Cheap Hyundai Tucson Plug-in Hybrid Car Insurance in 2026 (Cash Savings With These 10 Companies!)

Progressive, USAA, and State Farm are among our top picks for cheap Hyundai Tucson Plug-in Hybrid car insurance, with rates starting at $34 per month. These insurers offer a diverse array of coverage options, guaranteeing robust protection and providing customers with the peace of mind they need.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated January 2025

Company Facts

Min. Coverage for Hyundai Tucson Plug-in Hybrid

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Hyundai Tucson Plug-in Hybrid

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Hyundai Tucson Plug-in Hybrid

A.M. Best

Complaint Level

Pros & Cons

Car insurance is a crucial consideration for every car owner, and those with a Hyundai Tucson Plug-in Hybrid are no exception. Understanding the cost of car insurance for this vehicle can help you make informed decisions and ensure that you have adequate coverage without breaking the bank. Enter your ZIP code now.

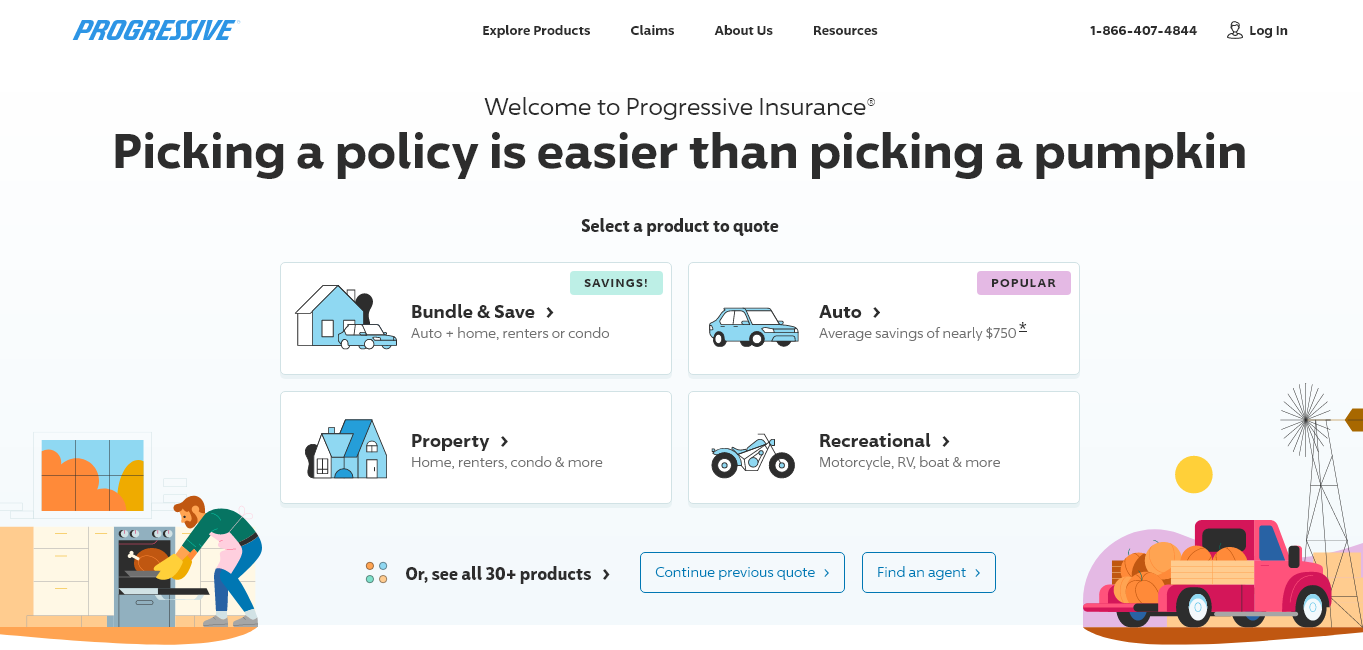

#1 – Progressive: Top Overall Pick

Pros

- Name Your Price Tool: Provides a unique feature that allows customers to customize their coverage and find a policy that fits their budget.

- Wide Range of Discounts: Offers various discounts such as multi-policy, safe driver, and online quote discounts, helping customers save more.

- Strong Online Presence: Known for its user-friendly website and mobile app, making it easy for customers to manage policies and file claims online. Read more through our Progressive insurance review.

Cons

- Rate Changes: Some customers may experience rate increases upon policy renewal or after filing claims, depending on their circumstances.

- Customer Service Variability: While generally praised for its online services, customer experiences with Progressive’s customer service may vary.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

- Dedicated to Military: USAA is dedicated to serving military members and their families, offering specialized discounts and tailored coverage.

- Excellent Customer Service: High ratings for customer service and claims satisfaction.

- Financial Strength: Strong financial stability and reliability. Read more through our USAA insurance review.

Cons

- Limited Eligibility: Only available to military personnel, veterans, and their families.

- Fewer Physical Locations: Limited physical branch locations compared to other insurers.

#3 – State Farm: Best for Personalized Service

Pros

- Personalized Service: Extensive network of local agents providing personalized service.

- Multiple Insurance Products: Offers a wide range of insurance products in addition to auto insurance.

- Customer Satisfaction: Generally positive reviews for customer satisfaction.

Cons

- Potentially Higher Premiums: Rates may be slightly higher compared to some competitors.

- Claim Handling: Some reports of delays or issues in the claims process. Follow us through our State Farm insurance review.

#4 – Allstate: Best for Hybrid Discounts

Pros

- New Car Replacement: Provides a new car replacement program within the first year if the car is totaled.

- Multiple Discounts: Offers a variety of discounts, including for safe driving, bundling, and vehicle safety features.

- Digital Tools: User-friendly online tools and mobile app for policy management. Learn more through our Allstate insurance review.

Cons

- Higher Starting Premiums: Starting premiums are higher compared to some other insurers.

- Mixed Customer Service Reviews: Some customers report varied experiences with customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- New Car Replacement: Provides a new car replacement program, which replaces your car with a brand-new one if it’s totaled within the first year.

- Extensive Discounts: Offers a variety of discounts, including for safe driving, bundling, and vehicle safety features.

- Digital Tools: User-friendly online tools and mobile app for policy management. Read more through our Liberty Mutual insurance review.

Cons

- Highest Premiums: With starting premiums at $45 per month, Liberty Mutual is on the higher end of the price spectrum.

- Mixed Claims Experience: Some customers report mixed experiences with the claims process, citing delays and communication issues.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Offers a vanishing deductible program that reduces deductibles for safe driving.

- Multi-Policy Discounts: Discounts available for bundling multiple policies. Learn more through our Nationwide insurance review.

- Nationwide Network: Extensive network of agents and service locations.

Cons

- Average Customer Service: Some customers report average experiences with customer service.

- Limited Specialty Coverage: May not offer as extensive specialty coverage options compared to some competitors.

#7 – Farmers: Best for Policy Discounts

Pros

- Policy Discounts: Offers various policy discounts, including for safety features and multi-policy bundling.

- Personalized Service: Access to local agents for personalized service.

- Claims Satisfaction: Generally positive reviews for claims satisfaction.

Cons

- Higher Premiums: Starting premiums are higher compared to several other insurers. Read more through our Farmers insurance review.

- Coverage Options: Some customers may find fewer coverage options compared to larger insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Competitive starting premiums at $52 per month.

- Discount Opportunities: Offers discounts for safe driving and multi-policy bundling.

- Strong Financial Ratings: Highly rated for financial stability. Learn more through our Travelers insurance review.

Cons

- Claims Process: Some reports of longer processing times for claims.

- Customer Service: Mixed reviews regarding customer service experiences.

#9 – American Family: Best for Safe Driver

Pros

- Safe Driver Discounts: Offers discounts for safe driving habits. Learn more through our American Family insurance review.

- Strong Customer Service: Generally positive feedback on customer service.

- Digital Tools: User-friendly website and mobile app for policy management.

Cons

- Higher Premiums: Starting premiums are higher compared to some competitors.

- Availability: Limited availability in certain regions compared to larger insurers.

#10 – The Hartford: Best for Senior Benefits

Pros

- Senior Benefits: Offers benefits tailored to seniors, including coverage options and discounts.

- Strong Financial Stability: Highly rated for financial strength. Learn more through our The Hartford insurance review.

- Customer Service: Generally positive feedback on customer service.

Cons

- Higher Premiums: Starting premiums are higher compared to many other insurers.

- Limited Eligibility: Availability may be limited compared to insurers with broader eligibility criteria.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Car Insurance Rates for the Hyundai Tucson Plug-In Hybrid

Factors That Influence the Cost of Hyundai Tucson Plug-In Hybrid Car Insurance

Comparing Car Insurance Quotes for the Hyundai Tucson Plug-In Hybrid

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Save Money on Hyundai Tucson Plug-In Hybrid Car Insurance

Frequently Asked Questions

What factors affect the cost of insurance for a Hyundai Tucson Plug-in Hybrid?

The cost of insurance for a Hyundai Tucson Plug-in Hybrid can be influenced by several factors such as the driver’s age, driving history, location, coverage options, deductible amount, and the insurance provider’s policies.

Are hybrid cars generally more expensive to insure compared to regular cars?

Hybrid cars, including the Hyundai Tucson Plug-in Hybrid, are not necessarily more expensive to insure than regular cars. Insurance rates depend on various factors, and while hybrid cars may have higher initial costs, they often come with safety features that can lower insurance premiums. Enter your ZIP code now.

Does the cost of insurance for a Hyundai Tucson Plug-in Hybrid vary by location?

Can I get discounts on insurance for a Hyundai Tucson Plug-in Hybrid?

Yes, you may be eligible for discounts on insurance for a Hyundai Tucson Plug-in Hybrid. Insurance companies often offer discounts for features like advanced safety systems, anti-theft devices, hybrid vehicle discounts, and good driving records. It’s recommended to inquire about available discounts with your insurance provider.

Is it necessary to have comprehensive coverage for a Hyundai Tucson Plug-in Hybrid?

While comprehensive coverage is not legally required, it is highly recommended for a Hyundai Tucson Plug-in Hybrid. Comprehensive coverage protects against damages not caused by collisions, such as theft, vandalism, natural disasters, and falling objects. Enter your ZIP code now to begin.

What are the starting monthly premiums for Progressive, USAA, and State Farm for insuring a Hyundai Tucson Plug-in Hybrid?

How does Progressive differentiate itself in terms of affordability and policy customization compared to other insurers listed?

Progressive distinguishes itself with competitive rates and a “Name Your Price” tool, allowing customers to customize coverage according to their budget.

What factors influence the cost of insurance for the Hyundai Tucson Plug-in Hybrid according to the article?

Insurance premiums for the Hyundai Tucson Plug-in Hybrid vary based on factors like vehicle type, safety features, driver’s age, driving history, location, and selected coverage levels, considering risks such as theft and repair costs. Enter your ZIP code now to begin.

What are some key considerations for choosing an insurance provider beyond just the premium rates?

How does the article recommend customers save money on car insurance for the Hyundai Tucson Plug-in Hybrid?

To save on insurance, compare quotes from multiple insurers, leverage discounts for safe driving and bundling policies, and utilize online tools provided by insurers for policy management.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.