Cheap Porsche 718 Cayman Car Insurance in 2026 (Earn Savings With These 10 Companies)

The best providers for cheap Porsche 718 Cayman car insurance are Progressive, State Farm, and American Family, with monthly rates starting at $92. Progressive offers qualifying coverage, State Farm excels in customer service, and American Family provides benefits for costco members, ensuring optimal protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated October 2024

13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for Porsche 718 Cayman

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Porsche 718 Cayman

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage for Porsche 718 Cayman

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsThe best insurers for cheap Porsche 718 Cayman car insurance are Progressive, State Farm, and American Family, all offering competitive monthly rates starting at $92.

Each of these top insurers brings a unique blend of affordability, comprehensive coverage, and customer-centric features to the table making your car safe while on the road. For a comprehensive review, see our in-depth guide titled “Roadside Assistance Coverage: A Complete Guide.”

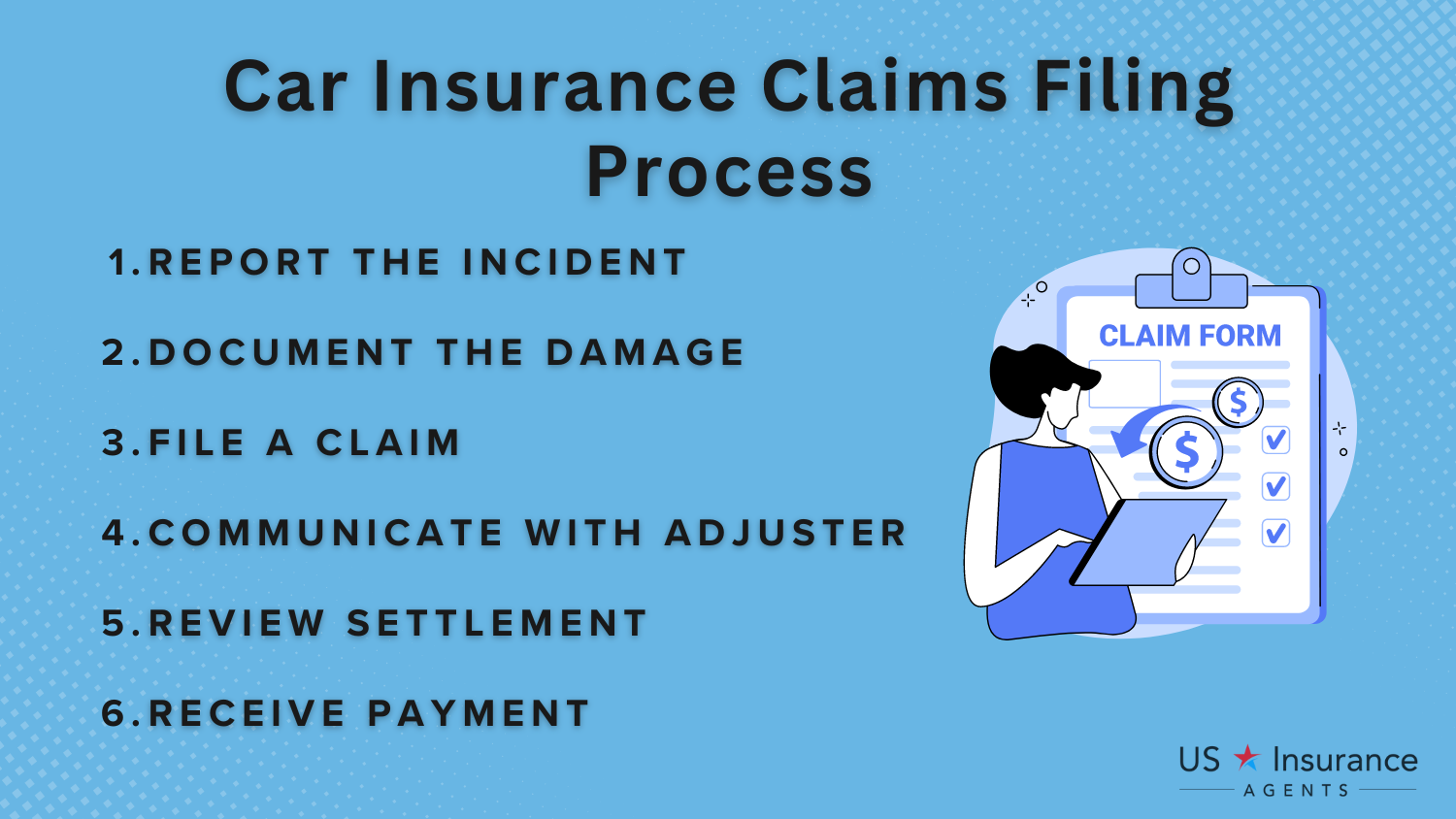

Our Top 10 Company Picks: Cheap Porsche 718 Cayman Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $92 A+ Qualifying Coverage Progressive

#2 $97 B Customer Service State Farm

#3 $101 A Costco Members American Family

#4 $108 A+ Widespread Availability Nationwide

#5 $113 A++ Bundling Policies Travelers

#6 $119 A+ Infrequent Drivers Allstate

#7 $126 A Contractor Equipment Farmers

#8 $131 A Online Tools Safeco

#9 $137 A Coverage Options Liberty Mutual

#10 $143 A+ Exclusive Benefits The Hartford

Discover which insurer provides the perfect blend of value and service tailored specifically for your Porsche 718 Cayman needs.

Enter your ZIP code above into our free comparison tool to see how much car insurance costs in your area.

- Progressive offers cheap Porsche 718 Cayman car insurance at $92 per month

- Find car insurance coverage that suits your Porsche 718 Cayman’s needs

- Evaluate the best value for your Porsche 718 Cayman car insurance

#1 – Progressive: Top Overall Pick

Pros

- Flexible Coverage Options: Progressive insurance review & ratings emphasize the company’s customizable insurance plans, allowing you to tailor coverage specifically for your Porsche 718 Cayman, including options like enhanced collision and comprehensive coverage.

- Advanced Discounts: They provide a variety of discounts that could be beneficial for a high-performance car like the Porsche 718 Cayman, such as bundling multiple policies and safe driver discounts.

- Innovative Tools: Progressive’s Snapshot® program tracks your driving habits, which can help you earn discounts based on your driving style, potentially reducing costs for insuring your Porsche.

Cons

- Complex Claims Process: Some users report that the claims process with Progressive can be more complicated compared to other insurers, which might be inconvenient if you need to file a claim for your Porsche 718 Cayman.

- Customer Service Variability: Experiences with Progressive’s customer service can be inconsistent, which may affect the level of support you receive for your Porsche insurance needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Personalized Customer Service: State Farm is known for its strong customer service, offering personalized attention that can help address any specific concerns related to your Porsche 718 Cayman.

- Wide Network of Agents: State Farm insurance review & ratings display the company’s large network of local agents, State Farm provides accessible, in-person service, which can be helpful for managing your Porsche’s insurance needs and discussing coverage options.

- Claims Satisfaction: State Farm generally receives high marks for claims satisfaction, which is crucial when dealing with repairs or replacements for your Porsche.

Cons

- Higher Premiums: State Farm’s premiums may be higher compared to some competitors, which could be a drawback if you’re looking to save on insurance for your Porsche 718 Cayman.

- Limited Digital Tools: While State Farm offers some online services, their digital tools may not be as advanced as those of other insurers, potentially affecting your ability to manage your policy online.

#3 – American Family: Best for Costco Members

Pros

- Exclusive Member Discounts: American Family provides special discounts for Costco members, which might be beneficial if you’re a member looking to insure your Porsche 718 Cayman.

- Comprehensive Coverage Options: They offer a range of coverage options that can be tailored to fit the specific needs of your Porsche, including road assistance and rental car coverage.

- Strong Support for High-Value Vehicles: American Family insurance review & ratings exhibit the company’s reputation for providing excellent coverage for high-value and performance vehicles like the Porsche 718 Cayman.

Cons

- Regional Variability: Coverage options and pricing can vary significantly by region, which may affect the insurance experience for your Porsche depending on where you live.

- Customer Service Issues: There have been reports of inconsistent customer service experiences, which could be problematic if you encounter issues with your Porsche’s insurance policy.

#4 – Nationwide: Best for Widespread Availability

Pros

- Wide Availability: Nationwide insurance review & ratings present the company’s extensive network ensures broad coverage options across the country, making it easier to find suitable insurance for your Porsche 718 Cayman no matter where you are located.

- Customizable Policies: They offer flexible policy options, allowing you to tailor coverage for your Porsche 718 Cayman to include additional protections like high-value vehicle coverage.

- Comprehensive Discounts: Nationwide provides various discounts, such as those for safe driving or bundling policies, which can help lower the cost of insuring your Porsche.

Cons

- Complex Policy Options: The variety of policy options can be overwhelming, making it challenging to choose the best coverage for your Porsche without thorough research.

- Mixed Customer Reviews: Nationwide has mixed customer reviews regarding claims handling and customer service, which may affect your experience if you need to file a claim for your Porsche.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Bundling Policies

Pros

- Bundling Benefits: Travelers offers significant discounts if you bundle multiple insurance policies, which can be a great advantage if you need to insure both your Porsche 718 Cayman and other assets.

- Wide Range of Coverage: Travelers insurance review & ratings highlight the company’s extensive coverage options, including specialized protections for high-performance vehicles like the Porsche 718 Cayman.

- Advanced Claims Support: Travelers is known for its robust claims support system, which can be beneficial if you encounter issues with your Porsche.

Cons

- Potential for Higher Rates: Depending on your driving profile, Travelers’ rates may be higher, which could impact your overall insurance costs for your Porsche 718 Cayman.

- Customer Service Variability: Some customers have reported inconsistent experiences with Travelers’ customer service, which might affect your overall satisfaction with your policy.

#6 – Allstate: Best for Infrequent Drivers

Pros

- Infrequent Driver Discounts: Allstate offers discounts for infrequent drivers, which could be advantageous if you don’t drive your Porsche 718 Cayman frequently.

- Comprehensive Coverage Options: They provide a range of coverage options that can be tailored to protect your Porsche, including roadside assistance and rental car coverage.

- User-Friendly Digital Tools: Allstate insurance review & ratings feature the company’s digital tools and mobile app offer a convenient way to manage your policy and file claims, which can be helpful for busy Porsche owners.

Cons

- Higher Premiums: Allstate’s premiums can be on the higher side, which may be a disadvantage if you’re looking to keep insurance costs low for your Porsche.

- Mixed Claims Experiences: There are mixed reviews about the claims process, which could be a concern if you need to file a claim for your Porsche 718 Cayman.

#7 – Farmers: Best for Contractor Equipment

Pros

- Tailored Coverage for Unique Vehicles: Farmers offers specialized coverage options that can be customized for high-value and unique vehicles like the Porsche 718 Cayman.

- Flexible Policy Management: Farmers insurance review & ratings demonstrate the company’s flexible policy management options, allowing you to adjust your coverage as needed for your Porsche.

- Strong Local Agent Support: Farmers has a network of local agents who can offer personalized service and support, which can be beneficial for managing your Porsche’s insurance needs.

Cons

- Higher Premiums: Farmers’ rates may be higher compared to some competitors, potentially impacting the affordability of insuring your Porsche.

- Customer Service Variability: Experiences with Farmers’ customer service can vary, which might affect the level of support you receive for your Porsche insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Safeco: Best for Online Tools

Pros

- Advanced Online Tools: Safeco offers comprehensive online tools and resources, making it easy to manage your policy and access support for your Porsche 718 Cayman.

- Customizable Coverage: Safeco insurance review & ratings flaunt the company’s range of coverage options that can be tailored to meet the specific needs of your Porsche, including high-value and performance vehicle coverage.

- Discount Opportunities: Safeco offers various discounts, such as those for safe driving and bundling, which can help reduce the cost of insuring your Porsche.

Cons

- Customer Service Issues: Some customers report challenges with Safeco’s customer service, which might impact your overall experience with your Porsche’s insurance policy.

- Potential Coverage Gaps: Depending on your location and specific needs, there could be gaps in coverage options that might not fully meet the needs of your Porsche 718 Cayman.

#9 – Liberty Mutual: Best for Coverage Options

Pros

- Diverse Coverage Options: Liberty Mutual offers a variety of coverage options, including protections tailored for high-performance and luxury vehicles like the Porsche 718 Cayman.

- Customizable Policy Features: They provide flexible policy features that can be adjusted to suit the unique needs of your Porsche, such as enhanced collision and comprehensive coverage.

- Discount Programs: Liberty Mutual review & ratings parade the company’s several discount programs, including those for safe driving and multi-policy bundles, which can help reduce your insurance costs.

Cons

- Complex Pricing Structure: Liberty Mutual’s pricing structure can be complex, making it challenging to determine the most cost-effective coverage for your Porsche.

- Mixed Customer Feedback: There are mixed reviews regarding customer service and claims handling, which might affect your overall satisfaction with your Porsche’s insurance.

#10 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits for Members: The Hartford insurance review & ratings spotlight the company’s exclusive benefits and discounts for certain groups, which can be advantageous if you’re eligible and looking to insure your Porsche 718 Cayman.

- High Coverage Limits: They provide high coverage limits and extensive protection options, ensuring that your Porsche is well-covered in various scenarios.

- Strong Reputation for Claims Support: The Hartford is known for its reliable claims support, which can be crucial for managing any issues with your Porsche’s insurance.

Cons

- Potentially Higher Costs: Depending on your profile and location, The Hartford’s insurance costs can be on the higher side, which might affect affordability for your Porsche.

- Limited Availability: The Hartford’s coverage options and availability can vary by region, which may impact your ability to obtain their insurance for your Porsche.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Factors Affecting Porsche 718 Cayman Insurance Costs

The cost of insuring a Porsche 718 Cayman can vary significantly based on several factors. Insurance providers take into consideration elements such as your age, driving history, location, and the level of coverage you choose. Younger drivers or individuals with a history of accidents or traffic violations may face higher premiums due to the perception of increased risk.

Additionally, where you live can also impact insurance rates. Areas with higher crime rates or more congested traffic may result in higher premiums. It’s important to understand these factors to accurately estimate the cost of Porsche 718 Cayman car insurance.

Porsche 718 Cayman Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $119 $207

American Family $101 $193

Farmers $126 $219

Liberty Mutual $137 $238

Nationwide $108 $197

Progressive $92 $184

Safeco $131 $227

State Farm $97 $189

The Hartford $143 $245

Travelers $113 $202

Liability-only coverage typically has lower premiums but provides limited protection, while comprehensive coverage offers more extensive coverage but may come with higher premiums. For an in-depth investigation, peruse our comprehensive guide named “How does the insurance company determine my premium?”

Choosing the Best Insurance for Your Porsche 718 Cayman

When insuring your Porsche 718 Cayman, understanding the coverage options and comparing rates are essential steps. Most policies include liability coverage, which helps cover costs if you cause an accident that injures someone or damages property.

For comprehensive protection, consider adding collision and comprehensive coverage to guard against theft, vandalism, and accidents. To find the best insurance for your Porsche 718 Cayman, compare rates from various providers, as pricing structures and available discounts can vary significantly.

The short answer is “yes.” Find out why warming up your EV in cold weather is a good idea and how to do it the right way: https://t.co/fYyijoeFOR pic.twitter.com/a7MD9tcKLW

— Progressive (@progressive) November 29, 2023

Gathering quotes from multiple insurers online can help you make an informed decision and secure the most competitive rate for the coverage you need.

Essential Tips for Saving on Porsche 718 Cayman Insurance

Insuring a luxury sports car like the Porsche 718 Cayman can be expensive, but there are strategies to help manage costs effectively. By understanding key aspects of insurance coverage and leveraging available discounts, you can reduce your premiums while ensuring comprehensive protection for your high-value vehicle.

- Bundle Policies for Discounts: Save on Porsche 718 Cayman insurance by bundling with other policies like homeowner’s or umbrella insurance. Multi-policy discounts can significantly lower your premiums. For a thorough examination, take a look at our detailed guide entitled “Homeowners Insurance: A Complete Guide.”

- Maintain a Clean Driving Record: A history of safe driving, including attending defensive driving courses and opting for a higher deductible, can help reduce your insurance costs.

- Prioritize Comprehensive Insurance: For your Porsche 718 Cayman, comprehensive coverage is vital as it safeguards against non-collision damages such as theft, vandalism, and natural disasters, ensuring peace of mind despite a potential increase in premium.

By bundling policies, maintaining a clean driving record, and prioritizing comprehensive coverage, you can find ways to save on insurance while safeguarding your Porsche 718 Cayman. Implementing these tips will help you balance cost and coverage, ensuring your sports car is well-protected and affordable to insure.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Right Insurance for Your Porsche 718 Cayman

When insuring your Porsche 718 Cayman, it’s crucial to explore various insurance providers as each offers distinct coverage options, discounts, and rates. Some insurers specialize in high-performance vehicles and provide tailored policies that better suit your needs.

Additionally, it’s important to dispel common misconceptions, such as the belief that insurance for luxury cars is always prohibitively expensive. While premiums for high-value vehicles can be higher, factors like your driving record and location play a significant role in determining the final cost.

Specifically, your location can greatly impact insurance rates; urban areas with higher crime rates and traffic congestion often lead to higher premiums, while rural areas may offer lower costs.

By researching different providers and understanding these factors, you can find the best coverage and value for your Porsche 718 Cayman. For a thorough analysis, consult our comprehensive guide named “Types of Car Insurance Coverage.”

Insurance Tips for Your Porsche 718 Cayman

Insuring a luxury sports car like the Porsche 718 Cayman involves unique considerations. Due to its high-performance capabilities and powerful engine, insurers often view it as a higher risk, which can lead to elevated premiums compared to standard vehicles.

When selecting a deductible, consider both your budget and the value of your Porsche 718 Cayman to find a balance between manageable premiums and potential costs. Understanding these factors helps you navigate the insurance process more effectively and ensures adequate coverage for your luxury vehicle.

Tips to Lower Porsche 718 Cayman Insurance Costs

Insuring a high-performance vehicle like the Porsche 718 Cayman can be costly, but there are several strategies to help reduce premiums. By exploring discounts, considering the vehicle’s age and condition, and maintaining optimal vehicle health, you can find ways to save on insurance.

- Utilize Discounts and Incentives: Explore available discounts for your Porsche 718 Cayman, such as those for safety features like anti-lock brakes and electronic stability control. For additional details, explore our comprehensive resource titled “Safety Features Car Insurance Discount.”

- Consider Vehicle Age and Condition: The age and condition of your Porsche 718 Cayman significantly influence insurance costs. Newer vehicles typically have higher premiums due to their value and repair costs, while well-maintained older cars may benefit from lower rates.

- Maintain Optimal Vehicle Condition: Regular maintenance, proper storage, and security features can contribute to lower insurance premiums for your Porsche 718 Cayman. Keeping your vehicle in good shape is a key factor in reducing insurance costs.

By taking advantage of available discounts and incentives, understanding how the age and condition of your Porsche 718 Cayman affect insurance costs, and ensuring your vehicle is well-maintained, you can effectively manage and lower your insurance premiums.

These proactive steps not only help you save money but also ensure that your luxury car remains well-protected. Regularly reviewing your insurance options and staying informed about potential savings can lead to significant long-term benefits, allowing you to enjoy the thrill of driving your Porsche 718 Cayman without the burden of excessive insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

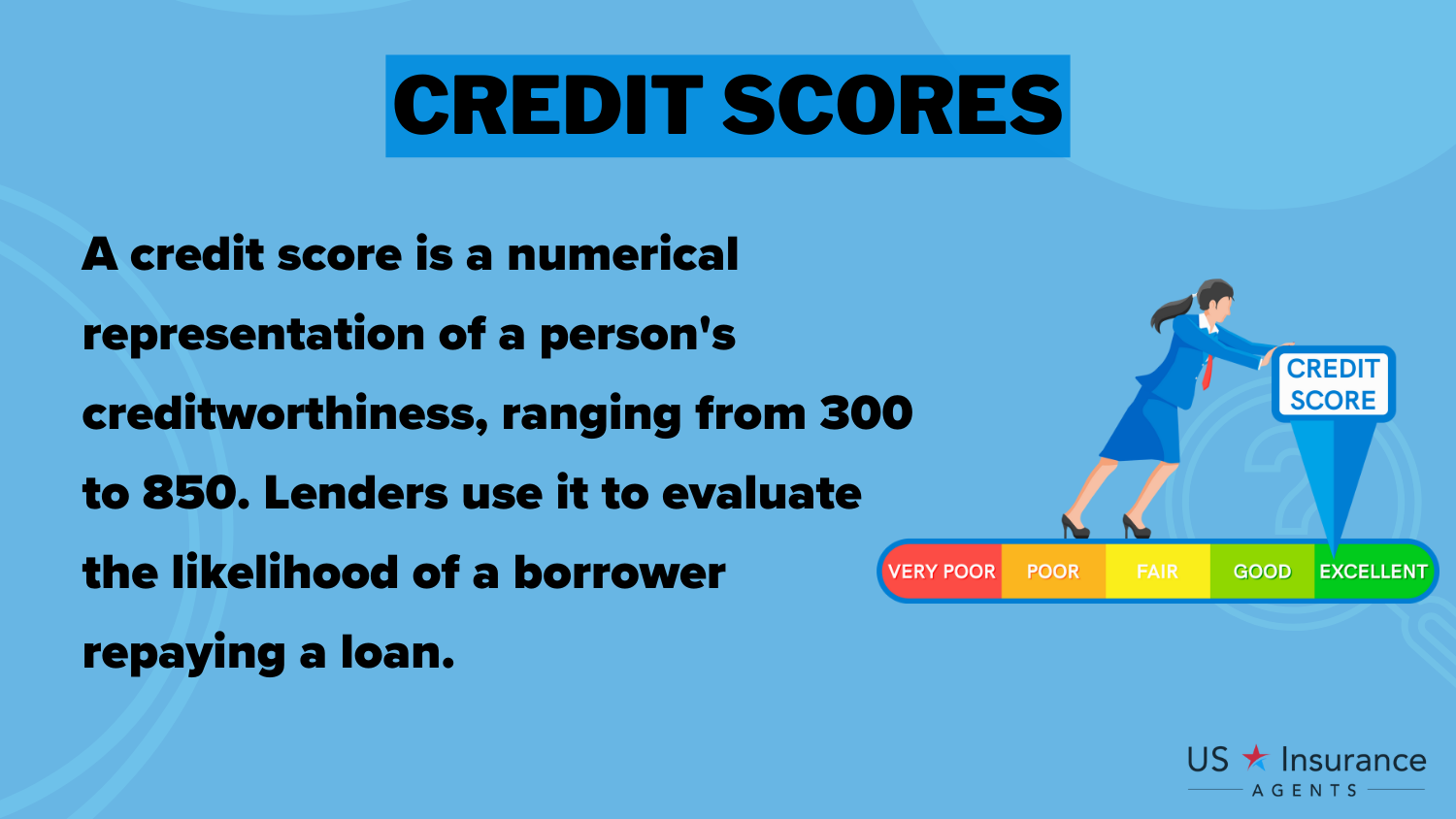

Credit Scores and Bundling for Porsche 718 Cayman Insurance

Insurers often use credit scores as a factor, with higher scores generally leading to lower premiums due to perceived lower risk. Conversely, lower credit scores can result in higher rates. To gain further insights, consult our comprehensive guide titled “Understanding Credit: A Score that Impacts Everything from Your Cell Phone Bill to Car Insurance.”

Maintaining good credit is beneficial, potentially reducing your insurance costs. Additionally, bundling your Porsche 718 Cayman insurance with other policies, such as homeowner’s or renter’s insurance, can offer significant advantages.

Optimizing Insurance for Your Porsche 718 Cayman

When insuring a high-performance vehicle like the Porsche 718 Cayman, it can be beneficial to find insurance providers specializing in luxury and sports cars. These specialized insurers have a deeper understanding of the unique risks associated with high-performance vehicles and can offer tailored coverage options.

Research these specialized insurers to find policies that are specifically designed to provide the best protection for your Porsche 718 Cayman. It’s important to ensure that your chosen insurer has experience and expertise in insuring luxury sports cars.

How old were you when you realized cupcake liners can help keep cup holders in your 🚙 stay clean? #TodayYearsOld pic.twitter.com/c1WXQticyM

— Progressive (@progressive) July 20, 2023

Additionally, the presence of safety features in your Porsche 718 Cayman can play a crucial role in reducing insurance premiums. Insurers value safety features that reduce the risk of accidents or injuries. To learn more, explore our comprehensive resource on commercial auto insurance titled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

Anti-lock brakes, traction control, airbags, and stability control systems are all examples of safety features that can potentially lower your insurance rates.

Case Studies: Tailored Insurance Solutions for Your Porsche 718 Cayman

Discover how Progressive, State Farm, and American Family offer customized insurance plans for your Porsche 718 Cayman.

- Case Study #1 – Cost-Efficient Coverage: Sophia, a Porsche 718 Cayman owner, opts for a higher deductible with Progressive. She benefits from lower premiums and discounts for safe driving, balancing cost and comprehensive coverage effectively. To delve deeper, refer to our in-depth report titled “Lesser Known Car Insurance Discounts.”

- Case Study #2 – Loyalty Rewards: Michael, a loyal State Farm customer, leverages their loyalty rewards and personalized service. Despite high traffic in his area, his clean driving record and State Farm’s discounts secure a favorable rate for his Porsche 718 Cayman.

- Case Study #3 – Member Discounts: Emily, a Costco member and Porsche 718 Cayman driver, chooses American Family for its member discounts and broad coverage. She enjoys significant savings and extensive protection due to American Family’s tailored policies.

These case studies illustrate how Progressive, State Farm, and American Family each offer unique benefits and tailored insurance solutions for Porsche 718 Cayman owners.

Scott W. Johnson Licensed Insurance Agent

By exploring various options and leveraging specific discounts, you can find an insurance plan that best fits your needs and preferences. Whether you’re seeking cost savings, loyalty rewards, or member perks, these insurers provide valuable choices to ensure your luxury vehicle is well-protected while optimizing your insurance expenses.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Conclusion: Finding the Best Insurance for Your Porsche 718 Cayman

Choosing the right insurance for your Porsche 718 Cayman involves balancing cost, coverage, and provider benefits. Progressive stands out with its competitive full coverage rate of $184, providing exceptional value for comprehensive protection.

However, State Farm and American Family also offer attractive options with unique benefits, such as loyalty rewards and member discounts. For a thorough understanding, refer to our detailed analysis titled “Best Loyalty Car Insurance Discounts.”

By evaluating these choices and considering your personal needs, you can secure a plan that offers both savings and robust coverage for your luxury vehicle.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

What is the cheapest Porsche 718 to insure and how does it compare to other models?

The Porsche 718 Cayman is among the more affordable Porsches to insure due to its relatively lower repair costs and performance specifications. Compared to higher-end models like the 718 GTS, the Cayman offers significant savings on insurance premiums.

How much is insurance for a Porsche Cayman GTS and how does it differ from an old Porsche?

Insurance for a Porsche Cayman GTS is higher due to its advanced features and performance capabilities. In contrast, older Porsche models might have lower premiums but can vary significantly based on their condition and repair history.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

In which country is Porsche the cheapest to buy and maintain a Porsche 718 Cayman?

Germany is typically the cheapest country for buying and maintaining a Porsche 718 Cayman. Lower purchase prices and maintenance costs in Germany make it more economical compared to other countries with higher and fees.

To expand your knowledge, refer to our comprehensive handbook titled “Cheapest Car Insurance Companies.”

How much does it cost to maintain a Porsche 718 Cayman and how does that compare to filling it up?

Maintaining a Porsche 718 Cayman can be expensive due to high-quality parts and specialized services. Filling up the tank is also relatively costly, reflecting the vehicle’s luxury status and performance.

Is a Porsche 718 Cayman considered a luxury car and is it the most affordable Porsche option?

Yes, the Porsche 718 Cayman is classified as a luxury car due to its high-end features and performance. However, it is one of the more affordable Porsche models compared to pricier options like the Porsche 911.

What age is car insurance most expensive for a Porsche 718 Cayman and why?

Car insurance for a Porsche 718 Cayman is most expensive for younger drivers, often due to perceived higher risk. Younger drivers face higher premiums as insurers consider them more likely to be involved in accidents.

To gain profound insights, consult our extensive guide titled “What age do you get cheap car insurance?”

How much does insurance cost for a Porsche Cayman compared to the cheapest Porsche model?

Insurance for a Porsche Cayman is typically more expensive than for the cheapest Porsche models, such as the Porsche Macan. The higher cost reflects the Cayman’s luxury status and higher repair costs.

Which is the best 718 model to buy for cost efficiency and insurance savings?

The Porsche 718 Cayman is generally the best model for cost efficiency and insurance savings. It provides a balance of performance and affordability compared to more expensive models like the 718 GTS or 718 Spyder.

Why do people like the Porsche Cayman and how does its popularity affect insurance costs, including liability coverage?

The Porsche Cayman is popular for its performance and stylish design. This popularity can lead to higher insurance costs, including liability coverage, due to increased demand, higher repair costs, and potentially more expensive replacement parts.

For a comprehensive overview, explore our detailed resource titled “Liability Insurance: A Complete Guide.”

Where is the Porsche 718 Cayman made and does its origin affect its insurance cost?

The Porsche 718 Cayman is made in Germany. While its origin doesn’t directly affect insurance costs, the high quality of German engineering can influence overall repair and maintenance expenses, which can impact insurance premiums.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.