Cheap Porsche 718 Spyder Car Insurance in 2026 (Top 10 Low-Cost Companies)

Progressive, State Farm, and Allstate emerge as top choices for cheap Porsche 718 Spyder car insurance, with rates starting at $85 per month. These leading companies offer competitive pricing and tailored coverage options, ensuring Porsche owners find affordable and comprehensive insurance solutions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated October 2024

13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for Porsche 718 Spyder

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Porsche 718 Spyder

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 11,640 reviews

11,640 reviewsCompany Facts

Min. Coverage for Porsche 718 Spyder

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsLooking for cheap Porsche 718 Spyder car insurance? With rates starting at just $85 per month, Progressive, State Farm, and Allstate stand out as top contenders offering competitive premiums tailored for high-performance vehicles.

Each insurer provides customizable policies and strong customer service, ensuring Porsche 718 Spyder owners get comprehensive coverage without overspending.

Our Top 10 Company Picks: Cheap Porsche 718 Spyder Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $85 A+ Qualifying Coverage Progressive

#2 $90 B Many Discounts State Farm

#3 $93 A+ Full Coverage Allstate

#4 $95 A Great Add-ons Farmers

#5 $97 A 24/7 Support Liberty Mutual

#6 $99 A+ Vanishing Deductible Nationwide

#7 $100 A++ Industry Experience Travelers

#8 $102 A Loyalty Rewards American Family

#9 $105 A+ Tailored Policies The Hartford

#10 $110 A+ Dividend Payments Amica

Whether you prioritize cost-effectiveness or robust coverage options, comparing quotes from these leading providers can help you find the best insurance solution for your luxury sports car. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive offers competitive rates specifically tailored for high-performance sports cars like the Porsche 718 Spyder, according to Progressive insurance review & ratings.

- Customizable Policies: They provide options to tailor coverage to fit specific needs, including comprehensive and collision coverage suitable for luxury vehicles like the Porsche 718 Spyder.

- Discount Opportunities: Various discounts are available, such as multi-policy discounts for bundling auto and home insurance, safe driver discounts, and discounts for safety features installed in the Porsche 718 Spyder.

Cons

- Customer Service Concerns: While Progressive generally receives positive feedback for its digital tools, some customers report mixed reviews regarding customer service experiences, including claims processing for the Porsche 718 Spyder.

- Coverage Limitations: Specific coverage limitations may apply to high-performance vehicles like the Porsche 718 Spyder, particularly regarding modifications and aftermarket parts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Multiple Policy Discounts

Pros

- Multiple Policy Discounts: State Farm offers substantial discounts for bundling auto and home insurance policies, which can help reduce overall insurance costs for the Porsche 718 Spyder, as highlighted in the State Farm insurance review & ratings.

- Personalized Service: State Farm is renowned for its personalized service through local agents, providing a more hands-on approach to insurance for owners of the Porsche 718 Spyder.

- Affordable Premiums: State Farm provides budget-friendly rates for Porsche 718 Spyder insurance, making it a cost-effective choice for drivers.

Cons

- Potentially Higher Premiums: Premiums for high-performance vehicles like the Porsche 718 Spyder may be higher compared to other insurers due to the vehicle’s value and performance capabilities.

- Limited Online Tools: While State Farm has been enhancing its online presence, its digital tools and resources may not be as extensive as those offered by some competitors for the Porsche 718 Spyder.

#3 – Allstate: Best for Wide Coverage Options

Pros

- Wide Coverage Options: Allstate offers a broad range of coverage options specifically designed for luxury and sports cars like the Porsche 718 Spyder, ensuring adequate protection against various risks.

- Claim Satisfaction: Allstate receives positive feedback for its claims handling process, providing reassurance to policyholders during stressful situations involving the Porsche 718 Spyder.

- Drivewise Program: Through its Drivewise program, Allstate offers discounts based on safe driving behavior, potentially lowering insurance premiums over time for the Porsche 718 Spyder.

Cons

- Higher Costs: Premiums for insuring high-value vehicles such as the Porsche 718 Spyder can be higher with Allstate compared to some competitors, reflecting the vehicle’s cost and performance, according to Allstate insurance review & ratings.

- Coverage Restrictions: Some restrictions may apply concerning modifications, aftermarket parts, and the Porsche 718 Spyder’s high-performance features, potentially limiting coverage options.

#4 – Farmers: Best for Customizable Coverage

Pros

- Customizable Coverage: Farmers Insurance offers flexibility in coverage options, allowing Porsche 718 Spyder owners to tailor policies to their specific needs, as highlighted in the Farmers insurance review & ratings.

- Discounts Available: Farmers provides various discounts, including those for safety features, multi-policy bundles, and safe driving habits, which can significantly reduce insurance premiums for the Porsche 718 Spyder.

- Strong Claims Support: Farmers generally receives positive feedback for its claims handling process, ensuring quick and efficient resolution of claims for the Porsche 718 Spyder.

Cons

- Cost Considerations: Due to the Porsche 718 Spyder’s high value and performance capabilities, insurance premiums with Farmers may be higher compared to less expensive or less powerful vehicles.

- Limited Availability: Coverage options and discounts offered by Farmers Insurance may vary depending on the policyholder’s location, potentially limiting accessibility in some areas for the Porsche 718 Spyder.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Specialized Coverage

Pros

- Specialized Coverage: Liberty Mutual offers specialized coverage options specifically designed for high-value and luxury vehicles like the Porsche 718 Spyder, ensuring comprehensive protection against various risks.

- Tech Savvy: Liberty Mutual provides modern online tools and a mobile app for convenient policy management, claims filing, and premium payments for owners of the Porsche 718 Spyder.

- Discounts: Liberty Mutual offers discounts for safety features installed in the Porsche 718 Spyder, as well as for good driving habits, helping to lower insurance costs, as detailed in the Liberty Mutual Review & Ratings.

Cons

- Premiums: Due to the Porsche 718 Spyder’s high value and performance, insurance premiums with Liberty Mutual may be higher compared to more economical or less powerful vehicles.

- Policy Limitations: Certain policy limitations may apply to luxury and sports cars like the Porsche 718 Spyder, potentially restricting coverage options based on modifications or aftermarket parts.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide provides an accident forgiveness program, which can help maintain lower insurance premiums even after an at-fault accident for the Porsche 718 Spyder.

- Nationwide On Your Side® Review: Nationwide offers a personalized insurance review through its Nationwide On Your Side® service, ensuring that Porsche 718 Spyder owners have adequate coverage.

- Good Discounts: Nationwide offers a variety of discounts, including multi-policy and safe driving discounts, helping policyholders save on overall insurance costs for the Porsche 718 Spyder.

Cons

- Premium Costs: Insurance premiums for sports cars like the Porsche 718 Spyder may be higher with Nationwide compared to insurers specializing in luxury and high-performance vehicles.

- Policy Options: While Nationwide offers a range of coverage options, some policyholders may find coverage options for luxury and sports cars limited compared to more specialized insurers, as noted in the Nationwide insurance review & ratings.

#7 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Travelers is known for offering competitive rates for luxury and sports cars like the Porsche 718 Spyder, potentially providing cost-effective insurance solutions.

- Customizable Policies: Travelers offers customizable policies that allow Porsche 718 Spyder owners to tailor coverage to their specific needs and preferences, as mentioned in the Travelers insurance review & ratings.

- Discounts: Travelers offers various discounts, including those for safety features, multi-policy bundles, and safe driving habits, which can help reduce insurance premiums for the Porsche 718 Spyder.

Cons

- Customer Service: While Travelers provides competitive rates and customizable policies, customer service experiences may vary, with some policyholders reporting mixed reviews regarding service and support for the Porsche 718 Spyder.

- Policy Restrictions: Specific restrictions may apply concerning modifications, aftermarket parts, and the high-performance features of the Porsche 718 Spyder, potentially impacting coverage options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Bundle Discounts

Pros

- Bundle Discounts: American Family offers significant discounts for bundling auto and home insurance policies, providing cost-saving opportunities for Porsche 718 Spyder owners, as detailed in the American Family insurance review & ratings.

- Custom Coverage: American Family provides flexibility in coverage options, allowing policyholders to tailor insurance policies to meet the unique needs of luxury vehicles like the Porsche 718 Spyder.

- Digital Experience: American Family offers modern online tools and a user-friendly mobile app for convenient policy management and claims filing for the Porsche 718 Spyder.

Cons

- Costs: Insurance premiums for high-performance vehicles such as the Porsche 718 Spyder may be higher with American Family compared to insurers focusing on more affordable or less powerful vehicles.

- Availability: Coverage options and discounts offered by American Family may vary by location, potentially limiting accessibility in certain regions for the Porsche 718 Spyder.

#9 – The Hartford: Best for AARP Membership Benefits

Pros

- AARP Membership Benefits: The Hartford offers special benefits for AARP members, including auto insurance discounts tailored for mature drivers, potentially reducing insurance premiums for Porsche 718 Spyder owners.

- Competitive Pricing: The Hartford provides competitive pricing for high-value vehicles, offering cost-effective insurance solutions for luxury and sports cars like the Porsche 718 Spyder.

- Specialized Coverage: The Hartford offers specialized coverage options designed to meet the unique needs of high-value and luxury vehicles like the Porsche 718 Spyder.

Cons

- Membership Requirements: AARP membership is required to access certain benefits and discounts offered by The Hartford, which may limit accessibility for some Porsche 718 Spyder owners, as noted in the The Hartford insurance review & ratings.

- Limited Accessibility: Availability of coverage options and discounts may vary depending on the policyholder’s location, potentially restricting accessibility in certain regions for the Porsche 718 Spyder.

#10 – Amica: Best for Coverage Options

Pros

- Coverage Options: Amica offers a wide range of coverage options that can be customized to meet the specific needs of luxury vehicles like the Porsche 718 Spyder.

- Dividend Policy: Amica policyholders may be eligible for dividends, providing potential financial rewards based on the company’s financial performance for the Porsche 718 Spyder.

- Discounts Available: Amica offers various discounts, including loyalty discounts for long-term policyholders and multi-policy discounts for bundling auto and home insurance for the Porsche 718 Spyder, as detailed in the Amica Homeowners Insurance Review.

Cons

- Premium Costs: Insurance premiums for high-performance vehicles such as the Porsche 718 Spyder may be higher with Amica compared to insurers specializing in less expensive or less powerful vehicles.

- Availability: Amica’s availability may be limited in some regions compared to larger insurers, potentially impacting accessibility to coverage options and discounts for the Porsche 718 Spyder.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

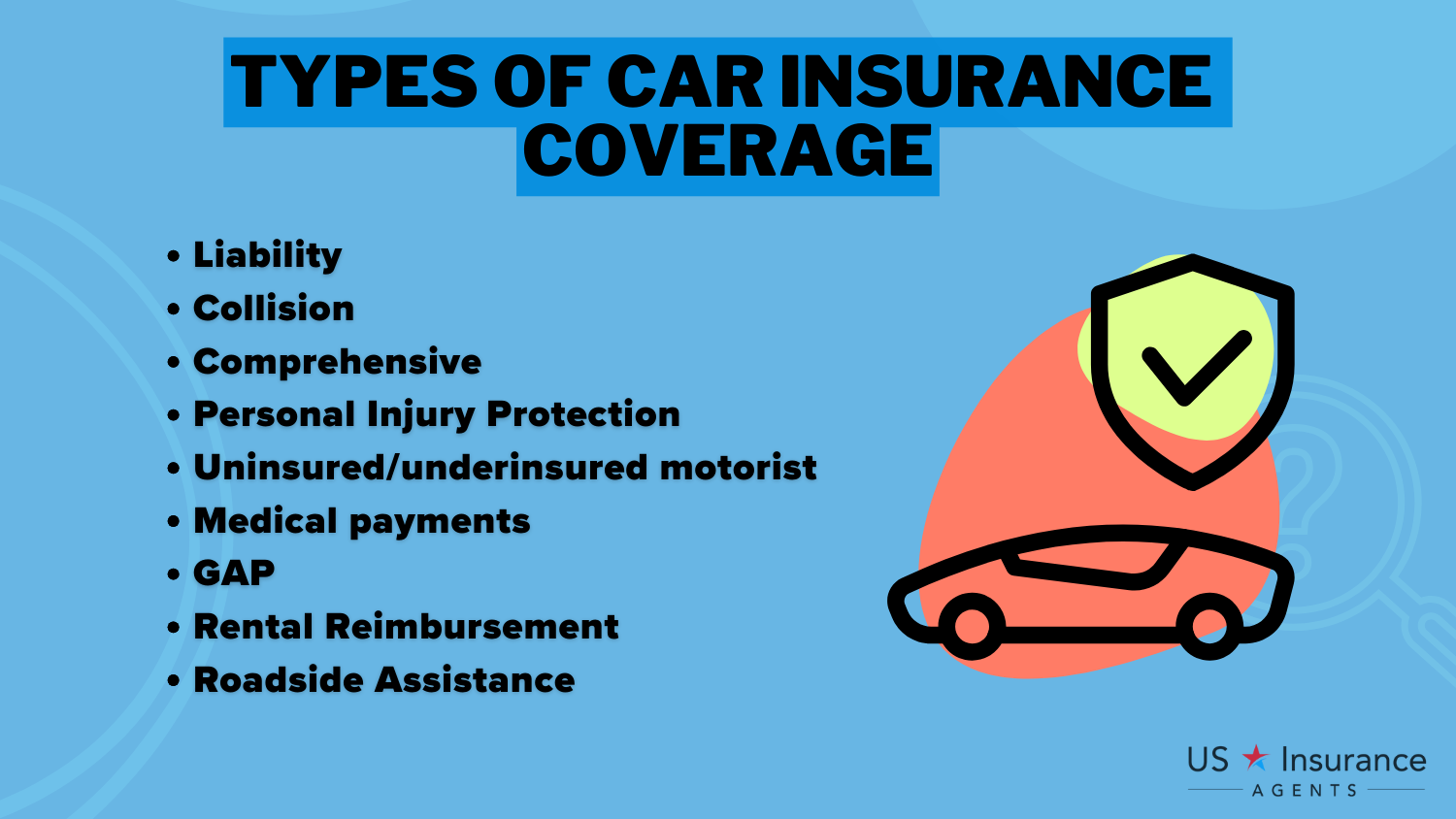

Factors Influencing Porsche 718 Spyder Insurance Costs

Many factors influence the cost of car insurance, and the Porsche 718 Spyder is no exception. Insurance companies consider factors such as the driver’s age, driving history, credit score, and location when determining insurance rates. Additionally, the value of the vehicle, its safety features, and the cost to repair or replace damaged parts are also taken into account.

Porsche 718 Spyder Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $93 $198

American Family $102 $225

Amica $110 $235

Farmers $95 $205

Liberty Mutual $97 $210

Nationwide $99 $215

Progressive $85 $190

State Farm $90 $195

The Hartford $105 $230

Travelers $100 $220

Since the Porsche 718 Spyder is a high-performance sports car, it is typically more expensive to insure than a standard sedan or SUV. This is primarily because sports cars are often involved in accidents due to their powerful engines and aggressive driving capabilities. Insurance companies may also consider the potential cost of repairs for luxury vehicles like the Porsche 718 Spyder, as specialized parts and labor can be costly.

Understanding the Insurance Rates for the Porsche 718 Spyder

Insurance rates for the Porsche 718 Spyder can vary depending on several factors. Generally, sports cars have higher premiums compared to other types of vehicles due to their increased risk of accidents and costly repairs. The cost of insuring a Porsche 718 Spyder can be influenced by the model year, trim level, and modifications made to the vehicle.

Tim Bain Licensed Insurance Agent

It is important to note that insurance rates can also vary between different insurance companies. Some insurers may specialize in providing coverage for luxury or sports cars and may offer more competitive rates for the Porsche 718 Spyder. It is recommended to obtain quotes from multiple insurers to ensure you are getting the best coverage at the most affordable price.

Average Porsche 718 Spyder Insurance Premiums

The average insurance premiums for the Porsche 718 Spyder can vary depending on several factors that have been previously mentioned. However, it is not uncommon for owners of this high-performance sports car to pay higher premiums compared to other vehicles. On average, insurance premiums for the Porsche 718 Spyder can range from a few thousand dollars to several thousand dollars per year.

It is important to keep in mind that these figures are just estimates, and actual insurance premiums can differ based on individual circumstances. As every situation is unique, it is recommended to contact insurance companies directly to obtain accurate quotes based on your specific circumstances. Continue reading our full “How does the insurance company determine my premium?” guide for extra tips.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Porsche 718 Spyder’s High-Risk Insurance Status

The Porsche 718 Spyder is often considered a high-risk vehicle to insure due to its performance capabilities. Its powerful engine and agile handling make it more prone to accidents, and insurance companies may view it as a higher risk compared to other types of vehicles.

Additionally, the cost of repairs for a luxury sports car like the Porsche 718 Spyder can significantly impact insurance rates. However, it is worth noting that insurance rates are not solely based on the make and model of the vehicle. Factors such as the driver’s age, driving history, and location are also taken into consideration.

While the Porsche 718 Spyder may be considered high-risk, responsible driving habits and a clean driving record can help offset some of the potential higher insurance costs. Explore our detailed analysis on “Car Insurance Startups Change How You Buy Car Insurance” for additional information.

Porsche 718 Spyder vs. Other Sports Cars: Insurance Costs

When considering insurance costs for the Porsche 718 Spyder, it is beneficial to compare them with other sports cars in a similar price range and performance category. This can provide insight into whether the insurance rates for the Porsche 718 Spyder are relatively high or within the average range.

While it is difficult to provide specific comparisons without knowing the exact make and model of the other sports cars, it is generally expected that high-performance sports cars will have higher insurance rates compared to standard vehicles.

However, there may be variations depending on the specific factors mentioned earlier. Get more insights by reading our expert “Compare Car Insurance Quotes” advice.

Affordable Porsche 718 Spyder Insurance Tips

Securing affordable car insurance for your Porsche 718 Spyder can be challenging due to its high-performance nature and luxury status. However, by understanding key factors and implementing smart strategies, you can reduce your premiums without compromising on coverage.

In this guide, we provide essential tips to help you find cost-effective insurance options for your Porsche 718 Spyder. Despite the potentially higher insurance costs associated with the Porsche 718 Spyder, there are ways to find affordable car insurance coverage without compromising on the necessary protection.

Here are some tips to keep in mind when shopping for insurance:

- Compare Quotes From Multiple Insurers: Taking the time to obtain quotes from different insurance companies can help you find the most competitive rates for your Porsche 718 Spyder.

- Increase Deductibles: Opting for a higher deductible – the amount you pay out of pocket before insurance coverage kicks in – can lower your insurance premiums. However, be sure to choose a deductible you can afford in case of an accident.

- Take Advantage of Discounts: Many insurance companies offer discounts for things like bundling multiple policies, having a good driving record, or completing defensive driving courses. Inquire about available discounts and see if you qualify.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that determine premiums based on actual driving behavior. If you are a safe and responsible driver, this type of insurance may result in lower premiums.

Finding affordable insurance for your Porsche 718 Spyder doesn’t have to be daunting. By maintaining a clean driving record, taking advantage of discounts, and comparing quotes from various providers, you can secure a policy that meets your needs and budget.

Use these tips to enjoy your Porsche 718 Spyder with peace of mind, knowing you have reliable and affordable coverage. For more information, explore our informative “Lesser Known Car Insurance Discounts for” page.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of Driving Record on Porsche 718 Spyder Insurance Costs

Your driving record plays a significant role in determining insurance costs for any vehicle, including the Porsche 718 Spyder. Insurance companies assess the risk of insuring an individual based on their driving history.

A clean driving record with no accidents or traffic violations indicates responsible driving behavior and often leads to lower insurance rates. On the other hand, if you have a history of accidents or traffic offenses, insurance companies may consider you a higher risk to insure and adjust your premiums accordingly.

It is important to maintain a safe driving record to not only ensure your safety but also to potentially secure lower insurance rates for your Porsche 718 Spyder. Expand your understanding with our thorough “Insurance Quotes Online” overview.

The Effect of Porsche 718 Spyder Mods on Insurance Rates

If you are considering making modifications to your Porsche 718 Spyder, it is essential to understand how they can affect your insurance rates. Modifications such as engine upgrades, body kits, or aftermarket exhaust systems can increase the value of your vehicle and impact the cost of repairs, potentially leading to higher insurance premiums.

It is crucial to inform your insurance company about any modifications made to your Porsche 718 Spyder to ensure that you have proper coverage.

Additionally, some insurers may offer specialized policies for modified vehicles, so it is worth exploring these options to find the best coverage at a competitive rate. Read our extensive guide on “Can I get car insurance for a car that is modified or customized?” for more knowledge.

New vs. Used Porsche 718 Spyder Insurance

When it comes to insuring a new versus a used Porsche 718 Spyder, there are some notable differences to consider. Insurance rates for a new vehicle are generally higher due to the higher cost to replace or repair the vehicle in the event of an accident. Dive deeper into “How to Get Free Insurance Quotes Online” with our complete resource.

Additionally, new cars may have more advanced safety features that can help reduce the risk of accidents and potential injuries, which can also impact insurance rates. On the other hand, insuring a used Porsche 718 Spyder may result in lower insurance premiums.

Used cars have already experienced some depreciation in value and may be deemed less risky to insure compared to their brand-new counterparts. However, it is important to keep in mind that factors such as the vehicle’s age, mileage, and condition can still affect insurance rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deductibles and Porsche 718 Spyder Insurance

When purchasing car insurance for your Porsche 718 Spyder, you will be presented with different deductible options. The deductible is the amount you must pay out of pocket before your insurance coverage starts to cover the remaining costs.

Typically, insurers offer deductible options ranging from a few hundred to a few thousand dollars. The deductible you choose can have a direct impact on your insurance premiums.

A higher deductible usually results in lower premiums, as you are agreeing to cover a larger portion of the costs in the event of an accident. However, it is important to assess your ability to afford the deductible in case of an accident or damage to your vehicle. Learn more by visiting our detailed “What is the difference between a deductible and a premium in car insurance?” section.

Discount Opportunities for Insuring Your Porsche 718 Spyder

Insurance companies often provide a range of discounts to help lower your insurance premiums for the Porsche 718 Spyder. These discounts are typically based on various factors such as your driving history, the safety features of your vehicle, and other qualifying criteria. One common discount is the good driver discount, which rewards drivers with a clean driving record and lower risk profiles.

Another way to save is through the multi-policy discount, available if you bundle multiple insurance policies, such as your car and home insurance, with the same provider. Additionally, anti-theft device discounts are offered for vehicles equipped with security features that reduce the risk of theft or vandalism.

Insurance companies also provide safety features discounts for cars that include advanced safety systems like anti-lock brakes, airbags, and stability control, which contribute to safer driving. Completing a defensive driving course can also make you eligible for discounts, as it demonstrates a commitment to safe driving practices.

To ensure you are taking advantage of all possible savings, be sure to ask your insurance provider about the specific discounts available and the eligibility requirements for each. By exploring these options, you can effectively reduce your Porsche 718 Spyder insurance costs. For further details, check out our in-depth “Safety Car Insurance Discounts” article.

The Importance of Comprehensive Coverage for Your Porsche 718 Spyder

Comprehensive coverage is an essential component of insurance for your Porsche 718 Spyder. Comprehensive coverage protects your vehicle from damages that may occur outside of accidents, such as theft, vandalism, or damage caused by natural disasters. Discover our comprehensive guide to “What is included in comprehensive car insurance?” for additional insights.

Given the value of the Porsche 718 Spyder, having comprehensive coverage can provide peace of mind knowing that you are financially protected against a wide range of risks.

While comprehensive coverage can add to the overall insurance premium cost, it is worth considering to safeguard your investment in the Porsche 718 Spyder. Discuss comprehensive coverage options with your insurance provider and ensure that the policy adequately covers your needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hidden Costs of Owning a Porsche 718 Spyder and Insurance

When considering the cost of owning a Porsche 718 Spyder, it is essential to understand and account for the hidden costs beyond the purchase price. While insurance is a significant component of these hidden costs, there are other factors to consider as well. Owning a luxury sports car like the Porsche 718 Spyder often comes with higher maintenance and repair costs compared to more common vehicles.

Specialized parts, labor, and servicing requirements can all contribute to increased expenses. Additionally, fuel costs may be higher for a high-performance vehicle with a powerful engine like the Porsche 718 Spyder. Insurance is an important part of the overall cost equation, as it provides financial protection in the event of an accident or unexpected damages.

It is crucial to budget and account for insurance costs when deciding to purchase a Porsche 718 Spyder to ensure that you can comfortably afford the full range of ownership expenses. Explore our detailed analysis on “How much is car insurance?” for additional information.

The Impact of Location on Porsche 718 Spyder Insurance Rates

Location plays a significant role in determining car insurance rates, including those for the Porsche 718 Spyder. Insurance companies consider factors such as the crime rate, traffic flow, and the number of vehicle accidents in your area when calculating insurance premiums. Areas with higher crime rates or congested roads may result in higher insurance rates.

Additionally, insurance regulations and laws can vary from one state or region to another, which can further influence insurance rates. For example, some regions may require higher minimum coverage limits or have specific laws regarding insurance coverage. It is important to be aware of how location can impact insurance rates for your Porsche 718 Spyder.

Kristine Lee Licensed Insurance Agent

When moving or considering purchasing a new vehicle, it may be beneficial to compare insurance rates between different areas to ensure you are making an informed decision. In conclusion, the cost of Porsche 718 Spyder car insurance can vary based on numerous factors such as driver demographics, vehicle value, driving record, and location.

While owning a high-performance sports car like the Porsche 718 Spyder may result in higher insurance premiums, it is crucial to accurately assess and budget for these costs in addition to other hidden expenses associated with luxury sports car ownership. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

By understanding the factors that influence insurance rates and exploring available discounts and coverage options, you can find affordable and comprehensive insurance coverage for your Porsche 718 Spyder. Get more insights by reading our expert “What states require car insurance?” advice.

Frequently Asked Questions

What factors determine the cost of insurance for a Porsche 718 Spyder?

Insurance costs depend on age, location, driving history, credit score, and chosen coverage level for the Porsche 718 Spyder.

Are Porsche 718 Spyder cars expensive to insure?

Yes, due to their high-performance nature, Porsche 718 Spyder cars are generally more costly to insure.

Does insurance cost for a Porsche 718 Spyder vary by location?

Yes, it can vary based on where the car is driven and stored, with higher rates in areas prone to accidents, theft, or vandalism.

Continue reading our full “Full Coverage Car Insurance: A Complete Guide” guide for extra tips.

Do insurers offer discounts for Porsche 718 Spyder owners?

Yes, discounts may apply based on age, driving record, safety features, or bundling policies with the same insurer.

What is the cheapest Porsche 718 Spyder car insurance available?

The cheapest Porsche 718 Spyder car insurance can vary, but Progressive often offers competitive rates for luxury sports cars.

Can I lower insurance costs for my Porsche 718 Spyder?

Yes, options include maintaining a clean record, choosing a higher deductible, installing anti-theft devices, and comparing quotes.

For more information, explore our informative “Can I bundle my car insurance with other policies?” page.

Is a Porsche 718 Spyder expensive to insure compared to other sports cars?

Yes, due to its high value and performance capabilities, Porsche 718 Spyder insurance tends to be more expensive than average sports cars.

See if you’re getting the best deal on car insurance by entering your ZIP code below

Does the color of a Porsche 718 Spyder affect insurance rates?

Insurance rates for Porsche 718 Spyder generally aren’t affected by color, but other factors like model year and driving record play a bigger role.

Which insurance provider offers the best coverage for a Porsche 718 Spyder?

Allstate and State Farm are noted for offering comprehensive coverage tailored for high-value vehicles like the Porsche 718 Spyder.

Expand your understanding with our thorough “Best Car Insurance” overview.

What are the average Porsche 718 Spyder auto insurance costs?

Average insurance costs for a Porsche 718 Spyder can range from $300 to $500 per month, depending on coverage and insurer.

Can I get full coverage Porsche 718 Spyder car insurance quotes online?

Where can I find full coverage Porsche 718 Spyder insurance quotes from different insurers?

What are the annual Porsche Spyder car insurance rates in different regions?

How much does insurance on a Porsche 718 Spyder typically cost monthly?

Where can I find cheap Porsche 718 Spyder car insurance near me?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.