Cheap Suzuki Grand Vitara Car Insurance in 2026 (Top 10 Low-Cost Companies)

Nationwide, State Farm, and Progressive lead the pack for cheap Suzuki Grand Vitara car insurance, with rates starting at $70/mo. This article delves into the pros and cons of these top providers, helping you navigate the best options for comprehensive and affordable coverage tailored to your Grand Vitara needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated January 2025

Company Facts

Min. Coverage for Suzuki Grand Vitara

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Suzuki Grand Vitara

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Suzuki Grand Vitara

A.M. Best Rating

Complaint Level

Pros & Cons

This article examines the factors influencing insurance premiums, explores coverage options, and highlights discounts to ensure you get the best deal. We provide a detailed comparison of the top providers, considering aspects like customer service, coverage benefits, and additional features to help you make an informed choice.

Our Top 10 Company Picks: Cheap Suzuki Grand Vitara Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $70 A+ Vanishing Deductible Nationwide

#2 $73 B Comprehensive Coverage State Farm

#3 $75 A+ Usage Discounts Progressive

#4 $76 A Safe Driver American Family

#5 $77 A++ Good Drivers Geico

#6 $78 A Personalized Service Farmers

#7 $79 A++ Car Replacement Travelers

#8 $80 A Roadside Assistance AAA

#9 $82 A Policy Discounts Liberty Mutual

#10 $85 A+ Accident Forgiveness Allstate

Discover how to find affordable and comprehensive insurance tailored to your Suzuki Grand Vitara needs. See if you’re getting the best deal on car insurance by entering your ZIP code above.

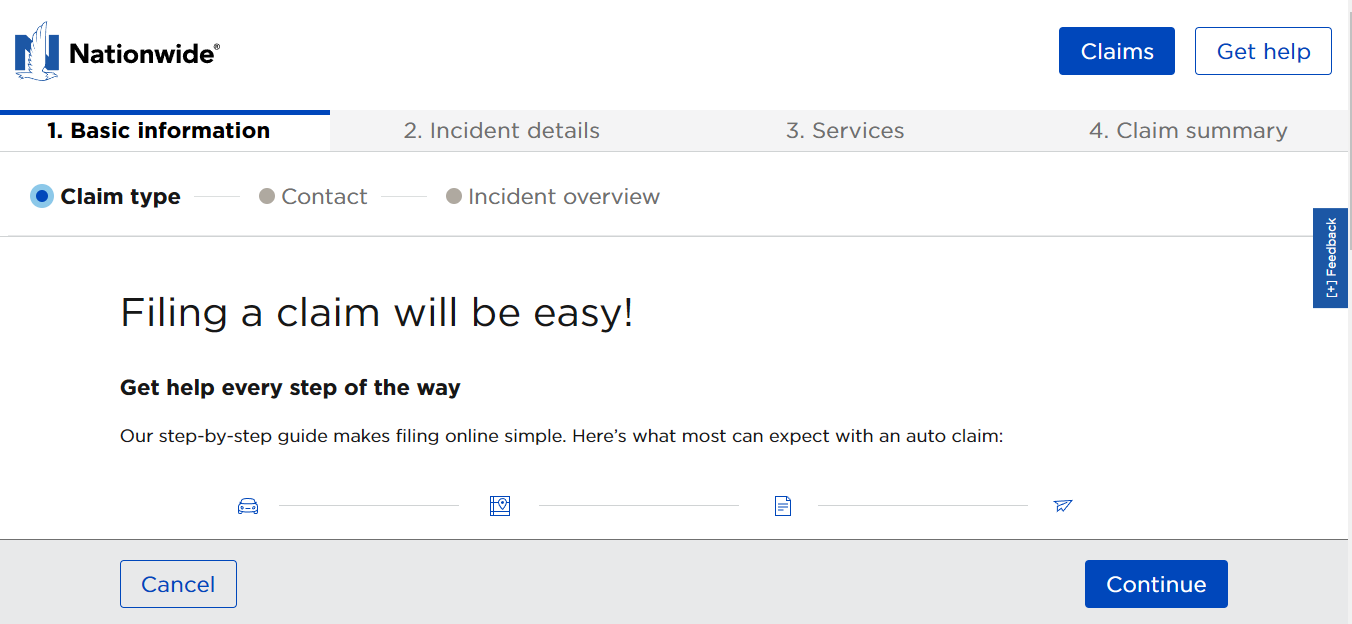

#1 – Nationwide: Top Overall Pick

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Suzuki Grand Vitara Insurance

The cost of car insurance for a Suzuki Grand Vitara can vary depending on several factors. One of the most significant factors is the driver’s age and driving history. Younger, inexperienced drivers or those with a history of accidents or traffic violations may face higher insurance rates compared to older, more experienced drivers with clean records.

Another factor that affects insurance premiums is the location where the vehicle will be primarily driven and parked. Areas with higher crime rates or dense traffic may result in higher insurance costs. Additionally, the frequency of vehicle thefts and accidents in a particular area can influence insurance rates.

Suzuki Grand Vitara Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $80 $145

Allstate $85 $150

American Family $76 $140

Farmers $78 $140

Geico $77 $142

Liberty Mutual $82 $155

Nationwide $70 $130

Progressive $75 $138

State Farm $73 $135

Travelers $79 $148

The make and model of the vehicle also play a role in determining the cost of insurance. The Suzuki Grand Vitara, being an SUV, may have higher insurance rates compared to smaller, less expensive vehicles due to the potential for more severe damages and injuries during accidents. The annual mileage of the vehicle is another consideration for insurance companies.

Vehicles that are driven longer distances tend to have higher insurance rates since there is a greater likelihood of being involved in an accident. Furthermore, the driver’s credit history can also impact the cost of car insurance for a Suzuki Grand Vitara. Insurance companies often use credit scores as a factor in determining insurance rates.

A lower credit score may result in higher premiums, as it is seen as an indicator of higher risk. In addition to the driver’s credit history, the level of coverage chosen by the policyholder can affect the cost of insurance. Opting for comprehensive coverage, which provides protection against a wider range of risks, may result in higher premiums compared to basic liability coverage.

What Affects Suzuki Grand Vitara Insurance Premiums

When it comes to the cost of insuring a Suzuki Grand Vitara, it’s essential to understand how insurance premiums work. Insurance companies consider a range of factors to determine the premium amount for a specific policy. Insurance providers use statistical data, actuarial tables, and algorithms to assess risk and calculate premiums.

They consider factors such as the driver’s age, marital status, driving history, credit score, and location. The insurance company will also consider the specific make, model, and year of the Suzuki Grand Vitara being insured. Insurance premiums are typically paid monthly, bi-annually, or annually.

Scott W. Johnson Licensed Insurance Agent

The premium amount can be affected by the chosen coverage options, deductibles, and any additional services or features included in the policy. Another factor that can affect the insurance premium for a Suzuki Grand Vitara is the driver’s annual mileage. Insurance companies may consider the average number of miles driven per year as a risk factor.

Drivers who have a higher annual mileage may be perceived as having a higher risk of being involved in accidents, which can result in higher premiums. In addition to the driver’s personal factors, the insurance premium for a Suzuki Grand Vitara can also be influenced by external factors such as the overall crime rate and accident rate in the area where the vehicle is primarily driven and parked.

Areas with higher crime rates or accident rates may result in higher insurance premiums due to the increased risk of theft or accidents. Explore our detailed analysis on “What are some ways to lower my car insurance premiums?” for additional information.

Suzuki Grand Vitara and Insurance Risk

As an SUV, the Suzuki Grand Vitara may be considered a high-risk vehicle for insurance purposes. SUVs tend to have higher insurance rates due to their size, weight, and potential for causing more damage in accidents.

Furthermore, insurance providers also consider the historical data on accident rates and claims associated with the Suzuki Grand Vitara and similar vehicles. If the data shows a higher likelihood of accidents or more expensive repairs, it can result in higher insurance rates for this particular model.

It’s important to note that while the Suzuki Grand Vitara may be considered a high-risk vehicle, insurance premiums can still vary significantly depending on the driver’s personal circumstances and the chosen insurance company. Get more insights by reading our expert “Full Coverage Car Insurance: A Complete Guide” advice.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Grand Vitara Insurance Costs with Other SUVs

When considering the cost of insuring a Suzuki Grand Vitara, it can be helpful to compare it with the insurance costs of other similar SUVs. Different insurance providers may have varying rates for different vehicle models and makes. Continue reading our full “Compare Car Insurance Quotes” guide for extra tips.

Researching and comparing multiple insurance quotes from various providers can give you a better understanding of the average insurance costs for a Suzuki Grand Vitara. Keep in mind that the rates can vary depending on the specific coverage options, deductibles, and any discounts or incentives offered by each insurance company.

Tips for Suzuki Grand Vitara Insurance Savings

While the cost of car insurance for a Suzuki Grand Vitara can be influenced by various factors, there are steps you can take to find affordable coverage. For more information, explore our informative “Lesser Known Car Insurance Discounts for” page.

Firstly, it’s essential to shop around and obtain quotes from multiple insurance providers. Comparing rates and coverage options can help you identify the most competitive and suitable policies for your needs. Consider increasing your deductible, which is the amount you pay out of pocket before insurance coverage applies.

Higher deductibles can result in lower premiums, but it’s important to ensure that you can comfortably afford the deductible in the event of a claim. Additionally, take advantage of any discounts or incentives available for insuring a Suzuki Grand Vitara. Many insurance companies offer discounts for features such as having anti-theft devices installed, completing defensive driving courses, or bundling multiple policies.

The Average Annual Cost of Insuring a Suzuki Grand Vitara

While the average annual cost of insuring a Suzuki Grand Vitara can vary depending on multiple factors, it’s useful to have a general idea of what to expect. On average, insuring a Suzuki Grand Vitara can cost anywhere from a few hundred to a few thousand dollars per year.

However, keep in mind that this is only a rough estimate, and the actual cost can be higher or lower depending on your personal circumstances and the specific insurance provider. Discover our comprehensive guide to “Insurance Quotes Online” for additional insights.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explore Insurance Options for Suzuki Grand Vitara

When it comes to insuring your Suzuki Grand Vitara, there are various coverage options to consider. The most basic coverage is liability insurance, which covers damages and injuries caused to others in an accident where you are at fault.

You may also opt for collision coverage, which helps pay for repairs or replacement of your Suzuki Grand Vitara if it is damaged in a collision. Comprehensive coverage can protect against damages resulting from events other than collisions, such as theft, vandalism, or natural disasters.

It’s important to carefully evaluate your needs and consider the value of your vehicle when choosing coverage options. Factors such as the age and condition of your Suzuki Grand Vitara can influence the cost and necessity of different coverage options. For further details, check out our in-depth “Collision vs. Comprehensive Car Insurance” article.

Save on Suzuki Grand Vitara Insurance Without Sacrificing Coverage

When looking to save money on Suzuki Grand Vitara car insurance, it’s crucial to strike a balance between affordability and adequate coverage. One way to save on insurance costs is to maintain a clean driving record. Avoiding accidents and traffic violations can help you qualify for better rates and discounts offered by insurance providers.

Choosing a higher deductible on your policy can also lower your premiums. However, carefully consider your financial situation and ability to pay the deductible in case of a claim. Exploring discounts and incentives offered by insurance providers is another avenue to save on car insurance costs.

Ask about any available discounts for safe driving, bundling multiple policies, or installing anti-theft devices in your Suzuki Grand Vitara. Explore our detailed analysis on “Can I bundle my car insurance with other policies?” for additional information.

Common Car Insurance Mistakes for Suzuki Grand Vitara

When purchasing car insurance for your Suzuki Grand Vitara, it’s important to avoid common mistakes that can lead to higher costs or inadequate coverage. One common mistake is solely focusing on the price of the premium without considering the coverage and deductibles. Opting for the cheapest policy may leave you with insufficient coverage or higher out-of-pocket expenses in the event of a claim.

Not comparing insurance quotes from multiple providers is another mistake to avoid. Rates can vary significantly between companies, so it’s crucial to shop around and obtain quotes from different insurers. Additionally, failing to disclose accurate information to the insurance company can lead to complications and potential denial of claims.

Provide the necessary details about your Suzuki Grand Vitara, your driving history, and any modifications or accessories accurately to ensure that you have the appropriate coverage. For further details, check out our in-depth “Commonly Misunderstood Insurance Concepts” article.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Choose an Insurance Provider for Suzuki Grand Vitara

When choosing an insurance provider for your Suzuki Grand Vitara, it’s essential to consider various factors beyond the cost of premiums. Look for insurance companies with a good reputation for customer service and claims handling. Online reviews and ratings from other policyholders can provide insights into the reliability and satisfaction level associated with different insurers.

Consider the financial strength and stability of the insurance company. You want to ensure that they have the resources to pay claims promptly and fulfill their obligations in case of an accident or loss.

Lastly, evaluate the available coverage options and additional services offered by the insurance provider. Some companies may offer additional benefits such as roadside assistance, rental car coverage, or guaranteed repairs. Learn more by visiting our detailed “How to Get Free Insurance Quotes Online” section.

How Your Driving Record Affects Suzuki Grand Vitara Insurance

Your driving record has a significant impact on the cost of insuring a Suzuki Grand Vitara. Insurance providers consider your history of accidents, traffic violations, and claims when calculating premiums. A clean driving record with no history of accidents or traffic violations generally results in lower insurance rates. Dive deeper into “How much is car insurance?” with our complete resource.

Conversely, a history of accidents or multiple traffic violations can lead to higher premiums as it indicates a higher risk for the insurer. If you have a less than ideal driving record, there are still options available to obtain affordable insurance. Some insurance companies specialize in providing coverage for high-risk drivers, although the rates may be higher compared to drivers with clean records.

Suzuki Grand Vitara Insurance Deductible Options

When obtaining car insurance for your Suzuki Grand Vitara, it’s important to understand the deductible options available to you. The deductible is the amount you must pay out of pocket before your insurance coverage applies. It’s crucial to choose a deductible that you can comfortably afford in case of a claim.

A higher deductible typically results in lower insurance premiums. However, it’s essential to weigh the savings against your ability to pay the deductible if you have an accident or need to make a claim. Read our extensive guide on “What is the difference between a deductible and a premium in car insurance?” for more knowledge.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Modifications Affect Suzuki Grand Vitara Insurance

If you have made modifications or added accessories to your Suzuki Grand Vitara, it can potentially impact the cost of insurance. Modifications that enhance the vehicle’s performance or increase its value can result in higher insurance rates.

This is because these modifications may increase the risk of accidents or the cost of repairs in case of an accident. Additionally, certain accessories such as anti-theft devices or advanced safety features may qualify you for discounts on your insurance premium.

It’s important to inform your insurance provider about any modifications or accessories to ensure that you have the appropriate coverage and potentially qualify for any available discounts. For more information, explore our informative “Can I get car insurance for a car that is modified or customized?” page.

Suzuki Grand Vitara Insurance Discounts & Incentives

Many insurance providers offer discounts and incentives that can help reduce the cost of insuring a Suzuki Grand Vitara. One common discount is the good driver discount, which rewards drivers with clean records or a certain number of accident-free years. Other potential discounts include multi-policy discounts for bundling multiple policies, such as home and auto insurance.

Chris Abrams Licensed Insurance Agent

Additionally, some insurance companies offer discounts for completing defensive driving courses, installing anti-theft devices, or being a member of certain professional organizations. It’s important to explore and inquire about the available discounts and incentives offered by different insurance providers to maximize potential savings on your Suzuki Grand Vitara car insurance.

In conclusion, the cost of Suzuki Grand Vitara car insurance can vary based on several factors, including the driver’s age and history, location, vehicle model, and more. Get more insights by reading our expert “Safety Car Insurance Discounts” advice.

By understanding the various influences on insurance premiums and considering different coverage options and discounts, drivers can find affordable and suitable insurance coverage for their Suzuki Grand Vitara. Remember to compare quotes, avoid common mistakes, and choose a reliable insurance provider to ensure peace of mind while protecting your investment. Enter your ZIP code below to see how much you could save.

Frequently Asked Questions

Is car insurance more expensive for Suzuki Grand Vitara compared to other vehicles?

The cost of car insurance for a Suzuki Grand Vitara can vary depending on various factors. It may be higher or lower than other vehicles based on factors such as the vehicle’s safety ratings, repair costs, and theft rates.

What is the Suzuki Grand Vitara insurance group?

The Suzuki Grand Vitara insurance group is generally rated as a mid-range group, which means that its insurance premiums are moderate compared to other vehicles.

Which is the cheapest car insurance brand for a Suzuki Grand Vitara?

Nationwide offers the cheapest car insurance brand for a Suzuki Grand Vitara, with rates starting at around $70 per month.

For further details, check out our in-depth “What types of car insurance coverage does Nationwide offer?” article.

What is the cheapest Suzuki Grand Vitara insurance available?

The cheapest Suzuki Grand Vitara insurance available is from Nationwide, which provides the lowest rates for basic coverage.

What is the best insurance for a Suzuki Grand Vitara?

Nationwide is considered the best insurance for a Suzuki Grand Vitara due to its competitive rates and comprehensive coverage options.

Can I negotiate Suzuki Grand Vitara insurance premiums?

Yes, you can negotiate Suzuki Grand Vitara insurance premiums by shopping around, asking for discounts, or adjusting your coverage.

Discover our comprehensive guide to “How does the insurance company determine my premium?” for additional insights.

What is the cheapest insurance for full coverage on a Suzuki Grand Vitara?

For full coverage on a Suzuki Grand Vitara, Progressive offers the cheapest insurance options, providing extensive coverage at a low cost.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What factors affect Suzuki Grand Vitara car insurance cost?

Factors affecting Suzuki Grand Vitara car insurance costs include your driving history, location, age, and the type of coverage you choose.

How can I find the lowest insurance premium for a Suzuki Grand Vitara?

To find the lowest insurance premium for a Suzuki Grand Vitara, compare quotes from multiple providers and look for discounts like multi-car or safe driver discounts.

Learn more by visiting our detailed “Safety Car Insurance Discounts” section.

Who offers the cheapest Suzuki Grand Vitara car insurance provider?

Nationwide is the cheapest Suzuki Grand Vitara car insurance provider, offering the most affordable rates for basic and full coverage.

What is the cheapest insurance for the Suzuki Grand Vitara model?

How can I reduce Suzuki Grand Vitara insurance rates?

What are some Suzuki Grand Vitara insurance savings tips?

How do Geico vs Progressive car insurance rates compare?

What are the best Suzuki Grand Vitara insurance options?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.