk car insurance.

Take a look at the table below to see how much high-risk coverage for 23-year-olds costs vs. standard insurance:

23-Year-Olds Car Insurance Monthly Rates for High-Risk vs. Standard Coverage by Provider

Insurance Company High Risk Standard

$310 $210

$290 $190

$325 $225

$280 $180

$330 $220

$300 $200

$340 $230

$285 $195

$315 $215

$265 $175

Insurance companies view continuous coverage as a positive factor, as it demonstrates responsibility and lowers the risk of uninsured accidents.

Can you insure a car that is not in your name? Even if you’re not currently driving or don’t own a vehicle, 23-year-old drivers should consider maintaining non-owner car insurance to ensure continuous coverage and protect themselves if they borrow or rent a car.

How Age Affects Car Insurance Premiums for 23-Year-Old Drivers

Age significantly impacts car insurance rates for 23-year-old drivers since insurers consider them more prone to accidents and risky behavior due to driving inexperience. Therefore, rates for 23-year-olds tend to be higher than older drivers.

Check out the table below to compare average monthly car insurance rates for 23-year-olds vs. other age groups:

Car Insurance Average Rates for 23-Year-Olds vs. Other Age

Age Rates

19-Year-Old $310

23-Year-Old

$190

29-Year-Old

$165

39-Year-Old

$150

49-Year-Old

$140

59-Year-Old

$130

69-Year-Old

$135

70+Year-Old $145

What age do you get cheaper car insurance? As you can see, insurance companies begin to lower car insurance rates once you turn 25.

How to Lower Auto Insurance Rates for 23-Year-Old Drivers

Car insurance can be pricier for 23-year-olds compared to older folks, but there are some easy ways to bring those costs down. Effective way is to maintain a clean driving record by avoiding traffic violations and accidents.

Some companies also use telematics programs to monitor driving habits and reward safe drivers with lower rates, which could be a good option for 23-year-old drivers.

Additionally, some insurers offer discounts for installing safety features in your vehicle or using telematics devices that track your driving habits.

For example, American Family’s KnowYourDrive program is a great way for 23-year-old drivers to save on auto insurance. So, get a quote from American Family Insurance to see if their coverage is right for you.

23-year-old drivers can also consider taking defensive driving courses, which insurance companies often reward with discounts. Another way to save money is by bundling your car insurance with other policies, such as renters’ insurance or homeowner’s insurance, to get significant savings.

Different Car Insurance Coverage Types 23-Year-Olds Should Know About

When searching for the best car insurance options for 23-year-olds, it’s crucial to consider factors such as coverage limits, deductibles, cost, and coverage needs.

For example, if you have an older car that isn’t worth much. Here are some other auto insurance coverages 23-year-olds should consider:

- Personal Injury Protection: Since young drivers are more prone to accidents, they should consider personal injury protection (PIP) insurance or medical payments coverage to help pay for injuries after an accident.

- Roadside Assistance: Roadside assistance coverage is a great option for young drivers away at school who might not have extensive knowledge of vehicle maintenance.

- Gap Insurance: Many young drivers lease or finance vehicles. So, gap insurance helps 23-year-old drivers pay the difference between what they owe and their car’s value after an accident. Read more to find the best car insurance for gap insurance.

However, if you have a newer or more expensive car, full coverage, which includes collision and comprehensive car insurance, may be needed for added protection. Always consider your coverage needs and compare insurance to have the best insurance for 23-year-olds.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

10 Cheapest Car Insurance Companies for 23-Year-Old Drivers

#1 – USAA: Cheapest for Military Families

Pros

- USAA’s Cheap Insurance Rates: You’ll find the cheapest overall rates for 23-year-old drivers with USAA. Read more in our USAA insurance review.

- Good Financial and Customer Service: USAA has an A+ rating from A.M. Best and a low complaint score. So, 23-year-olds concerned about customer service and financial security should consider USAA.

- One-Stop-Shop for Insurance: You can bundle various insurance products for 23-year-old drivers to maximize savings.

Cons

- Limited Eligibility: USAA’s auto insurance coverage is only available to 23-year-olds who served in the military or have a spouse or parent who did.

- Membership Required for Quote: You must have an active USAA membership to get a car insurance quote from the company.

#2 – American Family: Cheapest for All 23-Year-Olds

Pros

- Cheapest for All 23-Year-Olds: American Family offers some of the cheapest 23-year-old car insurance rates. (Read More: American Family Insurance Car Insurance Review & Ratings)

- Few Complaints: You can also rest assured that American Family has excellent customer service since it has a low complaint score from the National Association of Insurance Commissioners (NAIC).

- Good BBB Rating: American Family has an A rating from the Better Business Bureau.

Cons

- Higher Rates for Some Demographics: The average car insurance for 23-year-old male drivers might be higher compared to some specialized providers.

- Not Available in All States: You can only get American Family in 19 states.

#3 – State Farm: Various Discount Options

Pros

- Various Discounts: State Farm offers various car insurance discounts for 23-year-olds, like its good driver plan, good Student option, and Steer Clear program.

- High-Risk Rates: State Farm offers cheaper high-risk car insurance rates for 23-year-olds. Learn more in our State Farm car insurance review.

- Great Financial Ratings: State Farm’s financial health is rock-solid. That A++ grade from A.M. Best is a testament to its ability to handle claims.

Cons

- No Gap Insurance: One potential drawback for 23-year-old drivers with new vehicles is that State Farm doesn’t offer gap insurance.

- Discounts Vary: State Farm’s discount eligibility, availability, and amounts vary by state.

#4 – Geico: Cheapest for All Young Drivers

Pros

- Cheap for All Young Drivers: Geico still offer affordable rates for all 23-year-olds, you’ll find the lowest cost for drivers ranging from 16 to 25 from Geico. (Read More: Geico vs. State Farm Car Insurance)

- Long Discount List: Geico has one of the longest lists of car insurance discounts of any competitor. 23-year-old drivers could save even more with Geico’s pay-per-mile car insurance.

- Great Online Tools: Geico offers convenient online and mobile policy management for 23-year-olds with busy schedules.

Cons

- No Gap or Rideshare Insurance: Geico doesn’t offer gap or rideshare insurance. So, 23-year-olds who own a financed car or use their vehicle for a rideshare company might find that Geico isn’t their best fit.

- Few Local Agents: You won’t find many local agents for personalized customer service at Geico.

#5 – Nationwide: Excellent Usage-Based Savings

Pros

- Largest Usage-Based Discount: Nationwide SmartRide has the largest usage-based insurance discount of all the companies. So, 23-year-olds who drive safely should consider Nationwide.

- Vanishing Deductible: Nationwide’s vanishing deductible program awards you $100 off your deductible each year, which could lower the average car insurance for 23-year-old good drivers.

- Good Financial and Customer Service: Nationwide has an A+ from the Better Business Bureau and an A+ from A.M. Best.

Cons

- Not Available Nationwide: You can’t get a cheap car insurance policy for 23-year-olds from Nationwide in Alaska, Hawaii, Louisiana, or Massachusetts.

- Poor Claims Satisfaction: Nationwide has a below-average J.D. Power claims satisfaction score (Read More: Nationwide Insurance Review & Ratings).

#6 – Travelers: Many Unique Coverages

Pros

- Female Discounts: Car insurance for 23-year-old female drivers could save with Travelers car insurance discounts for multiple policies.

- Few Complaints: Travelers has a 0.31 complaint index from the NAIC, while the national average is 1.00. (Learn More: Travelers Insurance Review & Ratings)

- Many Coverages: With Travelers, car insurance for a 23-year-old can include new car replacement, gap insurance, and rideshare insurance options.

Cons

- Expensive With Poor Credit: Travelers has higher average car insurance rates for 23-year-old drivers with poor credit compared to other insurers.

- Low Customer Satisfaction: Travelers had low customer satisfaction compared to competitors, according to a 2023 study from J.D. Power.

#7 – Allstate: Best Pay-Per-Mile Program

Pros

- Best Pay-Per-Mile Program: Allstate Milewise, the company’s pay-per-mile insurance program, charges you based on how many miles you drive. Read more in our Allstate Milewise review.

- Perks and Benefits: One of the perks of being an Allstate policyholder is a safe driving bonus that you can get every six months.

- Claims Guarantee: If you do not feel that your claim is treated well, Allstate gives you a premium credit for a total of six months.

Cons

- Expensive DUI Rates: Allstate has some of the highest rates for 23-year-old drivers with a DUI, higher than other insurers without violations.

- Low J.D. Power Score: Allstate ranked low in the 2023 J.D. Power Auto Insurance Study (Learn More: Allstate Insurance Review & Ratings).

#8 – Farmers: Policy Customization

Pros

- Good Bundling Discounts: Farmers has some of the best discounts for bundling policies, such as auto, home, renters, or RV. (Read More: Farmers Car Insurance Review & Ratings)

- Policy Customization: Farmers allows you to shape your policy the way you want. This is especially valuable for those asking how much customized car insurance costs for 23-year-old drivers.

- Extensive Agency Network: 23-year-olds who want to work with a Farmers agent can likely find an in-person officer in their area.

Cons

- Not Available Everywhere: You can’t get a Farmers policy in Alaska, Delaware, Hawaii, Maine, New Hampshire, Rhode Island, Vermont, or West Virginia.

- Not the Cheapest: Other auto insurance companies with better financial ratings have lower rates than Farmers.

#9 – Liberty Mutual: Various Discounts

Pros

- Great Discounts: Liberty Mutual has a long list of discounts that could benefit 23-year-olds. (Read More: Liberty Mutual Review & Ratings)

- 24/7 Claims Assistance: 23-year-olds who keep late hours can file a claim or check on it 24/7 with Liberty Mutual.

- Available in all 50 States: You can get Liberty Mutual coverage in all 50 states.

Cons

- Expensive for Most Drivers: Liberty Mutual is one of the most expensive companies for various driver types and 23-year-olds.

- High Complaint Index: Liberty Mutual has a 3.09 complaint index score from the NAIC, three times higher than average.

#10 – Progressive: Name Your Price Tool

Pros

- Snapshot Program: With Progressive Snapshot, 23-year-olds who drive safely can lower their car insurance premiums by up to 30%. See how you could save in our Progressive Snapshot review.

- Name Your Price Tool: This program allows 23-year-old drivers to tell the tool how much they’re willing to pay for insurance.

- Mobile App: Progressive has a sophisticated mobile app for policy management and paying premiums.

Cons

- Most Expensive for 23-Year-Olds: Of all companies in our ranking, Progressive is the most expensive company for 23-year-old drivers. (Read More: Progressive Car Insurance Review & Ratings)

- Potential Rate Increases: You could see higher rates if you get involved in an accident with Progressive.

Shopping Around for Affordable Car Insurance for 23-Year-Olds

Shopping around for the best car insurance is vital for everyone, but it’s particularly crucial for 23-year-olds. USAA has the cheapest car insurance for 23-year-old drivers, averaging $60 monthly for minimum coverage, but only military members, veterans, and their families qualify for coverage. For 23-year-olds, it’s wise to get a USAA insurance quote online.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

What age group has the cheapest car insurance?

Teen drivers pay the highest rates for car insurance, averaging $310 monthly.

Why is my first-time insurance so expensive?

First-time insurance, particularly for 23-year-olds, can be expensive because insurers perceive new drivers as high risk because they lack driving history, which affects those who have the cheapest car insurance for new drivers.

What are some common mistakes to avoid when purchasing car insurance at 23?

One mistake 23-year-old drivers shopping for auto insurance should avoid is focusing on price and disregarding an insurer’s coverage or customer service. Additionally, failing to shop around and get cheap car insurance quotes for new drivers can result in missed opportunities for savings.

It’s also crucial to provide accurate information when obtaining monthly car insurance quotes, as any discrepancies can lead to issues in the future. Being aware of these common mistakes will help you make better choices and find the cheapest car insurance for 23-year-olds.

Which gender pays more for car insurance?

While gender-based pricing varies by state, men usually pay higher auto insurance rates than women due to higher accident rates.

Does car insurance automatically go down at 25?

While your auto insurance rates continue to fall when you turn 25, it’s not an automatic rule.

Will your insurance go down when you turn 23?

While you mostly hear about insurance going down when you turn 25 with Geico and other providers, you’ll see the most significant reduction in your early 20s. Learn more about when drivers in their 20s can expect to get cheaper rates in our guide that answers the question, “What age do you get cheaper car insurance?“

Does Geico offer pay-per-mile insurance?

No, Geico’s pay-per-mile is not available like some of its competitors.

How do 23-year-old motorists get around the intricacies of motor insurance?

Car insurance can be tricky as a young driver. Keep in mind to search for low-cost, dependable coverage that will safeguard you and your funds when an accident or unforeseen occurrences happen.

Do 23-year-old drivers qualify to be covered under their parents’ automobile policy?

Yes, for most instances, 23-year-old drivers can be included in their parents’ car insurance policy as additional drivers. This will at times result in lower premiums since the policy may already enjoy discounts or a good driving history.

Are there any discounts available for 23-year-old drivers to get cheaper car insurance?

Yes, the drivers who are 23 years of age frequently qualify for discounts so that they may lower the premiums on their auto insurance. Among the discounts frequently offered are good student insurance discounts, multi-policy discounts, and safe driver discounts.

Which car insurance is cheapest for 23-year-old drivers?

Can cheap car insurance for 23-year-old motorists be had without sacrificing coverage?

What are some tips for 23-year-old drivers to lower their car insurance premiums?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.