Cheap Fiat 500 Car Insurance in 2026 (Save Big With These 10 Companies!)

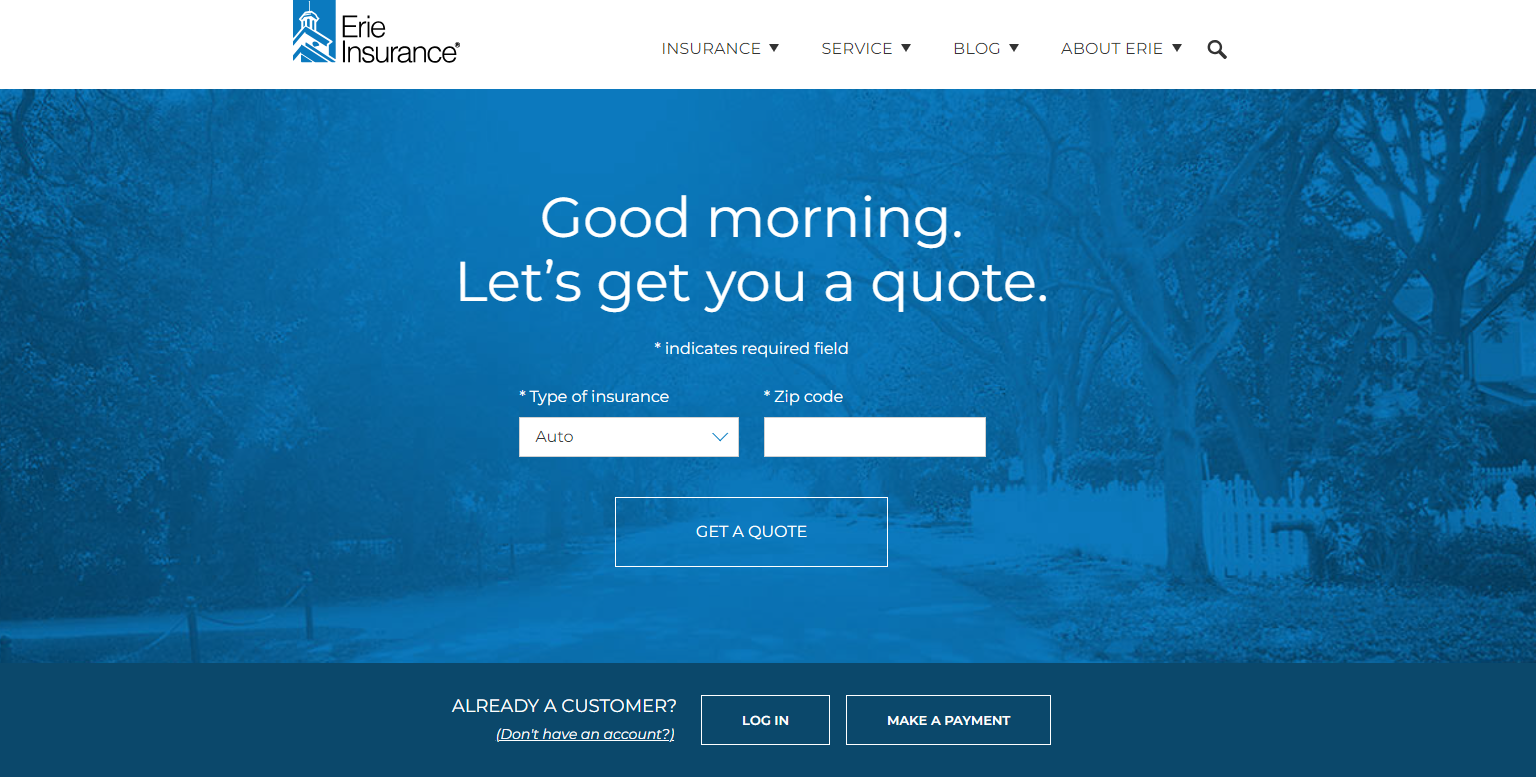

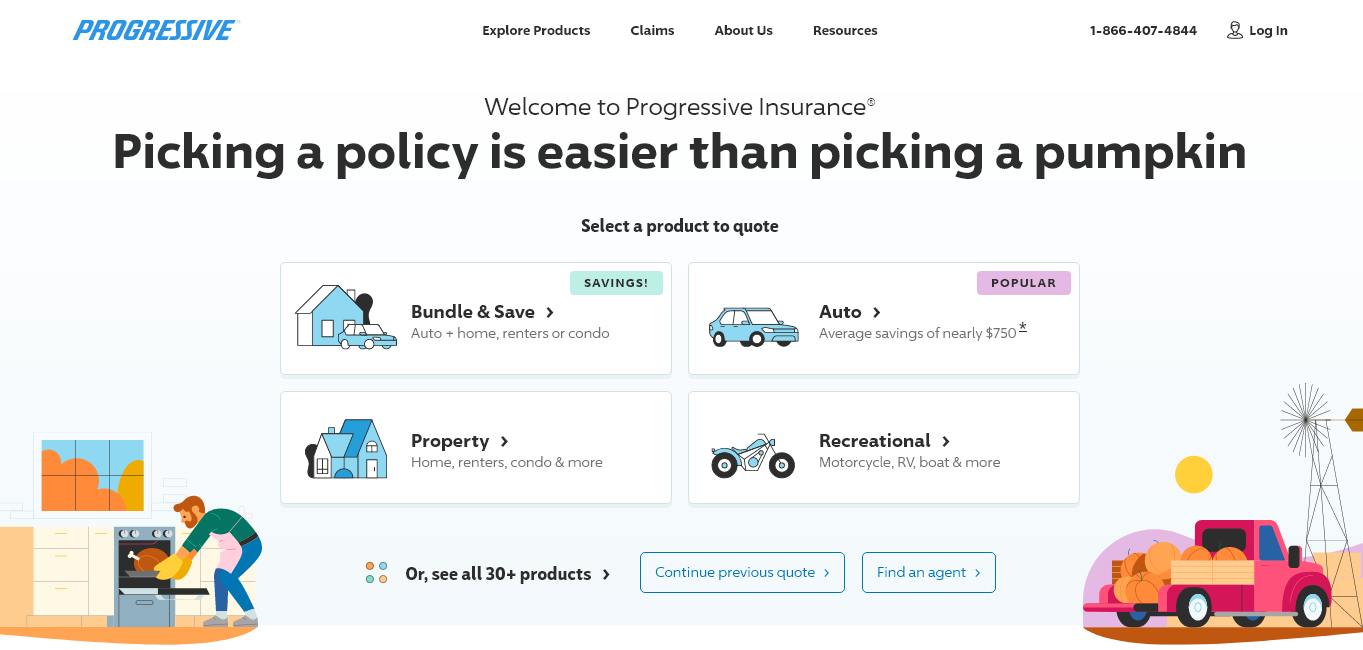

Cheap Fiat 500 car insurance is best offered by Erie, Progressive, and Nationwide, with rates as low as $75 per month. Erie balances cost and robust policies, while Progressive and Nationwide provide competitive rates and excellent customer service, ensuring comprehensive coverage tailored to your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated January 2025

Company Facts

Min. Coverage for Fiat 500

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Fiat 500

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Fiat 500

A.M. Best

Complaint Level

Pros & Cons

The best providers for cheap Fiat 500 car insurance are Progressive, USAA, and State Farm, with Erie offering rates as low as $75per month. This article delves into why these companies stand out, examining their affordability, comprehensive coverage options, and exceptional customer service.

Erie’s balance of cost-effectiveness and robust policies makes it the top pick overall. USAA and State Farm also provide competitive rates, making them excellent choices for Fiat 500 car insurance.

Our Top 10 Company Picks: Cheap Fiat 500 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $75 A+ Competitive Rates Erie

#2 $80 A+ Bundling Discounts Progressive

#3 $82 A+ Multi-Policy Discounts Nationwide

#4 $83 A++ Safe-Driving Discounts Travelers

#5 $85 A Competitive Rates Safeco

#6 $87 B Good Student State Farm

#7 $90 A Comprehensive Coverage MetLife

#8 $92 A Personalized Service Farmers

#9 $95 A Multi-Policy Discounts Liberty Mutual

#10 $99 A+ Customer Service Allstate

Insurance costs for other Fiat models vary

Save on Fiat 500 Car Insurance by Implementing Cost-Saving Strategies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Consider Types of Insurance are Necessary for A Fiat 500

Consider Where to Purchase Fiat 500 Car Insurance: The Bottom Line

Read more: Chubb Car Insurance Discounts

If you’re trying to find an affordable Fiat 500 car insurance company, you should compare quotes from multiple companies. Enter your ZIP code into our free quote comparison tool below to easily compare quotes.

Frequently Asked Questions

How much does it cost to insure a Fiat 500e?

The cost to insure a Fiat 500 is generally higher compared to other Fiat models due to its status as an electric vehicle. Insurance rates can vary widely based on factors like location, driving record, and coverage options.

What is the cheapest form of car insurance?

The cheapest form of car insurance is typically liability insurance, which covers bodily injury and property damage to others if you are at fault in an accident.

Why is the Fiat 500 a good car?

The Fiat 500 is considered a good car for its compact size, fuel efficiency, and stylish design. It’s particularly well-suited for urban environments and offers a fun driving experience.

How long do Fiat 500 engines last?

Fiat 500 engines can last a long time with proper maintenance, often reaching over 150,000 miles or more.

What is the cheapest category for car insurance?

The cheapest category for car insurance generally includes liability coverage, especially for older, less valuable vehicles.

What is the lowest form of car insurance?

The lowest form of car insurance is liability insurance, which is the minimum coverage required by law in most states.

What is the best car insurance?

The best car insurance depends on individual needs and circumstances, but companies like Geico, Erie Insurance, and Progressive are often recommended for their affordability and comprehensive coverage options.

What is the common problem with Fiat 500?

Common problems with the Fiat 500 include issues with the transmission, electrical system, and premature clutch wear.

Which model of Fiat 500 is best?

The best model of the Fiat 500 depends on personal preferences, but the Fiat 500 Abarth is often praised for its performance and sporty features.

What kind of car is a Fiat?

A Fiat is a compact car known for its small size, stylish design, and urban-friendly driving dynamics.

What are the pros and cons of Fiat?

What is the best small Fiat?

What are the advantages of a Fiat car?

How long will a Fiat last?

What are the main faults with a Fiat 500?

Who is known for cheapest car insurance?

Which type of car is cheapest to insure?

What is the lowest you can pay for car insurance?

Which insurance company is usually the cheapest?

What is the cheapest insurance for full coverage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.