Farmers vs. The Hartford Homeowners Insurance in 2026 (Head-to-Head Review)

Explore the Farmers and The Hartford homeowners insurance with $200k coverage at $120 and $115 per month, respectively, built for older homeowners and AARP members. Our Farmers vs. The Hartford homeowners insurance review compares identity theft, home systems, and full replacement options.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated April 2025

3,072 reviews

3,072 reviewsCompany Facts

$200k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 765 reviews

765 reviewsCompany Facts

$200k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsLook into Farmers vs. The Hartford homeowners insurance to see how each one helps older homeowners and AARP members with special policy programs.

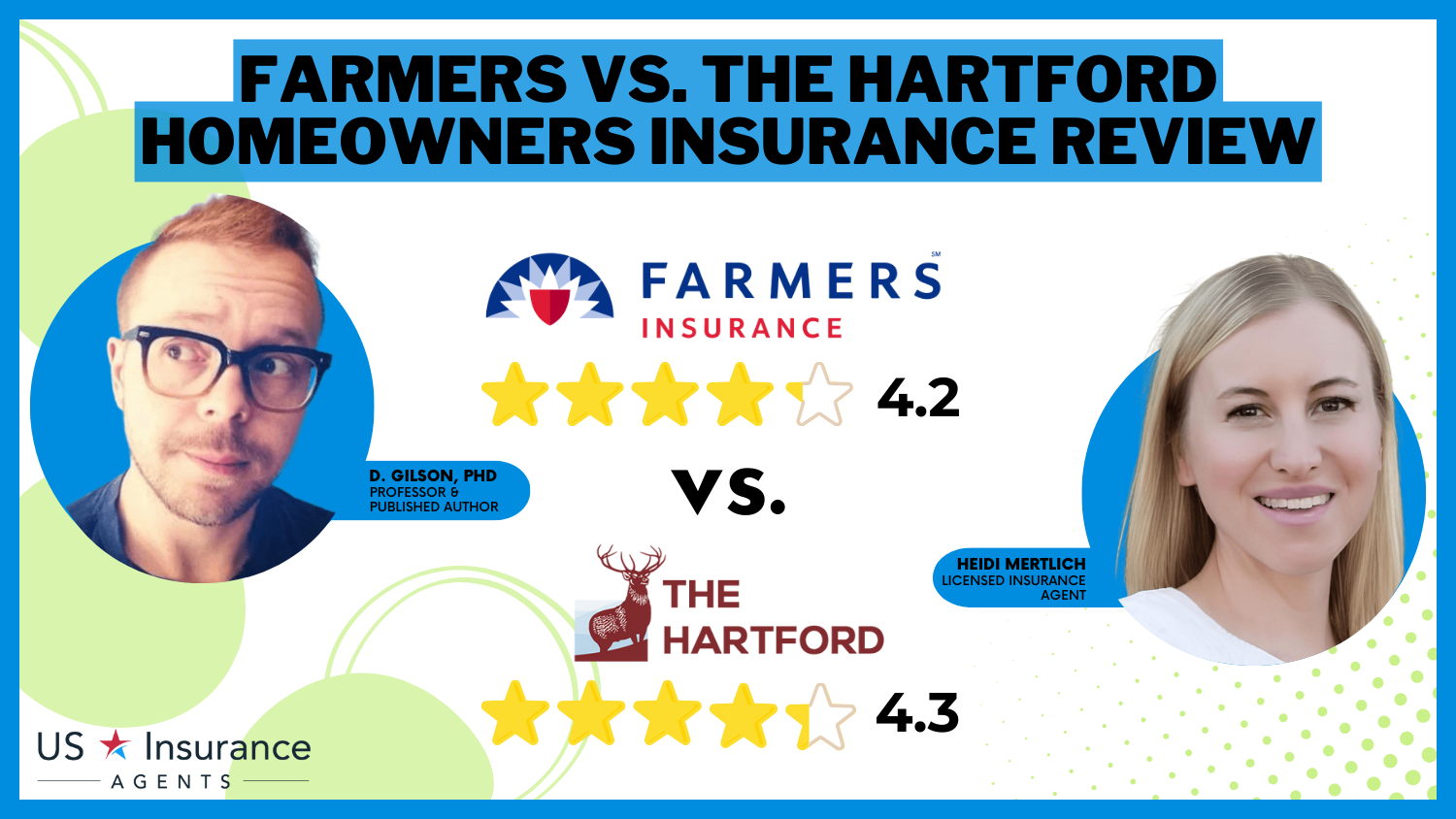

Farmers vs. The Hartford Homeowners Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.2 | 4.3 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 4.8 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.1 |

| Savings Potential | 4.5 | 4.3 |

| Farmers | The Hartford |

Farmers offers flexible coverage for single-family homes, condos, and mobile homes with strong local agent support.

The Hartford stands out with AARP-only perks and full home replacement value. Both include identity theft resolution and home system protection.

- Farmers vs. The Hartford home insurance includes exclusive programs

- Farmers offers local agent access and optional earthquake coverage

- The Hartford supports 24/7 claims and AARP-only replacement perks

Discover which is better between Farmers and The Hartford home insurance by using our free quote comparison tool.

How Farmers and The Hartford Insurance Rates Compare

Compare Farmers vs. The Hartford $1 million policy homeowners insurance rates to see how age and gender affect monthly premiums. Younger policyholders face significantly higher costs, with 16-year-olds paying up to $255 per month. Rates drop steadily with age. Across all categories, The Hartford consistently offers slightly lower premiums than Farmers.

Farmers vs. The Hartford Homeowners Insurance Monthly Rates

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $250 | $240 |

| 16-Year-Old Male | $255 | $245 |

| 30-Year-Old Female | $180 | $175 |

| 30-Year-Old Male | $185 | $180 |

| 45-Year-Old Female | $170 | $160 |

| 45-Year-Old Male | $175 | $165 |

| 60-Year-Old Female | $160 | $150 |

| 60-Year-Old Male | $165 | $155 |

This table shows that The Hartford has better prices, mainly for older people. The biggest price difference is seen with 60-year-olds. On the other hand, Farmers also offer good rates, but they are a bit higher across all age groups. When choosing between these two insurance companies, age and gender become key factors in determining the cost.

Farmers and The Hartford offer competitive rates, with Farmers averaging $120 for a $200k policy and The Hartford just behind at $115.

Home Insurance Monthly Rates by Policy Type

| Insurance Company | $200k Policy | $300k Policy | $500k Policy |

|---|---|---|---|

| $125 | $155 | $205 | |

| $128 | $158 | $208 | |

| $140 | $175 | $225 | |

| $120 | $150 | $200 | |

| $122 | $152 | $202 |

| $118 | $148 | $198 |

| $130 | $160 | $210 | |

| $110 | $140 | $190 | |

| $115 | $145 | $195 |

| $124 | $154 | $204 |

As coverage increases, both providers remain cost-efficient compared to their peers, such as Chubb and Progressive. The table below compares how each insurer ranks across common home policy amounts.

Both Farmers and The Hartford offer broad standard protections, but the additional options differ. Dwelling coverage helps pay to rebuild your home if it gets damaged by things like fire or wind. Personal property coverage protects your things—furniture, clothes, and gadgets—in case they are stolen or ruined.

Farmers vs. The Hartford Home Insurance Coverage Options

| Coverage Type |  |

|

|---|---|---|

| Additional Living Expenses | ✅ | ✅ |

| Dwelling Coverage | ✅ | ✅ |

| Earthquake Insurance | Available through separate policy | Available through separate policy |

| Flood Insurance | Available through separate policy | Available through separate policy |

| Home Systems Protection | ✅ | ✅ |

| Identity Theft Protection | ✅ | ✅ |

| Liability Coverage | ✅ | ✅ |

| Loss of Use | ✅ | ✅ |

| Medical Payments | ✅ | ✅ |

| Personal Injury Protection | Available (subject to state regulations) | Available (subject to state regulations) |

| Personal Property | ✅ | ✅ |

Liability insurance is there if someone sues you because of injury or harm caused by you or your family members. Medical payments cover costs for injuries to guests, no matter who is at fault. Loss of use, sometimes called additional living expenses, pays back temporary housing if your house cannot be lived in.

Both insurance companies have services for resolving identity theft issues and protecting home systems. If you want coverage for earthquakes or floods, you need to get separate policies. Also, whether you can get personal injury coverage depends on the rules of each specific state.

Read more: What a Typical Homeowners Insurance Policy Covers

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers vs. The Hartford: Customer Reviews and Ratings

The table compares consumer satisfaction and industry credibility scores between Farmers and The Hartford. Farmers shows slightly higher satisfaction on Consumer Reports but falls behind in NAIC complaints and A.M. Best strength.

Insurance Business Ratings & Consumer Reviews: Farmers vs. The Hartford

| Agency |  |

|

|---|---|---|

| Score: 706 / 1,000 Lower-Than-Average Satisafaction | Score: 701 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 82/100 High Customer Satisfaction | Score: 74/100 Good Customer Feedback |

|

| Score: 1.70 More Complaints Than Avg. | Score: 1.10 Avg. Complaints |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

The Hartford leads with superior ratings in ethical standards, complaint handling, and financial resilience. Farmers vs. The Hartford homeowners insurance market share shows a big difference in the type of customers.

Melanie Musson Published Insurance Expert

Even though Farmers has only 6% and The Hartford just 1%, the majority, a huge 93%, goes to other insurance companies.

This difference shows that even with good insurance programs from both, they still reach only a portion of customers compared to others.

Comment

byu/overflowingtruth from discussion

inhomeowners

A Reddit user said Farmers was one of the few insurance companies ready to cover their town in wildfire-prone California, and they gave okay rates. But after a major wildfire and a long evacuation, the company canceled all local policies, leaving many people without insurance during a difficult time.

Understanding Homeowners Insurance

Homeowners’ insurance is very important coverage for your property. It helps protect your home and its contents from damage caused by events such as natural disasters, theft, or accidents. This insurance keeps your investment safe and gives you peace of mind about money matters, ensuring you don’t have to face huge costs for repairs or replacements in the event of unexpected losses.

If you don’t have it, you will need to pay all costs yourself for rebuilding and replacing everything. Many mortgage lenders require insurance to protect their investment, so having it is a crucial part of owning a home.

Learn more: Tips for How to Get Cheap Home Insurance

Introduction to Farmers Homeowners Insurance

Farmers Group, Inc.—the parent company of Farmers—is honored to support millions of homes and businesses in every state and the District of Columbia through its customizable Farmers GroupSelect policies, which offer both discounts and flexible coverage options tailored to your needs and budget.

Farmers Insurance, which has more than 90 years of experience and a good financial rating, provides homeowners insurance that you can customize for different homes.

This includes single-family houses, condos, and mobile homes. Supported by many agents across the country, Farmers offers protection for your house’s structure and personal items inside the home, and liability coverage if someone gets hurt on your property or damage to others’ properties is caused by you or family members living with you.

It also includes extra living costs if you cannot live in your home because of a covered event, like a fire or severe storm damage. This makes it a reliable choice for specific help and trusted services. See how customers rate the best insurance companies for claims and service.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Introduction to The Hartford Homeowners Insurance

Now, we talk about The Hartford Insurance, a well-known company for homeowners’ insurance. The Hartford has been operating for more than 200 years, which makes it one of the oldest insurance companies in the United States.

The Hartford, now operating under its updated name, The Hartford Insurance Group, Inc., has been recognized as a World’s Most Ethical Companies Honoree 16 times by Ethisphere and continues its commitment to responsible practices through innovations like TrueLane®, a mobile app that rewards safe driving behavior.

The Hartford is known for its good name because it provides many kinds of insurance to people and companies, including homeowners’ insurance. To find out how much homeowners’ insurance costs, click here for more details.

The Hartford has very good financial ratings and has been serving customers for a long time, so it is a trusted choice for homeowners’ insurance. The company feels very proud about its promise of customer service and 24/7 claims support. In this way, customers get quick help when they really need it.

Farmers Insurance Pros and Cons

Pros:

- GroupSelect Program: Farmers’ GroupSelect offers personalized home insurance with job-related discounts.

- Full Replacement Cost: Farmers Insurance offers full dwelling replacement cost coverage. This means they pay for repairs or rebuilding of your home based on the real costs.

- Local Agent Network: With agents in all 50 states and D.C., policyholders benefit from personal support and faster claims handling.

Cons:

- Higher Entry Premiums: Farmers charges $76 monthly for its basic coverage, which is more expensive than that of several competitors targeting similar customer profiles.

- Limited Niche Perks: Lacks AARP-specific benefits and telematics tools, which reduces appeal for older homeowners or safe drivers.

The Hartford Pros and Cons

Pros:

- AARP Partnership: The Hartford Insurance offers special home insurance plans supported by AARP. These plans offer specific benefits to older homeowners.

- TrueLane App: The Hartford’s TrueLane app tracks your driving and rewards you for safe driving, potentially with discounts.

- 24/7 Claims Service: People who have The Hartford homeowners insurance can get support for claims anytime, 24/7.

Cons:

- Restricted Availability: The Hartford’s homeowners policies are associated with AARP membership, which means they are only available to AARP members.

- Lower Market Share: Having only 1% of the market share, The Hartford’s presence is limited. This means they may have fewer customers nationwide.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Direct Comparison of Farmers vs. The Hartford Homeowners Insurance

Coverage Comparison

When you compare Farmers and The Hartford side by side, it’s essential to examine the insurance coverage they offer. Both companies provide main parts like dwelling coverage, personal property coverage, liability insurance coverage, and extra living expenses coverage. However, the exact details and limits might differ depending on your policy and choices.

To decide which insurance company gives the best coverage for what you need, it’s necessary to look at the terms and conditions of their policies and compare them closely. Notice any extra coverages, exclusions, or limitations that might affect your choice.

Price Comparison

When comparing Farmers and The Hartford homeowners insurance, the prices show a clear pattern depending on age and policy size. For a $200k policy, Farmers usually costs around $120 each month. On the other hand, The Hartford is a bit cheaper with an average of $115 per month. This makes it better option for older homeowners who want to save money—particularly those who are members of AARP.

For larger $1M policies, the rates change significantly depending on age and gender. Young homeowners, such as 16-year-olds, must pay monthly premiums that can range from $0 to $255.

But older policyholders can save even more money with lower premiums. For all groups of people, The Hartford usually keeps premiums lower than Farmers, especially for those over 50 years old. Discover how to get free insurance quotes online to save money now.

Customer Service Comparison

Customer service is very important when comparing Farmers and The Hartford, as both companies have good claims support and dependable services. To choose between them, you should check customer reviews, the types of coverage they offer, prices, and digital tools such as mobile apps or account management options. Start smart with a guide to handling large insurance claims.

Ty Stewart Licensed Insurance Agent

This way, the decision aligns with what you need, your budget, and the features you like most. Unlock top Farmers or The Hartford home insurance deals by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What should you know about The Hartford Insurance vs. Farmers Insurance?

The Hartford offers full replacement cost coverage and AARP-only discounts, with an A.M. Best rating of A+ and a lower NAIC complaint index. Farmers provides dwelling, liability, and personal property coverage, averaging $120 per month for $200k policies, and broader agent availability nationwide. Upgrade your coverage with replacement cost homeowners insurance.

Is Farmers Insurance good homeowners insurance for your property?

Yes, Farmers Insurance is a solid choice for homeowners, offering customizable coverage for dwelling, personal property, and liability.

Is Hartford homeowners’ insurance good for your coverage needs?

Yes, Hartford provides trusted coverage, especially for AARP members, with added benefits like full replacement cost. Discover who offers better coverage between Farmers and The Hartford by entering your ZIP code into our free quote comparison tool.

How do Farmers Insurance and The Hartford compare for you?

Farmers offers more local agent access, while The Hartford stands out with AARP-only discounts and better complaint handling.

How does Farmers and Nationwide homeowners insurance affect your decision?

While both companies offer competitive discounts, Nationwide often rewards customers with savings on smart home devices and discounts on protective devices. In contrast, Farmers emphasizes multi-policy bundling and rewards for driving without claims.

Should you choose Farmers or Progressive home insurance?

Choose Farmers for $200,000 coverage at $120 per month, along with strong agent support. Go with Progressive for better digital tools and partner-backed policies with competitive bundling discounts.

How does Farmers and Safeco compare for your homeowners insurance needs?

You’ll find Farmers offers more agent support and policy bundling options, while Safeco may appeal to you with more specialized endorsements and online tools.

What should you consider in State Farm and The Hartford for home coverage?

State Farm offers a broad nationwide reach and customizable plans, while The Hartford provides strong service for seniors, including full replacement cost options and lower average monthly rates. Explore the key benefits and drawbacks in the State Farm car insurance review.

Should you choose Geico or The Hartford for your homeowners policy?

Choose The Hartford for AARP-only discounts, full replacement cost coverage, and an A+ A.M. Best rating. Geico partners with third-party insurers and offers strong digital tools, but limited direct policy control.

How does Progressive and The Hartford homeowners insurance work for your needs?

Progressive offers tech-friendly tools and partner-backed policies, while The Hartford delivers AARP-only benefits and slightly lower monthly premiums for older homeowners.

What should you know about Farmers and American Family for home coverage?

Are Farmers and Travelers better suited for your homeowner’s insurance?

Should you choose American Family or The Hartford for homeowners protection?

How does AAA vs. Farmers compare for your home insurance policy?

What should you consider in Farmers and Erie homeowners’ insurance?

How does American Family vs. Farmers stack up for your home insurance needs?

What should you know from Farmers’ home insurance reviews before choosing a policy?

What can you expect from The Hartford home insurance reviews as a policyholder?

Is Farmers Hawaii homeowners’ insurance the right choice for your island property?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.