Cheap Ford Transit 150 Van Car Insurance in 2026 (Top 10 Low-Cost Companies!)

Progressive, Safe Auto, and State Farm are top providers of cheap Ford Transit 150 Van car insurance, with rates starting at $50/month. These top insurers are known for their comprehensive and excellent customer service, offering affordable protection for Ford Transit 150 Van owners seeking insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Min. Coverage for Ford Transit 150 Van

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ford Transit 150 Van

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ford Transit 150 Van

A.M. Best

Complaint Level

Pros & Cons

The best providers of cheap Ford Transit 150 Van car insurance are Progressive, Safe Auto, and State Farm, offering rates as low as $50 per month.

These companies stand out for their extensive coverage options, exceptional customer service, and multiple discounts, making them the top choices for Ford Transit 150 Van owners.

Our Top 10 Company Picks: Cheap Ford Transit 150 Van Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $50 | A+ | Full Coverage | Progressive | |

| #2 | $53 | NR | Payment Options | Safe Auto |

| #3 | $55 | B | Military Families | State Farm | |

| #4 | $57 | A++ | Online Management | Geico | |

| #5 | $58 | A | Comprehensive Plans | Liberty Mutual |

| #6 | $60 | A+ | Bundling Discounts | Allstate | |

| #7 | $62 | A | New Replacement | Farmers | |

| #8 | $65 | A++ | Customer Service | USAA | |

| #9 | $68 | A+ | Custom Coverage | Nationwide |

| #10 | $70 | A | Safe Driver | American Family |

Protect your car from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

This article explores the factors influencing insurance rates, the importance of coverage, and tips for securing the most affordable options.

- Get cheap Ford Transit 150 Van insurance from Progressive at $50/month

- Customize coverage options for specific Ford Transit 150 Van needs

- Compare quotes and find discounts for optimal Ford Transit 150 Van insurance

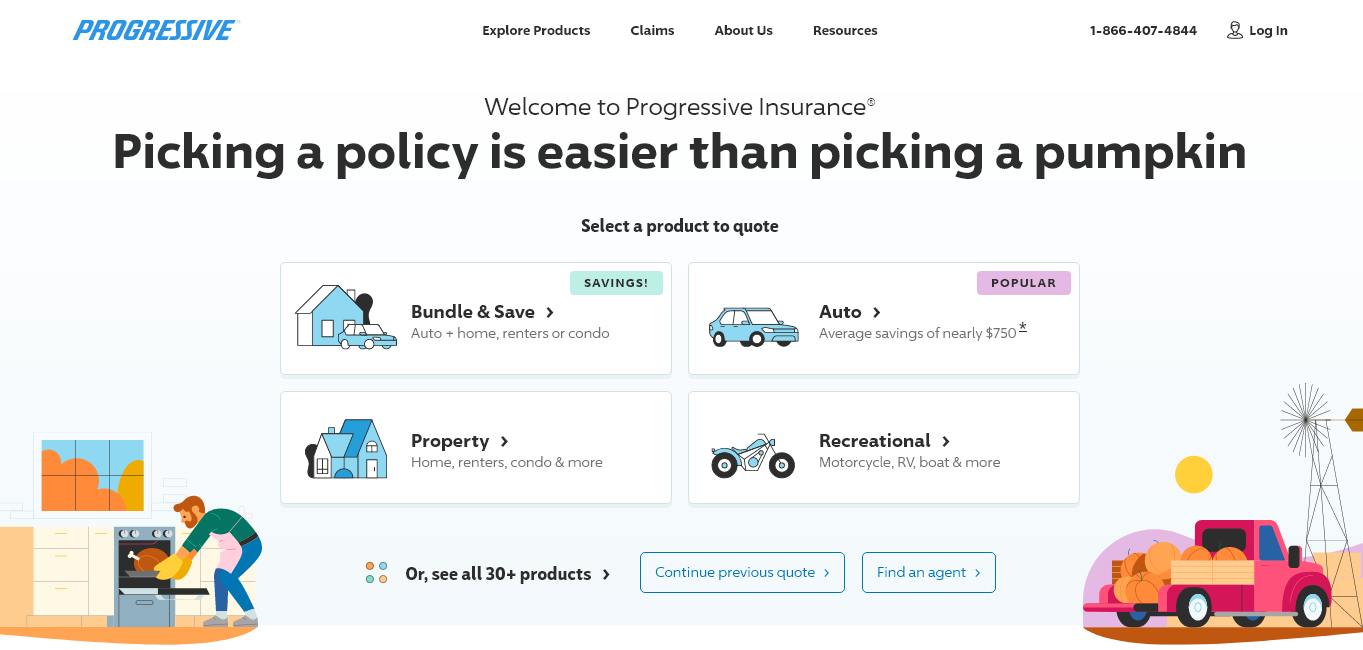

#1 – Progressive: Top Overall Pick

Pros

- Full Coverage Options: Progressive insurance review & ratings showcase the company’s wide range of coverage options, including comprehensive, collision, and liability insurance. This makes it suitable for drivers looking for extensive protection tailored to their needs.

- High Financial Strength (A+): Progressive holds a top-tier financial strength rating from A.M. Best, indicating its strong ability to meet financial obligations and pay claims promptly and reliably.

- Innovative Technology: Progressive leads in digital innovation with advanced online tools and a user-friendly mobile app that simplifies policy management, claims filing, and tracking repairs.

Cons

- Mixed Customer Service Reviews: While Progressive excels in digital innovation, customer service reviews are mixed. Some customers report positive experiences with efficient claims processing and helpful support, while others mention challenges in communication and resolution.

- Complex Claims Process: Despite their technological advancements, some policyholders find the claims process to be complex and less straightforward compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Safe Auto: Best for Payment Options

Pros

- Flexible Payment Options: Safe Auto stands out for offering flexible payment plans, which cater to customers looking for manageable payment schedules that align with their financial needs.

- Accessibility: Safe Auto insurance review & ratings display the company’s providing insurance to high-risk drivers or those with a history of driving violations, Safe Auto focuses on offering coverage options that may not be readily available through other insurers.

- Quick Quotes and Easy Enrollment: Safe Auto simplifies the insurance shopping experience with fast online quotes and easy enrollment processes, making it convenient for customers to get coverage quickly.

Cons

- Limited Coverage Choices: Safe Auto may not offer as broad a range of coverage options as larger insurers. This limitation can be a drawback for customers seeking extensive customization or specialized coverage.

- Customer Service Concerns: Like many insurers specializing in non-standard auto insurance, customer service reviews can vary. Some customers express dissatisfaction with responsiveness and support.

#3 – State Farm: Best for Military Family

Pros

- Military Family Focus: State Farm is highly regarded for its commitment to military personnel and their families, offering specialized insurance products tailored to their unique needs and circumstances.

- Extensive Agent Network: With a vast network of local agents across the country, State Farm provides personalized service and expert advice, ensuring customers receive tailored insurance solutions and ongoing support.

- Strong Reputation and Trust: State Farm insurance review & ratings exhibit the company’s strong reputation over decades for reliability, customer loyalty, and community involvement, contributing to its status as one of the largest insurers in the United States.

Cons

- Lower Financial Strength Rating (B): Despite its size and reputation, State Farm’s financial strength rating of B from A.M. Best is lower compared to some top-rated insurers. This may raise concerns for customers prioritizing maximum financial stability.

- Potentially Higher Costs: While State Farm offers comprehensive coverage and personalized service, its premiums may be higher compared to budget-focused insurers, potentially impacting cost-conscious customers.

#4 – Geico: Best for Financial Strength

Pros

- High Financial Strength (A++): Geico car insurance discounts present the company’s top-tier financial stability, holding an A++ rating from A.M. Best. This rating assures customers of the company’s ability to meet its financial obligations and pay claims promptly and reliably.

- User-Friendly Online Management: Geico is recognized for its industry-leading digital platforms, including a highly rated website and mobile app. These tools allow policyholders to manage policies, file claims, and obtain assistance efficiently, reflecting Geico’s commitment to customer convenience.

- Discount Opportunities: Geico offers various discounts, such as for bundling policies, maintaining a good driving record, and using safety devices in vehicles. These discounts can help customers save on premiums and enhance overall value.

Cons

- Customer Service Variability: While Geico excels in digital innovation, customer service reviews vary. Some customers report positive experiences with responsive support, while others mention challenges in communication and claims handling.

- Coverage Options: While Geico provides a range of standard coverage options, it may not offer as many specialized or customizable choices compared to larger insurers, potentially limiting options for certain customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Comprehensive Plans

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a broad array of insurance products, including comprehensive plans that cater to various needs and preferences. This flexibility allows customers to tailor coverage to suit their specific circumstances.

- Solid Financial Strength (A): Liberty Mutual Review & ratings highlight the company’s A rating from A.M. Best, Liberty Mutual demonstrates strong financial stability and a reliable ability to meet policyholder obligations, instilling confidence among customers.

- Discount Programs: Liberty Mutual provides numerous discount opportunities, such as for bundling policies, having a good driving record, and using safety features in vehicles. These discounts help customers save on premiums and enhance affordability.

Cons

- Customer Service Challenges: Like many large insurers, Liberty Mutual receives mixed reviews regarding customer service. While some customers appreciate the support provided, others report issues with responsiveness and claims processing.

- Competitive Pricing: While Liberty Mutual offers comprehensive coverage, its premiums may not always be as competitive as those offered by budget-focused insurers, potentially impacting price-sensitive customers.

#6 – Allstate: Best for Bundling Discounts

Pros

- Bundling Discounts: Allstate stands out for its substantial discounts for bundling home and auto insurance policies. This bundling opportunity allows customers to save significantly on premiums and simplify their insurance management.

- Strong Financial Rating (A+): Allstate maintains a high financial strength rating from A.M. Best, indicating superior financial stability and reliability in meeting policyholder obligations.

- Claims Satisfaction: Allstate insurance review & ratings feature the company’s consistently receives positive feedback for its claims handling process, emphasizing efficient resolution and customer support.

Cons

- Cost Considerations: While Allstate provides comprehensive coverage and excellent service, its premiums may be higher compared to some budget-focused insurers. This factor could be a consideration for price-sensitive customers.

- Customer Service Variability: Despite its positive claims satisfaction ratings, customer service experiences with Allstate can vary. Some customers report challenges with communication and responsiveness, impacting overall satisfaction.

#7 – Farmers: Best for New Replacement

Pros

- New Car Replacement Coverage: Farmers insurance review & ratings demonstrate the company’s new car replacement coverage for qualifying vehicles, providing added peace of mind for policyholders in the event of a total loss.

- Solid Financial Rating (A): Farmers maintains a strong financial stability rating from A.M. Best, ensuring reliable claims payments and financial security for customers.

- Customizable Policies: Farmers provides options for customizing policies to meet individual needs, allowing customers to tailor coverage and deductibles according to their preferences.

Cons

- Cost Considerations: While Farmers offers comprehensive coverage and customizable policies, its premiums may not always be as competitive as those offered by budget-focused insurers. This factor could influence decisions for cost-conscious customers.

- Customer Service Challenges: Like many insurers, Farmers receives mixed reviews regarding customer service. While some customers commend the support received, others express concerns about responsiveness and claims handling.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Customer Service

Pros

- Top-notch Customer Service: USAA is renowned for its exceptional customer service and high member satisfaction ratings. The company consistently ranks well in customer service surveys, reflecting its commitment to serving military members and their families.

- Military Focus: USAA insurance review & ratings flaunt the company’s specializes in providing insurance products and services tailored specifically to the unique needs of military personnel, veterans, and their families. This specialization ensures that customers receive relevant coverage and support.

- High Financial Strength (A++): USAA holds the highest financial strength rating from A.M. Best, indicating superior financial stability and reliability in meeting policyholder obligations.

Cons

- Membership Restrictions: USAA membership is limited to military personnel, veterans, and their immediate family members. This restriction may exclude eligibility for the general public seeking USAA’s specialized insurance products.

- Limited Availability: While USAA offers excellent service and coverage options, its availability may be limited depending on the geographical location of potential customers.

#9 – Nationwide: Best for Custom Coverage

Pros

- Custom Coverage Options: Nationwide provides a variety of customizable coverage options, allowing customers to tailor policies to meet their specific needs and preferences. This flexibility ensures that customers can obtain comprehensive coverage that aligns with their individual circumstances.

- Strong Financial Rating (A+): Nationwide maintains a strong financial stability rating from A.M. Best, indicating reliability in meeting policyholder obligations and providing financial security.

- Discount Opportunities: Nationwide insurance review & ratings parade the company’s various discount opportunities, such as for bundling policies, maintaining a good driving record, and using safety devices in vehicles. These discounts help customers save on premiums and enhance overall value.

Cons

- Customer Service Variability: Like many large insurers, Nationwide’s customer service experiences can vary. While some customers report positive interactions and support, others may encounter challenges with responsiveness or claims processing.

- Cost Considerations: While Nationwide offers comprehensive coverage and discount opportunities, its premiums may not always be as competitive as those offered by budget-focused insurers. This factor could influence decisions for price-sensitive customers.

#10 – American Family: Best for Safe Driver

Pros

- Safe Driver Discounts: American Family insurance review & ratings offers significant discounts and rewards for safe driving behavior, encouraging policyholders to maintain good driving habits and potentially lowering premiums.

- Personalized Service: American Family is known for providing personalized service through its network of local agents, who offer expert advice and guidance to customers, ensuring they receive tailored insurance solutions.

- Customer Satisfaction: American Family consistently receives positive feedback for its customer satisfaction and claims handling processes, emphasizing reliability and support during insurance-related incidents.

Cons

- Cost Considerations: While American Family provides comprehensive coverage and personalized service, its premiums may not always be as competitive as those offered by budget-focused insurers. This factor could be a consideration for customers prioritizing affordability.

- Coverage Options: While American Family offers a range of comprehensive coverage options, including for home and life insurance, its offerings may not be as extensive or specialized compared to larger insurers, potentially limiting options for certain customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciphering Ford Transit 150 Van Insurance Costs

Navigating the landscape of insurance costs for a Ford Transit 150 Passenger Van reveals a spectrum of pricing influenced by numerous variables. These factors include the driver’s demographics, location, driving history, and the level of coverage desired.

On average, monthly premiums for insuring a Ford Transit 150 Passenger Van range from about $83 to $208, totaling annual costs between $1,000 and $2,500. To gain further insights, consult our comprehensive guide titled “How does the insurance company determine my premium?”

Ford Transit 150 Van Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Monthly Rates | Full Coverage |

|---|---|---|

| Allstate | $60 | $125 |

| American Family | $70 | $140 |

| Farmers | $62 | $130 |

| Geico | $57 | $115 |

| Liberty Mutual | $58 | $135 |

| Nationwide | $68 | $145 |

| Progressive | $50 | $120 |

| SafeAuto | $53 | $110 |

| State Farm | $55 | $125 |

| USAA | $65 | $135 |

However, these figures are contingent upon individual circumstances and the insurance provider selected, making it crucial to assess all factors comprehensively to secure optimal coverage at the most competitive rates.

Factors Affecting Ford Transit 150 Van Insurance

Insuring your Ford Transit 150 Passenger Van involves considering various factors that impact insurance rates. These include driver age, location, driving history, credit score (where applicable), and the van’s specifications like safety features and potential commercial use. Understanding these elements helps in choosing suitable coverage that meets both your needs and budget effectively.

- Age and Driving Experience: Younger and less experienced drivers typically face higher insurance premiums due to perceived higher risk. For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?“

- Location: Urban areas generally have higher insurance rates due to increased traffic, accidents, and theft risks.

- Driving Record: A clean record with no accidents or violations can lead to lower insurance costs, while a history of incidents may increase premiums.

Insurance providers also consider the Ford Transit 150 Passenger Van’s characteristics, such as its size, safety features, and potential for commercial use, when calculating rates.

Additionally, the level of coverage chosen—whether liability, collision, or comprehensive—affects insurance premiums, making it crucial to align coverage needs with budget considerations.

The Vital Role of Insurance for Ford Transit 150 Passenger Vans

Car insurance is essential for safeguarding your Ford Transit 150 Passenger Van against a range of potential risks on the road. It provides crucial financial protection in cases of accidents, theft, or damage to your vehicle. Moreover, in many states, maintaining a minimum level of liability coverage is legally required to operate a Ford Transit 150 Passenger Van on public roads.

Insurance for your Ford Transit 150 Passenger Van not only shields your vehicle but also protects you from substantial financial liabilities. In the event of an accident, insurance can cover repair costs or even facilitate vehicle replacement, depending on the severity of the damage. To delve deeper, refer to our in-depth report titled “How to Document Damage for Car Insurance Claims.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Affordable Ford Transit 150 Van Insurance

If you’re looking to secure affordable car insurance for your Ford Transit 150 Passenger Van, consider the following tips:

- Shop around and compare quotes from multiple insurance providers to ensure you’re getting the best rate.

- Consider increasing your deductibles, which can help lower your premiums.

- Take advantage of discounts, such as bundling your Ford Transit 150 Passenger Van insurance with other policies like homeowners or renters insurance. For a thorough understanding, refer to our detailed analysis titled “Renters Insurance: A Complete Guide.”

- Maintain a clean driving record and attend defensive driving courses to demonstrate responsible driving behavior.

Another tip for finding affordable car insurance for your Ford Transit 150 Passenger Van is to consider installing anti-theft devices. Insurance providers often offer discounts for vehicles equipped with security features such as alarms or tracking systems.

Additionally, it’s important to regularly review and update your car insurance policy. As your circumstances change, such as moving to a safer neighborhood or reducing your annual mileage, you may be eligible for lower premiums.

Understanding Ford Transit 150 Van Insurance Coverage

When selecting insurance for your Ford Transit 150 Passenger Van, understanding the available coverage options is essential. Each type of coverage offers specific protections that cater to different aspects of potential risks on the road.

- Liability Coverage: Required in most states, it covers damages or injuries caused to others in an accident.

- Collision Coverage: Pays for damages to your Ford Transit 150 Passenger Van from collisions with vehicles or objects. To expand your knowledge, refer to our comprehensive handbook titled “Collision Car Insurance: A Complete Guide.”

- Comprehensive Coverage: Covers non-collision damages like theft, vandalism, or weather-related incidents.

Choosing the right coverage for your Ford Transit 150 Passenger Van involves assessing your needs and budget carefully.

Whether it’s mandatory liability coverage or optional comprehensive protection, having the right insurance ensures you’re prepared for unexpected events while driving.

Comparing Ford Transit 150 Van Insurance Quotes

When shopping for insurance for your Ford Transit 150 Passenger Van, comparing quotes from different providers is crucial. Insurance premiums can vary widely, so obtaining multiple quotes helps you find the most competitive price for your desired coverage.

It’s also important to research the reputation and customer service of each provider. Reading customer reviews and checking ratings with organizations like the Better Business Bureau provides insights into their reliability and responsiveness. Consider factors like deductibles, coverage limits, and additional benefits offered by each insurer. To gain profound insights, consult our extensive guide titled “What is embedded deductible?”

Chris Abrams Licensed Insurance Agent

Take advantage of discounts, such as safe driver or bundling discounts, which can further reduce your premiums. By carefully comparing these factors, you can confidently choose the best insurance coverage for your Ford Transit 150 Passenger Van.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Managing Insurance Costs for Ford Transit 150 Passenger Vans

Understanding how safety features and driving records impact insurance costs is crucial when insuring your Ford Transit 150 Passenger Van. Advanced vehicle technologies and a clean driving history can lead to significant savings on premiums.

- Impact of Safety Features: Safety technologies like anti-lock brakes, airbags, and electronic stability control on your Ford Transit 150 Passenger Van can qualify for insurance discounts, while features such as rearview cameras and adaptive cruise control can further reduce premiums by mitigating accident risks.

- Driving Record Influence: Your driving history significantly affects insurance rates for a Ford Transit 150 Passenger Van; maintaining a clean record generally lowers costs, whereas histories of accidents or traffic violations often lead to higher premiums due to increased perceived risk. For a comprehensive overview, explore our detailed resource titled “Car Accidents: What to do in Worst Case Scenarios.”

- Cost Reduction Strategies: Utilizing advanced safety features and maintaining a spotless driving record are effective strategies for minimizing insurance expenses for your Ford Transit 150 Passenger Van, ensuring optimal coverage at competitive rates.

By prioritizing advanced safety features and maintaining a clean driving record, you can effectively lower insurance expenses for your Ford Transit 150 Passenger Van. These proactive steps not only enhance safety but also ensure cost-effective coverage that meets your needs.

Maximizing Savings on Ford Transit 150 Van Insurance

When insuring a Ford Transit 150 Passenger Van, exploring discounts and savings opportunities can significantly reduce insurance costs.

Common discounts include multi-vehicle savings for insuring multiple vehicles with the same provider, discounts for safe drivers with clean records, and reductions for installing anti-theft devices like alarms or GPS trackers. For detailed information, refer to our comprehensive report titled “GPS Tracker Car Insurance Discount.”

Students with good grades may also qualify for lower premiums. To further minimize insurance expenses, consider adjusting your deductible and reviewing your policy regularly for additional discounts or changes in coverage needs. Driving responsibly and maintaining a clean driving record are essential to avoid accidents and traffic violations that could otherwise raise insurance premiums.

Choosing the Right Insurance for Your Ford Transit 150 Passenger Van

When selecting an insurance provider for your Ford Transit 150 Passenger Van, several critical factors should guide your decision-making process to ensure comprehensive coverage and peace of mind.

- Financial Stability: Choose an insurance provider with a strong financial position known for promptly paying claims.

- Customer Service: Research customer reviews to ensure reliable and responsive support.

- Coverage Options: Evaluate providers based on their range of coverage options and additional benefits to match your specific needs.

Choosing the right insurance provider for your Ford Transit 150 Passenger Van involves careful consideration of several key factors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Affordable Ford Transit 150 Van Insurance

Discover how real individuals secured cost-effective insurance solutions for their Ford Transit 150 Passenger Vans, offering insights to help you find affordable coverage without compromising protection.

- Case Study #1 – Safety Feature Savings: Sarah, a Ford Transit 150 owner, reduced her insurance premiums by utilizing advanced safety features such as anti-lock brakes and a rearview camera. For a comprehensive analysis, refer to our detailed guide titled “Best Safety Features Car Insurance Discounts.”

- Case Study #2 – Strategic Comparison: Michael meticulously compared insurance quotes from various providers and bundled his Ford Transit 150 insurance with his existing home insurance policy. This proactive approach shattered the myth of expensive van insurance, securing him a budget-friendly coverage package.

- Case Study #3 – Myth-Busting Research: Emma discovered misconceptions about van insurance costs and revisited her options. By comparing quotes and exploring available discounts, she switched to a more economical policy without compromising on coverage.

These case studies demonstrate that affordable insurance for your Ford Transit 150 Van is achievable through strategies like leveraging safety feature discounts, strategic comparison shopping, and dispelling common myths about insurance costs.

Scott W. Johnson Licensed Insurance Agent

Offering valuable insights and strategies to help you navigate the insurance landscape while ensuring you find affordable coverage without compromising on protection.

Final Verdict: Affordable Ford Transit 150 Van

The cost of Ford Transit 150 Passenger Van car insurance can vary based on several factors, including the driver’s profile, location, driving record, desired coverage, and the vehicle’s make and model.

To find the best insurance rate, compare quotes from multiple providers, consider available discounts, maintain a good driving record, and review your coverage periodically. For a thorough exploration, delve into our extensive guide titled “Best Car Insurance Discounts to Ask.”

By understanding these factors and debunking common misconceptions, you can make informed decisions and secure the most suitable car insurance for your Ford Transit 150 Passenger Van.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

What insurance group is a Ford Transit van and why is it considered a good van?

The insurance group for a Ford Transit van varies depending on the model and specifications, generally categorized higher due to its size and commercial use. It is considered a good van for its reliability, spaciousness, and versatile configurations suitable for various commercial and personal needs.

How much does it cost to insure a Ford Transit van and what type of car insurance is cheapest?

The monthly insurance costs for a Ford Transit van, which typically range from about $83 to $208, depend on factors like the driver’s age, location, driving history, and specific model year. Liability-only insurance tends to be the cheapest type of car insurance, covering damages to others’ property or injuries caused by your vehicle.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What insurance do you need for a van and what type of van is best for van life?

Vans typically require at least third-party liability insurance, covering damages to others’ property or injuries. Comprehensive and collision coverage are also recommended. The best vans for van life are spacious, reliable models like the Ford Transit or Mercedes-Benz Sprinter, known for their customization options and comfort.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Collision vs. Comprehensive Car Insurance.”

What are the disadvantages of the Ford Transit and why is Ford discontinuing the Transit?

Disadvantages of the Ford Transit may include higher maintenance costs, elevated insurance premiums due to its commercial classification, and potentially lower fuel efficiency depending on the model. Ford has no plans to discontinue the Transit; it remains a popular choice in the commercial van market.

Why Ford Transit is the best and what type of van is cheapest to insure?

The Ford Transit is favored for its reliability, spaciousness, and versatility across various commercial and personal uses. Smaller vans with lower engine sizes and less commercial use, like the Ford Transit Connect, tend to have cheaper insurance premiums due to their lower risk profile.

What does van insurance cover and can anyone get van insurance?

Van insurance typically covers third-party liability for damage to others’ property or injuries, with options for comprehensive and collision coverage to protect your own vehicle. Anyone who owns or leases a van for personal or commercial use can obtain van insurance, provided they meet the insurer’s criteria.

For an in-depth examination, consult our thorough guide entitled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

What type of van is best for van life and what insurance group is a Transit van?

Vans that excel in van life include spacious and reliable models like the Ford Transit or Mercedes-Benz Sprinter, offering ample room for customization and comfort. The insurance group for a Transit van varies but is generally higher due to its size and commercial use.

Which brand of car has the cheapest insurance and what is the cheapest van to insure?

Generally, smaller vans with lower engine sizes and less commercial use, such as the Ford Transit Connect, tend to have cheaper insurance premiums. The brand of car with the cheapest insurance can vary based on factors like model, usage, and the driver’s profile.

What category is a Ford Transit van and what brand is a transit van?

The Ford Transit van is categorized as a commercial vehicle due to its size and payload capacity, suited for various business and personal applications. It is manufactured by Ford, known for its durability and extensive lineup of commercial vehicles.

For a thorough exploration, delve into our extensive guide titled “Commercial Car Insurance Discount.”

What insurance group is a Transit van and what does van insurance cover?

The insurance group for a Transit van varies depending on its specifications and model year, generally categorized higher due to its size and intended commercial use. Van insurance typically covers liability for damage to others’ property or injuries, with options for comprehensive and collision coverage to protect your own vehicle.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.