Lemonade vs. The Hartford Renters Insurance in 2026 (Side-by-Side Review)

Lemonade vs. The Hartford renters insurance shows a clear difference in price and what you get—Lemonade comes in at $69, while The Hartford is $74. Lemonade includes AI-powered claims, no paperwork, and a $5K jewelry add-on. The Hartford offers ID fraud coverage, scheduled property, and live agent help.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated August 2025

0 reviews

0 reviewsCompany Facts

$100k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 765 reviews

765 reviewsCompany Facts

$100k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsLemonade vs. The Hartford renters insurance highlights the difference between tech-driven convenience and traditional, agent-guided coverage.

Lemonade’s $69 plan includes a $5K jewelry add-on, instant claims through the app, and no paperwork. The Hartford, priced at $74, offers identity fraud protection, scheduled property riders, and more flexibility with personal liability limits.

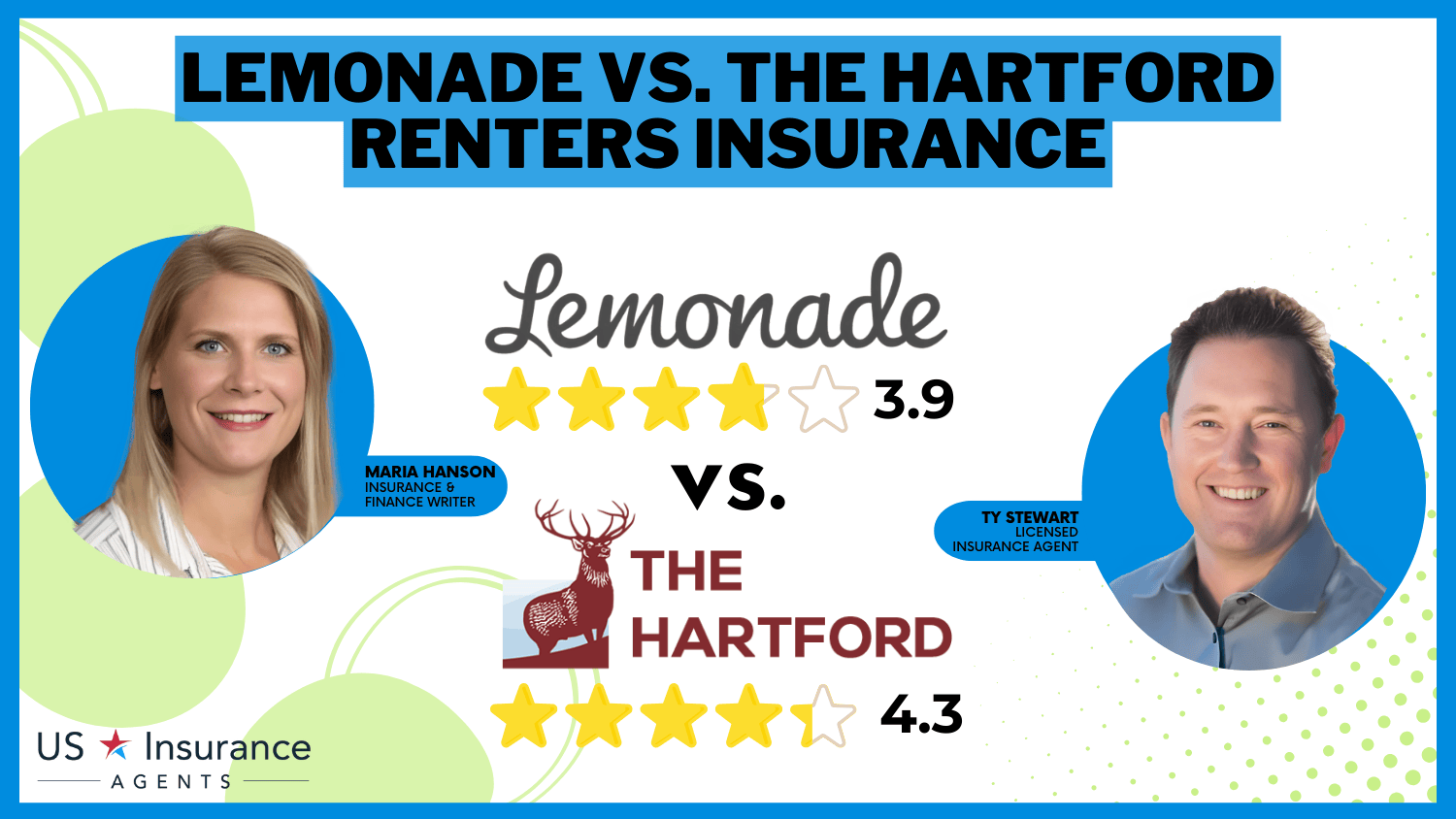

Lemonade vs. The Hartford Renters Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 3.9 | 4.3 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 4.0 | 4.8 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 4.3 | 5.0 |

| Coverage Value | 3.5 | 4.3 |

| Customer Satisfaction | 4.8 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.8 | 4.0 |

| Plan Personalization | 4.0 | 4.5 |

| Policy Options | 2.2 | 4.1 |

| Savings Potential | 4.2 | 4.3 |

| Lemonade | The Hartford |

While Lemonade caps loss-of-use coverage at 30% of personal property, The Hartford offers up to 20% but allows for more customization at the policy level.

This comparison shows how each company fits different lifestyles—Lemonade for speed and simplicity and The Hartford for tailored protection and personal support.

- Lemonade limits loss-of-use to 30% of personal property coverage

- The Hartford allows policy-level customization with rider options

- Lemonade processes claims instantly through its mobile-first platform

Easily compare the best renters insurance coverage, discounts, and providers when you use our free comparison tool.

Comparing Lemonade and The Hartford Auto Insurance Rates

Here’s a look at how age and gender can affect renters’ insurance rates from Lemonade and The Hartford on a $100K policy. The pricing reflects how each company views risk across different renter profiles.

Lemonade vs. The Hartford Renters Insurance Monthly Rates by $100k Policy

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $45 | $60 |

| 16-Year-Old Male | $48 | $63 |

| 30-Year-Old Female | $15 | $20 |

| 30-Year-Old Male | $17 | $22 |

| 45-Year-Old Female | $12 | $18 |

| 45-Year-Old Male | $13 | $19 |

| 60-Year-Old Female | $10 | $16 |

| 60-Year-Old Male | $11 | $17 |

Lemonade gives 16-year-old males a $35 break compared to The Hartford, showing how younger renters often pay more due to higher perceived risk. On the flip side, a 60-year-old female pays just $10 a month with Lemonade—38% less than The Hartford’s $16 rate.

The lowest rate overall goes to that same 60-year-old female with Lemonade, while the highest is a 16-year-old male with The Hartford at $63. Even in the middle-age range, there’s a $5–$6 monthly difference, making Lemonade’s tech-driven pricing a solid option across age groups.

For anyone looking to manage long-term costs, these rate differences can make a noticeable impact—especially when weighing your options among the best insurance providers.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hartford vs. Lemonade Pricing for Property Protection

When comparing The Hartford and Lemonade, the cost of renters’ insurance changes depending on how much coverage you choose. Both companies offer $100K and $300K options, making it easy to see how rates scale with the value of your personal belongings.

Lemonade vs. The Hartford Renters Insurance Monthly Rates by Coverage Amount

| Personal Property Coverage |  |

|

|---|---|---|

| $100k | $69 | $74 |

| $300k | $109 | $117 |

Lemonade charges $69 a month for $100K in coverage, coming in $5 cheaper than The Hartford’s $74. At the $300K level, Lemonade jumps to $109, while The Hartford increases to $117—still a 7% price gap in Lemonade’s favor.

That difference starts to matter more for renters with high-value items like designer furniture, expensive tech, or a luxury wardrobe. For those shopping for the cheapest renters insurance without giving up essential protection, Lemonade stands out for keeping costs lower across both tiers.

On the other hand, The Hartford may cost a bit more, but it offers more flexibility through customizable endorsements and the option to work with a live agent—something some renters still value.

Discount Comparison in Lemonade vs. The Hartford Renters Insurance

Discount eligibility can shift a monthly premium significantly, especially when multiple qualifying factors stack. This table outlines the percentage-based savings available through common discount categories between Lemonade and The Hartford.

Lemonade vs. The Hartford Renters Insurance Discounts by Savings Potential

| Discount |  |

|

|---|---|---|

| AutoPay | ❌ | 3% |

| Bundling | 10% | 5% |

| Claims-Free | ❌ | 12% |

| Good Tenant | ❌ | ❌ |

| Loyalty | 7% | 7% |

| Military | ❌ | 15% |

| New Customer | ❌ | ❌ |

| Occupation-Based | ❌ | ❌ |

| Paperless | 3% | ❌ |

| Protective Device | ❌ | ❌ |

| Referral | ❌ | ❌ |

| Safety Device | ❌ | ❌ |

| Security System | ❌ | ❌ |

| Student | ❌ | ❌ |

Lemonade offers a notably higher claims-free discount at 18%, which can lower a $15 premium to around $12, ideal for long-term renters without past losses. The AutoPay discount is slightly better at 6%, saving digital-first renters who prefer automatic billing about 90 cents on a $15 monthly policy.

In contrast, The Hartford includes a 5% loyalty discount, giving returning customers small recurring savings—roughly $4 per year on a $74 monthly policy. A standout Lemonade renters insurance discount is the 10% good tenant savings, which benefits applicants with strong rental histories or credit scores, adding meaningful value for responsible renters.

Ty Stewart Licensed Insurance Agent

Lemonade offers an 8% safety device discount, higher than The Hartford’s 5%, rewarding renters with smart home features. Stacking these offers is one of the best tips for getting cheap home insurance, potentially saving renters up to $60 a year.

Liability, Theft, and More in Lemonade vs. The Hartford Coverage

Coverage isn’t just a checklist—it’s what saves you when things go sideways. Lemonade renters insurance covers fire, theft, vandalism, liability, loss of use, and even pet damage—something The Hartford doesn’t include. That’s a real plus if you’ve got a dog or cat that might scratch up floors or cause other small accidents.

Lemonade vs. The Hartford Renters Insurance Coverage Options

| Coverage |  |

|

|---|---|---|

| Earthquake | ❌ | ✅ |

| Fire Damage | ✅ | ✅ |

| Flood Insurance | ❌ | ❌ |

| Identity Theft Protection | ✅ | ✅ |

| Liability | ✅ | ✅ |

| Loss of Use (Additional Living Expenses) | ✅ | ✅ |

| Medical Payments to Others | ✅ | ✅ |

| Personal Property | ✅ | ✅ |

| Pet Damage | ✅ | ❌ |

| Theft Protection | ✅ | ✅ |

| Vandalism Protection | ✅ | ✅ |

The Hartford, on the other hand, includes earthquake protection, which is huge for renters in quake-prone areas and something Lemonade doesn’t offer at all. Both companies provide identity theft coverage, but Lemonade’s app-based fraud alerts and quick digital tools make it easier for anyone who prefers managing things through their phone.

If your place becomes unlivable after a covered event, loss of use coverage helps cover temporary housing and expenses. There’s also medical payment coverage, which can help pay if a guest gets hurt in your home, no matter who’s at fault.

Choosing the right coverage depends on what risks are most relevant to your lifestyle. If you’ve got pets, rely on digital tools, and want fast claims, Lemonade may be the better fit. But for those living in earthquake zones or who want more traditional coverage, The Hartford could be the smarter choice.

Read more: Best Renters Insurance for Long-Term Renters

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Real Customers Say About Lemonade vs. The Hartford

When it comes to real-world performance, both Lemonade and The Hartford take very different approaches—and it shows in the data. From customer satisfaction to financial strength and complaint trends, how each company delivers service can impact your peace of mind as a renter.

Insurance Business Ratings & Consumer Reviews: Lemonade vs. The Hartford

| Agency |  |

|

|---|---|---|

| Score: 807 / 1,000 Avg. Satisfaction | Score: 701 / 1,000 Avg. Satisfaction |

|

| Score: B Fair Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 70/100 Average Customer Satisfaction | Score: 74/100 Good Customer Feedback |

|

| Score: 2.50 More Complaints Than Avg. | Score: 1.10 Avg. Complaints |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

The Hartford earns a J.D. Power score of 807 out of 1,000, highlighting strong claims satisfaction and agent support. Lemonade, with a 701 score, reflects a more hands-off digital model that works well for tech-savvy renters but may not appeal to those wanting more personal help. Financially, The Hartford’s A+ rating from A.M. Best suggests stronger long-term stability, while Lemonade holds a solid A rating.

In terms of complaints, Lemonade performs better with a 1.10 ratio, showing fewer issues per customer compared to The Hartford’s 2.50. While Consumer Reports rates them closely—Lemonade with a “B” and The Hartford at 70/100—Lemonade edges ahead with smoother digital interactions, while The Hartford’s long-standing reputation offers more consistency for those who prefer traditional support.

Lemonade and The Hartford both hold a solid spot in the renters’ insurance world, but neither leads the market. Their numbers say a lot about how renters weigh modern tech against long-time reliability. The Hartford edges ahead with 7% of the market compared to Lemonade’s 5%, showing that many still prefer traditional companies with agent support.

That small gap shows many renters still value personal service, while Lemonade’s growth proves tech and speed matter, too. With 88% choosing other insurers, both remain solid picks—especially if you’re after the cheapest renters insurance with reliable features.

One Reddit user shared a pretty honest take that’s worth considering. They pointed out that paying less doesn’t always mean getting the protection you really need.

Comment

byu/sea-lass-1072 from discussion

insanfrancisco

Basically, they’re saying it’s cool to save money, but only if that company will actually come through when you need them. Lemonade might cost a little more than Good Cover, but it’s proven. So, the real question is whether saving a few bucks each month is worth the gamble.

See more: How To Get Free Insurance Quotes Online

What to Know About Lemonade Renters Insurance

Lemonade renters insurance starts at just $5 a month and offers a smooth, app-based experience built for speed and simplicity. Its AI handles quotes and claims fast—some in under three minutes—so there’s no need for phone calls or paperwork.

Coverage includes personal property, liability, and loss-of-use, with optional add-ons for jewelry, electronics, and identity theft. Policies are backed by Lemonade Insurance Company and protect against theft, fire, water damage, and even guest injuries. Everything’s managed through the app, making it easy for renters who want things done quickly.

Lemonade also gives back—literally. Through its Giveback program, leftover premiums are donated to nonprofits. After acquiring Metromile, Lemonade added pay-per-mile car insurance, making it even more appealing for low-mileage drivers. Named one of the best renters’ insurance options by Forbes, Lemonade delivers speed, value, and a mission-driven approach that fits today’s budget-conscious, socially aware renters.

Learn more: Lemonade vs. Esurance Renters Insurance

What to Know About The Hartford Renters Insurance

The Hartford, through Trumbull Insurance Company and its broader group, offers renters insurance that covers your personal belongings, liability, and loss of use if something like a fire, theft, or even pet-related injury happens. With over 200 years of experience, it’s backed by a strong reputation and offers support through a network of agents, not just an app.

You can customize your policy to protect high-value items like laptops, jewelry, or collectibles, and even add floater insurance if something you own goes beyond standard limits. Identity theft coverage is included, too, which adds peace of mind. It’s a great option for renters who want flexible protection and real people to talk to when issues arise.

If you’re 50 or older, The Hartford’s AARP Renters Insurance Program offers added discounts and benefits. They also offer TrueLane, a driving app that gives safe drivers auto insurance discounts. Some policies come through Trumbull, but they’re all backed by The Hartford, so you’re still getting solid protection—great if you want more than just a bare-bones, cheap plan.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lemonade Insurance Pros and Cons

Pros

- Lowest Premium Option: Lemonade’s base policy starts at $5 per month, undercutting The Hartford’s $74 per month rate by a wide margin, ideal for renters on a budget.

- 3-Minute AI Claims: Its automated claims system can approve eligible claims in under three minutes, with no paperwork or phone calls—faster than any traditional insurer.

- $5,000 Jewelry Add-On: Policyholders can opt for additional riders covering high-value items like jewelry up to $5,000, which is great for renters with valuable personal items.

Cons

- No Local Agent Access: Lemonade operates entirely online with no physical agent network, which limits support for renters who prefer in-person guidance. Get all the details in our honest Lemonade renters insurance review today.

- Limited Loss-of-Use Flexibility: Loss-of-use coverage is capped at 30% of personal property limits, which may be lower than what traditional insurers offer for similar claims.

The Hartford Insurance Pros and Cons

Pros

- Strong A.M. Best Rating: The Hartford holds an A+ rating for financial strength from A.M. Best, reflecting its ability to pay out large or complex claims without delay.

- AARP Renters Insurance Program: Offers discounted rates and added protections through the AARP partnership, specifically designed for renters aged 50 and older.

- Scheduled Personal Property Add-Ons: Includes floater insurance endorsements for items like $10K+ jewelry or artwork, allowing renters to protect assets far above standard limits.

Cons

- Higher Base Premiums: Monthly cost for $100k in coverage sits at $74, which is $5 more than Lemonade and may not appeal to renters focused solely on price.

- Manual Claims Experience: Claims are primarily processed through agents or online forms, lacking the instant AI claim functionality offered by competitors like Lemonade. Learn how it compares in our full The Hartford insurance review.

Lemonade vs. The Hartford: A Side-by-Side Comparison

While both Lemonade and The Hartford offer renters insurance, they’re built for very different types of renters—with different expectations around tech, coverage options, and how they want to manage their policy.

Kristine Lee Licensed Insurance Agent

Lemonade is all about speed and simplicity. It’s 100% digital, with instant coverage, quick app-based claims, and no paperwork. The Giveback program adds a social touch by donating unused premiums to nonprofits. It’s a great fit for renters’ insurance for people living in apartments who want a smooth, low-cost experience they can manage entirely from their phone.

The Hartford takes a more traditional route, focusing on long-term support and personal guidance. Backed by over 200 years of experience, it offers policies through Trumbull Insurance in some states. Perks like TrueLane for auto savings and AARP benefits make it especially appealing to older renters or those who prefer a relationship with their insurer.

Lemonade is best for renters who want a no-fuss, tech-forward approach with the lowest possible monthly rate. The Hartford works well for those who want customizable protection, real support, and extra add-ons for more peace of mind. It all comes down to whether you prefer speed and convenience or personalized service with premium features. Find the best match for your needs using our free comparison tool.

Frequently Asked Questions

Is Lemonade renters insurance actually good?

Yes, Lemonade renters insurance is considered good due to its low monthly rates starting at $5, its seamless mobile app experience, and fast AI-driven claim approvals. It’s especially popular among apartment renters seeking basic coverage and digital convenience without the need for in-person agents.

Does Lemonade renters insurance pay out?

Yes, Lemonade renters insurance does pay out on approved claims. In fact, many claims are paid within 3–5 minutes for common losses like theft or water damage. More complex claims may require documentation and take longer, but Lemonade is known for transparent handling and speedy digital resolution.

Is Lemonade Insurance a reputable company?

Yes, Lemonade Insurance is reputable and licensed in all the states where it operates. It has an A rating from Demotech for financial stability and is consistently recognized for user satisfaction on platforms like J.D. Power and Associates Insurance Company and Consumer Reports. Its Giveback program and fast claims tech further boost its credibility.

Can you cancel Lemonade renters insurance anytime?

Yes, you can cancel Lemonade renters insurance anytime directly through the Lemonade app. There are no cancellation fees, and your unused premium will be refunded on a prorated basis, making it flexible for short-term renters or students.

What is Lemonade insurance known for?

Lemonade Insurance is known for its AI-powered claims processing, affordable rates starting at $5/month, and the Giveback program, which donates leftover premiums to charities chosen by policyholders. It’s also recognized for its minimalist app interface and instant policy setup.

How fast does Lemonade pay claims?

Lemonade pays qualifying claims in as little as 3 minutes using its AI-driven claims bot. About 30% of claims are handled instantly, while more complex cases involving high-value items may take 1–2 days for manual review, following a process similar to a guide to handling larger insurance claims.

What is the downside of Lemonade?

The biggest downside of Lemonade is its limited customer support, as it relies primarily on chatbots and email rather than live agents. It also caps loss-of-use coverage at 30% of personal property value, which may not be enough if you’re displaced for an extended period.

Will my landlord know if I cancel The Hartford renters insurance?

Yes, if your landlord was listed as an “interested party” on your policy, they will receive automatic cancellation notifications from The Hartford. Many landlords require renters to maintain active policies throughout the lease term, so canceling could lead to lease violations or additional fees.

How is Lemonade different from other insurance companies?

Lemonade differs from other insurance companies by offering a fully app-based experience, AI claims processing, and a nonprofit-oriented business model. Unlike traditional insurers, Lemonade takes a flat fee from premiums and gives unused funds to charities, which reduces their incentive to deny claims—an important distinction to consider when comparing contents insurance vs. renters insurance.

What are the disadvantages of The Hartford renters insurance?

Disadvantages of The Hartford renters insurance include higher base premiums, averaging $74 per month for $100k coverage, and slower claims processing that may require phone calls or in-person agent follow-up. It also lacks the instant, app-based experience offered by competitors like Lemonade.

What other types of insurance does Lemonade offer?

How much is Lemonade renters insurance?

Are valuables better covered under Lemonade vs. Geico renters insurance?

What type of renter benefits most in Lemonade vs. State Farm renters insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.