Erie Insurance Review & Ratings (2026)

In-depth Erie Insurance Review & Ratings: Unbiased Insights and Expert Analysis for Informed Decision-Making. Explore our comprehensive review of Erie Insurance, where we provide unbiased insights, expert analysis, and valuable information about their insurance products, coverage options, claims handling, customer experiences, and more. Delve into the intricate details of Erie Insurance to make well-informed decisions about your insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated January 2025

Erie Insurance was founded in Erie, Pennsylvania in 1925. The company started out as an automobile insurance provider and branched out over the years to include other insurance products, thus allowing them to better serve their customers. Erie Insurance trains all of their employees to emphasize the companies plan to be Above All in Service. This means that they offer exemplary customer service, as well as fair pricing to ensure that their customers receive the best policies at the best prices.

In this comprehensive review of Erie Insurance, the company’s history and evolution since its founding in 1925 as an automobile insurance provider in Erie, Pennsylvania, are explored. With an emphasis on exemplary customer service and fair pricing, Erie Insurance has expanded its offerings to include a diverse range of insurance products, serving 11 states.

The article highlights the company’s commitment to digital advancements, with a robust mobile app and online account management capabilities. It delves into the streamlined claims process, positive customer feedback, and the efficiency of Erie Insurance’s average claim processing time.

While specific pricing details are not provided, the review underscores the importance of personalized quotes and details various discounts available. The article also introduces Erie Insurance’s main competitors in the insurance landscape, providing readers with a comprehensive understanding of the industry’s key players and their distinct offerings.

Overall, the review equips readers with valuable insights to make informed decisions about their insurance needs.

What You Should Know About Erie Insurance Group

Erie Insurance, founded in 1925, traces its origins to Erie, Pennsylvania, where it started as an automobile insurance provider. Over the decades, the company has expanded its offerings beyond auto insurance to include a diverse range of insurance products.

Erie Insurance has maintained a commitment to providing exceptional service, emphasizing the mantra “Above All in Service.” This dedication extends not only to delivering exemplary customer service but also ensuring fair pricing to offer customers the best policies at competitive rates.

The company’s evolution reflects a strategic approach to better serve its clientele, making it a notable player in the insurance industry. As of the latest information available, Erie Insurance operates in 11 states, namely Illinois, Indiana, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin, providing insurance solutions to a wide geographic area.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie Insurance Group Insurance Coverage Options

Erie Insurance trains all of their employees to emphasize the companies plan to be Above All in Service. This means that they offer exemplary customer service, as well as fair pricing to ensure that their customers receive the best policies at the best prices.

- Automobile Insurance

- Homeowners Insurance

- Personal Property and Liability Insurance

- Life Insurance

- Business Insurance

To find the best insurance rates tailored to your requirements, take action now by entering your zip code. Our user-friendly tool allows you to compare rates from the top insurance providers in your area, ensuring you secure optimal coverage at competitive prices.

Don’t miss out on finding the ideal insurance solution that provides reliable protection, exceptional service, and affordability. Enter your zip code now and make the first step towards securing the insurance coverage you deserve.

Erie Insurance Group Insurance Rates Breakdown

Navigating the insurance landscape involves a crucial consideration of costs. In the case of Erie Insurance, understanding the pricing structure is key to making informed decisions.

While specific details about costs may not be explicitly outlined in this article, we’ll explore factors influencing Erie Insurance’s pricing strategies, such as the range of insurance products offered, available discounts, and the company’s commitment to fair pricing.

Cost Factors and Considerations

Erie Insurance provides a diverse array of insurance products, including auto, homeowners, and business insurance. The costs associated with these policies can vary based on factors such as coverage limits, deductibles, and individual circumstances.

The article emphasizes the availability of discounts, including those for multiple policies, safe driving records, and anti-theft devices. However, the exact cost details and pricing comparisons with other providers are not explicitly presented here.

While the article does not provide specific pricing information, it underscores Erie Insurance’s commitment to fair pricing and highlights the importance of obtaining personalized quotes to assess costs based on individual needs.

For accurate and up-to-date pricing details, interested individuals are encouraged to visit the Erie Insurance website, contact an agent, or use the online quote tool to tailor insurance coverage to their specific requirements.

Making informed decisions about insurance costs requires a comprehensive understanding of individual needs and the available policy options, and Erie Insurance aims to assist customers in navigating this crucial aspect of their coverage decisions.

Erie Insurance Group Discounts Available

Erie car insurance discounts recognizes the significance of providing policyholders with opportunities to save on their insurance premiums. The company offers a range of discounts, rewarding various factors that contribute to a safer and more secure insurance profile. Here’s a breakdown of the discounts available:

- Multiple Policies Discount: Combining multiple insurance policies, such as auto and homeowners insurance, can unlock substantial discounts, making it a cost-effective choice for customers bundling their coverage.

- Safe Driving Discounts: Erie Insurance values safe driving habits. Policyholders with a clean driving record and a history of responsible driving may qualify for discounts as a recognition of their commitment to road safety.

- Anti-Theft Device Discount: Installing anti-theft devices in your vehicle can lead to reduced premiums. Erie Insurance encourages proactive measures to safeguard against theft, offering financial incentives for these precautions.

- Longevity Car Insurance Discount: Loyalty is rewarded at Erie Insurance. Customers who maintain a longstanding relationship with the company may be eligible for a longevity discount, reflecting the company’s appreciation for customer loyalty.

While the specific percentage or amount of these discounts may vary based on individual circumstances and policy details, Erie Insurance’s commitment to providing opportunities for savings is evident, aiming to make insurance coverage more affordable and accessible for its policyholders.

To obtain personalized information on discounts and explore how they can apply to your unique situation, it’s recommended to connect with an Erie Insurance agent or utilize their online quote tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Excellence: A Deep Dive into Erie Insurance Reviews and Ratings

Erie Insurance: Coverage, Claims, Discounts

Erie insurance consistently receives high praise in Erie insurance claims reviews for its prompt and efficient claims processing, earning a reputation for reliability and customer satisfaction. Offering a range of coverage options, including Erie insurance collision coverage and Erie insurance comprehensive coverage, the company ensures peace of mind for drivers by addressing various scenarios on the road.

Moreover, Erie insurance full coverage plans cater to diverse needs, combining collision, comprehensive, and liability coverage into a comprehensive package. With an array of Erie insurance discounts available, from Erie insurance renters insurance to Erie insurance roof claim benefits, policyholders can maximize savings without compromising on quality.

These factors contribute to Erie Insurance’s ranking among the top insurance providers, supported by positive Erie insurance group reviews and a commitment to serving clients with excellence. Additionally, Erie insurance college student discount programs further demonstrate the company’s dedication to providing accessible and affordable coverage options for all demographics.

Comprehensive Home Protection: Erie Insurance Review & Ratings

Erie Insurance provides a comprehensive range of services, including Erie home insurance and Erie home warranty options, catering to diverse homeowner needs. In Erie home insurance reviews, customers frequently commend the company’s swift Erie ins claims processing, alleviating stress during challenging times.

The extensive Erie homeowners insurance coverage ensures that clients’ properties are shielded against various risks, fostering a sense of security. Consistently high Erie homeowners ratings underscore the company’s dedication to exceptional service. Furthermore, Erie’s A.M. Best rating reflects its financial stability and dependability, instilling confidence in policyholders.

Whether it’s handling an Erie insurance accident claim or facilitating Erie insurance bill payment, the company prioritizes customer convenience. Moreover, for those requiring flexibility, Erie insurance cancel policy options offer straightforward solutions, ensuring satisfaction throughout the insurance process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comprehensive Coverage and Seamless Service: Evaluating Erie Insurance

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Streamline Claims With Erie Insurance: Effortless Process for Policyholders

Ease of Filing a Claim

Erie Insurance offers a convenient and user-friendly claims process, allowing policyholders to file claims through multiple channels. Whether you prefer an online platform, phone assistance, or a mobile app, Erie Insurance caters to diverse preferences for a seamless experience.

Average Claim Processing Time

The average claim processing time with Erie Insurance is efficient and streamlined. Policyholders can expect a prompt evaluation and settlement of their claims, providing peace of mind during stressful situations.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback on claim resolutions and payouts for Erie Insurance is generally positive. Policyholders appreciate the fair and efficient handling of claims, ensuring they receive the compensation they deserve in a timely manner.

Erie Insurance’s Digital Advancements: Elevating Insurance Experience

Mobile App Features and Functionality

Erie Insurance offers a robust mobile app with a range of features and functionalities that empower policyholders. The app allows for easy policy management, claims filing, bill payments, and access to important documents. Its intuitive interface ensures a seamless user experience.

Online Account Management Capabilities

Erie Insurance provides comprehensive online account management capabilities, enabling policyholders to access and manage their policies, view billing information, and track claims from the comfort of their homes. The online portal offers a user-friendly interface for efficient management.

Digital Tools and Resources

Erie Insurance equips policyholders with a suite of digital tools and resources to enhance their insurance experience. From educational resources to calculators helping customers determine their coverage needs, these digital tools assist policyholders in making informed decisions and understanding their policies better.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Erie Insurance Group Ranks Among Providers

In the dynamic world of insurance, Erie Insurance faces competition from various industry players. Let’s explore some of its main competitors and understand what sets them apart.

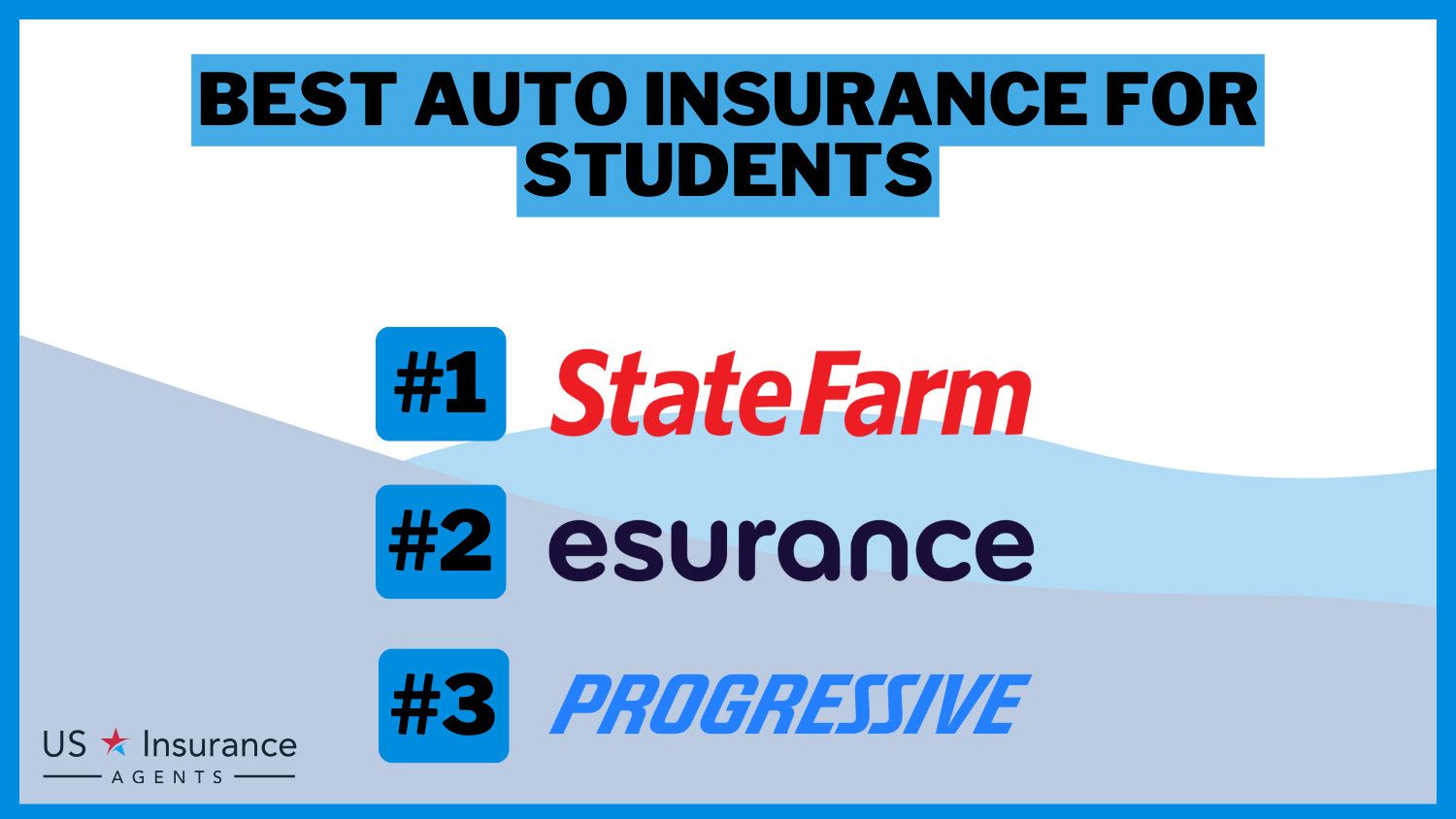

- State Farm Insurance: State Farm, a behemoth in the insurance industry, offers a comprehensive suite of insurance products, including auto, homeowners, life, and more. With a vast network of agents and a longstanding presence, State Farm is known for its personalized service and a range of coverage options.

- Allstate Insurance: Allstate is another major player, providing a diverse portfolio of insurance solutions. Renowned for its advertising campaigns and innovative coverage options, Allstate emphasizes customer convenience, offering digital tools and resources to enhance the insurance experience.

- Progressive Insurance: Progressive stands out for its technological advancements, particularly in the auto insurance sector. With a focus on user-friendly online platforms and competitive pricing, Progressive has carved a niche, appealing to tech-savvy consumers seeking efficient and affordable coverage.

- Geico Insurance: Known for its humorous advertising and straightforward approach, GEICO has become a household name. As a direct-to-consumer insurer, Geico leverages cost-effective strategies, often translating into competitive rates for customers seeking straightforward and budget-friendly options.

- Nationwide Insurance: Nationwide operates as a mutual insurance company, offering a range of coverage, including auto, home, and life insurance. With a commitment to member satisfaction and community involvement, Nationwide distinguishes itself through its cooperative structure.

Each of these competitors brings unique strengths and approaches to the insurance market. Understanding their key features and offerings can aid consumers in making informed decisions based on their individual needs and preferences.

Frequently Asked Questions

Does Erie Insurance cover Florida?

Erie Insurance offers coverage in Florida. However, coverage options may vary depending on the specific policy and location within the state.

Does Erie Insurance cover South Carolina?

Yes, Erie Insurance provides coverage in South Carolina. As with Florida, the specifics of coverage may vary based on policy details and location.

Does Erie Insurance cover Texas?

Yes, Erie Insurance operates in Texas and offers coverage options in the state.

How good is Erie Insurance?

Erie Insurance is generally regarded as a reputable insurance provider with a strong customer service record and competitive rates. However, individual experiences may vary.

Is Erie rate lock worth it?

Whether Erie rate lock is worth it depends on individual circumstances and preferences. Rate lock programs typically offer protection against premium increases for a specified period, providing stability and predictability in insurance costs. It’s advisable to evaluate the terms, costs, and benefits of the rate lock option and compare them with your insurance needs and budget to determine if it’s worthwhile for you.

How is Erie Insurance rated?

Erie Insurance typically receives high ratings for customer satisfaction and financial stability from independent rating agencies such as J.D. Power and AM Best.

Is Erie a good insurance company?

Yes, Erie Insurance is considered a good insurance company by many customers and industry experts due to its reliable coverage, strong customer service, and competitive rates.

Is Erie auto insurance good?

Erie auto insurance is generally well-regarded for its coverage options, customer service, and affordable premiums. Many policyholders report positive experiences with Erie for their auto insurance needs.

Is Erie auto insurance legit?

Yes, Erie auto insurance is a legitimate insurance provider with a long-standing reputation in the industry.

Is Erie auto insurance good?

Erie is often considered a good choice for car insurance due to its range of coverage options, competitive rates, and quality customer service. Many policyholders are satisfied with Erie’s car insurance offerings.

Is Erie home insurance good?

Is Erie homeowners legit?

Is Erie a good insurance company?

Is Erie Insurance cheap?

What states does Erie Insurance cover?

what states does Erie Insurance cover?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.