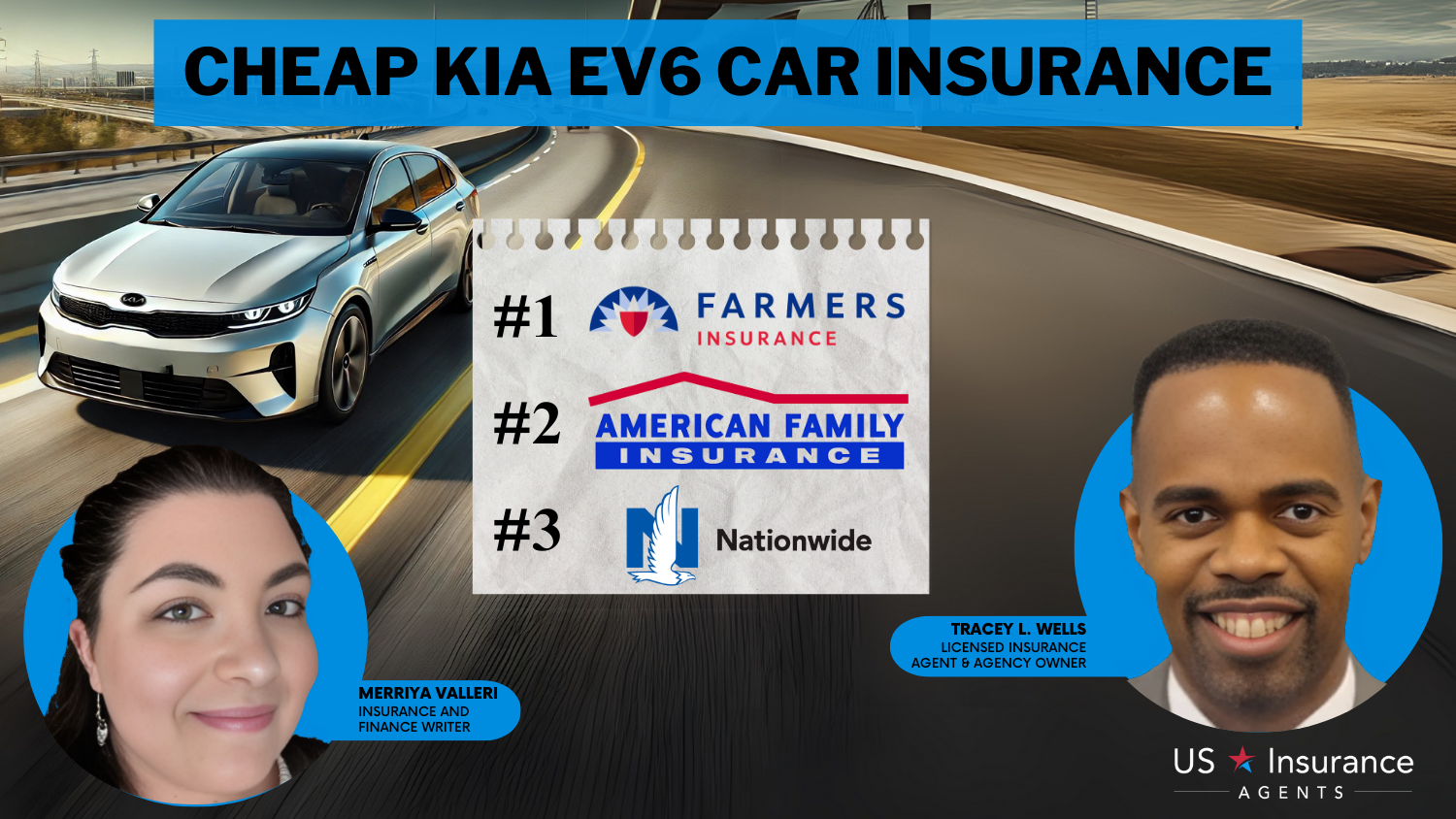

Cheap Kia EV6 Car Insurance in 2026 (Big Savings With These 10 Companies!)

For those seeking cheap Kia EV6 car insurance, Farmers, American Family, and Nationwide stand out as top choices, offering competitive rates starting at $50 per month. These companies excel in providing affordable and reliable car insurance options tailored to electric vehicles.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated March 2025

Company Facts

Min. Coverage for Kia EV6

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Kia EV6

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Kia EV6

A.M. Best

Complaint Level

Pros & Cons

Finding cheap Kia EV6 car insurance can be a daunting task, but understanding the top picks like Farmers, American Family, and Nationwide can simplify your search. These insurers stand out for their competitive pricing and comprehensive coverage options tailored specifically for electric vehicles.

Whether you prioritize affordability or comprehensive benefits, this guide will navigate you through the best options available to insure your Kia EV6 efficiently and effectively.

Our Top 10 Company Picks: Cheap Kia EV6 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $50 A++ Multi-Policy Holders Farmers

#2 $55 A++ Safe Drivers American Family

#3 $60 A+ EV Owners Nationwide

#4 $65 A++ Customizable Plans Progressive

#5 $68 B Customer Service State Farm

#6 $70 A Accident Forgiveness Liberty Mutual

#7 $72 A+ New Drivers Allstate

#8 $75 A+ Minimum Coverage Geico

#9 $78 A Variety Discounts Travelers

#10 $80 A++ Military Members USAA

Take the first step toward cheaper car insurance rates. Enter your ZIP code above to see how much you could save.

#1 – Farmers: Top Overall Pick

Pros

- Competitive Rates: Farmers offers cheap rates starting at $50/month for Kia EV6 insurance.

- Multi-Policy Discounts: Significant savings for bundling multiple policies like home and auto.

- Comprehensive Coverage: Tailored insurance options that cater to diverse needs. Unlock details in our guide “Farmers Insurance Review & Ratings.”

Cons

- Customer Service: Some customers report issues with responsiveness and claims processing.

- Limited Online Tools: Farmers’ online platform could be more user-friendly for managing policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – American Family: Best for Safe Drivers

Pros

- Affordable Rates: Starting at $55/month, American Family provides competitive pricing.

- Safe Driver Discounts: Rewards for safe driving habits and low-mileage usage.

- Personalized Service: Strong customer service reputation with local agents.

- Read up on the “American Family Insurance Review & Ratings” for more information.

Cons

- Coverage Options: Limited specialized coverage options compared to larger insurers.

- Availability: Not available in all states, which may limit coverage options for some.

#3 – Nationwide: Best for EV Owners

Pros

- Specific EV Coverage: Tailored insurance plans for electric vehicles like the Kia EV6. Check out insurance savings in our complete “Nationwide Insurance Review & Ratings.”

- Competitive Pricing: Starting at $60/month, Nationwide offers affordable premiums.

- Nationwide Network: Extensive network for easy claims processing and customer service.

Cons

- Coverage Limitations: EV-specific coverage may have restrictions or exclusions.

- Discounts: Limited availability of discounts compared to other insurers.

#4 – Progressive: Best for Customizable Plans

Pros

- Flexibility: Customizable insurance plans to fit individual needs and budgets. More information is available about this provider in our “Progressive Insurance Review & Ratings.”

- Name Your Price Tool: Unique tool allowing customers to find coverage within their budget.

- Innovation: Progressive is known for industry-leading technology and digital tools.

Cons

- Cost Transparency: Some customers find it difficult to understand total costs upfront.

- Customer Service: Mixed reviews on customer service quality and responsiveness.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Customer Service

Pros

- Established Reputation: Known for reliable customer service and claims handling.

- Financial Stability: A solid A.M. Best rating ensures financial security. See more details on our “State Farm Insurance Review & Ratings.”

- Variety of Policies: Offers a wide range of insurance products beyond auto.

Cons

- Premiums: Higher premiums compared to some competitors, starting at $68/month.

- Limited Discounts: Less competitive multi-policy discounts compared to other insurers.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Option to avoid rate increases after your first accident. Access comprehensive insights into our “Liberty Mutual Review & Ratings.”

- Comprehensive Coverage: Offers a broad range of coverage options for all needs.

- Technology: Utilizes advanced technology for claims processing and customer service.

Cons

- Pricing: Higher premiums starting at $70/month despite accident forgiveness.

- Complex Policies: Policies can be complex, making it challenging to understand coverage details.

#7 – Allstate: Best for New Drivers

Pros

- New Driver Discounts: Special discounts and incentives for new and young drivers.

- Nationwide Availability: Available in all states, providing widespread coverage.

- Mobile App: User-friendly app for managing policies and claims on the go. Discover insights in our “Allstate Insurance Review & Ratings.”

Cons

- Premiums: Higher average premiums, starting at $72/month for Kia EV6 insurance.

- Customer Satisfaction: Mixed reviews regarding claims processing and customer support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Minimum Coverage

Pros

- Low Premiums: Competitive rates starting at $75/month for minimum coverage.

- Digital Experience: Easy-to-use online tools and mobile app for policy management.

- Financial Strength: A+ rating from A.M. Best reflects strong financial stability. Discover more about offerings in our “What car insurance discounts does GEICO Secure Insurance Company offer?“

Cons

- Customer Service: Limited personal interaction with agents may not suit all customers.

- Coverage Options: Basic coverage options may not meet the needs of all drivers.

#9 – Travelers: Best for Variety Discounts

Pros

- Discount Variety: Offers a wide range of discounts, including multi-policy and safe driver.

- Customer Satisfaction: High ratings for customer service and claims processing.

- Coverage Options: Comprehensive options suitable for various driver profiles. Delve into our evaluation of “Travelers Insurance Review & Ratings.”

Cons

- Premiums: Higher premiums starting at $78/month may not be the most competitive.

- Availability: Limited availability in some regions, impacting coverage options.

#10 – USAA: Best for Military Members

Pros

- Exclusive Coverage: Tailored policies and discounts for military members and families.

- Customer Service: High customer satisfaction ratings for service and claims handling.

- Financial Strength: A++ rating from A.M. Best indicates exceptional financial stability. Learn more in our “USAA Insurance Review & Ratings.”

Cons

- Eligibility: Limited to military personnel and their families, excluding the general public.

- Online Services: Some users report limitations in online account management tools.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kia EV6 Insurance Rates Comparison: Minimum and Full Coverage by Top Providers

When considering insurance for the Kia EV6, understanding the varying coverage rates offered by different providers is crucial. This section outlines the monthly insurance rates for minimum and full coverage across top insurers, helping you make informed decisions based on your coverage needs and budget.

Discover more about offerings in our “Roadside Assistance Coverage: A Complete Guide.”

Kia EV6 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $72 $140

American Family $55 $115

Farmers $50 $110

Geico $75 $145

Liberty Mutual $70 $135

Nationwide $60 $120

Progressive $65 $130

State Farm $68 $125

Travelers $78 $150

USAA $80 $155

Insurance rates for the Kia EV6 vary significantly among providers, reflecting differences in coverage levels and insurer policies. For minimum coverage, Farmers offers the most affordable option at $50 per month, followed closely by American Family at $55 and Nationwide at $60. Geico and State Farm provide competitive rates at $75 and $68, respectively.

Melanie Musson Published Insurance Expert

For full coverage, Farmers remains cost-effective at $110 per month, while American Family and Nationwide offer rates of $115 and $120, respectively.

Liberty Mutual and Progressive fall within a similar range at $135 and $130 per month, respectively, while Geico and State Farm maintain competitive pricing at $145 and $125. Travelers and USAA present higher rates for full coverage, at $150 and $155 per month, respectively.

These rates highlight the importance of comparing coverage options to find the best insurance plan tailored to your needs and budget for your Kia EV6.

Factors That Influence the Cost of Kia EV6 Car Insurance

There are several factors that insurance providers take into account when determining the cost of insuring a Kia EV6. One of the primary influences is the vehicle’s value. As the Kia EV6 falls into the category of electric vehicles, it tends to have a higher value compared to conventional cars.

This means that if the vehicle is damaged or totaled, the insurance company would have to pay out a larger sum for a replacement. Consequently, this may result in higher insurance premiums.

Another factor to consider is your driving history and personal profile. Insurance companies often consider your age, gender, and driving record when calculating your rates. Younger drivers or those with a history of accidents or traffic violations may experience higher insurance costs.

Additionally, your location can also impact your rates. Urban areas, for example, tend to have higher rates due to increased risks of theft and accidents compared to rural areas.

The level of coverage you choose for your Kia EV6 can also affect your insurance costs. Comprehensive coverage, which includes protection against theft and damage not caused by accidents, generally results in higher premiums compared to basic liability coverage.

Furthermore, if you opt for a lower deductible, the amount you pay out of pocket in the event of a claim, your insurance premiums may also increase. Read up on the “Does my car insurance cover damage caused by an overheated engine?” for more information.

Understanding the Insurance Coverage Options for Kia EV6

When it comes to insuring your Kia EV6, it’s essential to understand the various coverage options available to you. The most common types of coverage include liability, collision, and comprehensive coverage.

Liability insurance covers damages and injuries if you’re at fault in an accident, while collision coverage provides protection for damages caused by colliding with another vehicle or object. Comprehensive coverage, on the other hand, covers damages that result from non-collision incidents, such as theft or weather-related damage.

Ty Stewart Licensed Insurance Agent

When considering coverage options, it’s recommended to consult with an insurance agent who specializes in electric vehicles. They can provide guidance on the specific coverage needs for an EV like the Kia EV6. Additionally, some insurance companies offer special policies designed specifically for electric vehicles, which may include coverage for unique components like battery packs.

Check out insurance savings in our complete “How much insurance coverage do I need?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for Your Kia EV6

While the cost of insurance for a Kia EV6 may seem high initially, there are ways to find affordable coverage. Here are some tips to help you lower your insurance premiums: Shop around and compare rates from multiple insurance providers, as each company calculates premiums differently, so it’s essential to get quotes from several insurers to find the most competitive rate.

Consider taking a defensive driving course, as completing an approved course can often lead to discounts from insurance companies. Ask about discounts for safety features, as the Kia EV6 comes equipped with advanced safety systems, such as collision avoidance and lane-keeping assist. Inquire about potential discounts for these features with your insurance provider.

Increase your deductible, as choosing a higher deductible can lower your premiums, but be sure to set a deductible that you can comfortably afford to pay out of pocket. Consider bundling your Kia EV6 insurance with other policies, such as homeowners or renters insurance, as many insurers offer discounts for bundling multiple policies.

By implementing these strategies, you can potentially reduce the cost of insuring your Kia EV6 without compromising on coverage. Access comprehensive insights into our “Best Safe Driver Car Insurance Discounts.”

Comparing Insurance Rates for the Kia EV6 With Other Electric Vehicles

If you’re specifically interested in the insurance rates for the Kia EV6 compared to other electric vehicles on the market, it’s crucial to conduct a thorough comparison. While rates can vary among insurance providers, some general trends can be observed. The Kia EV6’s insurance rates may be affected by factors such as its value, safety features, and repair costs.

When comparing rates, consider other electric vehicles in its class and how they stack up in terms of these factors. Additionally, keep in mind that rates can vary based on your personal profile and location.

Obtaining quotes from multiple insurance providers for the specific electric vehicles you’re considering can give you a better understanding of how the Kia EV6’s insurance rates compare to other models. However, it’s important to remember that rates are individualized, and what may be affordable for one person may not be the same for another, based on their unique circumstances.

Check out insurance savings in our complete guide “The Electric Car: History, Quotes and Online Resources.”

The Importance of Shopping Around for the Best Kia EV6 Car Insurance Rates

When it comes to insuring your Kia EV6, it’s crucial to shop around for the best rates. Insurance companies assess risk differently, so each provider may offer you a different premium for the same coverage. More information is available about this provider in our guide “Full Coverage Car Insurance: A Complete Guide.”

By obtaining quotes from multiple insurers, you can ensure you’re getting the most competitive rate for your Kia EV6. Remember, investing time in researching and comparing insurance rates can potentially save you a significant amount of money over the years.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Savings Opportunities on Kia EV6 Car Insurance

Insurance companies often provide various discounts and savings opportunities that can help reduce the cost of insuring your Kia EV6. These discounts can vary among insurers, but some common ones include:

- Multi-Policy Discount: If you have multiple policies with the same insurer, such as homeowners or renters insurance, you may be eligible for a discount.

- Safe Driver Discount: Insurance providers often offer discounts to drivers with a clean driving record and no recent accidents or traffic violations.

- Safety Feature Discounts: The advanced safety features of the Kia EV6, such as automatic emergency braking and adaptive cruise control, may qualify for additional savings.

- Low Mileage Discount: If you drive fewer miles annually, you may qualify for a discount since lower mileage often decreases the risk of accidents.

- Good Student Discount: If you’re a student with good grades, some insurers offer discounts to reward academic achievement.

- Green Vehicle Discount: Some insurance companies may offer discounts specifically for electric vehicles to promote sustainable transportation.

It’s important to inquire about these discounts when obtaining quotes to ensure you’re taking advantage of all potential savings opportunities. Delve into our evaluation of “Best Car Insurance Discounts to Ask for.”

Factors to Consider When Choosing an Insurance Provider for Your Kia EV6

When selecting an insurance provider for your Kia EV6, it’s important to consider several factors. First and foremost, evaluate the company’s reputation and financial stability. You want to ensure that the insurer has a solid track record of customer satisfaction and the financial strength to handle claims.

Unlock details in our guide “Your Insurance Agent’s Role in the Claims Process.”

Another crucial factor to consider is the insurer’s experience with electric vehicles. Look for insurers who specialize in coverage for EVs or have specific policies tailored to electric vehicles. These insurers are more likely to understand the unique needs and challenges associated with insuring an electric vehicle like the Kia EV6.

Additionally, evaluate the customer service and claims handling process of the insurer. A company with responsive customer service and a smooth claims process can make a significant difference in your overall experience if you need to file a claim.

Lastly, don’t forget to compare insurance rates and coverage options from multiple providers to ensure you’re getting the best value for your money. Consider using online comparison tools or consulting with an insurance agent who specializes in electric vehicles.

How the Kia EV6’s Safety Features Can Impact Your Car Insurance Rates

The Kia EV6 offers a range of advanced safety features designed to enhance driver and passenger safety. These features include collision avoidance assistance, blind-spot monitoring, lane-keeping assist, and more. Insurance companies often value these safety features because they reduce the risk of accidents and injuries, resulting in potential cost savings for insurers.

Having these safety features in your Kia EV6 may qualify you for discounts on your car insurance premiums. However, the specific savings and eligibility criteria may vary among insurance providers. When obtaining quotes, make sure to mention the safety features of your Kia EV6 and inquire about potential discounts that may be available to you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Misconceptions About Insuring Electric Vehicles Like the Kia EV6

There are several misconceptions when it comes to insuring electric vehicles like the Kia EV6. Let’s address some of the most common ones:

- Electric Vehicles Are More Expensive to Insure: Although EVs often have higher purchase prices than traditional vehicles, they aren’t necessarily more expensive to insure. Insurance rates depend on factors like vehicle value, safety features, and repair costs. Compare rates from different insurers to find the most affordable coverage for your Kia EV6.

- Electric Vehicle Batteries Are Not Covered Under Insurance: Many insurance policies cover the battery packs of electric vehicles, including the Kia EV6. However, it’s essential to review your policy’s terms and conditions to understand the extent of this coverage.

- Insuring an EV Is More Complicated: Insuring an electric vehicle may require specific considerations like coverage for charging equipment, but it doesn’t complicate the process. Many insurers are experienced with EVs and offer streamlined processes for EV owners.

By dispelling these misconceptions, you can approach the insurance process for your Kia EV6 with a clearer understanding and make informed decisions about coverage. Delve into our evaluation of “Best Electric Vehicle (EV) Car Insurance Discounts.”

Expert Advice on Lowering Your Kia EV6 Car Insurance Premiums

If you’re looking for expert advice on lowering your Kia EV6 car insurance premiums, here are some additional tips:

- Maintain a Clean Driving Record: One of the most effective ways to keep your insurance premiums low is by maintaining a clean driving history. Avoid accidents, traffic violations, and speeding tickets to demonstrate responsible driving behavior to insurers.

- Opt for Higher Deductibles: As mentioned earlier, choosing a higher deductible can lead to lower insurance premiums. Evaluate your financial situation and choose a deductible that you can comfortably afford to pay in case of a claim.

- Consider Telematics or Usage-Based Insurance: Some insurance companies offer telematics programs that track your driving habits and mileage. By enrolling in these programs and demonstrating safe driving behavior, you may qualify for discounts or lower premiums.

- Review Your Coverage Periodically: As your circumstances change and your Kia EV6 depreciates in value, it’s crucial to review your coverage regularly to ensure you’re not overpaying for insurance. Adjusting your coverage levels and deductible based on your current needs can potentially save you money.

- Seek Guidance From an Insurance Agent: Consulting with an insurance agent who specializes in electric vehicles can provide you with personalized advice on how to lower your Kia EV6 car insurance premiums. They can help you navigate the complex insurance landscape and find the best coverage options for your needs and budget.

By following these tips, you can secure affordable coverage while protecting your investment and ensuring peace of mind on the road. Discover insights in our “Car Driving Safety Guide for Teens and Parents.’

Average Comprehensive Coverage Cost for Kia EV6 vs. Similar Vehicles

When considering the average cost of comprehensive coverage for the Kia EV6 compared to other vehicles in its class, it’s important to note that rates can vary significantly based on several factors. These factors include your location, driving history, coverage levels, and the specific insurance company you choose. As a result, it’s challenging to provide a precise comparison without considering these individualized factors.

However, on average, it’s worth noting that electric vehicles, including the Kia EV6, may have slightly higher comprehensive coverage rates compared to their gasoline counterparts. This is primarily due to the higher value of electric vehicles and potentially higher repair costs associated with EV technology. Nevertheless, the difference in rates between the Kia EV6 and other vehicles in its class may not be substantial.

Ultimately, to get an accurate estimate of the cost of comprehensive coverage for your Kia EV6, it’s recommended to obtain quotes from multiple insurance providers, taking into account your unique circumstances and coverage needs. Learn more in our “What car insurance discounts does Electric Insurance Company offer?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Car Insurance Coverage for Your Kia EV6

When insuring your Kia EV6, it’s crucial to have a clear understanding of the various types of car insurance coverage available. Let’s briefly review the most common ones:

- Liability Coverage: This coverage is required in most states and provides protection if you are responsible for causing an accident that results in property damage or bodily injuries to others.

- Collision Coverage: Collision coverage pays for damages to your Kia EV6 if it collides with another vehicle or object, irrespective of fault. It is especially important for protecting your vehicle against repair costs.

- Comprehensive Coverage: Comprehensive coverage covers damages to your Kia EV6 resulting from incidents other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver who is unable to cover your damages or medical expenses adequately.

- Medical Payments Coverage: Medical payments coverage provides reimbursement for medical expenses incurred by you or your passengers due to injuries sustained in an accident, regardless of fault.

- Personal Injury Protection: This coverage, also known as PIP, provides broader protection for medical expenses, lost wages, and other related costs resulting from injuries sustained in an accident.

It’s important to determine which types of coverage are required by your state’s laws and consider additional coverage based on your personal circumstances and preferences.

How Your Location Can Affect the Cost of Insuring a Kia EV6

Your location can indeed impact the cost of insuring your Kia EV6. Insurance companies evaluate risk based on various factors, including the area you live in. Urban areas often have higher traffic congestion, which increases the likelihood of accidents and theft. As a result, insurance rates in urban areas tend to be higher. Unlock details in our “Car Accidents: What to do in Worst Case Scenarios.”

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Frequently Asked Questions

What factors affect the cost of Kia EV6 car insurance?

The cost of Kia EV6 car insurance can be influenced by several factors, including the driver’s age, driving record, location, coverage options, deductible amount, and the insurance company’s policies.

For additional details, explore our comprehensive resource titled “Best Car Insurance for 21-Year-Old Drivers.”

Are electric vehicles generally more expensive to insure?

Electric vehicles like the Kia EV6 can sometimes be more expensive to insure compared to traditional gasoline-powered cars. This is primarily due to higher repair costs and the specialized training required for technicians to work on electric vehicles.

Can the cost of Kia EV6 car insurance vary between different insurance companies?

Yes, the cost of Kia EV6 car insurance can vary significantly between different insurance companies. Each company has its own underwriting criteria, pricing models, and discounts, which can result in varying insurance premiums for the same vehicle and driver.

Is it possible to get discounts on Kia EV6 car insurance?

Yes, it is possible to obtain discounts on Kia EV6 car insurance. Many insurance companies offer discounts for factors such as having a clean driving record, bundling multiple policies, completing driver safety courses, or having certain safety features installed in the vehicle.

What are some ways to lower the cost of Kia EV6 car insurance?

There are several strategies to potentially lower the cost of Kia EV6 car insurance. These include shopping around and comparing quotes from different insurance companies, maintaining a good driving record, increasing deductibles, taking advantage of available discounts, and considering usage-based insurance programs.

To find out more, explore our guide titled “Can you lend your car to an uninsured driver?”

How long does the EV6 last?

The EV6 boasts a MotorTrend Road-Trip Range of 260 miles and can recharge up to 164 miles of range in just 15 minutes, ensuring convenient travel with an electric vehicle.

Is Kia EV6 a 7 seater?

The Kia EV6 is an electric vehicle with seating for five people.

Is Kia EV6 selling well?

Furthermore, electric vehicle (EV) sales saw a 22.7% increase for the year, totaling 80,999 units. The newly introduced Kia Niro EV achieved sales of 40,074 units, closely trailed by the acclaimed Kia EV6 with 36,195 units sold. Despite its delayed market entry, the Kia EV9 sold 2,843 units, while the e-Soul sold 1,887 units.

Is Kia EV6 a supercar?

Kia designed the EV6 GT to rival high-performance cars like Ferrari’s Roma and the Lamborghini Huracan Evo Spyder. It features the same 77.4-kilowatt-hour battery as other EV6 models but includes a stronger 160-kilowatt motor in the front and a more powerful 270-kW motor in the rear.

To learn more, explore our comprehensive resource on “Full Coverage Car Insurance: A Complete Guide.”

Is Kia EV6 100% electric?

The Kia EV6 stands out as an excellent fully electric vehicle—practical, spacious, and enjoyable to drive—and ranks among the top choices currently available in India.

What is the top speed of the Kia EV6?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.