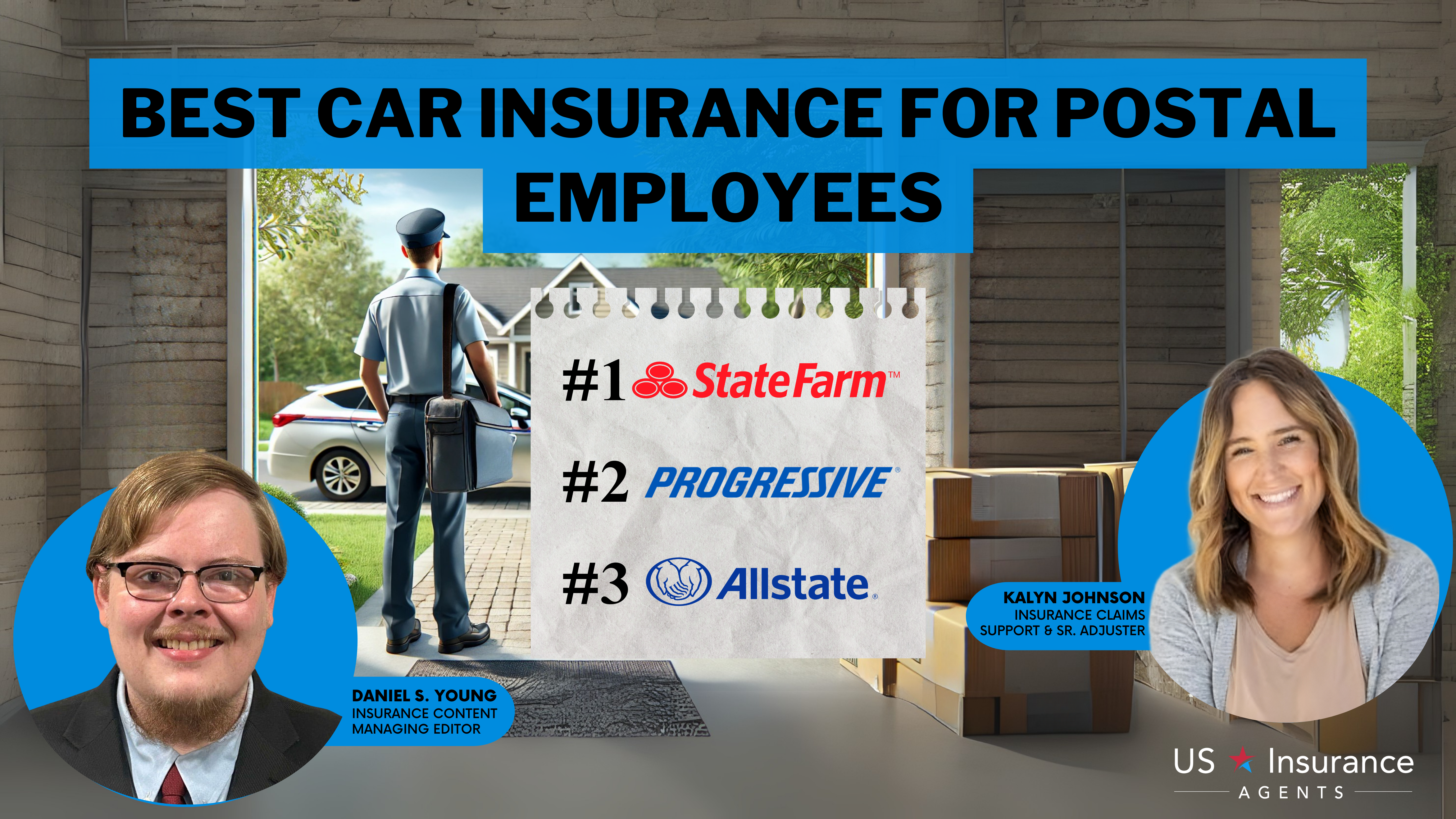

Best Car Insurance for Instacart Drivers in 2026 (Top 10 Companies)

Progressive, State Farm, and Allstate offer the best car insurance for Instacart drivers, with rates starting at $47 per month. Progressive provides excellent usage-based discounts, while State Farm and Allstate offer competitive multi-policy savings and comprehensive coverage for delivery drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated May 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsAlongside State Farm and Allstate, Progressive provides comprehensive coverage tailored to the unique needs of Instacart drivers.

Our Top 10 Company Picks: Best Car Insurance for Instacart Drivers

| Company | Rank | Instacart Driver Discount | Multi-Policy Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 15% | Usage Discount | Progressive | |

| #2 | 10% | 17% | Safe-Driving Discounts | State Farm | |

| #3 | 15% | 18% | Comprehensive Coverage | Allstate | |

| #4 | 8% | 20% | Military Savings | USAA | |

| #5 | 10% | 16% | Local Agents | Liberty Mutual |

| #6 | 7% | 14% | Accident Forgiveness | Nationwide |

| #7 | 12% | 19% | Vanishing Deductibles | Farmers | |

| #8 | 9% | 12% | Customizable Coverage | Travelers | |

| #9 | 11% | 15% | Bundling Policies | American Family | |

| #10 | 8% | 13% | Customer Service | Erie |

It’s considered one of the best insurance options for new drivers, offering policies that align with Instacart insurance requirements.

Explore the essential factors for Instacart drivers when choosing car insurance, the importance of comprehensive coverage, and tips for finding affordable options that meet the car requirements for Instacart deliveries.

- Progressive, State Farm, and Allstate cater to Instacart drivers’ needs

- Comprehensive coverage ensures financial protection for Instacart drivers

- Progressive offers competitive rates and tailored policies for Instacart drivers

Enter your ZIP code to compare Instacart car insurance rates. Find the best Instacart insurers to ensure the proper protection for yourself and your family.

#1 – Progressive: Top Overall Pick

Pros

- Usage-Based Discounts: Progressive offers a distinctive usage-based insurance discount, helping Instacart drivers save based on their driving behavior.

- Multi-Policy Savings: Progressive offers a discount of up to 15% for those who combine their insurance policies. Learn more in our “Progressive Insurance Review.”

- Customizable Insurance Coverage: Progressive offers adjustable coverage options, allowing Instacart drivers to tailor their insurance to their specific needs.

Cons

- Limited Discount for Instacart Drivers: Although Progressive offers some discounts, its 12% Instacart driver discount is lower than some competitors.

- Potential for Increased Rates: While Progressive’s coverage options are extensive, they may come with higher premiums depending on the driver’s location and driving history.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Safe-Driving Discounts

Pros

- Safe Driver Discounts: State Farm offers discounts for safe drivers, making it an ideal option for Instacart drivers with a clean driving record.

- Multi-Policy Savings: Bundling car insurance with State Farm can save Instacart drivers up to 17% on multi-policy savings.

- Reputable Insurer: State Farm has a good reputation for providing reliable customer service and financial strength, giving Instacart drivers peace of mind.

Cons

- Limited Discounts for Instacart Drivers: The 10% discount for Instacart drivers is relatively modest compared to those offered by other providers. Explore our “State Farm Car Insurance Review” for more insights.

- Availability of Discounts Varies: Not all discounts are available in every state, which could limit the savings potential for some drivers.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate provides complete coverage options, such as accident forgiveness, and is thus the best for Instacart drivers.

- Big Discounts: Allstate offers a 15% discount for Instacart drivers and a maximum of an 18% multi-policy discount, providing good opportunities for savings.

- Policy Customization: Allstate allows drivers to tailor their insurance coverage to their personal and professional needs.

Cons

- Higher Premiums: Allstate’s premium rates may be higher than those of other providers, which could offset the savings from their discounts.

- Availability of Discounts: Some discounts may not be available in all states or for all drivers, limiting potential savings. Learn more about them in our “Allstate Insurance Review.”

#4 – USAA: Best for Military Savings

Pros

- Military Savings: USAA provides generous discounts for military members and their families, making it a top choice for qualifying Instacart drivers. Elevate your knowledge with our “USAA Insurance Review & Ratings.“

- Multi-Policy Discount: USAA offers a 20% multi-policy discount, which offers significant savings when bundling home and auto insurance.

- High Customer Satisfaction: Known for its excellent customer service, USAA consistently ranks highly in the insurance industry.

Cons

- Limited Eligibility: USAA is only available to military members and their families, making it an unavailable option for non-military Instacart drivers.

- Discounts May Not Apply to All: While military members get significant savings, other discount options may not be as substantial as those offered by competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Local Agents

Pros

- Local Agent Network: Liberty Mutual offers the convenience of local agents, which means more tailored service and support for Instacart drivers.

- Multi-Policy Savings: Liberty Mutual offers a 16% discount for multi-policy and bundling options, making them suitable for individuals who require both home or renter insurance.

- Flexible Coverage Options: Liberty Mutual offers flexible coverage, allowing Instacart drivers to tailor their policies to suit their individual needs.

Cons

- Higher Premiums: Liberty Mutual’s premiums may be higher than those of some competitors, depending on the driver’s location and profile.

- Limited Discounts for Instacart Drivers: The 10% Instacart driver discount is lower than the discounts available with other companies. Check out our Liberty Mutual review.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness, which can benefit Instacart drivers who might experience an accident.

- Multi-Policy Discount: With up to a 14% multi-policy discount, Nationwide helps Instacart drivers save when bundling their car insurance with other policies.

- Competitive Rates: Nationwide offers competitive rates, making it a good choice for drivers seeking affordable insurance.

Cons

- Discount Limitations: Nationwide’s 7% Instacart driver discount is relatively small compared to other providers. Read our “Nationwide Insurance Review & Ratings” to find out more.

- Comprehensive Coverage: While Nationwide offers good basic coverage, it may lack some specialized options that other companies provide.

#7 – Farmers: Best for Vanishing Deductibles

Pros

- Vanishing Deductibles: Farmers offers an innovative vanishing deductible plan, which lowers your deductible over time if you maintain a clean driving history.

- Multi-Policy Discount: Farmers offers a 19% discount for bundling policies, which is substantial savings for those who need more than car insurance.

- Coverage for Instacart Drivers: Farmers extend coverage custom-tailored to Instacart driver requirements, featuring versatile liability and collision protection.

Cons

- Limited Discounts for Instacart Drivers: While Farmers provides a good 12% discount for Instacart drivers, it’s the best in the business. Unlock additional information in our “Farmers Insurance Review & Ratings.”

- Rates Can Be Higher: Depending on location and driver risk, farmers may pay higher premiums, affecting overall affordability.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customizable Coverage

Pros

- Customizable Insurance Coverage: Travelers provides various alternatives for customizing coverage to meet the unique needs of Instacart drivers.

- Discounts for Safe Driving: The availability of safe-driving discounts ensures that Instacart drivers can save on premiums for driving well.

- Multi-Policy Savings: Travelers provides a 12% multi-policy discount, considerably reducing the premium cost of bundling multiple insurance policies.

Cons

- Higher Premiums: Travelers’ premiums can be relatively high, especially for drivers in higher-risk categories. Enhance your comprehension with our “Travelers Insurance Review & Ratings.”

- Discount Variability: Discounts may vary by state or location, meaning some Instacart drivers may not qualify for the best savings.

#9 – American Family: Best for Bundling Policies

Pros

- Bundling Discounts: American Family offers discounts for bundling car insurance with other types of insurance, such as home or life insurance.

- Policy Customization: American Family offers flexible coverage products, allowing Instacart drivers to tailor their insurance to their specific needs.

- Solid Rates: The American Family provides competitive rates, which make it an excellent choice for drivers seeking affordable coverage.

Cons

- Limited Discounts for Instacart Drivers: The 11% discount for Instacart drivers is lower than some competitors’. Our “American Family Insurance Review & Ratings” provides further insights.

- Insurance Availability May Vary: American Family may not be available in all states, limiting access to their coverage for some Instacart drivers.

#10 – Erie: Best for Customer Service

Pros

- Excellent Customer Service: Erie is renowned for offering outstanding customer service and ensuring that Instacart drivers have assistance when needed.

- Insurance Discounts: Erie provides competitive, safe driving, and multi-policy bundling discounts, saving Instacart drivers money.

- Flexible Coverage: Erie offers several coverage plans to suit the particular needs of Instacart drivers. For expanded insights, see our “Erie Insurance Review & Ratings.”

Cons

- Insurance Rates Can Be High: Erie might charge higher insurance premiums, especially in some areas, which might counteract the discount benefit.

- Limited Availability of Discounts: Some discounts may not be available in all states, reducing the potential savings for Instacart drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Comparative Analysis of Insurance Discounts for Instacart Drivers

When assessing the financial considerations for Instacart drivers, a critical aspect is the insurance coverage they choose to protect their vehicles. The choice between full coverage and minimum coverage can significantly impact the monthly expenses incurred by drivers.

Here, we delve into the specific coverage rates of prominent insurance providers, shedding light on the nuances of the best car insurance discounts to ask for.

Instacart Drivers Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

The table reveals substantial variations among insurance providers when examining the specifics of the coverage rates. Liberty Mutual has the highest monthly premium for full coverage at $174, followed closely by Farmers at $139 and Allstate at $160. On the other end of the spectrum, USAA offers the most affordable full coverage at $59 per month.

How does auto insurance work with Instacart?

byu/FinsT00theleft ininstacart

Regarding minimum coverage, Erie provides the most economical option at $58 per month, with USAA and State Farm offering competitive rates at $59 and $86, respectively. These figures underscore the importance of drivers carefully considering their insurance needs, especially when it comes to whether Instacart verifies insurance and how it affects accident claims.

It’s also essential for Instacart drivers to have commercial auto insurance to ensure they’re properly covered while working. Exploring various providers can help find the right balance between comprehensive coverage and affordability. The disparity in rates among different companies highlights the need for Instacart drivers to conduct thorough research and make informed decisions based on their individual preferences and financial circumstances.

Understanding the Insurance Needs of Instacart Drivers

Instacart drivers have specific insurance needs due to the nature of their work. While personal car insurance policies may offer some coverage, they typically do not provide protection for accidents that occur during business-related activities. As an Instacart driver, you essentially use your vehicle for commercial purposes, creating a higher risk profile.

Therefore, obtaining car insurance that covers you while working for Instacart is crucial. One important aspect to consider when obtaining car insurance as an Instacart driver is liability coverage. Liability coverage is essential because it protects you in case you cause an accident that results in injury or property damage to others.

Jeff Root Licensed Life Insurance Agent

Without proper liability coverage, you could be held personally responsible for damages, which can be financially devastating. If you drive for Instacart, it’s essential to know if the company requires insurance. In addition to liability coverage, consider comprehensive and collision coverage, as driving for Instacart often highlights the importance of these coverages.

Also, remember the Instacart driver pay rate, as insurance costs can impact your earnings. Collision coverage, on the other hand, covers damages to your vehicle in the event of a collision with another vehicle or object. Comprehensive and collision coverage can provide peace of mind and financial protection in various situations.

The Importance of Comprehensive Coverage for Instacart Drivers

Extensive coverage is crucial for Instacart drivers, safeguarding against non-collision damages like theft, vandalism, or weather-related incidents. Given the inherent risks of the Instacart driving role, comprehensive coverage is essential, providing both peace of mind and crucial financial protection from unforeseen damages.

Comprehensive coverage protects against non-collision incidents, like hitting an animal or falling objects. Since Instacart does not provide insurance, drivers must have their own coverage. This also helps with Instacart tip protection and ensures you meet the Instacart driving record requirements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing Car Insurance for Instacart Drivers

When selecting car insurance as an Instacart driver, ensure the policy includes commercial use coverage to protect you during work-related incidents. Be aware of Instacart’s insurance requirements and whether they check your driving record. The right Instacart auto insurance ensures you’re fully covered while driving for the platform.

Additionally, you should evaluate the coverage limits, deductible amounts, and the type of coverage offered, such as comprehensive, collision, and liability insurance. It is also important to consider the reputation and financial stability of the insurance provider to ensure they will be there for you in the event of a claim.

Another important factor to consider when choosing car insurance as an Instacart driver is the cost of the policy. While it is crucial to have adequate coverage, finding a policy that fits your budget is also essential. Compare quotes from different insurance providers to ensure you are getting the best value for your money.

Some insurance companies offer discounts for Instacart drivers, so ask about available rates. If you’re wondering if you need special insurance for Instacart, personal car insurance may not cover you while driving for the platform. Consider Instacart driver insurance and ensure you meet the Instacart license requirements for full protection.

Comparing Different Car Insurance Providers for Instacart Drivers

When searching for the best car insurance for Instacart drivers, it is crucial to compare different providers. Look into their coverage options, pricing, customer service reputation, and any additional perks they may offer, such as roadside assistance. Obtaining quotes from multiple providers allows you to decide based on your needs and budget.

Additionally, it is important to consider the financial stability of the insurance providers you are comparing. Research their financial ratings and stability to ensure that they can fulfill their obligations in the event of a claim. You can check their ratings with independent agencies such as A.M. Best or Standard & Poor’s.

Choosing a financially stable insurance provider will give you peace of mind, knowing they can provide the necessary coverage when you need it most. This is especially important if you wonder, “Do I need commercial auto insurance for Instacart?” A reliable provider can also assist with Instacart roadside assistance and ensure your policy meets Instacart vehicle requirements, giving you the protection tailored to your needs as an Instacart driver.

Must-Have Coverage Options for Instacart Drivers

As an Instacart driver, ensuring adequate insurance coverage is paramount. Here are the must-have coverage options to safeguard your journey.

- Liability Coverage: Protects against claims for injury or property damage caused by accidents.

- Comprehensive Coverage: Provides financial protection for non-collision incidents like theft or vandalism.

- Collision Coverage: This covers damages to your vehicle from collisions with other vehicles or objects.

Ensure you’re adequately protected on the road as an Instacart driver with these essential coverage options.

Read More: Collision vs. Comprehensive Car Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for Instacart Drivers

While securing adequate car insurance is crucial, finding affordable coverage is equally important. Here are some tips to help Instacart drivers find affordable car insurance:

- Shop around and compare quotes from multiple insurance providers.

- Consider opting for higher deductibles to reduce premium costs.

- Check if you qualify for discounts based on your driving history or affiliation with certain organizations.

- Bundle your car insurance policy with other insurance policies, such as renter’s or homeowner’s insurance, to potentially lower the overall cost.

Another tip for finding affordable car insurance for Instacart drivers is maintaining a clean driving record. Insurance providers often offer lower rates to drivers with a safe driving history. Avoiding traffic violations and accidents can help keep insurance premiums affordable.

Additionally, it’s important to consider the type of vehicle you drive when looking for affordable car insurance. If you’re an Instacart driver, knowing when Instacart is the busiest can help determine if you need a more reliable vehicle. Whether using your own car or an Instacart car rental, the vehicle’s make, model, and safety features will affect insurance costs. Also, if you need Instacart commercial insurance, the type of vehicle you use for deliveries can impact your premiums.

Tips for Filing Claims and Dealing With Car Accidents as an Instacart Driver

If you’re involved in a car accident as an Instacart driver, it’s vital to follow the proper steps for filing claims and dealing with the aftermath:

- Immediately report the accident to your insurance provider.

- Gather evidence, such as photos and witness statements, to support your claim.

- Provide accurate and detailed information about the accident to your insurance company.

- Cooperate with the insurance claims process and promptly respond to any requests for information.

- Keep track of all expenses related to the accident, such as medical bills or repair costs.

By taking these steps, you can navigate the accident’s aftermath effectively and protect your interests. Stay safe on the road.

Read More: How to File a Car Insurance Claim

Driving Success Stories: Top Insurers for Instacart Drivers

In the dynamic world of gig economy driving, tailored insurance solutions are crucial for Instacart drivers seeking both affordability and comprehensive coverage. Let’s explore how top insurers have crafted specialized offerings to meet the diverse needs of Instacart drivers.

- Case Study #1 – Tailored Coverage: Emma, an Instacart driver, sought insurance that suited her unique profession. Progressive’s Usage Discount, tailored for gig economy workers, proved pivotal. By tracking her work-related mileage, Emma secured a 12% discount. This tailored approach reflects Progressive’s commitment to understanding diverse work scenarios and offers Emma affordable coverage, enhancing her driving experience.

- Case Study #2—Safety Net: Mike, an Instacart driver, valued safe driving incentives. State Farm’s Drive Safe and Save, with up to a 10% base discount and 17% for safe practices, brought him substantial savings, highlighting their commitment to responsible driving.

- Case Study #3 – Comprehensive Support: Jessica, an Instacart driver, prioritized comprehensive coverage. Allstate’s Comprehensive Coverage, with a standard 15% savings and an extra 18% discount, proved invaluable in protecting her against non-collision incidents. Allstate’s commitment to providing extensive protection resonated with Jessica’s need for financial security, demonstrating their dedication to supporting Instacart drivers comprehensively.

Progressive, State Farm, and Allstate prioritize driver safety through tailored discounts and coverage options. For example, Progressive offers discounts for completing defensive driving courses, which can lower insurance premiums. This encourages safer driving while helping Instacart drivers save on their coverage.

Melanie Musson Published Insurance Expert

In conclusion, these case studies highlight insurers’ dedication to meeting Instacart drivers’ unique needs, especially regarding whether Instacart requires car insurance. From recognizing safe driving to offering comprehensive coverage, Progressive, State Farm, and Allstate prioritize driver safety and security.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Considerations for Instacart Drivers

In conclusion, as an Instacart driver, you must have the right car insurance coverage to protect yourself, your passengers, and your vehicle. By understanding your specific insurance needs, comparing providers, and being proactive in finding affordable options, you can secure the best car insurance for your profession.

Remember to consider factors such as comprehensive coverage, coverage limits, and any available special discounts or programs. By entering your ZIP code, you can access tailored options that suit your needs.

Follow defensive driving practices, avoid common mistakes, and understand the impact of your driving record to navigate the ride-share industry confidently and with peace of mind.

Frequently Asked Questions

What specific insurance needs do Instacart drivers have?

Instacart drivers have distinct insurance needs due to using their vehicles for business purposes. Personal car insurance may not cover accidents during work-related activities, necessitating specialized coverage.

Why is comprehensive coverage crucial for Instacart drivers?

Comprehensive coverage is vital for Instacart drivers as it protects against non-collision incidents like theft, vandalism, or weather-related damages. Given the nature of their work, this coverage ensures financial protection in various unforeseen circumstances.

How can Instacart drivers find affordable car insurance?

To find affordable car insurance, Instacart drivers should compare quotes from different providers, inquire about discounts for their profession, maintain a clean driving record, and consider the type of vehicle they drive to impact insurance costs positively.

What factors should Instacart drivers consider when choosing car insurance?

Instacart drivers should prioritize coverage for commercial use, evaluate coverage limits, deductibles, and types (liability, comprehensive, collision). Additionally, assessing the insurer’s reputation and financial stability is essential for reliable support in case of claims.

What are the unique insurance considerations for Instacart drivers in the ride-share industry?

Instacart drivers in the ride-share industry should review the coverage provided by the platform, address any coverage gaps, and consider purchasing additional coverage to ensure comprehensive protection while actively engaged in deliveries.

What is the best insurance for Instacart drivers?

The best insurance for Instacart drivers typically offers coverage tailored to gig economy workers’ needs, such as AIG Insurance, State Farm Insurance, or Travelers Insurance.

Do Instacart drivers need commercial insurance?

While Instacart doesn’t explicitly require commercial insurance, it’s essential to check with your insurance provider to ensure you’re adequately covered for commercial use, especially if you’re using your vehicle for delivery.

Does Instacart provide insurance for drivers?

Instacart offers insurance coverage for its drivers, but it’s essential to review the terms and conditions to understand the extent of coverage provided and whether additional coverage may be necessary.

Does Progressive cover Instacart drivers?

Progressive offers insurance coverage that may extend to Instacart drivers. However, it’s crucial to verify with Progressive to confirm coverage specifics and any additional requirements.

Enter your ZIP code into our free quote tool below to compare your Instacart auto insurance rates from Progressive against other top competitors.

Does State Farm cover Instacart drivers?

State Farm may provide insurance coverage for Instacart drivers, but it’s recommended to contact State Farm directly to inquire about coverage options and any necessary adjustments to your policy.

Does Instacart check insurance or driving records?

What type of insurance do new drivers need for Instacart?

Does Instacart offer health insurance or roadside assistance for drivers?

What are the insurance requirements for Instacart drivers?

What is the Instacart accident claims process?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.