Cheap Chrysler Concorde Car Insurance in 2026 (10 Most Affordable Companies)

State Farm, Travelers, and USAA are the top picks for cheap Chrysler Concorde car insurance, with monthly rates as low as $35. This guide explores how these leading providers offer the most affordable options, factors influencing costs, and tips for finding the best coverage to get the most value for your money.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2024

18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Chrysler Concorde

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage for Chrysler Concorde

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage for Chrysler Concorde

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsWhen it comes to finding cheap Chrysler Concorde car insurance, State Farm, Travelers, and USAA emerge as the top contenders, offering monthly rates as low as $35.

In this comprehensive guide, we delve into the intricacies of insurance rates for the Chrysler Concorde, exploring factors such as driver demographics, vehicle safety features, and location impact. See if you’re getting the best deal on car insurance by entering your ZIP code above.

Our Top 10 Company Picks: Cheap Chrysler Concorde Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $35 B Nationwide Network State Farm

#2 $40 A++ Multiple Discounts Travelers

#3 $45 A++ Military Benefits USAA

#4 $50 A+ Customer Service Amica

#5 $55 A+ Vanishing Deductible Nationwide

#6 $60 A Customized Plans Farmers

#7 $65 A Accident Forgiveness Liberty Mutual

#8 $70 A++ Affordable Rates Geico

#9 $75 A+ Snapshot Program Progressive

#10 $80 A+ Safe Driving Allstate

While many factors contribute to insurance costs, State Farm stands out as the top pick overall, providing competitive rates and comprehensive coverage options.

- Top picks for cheap Chrysler Concorde insurance: State Farm, Travelers, USAA

- Factors affecting rates: driver age, vehicle safety, location

- State Farm stands out choice with affordable rates and coverage

#1 – State Farm: Top Overall Pick

Pros

- Reputation for Customer Service: State Farm is known for excellent customer service and support, as highlighted in the State Farm insurance review & ratings.

- Discounts for Safety Features: Offers discounts for vehicles equipped with anti-theft devices, airbags, and other safety features.

- Bundling Options: Provides discounts for bundling home and auto insurance.

Cons

- Higher Premiums for Young Drivers: Typically charges higher premiums for younger or inexperienced drivers.

- Limited Coverage for Modified Cars: May not offer sufficient coverage options for heavily modified or vintage Chrysler Concordes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Competitive Pricing

Pros

- Competitive Pricing: Offers competitive rates for Chrysler Concorde insurance.

- Discounts for Hybrid/Electric Vehicles: Special discounts for eco-friendly vehicles, as mentioned in the Travelers insurance review & ratings.

- Comprehensive Coverage Options: Offers extensive coverage options, including roadside assistance and gap insurance.

Cons

- Limited Availability of Agents: Fewer local agents may result in less personalized service.

- Higher Premiums for High-Risk Drivers: Tends to charge more for drivers with a history of accidents or violations.

#3 – USAA: Best for Competitive Rates for Eligible Members

Pros

- Excellent Customer Satisfaction: Consistently high customer satisfaction ratings.

- Competitive Rates: Offers highly competitive rates for eligible members.

- Comprehensive Coverage Options: Wide range of coverage options, including for vintage and modified cars.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer physical locations compared to larger insurers, as noted in the USAA insurance review & ratings.

#4 – Amica: Best for Customer Service Excellence

Pros

- Customer Service Excellence: Highly rated for customer service and claims satisfaction.

- Dividend Policies: Offers dividend policies that can return a portion of your premium.

- Flexible Coverage Options: Customizable coverage options to fit specific needs, as detailed in the Amica Homeowners Insurance Review.

Cons

- Higher Premiums: Can be more expensive compared to other insurers.

- Limited Availability: Not available in all states.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Deductible decreases for each year of safe driving.

- On Your Side® Review: Annual reviews to ensure policyholders get the best rates and coverage.

- Accident Forgiveness: Helps prevent rate increases after the first at-fault accident.

Cons

- Higher Rates for High-Risk Drivers: Tends to have higher premiums for those with poor driving records.

- Mixed Customer Service Reviews: Customer service experiences can vary widely, as noted in the Nationwide insurance review & ratings.

#6 – Farmers: Best for Customized Coverage

Pros

- Customized Coverage: Flexible policies tailored to individual needs.

- Accident Forgiveness: Available to prevent premium increases after an accident.

- Discounts for Safety Features: Savings for vehicles with advanced safety features, as highlighted in the Farmers insurance review & ratings.

Cons

- Higher Base Rates: Generally higher base rates compared to some other insurers.

- Limited Online Tools: Online account management and resources are less comprehensive.

#7 – Liberty Mutual: Best for Various Discounts

Pros

- Better Car Replacement: Replaces totaled cars with a model one year newer.

- Various Discounts: Offers multiple discounts, including for safety features and bundling policies.

- Accident Forgiveness: Protects rates from increasing after the first accident.

Cons

- Mixed Customer Service Reviews: Experiences with customer service and claims handling can be inconsistent.

- Higher Rates in Some Areas: Premiums can be higher in certain geographic regions, as noted in the Liberty Mutual Review & Ratings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Known for offering some of the lowest rates in the industry, Geico Car Insurance Discounts are widely sought after by savvy customers.

- Digital Tools: Easy-to-use online tools for managing policies and filing claims.

- Multi-Policy Discounts: Significant discounts available when bundling multiple policies.

Cons

- Customer Service: Mixed reviews on customer service quality.

- Limited Local Agents: Fewer local agents may mean less personalized service.

#9 – Progressive: Best for Snapshot Program

Pros

- Customizable Coverage: Flexible coverage options allow for tailoring policies to fit specific needs.

- Snapshot Program: Usage-based insurance program can lead to significant discounts for safe drivers.

- Wide Range of Discounts: Multiple discounts available, including for multi-car policies, good students, and safe drivers.

Cons

- Higher Rates After Claims: Premiums may increase significantly after filing a claim, according to Progressive insurance review & ratings.

- Complex Policies: Some customers find the range of options and policies complicated and difficult to navigate.

#10 – Allstate: Best for Good Hands® Network

Pros

- Good Hands® Network: Extensive network of agents provides personalized service and support.

- Claim Satisfaction Guarantee: Offers a satisfaction guarantee for the claims process, according to Allstate insurance review & ratings.

- Safe Driving Discounts: Provides discounts for safe driving habits and for completing defensive driving courses.

Cons

- Higher Base Rates: Generally higher base rates compared to other discount-focused insurers.

- Coverage Gaps for Vintage Cars: May not provide comprehensive coverage options for vintage Chrysler Concorde models.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

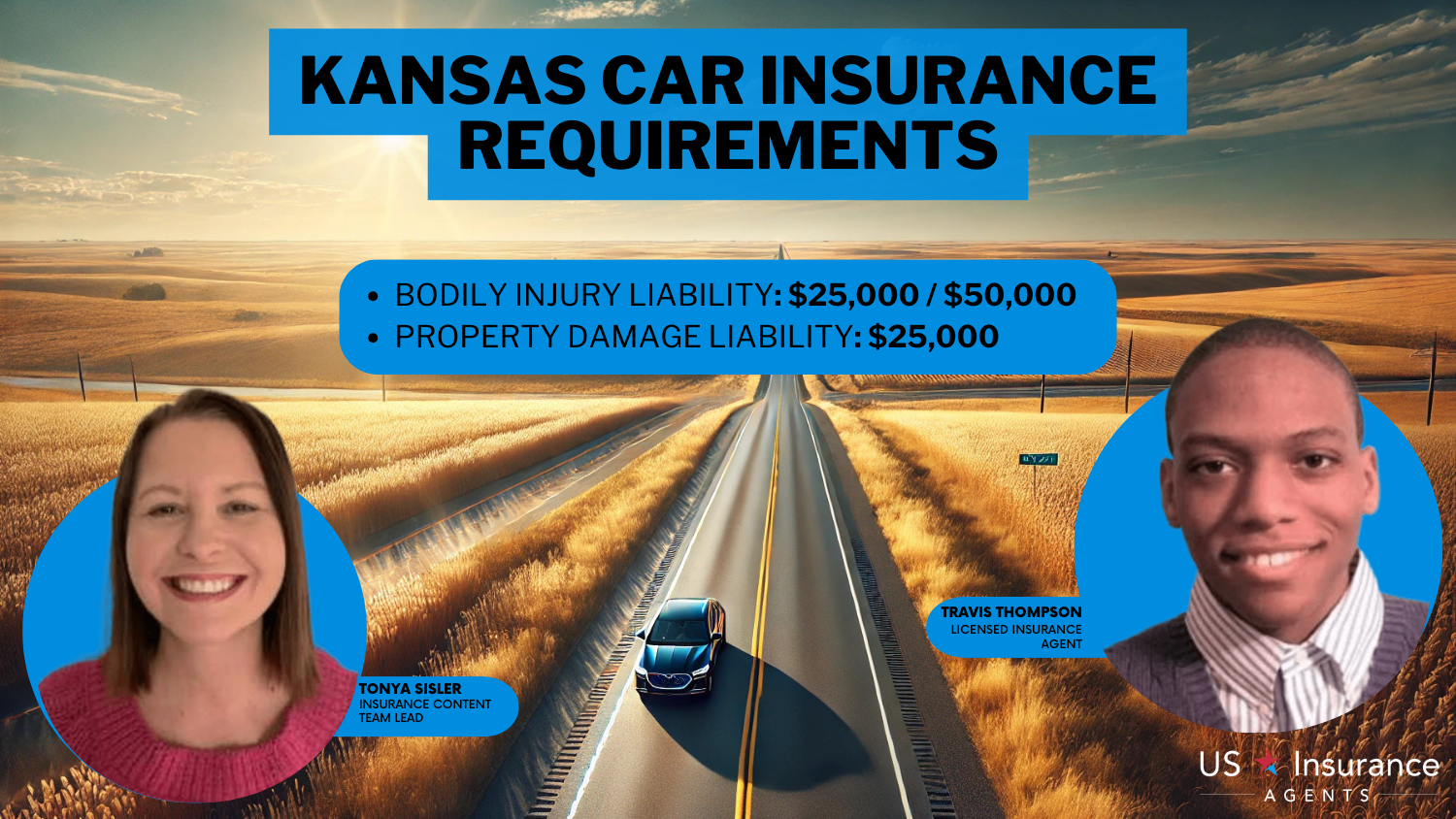

Understanding the Insurance Requirements for a Chrysler Concorde

Before you start looking for car insurance for your Chrysler Concorde, it’s important to understand the insurance requirements set by your state. Each state has its own minimum liability insurance coverage requirements, which typically include bodily injury liability and property damage liability. It’s important to comply with these requirements to ensure you are legally covered on the road.

In addition to the minimum liability coverage requirements, it’s also important to consider additional coverage options for your Chrysler Concorde. Comprehensive coverage can protect you against non-collision related damages, such as theft, vandalism, or natural disasters.

Kristine Lee Licensed Insurance Agent

Collision coverage, on the other hand, can help cover the cost of repairs or replacement if your vehicle is involved in an accident. It’s recommended to evaluate your individual needs and budget to determine the appropriate level of coverage for your Chrysler Concorde.

Comparing Insurance Rates for Different Models of the Chrysler Concorde

When shopping for car insurance for your Chrysler Concorde, it’s a good idea to compare rates from different insurance companies. Rates can vary significantly between insurers, so it’s worth taking the time to shop around and find the best deal. Requesting quotes from multiple companies can help you determine the average cost of insurance for your specific model and coverage needs.

One factor that can affect insurance rates for different models of the Chrysler Concorde is the car’s safety features. Insurance companies often offer lower rates for vehicles equipped with advanced safety features such as anti-lock brakes, airbags, and electronic stability control. These features can help reduce the risk of accidents and injuries, making the car less expensive to insure.

Another factor that can impact insurance rates is the car’s age and condition. Older models of the Chrysler Concorde may have higher insurance rates due to their increased risk of mechanical issues and higher likelihood of being stolen.

Car Insurance for Chrysler Concorde: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $175

Amica $50 $145

Farmers $60 $155

Geico $70 $165

Liberty Mutual $65 $160

Nationwide $55 $150

Progressive $75 $170

State Farm $35 $120

Travelers $40 $130

USAA $45 $125

Additionally, if the car has been involved in previous accidents or has a history of frequent claims, insurance companies may charge higher premiums to offset the increased risk. Discover our comprehensive guide to “How much is car insurance?” for additional insights.

Factors That Affect the Cost of Chrysler Concorde Car Insurance

There are various elements that insurance companies consider when determining the cost of insuring a Chrysler Concorde. Some of the key factors include:

- Driving Record: Your driving history plays a significant role in determining your insurance rates. If you have a clean driving record with no accidents or traffic violations, you are likely to pay lower premiums.

- Age: Younger drivers tend to pay higher insurance rates compared to more experienced drivers. This is because inexperienced drivers are considered higher risk.

- Location: Where you live also affects your insurance rates. If you reside in an area with high accident rates or theft rates, you can expect to pay more for your car insurance.

- Credit History: Some insurance companies also look at your credit history when determining your insurance rates. Maintaining a good credit score can help you get better rates.

- Model Year and Value: The age and value of your Chrysler Concorde will also impact your insurance rates. Newer and more expensive models typically have higher premiums.

- Annual Mileage: The number of miles you drive in a year can affect your insurance rates. If you have a long commute or frequently use your vehicle for long trips, you may have higher premiums.

- Deductible: The amount you choose for your deductible can also impact your insurance rates. A higher deductible can lower your premiums but will mean you pay more out of pocket in the event of a claim.

- Vehicle Safety Features: The presence of safety features in your Chrysler Concorde can also affect your insurance rates. Insurance companies often offer discounts for vehicles equipped with features such as anti-lock brakes, airbags, and anti-theft devices.

- Insurance History: Your previous insurance history can also impact your rates. If you have a history of filing multiple claims or have been involved in frequent accidents, insurance companies may consider you a higher risk and charge higher premiums.

Remember to regularly review your insurance policy to make adjustments as your circumstances change and to explore discounts that you may be eligible for. By staying informed and proactive, you can effectively manage the cost of insuring your Chrysler Concorde while maintaining adequate coverage and peace of mind on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for Your Chrysler Concorde

While insurance rates for a Chrysler Concorde may vary, there are several steps you can take to find more affordable coverage:

- Consider Increasing Your Deductible: Opting for a higher deductible can lower your insurance premiums.

- Look for Discounts: Many insurance companies offer discounts for things like safe driving records, bundling policies, or completing defensive driving courses. Be sure to ask about any available discounts.

- Improve Your Credit Score: Maintaining good credit can help lower your insurance rates.

- Drive Safely: Avoiding accidents and traffic violations can keep your insurance rates lower over time.

- Consider Usage–Based Insurance: Some insurers offer usage-based insurance programs where your rates are determined by driving habits and mileage. If you are a low-mileage driver or have safe driving habits, this may result in lower premiums.

Additionally, it can be beneficial to shop around and compare quotes from multiple insurance providers. Rates can vary significantly between companies, so taking the time to research and compare options can help you find the most affordable coverage for your Chrysler Concorde. For more information, explore our informative “Best New Vehicle Car Insurance Discounts” page.

Exploring Coverage Options for Your Chrysler Concorde

When it comes to car insurance, you have several coverage options to consider. In addition to the state-required liability coverage, you may want to consider additional coverage such as:

- Collision Coverage: This coverage helps pay for damage to your Chrysler Concorde in the event of a collision, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against non-collision-related incidents such as theft, vandalism, fire, or weather damage.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you financially if you are involved in an accident with a driver who does not have insurance or does not have enough coverage to pay for damages.

- Medical Payments Coverage: Medical payments coverage pays for medical expenses for you and your passengers in the event of an accident.

In conclusion, exploring coverage options for your Chrysler Concorde involves understanding the various types of insurance available, including liability, collision, comprehensive, and additional add-ons such as roadside assistance and rental car coverage.

By carefully considering your driving habits, budget, and the specific needs of your vehicle, you can select a policy that provides optimal protection and peace of mind. Taking the time to review and compare different insurance providers and plans will ensure that you find the best coverage to keep your Chrysler Concorde well-protected on the road. Explore our detailed analysis on “Collision Car Insurance: A Complete Guide” for additional information.

The Importance of Shopping Around for the Best car Insurance Deal for Your Chrysler Concorde

It’s important to remember that when it comes to car insurance, not all policies are created equal. That’s why it’s crucial to shop around and compare different insurance options for your Chrysler Concorde.

By taking the time to research and obtain quotes from multiple insurers, you can find the best deal that meets your coverage needs and budget. Expand your understanding with our thorough “Insurance Quotes Online” overview.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Mistakes to Avoid When Purchasing Car Insurance for a Chrysler Concorde

How to Save Money on Chrysler Concorde Car Insurance Without Compromising Coverage

Finding affordable car insurance is crucial, but equally important is ensuring you have sufficient coverage. If you’re able to cover out-of-pocket expenses in case of a claim, opting for a higher deductible can be beneficial.

Take advantage of discounts like safe driver or multi-policy discounts that insurance companies offer. For older vehicles with lower value like a Chrysler Concorde, consider reducing coverage to match its current worth.

It’s essential to review your policy annually and make adjustments according to your current circumstances to ensure you’re adequately covered. By implementing these strategies, you can save money on your Chrysler Concorde car insurance while maintaining the coverage you need.

Regularly reassessing your insurance needs and staying informed about available discounts can help you find the most cost-effective policy. Learn more by visiting our detailed “Lesser Known Car Insurance Discounts” section.

Expert Advice on Getting the Best Value Car Insurance for Your Chrysler Concorde

When it comes to finding the best value car insurance for your Chrysler Concorde, it can be helpful to seek expert advice. Insurance agent or brokers specializing in auto insurance can provide valuable insights and help you navigate the complexities of the insurance market. They can assist you in finding the right coverage options and ensure you get the best value for your money.

Incorporating expert advice ensures you secure the best value car insurance for your Chrysler Concorde. By leveraging insights from professionals, you can make informed decisions tailored to your vehicle and driving needs, ultimately optimizing protection and cost-effectiveness for your peace of mind on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Benefits of Bundling Car Insurance With Other Policies for Your Chrysler Concorde

Bundling car insurance with other policies for your Chrysler Concorde offers a range of significant benefits. Not only does it potentially lower your overall insurance costs, but it also simplifies management by consolidating policies under one provider.

If you have additional insurance needs, bundling your car insurance with other policies can offer several benefits:

- Cost Savings: Insurance companies often provide discounts for bundling multiple policies.

- Simplified Management: Managing multiple policies from a single insurer can be more convenient as you have a single point of contact for all your insurance needs.

- Enhanced Coverage: Bundling policies can sometimes provide additional coverage options or higher coverage limits.

Additionally, bundling can often lead to enhanced coverage options and increased savings, making it a practical and advantageous choice for protecting your Chrysler Concorde comprehensively. Dive deeper into “Can I bundle my car insurance with other policies?” with our complete resource.

Understanding the Factors That Make Chrysler Concorde Car Insurance More Expensive

Understanding the factors that contribute to higher Chrysler Concorde car insurance rates is crucial for informed decision-making. Several key factors include the vehicle’s model year, repair costs, safety ratings, and the driver’s personal driving history and location.

While there are ways to lower the cost of Chrysler Concorde car insurance, some factors may contribute to higher premiums:

- High Accident Rates: If the Chrysler Concorde model has a history of being involved in more accidents, insurance rates may be higher.

- Theft Risk: The likelihood of theft or vandalism can impact insurance rates, especially if your area has a higher crime rate.

- Expensive Repairs: If the Chrysler Concorde requires costly repairs or parts, insurance companies may charge higher rates to offset potential expenses.

By comprehending these elements, you can better navigate insurance options and potentially mitigate costs through informed choices and proactive measures. Read our extensive guide on “How does the insurance company determine my premium?” for more knowledge.

Tips for Lowering Your Premium When Insuring a Chrysler Concorde

While insurance rates can vary, there are steps you can take to potentially lower your premium when insuring a Chrysler Concorde:

- Compare rates from multiple insurance companies to find the most affordable option.

- Increase your deductible if you can afford to pay higher out-of-pocket costs in case of a claim.

- Take advantage of available discounts such as safe driving discounts or multi-policy discounts.

- Consider installing anti-theft devices or security systems to reduce the risk of theft.

By implementing these strategies, you can effectively lower your car insurance premiums for your Chrysler Concorde without compromising on essential coverage.

Regularly reassessing your insurance needs and staying informed about available discounts can help you maintain the most cost-effective policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Specialized Insurance Options for Vintage or Modified Chrysler Concordes

If you own a vintage or modified Chrysler Concorde, you may require specialized insurance coverage. Standard insurance policies may not adequately cover the unique needs and value of these vehicles. Therefore, it is essential to seek out insurance companies that offer policies specifically tailored to vintage or modified cars.

These specialized policies may provide coverage for replacement parts, agreed value, or modifications. Expand your understanding with our thorough “Can I bundle my Nationwide car insurance with other policies?” overview.

How to Navigate the Claims Process When Insuring a Chrysler Concorde

Navigating the claims process when insuring a Chrysler Concorde requires understanding the specific steps and documentation needed to ensure a smooth and efficient resolution.

In the unfortunate event of an accident or damage to your Chrysler Concorde, it’s important to know how to navigate the claims process. Here are some steps to follow:

- Report the Incident: Contact your insurance company as soon as possible to report the incident and file a claim. Provide all required information and documentation.

- Document the Damage: Take photos or videos of the damage to your Chrysler Concorde as evidence for your claim.

- Obtain Repair Estimates: Get repair estimates from authorized mechanics or body shops and submit them to your insurance company. For more information, explore our informative “How to Document Damage for Car Insurance Claims” page.

- Follow Instructions: Cooperate with your insurance company and follow their instructions throughout the claims process.

- Keep Records: Keep copies of all correspondence, documents, and receipts related to your claim. This will help track the progress and ensure a smoother resolution.

By following these guidelines, you can confidently manage any claims that arise and safeguard your investment in your Chrysler Concorde.

Analyzing the Average Cost of Chrysler Concorde Car Insurance Compared to Other Models

When analyzing the average cost of Chrysler Concorde car insurance compared to other models, it’s important to consider the factors mentioned earlier, such as driving record, location, and coverage options. While it is difficult to provide an exact figure without specific details, comparing rates from multiple insurance companies is the best way to determine the average cost for your Chrysler Concorde.

In conclusion, the cost of Chrysler Concorde car insurance depends on various factors such as driving record, age, location, model year, and deductible. To find affordable car insurance, it’s crucial to shop around, compare car insurance quotes, and consider available discounts.

Understanding the insurance requirements for your Chrysler Concorde and exploring coverage options will help you make informed decisions.

Chris Abrams Licensed Insurance Agent

By being proactive and using the tips outlined in this article, you can find the best value car insurance that meets your needs and budget. Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

What factors influence the Chrysler Concorde Limited car insurance cost?

Factors influencing the cost include driver demographics, vehicle safety features, location, driving history, and the insurance provider’s rates.

How can I find the cheapest Chrysler Concorde Limited car insurance quotes?

You can find the cheapest quotes by comparing rates from top providers like State Farm, Travelers, and USAA, which offer monthly rates as low as $35.

Which are the best car insurance companies for Chrysler Concorde Limited?

The best companies for insuring a Chrysler Concorde Limited include State Farm, Travelers, and USAA due to their competitive rates and comprehensive coverage options. Continue reading our full “What is comprehensive coverage?” guide for extra tips.

Does the Chrysler Concorde Limited insurance cost by model year vary significantly?

Yes, the cost can vary significantly depending on the model year, with older models potentially having higher rates due to increased risk of mechanical issues and theft.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What are the primary contributors to the Chrysler Concorde Limited insurance expense?

Primary contributors include the driver’s age, location, driving history, credit score, and the insurance provider’s rates.

What steps can I take to secure the cheapest car insurance for Chrysler Concorde Limited?

To secure the cheapest insurance, maintain a clean driving record, opt for a higher deductible, bundle policies, and take advantage of available discounts. Get more insights by reading our expert “Can I bundle my USAA car insurance with other policies?” advice.

How do I compare Chrysler Concorde Limited car insurance quotes effectively?

Use online comparison tools and contact insurance agents directly to gather multiple quotes and compare prices and coverage options.

What should I know about Chrysler Concorde Limited insurance rates comparison?

Comparing rates involves looking at quotes from different providers, considering factors like coverage options, discounts, and customer service.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

How are Chrysler Concorde Limited insurance scores calculated?

Insurance scores are calculated based on factors like driving record, credit history, and claims history. Explore our detailed analysis on “How does my driving record affect my parents insurance rates?” for additional information.

What are the car insurance needs for Chrysler Concorde Limited owners?

Owners need to meet state minimum liability requirements and may also consider additional coverage such as comprehensive and collision insurance.

Why is Chrysler Concorde Limited insurance quotes comparison important?

How do Chrysler Concorde Limited insurance costs compare to insurance costs for other cars?

What is the overall cheapest car insurance available?

What is considered the lowest form of car insurance?

Which car insurance group is known as the cheapest car insurance group?

Which is usually the cheapest insurance company for car insurance?

What is the most basic car insurance one can purchase?

Can you provide an insurance premium definition?

Who offers the cheapest car insurance in Texas?

Who provides the cheapest car insurance in Florida?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.