Cheap Cadillac CT5 Car Insurance in 2024 (Best 10 Companies for Savings!)

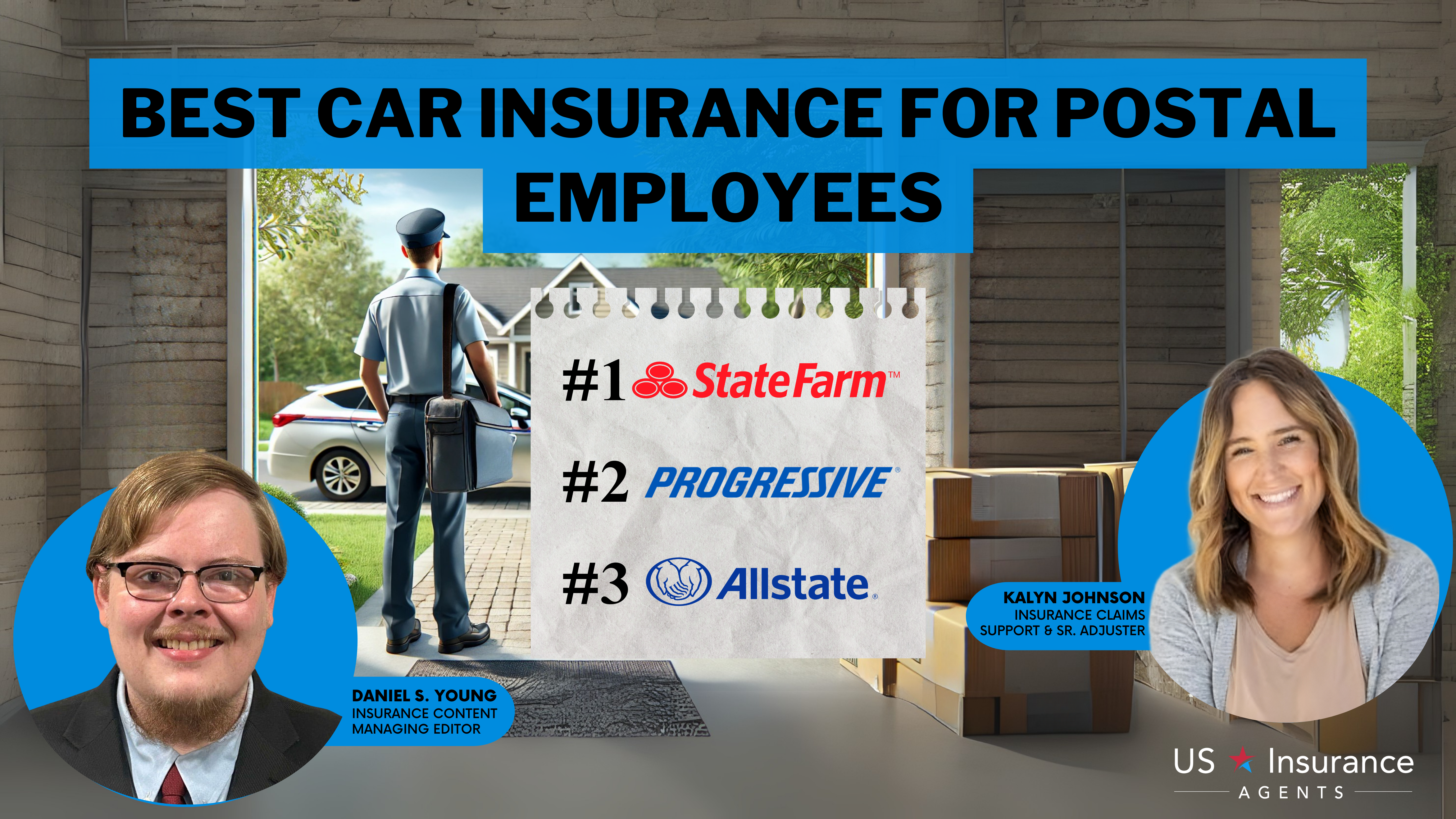

Progressive, State Farm, and Allstate, offer the best cheap Cadillac CT5 car insurance, starting as low as $57/month. These insurers offer affordable rates and comprehensive coverage, ensuring exceptional service and value for your Cadillac CT5. Perfect for anyone in search of affordable and dependable security.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated January 2025

Company Facts

Min. Coverage for Cadillac CT5

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Cadillac CT5

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Cadillac CT5

A.M. Best

Complaint Level

Pros & Cons

Progressive, State Farm, and Allstate provide cheap Cadillac CT5 car insurance with comprehensive coverage options, ensuring competitive rates tailored to your needs.

Factors such as the vehicle’s value, safety features, driver’s age, driving record, and credit history all play a role in determining insurance costs.

Our Top 10 Company Picks: Cheap Cadillac CT5 Car Insurance

Company Rank Monthly Rates Safe Driver Discount Best For Jump to Pros/Cons

#1 $57 10% Online Convenience Progressive

#2 $59 22% Many Discounts State Farm

#3 $60 15% Add-on Coverages Allstate

#4 $65 25% Cheap Rates Geico

#5 $72 18% Customizable Polices Liberty Mutual

#6 $75 30% Usage Discount Nationwide

#7 $79 20% Accident Forgiveness Travelers

#8 $86 12% Local Agents Farmers Insurance

#9 $92 28% Local Agents AAA Insurance

#10 $95 17% Military Savings USAA/a>

By carefully considering these factors and comparing quotes, drivers can secure the perfect coverage for their Cadillac CT5 while keeping costs in check.

Get fast and cheap auto insurance coverage today with our quote comparison tool.

- Progressive offers Cadillac CT5 insurance from $57/month

- Factors like vehicle value, safety features, and driver’s history affect insurance costs

- Find comprehensive coverage with Progressive, State Farm, and Allstate

#1 – Progressive: Top Overall Pick

Pros

- Online Convenience: Progressive offers an easy-to-use online platform for managing policies, making it convenient for tech-savvy customers.

- Safe Driver Discount: With a 10% safe driver discount, Progressive incentivizes and rewards safe driving habits, potentially lowering premiums for responsible drivers.

- Variety of Discounts: Progressive offers various discounts beyond safe driving, providing opportunities for customers to save money through different avenues. Read more about our Progressive insurance review & ratings.

Cons

- Limited Local Support: Some customers may prefer face-to-face interaction with local agents, which Progressive may not offer as extensively as other providers.

- Price may not be the Cheapest: While Progressive offers competitive rates, it may not always provide the absolute lowest prices for all customers compared to other options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Many Discounts

Pros

- Numerous Discounts: State Farm offers a broad range of discounts, such as a generous 22% discount for safe drivers, which can greatly lower premiums for qualifying policyholders. Explore our State Farm insurance review & ratings.

- Local Agents: Emphasizing local agents, State Farm delivers personalized service and support for customers who prefer a more direct and hands-on experience.

- Tailored Policies: State Farm’s adaptable policies let customers tailor coverage to their needs, ensuring essential protection without unnecessary expenses.

Cons

- Potentially Higher Rates: Despite discounts, State Farm’s rates may still be higher than some competitors, particularly for drivers with less-than-perfect driving records or credit scores.

- Limited Online Options: While State Farm offers online tools, its emphasis on local agents may mean fewer online resources and conveniences compared to fully digital insurers.

#3 – Allstate: Best for Comprehensive Coverages

Pros

- Add-on Coverages: Allstate’s focus on add-on coverages allows customers to enhance their policies with additional protections like roadside assistance or rental car reimbursement.

- Safe Driver Discount: With a 15% safe driver discount, Allstate rewards responsible driving habits, potentially leading to lower premiums for eligible policyholders. Take a look at our Allstate insurance review & ratings.

- Strong Customer Support: Allstate is known for its reliable customer service, providing assistance and support to policyholders whenever they need it.

Cons

- Price Point: While offering a range of coverages, Allstate’s premiums may be slightly higher compared to some competitors, making it less budget-friendly for certain customers.

- Limited Discounts: While Allstate offers some discounts, its selection may not be as extensive as other providers, potentially limiting opportunities for savings for certain policyholders.

#4 – Geico: Best for Low Rates

Pros

- Cheap Rates: Geico offers some of the most competitive rates, making it an attractive option for budget-conscious customers seeking affordable insurance coverage. To learn more, read about Geico insurance premium details.

- High Safe Driver Discount: With a 25% safe driver discount, Geico rewards safe driving habits, potentially leading to significant savings for eligible policyholders.

- Online Convenience: Geico’s user-friendly online platform makes it easy for customers to manage their policies, file claims, and access support, enhancing overall convenience.

Cons

- Limited Coverage Options: While Geico provides basic coverage options, its offerings may be less comprehensive compared to other providers, potentially leaving some customers with gaps in coverage.

- Customer Service Reviews: Despite its affordability and convenience, Geico’s customer service reviews vary, with some customers reporting less satisfactory experiences with claims handling and support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: Liberty Mutual review & ratings offers customizable policies, allowing customers to tailor coverage to their specific needs and preferences, ensuring they get the protection they require without paying for unnecessary extras.

- Decent Safe Driver Discount: With an 18% safe driver discount, Liberty Mutual incentivizes safe driving behaviors, potentially lowering premiums for responsible drivers.

- Add-on Coverages: Liberty Mutual offers add-ons like roadside assistance and rental car coverage, empowering customers to boost their policies with extra protection.

Cons

- Higher Rates: While offering customizable coverage options, Liberty Mutual’s premiums may be higher compared to some competitors, making it less affordable for certain customers.

- Complex Claims Process: Some customers faced challenges with Liberty Mutual’s claims, citing delays and complexities, potentially impacting overall satisfaction.

#6 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers a significant 30% usage discount, rewarding customers who drive fewer miles, which can result in substantial savings for those who don’t frequently use their vehicles.

- Various Coverage Options: Our Nationwide insurance review & ratings provides a wide range of coverage options, allowing customers to tailor their policies to meet their specific needs and preferences.

- Strong Financial Stability: Nationwide has a solid financial reputation and stability, giving customers peace of mind knowing that their insurer is financially secure and capable of fulfilling claims obligations.

Cons

- Potentially Higher Rates: Despite offering a usage discount, Nationwide’s premiums may still be higher compared to some competitors, particularly for customers who don’t qualify for the usage discount.

- Limited Discounts: While Nationwide offers a usage discount, its selection of additional discounts may be more limited compared to other providers, potentially reducing opportunities for additional savings.

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness, ensuring customers keep their current rates post at-fault accidents, aiding in long-term premium affordability.

- Stable Rates: Travelers is known for its stable rates, providing customers with consistency and predictability in their insurance costs, which can be reassuring for budget-conscious individuals.

- Multiple Policy Discounts: Travelers offers discounts for bundling multiple policies, such as home and auto insurance, providing customers with additional opportunities to save on their premiums. Take a look at our Travelers insurance review & ratings for more details.

Cons

- Limited Online Tools: Travelers’ online tools and digital services may be less robust compared to some competitors, potentially affecting convenience and accessibility for tech-savvy customers.

- Coverage Options: Travelers provides standard coverage but offers fewer additional options compared to competitors, potentially limiting customer customization.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers Insurance: Best for Personalized Service

Pros

- Local Agents: Farmers emphasizes local agents, providing personalized service and assistance for customers who prefer face-to-face interactions and guidance throughout the insurance process.

- Decent Safe Driver Discount: With a 12% safe driver discount, Farmers rewards safe driving habits, potentially leading to lower premiums for eligible policyholders.

- Wide Range of Coverage Options: Farmers offers a comprehensive selection of coverage options, allowing customers to tailor their policies to their specific needs and preferences. Check out our Farmers insurance review & ratings for more details.

Cons

- Potentially Higher Rates: Despite discounts and coverage options, Farmers’ premiums may still be higher compared to some competitors, particularly for certain demographics or risk profiles.

- Claims Process: Some customers faced challenges with Farmers’ claims, citing delays or difficulties, potentially impacting overall satisfaction with the company’s service.

#9 – AAA Insurance: Best for Local Agents

Pros

- Local Agents: AAA prioritizes local agents for personalized service, offering face-to-face support and guidance throughout the insurance process, ideal for hands-on customers.

- High Safe Driver Discount: With a substantial 28% safe driver discount, AAA rewards safe driving habits, potentially leading to significant savings for eligible policyholders.

- Membership Benefits: In line with our AAA insurance review & ratings, the company offers additional benefits beyond insurance, such as roadside assistance and discounts on travel and retail services, enhancing overall value for members.

Cons

- Potentially Higher Premiums: Despite discounts and membership benefits, AAA’s premiums may be higher compared to some competitors, particularly for certain demographics or risk profiles.

- Limited Availability: AAA insurance may not be available in all areas, limiting access for potential customers who live outside of AAA service regions.

#10 – USAA: Best for Military Savings

Pros

- Military Savings: USAA delivers exclusive savings for military members and families with tailored insurance options, ensuring significant cost savings through discounts.

- Strong Financial Stability: USAA has a solid financial reputation and stability, giving customers peace of mind knowing that their insurer is financially secure and capable of fulfilling claims obligations.

- Member Satisfaction: USAA earns praise for top-tier customer satisfaction, bolstered by stellar service and claims handling, fostering trust and contentment among customers. For detailed information, refer to our USAA insurance review & ratings.

Cons

- Membership Eligibility: USAA insurance is exclusively for military members, veterans, and their families, excluding those who don’t meet eligibility criteria.

- Limited Coverage Options: USAA’s coverage options are standard, with fewer extras than other insurers, potentially limiting customization for non-military needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence Cadillac CT5 Car Insurance Rates

When insurance companies determine the cost of insuring a Cadillac CT5, they consider several factors. These factors include the vehicle’s value, the cost of repairs, safety features, and the likelihood of theft. Additionally, insurance companies take into account the driver’s age, driving record, and credit history.

The value of the Cadillac CT5 plays a significant role in insurance rates. Luxury vehicles tend to have higher repair costs and are more likely to be targeted by thieves, which leads to higher insurance premiums.

Safety features are another important consideration for insurance companies. The Cadillac CT5 comes equipped with a range of advanced safety features such as lane-keeping assist, forward collision warning, and automatic emergency braking. These features can reduce the risk of accidents and lower insurance rates.

The driver’s age and driving record are also taken into account. Younger, less experienced drivers may face higher insurance premiums due to their increased risk of accidents. Similarly, drivers with a history of traffic violations and accidents may be deemed higher risk and therefore charged higher rates.

Lastly, a driver’s credit history can impact insurance rates. Insurers often use credit scores to assess a policyholder’s likelihood of filing a claim. A lower credit score may result in higher insurance premiums.

Cadillac CT5 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $92 $179

Allstate $60 $156

Farmers $86 $176

Geico $65 $162

Liberty Mutual $72 $167

Nationwide $75 $172

Progressive $57 $145

State Farm $59 $152

Travelers $79 $175

USAA $95 $182

Understanding the Cost of Insuring a Cadillac CT5

The cost of insuring a Cadillac CT5 varies based on factors like age, driving history, location, and coverage level. Monthly premiums average $125 to $208, but rates can differ. Younger drivers and those with traffic violations face higher premiums, while a clean record lowers costs. Urban areas and comprehensive coverage also increase expenses.

Dani Best Licensed Insurance Producer

Beyond insurance, owning a Cadillac CT5 involves additional costs such as maintenance, fuel, and registration fees. Luxury vehicles like the Cadillac CT5 generally have higher maintenance costs, and fuel efficiency and gasoline prices affect overall expenses. Registration fees vary by state and should be included in the ownership budget. Understanding these factors helps potential owners make informed financial decisions.

Tips for Finding Affordable Car Insurance for Your Cadillac CT5

While car insurance for a luxury vehicle like the Cadillac CT5 may not be the cheapest, there are strategies to help you find more affordable rates:

- Compare Quotes From Multiple Insurance Providers: Shop around and get quotes from various insurers to find the best rates for your Cadillac CT5.

- Opt for Higher Deductibles: Choosing a higher deductible can reduce your premium, but make sure it’s a manageable amount in case of an accident.

- Utilize Discounts: Many insurers offer discounts for safety features, anti-theft systems, and bundled policies. Inquire about available discounts when getting quotes.

- Bundle Your Policies: If you have other insurance needs like homeowners or renters insurance, bundling them with your car insurance could lead to significant savings.

- Maintain a Clean Driving Record: Avoiding traffic violations and accidents can help keep your insurance rates lower. Safe driving habits are crucial for both safety and savings.

When insuring your Cadillac CT5, affordable coverage is readily attainable. By comparing quotes, modifying deductibles, exploring discounts, combining policies, and upholding a clean driving history, you can obtain the necessary protection without straining your finances. Remember these pointers as you navigate the insurance realm, and you’ll confidently journey ahead with peace of mind and some savings to spare.

The breakdown details car insurance discounts tailored for Cadillac CT5 owners from leading providers. These discounts, varying from 10% to 30%, encompass diverse incentives such as safe driving rewards, multi-policy bundling, and usage-based programs.

For instance, Nationwide extends a generous 30% discount through its SmartRide program, while Progressive offers a 10% reduction via its Snapshot program. These customizable options empower Cadillac CT5 drivers to curate insurance plans that align with their driving behaviors and policy needs, potentially reducing their overall insurance expenses.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Role of Deductibles in Cadillac CT5 Insurance Premiums

A deductible refers to the sum you must personally cover before your full coverage car insurance begins to apply. Deciding on your deductible is a crucial step when selecting insurance for your Cadillac CT5.

Generally, a higher deductible will result in a lower premium, while a lower deductible will come with a higher premium. It’s important to strike a balance and choose a deductible that you can comfortably afford in case of an accident.

Consider your financial situation and weigh the potential savings on premiums against the amount you would have to pay in the event of a claim. Be sure to choose a deductible that aligns with your budget and risk tolerance.

The Geographical Influence on Cadillac CT5 Insurance Rates

The cost of insuring your Cadillac CT5 hinges significantly on your location. Factors such as crime rates, traffic density, and the prevalence of uninsured drivers all play a pivotal role in determining insurance premiums.

Urban areas, characterized by higher crime rates and congested traffic, typically incur higher insurance costs due to increased risks of accidents, theft, and vandalism. Conversely, rural or suburban areas generally boast lower insurance premiums owing to reduced crime rates and less traffic congestion.

Moreover, the frequency of uninsured drivers in your vicinity can also influence insurance rates. Regions with a higher number of uninsured motorists often witness insurers raising premiums to offset potential damages from accidents involving these drivers. Understanding these location-based dynamics can aid in making informed decisions regarding where to reside and budgeting for your Cadillac CT5 insurance expenses.

Case Studies: Exploring Best Company Experiences for Cadillac CT5 Car Insurance

The following fictional case studies are based on real-world scenarios, illustrating how Cadillac CT5 owners can secure car insurance from top providers. These examples highlight the benefits and experiences of choosing Progressive, State Farm, and Allstate for their insurance needs.

- Case Study #1 – Savings Through Custom Coverage: John, a 35-year-old from Texas, chose Progressive for his Cadillac CT5, paying $125 monthly for comprehensive coverage with extras like roadside assistance. He appreciated the user-friendly app, which made managing his policy and filing claims easy, resulting in significant savings and convenience.

- Case Study #2 – Maximizing Discounts for Lower Premiums: Sarah, a 42-year-old from California, chose State Farm for her Cadillac CT5. With a monthly premium of $137, she received a multi-policy discount by bundling her auto and home insurance, plus a safe driver car insurance discount for her clean record. State Farm’s comprehensive coverage and personalized customer service made Sarah feel confident and well-protected.

- Case Study #3 – Enhanced Coverage: Michael, a 50-year-old retired military officer from Florida, chose Allstate for his Cadillac CT5. With a monthly premium of $142, he got comprehensive coverage, collision coverage, accident forgiveness, and new car replacement. Michael appreciated Allstate’s extensive coverage and extra benefits, along with their responsive customer service and efficient claims process.

These case studies provide insight into the advantages Cadillac CT5 owners can enjoy by choosing insurance coverage from leading providers such as Progressive, State Farm, and Allstate.

Zach Fagiano Licensed Insurance Broker

Each of these insurers offers distinct benefits customized to accommodate various needs and preferences, showcasing the diverse advantages available to Cadillac CT5 owners when selecting their insurance provider.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Summary: Navigating Affordable Insurance for Your Cadillac CT5

Finding affordable insurance for luxury cars like the Cadillac CT5 can be a challenge, but with the right approach, competitive rates are within reach. This comprehensive guide explores the factors influencing insurance costs for the Cadillac CT5, offering insights into top insurance companies such as Progressive, State Farm, and Allstate.

By considering variables like safety features, driving history, and available discounts, drivers can secure comprehensive coverage without breaking the bank. Expertly written by insurance and finance professionals, this resource equips readers with the knowledge to make informed decisions and maximize savings on Cadillac CT5 car insurance.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Frequently Asked Questions

Is Cadillac a high maintenance car?

Costs will also vary depending on the model of your car; the more complex the car, the higher the repair bill. Cadillacs produce maintenance costs that are among the highest in the industry. According to RepairPal, an information hub for auto repairs, Cadillacs cost on average $783 to repair.

For more information, check out our comprehensive guide titled “How can I find a reputable auto body shop to repair my vehicle after an accident?” for valuable insights.

Which type of car is cheapest to insure?

Type of vehicle like Small SUVs and minivans generally receive lower auto insurance rates, while sedans and large SUVs cost more to insure. Cheap car insurance is difficult to find for those with pickup trucks, electric vehicles, luxury models and sports cars.

Enter your ZIP code below to explore which companies have the cheapest auto insurance rates for you.

Are parts expensive for Cadillac?

As you can see, Cadillac parts are quite expensive, even at the used cost. And then there is the dilemma of deciding if you even want to install a used part in the first place and risk having to repeat the repair all over again in a few months

Which type of car insurance is best?

Yes, the premium for comprehensive care insurance is on the higher side when compared to the other types of car insurance. This is only because comprehensive car insurance offers more protection for your car than other types of motor insurance.

For additional details, explore our comprehensive resource titled “What is comprehensive coverage?“

Is Cadillac considered luxury?

Since its establishment in 1902, Cadillac has been synonymous with luxury, elegance, and innovation. The brand has always aimed to produce vehicles that offer a premium driving experience, combining high-end materials, advanced technology, and superior craftsmanship.

Why is Cadillac so popular?

The vehicles were embodiments of comfort, sophistication, and technological advancements, attracting those who desired the ultimate in automotive luxury. As the “Standard of the World,” Cadillac became an emblem of American luxury, with each model reflecting a commitment to craftsmanship, quality, and innovation.

What is the best insurance for luxury cars?

State Farm, Travelers and Progressive are the best car insurance companies for luxury cars. Exotic cars usually need a specialty insurance company like Hagerty, Grundy Insurance or PURE Insurance.

To gain further insights, consult our comprehensive guide titled “Best Car Insurance by Vehicle“

Are Cadillacs good high mileage cars?

On average, a Cadillac lasts for about 200,000 miles, but again it depends on the care and maintenance you provide to the car. When comparing luxury brands, their models are quite reliable and dependable. Although the Cadillac reviews are mixed, you can rely on the newer models to last a little longer.

What type of car insurance is cheapest?

Typically, fully comprehensive insurance is the least expensive, though prices are influenced by individual circumstances.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

How long do Cadillac engines last?

A Cadillac, in general, can last over 200,000 miles and up to 20 years, depending on its usage and maintenance. A well-kept car, for sure, can give you a longer ride. Engineering excellence and top-notch technology integration have made Cadillac a prominent name among luxury automakers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.