Cheap Jaguar XF Car Insurance in 2026 (Cash Savings With These 10 Companies!)

Progressive, The Hartford, and Travelers offer the best cheap Jaguar XF car insurance, with rates starting as low as $110 per month. These companies stand out for their competitive pricing, comprehensive coverage options, and excellent customer service. Compare car insurance quotes and save now.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated September 2024

Company Facts

Min. Coverage for Jaguar XF

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jaguar XF

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jaguar XF

A.M. Best Rating

Complaint Level

Pros & Cons

The best providers for cheap Jaguar XF car insurance are Progressive, The Hartford, and Travelers. These companies offer the most competitive pricing, extensive coverage options, and top-rated customer service.

This article delves into how various factors like model year, trim level, and driving history affect insurance costs. It also provides valuable tips on lowering your premiums and securing the best deals.

Our Top 10 Company Picks: Cheap Jaguar XF Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $110 A+ Competitive Rates Progressive

#2 $115 A+ Senior Friendly The Hartford

#3 $118 A++ Flexible Policies Travelers

#4 $119 A Customizable Coverage Safeco

#5 $120 B Comprehensive Discounts State Farm

#6 $121 A+ Affordable Premiums Nationwide

#7 $122 A+ Reliable Service Allstate

#8 $123 A Personalized Plans Farmers

#9 $125 A Member Benefits AAA

#10 $130 A Adjustable Deductibles Liberty Mutual

By the end, you will have a comprehensive understanding of the factors that contribute to insurance costs and how you can potentially lower your premiums. Learn more in our “How does the insurance company determine my premium?“

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you.

#1 – Progressive: Top Overall Pick

Pros

- Low Monthly Rates: Progressive offers competitive rates starting at $110 per month. More information is available about this provider in our “Progressive Insurance Review & Ratings.”

- Snapshot Program: Progressive’s usage-based insurance can save you money based on your driving habits.

- Mobile App: The Progressive app allows easy policy management and claims reporting.

Cons

- Claims Process: Some customers report a lengthy claims process.

- Coverage Limitations: Progressive’s coverage options might not be as extensive as some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

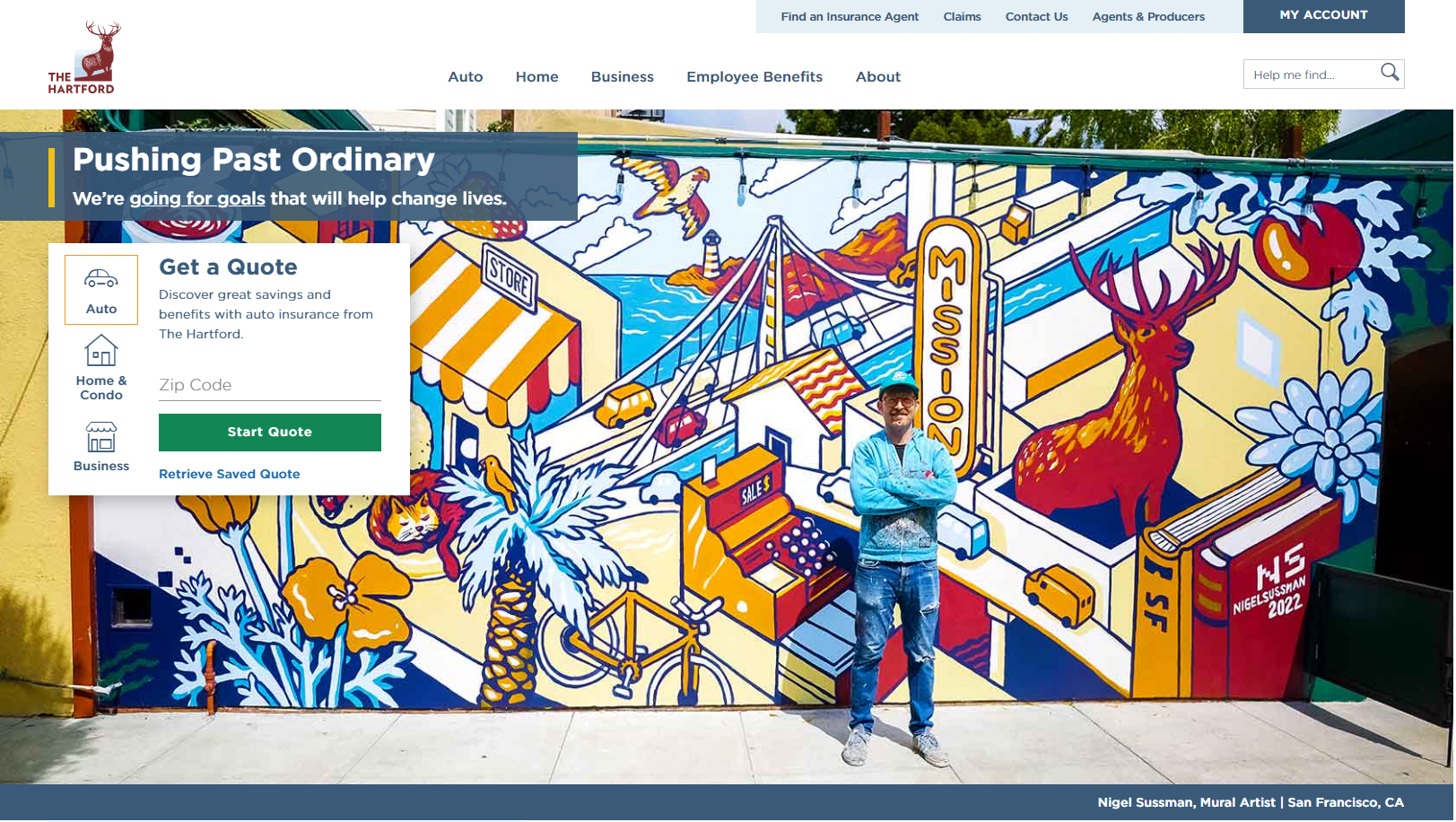

#2 – The Hartford: Best for Senior-Friendly

Pros

- AARP Partnership: Special programs and discounts for AARP members.

- Customer Service: High-quality customer service tailored to seniors. Learn more in our “The Hartford Insurance Review & Ratings.”

- Accident Forgiveness: The first accident doesn’t raise your premium.

Cons

- Price: Monthly rates start at $115, which can be higher than some other providers.

- Eligibility: Some benefits are only available to AARP members.

#3 – Travelers: Best for Flexible Policies

Pros

- Policy Customization: Wide range of flexible policy options to fit individual needs.

- Claims Support: Excellent claims support with a quick response time. Delve into our evaluation of “Travelers Insurance Review & Ratings.”

- Innovative Technology: Advanced technology for policy management and accident reporting.

Cons

- Monthly Rates: Starting at $118, it can be more expensive than some other providers.

- Availability: Not all discounts and policy options are available in every state.

#4 – Safeco: Best for Customizable Coverage

Pros

Pros

- Custom Coverage: Highly customizable coverage options to meet diverse needs.

- Roadside Assistance: Comprehensive roadside assistance included. Learn more in our “Safeco Insurance Review & Ratings.”

- User-Friendly App: Convenient mobile app for policy management and claims.

Cons

- Rates: Starting at $119, premiums can be higher than some competitors.

- Customer Reviews: Mixed reviews on customer service experiences.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Comprehensive Discounts

Pros

- Discounts: Offers a wide range of discounts, including multi-policy and safe driver discounts.

- Claims Process: Streamlined and efficient claims process. See more details on our “State Farm Insurance Review & Ratings.”

- Educational Resources: Extensive resources and tools for policyholders.

Cons

- Premium Costs: Despite discounts, premiums might still be relatively higher.

- Digital Experience: The mobile app and online tools are not as advanced as competitors.

#6 – Nationwide: Best for Affordable Premiums

Pros

- Competitive Rates: Affordable premiums starting at $121 per month.

- Multi-Policy Discounts: Savings when bundling multiple policies. Check out insurance savings in our complete “Nationwide Insurance Review & Ratings.”

- Accident Forgiveness: First accident doesn’t increase your premium.

Cons

- Claims Handling: Mixed reviews on the efficiency of claims handling.

- Coverage Options: May lack some specialized coverage options.

#7 – Allstate: Best for Reliable Service

Pros

- Claims Satisfaction: High claims satisfaction ratings. Discover insights in our “Allstate Insurance Review & Ratings.”

- Local Agents: Strong network of local agents for personalized support.

- Digital Tools: Robust digital tools for policy management.

Cons

- Rates: Monthly premiums start at $122, higher than some competitors.

- Coverage Cost: Comprehensive coverage options can be costly.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

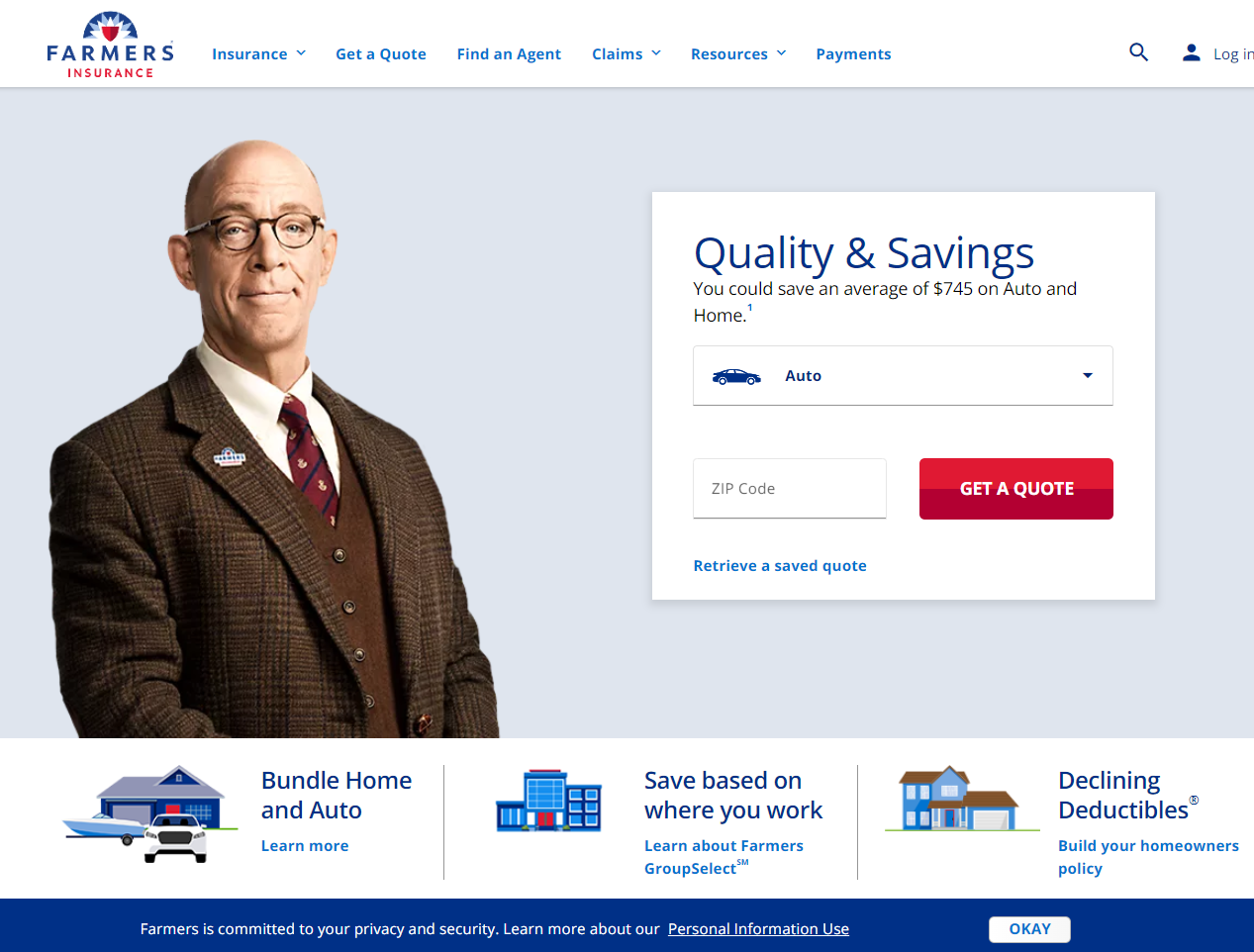

#8 – Farmers: Best for Personalized Plans

Pros

- Customization: Personalized plans to meet specific needs.

- Local Agents: Extensive network of local agents. Unlock details in our “Farmers Insurance Review & Ratings.”

- Educational Resources: Provides resources to help policyholders understand coverage.

Cons

- Premiums: Monthly rates start at $123, higher than some competitors.

- Digital Experience: The mobile app and online tools need improvement.

#9 – AAA: Best for Member Benefits

Pros

- Membership Perks: Exclusive benefits and discounts for AAA members.

- Travel Discounts: Discounts on travel-related expenses.

- Strong Reputation: Trusted brand with a long history. Check out insurance savings in our complete “AAA Insurance Review & Ratings.”

Cons

- Rates: Monthly premiums start at $125, higher than some other providers.

- Membership Requirement: Some benefits require AAA membership.

#10 – Liberty Mutual: Best for Adjustable Deductibles

Pros

- Flexible Deductibles: Adjustable deductible options to fit your budget.

- User-Friendly App: Convenient mobile app for managing policies.

- Customer Support: Responsive and helpful customer support. Access comprehensive insights into our “Liberty Mutual Review & Ratings.”

Cons

- Rates: Monthly premiums start at $130, higher than other competitors.

- Mixed Reviews: Varied customer experiences with claims handling.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Monthly Rates for Jaguar XF Car Insurance

The table below provides a detailed comparison of monthly rates for Jaguar XF car insurance from various providers. It includes rates for both minimum coverage and full coverage, helping you choose the best option for your needs and budget.

Jaguar XF Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $125 $260

Allstate $122 $255

Farmers $123 $257

Liberty Mutual $130 $270

Nationwide $121 $253

Progressive $110 $240

Safeco $119 $249

State Farm $120 $250

The Hartford $115 $245

Travelers $118 $248

Progressive offers the lowest rates for both minimum and full coverage, with $110 and $240, respectively. In contrast, Liberty Mutual has the highest rates, with $130 for minimum coverage and $270 for full coverage. Nationwide, The Hartford, and Travelers also provide competitive rates, making them worthy considerations depending on your coverage needs. See more details on our “How much insurance coverage do I need?”

The table clearly demonstrates the variation in monthly premiums among different insurance providers, helping you make an informed decision for your Jaguar XF.

Factors That Influence the Cost of Jaguar XF Car Insurance

The cost of car insurance for a Jaguar XF is determined by various factors. One of the primary elements that can affect your premium is the model year of your vehicle. Generally, newer models tend to have higher insurance rates due to their increased value and potential repair costs.

Additionally, the trim level of your Jaguar XF can impact your insurance premium. Higher-end trim levels with additional features and performance enhancements may lead to higher insurance costs.

Another significant factor is your driving record. Insurance providers consider your history of accidents, traffic citations, and claims when determining your premium. If you have a clean driving record with no past incidents, you are likely to receive more favorable insurance rates. Conversely, a history of accidents or traffic violations can significantly increase your premiums.

Insurance companies also take into account your location when calculating the cost of car insurance. Urban areas with higher population densities and higher rates of theft and vandalism tend to have higher insurance rates compared to rural or suburban areas. Therefore, where you live can have a substantial impact on the cost of insuring your Jaguar XF.

Additionally, your age and gender can also influence the cost of car insurance for a Jaguar XF. Younger drivers, especially those under the age of 25, are often considered higher risk and may face higher insurance premiums.

Similarly, statistics show that male drivers tend to have more accidents and file more claims than female drivers, resulting in potentially higher insurance rates for men. More information is available about this provider in our “How to File a Home Insurance Claim.”

Understanding the Insurance Premium Structure for Jaguar XF

When it comes to insuring your Jaguar XF, it’s essential to understand the insurance premium structure. Insurance premiums typically consist of several components, including liability coverage, comprehensive coverage, collision coverage, and personal injury protection.

Liability coverage is the most basic type of insurance required by law in most states. It provides financial protection if you cause an accident and are responsible for injuries or damages to others. Comprehensive coverage, on the other hand, protects your vehicle from non-collision-related incidents such as theft, vandalism, or weather damage.

Collision coverage covers damages to your Jaguar XF caused by collisions with other vehicles or objects. Lastly, personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers in the event of an accident.

Understanding the insurance premium structure for your Jaguar XF can help you make informed decisions when selecting coverage options. It’s important to note that insurance premiums can vary based on factors such as your driving history, location, and the value of your vehicle.

Jeff Root Licensed Life Insurance Agent

Additionally, some insurance providers may offer additional coverage options, such as roadside assistance or rental car reimbursement, which can be added to your policy for an extra cost. By understanding the different components of insurance premiums and considering your specific needs, you can ensure that you have the right coverage in place to protect your Jaguar XF.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Insurance Rates for Different Model Years of Jaguar XF

The insurance rates for different model years of Jaguar XF can vary significantly. Generally, newer models are more expensive to insure due to their higher value and repair costs. However, specific safety features and advanced driver assistance systems (ADAS) present in newer models may help lower insurance premiums.

Check out insurance savings in our complete “Best Safety Features Car Insurance Discounts.”

Insurance companies take into consideration the vehicle’s safety rating, theft rate, and repair costs when calculating insurance rates. Newer model years of the Jaguar XF often come equipped with innovative safety technologies, such as forward collision warning, lane departure warning, and blind-spot monitoring. These features can reduce the risk of accidents and injuries, potentially leading to lower insurance premiums.

Conversely, older model years of the Jaguar XF may have higher insurance rates due to their lower safety ratings and limited availability of certain safety features. However, it’s essential to consider all factors when comparing insurance rates for different model years, as individual circumstances can also affect premium costs.

Another factor that can affect insurance rates for different model years of Jaguar XF is the overall reliability of the vehicle. Newer model years may have improved reliability and fewer mechanical issues, which can result in lower insurance premiums.

Insurance companies often consider the likelihood of a vehicle needing repairs or experiencing breakdowns when determining rates. Therefore, it’s important to research the reliability ratings and customer reviews of different model years to get a comprehensive understanding of their potential impact on insurance costs.

When considering Jaguar XF insurance cost, factors such as model year, trim level, and driving history significantly influence premiums. It’s essential to compare quotes to find the best coverage that fits your needs and budget.

Comprehensive coverage options, including liability, collision, and personal injury protection, are crucial when insuring a luxury vehicle like the Jaguar XF. Understanding these factors can help you secure affordable insurance while protecting your investment.

Tips to Lower Your Jaguar XF Car Insurance Premiums

While insurance costs for a Jaguar XF may be higher compared to less expensive vehicles, there are ways to potentially lower your premiums. Here are some tips to help you reduce the cost of car insurance for your Jaguar XF:

- Shop Around: Compare quotes from multiple insurance providers. Each company has its own pricing models and discounts, so obtaining quotes from various insurers will help you find the most competitive rates.

- Maintain a Clean Driving Record: Avoid accidents, traffic violations, and claims as these can significantly impact your insurance rates. Safe driving habits can lead to considerable savings over time.

- Increasing Your Deductibles: Choosing a higher deductible means you will pay more out of pocket in the event of an incident, but it can result in lower insurance premiums.

- Usage-Based and Discount: Some insurers offer telematics programs to monitor driving habits, rewarding safe behaviors with premium discounts. Discounts may also apply for bundling policies, installing anti-theft devices, or completing defensive driving courses. Ask about these options to reduce your insurance costs.

- Maintain a Good Credit Score: Insurance companies often consider your credit history when determining your premiums. By maintaining a good credit score, you may be eligible for lower insurance rates.

- Install Safety Features in Your Jaguar XF: Adding safety features such as anti-lock brakes, airbags, and a security alarm system can reduce the risk of accidents and theft, which may result in lower insurance premiums.

By following these tips and exploring other cost-saving measures, you can potentially lower your Jaguar XF car insurance premiums. Discover more about offerings in our “Is car theft covered by car insurance?”

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

What factors affect the cost of Jaguar XF car insurance?

The cost of Jaguar XF car insurance can be influenced by several factors, including the driver’s age, location, driving history, credit score, coverage options, and the value of the car.

For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?”

Does the type of Jaguar XF model affect the insurance cost?

Yes, the specific model of the Jaguar XF can impact the insurance cost. Generally, more expensive and high-performance models may have higher insurance premiums due to their higher value and potential for increased risk.

Are there any discounts available for Jaguar XF car insurance?

Insurance providers often offer various discounts that can help reduce the cost of Jaguar XF car insurance. These may include discounts for safe driving records, multiple policies with the same insurer, anti-theft devices installed in the car, and completion of defensive driving courses.

Do insurance rates vary based on the driver’s age?

Yes, the age of the driver can affect the insurance rates for a Jaguar XF. Younger and inexperienced drivers typically face higher premiums due to the higher statistical likelihood of accidents and claims. Older and more experienced drivers may qualify for lower insurance rates.

Is it necessary to have comprehensive coverage for a Jaguar XF?

While comprehensive coverage is not legally required, it is highly recommended for a valuable car like the Jaguar XF. Comprehensive coverage provides protection against theft, vandalism, natural disasters, and other non-collision incidents that can cause damage to the vehicle.

To find out more, explore our guide titled “Does National General Insurance car insurance cover damage caused by a natural disaster if I only have liability coverage?”

How much is insurance on a Jaguar XF?

The average insurance cost for a Jaguar XF is $277 each month for a full-coverage policy.

Is Jaguar XF a luxury car?

The Jaguar XF (X250) is a high-end luxury sports sedan produced and sold by the British car manufacturer Jaguar Cars.

Why are Jaguars so expensive?

Jaguar, with almost a century-long legacy of sophistication, power, and prestige, justifies its high prices for both the vehicles and their upkeep. As a top-tier luxury acquisition epitomizing style and performance, its operational costs are more akin to those of exotic cars than standard ones.

Is A Jaguar XF A Good car?

The Jaguar XF offers a more competitive price than its primary rivals, such as the Audi A6, BMW 5 Series, and Mercedes E-Class. This is notable considering its high level of standard equipment. However, its resale values aren’t as robust as those of its main competitors, meaning it will depreciate faster.

To learn more, explore our comprehensive resource on “Best Car Insurance for College Students.”

How long will a Jaguar XF last?

What is the lifespan of a Jaguar XF? The expected lifespan of a Jaguar XF is around 136,000 miles before it reaches its maximum life expectancy. The type of fuel used is a significant factor in determining the vehicle’s lifespan.

Is Jaguar XF a fast car?

Why did they discontinue the Jaguar XF?

Which Jaguar XF engine is best?

Which is better XE or XF Jaguar?

Is Jaguar XF a reliable car?

How much does a Jaguar XF cost?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Pros

Pros