Best Business Insurance for Haunted Houses in 2026 (Your Guide to the Top 10 Companies)

Travelers, Nationwide, and Progressive offer the best business insurance for haunted houses, starting at just $220 a month. These providers excel in comprehensive coverage options tailored specifically for the unique needs of haunted houses. Their policies ensure robust protection against common industry risks.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Natasha McLachlan is a writer who currently lives in Southern California. She is an alumna of California College of the Arts, where she obtained her B.A. in Writing and Literature. Her current work revolves around insurance guides and informational articles. She truly enjoys helping others learn more about everyday, practical matters through her work.

Natasha McLachlan

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated February 2025

hide

1,734 reviews

1,734 reviewsCompany Facts

Full Coverage for Haunted Houses

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Haunted Houses

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Haunted Houses

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews

When operating a haunted house business, it is crucial to have insurance coverage to protect your business against various risks, especially personal injury lawsuits. In this article, we will explore the importance of insurance for haunted houses and the different types of commercial insurance coverage you should consider.

Our Top 10 Company Picks: Best Business Insurance for Haunted Houses

| Company | Rank | Property Liability Discount | Special Events Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 15% | Specialized Coverage | Travelers | |

| #2 | 10% | 13% | Business-Property Coverage | Nationwide |

| #3 | 11% | 14% | Policy Options | Progressive | |

| #4 | 14% | 17% | Online Convenience | Chubb | |

| #5 | 13% | 16% | Tailored Coverage | CNA | |

| #6 | 11% | 14% | Add-on Coverages | The Hartford |

| #7 | 10% | 13% | Bundling Policies | Farmers | |

| #8 | 9% | 12% | Usage Discount | Liberty Mutual |

| #9 | 8% | 11% | Business-Owners Policy | Allstate | |

| #10 | 9% | 12% | Local Agents | State Farm |

We’ll also provide information on finding the best insurance providers and factors that determine the cost of insurance. Additionally, we’ll discuss common situations covered by general liability insurance and other types of coverage that haunted house businesses should have. Finally, we’ll offer some additional steps you can take to protect your business.

Use our free quote comparison tool above and find the best business insurance company for your budget and needs.

- Travelers offers the best rates and coverage for haunted houses

- Policies address common risks like injuries and property damage

- Tailored insurance options cater specifically to haunted house businesses

Haunted Houses Business Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $225 | $675 | |

| $260 | $780 | |

| $220 | $660 | |

| $245 | $735 | |

| $255 | $765 |

| $230 | $700 |

| $240 | $720 | |

| $230 | $690 | |

| $235 | $705 |

| $250 | $750 |

The coverage rates for haunted houses vary significantly across different insurance companies. Allstate, for example, offers minimum coverage starting at $225 and goes up to $675 for full coverage. Comparatively, CNA presents a slightly lower entry point at $220 with full coverage reaching up to $660. On the higher end, Chubb’s rates start at $260 and peak at $780.

For those seeking a balance between affordability and comprehensive protection, companies like Nationwide and State Farm provide plans starting at $230, with their full coverage capping at $700 and $690, respectively. These variations in pricing highlight the importance of comparing both the lower and upper limits of what insurers offer to ensure that both basic and extensive needs are met within budget constraints.

The Best Insurance Coverage for Haunted House Businesses

General liability insurance is a fundamental component of insurance coverage for haunted house businesses. It provides protection against a wide range of risks and is designed to safeguard your business from claims related to personal injury, property damage, and advertising injury. Here are some key points to understand about general liability insurance:

- Coverage for Personal Injury: Whether it’s a slip and fall accident, a customer getting injured by a prop, or someone experiencing emotional distress, general liability insurance can cover medical expenses, legal fees, and settlements or judgments resulting from such claims.

- Coverage for Property Damage: If a visitor’s personal belongings get damaged due to the actions of your staff or the environment within the attraction, general liability insurance can help cover the cost of repair or replacement.

- Coverage for Advertising Injury: Haunted house businesses often engage in advertising and marketing activities to attract customers. General liability insurance can offer protection against the types of advertising injury claims.

- Legal Defense Costs: In addition to covering settlements and judgments, general liability insurance also helps with legal defense costs. If your haunted house business is sued, the insurance policy can cover attorney fees, court expenses, and other related costs associated with defending your business against the claim.

- Coverage Extensions: These extensions can provide additional protection tailored to the unique risks faced by haunted house businesses. Some common coverage extensions include liquor liability insurance, professional liability insurance, and cyber liability insurance.

Carefully review the terms and conditions of your general liability insurance policy to understand the specific coverage limits, exclusions, and any additional endorsements or extensions available.

By having the appropriate general liability coverage, you can mitigate financial risks and protect your haunted house business from potential lawsuits and claims.

Unveiling the Protection: General Liability Insurance for Haunted House Businesses

General liability insurance provides coverage for a wide range of risks that haunted house businesses may encounter. Here is a list of common risks covered by general liability insurance:

- Slip and Fall Accidents: If a customer or visitor slips, trips, or falls within your haunted house premises and suffers injuries, general liability insurance can cover medical expenses, legal fees, and potential settlements or judgments arising from such incidents.

- Property Damage: Accidental damage to customers’ property, such as personal belongings, caused by your haunted house activities or staff, can be covered by general liability insurance. This includes situations where props or decorations may inadvertently cause damage.

- Personal Injury: General liability insurance can protect your business against claims of personal injury, which may arise from incidents like physical contact with visitors, emotional distress caused by fright or intense experiences, or allegations of false imprisonment.

- Advertising Injury: Haunted house businesses engage in various advertising and promotional activities. General liability insurance can cover claims related to advertising injury, such as defamation, copyright infringement, or false advertising, which may arise from your marketing efforts.

- Product Liability: If your haunted house sells merchandise, such as costumes or souvenirs, and a customer claims to have been harmed or injured by a defective product, general liability insurance can provide coverage for product liability claims.

- Completed Operations: Completed operations coverage protects your business against claims that arise from incidents or injuries that occur after a customer has left your haunted house but can be linked back to their experience at your attraction.

- Legal Defense Costs: General liability insurance can help cover the costs of legal defense, including attorney fees, court expenses, and settlements or judgments, if your business is sued due to a covered claim.

Each insurance policy may have specific terms, conditions, and exclusions, so it’s crucial to review your policy carefully to understand the exact coverage provided by your general liability insurance.

Jeff Root Licensed Life Insurance Agent

By having comprehensive general liability coverage, you can protect your haunted house business from potential financial losses and focus on providing an enjoyable and safe experience for your customers. To learn more, explore our comprehensive resource on “Commercial General Liability (CGL) Insurance: A Complete Guide.”

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Insurance Choices for Your Haunted House Business

When seeking insurance coverage for your haunted house business, you have several options to consider. Here are some places where you can explore and obtain the coverage you need:

Traditional Insurance Companies:

To insure your haunted house business, consider reaching out to well-established insurance companies specializing in business insurance, as they often offer policies tailored to your industry. Additionally, local insurance agents or brokers can help evaluate your needs and connect you with suitable providers.

For more on the benefits of working with agents, see our article “How much do insurance agents make?“. Also, research companies known for comprehensive coverage, excellent customer service, and competitive pricing to ensure you get the best protection for your business.

Online Insurance Providers:

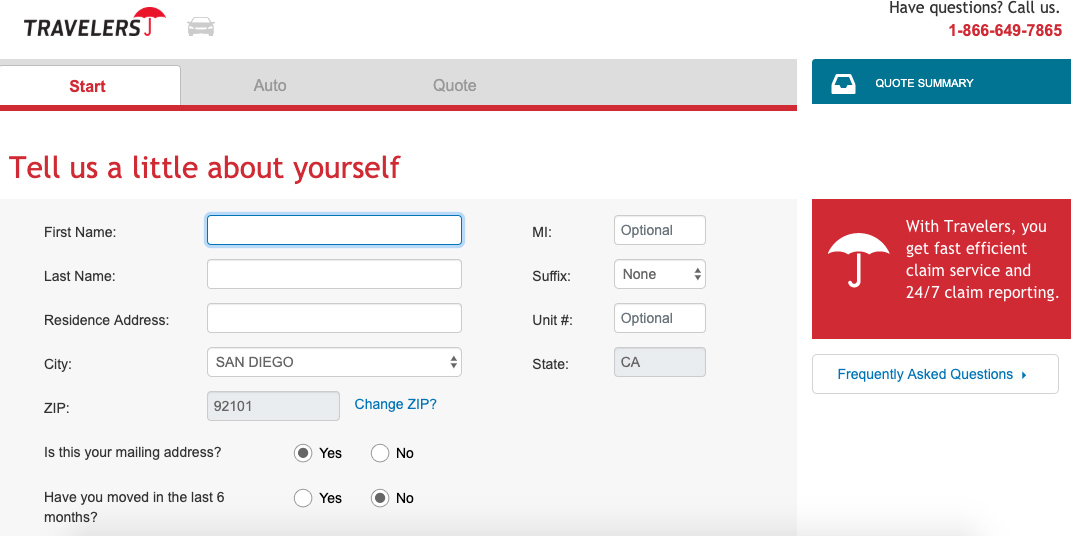

When searching for insurance for your business, consider exploring online insurance marketplaces. These platforms provide a convenient method to compare quotes from various providers, featuring user-friendly interfaces that enable you to tailor coverage options to meet your specific needs.

Additionally, some online insurance companies specialize in serving small businesses and may offer insurance solutions specifically for haunted house businesses, complete with a streamlined purchasing process. It’s also beneficial to look for online insurance providers that boast positive customer reviews, transparent policies, and accessible customer support to ensure a satisfactory experience.

Industry Associations and Groups:

Investigate whether there are any industry associations or groups tailored specifically for haunted house businesses. These organizations often have exclusive partnerships with insurance providers, potentially offering specialized coverage options or discounts to their members.

Additionally, consider engaging with fellow haunted house business owners at industry forums or networking events. This interaction can be a valuable source of recommendations and insights, as these owners might share their experiences with insurance providers they have successfully partnered with.

Insurance Brokers:

Consider the benefits of partnering with an insurance broker who specializes in commercial insurance for haunted house businesses. These brokers possess an extensive understanding of the insurance market, which equips them to expertly guide you through the myriad of coverage options available.

They can meticulously analyze your specific business requirements, advocate on your behalf by shopping around, and engage in negotiations with insurance companies. This approach ensures that you receive the most appropriate coverage tailored to your needs, all while securing competitive rates.

Remember to gather multiple quotes and compare the coverage, policy terms, and pricing offered by different providers. This allows you to make an informed decision and choose the insurance provider that best meets your haunted house business’s requirements.

Covering Unique Situations: Specialized Coverage for Haunted House Businesses

In addition to general liability insurance, there are several other types of coverage that can be beneficial for a haunted house business. These additional policies address specific situations and risks that may arise in the operation of your haunted house. Here are some key types of coverage to consider:

- Liquor Liability Insurance: This coverage protects your business from claims and damages related to alcohol-induced incidents. It can cover incidents such as injuries caused by intoxicated patrons, property damage resulting from intoxicated behavior, or accidents caused by drunk driving after leaving your haunted house premises.

- Professional Liability Insurance: It also known as errors and omissions insurance, can provide coverage in case of claims related to professional negligence, errors, or omissions committed by your employees or contractors. This coverage can help protect your business if a visitor claims they were harmed or injured due to the actions or negligence of your performers.

- Cyber Liability Insurance: It helps safeguard your business from the financial consequences of such incidents. It can provide coverage for costs related to data breach notifications, forensic investigations, credit monitoring services for affected individuals, legal expenses, and potential liability claims resulting from the breach.

- Employment Practices Liability Insurance (EPLI): This type of insurance protects your business against claims made by employees regarding employment-related issues, such as discrimination, wrongful termination, sexual harassment, or violation of labor laws.

- Property Insurance: This coverage protects your physical assets from risks like fire, vandalism, theft, or natural disasters. It can help cover the cost of repairs, replacements, and any resulting business interruption.

- Workers’ Compensation Insurance: It is necessary to protect your employees in case of work-related injuries or illnesses. If an employee slips and falls, suffers an injury from a prop, or experiences health issues due to exposure to special effects, workers’ compensation insurance can cover medical expenses, rehabilitation costs, and a portion of lost wages.

These are just a few examples of specific situations coverage that may be relevant to your haunted house business.

It’s important to assess the unique risks and needs of your business and consult with insurance agents (read our “Best Business Insurance for Insurance Agents” for more information) to determine the most appropriate coverage options.

Calculating the Price: General Liability Insurance for Haunted Houses

The cost of general liability insurance for a haunted house business can vary based on several factors. To give you a better understanding, here are some key factors that insurance providers consider when determining the cost of your policy:

The location of your haunted house is a crucial factor in determining insurance costs. If it is situated in an area with higher crime rates or a history of frequent lawsuits, you may face higher insurance premiums. Additionally, the annual revenue of your haunted house significantly influences insurance costs, as higher revenue often indicates a larger scale of operations, which can lead to increased premiums.

The number of employees also plays a role; more employees typically increase the risk of accidents or potential liability claims, consequently driving up premiums. Insurance companies also take into account your claims history to assess the risk associated with your business; a haunted house with frequent claims or lawsuits will likely incur higher insurance costs.

Melanie Musson Published Insurance Expert

Furthermore, the coverage limits you select for your general liability insurance policy affect the cost; opting for higher coverage limits provides more financial protection but also comes with higher premiums. If you choose to add extra coverage, such as liquor liability insurance or professional liability insurance, this will also increase the overall cost of your insurance package.

These factors can vary between insurance providers, and each provider may have their own method of calculating premiums (For more information, read our “How does the insurance company determine my premium?”). To find the most accurate and competitive quote, it’s recommended to obtain multiple quotes from different insurers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Going Beyond Insurance: Enhancing the Safety of Your Haunted House Business

In addition to obtaining insurance coverage, there are several proactive measures you can take to further protect your haunted house business. Implementing these steps will help minimize risks, enhance safety measures, and provide a secure environment for your customers and employees. Consider the following eight actions:

- Implement thorough safety protocols. Establish comprehensive safety procedures and protocols to ensure that your haunted house operates in a safe and secure manner.

- Train employees on safety measures. Provide comprehensive training to your employees on safety protocols, emergency procedures, and customer interaction.

- Maintain proper documentation. Keep detailed records of safety inspections, maintenance activities, and employee training. Proper documentation can be valuable in demonstrating your commitment to safety and risk management in the event of a claim or lawsuit.

- Establish clear policies and guidelines. Develop and enforce clear policies and guidelines regarding customer safety, employee conduct, and risk management.

- Conduct regular safety drills. Perform regular safety drills to train your staff on emergency procedures such as evacuations, first aid, and response to potential incidents.

- Secure the premises. Implement appropriate security measures to protect your haunted house premises, including installing security cameras, alarms, and adequate lighting.

- Obtain legal and insurance advice. Consult with legal professionals and insurance providers who specialize in haunted house businesses.

- Regularly review and update your insurance coverage. As your haunted house business evolves and grows, periodically review your insurance coverage to ensure it aligns with your current needs.

By implementing these additional steps, you demonstrate a strong commitment to safety, risk management, and customer satisfaction.

Prioritizing the security and well-being of your customers and employees not only safeguards your business but also enhances your reputation as a responsible and reliable haunted house operator.

Learn more: Life and Death: Exploring Haunted Houses in the U.S.

Case Studies: Mitigating Risks With Business Insurance for Haunted Houses

Business insurance plays a vital role in safeguarding companies from unforeseen risks and liabilities. This article examines several case studies on how different types of insurance provide essential protection for businesses in specialized sectors.

- Case Study #1 – General Liability Insurance in Action: A haunted house owner, let’s call them Alex, runs a popular haunted attraction with various interactive elements. During the peak season, a customer accidentally trips over a prop and suffers a broken arm. The customer decides to file a lawsuit against the haunted house, claiming negligence and seeking compensation for medical expenses and pain and suffering.

- Case Study #2 – Commercial Property Insurance Safeguards: Imagine a scenario where a fire breaks out in the storage area of a haunted house, causing significant damage to props, decorations, and the building itself. Without commercial property insurance, the haunted house owner, let’s call them Emily, would face substantial losses and potentially struggle to recover.

- Case Study #3 – Workers’ Compensation Coverage for Employee Injuries: In a haunted house that utilizes actors, makeup artists, and other staff, there is a risk of on-the-job injuries. Consider the case of Sarah, an actor working at a haunted house. One evening, Sarah slips and falls on a wet surface, resulting in a severe back injury.

- Case Study #4 – Commercial Umbrella Insurance for Costly Lawsuits: The commercial umbrella policy extends the liability coverage beyond the general liability policy limit, covering the excess or excluded (read our “What is exclusion?” for more information) costs associated with the lawsuit. This coverage ensures that Michael’s haunted house business is protected from significant financial losses resulting from high-value claims.

The discussed case studies clearly demonstrate the importance of comprehensive business insurance. By covering a range of incidents from property damage to personal injuries, insurance ensures that businesses can operate smoothly and withstand potential financial challenges.

In Recap: Business Insurance for Haunted Houses

Running a haunted house business entails risks that necessitate adequate insurance coverage. General liability insurance serves as a crucial policy, protecting against customer injuries and property damage. Commercial property insurance shields the business from unforeseen events, while workers’ compensation insurance supports employees in case of work-related injuries.

Laura Walker Former Licensed Agent

Commercial umbrella insurance provides additional coverage for high-value claims. By combining comprehensive insurance coverage (read our “What is comprehensive coverage?” for more information) with proactive safety measures, haunted house owners can create thrilling experiences while protecting their business and assets.

Assessing individual needs and consulting with insurance professionals is vital for tailoring coverage to specific requirements. With the right insurance in place, owners can focus on delivering unforgettable scares and ensuring the long-term success of their haunted house venture.

Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

Frequently Asked Questions

How important is insurance for haunted house businesses, and why should I consider it?

Insurance is crucial for haunted house businesses as it provides protection against various risks, especially personal injury lawsuits. It safeguards your business and assets, offering financial support in case of unexpected events.

For additional details, explore our comprehensive resource titled “Insurance Quotes Online.”

What are the top three insurance providers for haunted houses, and what sets them apart?

Travelers, Nationwide, and Progressive lead the pack. Travelers offers specialized coverage and discounts, while Nationwide focuses on business-property coverage. Progressive stands out for its flexibility and diverse policy options.

What discounts can I expect when insuring my haunted house, and how do they vary among providers?

Discounts vary, with Travelers offering up to 15%, Nationwide up to 13%, and Progressive up to 14%. These discounts often include multi-policy and usage discounts, contributing to overall cost savings.

What do you need for a haunted house?

There’s lighting, flooring, walls, fencing, props, animatronics, touch pads, sound systems, fog machines and safety equipment – just to name a few.

How do the ratings from A.M. Best impact my choice of insurance provider for a haunted house business?

A.M. Best ratings indicate the financial strength and stability of an insurance company. Opt for providers with higher ratings (like A or A+) as they are more likely to meet their financial obligations and provide reliable coverage.

What is haunted house insurance?

Haunted house insurance is a specialized form of business insurance designed to cover the unique risks associated with operating a haunted attraction, such as injuries to visitors and damage to property.

What factors should I consider when choosing an insurance provider for my haunted house business?

Consider factors like coverage options, discounts, customer reviews, and online convenience. Assess your business’s specific needs to find a provider that offers tailored solutions and aligns with your priorities.

What scares people the most in haunted houses?

The first most common play reactions is the jump scare.

Find the best commercial car and truck insurance for your business needs by entering your ZIP code below into our free comparison tool today.

How can I get a haunted house insurance quote?

To receive a haunted house insurance quote, contact insurance companies that offer specialty coverage for entertainment venues, or fill out an online form on their websites specifying your attraction’s details.

To find out more, explore our guide titled “How to Get Free Insurance Quotes Online.”

Who needs Haunted House Insurance?

Anyone operating a haunted house or haunted attraction, including seasonal events or permanent installations, needs this type of insurance to protect against potential claims and losses.

What types of insurance should you consider for your Haunted House Attraction?

Who are the Marketing Partners for Haunted Attractions?

What other insurance coverage should you consider?

Why is General Liability Insurance important?

What does Commercial Property Insurance cover?

How much does Haunted House Insurance typically cost?

What factors impact the cost of Haunted House Insurance premiums?

How do you build a successful haunted house?

How do I make my house a haunted house?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.