Cheap Cadillac ATS Car Insurance in 2026 (Save With These 10 Companies!)

Discover the best providers for cheap Cadillac ATS car insurance: State Farm, Travelers, and Nationwide stand out with minimum rates as low as $40/month. These companies offer competitive premiums and extensive coverage options tailored to your Cadillac needs, ensuring value and security.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated November 2024

Company Facts

Min. Coverage for ATS

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for ATS

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for ATS

A.M. Best

Complaint Level

Pros & Cons

The top picks for cheap Cadillac ATS car insurance are State Farm, Travelers, and Nationwide, known for their competitive coverage options and customer service.

These providers offer tailored policies that enhance the value and protection of your Cadillac, making them popular choices among ATS owners. Learn more in our “Cadillac Car Insurance Discount.”

Our Top 10 Company Picks: Cheap Cadillac ATS Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $40 B Financial Strength State Farm

#2 $53 A++ Affordable Rates Travelers

#3 $59 A+ Accident Forgiveness Nationwide

#4 $60 A++ High-Value Vehicles Chubb

#5 $66 A Dividend Payments American Family

#6 $69 A+ Competitive Rates Progressive

#7 $70 A+ Customer Service Amica Mutual

#8 $76 A Safe-Driving Discounts Farmers

#9 $87 A+ Multi-Policies Discount Allstate

#10 $91 A Customizable Policies Liberty Mutual

Understanding the factors that affect your insurance rates, such as location and driving history, can help you make better decisions when choosing a policy. This article explores various ways to reduce costs while ensuring you receive the coverage necessary for your Cadillac ATS.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs. See more details on our State Farm car insurance review & ratings.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Affordable Rates

Pros

- Competitive Pricing: Travelers offers competitive monthly rates, making it a budget-friendly option.

- Extensive Policy Options: Travelers provides a wide array of policy choices to suit various needs.

- Strong Financial Ratings: Backed by an A++ rating from A.M. Best, ensuring reliability. More information is available about this provider in our Travelers car insurance review & ratings.

Cons

- Customer Service Variability: Customer service quality can vary significantly by region.

- Claims Process: Some users report a slower claims process compared to industry standards.

#3 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide does not increase premiums after the first at-fault accident.

- Loyal Customer Benefits: Long-term customers can access enhanced policy benefits. Read up on the “Nationwide Insurance Review & Ratings” for more information.

- Flexible Payment Options: Nationwide offers various payment plans to accommodate different budgets.

Cons

- Higher Starting Rates: Starting rates are slightly higher than some direct competitors.

- Coverage Limitations: Some coverage options are not as comprehensive as those offered by higher-ranked insurers.

#4 – Chubb: Best for High-Value Vehicles

Pros

- Specialty Coverage: Chubb specializes in insurance for high-value vehicles with tailored coverage.

- Agreed Value Coverage: Policyholders receive the full insured amount for a total loss without depreciation.

- Global Coverage: Provides international insurance coverage for travelers. Check out insurance savings in our complete Chubb insurance review & ratings.

Cons

- Premium Pricing: Chubb’s premiums are typically higher, reflecting its focus on high-value vehicles.

- Selective Policy Availability: Not all services are available to every customer, depending on the location and the vehicle’s value.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Dividend Payments

Pros

- Dividend Policies: Eligible policyholders can receive dividends, reducing overall insurance costs. Discover more about offerings in our American Family insurance review & ratings.

- Customizable Policies: Offers a range of add-ons and customization options for personal insurance needs.

- Robust Online Tools: American Family provides comprehensive online resources for managing policies.

Cons

- Limited Availability: Services are not available in all states, limiting access for some potential customers.

- Higher Rates for Riskier Profiles: Rates can escalate significantly for customers with less-than-ideal driving records.

#6 – Progressive: Best for Competitive Rates

Pros

- Price Comparison Tool: Progressive’s tool allows customers to compare insurer rates directly. Access comprehensive insights into our Progressive insurance review & ratings.

- Name Your Price Tool: Helps customers find policies that fit their budget without sacrificing coverage.

- Wide Acceptance: Offers policies to a broader range of drivers, including those with higher risk.

Cons

- Variable Customer Satisfaction: Customer satisfaction can vary widely based on individual experiences.

- Policy Upselling: Some customers report aggressive upselling of additional features.

#7 – Amica Mutual: Best for Customer Service

Pros

- Customer Satisfaction: Amica consistently ranks high for customer service and client satisfaction.

- Mutual Company Benefits: As a mutual company, policyholders may receive dividends. Delve into our evaluation of Amica car insurance discounts.

- Extensive Coverage Options: Offers a broad selection of coverage options and endorsements.

Cons

- Higher Premiums: Premiums can be higher than average, reflecting its extensive service and coverage options.

- Limited Physical Locations: Fewer local offices, which might affect those preferring in-person service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Safe-Driving Discounts

Pros

- Safe Driver Rewards: Farmers offers substantial discounts and incentives for safe driving. Unlock details in our Farmers car insurance review & ratings.

- Customizable Coverage: Allows significant customization of policies to fit individual needs.

- Educational Resources: Provides extensive resources and tools for understanding insurance.

Cons

- Rate Fluctuations: Customers may experience rate increases at renewal, even without claims.

- Claims Handling Issues: Some users report dissatisfaction with the claims process efficiency.

#9 – Allstate: Best for Multi-Policies Discount

Pros

- Multiple Policy Discounts: Significant savings available when bundling multiple types of policies.

- Wide Range of Products: Offers a broad array of insurance products, catering to diverse needs.

- Innovative Tools: Provides tools and apps for policy management and claims handling. Discover insights in our Allstate insurance review & ratings.

Cons

- Higher Costs for Single Policies: Single policy premiums can be high without bundling.

- Customer Service Variability: Customer service experience can vary depending on the region and agent.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Policies: Known for offering highly customizable policy options. If you want to learn more about the company, head to our Liberty Mutual car insurance review & ratings.

- Accident Forgiveness: Offers accident forgiveness, not increasing rates after the first incident.

- Strong Online Presence: Provides robust online tools for quote comparison and policy management.

Cons

- Inconsistent Pricing: Pricing can be inconsistent and sometimes higher than competitors.

- Customer Service Complaints: Some customers report dissatisfaction with claim resolution and service quality.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Insurance Rates for Cadillac ATS: Minimum vs. Full Coverage

Selecting the right insurance for your Cadillac ATS involves understanding how rates can vary depending on the coverage level. This section delves into the monthly rates provided by various insurers for both minimum and full coverage.

Cadillac ATS Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $87 | $200 |

| American Family | $66 | $166 |

| Amica Mutual | $70 | $185 |

| Chubb | $60 | $150 |

| Farmers | $76 | $192 |

| Liberty Mutual | $91 | $205 |

| Nationwide | $59 | $144 |

| Progressive | $69 | $170 |

| State Farm | $40 | $102 |

| Travelers | $53 | $139 |

When looking at monthly car insurance rates for the Cadillac ATS, it becomes evident that the cost can differ significantly between minimum and full coverage. For example, State Farm offers the most affordable rates, with minimum coverage starting at just $40 and full coverage at $102 per month. In contrast, Liberty Mutual presents higher rates, charging $91 for minimum and $205 for full coverage.

This pattern is consistent across other insurers; Nationwide offers economical options at $59 and $144, respectively, whereas Farmers’ rates are at $76 for minimum and $192 for full coverage.

Such variations highlight the importance of comparing insurance options based on coverage levels to find the most suitable and cost-effective policy for your needs. See more details on our “How much insurance coverage do I need?”

Factors That Influence the Cost of Cadillac ATS Car Insurance

Several key factors can impact the cost of insuring a Cadillac ATS. One of the primary factors insurance companies consider is the age and driving experience of the person being insured. Younger and less experienced drivers often face higher insurance rates due to the increased likelihood of accidents and claims.

Another essential factor is the location where the vehicle will be primarily driven and parked. Insurance rates can vary depending on the accident and theft rates in a specific area, so urban areas or regions with higher crime rates may result in higher insurance premiums for your Cadillac ATS. Read up on the “Car Accidents: What to do in Worst Case Scenarios” for more information.

The type of coverage and policy limits you choose will also influence the cost of insurance. It’s important to carefully consider your coverage needs and evaluate the different options available to you.

Additionally, the make and model of the Cadillac ATS can also affect the cost of car insurance. Insurance companies take into account the safety features, repair costs, and overall risk associated with a particular vehicle. The Cadillac ATS is known for its advanced safety features and solid build quality, which may result in lower insurance premiums compared to other luxury cars in its class.

Understanding the Different Insurance Options for a Cadillac ATS

When insuring your Cadillac ATS, you’ll have several insurance options to choose from. The most basic type of coverage is liability insurance, which covers the cost of damage or injuries you cause to others in an accident. This is typically required by law in most states.

In addition to liability insurance, you can also opt for collision coverage, which covers the cost of repair or replacement if your vehicle is damaged in a collision. Comprehensive coverage is another option, providing protection against theft, vandalism, and other non-collision incidents.

Lastly, you may want to consider additional coverage options such as uninsured/underinsured motorist coverage or personal injury protection, depending on your needs and preferences.

It’s important to note that the cost of insurance for a Cadillac ATS can vary depending on several factors. These factors may include your driving record, the location where you live, the age and condition of your vehicle, and the level of coverage you choose. It’s recommended to compare quotes from different insurance providers to find the best coverage and rates for your Cadillac ATS.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Insurance Rates for the Cadillac ATS With Other Luxury Vehicles

It’s important to note that the cost of insurance for a Cadillac ATS may vary compared to other luxury vehicles. Insurance rates are calculated based on several factors specific to the make and model of a vehicle, including its safety features, repair costs, and likelihood of theft. Check out insurance savings in our complete “Is car theft covered by car insurance?”

Compared to other luxury vehicles, the Cadillac ATS has been praised for its safety features, which can positively impact insurance rates. Additionally, the availability of aftermarket parts and specialized repair facilities may also affect insurance costs for this particular vehicle.

Another factor that can influence insurance rates for the Cadillac ATS is the driver’s personal profile. Insurance companies take into account factors such as the driver’s age, driving history, and location when determining premiums. Younger drivers or those with a history of accidents or traffic violations may face higher insurance costs for the Cadillac ATS compared to older, more experienced drivers with clean records.

Tips for Finding Affordable Car Insurance for Your Cadillac ATS

While insurance rates for a Cadillac ATS may vary, there are several steps you can take to find more affordable car insurance. First and foremost, consider shopping around and obtaining quotes from multiple insurance providers. This will allow you to compare rates and coverage options.

Additionally, being a safe and responsible driver can also help you secure lower insurance premiums. Maintaining a clean driving record and avoiding accidents can often lead to discounts and lower rates. Discover more about offerings in our “Does your car insurance rate go up the more cars you have?”

Another potential way to save on Cadillac ATS car insurance is by bundling it with other policies. Many insurance companies offer discounts for bundling auto insurance with homeowners or renters insurance, so it’s worth exploring this option if you have multiple insurance needs.

Furthermore, it’s important to consider the deductible amount when looking for affordable car insurance for your Cadillac ATS. A higher deductible can often result in lower monthly premiums. However, it’s essential to ensure that you can comfortably afford the deductible amount in the event of an accident or damage to your vehicle.

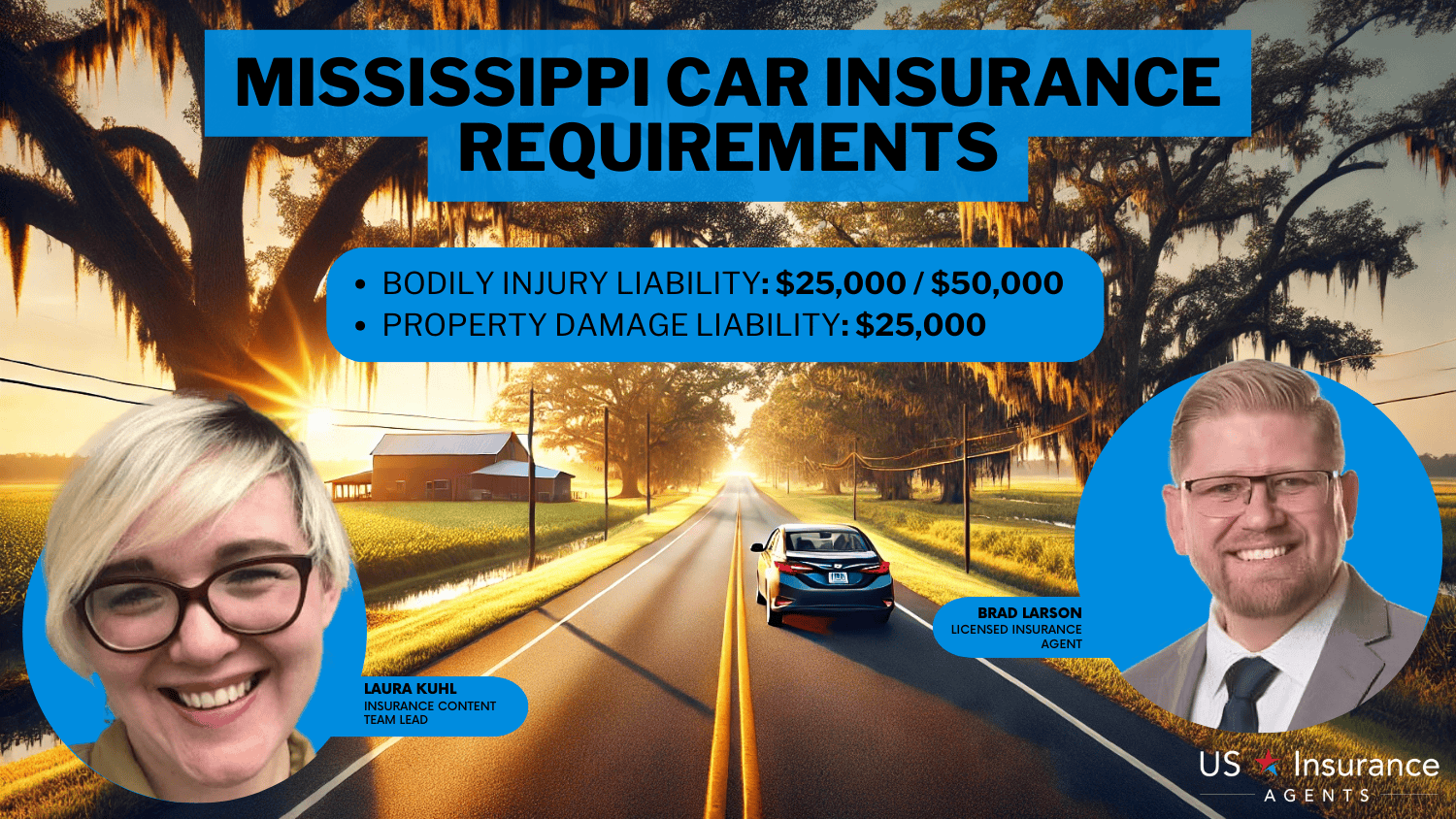

The Average Cost of Insurance for a Cadillac ATS in Different States

The average cost of insurance for a Cadillac ATS can vary significantly depending on the state in which you reside. Factors such as state minimum coverage requirements and local driving conditions can influence insurance rates.

For instance, states with higher accident rates or densely populated urban areas may have higher insurance premiums for the Cadillac ATS. Furthermore, state laws and regulations can also affect insurance costs.

Jeff Root Licensed Life Insurance Agent

It’s essential to research and compare insurance rates specific to your state when determining the cost of insuring a Cadillac ATS.

In addition to state-specific factors, there are other variables that can impact the cost of insurance for a Cadillac ATS. One such factor is the driver’s age and driving history. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums. Access comprehensive insights into our “Cheapest Car Insurance for 23-Year-Old Drivers.”

Another factor to consider is the level of coverage chosen. Opting for comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, will typically result in higher insurance costs compared to basic liability coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Cadillac ATS Car Insurance Without Sacrificing Coverage

While it’s crucial to obtain adequate coverage for your Cadillac ATS, there are ways to save money without sacrificing coverage levels. One option is to consider increasing your deductible, which is the amount you pay out of pocket before your insurance policy kicks in.

By choosing a higher deductible, you may be able to lower your premium. However, it’s important to weigh the potential savings against the amount you would have to pay in the event of an accident or claim. Delve into our evaluation of “How does the insurance company determine my premium?”

Additionally, taking advantage of discounts and incentives offered by insurance companies can help reduce the cost of insurance for your Cadillac ATS. Some common discounts include safe driver discounts, multiple vehicle discounts, and good student discounts.

Another way to save money on Cadillac ATS car insurance is to bundle your insurance policies. Many insurance companies offer discounts for customers who have multiple policies with them, such as combining your auto insurance with your homeowner’s or renter’s insurance.

Exploring Discounts and Incentives Available for Insuring a Cadillac ATS

Insurance providers may offer a variety of discounts and incentives specifically tailored for insuring a Cadillac ATS. These discounts could include features such as anti-theft device discounts, electronic stability control discounts, and discounts for vehicles equipped with certain safety features.

It’s important to inquire about these potential discounts when obtaining quotes and comparing insurance providers for your Cadillac ATS. Taking advantage of available discounts can help you save money on insurance while still ensuring adequate coverage. Unlock details in our “Compare Car Insurance Quotes.”

The Importance of Proper Coverage Levels for Your Cadillac ATS

When insuring your Cadillac ATS, it’s important to select coverage levels that adequately protect you and your vehicle. While higher coverage limits may result in slightly higher premiums, they can provide greater financial protection in the event of an accident.

Choosing the appropriate liability coverage can help ensure that you are protected if you cause damage to other vehicles or property. Additionally, selecting comprehensive and collision coverage that reflects the value of your Cadillac ATS can help cover the cost of repairs or replacement in case of damage or theft.

It’s crucial to carefully assess your coverage needs and consult with an insurance professional to determine the appropriate coverage levels for your Cadillac ATS. Discover insights in our “Full Coverage Car Insurance: A Complete Guide.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Misconceptions About Insuring a Cadillac ATS

There are several common misconceptions about insuring a Cadillac ATS that can impact your understanding of insurance costs. One misconception is that luxury vehicles inherently have higher insurance rates.

While luxury vehicles can have higher repair and replacement costs, they are often equipped with advanced safety features, which can mitigate potential risks and result in more competitive insurance rates.

Another misconception is that insuring a Cadillac ATS is unaffordable. While insurance rates can vary, there are many ways to find affordable coverage for your Cadillac ATS by comparing quotes, utilizing discounts, and exploring different coverage options. Learn more in our “Lesser Known Car Insurance Discounts.”

How Your Driving Record Can Impact the Cost of Insuring a Cadillac ATS

Your driving record plays a significant role in determining the cost of insuring a Cadillac ATS. Insurance providers assess your driving history to evaluate the likelihood of accidents or claims.

If you have a clean driving record with no accidents or traffic violations, you may be eligible for safe driver discounts, which can help reduce the cost of insurance for your Cadillac ATS. Conversely, a history of accidents or violations can result in higher insurance premiums. See more details on our “Best Safe Driver Car Insurance Discounts.”

It’s essential to maintain a safe driving record and practice responsible driving habits to secure the most favorable insurance rates for your Cadillac ATS.

The Benefits of Bundling Your Cadillac ATS Insurance With Other Policies

One way to save money on Cadillac ATS car insurance is to bundle it with other insurance policies. Insurance companies often offer discounts for bundling multiple policies, such as auto and home insurance or auto and renters insurance.

Melanie Musson Published Insurance Expert

Bundling your insurance can lead to significant savings and simplify the insurance process by having all of your policies with one provider. It’s important to compare quotes and evaluate the overall coverage and savings potential before bundling your Cadillac ATS insurance. Discover more about offerings in our “Can I bundle my car insurance with other policies?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Steps to Take after an Accident to Ensure a Smooth Insurance Claim Process for Your Cadillac ATS

In the unfortunate event of an accident involving your Cadillac ATS, it’s essential to take certain steps to ensure a smooth insurance claim process. First, ensure the safety of all parties involved and contact the necessary authorities.

Document the accident scene by taking pictures and gathering information from any witnesses. Additionally, exchange information with the other driver(s) involved, including insurance details. Delve into our evaluation of “Why You Should Always Take Pictures After a Car Accident.”

Notify your insurance company as soon as possible and provide all relevant information about the accident. Your insurance company will guide you through the claims process and provide assistance in repairing or replacing your Cadillac ATS.

The Role of Deductibles in Determining the Cost of Insuring a Cadillac ATS

The deductible is an essential factor in determining the cost of insuring a Cadillac ATS. The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in.

Generally, higher deductibles will result in lower insurance premiums. However, it’s important to carefully consider your financial situation and the potential cost of an accident before selecting a higher deductible. Discover more about offerings in our “What is the difference between a deductible and a premium in car insurance?”

Selecting a deductible that strikes a balance between affordable premiums and reasonable out-of-pocket expenses can help you find the right coverage for your Cadillac ATS.

Factors to Consider When Choosing an Insurance Provider for Your Cadillac ATS

When choosing an insurance provider for your Cadillac ATS, several factors should be considered. Firstly, evaluate the financial stability and reputation of the insurance company. You want to ensure that the company will be able to fulfill its obligations in the event of an accident or claim.

Additionally, customer service and claims handling are critical. Research customer reviews and ratings to get an idea of the company’s level of service and how they handle claims for Cadillac ATS owners.

Furthermore, compare quotes and coverage options from multiple insurance providers to find the best insurance rates and coverage for your Cadillac ATS. Unlock details in our “Multiple owner vehicle who is required to carry insurance.”

By considering these factors, you can make an informed decision when selecting an insurance provider for your Cadillac ATS, ensuring you have the appropriate coverage at the best possible price.

In summary, the cost of Cadillac ATS car insurance can vary depending on various factors such as the driver’s age, location, and coverage options chosen. It’s important to research and compare quotes from multiple insurance providers to find the most affordable and suitable coverage for your Cadillac ATS.

Ty Stewart Licensed Insurance Agent

By understanding the factors that influence insurance rates, exploring available discounts, and selecting appropriate coverage levels, you can secure the best insurance options for your Cadillac ATS.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of insurance for a Cadillac ATS?

The cost of insurance for a Cadillac ATS can be influenced by various factors such as the driver’s age, location, driving history, credit score, coverage limits, deductibles, and the specific model and year of the Cadillac ATS.

For additional details, explore our comprehensive resource titled “Car Driving Safety Guide for Teens and Parents.”

Is insurance more expensive for a Cadillac ATS compared to other cars?

The insurance cost for a Cadillac ATS can vary depending on the factors mentioned earlier. Generally, luxury cars like the Cadillac ATS may have higher insurance rates due to their higher value and potentially higher repair costs.

Are there any discounts available for Cadillac ATS car insurance?

Insurance companies often offer various discounts that can help reduce the cost of insurance for a Cadillac ATS. These discounts may include safe driver discounts, multi-policy discounts, anti-theft device discounts, good student discounts, and more. It’s recommended to check with insurance providers to see what discounts are available.

What is the average cost of insurance for a Cadillac ATS?

The average cost of insurance for a Cadillac ATS can vary depending on multiple factors. However, the estimated average monthly insurance cost for a Cadillac ATS is around $125 to $167.

How can I find the best insurance rate for a Cadillac ATS?

To find the best insurance rate for a Cadillac ATS, it’s advisable to shop around and compare quotes from different insurance companies. Additionally, maintaining a good driving record, opting for higher deductibles, and considering bundling insurance policies can help in obtaining a more favorable insurance rate.

To find out more, explore our guide titled “How To Get Free Insurance Quotes Online.”

What is the typical insurance cost for a 2014 Cadillac ATS?

The insurance cost for a 2014 Cadillac ATS can vary widely based on factors such as your driving history, location, and the level of coverage chosen, but average monthly rates typically range from around $100 to $125.

What type of car insurance is cheapest?

Generally, fully comprehensive insurance tends to be the most affordable option, although individual circumstances can affect the pricing.

Is owning a Cadillac expensive?

Cadillacs are known for having some of the highest maintenance costs in the automotive industry. RepairPal, a resource for auto repair information, notes that Cadillacs typically cost about $65 per month to maintain, with certain models potentially costing more.

Is Progressive cheaper than Geico?

Geico and Progressive both provide affordable car insurance nationwide. Generally, Geico’s monthly rates are lower, while Progressive often presents more competitive rates for high-risk drivers—those with recent DUIs, at-fault accidents, or speeding violations on their records.

To learn more, explore our comprehensive resource on “Does my car insurance cover damage caused by a DUI or other criminal activity?”

What is the best car insurance for bad credit?

Based on our rate estimates, the top providers offering affordable auto insurance for individuals with lower credit scores are USAA, Geico, Nationwide, and Progressive.

Are older or newer cars cheaper to insure?

Is insurance cheaper if your car is paid off?

Are Cadillac ATS expensive to maintain?

What is the average income of a Cadillac owner?

Can my credit score lower my car insurance?

Do car insurance quotes hurt your credit?

What is the most trusted car insurance company?

How much does it cost to insure a Cadillac CTS?

Are parts for Cadillac more expensive?

Do Cadillacs depreciate quickly?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.