Totaled Car Value Calculator for 2026 (Estimate Your Payout)

A totaled car value calculator estimates how much your insurance will pay if your vehicle is declared a total loss. If your car is newer, consider getting gap insurance to cover the difference between your car's value and loan balance. Rebuilt title full coverage typically costs $180 to $220 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated February 2026

When your car is totaled in an accident, determining its value becomes crucial for securing fair compensation from your insurance company.

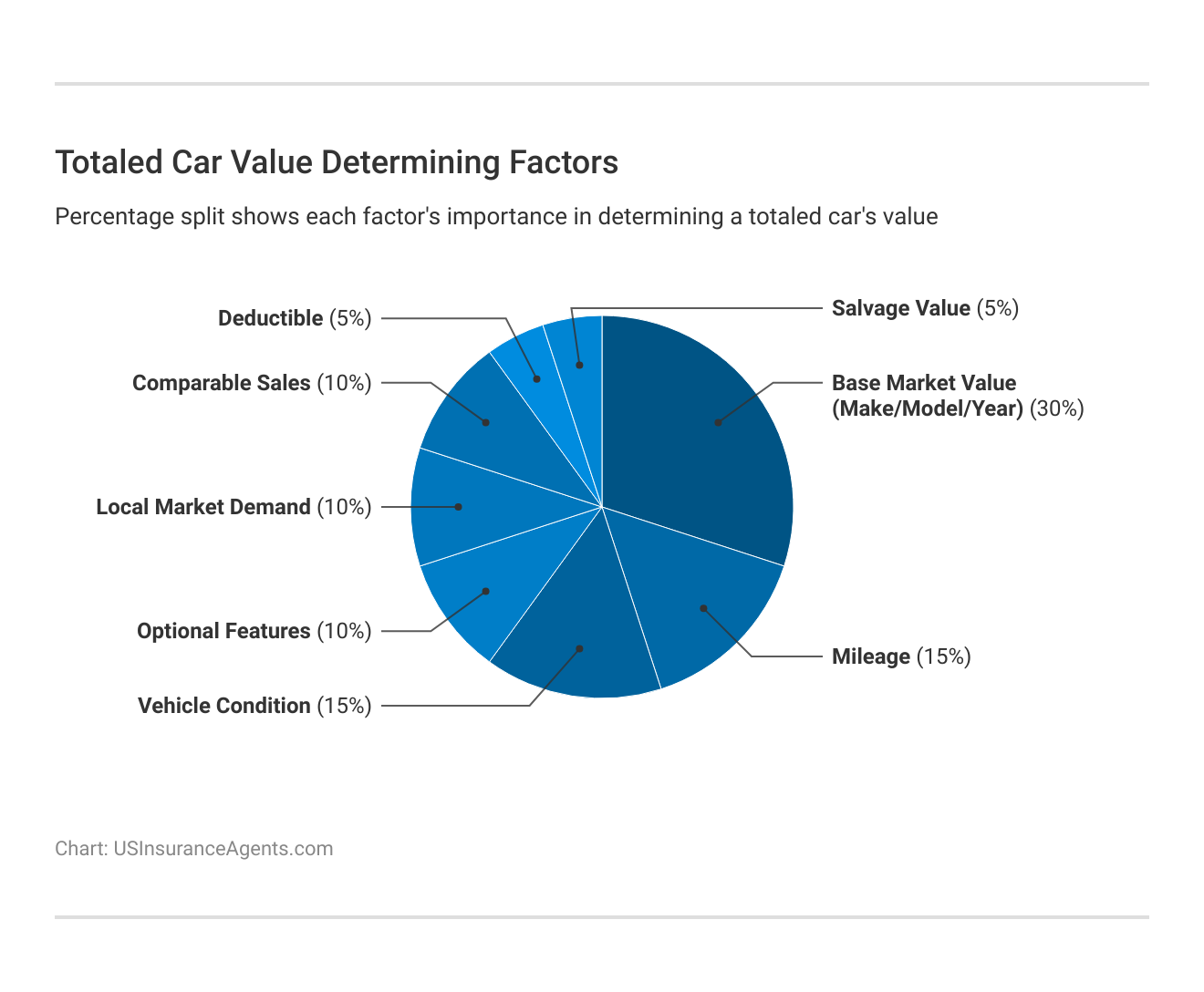

- Base market value (30%), mileage (15%), and condition (15%) determine the payout

- Vehicles are declared totaled when repairs reach 70-80% of ACV

- Gap insurance covers the ACV to the loan balance difference

A totaled car value calculator helps estimate your vehicle’s actual cash value, enabling you to understand what payout to expect before you file a car insurance claim. These tools evaluate factors like market value, depreciation, mileage, and vehicle condition to provide accurate assessments.

Using an insurance total loss payout calculator empowers you to negotiate confidently with insurers and ensures you receive appropriate compensation for your totaled vehicle.

Shopping around for multiple quotes can help you save. Enter your ZIP code into our free comparison tool to get started.

Car Totaled Calculator: Estimate Your Vehicle’s Value

A totaled car value calculator is a method to ascertain how much your totaled car is worth after an accident. This tool instructs you on how to evaluate your car by computing its actual cash value (ACV) using an actual cash value car calculator.

Ty Stewart Licensed Insurance Agent

It’s also wise to run your own numbers using a totaled car calculator or a free car value after-accident calculator. Understanding what you should do if your vehicle is deemed a total loss can help you negotiate for a fair payout.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Classify a Totaled Car

When you’re involved in an accident that causes significant damage to your vehicle, it doesn’t automatically mean your car is a total loss. Your car is generally considered totaled if repair costs exceed its current value, though insurance companies typically declare it totaled when repairs reach 70-80% of the actual cash value.

State laws regulate these criteria – for example, California declares a vehicle totaled when combined repair costs and salvage value meet or exceed the actual cash value. Actual Cash Value (ACV) is the amount your insurance company will pay you after a covered loss based on the current market value of the item, not what you originally paid for it.

If you’re wondering, “How much will I get for my totaled car?” there are several key factors that determine your totaled car’s final value. See the table below:

Key Factors That Determine a Totaled Car's Value

| Term | Details |

|---|---|

| Actual Cash Value | A car’s value at the time of loss, minus depreciation. |

| Comparable Sales | Recent sales of similar cars help determine value. |

| Deductible | The amount subtracted from your insurance payout. |

| Mileage | Higher mileage usually reduces a vehicle’s value. |

| Optional Features | Features like leather seats or navigation increase value. |

| Payout Formula | Based on ACV minus deductible and other adjustments. |

| Salvage Value | The car’s value if sold for parts or kept after a total loss. |

| Vehicle Condition | Judged by wear, damage, and maintenance history. |

| Vehicle Make, Model & Year | Key factors in estimating base market value. |

The actual cash value represents your car’s estimated worth at the time of loss, calculated as market value minus depreciation. Your vehicle’s make, model, year, and mileage establish the baseline using tools like Kelley Blue Book, while condition assessment and comparable local sales help refine estimates.

Optional features may increase value, but your insurance deductible will be subtracted from the final payout. The payout formula is actual cash value minus deductible, plus or minus adjustments for taxes and salvage value if you keep the vehicle.

The chart shows that base market value (make/model/year) represents 30% of your totaled car’s valuation, making tools like the Kelley Blue Book totaled car value calculator essential for accurate assessments. These percentage breakdowns are particularly important when using specialized tools like a diminished value calculator in Nevada.

How Salvage and Rebuilt Titles Affect Insurance Costs

The table above highlights how salvage and rebuilt titles impact insurance costs, which directly affects your payout when using the car totaled calculator. Vehicles with salvage titles often lack collision car insurance, and if available, it comes from high-risk providers at much higher rates, from $210 to $280 for full coverage.

Salvage & Rebuilt Title Auto Insurance Monthly Rates

| Coverage Level | Rebuilt Title | Salvage Title |

|---|---|---|

| Minimum Coverage | $75–$90 | $80–$100 |

| Full Coverage | $180–$220 | $210–$280 |

Rebuilt titles are slightly more insurable but still cost 25% to 60% more than clean titles. These increased premiums reflect the insurer’s concerns over diminished value, incomplete repair records, and higher perceived risk.

Calculating Your Totaled Car’s Insurance Value

Calculating your totaled car’s value requires a systematic approach using a car total loss value calculator to determine the actual cash value (ACV) that forms the basis of your insurance settlement. This process begins with establishing your vehicle’s current market value, then subtracting depreciation and diminishment factors.

- Research Vehicle’s Market Value: Use reliable valuation sites like Kelley Blue Book and the National Automobile Dealers Association based on year, make, and model. When asking, “How much is my totaled car worth in a calculator?” these resources provide the foundation for accurate assessments.

- Find Comparable Vehicle Sales: Obtain current market prices to validate your research, comparing vehicles that match your specifications. This comparison is crucial when determining how much a totaled car is worth in your specific situation.

- Document Vehicle Enhancements: Gather receipts for premium upgrades like specialty packages or customized rims. This documentation proves valuable when working with insurance adjusters using totaled car insurance payout calculators.

- Apply the Calculation Formula: The final payout equals actual cash value minus your deductible, plus or minus adjustments for taxes, title fees, and salvage value. This approach ensures fair compensation based on your vehicle’s true worth.

Let’s say you own a 2019 Honda Accord EX with 45,000 miles, and it’s been totaled in a car accident. You want to estimate your totaled car value before accepting the insurer’s offer.

- Market Value: $22,000

- Mileage Penalty: -$800

- Condition Adjustment: +$500

- Recent Modifications: +$300

- Estimated Totaled Car Value: $22,000

- Final Insurance Payout: $22,000 (ACV) – $500 (Deductible) = $21,500

If your insurer offers only $19,500, there’s a clear discrepancy. This is when bringing in an independent appraiser can make a difference in your settlement.

How Insurance Pays for a Totaled Car

Your insurance will pay you up to the actual cash value of your totaled vehicle as long as you have the right car insurance. That’s why it’s important to consider the types of auto coverage available so you have the right protection on your vehicle.

The most common kinds of car insurance include:

- General liability

- Uninsured/underinsured

- Comprehensive

- Collision

- Medical payments

- Personal injury protection

While general liability only meets basic legal requirements and won’t cover your car’s damages, full coverage car insurance, which includes comprehensive and collision coverage, will. These policies pay the ACV if your vehicle is declared a total loss due to an accident, theft, or natural disaster.

To estimate your potential payout, tools like a car total loss value calculator can help you determine if your vehicle meets the criteria for a total loss.

It’s important to understand the difference between actual cash value and replacement cost value. ACV reflects your car’s depreciated market value, while replacement cost represents what it would cost to buy a similar new car. Because most vehicles begin depreciating immediately after purchase, many drivers add gap coverage.

Kristine Lee LICENSED INSURANCE AGENT

Leasing companies often require it, and rates can be as low as $20 per month. Using a car total loss value calculator alongside gap insurance can ensure a more accurate and financially secure settlement.

Read More: What is the difference between agreed value and actual cash value car insurance coverage?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Right Tools to Calculate Totaled Car Value

Discovering a universally recognized online tool to calculate totaled car value isn’t straightforward. You’ll have to search around to determine your car’s actual cash value (ACV). Although this might feel like extra effort, it’s worthwhile.

Understanding your car’s ACV helps you assess if your insurer’s offer is fair. Tools like the USAA diminished value calculator and vehicle actual cash value calculator can guide your estimate.

If you lack comprehensive coverage for your vehicle and are concerned about the potential consequences of your car being declared a total loss, it’s advisable to explore options for securing the most suitable coverage. This could involve researching different insurance plans to find the best fit for your needs, particularly considering the potential scenarios involving a vehicle total loss calculator or a wrecked car value calculator.

Learn How to Use the Totaled Car Value Calculator Tools

Understanding how to calculate your totaled car’s value empowers you to negotiate fair settlements with insurance companies. By researching market values, documenting vehicle enhancements, and using an insurance value of car calculator, you can ensure accurate assessments of your vehicle’s worth.

Remember that having adequate types of car insurance coverage, particularly comprehensive and collision, is essential for total loss protection. While the process may seem complex, taking time to understand your car’s actual cash value helps secure the compensation you deserve when dealing with a totaled vehicle. See how much you could save on coverage by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What is a totaled car value calculator?

A totaled car value calculator is a tool that helps determine the actual cash value (ACV) of a vehicle that has been declared a total loss by an insurance company. When a car is “totaled,” it means the cost to repair the damage exceeds a certain percentage of the vehicle’s value (typically 70-80%, depending on the state and insurer).

Can you use specialized calculators for different situations?

Yes, depending on your specific situation, you can use tools like a diminished value calculator in Arizona, a Nashville car accident diminished value calculator, or a stolen car insurance payout calculator.

Do vehicle enhancements affect your payout?

Yes, documented upgrades like premium sound systems or custom rims can increase your car’s total value if you provide receipts to adjusters.

Read More: Does my car insurance cover damage to my car’s stereo or other aftermarket accessories?

How is the insurance payout for a totaled car calculated?

The insurance payout for a totaled car is calculated using the ACV car value calculator. The final amount equals the actual cash value minus your deductible, with adjustments for taxes and fees, following a car accident.

What should you do if you disagree with your insurance company’s valuation?

Gather comparable vehicle sales data, document any enhancements, and consider hiring an independent appraiser to support your case for a higher settlement. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code to begin.

How much is your car worth for insurance if it’s crashed?

After a car accident, your vehicle’s valuation for insurance purposes hinges on variables such as its current market value, the extent of your policy coverage, and the deductible in place. This assessment involves considering factors like its actual cash value, with tools such as a car salvage value calculator or a car total loss calculator often utilized to determine the appropriate compensation.

What factors are considered when using a calculated total loss value tool?

A tool for calculating total loss value aids in assessing the worth of a vehicle that an insurance company has deemed a total loss. This can include factors like using the Geico actual cash value calculator to determine compensation.

What is the process for disputing the estimation provided by a car insurance valuation calculator?

Challenging the estimate generated by a car insurance valuation calculator might entail presenting supplementary evidence or consulting with experts. This process could also involve utilizing a salvage car prices calculator for additional valuation insights.

What if your car has a rebuilt title?

Use a rebuilt title value calculator to determine your vehicle’s worth, as rebuilt titles typically have lower market values than clean titles. See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

Can you buy back your totaled car, and is there an insurance buy-back calculator?

The possibility of repurchasing your totaled vehicle and the procedures entailed hinge on the regulations of your state and the policies set by your insurance provider. This is particularly pertinent when considering factors such as the car value calculator for insurance and the cash value car calculator.

How does a stolen car insurance payout calculator work?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.