Cheap Jeep Wrangler Car Insurance in 2026 (Save Money With These 10 Companies)

USAA, Farmers, and AAA offer the best cheap Jeep Wrangler car insurance, with rates starting as low as $41 per month. These providers stand out for their competitive pricing, extensive coverage options, and excellent customer service, making them the top choices for insuring your Wrangler affordably.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2024

Company Facts

Min. Coverage for Jeep Wrangler

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jeep Wrangler

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jeep Wrangler

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Jeep Wrangler car insurance are USAA, Farmers, and AAA, known for their affordability and excellent coverage options.

These companies stand out in the competitive insurance market by offering tailored policies that meet the specific needs of Jeep Wrangler owners. Learn more in our “Compare Car Insurance Quotes.”

Our Top 10 Company Picks: Cheap Jeep Wrangler Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $41 | A++ | Military Savings | USAA | |

| #2 | $45 | A | Customizable Policies | Farmers | |

| #3 | $52 | A | Roadside Assistance | AAA |

| #4 | $55 | B | Financial Strength | State Farm | |

| #5 | $65 | A+ | Exclusive Benefits | The Hartford |

| #6 | $74 | A+ | Customer Service | Progressive | |

| #7 | $78 | A++ | Bundling Policies | Travelers | |

| #8 | $82 | A | Loyalty Discounts | American Family | |

| #9 | $90 | A+ | Vanishing Deductible | Nationwide |

| #10 | $98 | A+ | Multi-Policies Discount | Allstate |

With a focus on comprehensive protection, they provide peace of mind through reliable customer service and robust benefits. For Wrangler enthusiasts looking for value without compromising on quality, these insurers offer the best solutions.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

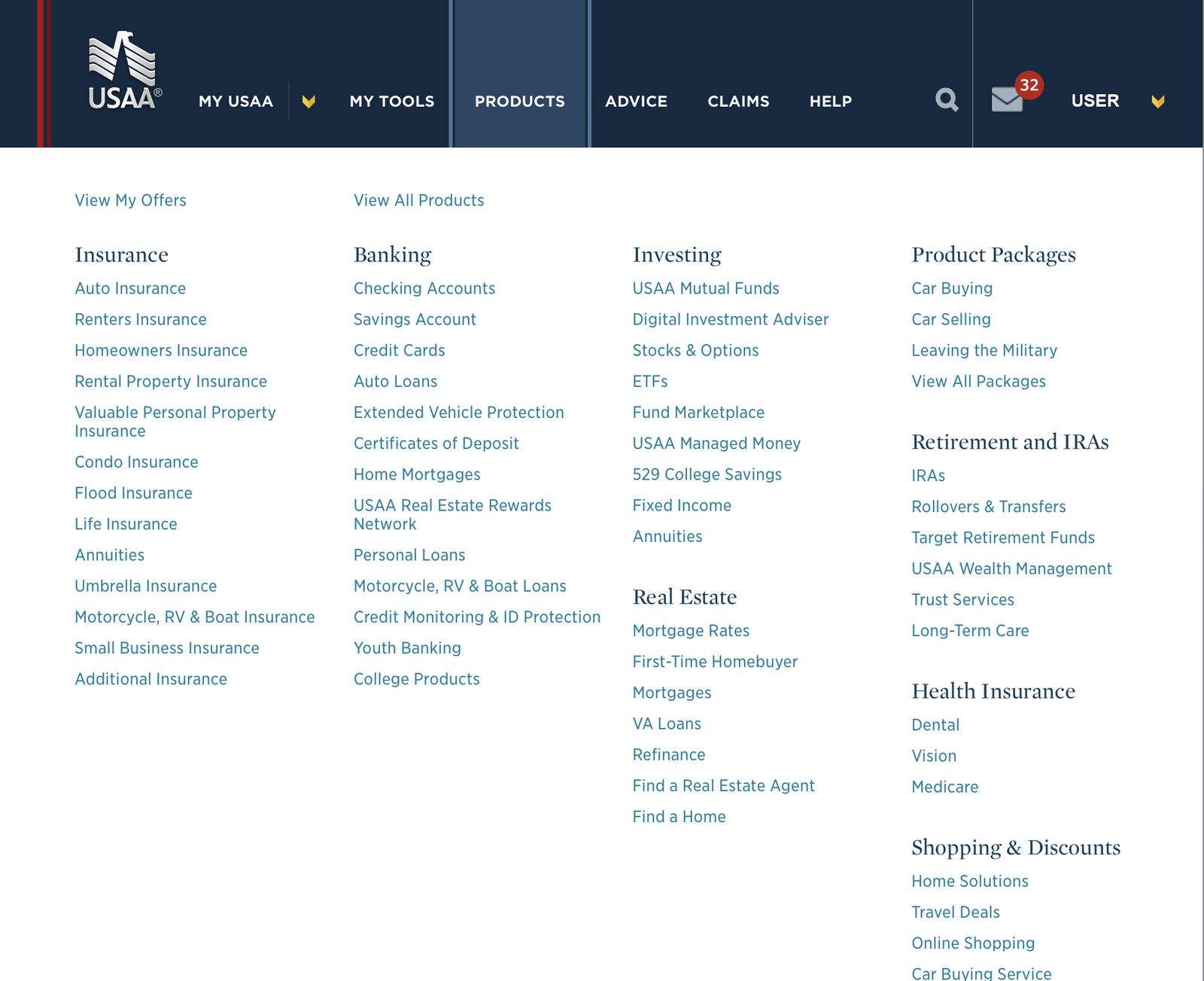

#1 – USAA: Top Overall Pick

Pros

- Exclusive Rates for Military: USAA offers exceptionally low rates specifically for military members and their families.

- Top-Tier Financial Rating: Backed by an A++ rating from A.M. Best, indicating superior financial stability. See more details on our USAA insurance review & ratings.

- Comprehensive Coverage Options: Offers a wide range of coverage that caters to the diverse needs of military families.

Cons

- Limited Availability: Only available to military members, veterans, and their immediate family members.

- Fewer Physical Locations: Compared to other insurers, USAA has fewer physical branches, which might affect those preferring face-to-face service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Customizable Policies

Pros

- Highly Customizable Coverage: Farmers offers numerous add-ons and policy options allowing for tailored coverage.

- Robust Online Tools: Provides a comprehensive set of online tools for easy management of policies.

- Effective Claims Process: Known for a straightforward and customer-friendly claims process. More information is available about this provider in our Farmers car insurance review & ratings.

Cons

- Higher Rates for Some: Premiums can be higher for those without opportunities for discounts.

- Complexity in Policy Options: The vast array of options could be overwhelming for some customers.

#3 – AAA: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: AAA is renowned for its excellent roadside assistance services.

- Bundle Discounts: Offers discounts for bundling auto insurance with other types of insurance. Read up on the “AAA Insurance Review & Ratings” for more information.

- Various Membership Perks: Insurance comes with the additional benefits of a AAA membership, including travel discounts.

Cons

- Membership Required: Insurance purchase requires a AAA membership, which comes with an annual fee.

- Variable Customer Service: Service quality can vary significantly between different regional clubs.

#4 – State Farm: Best for Financial Strength

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs. Check out insurance savings in our complete State Farm car insurance review & ratings.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Exclusive Benefits

Pros

- Tailored for Older Drivers: Offers specialized coverage and benefits for AARP members. Discover more about offerings in our The Hartford insurance review & ratings.

- Lifetime Repair Guarantee: Provides a lifetime car repair guarantee when you use one of their approved repair shops.

- RecoverCare Advantage: Unique benefit that helps cover costs after an accident for tasks you might not manage alone.

Cons

- AARP Membership Required: To get the most out of their benefits, an AARP membership is necessary.

- Higher Rates for Non-Members: Non-AARP members may face significantly higher rates.

#6 – Progressive: Best for Customer Service

Pros

- Name Your Price Tool: Progressive’s tool allows customers to state their insurance budget to find matching policies.

- Loyalty Rewards: Progressive offers various loyalty rewards, including small accident forgiveness. Access comprehensive insights into our Progressive car insurance review & ratings.

- Wide Range of Discounts: Numerous discounts available, from multi-car to safe driver discounts.

Cons

- Inconsistent Agent Experience: The quality of service can vary depending on the agent or representative.

- Higher Premiums Without Discounts: Base rates can be high if you don’t qualify for discounts.

#7 – Travelers: Best for Bundling Policies

Pros

- Multi-Policy Discounts: Offers competitive discounts for customers who bundle multiple policies.

- IntelliDrive Program: A telematics program that can lead to discounts for safe driving. Delve into our evaluation of Travelers insurance review & ratings.

- Wide Coverage Options: Provides a broad range of coverage options, including gap insurance and ride-sharing.

Cons

- Complex Quote Process: Getting a quote can be more time-consuming compared to other insurers.

- Customer Satisfaction Varies: Some customers report dissatisfaction with claims handling.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Loyalty Discounts

Pros

- Generous Loyalty Discounts: Offers substantial discounts for long-term customers. Unlock details in our American Family insurance review & ratings.

- Wide Range of Coverage: Covers everything from standard auto insurance to pet insurance if your pet is injured in a crash.

- MyAmFam App: A highly functional app that simplifies policy management and claims.

Cons

- Limited Availability: Services are not available nationwide.

- Varied Customer Service: Customer service quality can vary from region to region.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Deductible decreases for each year of safe driving, potentially reaching $0.

- On Your Side Review: Offers personalized insurance assessments to ensure your coverage meets your needs.

- Accident Forgiveness: Helps prevent your rates from increasing after your first at-fault accident. Discover insights in our Nationwide insurance review & ratings.

Cons

- Higher Premiums: Initial premiums may be higher compared to other national providers.

- Limited Availability in Some States: Not all services and discounts are available in every state.

#10 – Allstate: Best for Multi-Policies Discount

Pros

- Strong Multi-Policy Discounts: Allstate offers robust discounts for customers who bundle their insurance policies.

- Drivewise Program: Offers rewards for safe driving through a telematics program. If you want to learn more about the company, head to our Allstate insurance review & ratings.

- Wide Range of Options: Extensive coverage options including personal umbrella policies.

Cons

- Higher Rates: Generally, Allstate’s rates are on the higher end, especially without discounts.

- Variable Claim Satisfaction: Customer satisfaction with claims processing can be inconsistent.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Rates for Jeep Wrangler Insurance: Minimum vs Full Coverage

When selecting insurance for a Jeep Wrangler, considering both minimum and full coverage options offered by various providers can help you make a more informed decision. Here’s a detailed look at how monthly rates compare across different insurance companies.

Jeep Wrangler Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $52 $140

Allstate $98 $265

American Family $82 $216

Farmers $45 $112

Nationwide $90 $237

Progressive $74 $193

State Farm $55 $148

The Hartford $65 $167

Travelers $78 $206

USAA $41 $108

For Jeep Wrangler owners, the monthly insurance costs can vary significantly depending on whether you opt for minimum or full coverage. USAA presents the most affordable options in both categories, with rates starting at $41 for minimum coverage and going up to $108 for full coverage. On the higher end, Allstate charges $98 for minimum and $265 for full coverage, reflecting a premium pricing strategy.

Other notable mentions include Farmers, which offers highly competitive rates at $45 for minimum and $112 for full coverage, and State Farm, with its reasonable rates of $55 and $148 respectively.

This range in pricing demonstrates the importance of comparing both types of coverage across various insurers to find the best fit for your budget and coverage needs. See more details on our “Full Coverage Car Insurance: A Complete Guide.”

Factors That Affect Jeep Wrangler Car Insurance Rates

Several factors can influence the cost of insuring your Jeep Wrangler. One significant factor is the model and year of your vehicle. Newer models may come with a higher price tag for insurance due to their higher market value. Additionally, the trim level you choose, such as the Rubicon or Sahara, can also affect your premiums.

The Jeep Wrangler’s powerful engine and off-road capabilities may also contribute to higher insurance rates. Insurance companies consider the likelihood of accidents and the potential cost of repairs when determining premiums. The Wrangler’s rugged nature and adventurous spirit may make it a bit riskier to insure.

Melanie Musson Published Insurance Expert

Other factors that can impact your insurance rates include your location, driving record, and age. If you live in an area prone to theft or accidents, you may face higher premiums. Similarly, a history of traffic violations or at-fault accidents can lead to increased insurance costs. Discover insights in our “Car Accidents: What to do in Worst Case Scenarios.”

Another factor that can affect Jeep Wrangler car insurance rates is the usage of the vehicle. If you primarily use your Wrangler for off-road adventures or as a recreational vehicle, insurance companies may consider it to be at a higher risk of damage or accidents. This could result in higher premiums compared to if you primarily use your Wrangler for daily commuting or regular city driving.

Furthermore, the safety features and modifications on your Jeep Wrangler can also impact your insurance rates. Vehicles equipped with advanced safety features such as anti-lock brakes, traction control, and airbags may be eligible for discounts on insurance premiums. On the other hand, modifications like lift kits or aftermarket accessories may increase the cost of insurance due to the potential for increased risk or higher repair costs.

Understanding the Different Types of Car Insurance for Jeep Wrangler

When it comes to insuring your Jeep Wrangler, there are several types of coverage to consider. The most common types include liability, collision, and comprehensive insurance.

Liability insurance covers damages caused to other people and their property if you are at fault in an accident. This is typically required by law in most states. Collision insurance, on the other hand, covers damages to your own vehicle resulting from a collision with another vehicle or object. Lastly, comprehensive insurance protects against non-collision incidents, such as theft, vandalism, or damage caused by natural disasters.

It’s essential to assess your insurance needs based on your usage of the Jeep Wrangler. If you frequently take your vehicle off-road or participate in adventurous activities, you may want to consider additional coverage to protect against potential risks.

One additional type of car insurance to consider for your Jeep Wrangler is uninsured/underinsured motorist coverage. This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. It can help pay for medical expenses, lost wages, and other damages.

Another important factor to consider when choosing car insurance for your Jeep Wrangler is the deductible. The deductible is the amount of money you are responsible for paying out of pocket before your insurance coverage kicks in. Unlock details in our “What is the difference between a deductible and a premium in car insurance?”

A higher deductible can lower your insurance premium, but it also means you will have to pay more if you need to file a claim. Consider your budget and the value of your vehicle when deciding on a deductible amount.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for Your Jeep Wrangler

While Jeep Wrangler car insurance rates can vary, there are several strategies you can employ to find more affordable options. To start, comparing quotes from different insurance providers is crucial. Each insurer may have different pricing models and discounts available, so taking the time to research and obtain multiple quotes can save you money.

Another tip is to consider bundling your car insurance with other insurance policies, such as home or renters insurance. Many insurance companies offer multi-policy discounts, reducing the overall cost of your coverage.

Additionally, maintaining a good driving record and credit score can have a positive impact on your insurance rates. Avoiding traffic violations and practicing safe driving habits can help lower your premiums. Similarly, having a good credit score demonstrates financial responsibility and may lead to more favorable insurance rates.

Lastly, discussing available discounts with your insurance provider is essential. Some insurers offer discounts for features like anti-theft devices, safety features, or completing defensive driving courses. Taking advantage of these discounts can help reduce your insurance costs. Delve into our evaluation of “Best Anti Theft System Car Insurance Discounts.”

It’s also worth considering the deductible amount when looking for affordable car insurance for your Jeep Wrangler. The deductible is the amount you’ll have to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can often result in lower monthly premiums, but it’s important to make sure you can afford the deductible amount in case of an accident.

Furthermore, it can be beneficial to explore specialized insurance providers that cater specifically to Jeep Wrangler owners. These companies may offer tailored coverage options and discounts that are specifically designed for Jeep Wrangler vehicles. Researching and reaching out to these specialized providers can help you find more affordable and comprehensive insurance coverage for your Jeep Wrangler.

Comparing Car Insurance Quotes for Jeep Wrangler: What to Consider

When comparing car insurance quotes for your Jeep Wrangler, it’s important to consider more than just the price. While affordability is significant, you should also evaluate the coverage each quote offers. Ensure that the policy provides adequate protection for your specific needs.

Additionally, examine the insurance company’s reputation and financial stability. Reading customer reviews and checking the company’s financial ratings can give you an idea of their service quality and ability to handle claims effectively.

Jeff Root Licensed Life Insurance Agent

It’s also crucial to review policy details, such as deductibles, limits, and exclusions. Understanding these terms and conditions will help you make an informed decision about your coverage.

Another important factor to consider when comparing car insurance quotes for your Jeep Wrangler is the level of customer service provided by the insurance company. Look for a company that offers responsive and helpful customer support, as this can make a significant difference in your overall experience.

Furthermore, take into account any additional benefits or discounts that may be available with each insurance quote. Some companies offer perks such as roadside assistance, rental car coverage, or discounts for safe driving habits. These extras can add value to your policy and potentially save you money in the long run. Discover more about offerings in our “Lesser Known Car Insurance Discounts.”

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of Jeep Wrangler car insurance?

The cost of Jeep Wrangler car insurance can be influenced by various factors such as the driver’s age, location, driving history, coverage options, deductible amount, and the specific model and year of the Jeep Wrangler.

For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?”

Are Jeep Wranglers expensive to insure compared to other cars?

Insurance costs for Jeep Wranglers can vary depending on the factors mentioned earlier. However, due to its off-road capabilities and potential for higher repair costs, Jeep Wranglers may have slightly higher insurance premiums compared to some other vehicles.

What are some ways to lower the cost of Jeep Wrangler car insurance?

There are several ways to potentially reduce the cost of Jeep Wrangler car insurance. These include maintaining a clean driving record, opting for higher deductibles, bundling insurance policies, taking advantage of available discounts, installing anti-theft devices, and comparing quotes from multiple insurance providers.

Does the age of the Jeep Wrangler affect insurance rates?

Yes, the age of the Jeep Wrangler can impact insurance rates. Generally, newer models may have higher insurance premiums due to their higher value and potential for costlier repairs or replacement. As the vehicle gets older, its value may decrease, which could result in lower insurance rates.

To find out more, explore our guide titled “Best Car Insurance by Vehicle.”

Do different Jeep Wrangler models have different insurance costs?

Yes, different Jeep Wrangler models may have varying insurance costs. Factors such as the model’s safety features, engine size, and overall value can influence insurance rates. For example, a Jeep Wrangler Rubicon with more advanced safety

Why is Jeep Wrangler resale so high?

Jeep Wranglers are highly sought after, which means they don’t depreciate as much. Their strong, cult-like following helps them retain their value over time, even with depreciation. Regardless of the model year, there’s always a demand for them.

How long will a Wrangler last?

Are you curious about the lifespan of a Jeep Wrangler? With adequate maintenance, a Jeep Wrangler can typically last between 10 to 15 years. The most robust models of the Jeep Wrangler can reach up to 400,000 miles, although they generally last between 100,000 to 280,000 miles. These vehicles are somewhat durable.

To learn more, explore our comprehensive resource on “Jeep Car Insurance Discount.”

Are Jeep Wranglers good in accidents?

The IIHS safety ratings for the Jeep Wrangler were mixed, particularly in the crashworthiness category. The midsize SUV received a ‘good’ rating for moderate overlap front testing, side impacts, roof strength, and head restraints.

Shopping around for multiple quotes can help you save. Enter your ZIP code into our free comparison tool below to get started.

Why are Wrangler Jeeps so expensive?

Lack of Competition. Dubbed “the king of off-road vehicles,” the Jeep Wrangler remains dominant largely because there are no other vehicles that match its utilitarian capabilities. As a result, FCA is able to charge more for its vehicles compared to other brands and models.

Is a Jeep Wrangler a reliable car?

When evaluating a Jeep Wrangler, reliability often plays a crucial role for prospective buyers. Recognized for its robust construction and off-road capabilities, the Jeep Wrangler is generally seen as durable. However, the reliability may differ between various model years.

Learn more by reading our guide titled “How To Get Free Insurance Quotes Online.”

At what mileage do Jeeps start having problems?

Is it worth buying a Jeep with over 100k miles?

Which Jeeps don’t hold value?

Are Jeeps worth the investment?

Why are jeeps so poorly rated?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.