Cheap Smart Fortwo Electric Drive Cabrio Car Insurance in 2026 (Top 10 Companies for Savings)

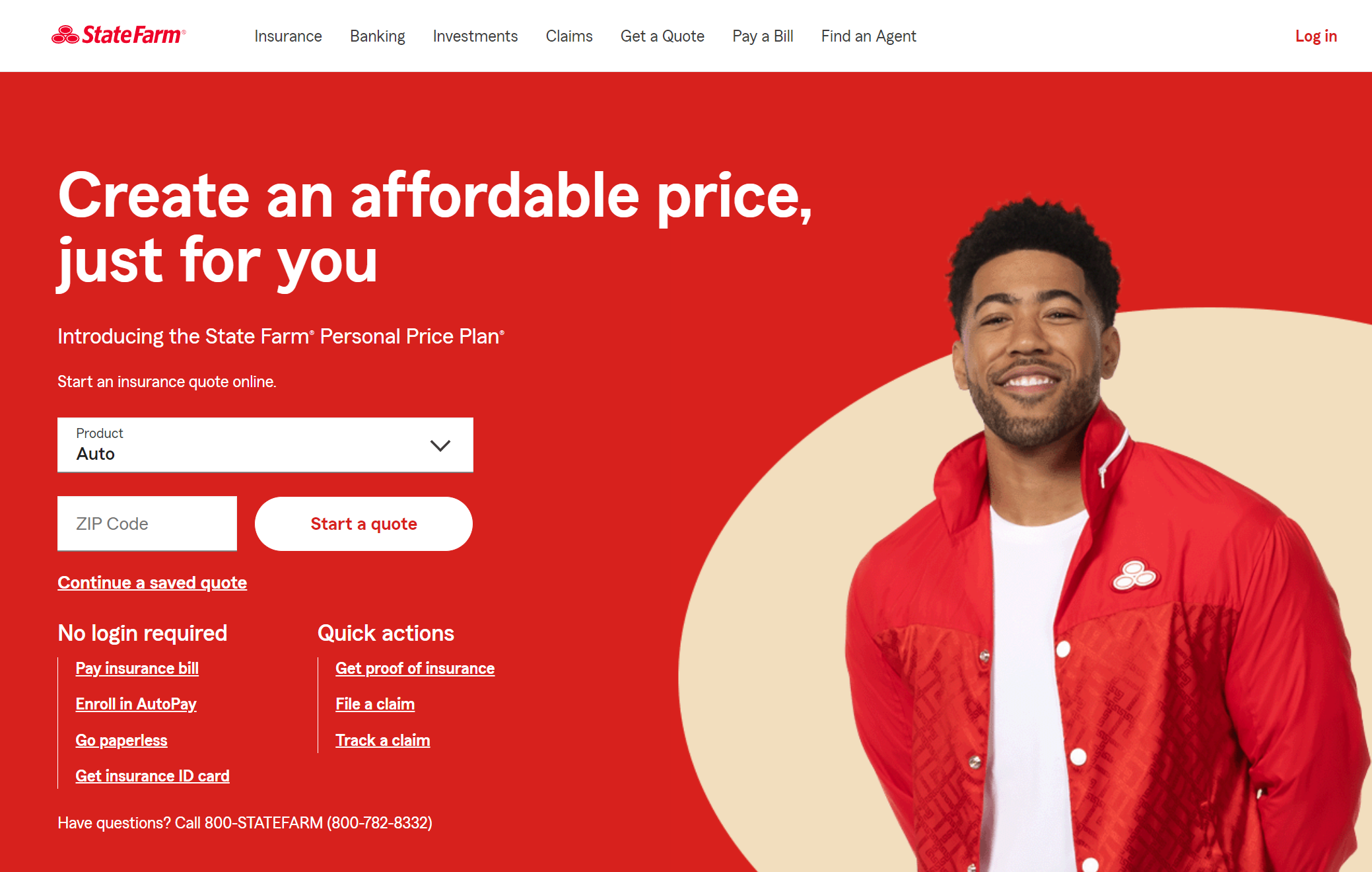

The top picks for cheap Smart Fortwo Electric Drive Cabrio car insurance are State Farm, USAA, and American Family. State Farm offers the best rate at $80 per month with discount options, USAA provides military benefits, and American Family offers flexible coverage, making them ideal for affordable auto insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated September 2024

Company Facts

Min. Coverage for Smart Fortwo Electric Drive Cabrio

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Smart Fortwo Electric Drive Cabrio

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Smart Fortwo Electric Drive Cabrio

A.M. Best

Complaint Level

Pros & Cons

State Farm offers the best overall rate at $80 per month, providing great discount options. USAA is ideal for military members with unique benefits, while American Family stands out for its flexible coverage.

Our Top 10 Company Picks: Cheap Smart Fortwo Electric Drive Cabrio Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $80 B Discount Options State Farm

#2 $82 A++ Military Benefits USAA

#3 $85 A Flexible Coverage American Family

#4 $86 A+ Affordable Rates Progressive

#5 $88 A Policy Discounts Liberty Mutual

#6 $89 A++ Customizable Plans Travelers

#7 $90 A Customer Service Farmers

#8 $93 A+ Accident Forgiveness The Hartford

#9 $95 A+ Coverage Variety Nationwide

#10 $100 A+ Bundling Savings Allstate

These providers, including State Farm, offer the best balance of affordability and comprehensive auto insurance. To delve deeper, refer to our in-depth report titled “State Farm Car Insurance Review & Ratings.”

Find the best comprehensive car insurance quotes by entering your ZIP code above into our free comparison tool today.

- State Farm offers cheap Smart Fortwo Electric Drive Cabrio insurance at $80/month

- State Farm provides excellent discount options for affordable coverage

- State Farm is renowned for its comprehensive and cost-effective auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Factors That Influence Cheap Smart Fortwo Electric Drive Cabrio Car Insurance Rates

When choosing insurance for your cheap Smart Fortwo Electric Drive Cabrio, key factors like vehicle value, model year, and driving history affect premiums, making it essential to understand these elements for optimal coverage.

- Vehicle Value: The value of the cheap Smart Fortwo Electric Drive Cabrio can increase insurance premiums due to high repair or replacement costs.

- Model Year and Features: Newer cheap Smart Fortwo Electric Drive Cabrio models with advanced safety features may benefit from lower insurance rates.

- Driver’s Age: Younger drivers with a cheap Smart Fortwo Electric Drive Cabrio may face higher insurance premiums due to elevated risk. To gain further insights, consult our comprehensive guide titled “What age do you get cheap car insurance?“

- Driving History: A cheap Smart Fortwo Electric Drive Cabrio driver with a history of accidents or traffic violations might experience increased insurance rates.

- Location: Living in an area with high theft or accident rates can lead to higher insurance premiums for your cheap Smart Fortwo Electric Drive Cabrio.

By considering the cheap Smart Fortwo Electric Drive Cabrio’s value, model year, and your personal driving record, you can better navigate your insurance options.

Smart Fortwo Electric Drive Cabrio Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $100 $155

American Family $85 $140

Farmers $90 $145

Liberty Mutual $88 $142

Nationwide $95 $152

Progressive $86 $138

State Farm $80 $135

The Hartford $93 $150

Travelers $89 $144

USAA $82 $139

Taking these factors into account will help you find affordable, comprehensive, and suitable auto insurance coverage for your vehicle.

Comparing Car Insurance Options for Cheap Smart Fortwo Electric Drive Cabrio Vehicles

When comparing car insurance options for cheap Smart Fortwo Electric Drive Cabrio vehicles, it’s crucial to gather quotes from various providers to find the best deal. Start by looking at different policies to see which offers the most affordable rates for cheap Smart Fortwo Electric Drive Cabrio car insurance.

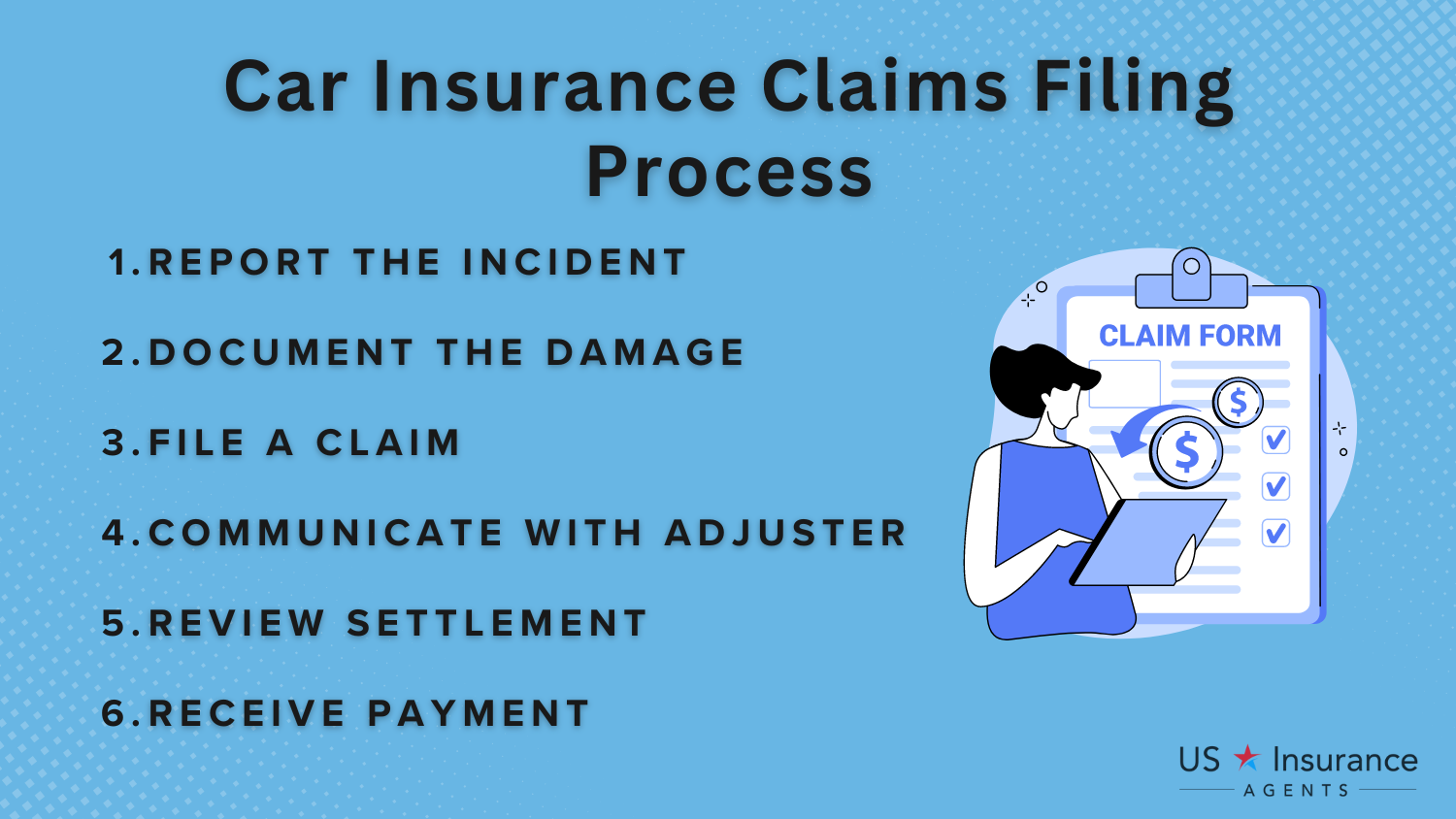

Evaluate coverage limits, deductibles, and any additional benefits each policy provides. Pay close attention to any exclusions or limitations that might affect your coverage. Additionally, consider the reputation of each insurance company for customer service and claims handling.

By thoroughly comparing these factors, you can secure the best cheap Smart Fortwo Electric Drive Cabrio car insurance that meets your needs.

This process helps you get comprehensive protection while keeping premiums low. For additional details, explore our comprehensive resource titled “How does the insurance company determine my premium?”

Tips for Finding Cheap Smart Fortwo Electric Drive Cabrio Car Insurance

Finding cheap Smart Fortwo Electric Drive Cabrio car insurance requires a strategic approach. By comparing quotes, exploring discounts, and reviewing coverage options, you can secure the best deal for your vehicle.

- Compare Quotes: Gather quotes from multiple providers to find the best rates for cheap Smart Fortwo Electric Drive Cabrio car insurance.

- Check Coverage Limits: Evaluate coverage limits to ensure you get the right protection with your cheap Smart Fortwo Electric Drive Cabrio car insurance.

- Look for Discounts: Explore available discounts to reduce the cost of your cheap Smart Fortwo Electric Drive Cabrio car insurance. To learn more, explore our comprehensive resource on commercial auto insurance titled “Lesser Known Car Insurance Discounts.”

- Review Deductibles: Choose a deductible amount that balances your budget and premiums for cheap Smart Fortwo Electric Drive Cabrio car insurance.

- Assess Customer Service: Consider the reputation for customer service of insurers offering cheap Smart Fortwo Electric Drive Cabrio car insurance.

Using these tips for finding cheap Smart Fortwo Electric Drive Cabrio car insurance will help you get the most value and protection for your money.

Follow these strategies to achieve affordable and comprehensive coverage for your cheap Smart Fortwo Electric Drive Cabrio, ensuring both peace of mind and financial savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Your Smart Fortwo Electric Drive Cabrio Car Insurance Premiums

To save on cheap Smart Fortwo Electric Drive Cabrio car insurance premiums, implement these strategies. Maintaining a clean driving record is essential, as violations and accidents can raise your rates. For a thorough understanding, refer to our detailed analysis titled “Car Accidents: What to do in Worst Case Scenarios.”

Take advantage of discounts by asking your insurance provider about available options for anti-theft devices, safety features, or bundling policies. Increasing your deductibles can also lower your premiums, but choose an amount that aligns with your budget.

Shopping around and obtaining quotes from multiple insurance companies ensures you get the best rate for your cheap Smart Fortwo Electric Drive Cabrio car insurance.

Scott W. Johnson Licensed Insurance Agent

Additionally, consider usage-based insurance if you drive infrequently, as this can reduce premiums. By applying these tips, you can lower your cheap Smart Fortwo Electric Drive Cabrio car insurance costs.

Understanding Coverage Options For Your Smart Fortwo Electric Drive Cabrio Car Insurance

Understanding coverage options for your cheap Smart Fortwo Electric Drive Cabrio car insurance is essential to ensure you get the right protection. The types of coverage available can vary, so it’s important to explore different options to find the best fit for your needs.

Liability coverage is crucial as it covers injuries and damages you cause to others in an accident deemed your fault. Collision coverage helps with repairs or replacement if your cheap Smart Fortwo Electric Drive Cabrio is damaged in a collision with another vehicle or object.

Comprehensive coverage is also important, as it protects against damages from non-collision events like theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage safeguards you if you’re in an accident with a driver who lacks adequate insurance.

Personal injury protection covers medical expenses and other related costs from an accident, regardless of fault or the severity of the injuries.

By understanding these coverage options, you can better tailor your cheap Smart Fortwo Electric Drive Cabrio car insurance policy to meet your needs.

Tips For Lowering Your Cheap Smart Fortwo Electric Drive Cabrio Car Insurance Rates

To save money on your cheap Smart Fortwo Electric Drive Cabrio car insurance, applying specific strategies can make a significant difference. Implementing these tips will help you lower your cheap Smart Fortwo Electric Drive Cabrio car insurance rates effectively.

- Maintain a Good Credit Score: Keep a solid credit history to help lower your cheap Smart Fortwo Electric Drive Cabrio car insurance rates.

- Opt for Higher Deductibles: Choosing a higher deductible can reduce your premiums for cheap Smart Fortwo Electric Drive Cabrio car insurance.

- Explore Available Discounts: Ask about discounts for electric vehicles or safety features to save on your cheap Smart Fortwo Electric Drive Cabrio car insurance. To expand your knowledge, refer to our comprehensive handbook titled “Best Safety Features Car Insurance Discounts.”

- Bundle Your Policies: Combining your cheap Smart Fortwo Electric Drive Cabrio car insurance with other policies may qualify you for a multi-policy discount.

- Drive Safely: Avoid accidents and traffic violations to keep your cheap Smart Fortwo Electric Drive Cabrio car insurance rates lower over time.

By following these strategies, you can optimize your savings on cheap Smart Fortwo Electric Drive Cabrio car insurance.

Adjusting your approach to insurance can lead to significantly more affordable premiums and improved coverage options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Providers for Cheap Smart Fortwo Electric Drive Cabrio Car Insurance

Choosing the right insurance for your cheap Smart Fortwo Electric Drive Cabrio is crucial for securing the best coverage at an affordable price. The following fictional case studies highlight how State Farm, Erie, and Progressive stand out in providing excellent insurance options.

- Case Study #1 – Best Discount Options: Lisa chose State Farm for its $80 monthly rate and robust discount options. Bundling her auto and homeowner’s policies led to reduced premiums and comprehensive coverage.

- Case Study #2 – Reliable Coverage: Mark chose Erie for their reliable service. After an accident, Erie’s quick claims process swiftly repaired his cheap Smart Fortwo Electric Drive Cabrio. To gain profound insights, consult our extensive guide titled “How to Document Damage for Car Insurance Claims.”

- Case Study #3 – Flexible Policies: Emma picked Progressive for their adaptable policies. After moving, Progressive made it easy to adjust her coverage, maintaining affordability and service quality.

These are only fictional case studies based on real-world scenarios, demonstrating how different providers cater to the needs of cheap Smart Fortwo Electric Drive Cabrio owners.

Each example illustrates the strategies and benefits these companies offer to keep insurance affordable for this specific vehicle.

Final Verdict: Tips for Securing Cheap Smart Fortwo Electric Drive Cabrio Car Insurance

This article explores various strategies for securing cheap Smart Fortwo Electric Drive Cabrio car insurance premiums. By comparing quotes from multiple providers and considering options such as higher deductibles and available discounts, drivers can find affordable rates tailored to their needs.

The article also highlights the benefits of maintaining a clean driving record and bundling policies to maximize savings. For a comprehensive overview, explore our detailed resource titled “Can I bundle my car insurance with other policies?”

Case studies of Erie, Progressive, and State Farm demonstrate real-world scenarios where these companies have provided exceptional service and competitive rates, illustrating the importance of choosing the right provider for comprehensive coverage and affordability.

Erie excels in offering customizable policies to suit individual needs, while Progressive is known for its extensive discounts and usage-based insurance programs.

Melanie Musson Published Insurance Expert

State Farm, with its widespread network and customer-first approach, ensures reliable support and affordable premiums for cheap Smart Fortwo Electric Drive Cabrio owners.

Avoid overpaying for your car insurance by entering your ZIP code below in our free comparison tool to find which company has the lowest rates.

Frequently Asked Questions

When is it necessary to get insurance for a Smart Fortwo Electric Drive Cabrio?

Insurance for a cheap Smart Fortwo Electric Drive Cabrio is necessary from the moment you purchase the vehicle, as it’s required by law to drive legally and protect against potential risks.

What is the average insurance cost for a Smart Fortwo Electric Drive Cabrio?

The average insurance cost for a cheap Smart Fortwo Electric Drive Cabrio varies by provider and location but generally falls within a lower range compared to other vehicles due to its compact size and safety features.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Where can I find cheap Smart Fortwo Electric Drive Cabrio car insurance?

You can find cheap Smart Fortwo Electric Drive Cabrio car insurance by comparing car insurance quotes from multiple insurance providers online, using insurance comparison websites, and checking with insurers known for competitive rates.

How does Smart Fortwo Electric Drive Cabrio car insurance compare to other vehicles?

Cheap Smart Fortwo Electric Drive Cabrio car insurance is typically cheaper than insurance for larger or more expensive vehicles due to its lower risk profile and the cost of repairs.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

How much does it cost to insure a Smart Fortwo Electric Drive Cabrio?

The cost to insure a cheap Smart Fortwo Electric Drive Cabrio depends on factors like your location, driving history, and chosen coverage level, but it’s generally lower compared to other vehicles.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

What is covered by cheap Smart Fortwo Electric Drive Cabrio car insurance?

Cheap Smart Fortwo Electric Drive Cabrio car insurance usually covers liability, collision, comprehensive, and possibly additional protections like roadside assistance, depending on the policy.

To enhance your understanding, explore our comprehensive resource on business insurance titled “Roadside Assistance Coverage: A Complete Guide.”

What is the difference between Smart insurance and other car insurance policies?

Smart insurance specifically refers to coverage for Smart vehicles, including models like the cheap Smart Fortwo Electric Drive Cabrio, and may include unique discounts or benefits relevant to the brand.

Is Smart Fortwo Electric Drive Cabrio insurance typically considered cheap?

Yes, cheap Smart Fortwo Electric Drive Cabrio insurance is often considered cheap compared to other types of insurance due to the vehicle’s safety features and low repair costs.

How much would a Smart Fortwo Electric Drive Cabrio cost to insure compared to a standard Smart car?

Insurance costs for a cheap Smart Fortwo Electric Drive Cabrio might be slightly higher than for a standard Smart car due to the additional value and technology, but both generally fall into the lower range for car insurance.

How much can you expect to pay for insurance on a Smart Fortwo Electric Drive Cabrio?

The amount you pay for insurance on a cheap Smart Fortwo Electric Drive Cabrio will vary, but it is generally less expensive than insurance for larger or more high-performance vehicles.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.