Cheap Chevrolet Bolt EUV Car Insurance in 2026 (Save Big With These 10 Companies!)

Erie, State Farm, and Mercury offer the best rates for cheap Chevrolet Bolt EUV car insurance, starting at just $48 monthly. These providers stand out for their competitive premiums, comprehensive coverage options, excellent customer service, and reliable claims handling for Bolt EUV owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Min. Coverage for Chevrolet Bolt EUV

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Bolt EUV

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Bolt EUV

A.M. Best Rating

Complaint Level

Pros & Cons

These companies offer competitive premiums tailored specifically for the Bolt EUV, ensuring cost-effective solutions for owners. Factors influencing the insurance costs include the driver’s location, driving history, and the vehicle’s safety features.

Our Top 10 Company Picks: Cheap Chevrolet Bolt EUV Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $48 A+ Customer Satisfaction Erie

#2 $50 B Competitive Rates State Farm

#3 $52 A+ Lower Premiums Mercury

#4 $54 A Member Benefits AAA

#5 $55 A+ Discount Options Progressive

#6 $58 A++ Coverage Variety Travelers

#7 $60 A Policy Bundling Nationwide

#8 $62 A Flexible Policies Farmers

#9 $63 A Customizable Plans Liberty Mutual

#10 $65 A Affordable Rates The General

By understanding these elements, Bolt EUV owners can secure the most advantageous insurance rates while enjoying robust protection.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- Erie is the top pick for cheap Chevrolet Bolt EUV car insurance

- The Bolt EUV’s advanced safety features can lower insurance costs

- Location significantly impacts insurance rates for the Bolt EUV

#1 – Erie: Top Overall Pick

Pros

- Consistent Payouts: Erie is known for reliable claim settlements, ensuring customer satisfaction. Learn more in our Erie insurance review & ratings.

- Rate Lock Feature: Erie offers a rate lock feature that prevents your insurance rate from increasing after a claim.

- Accident Forgiveness: Policyholders benefit from accident forgiveness policies that prevent rates from skyrocketing after the first at-fault accident.

Cons

- Regional Availability: Erie’s coverage is limited to certain regions, which may not be accessible to everyone.

- Fewer Online Resources: Compared to competitors, Erie offers fewer online tools for managing policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Competitive Rates

Pros

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides substantial discounts for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored for different needs. See more details on our State Farm insurance review & ratings.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#3 – Mercury: Best for Low Premiums

Pros

- Affordable Options: Mercury offers some of the lowest rates for basic coverage.

- Customizable Coverage: Allows extensive customization of policies to suit individual needs.

- Efficient Claim Service: Known for quick and efficient claim processing. Read up on the “Mercury Insurance Review & Ratings” for more information.

Cons

- Customer Service Variability: Some customers report variability in service quality.

- Coverage Limitations: Certain unique coverages are not as comprehensive as offered by other insurers.

#4 – AAA: Best for Member Benefits

Pros

- Travel Discounts: Offers extensive travel discounts and benefits for members. More information is available about this provider in our AAA insurance review & ratings.

- High Customer Loyalty: Known for high customer satisfaction and loyalty benefits.

- Vehicle Service Add-ons: Provides discounts on vehicle services and products.

Cons

- Membership Requirement: Requires AAA membership for insurance, which is an additional cost.

- Higher Rates for Non-Members: Non-members may face significantly higher rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Discount Options

Pros

- Snapshot Program: Offers a usage-based discount program called Snapshot for safe drivers.

- Multiple Discount Offers: Provides numerous discounts for online policy purchase, multi-car, and safe drivers.

- Online Tools: Progressive is known for its strong online policy management tools. Check out insurance savings in our complete Progressive insurance review & ratings.

Cons

- Higher Rates for High-Risk: May charge higher premiums for high-risk drivers compared to competitors.

- Customer Service Issues: Some customers report issues with claim service and support.

#6 – Travelers: Best for Coverage Variety

Pros

- Extensive Coverage Options: Offers a wide variety of coverage options, from basic to highly specialized policies.

- Green Home Discount: Provides discounts for certified green homes. Discover more about offerings in our Travelers insurance review & ratings.

- Loss Prevention Program: Offers discounts for homes with protective devices installed.

Cons

- Pricing Inconsistency: Rates can vary significantly depending on the state and the individual’s profile.

- Complex Policies: Some customers find their policy options and details complex and difficult to understand.

#7 – Nationwide: Best for Policy Bundling

Pros

- Bundling Advantages: Significant discounts for customers who bundle home and auto insurance.

- Free Annual Policy Review: Offers free annual policy evaluations to adjust coverage as needed.

- Vanishing Deductible: Reduces your deductible for each year of safe driving. Access comprehensive insights into our Nationwide insurance review & ratings.

Cons

- Average Customer Satisfaction: Has average scores in customer satisfaction studies.

- Rate Adjustments: Customers may experience rate increases after the policy period.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Flexible Policies

Pros

- Customizable Policies: Offers highly flexible policies that can be tailored to individual needs.

- New Car Pledge: Replaces totaled cars with the latest model year if within the first two ownership years.

- Incident Forgiveness: Forgives one accident every three years without premium increase. Delve into our evaluation of Farmers insurance review & ratings.

Cons

- Costly Premiums: Premiums tend to be higher, especially for more comprehensive coverage.

- Limited Availability: Not all policies are available in every state.

#9 – Liberty Mutual: Best for Customizable Plans

Pros

- Tailored Packages: Allows extensive customization of insurance packages to fit personal needs.

- Accident Forgiveness: Offers accident forgiveness, helping to maintain your rate post-accident.

- Multiple Policy Discounts: Provides discounts for bundling different types of insurance. Unlock details in our Liberty Mutual review & ratings.

Cons

- Variable Customer Service: Customer service quality varies regionally.

- Higher Rates Post-Claim: Rates may increase significantly after a claim.

#10 – The General: Best for Affordable Rates

Pros

- Accepts High-Risk Drivers: Welcomes drivers with less-than-perfect driving records.

- Low Down Payments: Offers low down payment options to make insurance more accessible.

- Flexible Payment Plans: Provides flexible payment options to suit different budgets. Discover insights in our The General car insurance review & ratings.

Cons

- Basic Coverage: Coverage options are more basic and less comprehensive.

- Customer Service Concerns: Some users report less satisfactory customer service experiences.

Chevrolet Bolt EUV Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $54 $125

Erie $48 $105

Farmers $62 $135

Liberty Mutual $63 $138

Mercury $52 $115

Nationwide $60 $130

Progressive $55 $120

State Farm $50 $110

The General $65 $140

Travelers $58 $125

For minimum coverage, Erie offers the lowest monthly rate at $48, followed closely by Mercury and State Farm with rates of $52 and $50 respectively. On the higher end, The General demands $65 per month.

For full coverage, which provides more comprehensive protection, Erie again presents a competitive rate at $105 monthly, substantially less than The General, which tops the list at $140. Learn more in our “Full Coverage Car Insurance: A Complete Guide.”

This range shows the diversity in pricing structures and highlights the importance of comparing both coverage types to find the best insurance solution for the Chevrolet Bolt EUV.

Understanding the Factors That Impact Chevrolet Bolt EUV Car Insurance Rates

When it comes to determining car insurance rates for a Chevrolet Bolt EUV, insurance companies take several factors into account. One of the primary factors is the age and driving experience of the primary driver.

Younger and less experienced drivers generally pay higher insurance premiums due to the increased likelihood of accidents. Other factors include the driver’s record, the location of the vehicle, and the deductible and coverage options chosen.

Another important factor that can impact Chevrolet Bolt EUV car insurance rates is the vehicle’s safety features. Insurance companies often offer discounts for vehicles equipped with advanced safety features such as automatic emergency braking, lane departure warning, and adaptive cruise control. These features can help reduce the risk of accidents and injuries, leading to lower insurance premiums.

Additionally, the frequency and severity of thefts and accidents involving Chevrolet Bolt EUV can also affect insurance rates. If the vehicle has a higher likelihood of being stolen or involved in accidents, insurance companies may charge higher premiums to compensate for the increased risk. This is why it’s important to park the vehicle in a secure location and take necessary precautions to prevent theft.

Exploring the Average Cost of Insuring a Chevrolet Bolt EUV

Typically, the monthly cost of insuring a Chevrolet Bolt EUV varies between $125 and $208. However, it’s important to note that this is a general estimate, and individual rates may vary based on the previously mentioned factors. It’s always recommended to obtain personalized quotes from insurance providers to obtain a more accurate idea of the cost of insuring your specific Chevrolet Bolt EUV.

There are several factors that can influence the cost of insuring a Chevrolet Bolt EUV. One of the main factors is the driver’s age and driving history. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums.

Additionally, the location where the vehicle is primarily driven and parked can also impact insurance rates. Urban areas with higher rates of accidents or vehicle theft may result in higher premiums. See more details on our “Is car theft covered by car insurance?”

Another factor that can affect insurance costs is the level of coverage chosen. Basic liability coverage is typically the minimum requirement, but additional coverage options such as collision, comprehensive, and uninsured/underinsured motorist coverage can provide added protection. However, these additional coverages may also increase the overall cost of insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence the Insurance Cost of a Chevrolet Bolt EUV

Several factors can influence the cost of insuring a Chevrolet Bolt EUV. These include the driver’s age, driving experience, driving record, location, and the specific coverage and deductible options chosen. Insurance providers also consider statistics such as accident rates for similar vehicles, theft rates, and safety ratings when determining insurance premiums.

In addition to these factors, the insurance cost of a Chevrolet Bolt EUV may also be influenced by the driver’s credit history. Insurance providers often take into account the driver’s credit score when determining premiums.

A higher credit score is generally associated with lower insurance rates, as it is seen as an indicator of responsible financial behavior. On the other hand, a lower credit score may result in higher insurance premiums. Check out insurance savings in our complete “How does the insurance company determine my premium?”

Comparing Different Insurance Providers for Chevrolet Bolt EUV Coverage

When searching for car insurance for your Chevrolet Bolt EUV, it’s crucial to compare quotes from different insurance providers. Each company has its own method for determining rates, and prices can vary significantly.

By comparing multiple quotes, you can ensure that you are getting the best possible pricing and coverage for your Chevrolet Bolt EUV. Discover more about offerings in our “Insurance Quotes Online.”

One important factor to consider when comparing insurance providers for your Chevrolet Bolt EUV is the coverage options they offer. Different providers may have different levels of coverage available, so it’s important to carefully review the details of each policy. Look for coverage options that align with your specific needs and preferences, such as comprehensive coverage, collision coverage, and liability coverage.

In addition to coverage options, it’s also important to consider the reputation and customer service of each insurance provider. Look for reviews and ratings from other Chevrolet Bolt EUV owners to get an idea of how satisfied they are with their insurance provider. Good customer service can make a big difference when it comes to filing claims and resolving any issues that may arise.

Tips for Finding Affordable Car Insurance for Your Chevrolet Bolt EUV

There are several strategies you can employ to find affordable car insurance for your Chevrolet Bolt EUV. First and foremost, maintain a good driving record by obeying traffic laws and avoiding accidents. This can help you qualify for lower insurance premiums.

Additionally, you can opt for higher deductibles, maintain a good credit score, bundle your insurance policies, and inquire about any available discounts specifically applicable to the Chevrolet Bolt EUV. Access comprehensive insights into our “Can I bundle my car insurance with other policies?”

Another tip for finding affordable car insurance for your Chevrolet Bolt EUV is to consider installing safety features in your vehicle. Insurance companies often offer discounts for vehicles equipped with features such as anti-lock brakes, airbags, and anti-theft devices. By investing in these safety features, you not only enhance the security of your car but also potentially reduce your insurance costs.

Kristine Lee Licensed Insurance Agent

Furthermore, it is beneficial to shop around and compare quotes from different insurance providers. Each company may have its own pricing structure and discounts, so taking the time to research and obtain multiple quotes can help you find the most affordable option for your Chevrolet Bolt EUV. Online comparison tools and contacting insurance agents directly are effective ways to gather and compare quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comprehensive Coverage for Your Chevrolet Bolt EUV

When insuring your Chevrolet Bolt EUV, it’s highly recommended to include comprehensive coverage in your insurance policy. Comprehensive coverage protects your vehicle against damage caused by incidents other than collisions, such as theft, vandalism, weather-related damage, and animal collisions. While comprehensive coverage does add to the cost of your insurance premium, it provides valuable protection in various situations.

One important aspect of comprehensive coverage is its coverage for weather-related damage. Weather events such as hailstorms, hurricanes, and floods can cause significant damage to your Chevrolet Bolt EUV. Delve into our evaluation of “Collision vs. Comprehensive Car Insurance.”

With comprehensive coverage, you can have peace of mind knowing that your vehicle is protected against these unpredictable weather conditions. Additionally, comprehensive coverage also extends to cover damage caused by falling objects, such as tree branches or debris during a storm.

How Does the Safety Rating of the Chevrolet Bolt EUV Affect Insurance Rates

The safety rating of the Chevrolet Bolt EUV can have an impact on insurance rates. Insurance providers often take into consideration the safety features and crash test ratings of a vehicle when setting premiums. Vehicles with higher safety ratings and advanced safety features may benefit from lower insurance rates because they are deemed safer and less prone to accidents.

One of the key factors that insurance providers consider when determining insurance rates is the likelihood of a vehicle being involved in an accident. The safety rating of the Chevrolet Bolt EUV plays a crucial role in this assessment. Unlock details in our “Best Safety Features Car Insurance Discounts.”

A higher safety rating indicates that the vehicle has undergone rigorous testing and has demonstrated a higher level of protection for its occupants in the event of a crash. As a result, insurance providers may view the Chevrolet Bolt EUV as a lower risk vehicle, leading to potentially lower insurance premiums.

In addition to the safety rating, insurance providers also take into account the availability and effectiveness of advanced safety features in a vehicle. The Chevrolet Bolt EUV is equipped with a range of advanced safety technologies, such as forward collision warning, lane departure warning, and automatic emergency braking.

These features can help prevent or mitigate accidents, reducing the likelihood of insurance claims. As a result, insurance providers may offer lower insurance rates for the Chevrolet Bolt EUV due to its advanced safety features.

Understanding the Deductible Options for Chevrolet Bolt EUV Car Insurance

When selecting car insurance for your Chevrolet Bolt EUV, you will have to choose a deductible amount. A deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. The higher the deductible you choose, the lower your insurance premium will be.

However, it’s important to ensure that you can comfortably afford your chosen deductible in the event of an accident or damage to your vehicle. Discover insights in our “How to Document Damage for Car Insurance Claims.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explaining the Different Types of Coverage Available for Your Chevrolet Bolt EUV

There are several types of coverage available to protect your Chevrolet Bolt EUV. Liability coverage, which is typically required by law, protects you from financial responsibility if you are at fault in an accident that causes injury or property damage to others. Collision coverage pays for damage to your Chevrolet Bolt EUV in the event of a collision, regardless of fault.

Additionally, comprehensive coverage protects against non-collision events, as mentioned earlier, and there are other optional coverages such as uninsured/underinsured motorist coverage and medical payments coverage. Learn more in our “How does the car insurance claims process differ for uninsured/underinsured motorist coverage?“

Are There Any Discounts Available on Car Insurance for a Chevrolet Bolt EUV

Insurance providers often offer various discounts that can help reduce the cost of insuring a Chevrolet Bolt EUV. Some common discounts include safe driver discounts, multi-policy discounts (when you bundle your auto and home insurance, for example), good student discounts, and anti-theft device discounts.

It’s always a good idea to inquire with insurance providers about available discounts specific to the Chevrolet Bolt EUV. See more details on our “Best Safe Driver Car Insurance Discounts.”

How to Save Money on Your Chevrolet Bolt EUV Insurance Premiums

In addition to taking advantage of available discounts, there are other ways to save money on your Chevrolet Bolt EUV insurance premiums. One strategy is to maintain a good credit score, as insurance providers often consider credit history when calculating rates.

Additionally, increasing your deductible, maintaining a clean driving record, and comparing quotes from different insurance providers can all result in potential savings. Check out insurance savings in our complete “Car Driving Safety Guide for Teens and Parents.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Consider When Choosing an Insurance Provider for Your Chevrolet Bolt EUV

When selecting an insurance provider for your Chevrolet Bolt EUV, it’s important to consider several factors. These include the provider’s reputation, financial stability, customer service track record, coverage options, and available discounts.

Ty Stewart Licensed Insurance Agent

It’s also beneficial to read customer reviews and seek recommendations from friends, family, or trusted advisors to ensure you choose an insurance provider that meets your needs and preferences. Discover more about offerings in our “Adding a Relative to Your Insurance Policy.”

Expert Advice on Getting the Best Car Insurance Rates for a Chevrolet Bolt EUV

Obtaining the best car insurance rates for your Chevrolet Bolt EUV requires some research and due diligence. Consulting with insurance experts, such as independent insurance agents, can provide valuable insights and guidance.

These professionals have access to multiple insurance providers and can provide personalized recommendations based on your specific needs and circumstances.

The Impact of Location on Chevrolet Bolt EUV Car Insurance Costs

The location where you reside can have a significant impact on your Chevrolet Bolt EUV car insurance costs. Insurance providers consider factors such as the crime rate in your area, the likelihood of accidents, and local driving conditions when determining premiums. Generally, urban areas with higher traffic density and crime rates tend to have higher insurance rates compared to rural areas with less traffic and lower crime rates.

In conclusion, the cost of car insurance for a Chevrolet Bolt EUV varies depending on factors such as the driver’s age and experience, driving record, location, coverage options, and deductible choices. Access comprehensive insights into our “Best Car Insurance for 21-Year-Old Drivers.”

By understanding these factors, comparing quotes from different insurance providers, and employing money-saving strategies, drivers can find affordable insurance for their Chevrolet Bolt EUV while ensuring they have adequate coverage and protection.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of Chevrolet Bolt EUV car insurance?

The cost of Chevrolet Bolt EUV car insurance can be influenced by several factors such as the driver’s age, location, driving history, coverage options chosen, deductible amount, and the insurance company’s rating.

For additional details, explore our comprehensive resource titled “Cheapest Car Insurance for 23-Year-Old Drivers.”

Are there any specific safety features of the Chevrolet Bolt EUV that can help reduce insurance costs?

Yes, the Chevrolet Bolt EUV comes with various safety features that can potentially lower insurance costs. These features may include advanced driver assistance systems, collision warning systems, lane departure warning, adaptive cruise control, and anti-theft devices.

Does the cost of Chevrolet Bolt EUV car insurance vary by location?

Yes, the cost of car insurance for the Chevrolet Bolt EUV can vary by location. Insurance companies consider factors such as the crime rate, population density, and accident frequency in the area when determining insurance premiums.

Are there any discounts available for insuring a Chevrolet Bolt EUV?

Yes, insurance companies often offer discounts for insuring vehicles with certain safety features. Additionally, you may be eligible for discounts based on your driving record, bundling multiple insurance policies, or being a member of certain organizations.

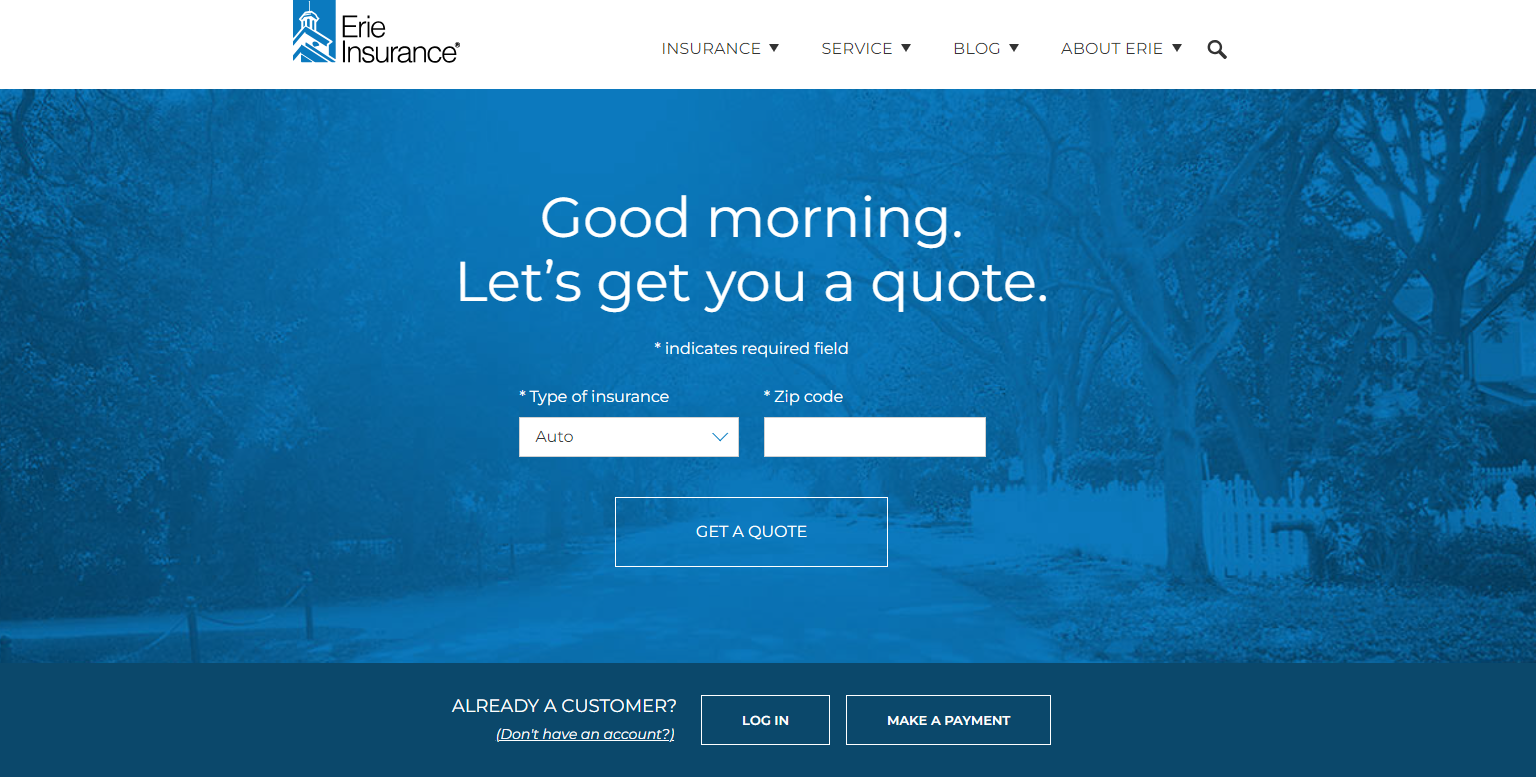

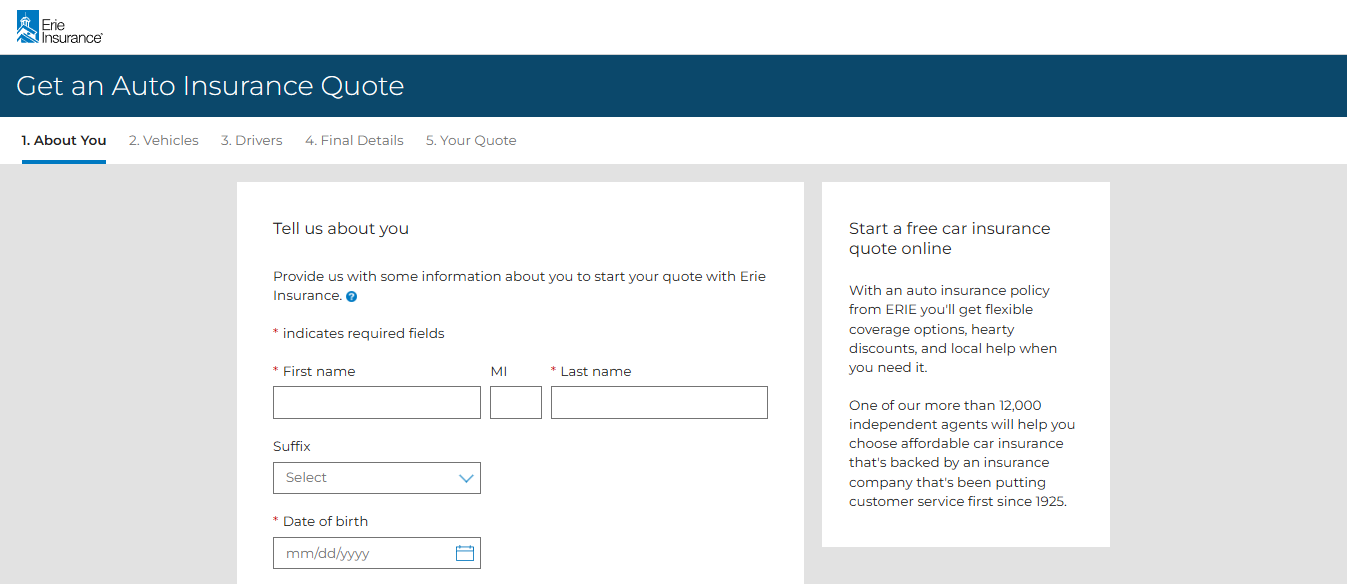

Can I get a quote for Chevrolet Bolt EUV car insurance online?

Yes, many insurance companies provide online platforms where you can obtain a quote for Chevrolet Bolt EUV car insurance. These platforms typically require you to provide information about your driving history, location, and coverage preferences to generate a personalized quote.

To find out more, explore our guide titled “How To Get Free Insurance Quotes Online.”

Is Chevy Bolt cheap to insure?

The Chevy Bolt is costly to insure, with an average monthly rate of $132. State Farm offers the lowest insurance rates for the Chevy Bolt, although these can differ based on the model year, the driver’s age, and the insurance company.

Is car insurance cheaper for EV?

Insurance for electric vehicles typically costs around 20% more per month than insuring a gasoline-powered car.

Is Chevy Sonic cheap to insure?

Car insurance for a Chevrolet Sonic is approximately $146 per month, which is $475 less annually than the average for popular hatchback models. This estimate is based on a comparison study that considers a 40-year-old good driver with full coverage and good credit, driving about 13,000 miles per year.

What is the life expectancy of a Chevy Bolt?

The battery in the Chevy Bolt EV or Bolt EUV is assured to last at least 8 years or 100,000 miles with a new battery.

To learn more, explore our comprehensive resource on “Chevrolet Car Insurance Discount.”

Do EV cars lose value?

Older electric vehicles tend to lose value more quickly than gasoline-powered cars. Yet, a study from 2024 indicates that this pattern does not apply to newer models. It was discovered that early battery and plug-in hybrid electric vehicles, particularly those with limited driving ranges, depreciated more rapidly than vehicles powered by gasoline or hybrid electric systems.

Do EV cars really save money?

Why is collision insurance so high?

Why is GM discontinuing the Bolt?

How much does it cost to replace a battery in a Chevy Bolt?

Why are so many people against EV?

Will EV become cheaper in the future?

Who typically has the cheapest insurance?

Does credit score affect car insurance?

What happens if you crash a Bolt car?

Does Bolt refund if the driver cancels?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.