Cheap Mitsubishi Mirage G4 Car Insurance in 2026 (Save With These 10 Companies)

Cheap Mitsubishi Mirage G4 car insurance can be found with Progressive, State Farm, and Liberty Mutual, offering rates as low as $42 per month. These companies are the cheapest due to their competitive pricing, coverage options, and customer service. Comparing these providers ensures the best savings and coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

Company Facts

Min. Coverage for Mirage G4

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mirage G4

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mirage G4

A.M. Best

Complaint Level

Pros & Cons

Discovering cheap Mitsubishi Mirage G4 car insurance is essential. Top picks like Progressive, State Farm, and Liberty Mutual offer rates starting at $42 per month, ideal for budget-conscious drivers. This article explores factors affecting insurance costs such as driving record, location, and safety features.

It covers key coverage options including liability, comprehensive, and collision, and highlights ways to secure discounts through safe driving and policy bundling. Understanding these details helps drivers find the best insurance tailored to their needs. Explore further in our article titled “Best Car Insurance.”

Our Top 10 Company Picks: Cheap Mitsubishi Mirage G4 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

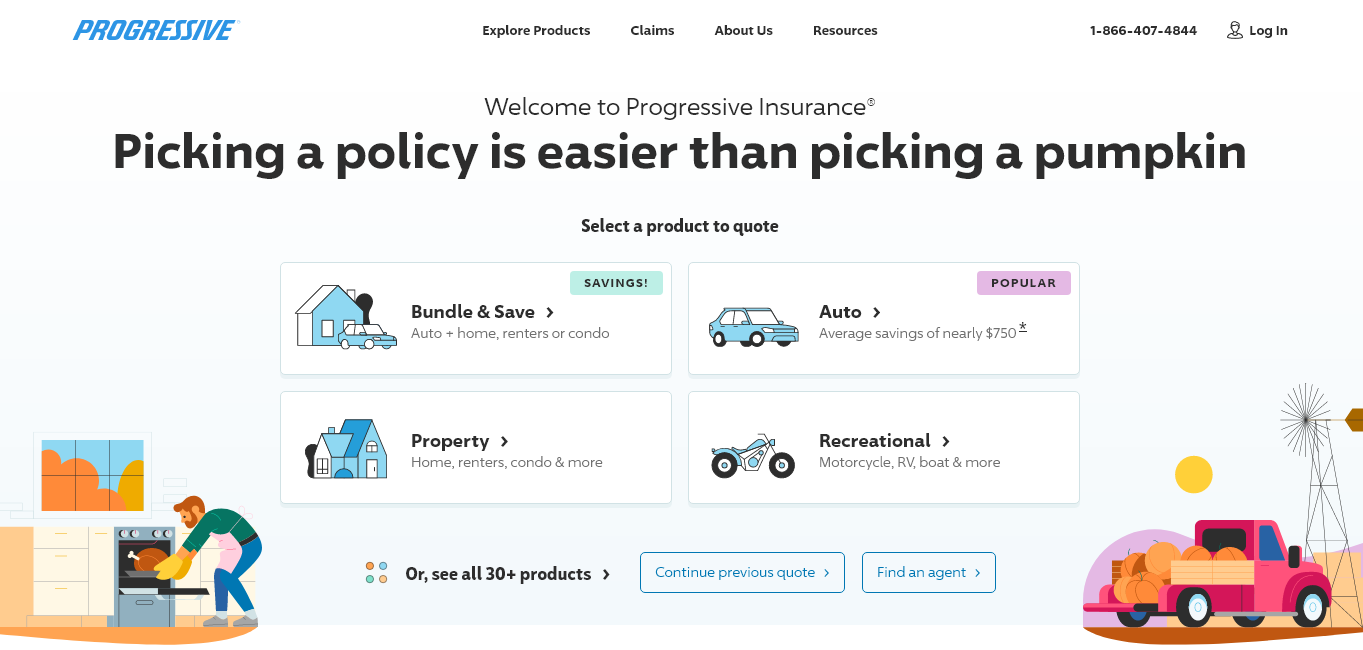

#1 $42 A+ Qualifying Coverage Progressive

![]()

#2 $45 B Customer Service State Farm

#3 $47 A Add-on Coverages Liberty Mutual

#4 $50 A+ Infrequent Drivers Allstate

#5 $52 A+ Widespread Availability Nationwide

#6 $55 A++ Bundling Policies Travelers

#7 $57 A Customizable Policies Farmers

#8 $60 A Loyalty Rewards American Family

#9 $63 A+ Exclusive Benefits The Hartford

#10 $65 A++ Senior Discounts Geico

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

- Cheap Mitsubishi Mirage G4 car insurance rates with Progressive from $42/month

- Factors like location, driving record, and safety features affect costs

- Essential coverage options include liability, comprehensive, and collision

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mitsubishi Mirage G4 Car Insurance Rates: Monthly Costs Compared

Discover monthly insurance rates for the Mitsubishi Mirage G4 across various coverage levels and providers. Whether you need minimum coverage for budget savings or full coverage for comprehensive protection, these insights will help you choose the right insurance plan.

Mitsubishi Mirage G4 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $125

American Family $60 $145

Farmers $57 $140

Geico $65 $155

Liberty Mutual $47 $120

Nationwide $52 $130

Progressive $42 $110

State Farm $45 $115

The Hartford $63 $150

Travelers $55 $135

Understanding the Insurance Coverage Options for the Mitsubishi Mirage G4

When insuring your Mitsubishi Mirage G4, it’s crucial to understand the different coverage options available. Most states require drivers to have at least liability insurance, which covers damages to other parties in an accident. However, liability insurance does not cover damages to your own vehicle.

Eric Stauffer Licensed Insurance Agent

For comprehensive coverage, which is optional, insurance companies provide protection against various risks such as theft, vandalism, fire, and weather-related damages. Collision coverage, another optional coverage, protects your vehicle in the event of an accident where you are at fault. It covers the cost of repairing or replacing your vehicle, regardless of who is at fault.

Insurance companies also offer additional coverage options, such as uninsured/underinsured motorist coverage, personal injury protection (PIP), and medical payments coverage. These can provide additional financial protection in specific circumstances, but they may come at an additional cost. Enhance your knowledge by reading our “What is comprehensive coverage?“

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for Your Mitsubishi Mirage G4

Comparing Car Insurance Quotes for the Mitsubishi Mirage G4

When comparing car insurance quotes for your Mitsubishi Mirage G4, it’s essential to consider the coverage limits, deductibles, and any additional factors specific to your situation. Ensure that the quotes you receive provide adequate coverage for your needs and compare the total cost, including any deductibles and fees.

While affordability is an important factor, it’s equally important to ensure that the insurance provider has a good reputation for customer service and quick claims processing. Read customer reviews, check the financial stability of the insurance company, and consider the overall value offered before making a decision.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Insurance Providers Offering Coverage for the Mitsubishi Mirage G4

Debunking Common Misconceptions About Mitsubishi Mirage G4 Car Insurance

There are several common misconceptions about car insurance rates for the Mitsubishi Mirage G4. One misconception is that all insurance providers charge similar rates for the same coverage. In reality, insurance premiums can vary significantly between companies due to their individual risk assessments and pricing models.

Another misconception is that insuring a Mitsubishi Mirage G4 is always expensive due to its lower price point. While the cost of the vehicle may be a factor, many other elements, such as driving record, location, and safety features, play a significant role in determining insurance rates. By being aware of these factors, you can find affordable insurance for your Mitsubishi Mirage G4.

Expand your understanding with our article called “Commonly Misunderstood Insurance Concepts.”

How Your Driving Record Affects the Cost of Insuring a Mitsubishi Mirage G4

Insurance companies closely evaluate your driving record when determining premiums for a Mitsubishi Mirage G4. A clean driving record with no accidents or traffic violations demonstrates responsible driving habits and a lower risk of future claims. As a result, you can expect lower insurance rates if you have a spotless driving record.

On the contrary, a history of accidents, traffic violations, or previous claims can increase your insurance premiums. Insurance companies view a poor driving record as an indicator of a higher likelihood of future accidents, thereby increasing the risk they assume by insuring you. For additional insights, refer to our “How much is car insurance?“

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact of Age and Experience on Mitsubishi Mirage G4 Car Insurance Rates

Age and driving experience significantly impact the cost of car insurance for a Mitsubishi Mirage G4. Younger drivers, particularly those under the age of 25, often face higher insurance rates due to their limited driving experience. Insurance companies consider younger drivers as higher risk and therefore assign higher premiums to offset that risk.

However, as drivers gain more experience and reach middle age, insurance rates typically decrease. Older drivers with a longer history of safe driving are viewed by insurers as less likely to engage in risky driving behavior or be involved in accidents, resulting in lower insurance premiums. Gain deeper understanding through our article entitled “Mileage-Based Car Insurance.”

Insurance companies offer various discounts and savings opportunities that can help reduce the cost of insuring a Mitsubishi Mirage G4. One common discount is the safe driver discount, which recognizes individuals with a clean driving record and rewards them with lower premiums. Additionally, completing a defensive driving course can also qualify you for further discounts.

Some insurance providers offer good student discounts for students who maintain excellent grades. This incentive reflects the belief that responsible academic behavior often translates into responsible driving habits. Furthermore, installing anti-theft devices or safety features such as alarms, GPS tracking systems, or steering wheel locks can make you eligible for additional discounts on your insurance premiums.

Find out more by reading our article titled “Best Car Insurance for Comprehensive Coverage.“

Your location plays a significant role in determining your Mitsubishi Mirage G4 car insurance premiums. Insurance companies take into account the risk factors associated with your specific area, including the likelihood of theft, vandalism, accidents, and general road conditions.

Urban areas with high population densities generally experience higher traffic volume and greater potential for accidents. Additionally, areas with higher crime rates may pose a greater risk of theft or vandalism. As a result, insurance premiums are often higher when residing in highly populated urban areas or areas with higher rates of crime.

Conversely, rural areas with lower population densities and fewer risks may result in lower insurance premiums. Insurance companies consider the decreased likelihood of accidents and lower exposure to theft or vandalism. Explore further with our article entitled “Best Car Insurance in Your State.”

Safety Features Impact on Mirage G4 Insurance

The safety features installed in your Mitsubishi Mirage G4 can influence the cost of car insurance. Insurance companies often provide discounts for vehicles equipped with advanced safety features that reduce the risk of accidents and potential injuries.

Common safety features that can affect insurance premiums include anti-lock braking systems (ABS), adaptive cruise control, lane departure warning, blind-spot detection, and automatic emergency braking. These features demonstrate your commitment to safe driving and can result in lower insurance premiums. Gain insights by reading our article titled “Best Safety Features Car Insurance Discounts.”

Comprehensive and collision coverage are two optional insurance coverage options for your Mitsubishi Mirage G4. Comprehensive coverage provides protection against various risks that are not a result of a collision. This may include damages caused by theft, vandalism, fire, weather-related events such as storms or hail, falling objects, or collisions with animals.

Progressive offers the best overall car insurance rates for Mitsubishi Mirage G4 drivers, starting at just $42 per month.

Comprehensive coverage is essential for protecting your vehicle from non-collision-related damages. Collision coverage, as the name suggests, covers damages to your vehicle resulting from a collision, regardless of fault. Whether you collide with another vehicle, an object, or a stationary structure, collision coverage will cover the cost of repairing or replacing your Mitsubishi Mirage G4.

When considering comprehensive and collision coverage for your Mitsubishi Mirage G4, it’s important to weigh the value of your vehicle against the cost of coverage. Older vehicles with lower market values may not justify the cost of comprehensive and collision coverage. Deepen your understanding with our article called “Collision vs. Comprehensive Car Insurance.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing an Insurance Deductible for Your Mirage G4

When selecting a deductible for your Mitsubishi Mirage G4 car insurance, it’s crucial to consider your personal financial situation. The deductible is the amount you must pay out of pocket before your insurance coverage begins. Opting for a higher deductible can lower your monthly premium, offering potential savings in the short term.

However, it’s essential to choose a deductible that you can comfortably afford to pay in the event of a claim. Carefully assess your financial situation and determine the right balance between your monthly premium and deductible to minimize potential financial strain. Uncover more by delving into our article entitled “What is Affordable coverage?“

Maintaining your Mitsubishi Mirage G4 through regular maintenance, such as scheduled services and inspections, can positively impact your car insurance rates. Insurance companies view well-maintained vehicles as less prone to mechanical failures or accidents caused by negligence.

Regular maintenance demonstrates responsible vehicle ownership and a commitment to safe driving. Insurers consider this when calculating premiums, potentially resulting in lower rates for well-maintained vehicles. Discover more by delving into our article entitled “Cheapest Car Insurance Companies.”

If you are considering modifying or customizing your Mitsubishi Mirage G4, it’s important to understand that these changes can impact your car insurance costs. Modifications such as adding performance-enhancing parts, altering the suspension, or installing cosmetic enhancements may increase the risk associated with your vehicle.

Insurers may consider these modifications as increasing your vehicle’s value or making it more attractive to thieves, resulting in higher insurance premiums. It’s crucial to inform your insurance provider about any modifications to ensure appropriate coverage. Failure to disclose modifications could potentially invalidate your insurance policy in the event of a claim.

Uncover additional insights in our article called “Types of Car Insurance Coverage.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benefits of Bundling Your Mitsubishi Mirage G4 Insurance

Bundling your Mitsubishi Mirage G4 car insurance with other policies offers several benefits. Many insurance providers offer discounts when you combine multiple policies, such as homeowners or renters insurance, with your car insurance. Bundling not only simplifies managing your insurance needs by consolidating them into one provider but can also result in significant cost savings.

Michelle Robbins Licensed Insurance Agent

By combining your policies, you may be eligible for multi-policy discounts that can help reduce your overall insurance premiums. However, it’s essential to compare bundled rates with individual policies to ensure that the savings justify combining your coverage. Additionally, confirm that the insurance provider meets your specific needs and offers competitive rates and quality customer service.

In conclusion, the cost of Mitsubishi Mirage G4 car insurance is influenced by various factors, including driving record, age and experience, location, safety features, deductibles, maintenance, modifications, and customizations.

By understanding these factors and following the tips provided, you can navigate the process of finding affordable car insurance coverage that meets your needs while protecting your Mitsubishi Mirage G4. Remember to consider. Dive deeper into our “Low Mileage Car Insurance Discount” for a comprehensive understanding.

Find cheap car insurance quotes by entering your ZIP code.

Frequently Asked Questions

What factors affect the cost of Mitsubishi Mirage G4 car insurance?

The cost of Mitsubishi Mirage G4 car insurance can be influenced by several factors, including the driver’s age, driving record, location, coverage options, deductible amount, and the insurance company’s rates.

Delve into the depths of our “Cheap Mitsubishi Outlander Sport Car Insurance” for additional insights.

Are there any specific safety features of the Mitsubishi Mirage G4 that can lower insurance costs?

Yes, the Mitsubishi Mirage G4 comes equipped with various safety features such as anti-lock brakes, stability control, and multiple airbags. These safety features can potentially lower insurance costs as they reduce the risk of accidents and injuries.

Does the cost of Mitsubishi Mirage G4 car insurance vary by location?

Yes, the cost of car insurance for a Mitsubishi Mirage G4 can vary depending on the location. Factors such as the crime rate, population density, and frequency of accidents in the area can affect insurance rates.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Are there any discounts available for Mitsubishi Mirage G4 car insurance?

Many insurance companies offer discounts for various factors related to the Mitsubishi Mirage G4. These may include discounts for having multiple policies with the same insurer, being a safe driver, having anti-theft devices installed, or being a member of certain professional organizations.

Can I customize my Mitsubishi Mirage G4 car insurance coverage?

Yes, most insurance companies provide options to customize your coverage for a Mitsubishi Mirage G4. You can typically choose the level of liability coverage, comprehensive coverage, collision coverage, and additional coverage options based on your specific needs and budget.

Uncover more about our “Cheap Mitsubishi Outlander Car Insurance” by reading further.

Is a Mitsubishi Mirage G4 a good car?

The Mitsubishi Mirage G4 is generally considered a good car for its affordability, fuel efficiency, and compact size, though it may lack in power and luxury features compared to competitors.

What factors influence the insurance premium for a Mitsubishi Mirage G4?

The factors include the driver’s age, driving history, location, coverage level, deductible amount, and the car’s safety features and theft rates.

Are there specific insurance companies that offer better rates for Mitsubishi Mirage G4 owners?

Yes, rates can vary by company. It’s best to compare quotes from multiple insurers to find the best rate.

Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

How does the safety rating of the Mitsubishi Mirage G4 affect insurance costs?

A higher safety rating can lower insurance costs, as safer cars are less likely to be involved in accidents and incur expensive claims.

Expand your understanding with our “Cheap Mitsubishi Raider Car Insurance.”

What types of coverage are recommended for a Mitsubishi Mirage G4?

Recommended coverage includes liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How does the age and condition of a Mitsubishi Mirage G4 impact insurance rates?

Are there any common discounts available for insuring a Mitsubishi Mirage G4?

How does the location where you drive and park your Mitsubishi Mirage G4 affect your insurance premium?

What is the average cost of insurance for a new Mitsubishi Mirage G4?

How can a Mitsubishi Mirage G4 owner lower their insurance costs?

What should a Mitsubishi Mirage G4 owner look for when comparing insurance policies?

How long will a Mitsubishi engine last?

Is the Mirage G4 a good car?

Is the Mirage G4 fuel-efficient?

Which is better, Mirage or Vios?

Can Mirage G4 go to Baguio?

Which brand of car has the cheapest insurance?

Which insurance group is the cheapest?

What is the most basic car insurance?

What is zero car insurance?

What is the lowest level of car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.