Best Car Insurance for Single Parents in 2026 (Find the Top 10 Providers Here)

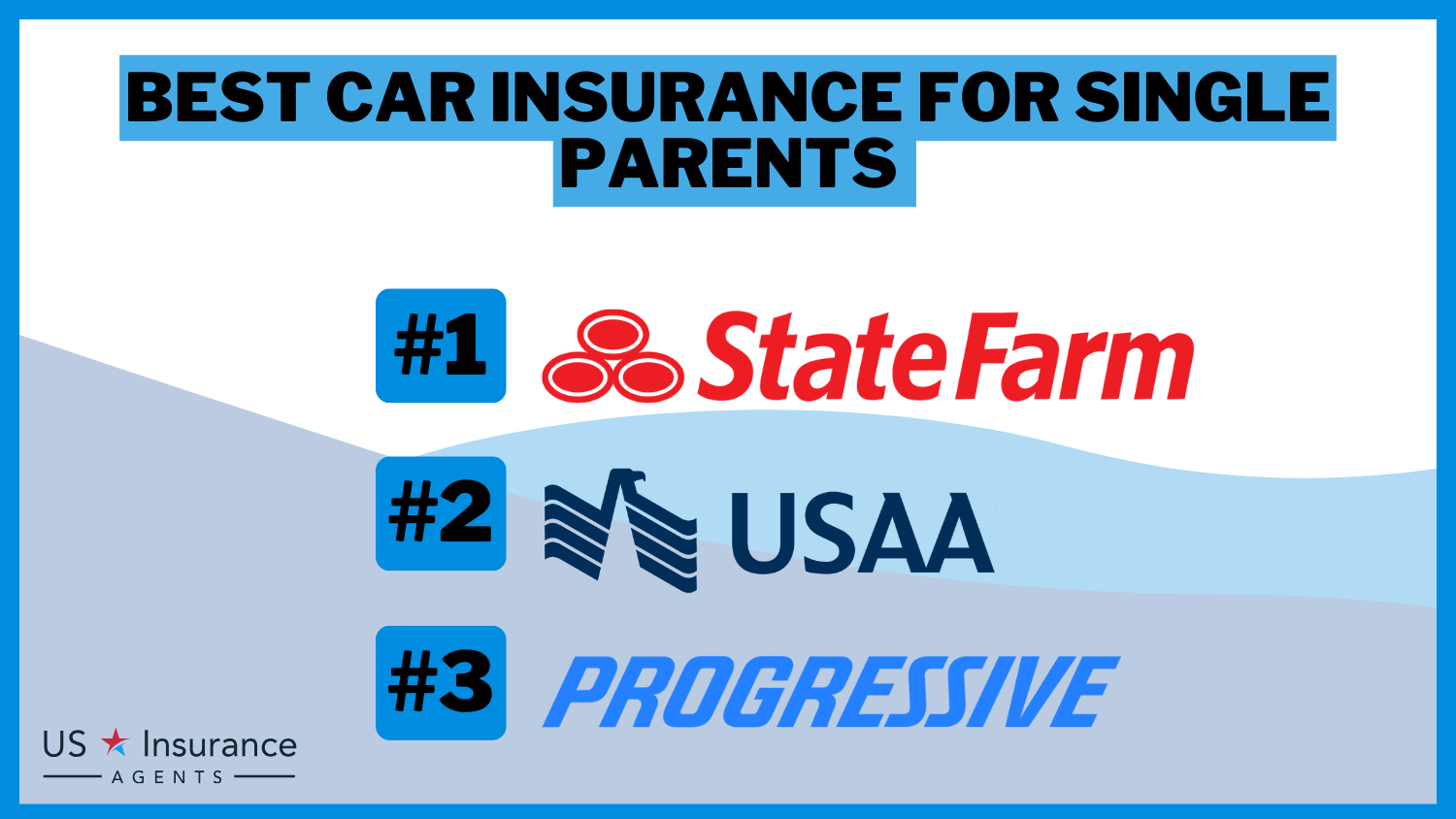

State Farm, USAA, and Progressive offer the best car insurance for single parents with up to 20% discounts and rates from $80/month. Ideal for single moms and dads seeking affordable, comprehensive coverage, these providers understand the unique challenges faced by single-parent families.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated February 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Single Parents

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Single Parents

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Single Parents

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsThe top picks for the best car insurance for single parents are State Farm, USAA, and Progressive, known for offering competitive rates and comprehensive coverage.

State Farm leads the pack with rates starting as low as $80/month, making it the best option for single parents looking for affordability without compromising on protection.

Our Top 10 Company Picks: Best Car Insurance for Single Parents

| Company | Rank | Multi-Policy Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 15% | Family Coverage | State Farm | |

| #2 | 25% | 10% | Military Families | USAA | |

| #3 | 15% | 30% | Customizable Plans | Progressive | |

| #4 | 25% | 20% | Accident Forgiveness | Allstate | |

| #5 | 20% | 12% | New Car Replacement | Liberty Mutual |

| #6 | 25% | 10% | Family Discounts | Nationwide |

| #7 | 15% | 15% | Usage-Based Savings | Farmers | |

| #8 | 20% | 23% | Safe Driving Rewards | Travelers | |

| #9 | 20% | 20% | Member Benefits | AAA Insurance |

| #10 | 10% | 30% | Online Convenience | Esurance |

To ensure you get the best rates and coverage tailored to your needs, we invite you to enter your ZIP code below. Compare rates from the best insurance providers and take the first step towards securing the optimal car insurance for you and your family.

#1 – State Farm: Top Overall Pick

Pros

- Affordable Rates: State Farm offers competitive average monthly rates for good drivers, providing cost-effective options for single parents.

- High Financial Stability: With an A+ rating from A.M. best, State Farm demonstrates a high level of financial stability, reassuring customers of its ability to fulfill claims and obligations.

- Low Complaint Level: State Farm insurance review & ratings reveal that the company experiences a minimal level of complaints, suggesting that the majority of policyholders are pleased with their customer service.

Cons

- Limited Discounts: While State Farm provides a family-centric approach, its discounts are relatively standard, lacking the extensive offerings seen with some competitors.

- Coverage Customization: Some users might find the customization options limited compared to other providers, potentially impacting the ability to tailor coverage precisely.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Military-Focused Benefits: USAA caters to military families, offering specialized coverage and discounts, making it an excellent choice for single parents with military affiliations.

- Exceptional Rates: With an average monthly rate of $62.75 for good drivers, USAA provides one of the most cost-effective solutions among the top providers.

- Low Complaint Level: Similar to State Farm, USAA boasts a low complaint level, reflecting high customer satisfaction.

Cons

- Limited Eligibility: Access to USAA car insurance is limited to military personnel and their families, excluding the general public. For more details, refer to our USAA home and car insurance review & ratings.

- Smaller Network: USAA has a smaller network of offices and agents compared to some larger competitors, potentially affecting the availability of in-person assistance.

#3 – Progressive: Best for Customization Champion

Pros

- Highly Customizable Plans: Progressive insurance review & ratings highlight its distinction in offering customizable plans, which enable single parents to adapt coverage according to their unique requirements.

- Significant Safe Driver Discount: With a 30% safe driver discount, Progressive rewards good driving behavior, contributing to potential savings for policyholders.

- Innovative Usage-Based Savings: Progressive offers usage-based savings, allowing drivers to save money by demonstrating safe driving habits.

Cons

- Higher Average Monthly Rates: Progressive has a slightly higher average monthly rate for good drivers compared to some competitors, potentially impacting budget-conscious single parents.

- Average A.M. Best Rating: While still a respectable A rating, Progressive’s A.M. best rating is slightly lower than State Farm and USAA, suggesting a slightly lower level of financial stability.

#4 – Allstate: Best for Accident Forgiveness

Pros

- Generous Accident Forgiveness: Allstate offers a substantial 25% multi-policy discount along with a 20% safe driver discount, emphasizing accident forgiveness and promoting savings for single parents.

- Variety of Discounts: With a range of discounts, including accident forgiveness and safe driver discounts, Allstate provides multiple opportunities for policyholders to save money on their premiums.

- Diverse Coverage Options: Allstate’s accident forgiveness feature can be particularly advantageous for single parents, offering protection against potential rate increases after an at-fault accident.

Cons

- Higher Premiums: Despite the discounts, Allstate’s average monthly rates may still be relatively higher for good drivers, potentially affecting the affordability for some single parents.

- Mixed Customer Reviews: Allstate insurance review & ratings reveal a prominent standing, though certain customer feedback hints at diverse experiences, pointing to fluctuations in customer contentment.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for New Car Replacement

Pros

- New Car Replacement Benefit: Liberty Mutual distinguishes itself with a 20% multi-policy discount and a 12% safe driver discount, and notably, a new car replacement benefit, providing added value for single parents with newer vehicles.

- Wide Range of Discounts: Liberty Mutual review & ratings highlight that, in addition to benefits for safe drivers, the company provides a range of discounts that could significantly reduce car insurance costs for single parents.

- Innovative Coverage Features: The new car replacement benefit is an innovative feature that can be particularly appealing for single parents who prioritize the protection of their recent vehicle investments.

Cons

- Moderate Discounts: While Liberty Mutual provides discounts, the percentages are moderate compared to some competitors, potentially offering fewer savings opportunities.

- Customer Service Concerns: Some customer reviews may highlight concerns regarding Liberty Mutual’s customer service, indicating potential areas for improvement.

#6 – Nationwide: Best for Family Discounts

Pros

- Family Discounts: Nationwide stands out with a 25% multi-policy discount and a 10% safe driver discount, specifically catering to families, which can be beneficial for single parents seeking comprehensive coverage.

- Well-Established Network: Nationwide insurance review & ratings highlight the company’s longstanding stability and extensive network of offices and agents, ensuring accessibility for its policyholders.

- Coverage Customization: Nationwide’s emphasis on family discounts aligns well with the needs of single parents, allowing for tailored coverage that suits their specific requirements.

Cons

- Average Safe Driver Discount: While Nationwide provides a safe driver discount, it may be perceived as average compared to some competitors, potentially impacting the overall savings for policyholders.

- A.M. Best Rating: Nationwide’s A.M. best rating is not provided in the provided content, and this information is crucial for assessing the company’s financial stability.

#7 – Farmers: Best for Usage-Based Savings

Pros

- Usage-Based Savings: Farmers offers a 15% discount for usage-based savings, allowing single parents to potentially lower their premiums based on their driving habits.

- Balanced Discounts: With both a multi-policy discount and usage-based savings, Farmers provides a balanced approach to discounts, catering to different aspects of a policyholder’s profile.

- Established Company: Farmers insurance review & ratings highlight the company’s status as a reputable insurer, providing consistent stability and trustworthiness for its clients.

Cons

- Moderate Discounts: While Farmers provides discounts, they may be perceived as moderate compared to some competitors, potentially limiting the overall savings for policyholders.

- Customer Service Variability: Like any large insurance company, customer service experiences with Farmers can vary, and some customers may report concerns in this area.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Safe Driving Rewards

Pros

- Safe Driving Rewards: Travelers offers a significant 20% multi-policy discount and a remarkable 23% safe driving rewards, emphasizing the importance of safe driving behavior for potential savings.

- Comprehensive Coverage Options: Travelers insurance review & ratings indicate the company offers an extensive selection of coverage choices, enabling single parents to tailor their insurance policies to suit their unique requirements.

- Strong Financial Stability: Travelers generally maintains a strong financial stability, as indicated by its A.M. Best rating, providing reassurance to policyholders.

Cons

- Potentially Higher Premiums: While safe driving rewards are appealing, Travelers’ average monthly rates may still be relatively higher for good drivers, potentially impacting affordability.

- Limited Online Presence: Travelers may have a more traditional approach, and those who prefer managing their policies online might find limited conveniences compared to some competitors.

#9 – AAA: Best for Member Benefits

Pros

- Member Benefits: AAA offers a 20% multi-policy discount along with 20% member benefits, providing a unique combination of savings opportunities for single parents.

- Diverse Service Offerings: Beyond car insurance, AAA offers a variety of services, including roadside assistance, potentially adding value for policyholders.

- Established Reputation: AAA is a well-known and reputable organization, which can contribute to a sense of trust and confidence for policyholders.

Cons

- Limited Accessibility: AAA membership is required to access their insurance services, potentially limiting availability for those who are not AAA members.

- Potential Cost: When reviewing the overall affordability of the insurance, it’s important to take into account the cost of AAA membership along with the benefits it offers. This factor plays a crucial role in the “AAA Insurance Review & Ratings.”

#10 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Esurance distinguishes itself with a 10% multi-policy discount and an impressive 30% online convenience discount, offering significant savings for those who prefer online management.

- Competitive Online Presence: As an online-focused provider, Esurance provides a streamlined and convenient online experience for policy management, catering to tech-savvy customers.

- Innovative Approach: The emphasis on online convenience reflects Esurance’s innovative approach to insurance, aligning with the preferences of a modern, digitally-oriented customer base.

Cons

- Limited Personalized Service: While the online ease of use is a highlight of Esurance insurance review & ratings, it may detract from the personal, in-person service that certain clients might favor.

- Varied Customer Experiences: As with any insurer, customer experiences can vary, and some may report concerns related to claims processing or customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance for Single Parents: Navigating Coverage Options

As the number of single parents continues to rise, finding affordable and comprehensive car insurance becomes crucial for ensuring family safety while staying within budget.

Examining the specifics, State Farm leads with an affordable $80 monthly rate for minimum coverage, emphasizing cost-effectiveness. For those seeking broader protection, State Farm, USAA, and Esurance provide competitive rates at $250 monthly for full coverage, striking a balance between affordability and comprehensive safeguards.

Single Parents Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $100 | $300 |

| $120 | $400 | |

| $80 | $250 | |

| $130 | $350 | |

| $110 | $320 |

| $100 | $300 |

| $90 | $280 | |

| $80 | $250 | |

| $100 | $300 | |

| $80 | $250 |

Companies like Farmers, Nationwide, and Travelers offer rates ranging from $300 to $350, underscoring a commitment to family-centric solutions and peace of mind on the road.

According to the Pew Research Center, the number of single parents is rising, and single moms and dads need options for keeping their families safe while staying within budget. What types of car insurance provide help for single parents? And in what specific situations will you need to address the details of your policy? Below are a few things to keep in mind when finding car insurance for single moms and dads.

Car Insurance With Increased Coverage for Single Parents

Minimum car insurance coverage in most states will only cover injuries caused to someone else. But making sure they are adequately covered is particularly important to most single parents as they are usually the primary — if not the only — breadwinners.

Jeff Root Licensed Life Insurance Agent

- Personal Injury Protection (PIP) Insurance: A Complete Guide

- Collision Car Insurance: A Complete Guide

- Liability Insurance: A Complete Guide

Most insurance companies offer these types of additional coverage that can help provide single moms and dads with peace of mind.

Other Car Insurance Add-Ons That Can Help Single Parents

- Roadside Assistance Coverage: A Complete Guide

- Best Car Insurance for Towing and Roadside Assistance

- Best Car Insurance for Rental Reimbursement Coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Single Parents With Teen Drivers

If your teen has a driver’s license, adding them to your existing policy is likely the best way to go. While insuring a teen driver is expensive because of the risk they represent, adding your teen to your policy will be less expensive than purchasing a policy for them. For more details, please consult the articles provided below:

- Car Driving Safety Guide for Teens and Parents

- Best Car Insurance for 21-Year-Old Drivers

- Best Car Insurance for Teens in California

- Best Car Insurance for College Students

- Best Car Insurance for Teens in Hawaii

- Best Car Insurance for Teens in Florida

- Best Car Insurance for Teens in South Dakota

- Best Car Insurance for Teens in Ohio

Car insurance companies offer student discounts and other incentives to help you keep the rates more affordable. And if your teen goes away for school, you may also qualify for a distant driver discount.

Car Insurance for Divorced Parents

A change in marital status may affect your insurance rates since insurance companies calculate them based in part on driver demographics. Divorced parents with teen drivers may both need to add their children to their policy to ensure full coverage.

Discuss with your insurance provider regarding your status as a single parent and any custody arrangements you have, to determine the most suitable options for your single parent car insurance needs. For more details, check out our “Do car insurance rates increase after getting a divorce?” guide.

Keeping Car Insurance Affordable for Single Parents

So, how can single parents find more affordable car insurance without sacrificing quality? Several strategies can help single parents lower their car insurance costs while maintaining or even improving their coverage:

- Defensive Driving Courses: Defensive driving courses can lower your car insurance rates by not just enhancing your driving capabilities but also making you eligible for insurance cost reductions.

- Clean Driving Record: A clean driving record demonstrates to insurance companies that you’re a lower risk, which can lead to lower premiums.

- Choosing the Right Car: Opt for a car that’s known for reliability and safety. Certain makes and models are cheaper to insure due to lower repair costs.

- Good Credit Score: A good credit score can reflect positively on your insurance rates, as it indicates financial reliability.

- Student Discounts: If you’re pursuing education, you might be eligible for student discounts. These can depend on factors like age and academic performance.

While insurance rates can be influenced by factors beyond your control, such as demographics, taking advantage of available discounts is within your power.

For single parents managing car insurance costs, the key is to explore all available options for discounts and make informed decisions when selecting a vehicle. By taking proactive steps such as improving driving skills and maintaining a good credit score, single parents can find quality car insurance that fits their budget, ensuring peace of mind and financial security.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Navigating Car Insurance for Single Parents

Single parents face unique challenges in finding car insurance that balances affordability with comprehensive coverage. These case studies illustrate the importance of tailored insurance policies that cater to different family dynamics, driving habits, and financial needs.

- Case Study #1 – Comprehensive Coverage: Emily discovered a best safe driver car insurance discounts policy that includes incentives for cautious driving and the option to bundle multiple policies, providing comprehensive coverage for her family at an affordable cost.

- Case Study #2 – Teen Driver Coverage: John chose an insurer providing a good student discount and a telematics program, allowing affordable coverage for his teenage son and promoting responsible driving.

- Case Study #3 – Flexible Coverage: Sarah selected an insurance company known for excellent customer service and flexible policies, addressing her need for child safety seat coverage and adaptable payment options.

- Case Study #4 – Affordable Multi-Car Insurance: David opted for an insurer that offered a multi-car discount and safe driving incentives, making it feasible to insure multiple vehicles and teen drivers affordably.

The Bottom Line on Buying Car Insurance as a Single Parent

If you shop around for discounts, you may be able to make better coverage more affordable. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

Do insurance companies offer increased coverage options for single parents?

Yes, most insurance companies offer additional coverage options that can provide single parents with peace of mind, such as liability coverage, collision coverage, and comprehensive coverage.

What are some other car insurance add-ons that can help single parents?

Single parents can benefit from various add-ons, such as roadside assistance, rental car coverage, and gap insurance, among others. Please review our information regarding “Is Gap Insurance transferable from one vehicle to another?” for more details.

How can single parents keep insurance rates affordable?

Single parents can keep insurance rates affordable by comparing quotes from multiple insurance companies, increasing their deductibles, and taking advantage of discounts offered by insurers, such as safe driving discounts and student discounts. Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area

How can single parents find the right car insurance coverage?

Single parents can find the right car insurance coverage by comparing quotes from multiple insurance companies, understanding their coverage needs, and asking their insurance agent questions about the policy. They can also check online reviews and ratings to help them make an informed decision.

Can single parents get insurance coverage for their children?

Yes, single parents can get insurance coverage for their children by adding them to their policy. They may also want to consider additional coverage options, such as medical payments coverage, to ensure their children are fully covered.

Are there discounts available for single parents?

Yes, insurance companies offer various discounts for single parents, such as multi-policy discounts, safe driving discounts, and student discounts, among others.

What is the best car insurance for single moms looking for comprehensive coverage?

The best car insurance for single moms typically combines affordability with comprehensive coverage, offering peace of mind. Providers like State Farm, USAA, and Progressive are known for their competitive rates and discounts for single-parent families.

How can single moms find the best insurance for single moms for their unique needs?

Single moms can find the best insurance for single moms by comparing quotes from multiple providers, looking for discounts specifically aimed at single parents, and choosing policies that offer a balance between cost and coverage. It’s essential to consider providers that understand the challenges faced by single parents.

Are there specific car insurance assistance for single moms programs?

Yes, some insurance companies and organizations offer car insurance assistance for single moms, including discounted rates and special programs designed to help single-parent families afford their car insurance premiums.

How can single mothers reduce their car insurance expenses?

Single mothers can reduce their car insurance for single mothers costs by taking advantage of discounts available for good driving records, bundling insurance policies, and enrolling in defensive driving courses. Additionally, increasing deductibles can lower premium costs.

Check out our best defensive driver car insurance discounts for further details.

What factors should single moms consider when looking for cheap car insurance for single moms?

What are the key strategies for finding cheap car insurance for single mothers?

How to save on single-parent auto insurance?

How is car insurance split between divorced parents?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.