Cheap Mercedes-Benz Sprinter 2500 Car Insurance in 2026 (Best 10 Companies for Savings)

State Farm, USAA, and The Hartford stand out as the top picks for cheap Mercedes-Benz Sprinter 2500 car insurance. These companies offer some of the most affordable rates, with premiums starting as low as $65/month. Their comprehensive coverage options and discounts ensure you get the best value for your money.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2025

Company Facts

Min. Coverage for Mercedes-Benz Sprinter 2500

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mercedes-Benz Sprinter 2500

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mercedes-Benz Sprinter 2500

A.M. Best Rating

Complaint Level

Pros & Cons

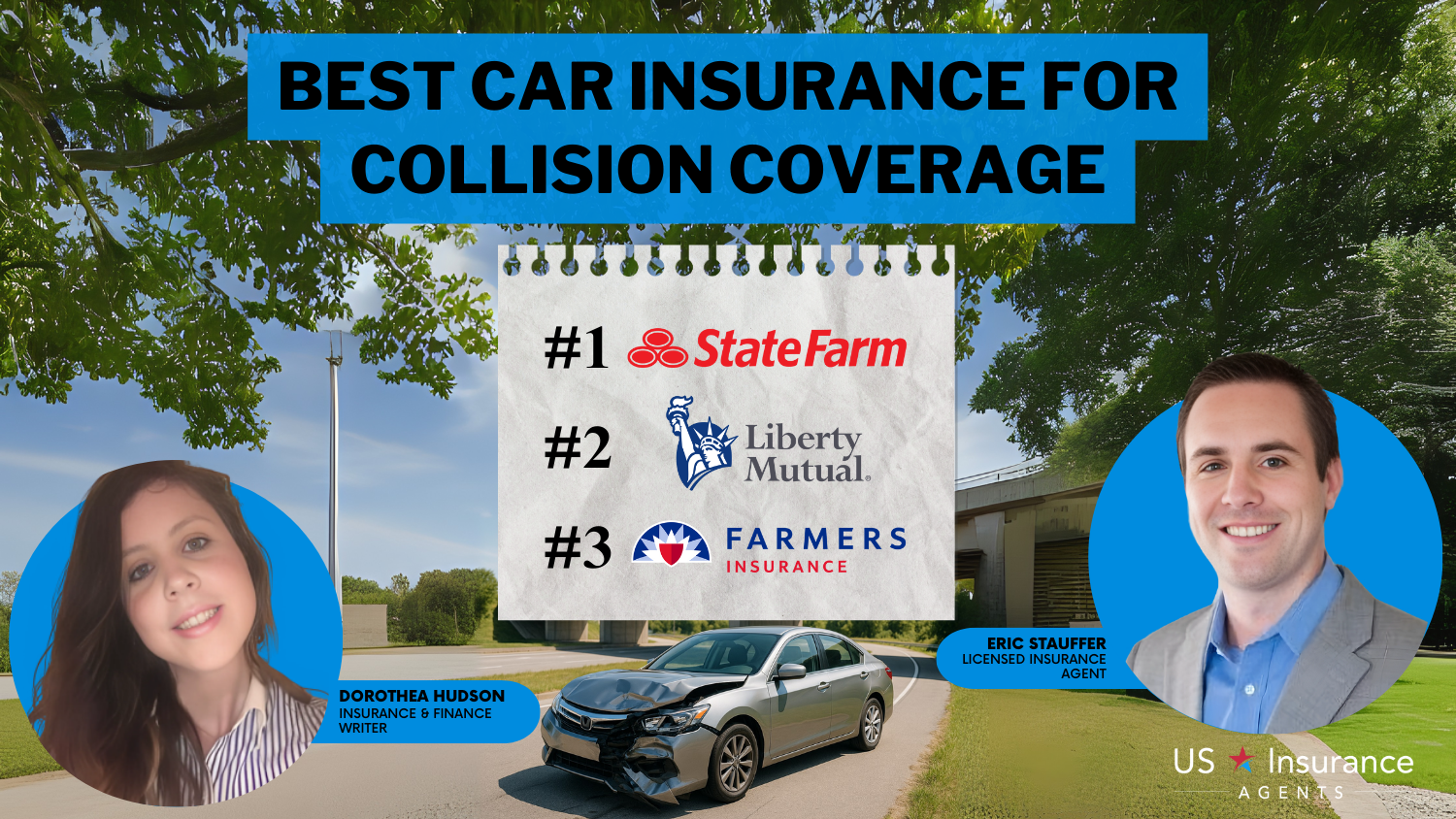

State Farm, USAA, and The Hartford are the top providers for cheap Mercedes-Benz Sprinter 2500 car insurance, offering the lowest rates and comprehensive coverage options.

State Farm leads with premiums starting at $65 per month, ensuring you get the best value. This article evaluates these companies based on affordability, customer service, and coverage benefits.

Our Top 10 Company Picks: Cheap Mercedes-Benz Sprinter 2500 Car Insurance

Company Rank Monthly Rates Good Driver Discount Best For Jump to Pros/Cons

#1 $65 10% Customer Service State Farm

#2 $70 15% Military Members USAA

#3 $72 15% AARP Members The Hartford

#4 $73 15% Vanishing Deductible Nationwide

#5 $74 12% Customer Service American Family

#6 $75 10% Online Tools Progressive

#7 $76 10% Hybrid Drivers Travelers

#8 $77 12% New Car Owners Liberty Manual

#9 $79 10% Personalized Coverage Farmers

#10 $80 10% Local Agents Allstate

Discover why these insurers stand out and how they can meet your needs effectively. See if you’re getting the best deal on car insurance by entering your ZIP code above.

#1 – State Farm: Top Overall Pick

Pro

- Comprehensive Coverage: State Farm offers extensive coverage options for the Mercedes-Benz Sprinter 2500, including liability, collision, comprehensive, medical payments, and more. This ensures that your vehicle is protected under various circumstances.

- Affordable Rates: Known for competitive pricing, State Farm provides a range of discounts that can significantly reduce your premiums. Discounts include those for safe drivers, multiple policies, and vehicle safety features, as highlighted in the State Farm insurance review & ratings.

- Usage-Based Insurance: State Farm’s Drive Safe & Save program allows policyholders to potentially lower their rates based on their driving habits. This program benefits safe drivers by offering discounts for good behavior on the road.

Cons

- Limited Availability: Some specialized coverage options might not be available in all regions, potentially limiting your choices depending on your location.

- Discount Eligibility: While there are numerous discounts, some of them have strict eligibility requirements, which might make it difficult for all policyholders to qualify.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Exclusive Membership

Pros

- Exclusive Membership: USAA specializes in serving military members, veterans, and their families, offering tailored insurance products that meet their unique needs, as mentioned in the USAA insurance review & ratings.

- Competitive Rates: USAA offers very competitive rates for the Mercedes-Benz Sprinter 2500, often lower than many other providers, with additional savings for military families.

- Comprehensive Coverage: They provide a wide range of coverage options, including specialty coverages like military installation protection and worldwide insurance for service members stationed abroad.

Cons

- Membership Restriction: Insurance products are only available to military members, veterans, and their families, which excludes a significant portion of the general population.

- Limited Physical Locations: While USAA offers excellent online and phone support, they have fewer physical branch locations compared to other major insurers, which might be a drawback for those who prefer in-person interactions.

#3 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits: The Hartford has a special partnership with AARP, offering exclusive benefits and discounts to AARP members, which can result in significant savings.

- Bundling Options: The Hartford provides discounts for bundling multiple insurance policies, such as auto and home insurance, which can reduce overall insurance costs.

- Senior-Focused Services: They offer features specifically designed for older drivers, including RecoverCare, which helps cover costs for home services if you’re injured in an accident.

Cons

- Pricing: For non-AARP members, the insurance premiums can be higher compared to other insurers, as detailed in the The Hartford insurance review & ratings.

- Coverage Limitations: Some specialized coverages and discounts might not be available in all states, potentially limiting the benefits you can receive.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a unique Vanishing Deductible program that reduces your deductible by $100 for each year of safe driving, up to $500.

- Comprehensive Coverage: They provide extensive coverage options, including gap insurance, accident forgiveness, and rental car reimbursement, as mentioned in the Nationwide insurance review & ratings.

- Discounts: They offer multiple discounts, such as multi-policy, safe driver, and anti-theft device discounts, which can lower your premiums.

Cons

- Premiums: Premiums can be higher for high-risk drivers, which might make their policies less affordable for some.

- Online Services: Some users have reported that Nationwide’s online services are less user-friendly compared to other insurers, potentially making it harder to manage policies and claims online.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: American Family offers a wide range of coverage options, including collision, comprehensive, liability, uninsured motorist, and more, tailored to meet the needs of Mercedes-Benz Sprinter 2500 owners.

- Discounts: They provide various discounts, such as those for safe drivers, multi-policy holders, young drivers, and good students, which can help lower insurance costs, according to American Family insurance review & ratings.

- Personalized Service: With a network of local agents, American Family provides personalized insurance solutions and face-to-face interactions, which many customers find valuable.

Cons

- Availability: Coverage might not be available in all states, limiting the accessibility of their insurance products for some potential customers.

- Premiums: Insurance premiums can be higher for younger drivers or those with less favorable driving records, which might make their policies less competitive in certain cases.

#6 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive is known for offering affordable rates and flexible payment options, making it easier for budget-conscious customers to insure their Mercedes-Benz Sprinter 2500.

- Snapshot Program: Their usage-based insurance program, Snapshot, rewards safe driving habits with potential discounts, which can lead to lower premiums over time..

- Comprehensive Coverage: They offer a wide range of coverage options, including liability, collision, comprehensive, and specialized coverages like pet injury protection.

Cons

- Customer Service: Progressive has mixed reviews regarding customer service and claims handling, with some customers reporting dissatisfaction with the responsiveness and resolution of their claims, according to Progressive insurance review & ratings.

- Rate Increases: Some policyholders have experienced significant rate increases after filing claims, which can make the insurance more expensive in the long run.

#7 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers offers a wide range of coverage options, including gap insurance, accident forgiveness, and roadside assistance, providing thorough protection for your Mercedes-Benz Sprinter 2500.

- Discounts: They provide multiple discounts, such as for safe driving, multi-policy, homeownership, and hybrid vehicles, which can help reduce insurance costs.

- Customizable Policies: They offer flexible policy options that allow customers to tailor their coverage to meet specific needs and preferences, as mentioned in the Travelers insurance review & ratings.

Cons

- Premiums: Insurance premiums with Travelers can be higher compared to some other insurers, which might make their policies less attractive to price-sensitive customers.

- Customer Service: While generally positive, some customers have reported less satisfactory experiences with customer service, particularly regarding claims processing times.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, which means your rates won’t increase after your first accident, providing peace of mind for policyholders, as highlighted in the Liberty Mutual Review & Ratings.

- Comprehensive Coverage: They provide a wide range of coverage options, including new car replacement, better car replacement, and gap insurance.

- Discounts: Liberty Mutual offers numerous discounts, such as those for safe drivers, multi-policy holders, and homeowners, helping to lower premiums.

Cons

- Pricing: Liberty Mutual can be more expensive compared to other insurers, especially for younger or high-risk drivers.

- Rate Increases: Some customers have reported significant rate increases over time, particularly after filing claims, which can make the insurance more costly in the long run.

#9 – Farmers: Best for Multiple Discounts

Pros

- Multiple Discounts: Farmers offers various discounts, such as those for safe drivers, bundling policies, and insuring multiple vehicles, which can help lower premiums.

- Comprehensive Coverage: They offer a wide range of coverage options, including collision, comprehensive, liability, and uninsured motorist coverage, ensuring comprehensive protection for your vehicle.

- Claims Support: They offer a straightforward and efficient claims process, making it easier for policyholders to file and manage claims.

Cons

- Premiums: Insurance premiums with Farmers can be higher for high-risk drivers or those with less favorable driving records, which might make their policies less competitive, as noted in the Farmers insurance review & ratings.

- Online Tools: Some users find Farmers’ online tools and website less intuitive compared to other insurers, which can make managing policies and claims more challenging.

#10 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate offers extensive coverage options, including accident forgiveness, new car replacement, and sound system insurance, providing robust protection for your Mercedes-Benz Sprinter 2500, according to Allstate insurance review & ratings.

- Discounts: They provide multiple discounts, such as those for safe driving, bundling policies, and setting up automatic payments, which can help lower premiums.

- Claims Satisfaction: Allstate is known for its efficient and user-friendly claims process, making it easy for policyholders to file and manage claims.

Cons

- Premiums: Allstate’s insurance premiums can be more expensive compared to some other insurers, particularly for younger drivers or those with less favorable driving records.

- Rate Increases: There is potential for significant rate increases after filing claims, which can make the insurance more costly over time.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Sprinter 2500 Insurance Rates

When it comes to insurance rates for your Mercedes-Benz Sprinter 2500 Cargo, several factors come into play. These include your age, location, driving record, credit history, and the value of your vehicle.

Additionally, insurance companies will consider the safety features of your Sprinter, such as anti-theft devices, airbags, and advanced driver-assistance systems. The more safety features your vehicle has, the lower your insurance rates are likely to be.

Mercedes-Benz Sprinter 2500 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $130

American Family $74 $124

Farmers $79 $129

Liberty Mutual $77 $127

Nationwide $73 $123

Progressive $75 $125

State Farm $65 $115

The Hartford $72 $122

Travelers $76 $126

USAA $70 $120

Another crucial factor that affects your insurance rates is the level of coverage you choose. Opting for comprehensive coverage that includes protection against theft, fire, vandalism, and other perils will lead to higher premiums. On the other hand, choosing only basic liability coverage will result in lower costs. It’s important to assess your needs and risks to determine the appropriate level of coverage for your Sprinter.

Importance of Insurance for Your Sprinter 2500 Cargo

Car insurance is essential for protecting your Mercedes-Benz Sprinter 2500 Cargo. Accidents, theft, and other unforeseen events can lead to significant financial loss if you don’t have adequate insurance coverage. With the right policy in place, you can have peace of mind knowing that your vehicle is protected against a range of risks.

Kristine Lee Licensed Insurance Agent

In addition to protecting your vehicle, car insurance also provides liability coverage. This means that if you are found responsible for causing an accident that results in property damage or injuries to others, your insurance policy will cover the costs, up to the policy limits. Without insurance, you could be personally on the hook for these expenses, which can be financially devastating.

Types of Insurance Coverage for Sprinter 2500 Cargo

When insuring your Mercedes-Benz Sprinter 2500 Cargo, understanding the various types of car insurance coverage is essential. From liability and comprehensive to collision and cargo insurance, each type offers specific protections tailored to your needs. This guide explores the different coverage options available to ensure your Sprinter 2500 Cargo is fully protected on the road.

Understanding these options will help you choose the right coverage for your needs:

- Liability Coverage: This is the most basic form of car insurance and is required in most states. It provides coverage for property damage and bodily injury to others if you are found at fault in an accident.

- Collision Coverage: This coverage pays for damages to your Sprinter caused by a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive coverage protects against non-collision events such as theft, vandalism, fire, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection in case you are involved in an accident with a driver who does not have insurance or does not have enough coverage to pay for damages.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

It’s important to carefully evaluate your needs and budget when choosing the right combination of coverage for your Mercedes-Benz Sprinter 2500 Cargo.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Right Insurance for Your Sprinter 2500 Cargo

Choosing the right car insurance provider for your Mercedes-Benz Sprinter 2500 Cargo is a critical decision. Key factors to consider include the provider’s financial stability, ensuring they have the resources to pay claims, and their reputation and customer service, which can be assessed through reviews and recommendations.

Jimmy helps Jake jazz up the jingle. pic.twitter.com/OFYjSTwy2G

— State Farm (@StateFarm) December 14, 2023

Additionally, evaluate the efficiency of their claims process, as a smooth experience is crucial during stressful times. Investigate available discounts, such as multi-vehicle or safe driver discounts, and compare prices to find competitive rates for the coverage you need.

By considering these factors and conducting thorough research, you can select a provider that meets your needs and offers reliable coverage for your Sprinter 2500 Cargo. Explore our detailed analysis on “Car Insurance Startups Change How You Buy Car Insurance” for additional information.

Comparing Insurance Quotes for Sprinter 2500 Cargo

When comparing car insurance quotes for your Mercedes-Benz Sprinter 2500 Cargo, it’s important to gather quotes from multiple providers. Each insurance company uses its own formula to calculate premiums, taking into account factors such as your driving record, location, age, and credit history.

By obtaining quotes from different providers, you can compare the rates and coverage options each offers. Keep in mind that the lowest price may not always be the best option. Consider the level of coverage provided and the reputation and customer service of the insurance company. Balancing affordability with quality coverage is key.

Additionally, be sure to review all policy details, including deductibles, coverage limits, and any exclusions or restrictions that may apply. Understanding the fine print will help you make an informed decision and ensure that you have the right coverage for your Mercedes-Benz Sprinter 2500 Cargo.

Tips to Lower Your Sprinter 2500 Cargo Insurance Premiums

If you’re looking to reduce your Mercedes-Benz Sprinter 2500 Cargo insurance premiums, there are several effective strategies you can employ.

From exploring discounts to adjusting your coverage options, these tips will help you find ways to lower your insurance costs without sacrificing essential protection. Discover practical methods to save on your Sprinter 2500 Cargo insurance and keep your expenses in check.

There are several strategies you can employ to lower your Mercedes-Benz Sprinter 2500 Cargo car insurance premiums:

- Bundle Policies: Consider bundling your car insurance with other policies (such as home or renters insurance) to take advantage of multi-policy discounts offered by insurance companies.

- Shop Around: Don’t settle for the first quote you receive. Compare rates from multiple providers to ensure you are getting the best deal.

- Ask About Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, and loyalty discounts. Many insurance companies offer various discounts that can help reduce the cost of your premiums.

- Improve Your Credit Score: Maintaining a good credit score can positively impact your insurance rates. Pay your bills on time, reduce credit card balances, and monitor your credit report regularly.

- Consider Higher Deductibles: Increasing your deductibles can lower your premiums. However, be sure you can comfortably afford the higher deductible amount in case of a claim.

By implementing these strategies, you can potentially reduce the cost of your Mercedes-Benz Sprinter 2500 Cargo car insurance premiums while still maintaining the necessary coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Insurance Mistakes for Sprinter 2500 Cargo

When insuring your Mercedes-Benz Sprinter 2500 Cargo, it’s crucial to avoid common mistakes that could lead to inadequate coverage or higher premiums. First, avoid underinsuring to save money, as this can leave you vulnerable to significant financial losses. Always review your policy details carefully, including deductibles, coverage limits, and exclusions, to ensure you have the protection you need.

Keep your policy updated by informing your insurance provider of any changes to your vehicle or driving habits to avoid denied claims or insufficient coverage. Take advantage of available discounts by inquiring about them, and don’t settle for the first quote you receive; compare rates from multiple providers to find the best coverage at the most competitive price.

By steering clear of these pitfalls, you can ensure that your Sprinter 2500 Cargo is well-protected and that you are getting the best value for your insurance premiums. Continue reading our full “Full Coverage Car Insurance: A Complete Guide” guide for extra tips.

Understanding Sprinter 2500 Cargo Insurance Claims

Knowing how the claims process works for your Mercedes-Benz Sprinter 2500 Cargo insurance is crucial in the event of an accident or other covered claim. While the process may vary slightly by provider, it generally involves reporting the incident to your insurance company, which will then arrange for a damage assessment of your Sprinter.

Based on the extent of the damage, your insurer will coordinate repairs or replacement at an authorized facility, either covering costs directly or providing reimbursement per your policy terms. Throughout the process, keep detailed records of all communications, paperwork, and expenses, as these can help resolve any issues that may arise.

Finally, your insurance company will settle the claim by issuing a payment or covering repair costs once the work is completed. Prompt communication and careful adherence to your provider’s instructions are key to ensuring a smooth claims experience, so reach out to your insurance agent or claims representative with any questions or concerns. Dive deeper into “How to File a Car Insurance Claim” with our complete resource.

Factors for Valuing Your Sprinter 2500 Cargo for Insurance

When determining the value of your Mercedes-Benz Sprinter 2500 Cargo for insurance purposes, several factors are crucial. The market value of your Sprinter, influenced by its age, mileage, condition, and features, is a primary consideration.

Additionally, any modifications or additions to your vehicle can increase its value, so it’s important to inform your insurance provider about these changes for adequate coverage. Depreciation also affects the vehicle’s value over time, which should be considered when setting up your insurance. For total loss scenarios, ensure that your coverage includes the replacement cost of your Sprinter with a comparable vehicle.

Finally, market trends, such as demand for similar vehicles and economic conditions, can impact your Sprinter’s value. Accurate assessment of these factors with the help of your insurance provider or an independent appraiser is essential for obtaining the right coverage for your Sprinter 2500 Cargo. Learn more by visiting our detailed “How much insurance coverage do I need?” section.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benefits of Bundling Your Sprinter 2500 Cargo Insurance

Bundling your Mercedes-Benz Sprinter 2500 Cargo insurance with other policies offers several advantages that can enhance both your coverage and savings. By combining your vehicle insurance with other types of coverage, such as home or auto insurance, you can often qualify for discounts from your insurance provider.

Tim Bain Licensed Insurance Agent

These savings can significantly reduce your overall insurance costs. Additionally, bundling simplifies your insurance management by consolidating multiple policies under one provider, which can streamline billing and make it easier to track your coverage and manage your claims. Find cheap car insurance quotes by entering your ZIP code below.

Bundling also provides the convenience of having a single point of contact for all your insurance needs, which can lead to better customer service and personalized support from your insurer. Overall, bundling can offer both financial benefits and practical advantages for managing your Sprinter 2500 Cargo insurance. For further details, check out our in-depth “Can I bundle my car insurance with other policies?” article.

Frequently Asked Questions

Are Mercedes-Benz Sprinter 2500 expensive to insure?

The cost of insuring a Mercedes-Benz Sprinter 2500 can be higher due to its size and value. Factors such as coverage options and driving history also affect the cost.

How much does it cost to insure a Mercedes-Benz Sprinter 2500?

The cost to insure a Mercedes-Benz Sprinter 2500 varies based on factors such as coverage levels, location, and the driver’s record. On average, expect to pay a higher premium for camper van insurance.

Learn more by visiting our detailed “Insurance Quotes Online” section.

Why is insurance so high on a Mercedes-Benz Sprinter 2500?

Insurance is high on a Mercedes-Benz Sprinter 2500 due to the car’s luxury status, high repair costs, and advanced technology, which increases the risk for insurance companies.

What type of insurance do you need on Mercedes-Benz Sprinter 2500?

Insurance needed for a Mercedes-Benz Sprinter 2500 typically includes liability coverage, cargo insurance, and possibly commercial auto insurance depending on the van’s use.

Dive deeper into “Liability Insurance: A Complete Guide” with our complete resource.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Why is my Mercedes-Benz Sprinter 2500 car insurance so high?

The high cost of Mercedes-Benz Sprinter 2500 car insurance may be due to factors like the camper’s value, the type of coverage you have, and your driving history.

Read our extensive guide on “How To Get Free Insurance Quotes Online” for more knowledge.

What insurance do I need for a Mercedes-Benz Sprinter 2500?

Insurance for a Mercedes-Benz Sprinter 2500 typically includes liability coverage, comprehensive and collision coverage, and possibly roadside assistance.

Are Mercedes-Benz Sprinter 2500 car insurance expensive?

Yes, Mercedes-Benz Sprinter 2500 car insurance can be expensive to insure due to their value, coverage needs, and usage, which can drive up insurance premiums.

What is the best Mercedes-Benz Sprinter 2500 car insurance?

The best Mercedes-Benz Sprinter 2500 car insurance company offers comprehensive coverage options, high limits, and discounts. Companies like State Farm and USAA are often recommended.

Expand your understanding with our thorough “Best Insurance Companies” overview.

Does putting windows in a van affect insurance?

The impact of windows on van insurance depends on the extent of modifications and the insurance policy. Adding windows might increase the cost of insurance.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What kind of insurance do you put on Mercedes-Benz Sprinter 2500?

The kind of insurance for a Mercedes-Benz Sprinter 2500 includes liability coverage, comprehensive and collision coverage, and optional add-ons like roadside assistance or personal effects coverage.

For more information, explore our informative “Collision vs. Comprehensive Car Insurance” page.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.