Best Business Insurance for eCommerce Businesses in 2026 (Top 10 Companies)

Discover the top providers offering the best business insurance for eCommerce businesses. Enjoy substantial discounts of up to 25% on carefully tailored coverage options to meet your business requirements. Safeguard your online success and ensure seamless continuity of operations.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Company, Healthl...

Melissa Morris

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated February 2025

82 reviews

82 reviewsCompany Facts

Full Coverage for eCommerce Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews 1,734 reviews

1,734 reviewsCompany Facts

Full Coverage for eCommerce Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for eCommerce Businesses

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsWhether you’re selling physical products, providing services, or managing a website, having the right insurance can help safeguard your business against potential risks and ensure its long-term success. Enter your ZIP code above to get started on comparing business insurance quotes.

Our Top 10 Company Picks: Best Business Insurance for eCommerce Businesses

| Company | Rank | Cyber Liability Discount | Business Owner's Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

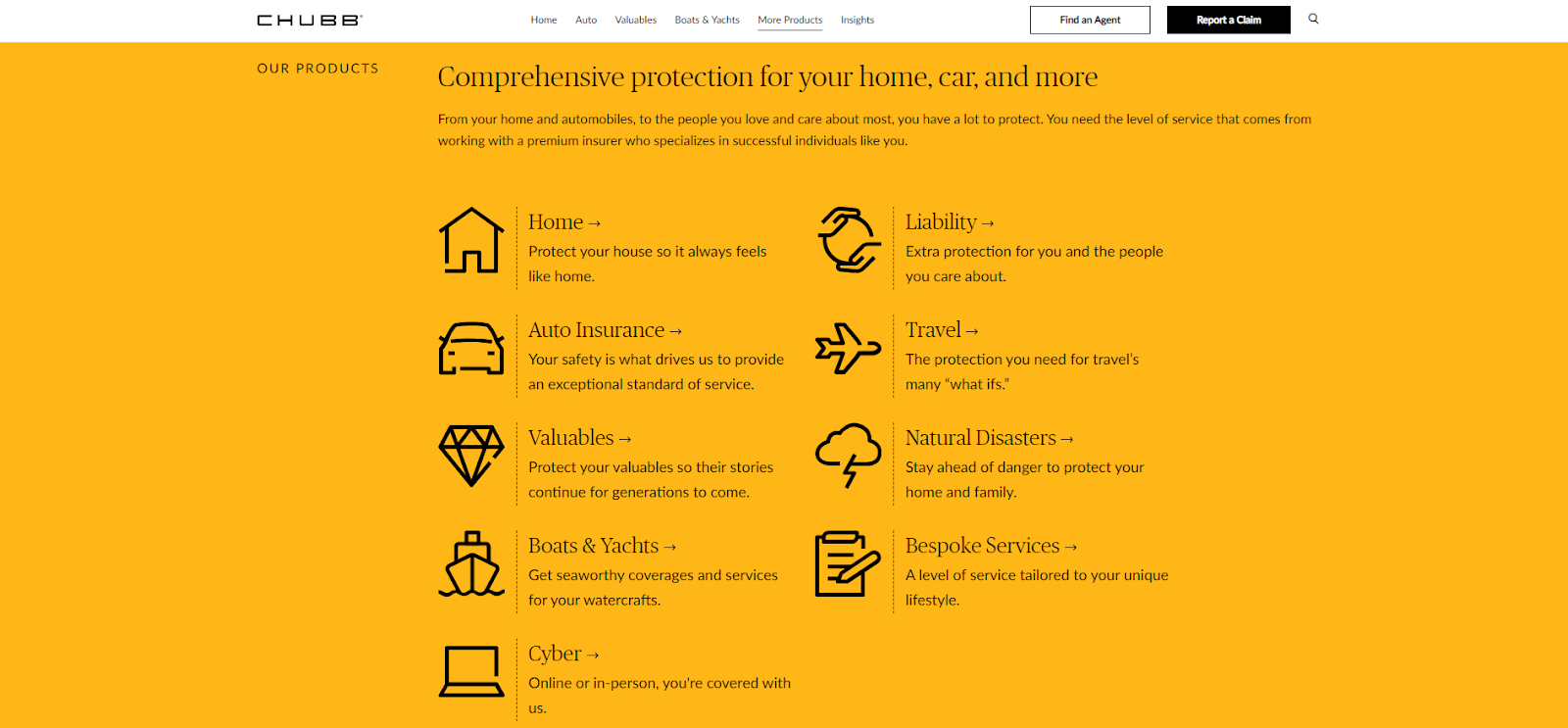

| #1 | 10% | 15% | Specialized Coverage | Chubb |

|

| #2 | 8% | 12% | Accident Forgiveness | Travelers |

|

| #3 | 7% | 14% | Comprehensive Coverage | State Farm |

|

| #4 | 9% | 13% | Online Convenience | Progressive |

|

| #5 | 8% | 12% | Bundling Policies | Nationwide |

|

| #6 | 6% | 10% | Customizable Polices | Liberty Mutual |

| #7 | 7% | 15% | Deductible Reduction | The Hartford |

| #8 | 5% | 11% | Customer Service | Farmers |

|

| #9 | 8% | 14% | Add-on Coverages | Allstate |

|

| #10 | 6% | 12% | Customizable Coverage | American Family |

Explore comprehensive solutions that guarantee optimal protection, allowing you to focus on growing your online business with confidence.

- Top business insurance providers for eCommerce are Chubb, Travelers, State Farm

- Discounts up to 25% on tailored coverage

- Comprehensive coverage for best ecommerce business insurance

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Protect Your Online Store: The Importance of Business Insurance for eCommerce Businesses

Ecommerce businesses need insurance to mitigate the financial risks associated with their operations. While online stores may not have the same liabilities as physical retailers, they still face unique challenges that can impact their profitability and reputation. Here are some reasons why insurance is crucial for ecommerce businesses:

- Shipping-Related Risks: Whether you handle shipping in-house or use dropshipping, shipping issues can lead to financial losses and dissatisfied customers. Ecommerce business insurance can cover costs arising from shipping delays, lost or damaged shipments, and other related problems.

- Product Liability: If your business sells physical products, you need protection against potential claims of defective or harmful products. Product liability insurance can help cover legal expenses, medical costs, and settlements in case a customer is injured or experiences property damage due to a product you sell.

- Legal Claims and Lawsuits: Ecommerce businesses can be vulnerable to legal claims and lawsuits from customers, competitors, or other parties. Having insurance coverage can help protect your business by providing funds for legal defense, settlement costs, and potential damages.

- Business Interruption: Unexpected events such as natural disasters or accidents can disrupt your ecommerce operations. Business interruption insurance ensures that you have financial support to cover lost income and essential expenses during these challenging times, allowing your business to recover more quickly.

- Cybersecurity Threats: With the increasing prevalence of cyberattacks, protecting your online store from data breaches and other cybersecurity risks is essential. Cybersecurity insurance can provide coverage for costs associated with data breaches, including customer notification, credit monitoring, and legal expenses.

- Specific Industry Regulations: Depending on your location and the nature of your ecommerce business, there may be specific insurance requirements imposed by local regulations. It’s important to understand and comply with these regulations to avoid potential penalties or legal issues.

Securing business insurance for your ecommerce store is a vital step toward safeguarding your investment and ensuring the longevity of your business. By taking the time to assess your unique risks and choose the right coverage, you can protect your online store against shipping issues, product liability, legal claims, business interruptions, cybersecurity threats, and regulatory challenges.

Jeff Root Licensed Life Insurance Agent

By having the right insurance coverage in place, ecommerce businesses can minimize financial risks, ensure continuity of operations, and protect their reputation in the marketplace. Find additional information in “What is Marketplace?”

Safeguard Your Online Success: Exploring Essential Business Insurance for eCommerce Businesses

Now that we understand the importance of insurance for ecommerce businesses, let’s explore some of the key types of coverage available:

- General Liability Insurance: This coverage protects your business against claims of bodily injury or property damage that occur during the course of your operations. It covers medical expenses, legal fees, and settlements resulting from accidents or incidents involving customers or third parties.

- Product Liability Insurance: If your business sells physical products, product liability insurance is crucial. It provides protection against claims arising from defective products, injuries caused by product use, or damages resulting from faulty merchandise. This coverage helps cover legal expenses, medical costs, and potential settlements.

- Cybersecurity Insurance: Given the increasing threat of cyberattacks, cybersecurity insurance is essential for protecting your online store and customer data. It covers costs related to data breaches, including customer notification, credit monitoring, forensic investigations, legal expenses, and potential damages resulting from the breach.

- Business Interruption Insurance: This coverage is designed to help your business recover from unexpected events that disrupt your operations, such as natural disasters, fires, or other incidents. It provides financial support to cover lost income, ongoing expenses, and the costs of getting your business back up and running.

- Workers’ Compensation Insurance: If you have employees, workers’ compensation insurance is typically required by law. It provides coverage for medical expenses and lost wages if an employee is injured or becomes ill on the job. Explore “What is Worker’s compensation?” to learn more.

- Professional Liability Insurance: Also known as errors and omissions insurance, professional liability insurance protects businesses that provide professional services. It covers claims of negligence, errors, or omissions that result in financial losses for clients or third parties.

These are just a few examples of insurance coverage options available for ecommerce businesses.

The specific types and extent of coverage you need will depend on factors such as the nature of your business, the products or services you offer, and your location.

Understanding the Cost: Estimating Business Insurance Expenses for eCommerce Businesses

The cost of ecommerce insurance can vary depending on several factors, including:

- Size and Revenue of Your Business: Larger businesses with higher revenue may have higher insurance costs due to increased liability exposure.

- Nature of Your Business: Certain industries or products may carry higher risks, leading to higher insurance premiums. Find out more about “How does the insurance company determine my premium?” to enhance your understanding.

- Coverage Limits and Deductibles: The level of coverage and deductibles you choose will affect the cost of insurance.

- Claims History: A history of past claims may result in higher insurance costs.

- Location: Insurance costs can vary based on your business’s location, including local regulations and risk factors specific to the area.

To determine the cost of insurance for your ecommerce business, it’s advisable to obtain quotes from multiple insurance providers. By comparing the coverage options and costs, you can make an informed decision that best suits your business’s needs and budget.

eCommerce Business Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$70 $180

$60 $160

$75 $200

$73 $195

$71 $185

$67 $175

$73 $190

$65 $170

$63 $165

$70 $180

For an eCommerce business, American Family offers the best monthly rates for both full coverage and minimum coverage. American Family provides full coverage for $160 per month and minimum coverage for $60 per month. This makes American Family the most cost-effective choice compared to other insurance companies.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: How Business Insurance Safeguards eCommerce Businesses

Explore how business insurance plays a pivotal role in safeguarding eCommerce ventures through three compelling case studies. From tailored coverage to specialized features, discover how insurance partnerships empower businesses to navigate challenges and thrive in the digital marketplace.

- Case Study #1 – Elevating Protection With Specialized Coverage: Elegantcrafts found tailored insurance from Chubb for their unique handmade products, ensuring coverage against shipping damages. With Chubb’s risk management expertise, they implemented safety measures, enabling confident international expansion and enhancing their online boutique’s reputation.

- Case Study #2 – Experience Peace of Mind With Accident Forgiveness: Fastwheels Auto Parts found relief from soaring insurance costs with Travelers’ accident forgiveness feature, aiding financial planning. Streamlined policy management and bundling discounts made Travelers a trusted partner for their fleet-focused eCommerce business. For more information, read our “Fleet Vehicle Insurance: A Complete Guide.“

- Case Study #3 – Unmatched Security Through Comprehensive Coverage: Techgadgets Hub chose State Farm for comprehensive insurance due to its reputation and varied coverage options, enabling tailored protection for their diverse product range. Despite slightly higher costs, State Farm’s personalized service and extensive coverage provided peace of mind, allowing Techgadgets Hub to thrive with unmatched security.

These case studies underscore the critical importance of robust insurance coverage for eCommerce enterprises. By partnering with trusted insurers like Chubb, Travelers, and State Farm, businesses can fortify themselves against uncertainties, enabling growth, confidence, and peace of mind in an ever-evolving landscape.

Summary: Safeguarding eCommerce Success – The Importance of Business Insurance

Insurance plays a crucial role in the success and sustainability of ecommerce businesses. With the unique risks and liabilities associated with online operations, having the right coverage is essential. Whether it’s protecting against shipping delays, product defects, or legal claims, insurance provides a safety net to mitigate financial losses and maintain business continuity.

General liability insurance safeguards businesses against bodily injury and property damage claims, while product liability insurance is vital for those selling physical products to protect against potential defects and injuries. Learn more from “Commercial General Liability (CGL) Insurance: A Complete Guide.”

Cybersecurity insurance is increasingly important in today’s digital landscape, offering coverage for data breaches and related expenses. Business interruption insurance helps ecommerce businesses recover from unexpected events and resume operations smoothly.

Schimri Yoyo Licensed Agent & Financial Advisor

Insurance costs vary based on factors like business size, industry, coverage limits, and location. Comparing quotes from various providers helps find the best coverage for your needs and budget. Insurance safeguards your ecommerce business’s financial stability, reputation, and customer trust, allowing you to focus on growth with peace of mind.

Partner with a reliable insurance provider and assess your specific risks for comprehensive coverage. Understanding insurance and securing the right coverage empowers ecommerce businesses to thrive confidently. Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

Frequently Asked Questions

What insurance do you need for an online shop?

For an online shop, essential insurance coverage includes general liability insurance, product liability insurance, cyber liability insurance, and business interruption insurance. To find the best ecommerce business insurance, it’s advisable to compare quotes from various providers.

What insurance is most important for a business?

The most important insurance for a business depends on its nature and operations. However, general liability insurance is often considered crucial as it provides coverage for bodily injury, property damage, and advertising injury claims. To find the best ecommerce insurance, businesses should consider their specific needs and compare options.

Find the best commercial insurance rates for your ecommerce business by entering your ZIP code into our free comparison tool below.

Who takes product liability insurance?

Product liability insurance is typically taken by manufacturers, wholesalers, distributors, and retailers to protect against claims arising from the use of their products. It’s an important component of the best insurance for ecommerce to mitigate risks associated with selling products online.

For additional information, check out “Best Business Insurance for Wholesale Distributors“

Do you need insurance for e-commerce?

Yes, insurance is necessary for ecommerce businesses to protect against various risks such as product liability claims, cyber threats, and business interruptions. Finding the best insurance for ecommerce business involves assessing risks and obtaining tailored coverage options.

Is e-commerce a high-risk business?

E-commerce can involve certain risks, such as cyber attacks, product defects, and shipping-related issues. However, with proper risk management strategies and insurance coverage, these risks can be mitigated. It’s important for e-commerce businesses to invest in the best insurance for ecommerce to safeguard their operations.

Do you need insurance to sell on Etsy?

While Etsy doesn’t require sellers to have insurance, it’s advisable to have coverage such as general liability insurance and product liability insurance to protect against potential risks. Sellers on Etsy should explore options to find the best insurance for ecommerce business to mitigate liabilities.

Explore “Best Business Insurance for Etsy Businesses” for insights.

What is e-commerce liability?

E-commerce liability refers to the legal responsibility that online businesses have for any harm or damage caused to customers, third parties, or their property as a result of their products or services. To protect against e-commerce liability, businesses should consider obtaining the best insurance for ecommerce business.

What three things are required for eCommerce?

Three essential components for eCommerce include a website or online platform, products or services to sell, and a secure payment gateway to process transactions. To ensure smooth operations, e-commerce businesses should also prioritize obtaining the best insurance for e-commerce.

Is insurance necessary for dropshipping businesses?

Yes, insurance is necessary for dropshipping businesses to protect against various risks such as product liability claims, shipping-related issues, and cyber threats. Dropshipping businesses should prioritize obtaining the best insurance for ecommerce to safeguard their operations and mitigate liabilities effectively.

Consider reading “Best Business Insurance for Amazon Drop Shippers” for more.

What is the difference between general insurance and product liability insurance?

General liability insurance provides coverage for various liability claims, including bodily injury, property damage, and advertising injury. Product liability insurance specifically covers claims related to injuries or damages caused by products sold or manufactured by a business. Understanding these differences is crucial in selecting the best insurance for ecommerce.

Which type of insurance is advisable to avoid?

How would you explain the importance of insurance for a business owner?

What are the benefits of insurance to customers?

What insurance do you need for a physical shop?

Does Shopify provide insurance coverage?

Do you need insurance on a product before selling it online?

What is cyber insurance, and what does it generally cover?

Does business insurance typically cover cyber attacks?

What type of insurance is used the most in eCommerce?

How can a business owner ensure they have adequate insurance coverage for their eCommerce venture?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.