Best Car Insurance for Dentists in 2026 (Top 10 Companies)

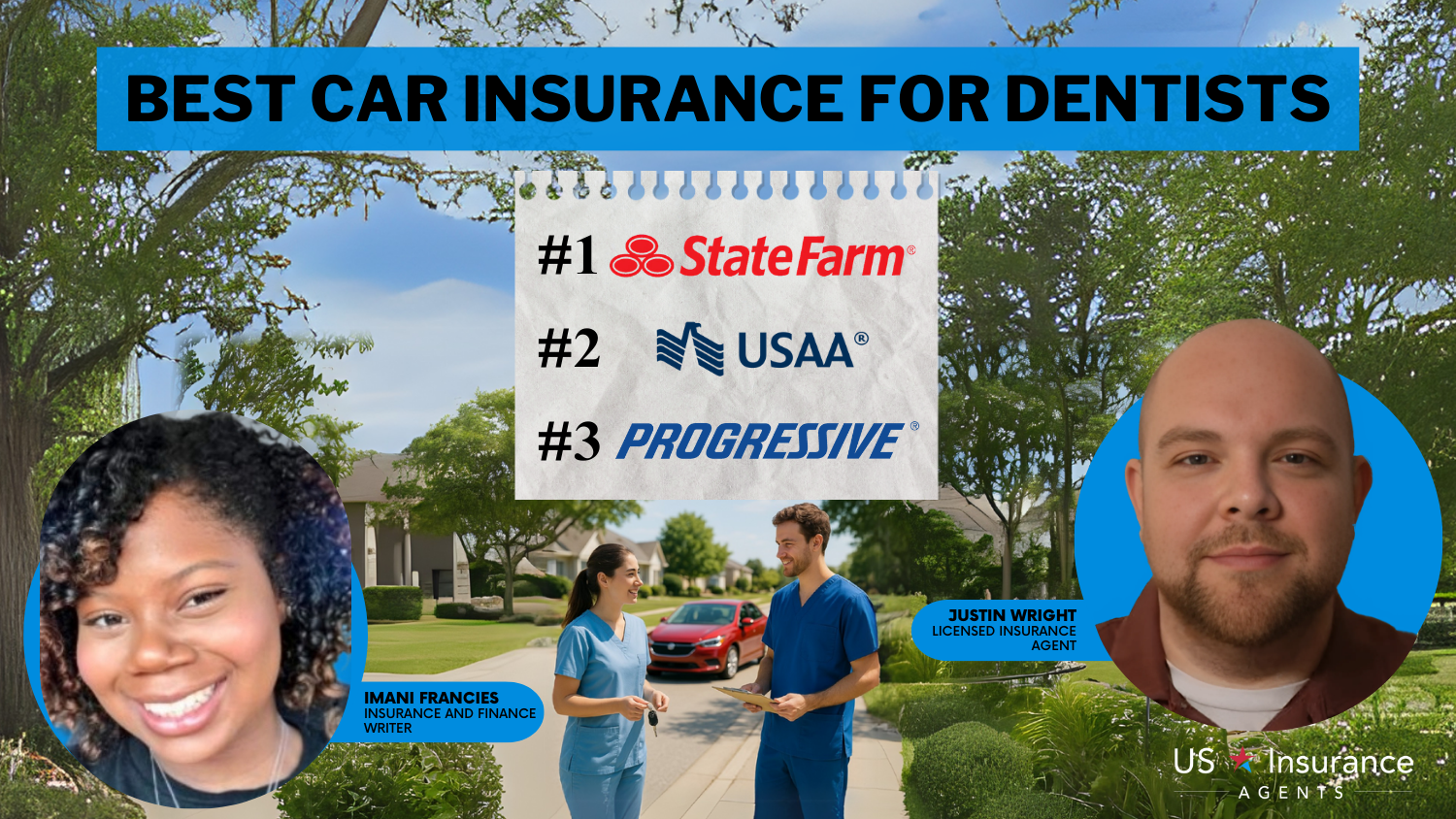

Explore top car insurance options for dentists from State Farm, USAA, and Progressive, with premiums starting as low as $100 a month. State Farm holds an A++ A.M. Best rating, USAA offers the lowest rates, and Progressive provides up to 30% savings for good drivers, a smart, budget-friendly choice for dentists.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Imani Francies is a finance and insurance writer who has strong media and communication skills with a bachelor's degree from Georgia State University. She began her writing career freelancing with various blogs and internships while working full-time as an early childhood educator. She has significant experience in both print and online media as a writer, editor, and author. She works efficient...

Imani Francies

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated August 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Dentists

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Dentists

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Dentists

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsState Farm, USAA, and Progressive offer the best car insurance for dentists, with coverage starting at $100 a month.

Finding car insurance tailored to dentists’ unique needs can be challenging. This guide helps dentists find the right coverage options by analyzing their driving records.

Our Top 10 Company Picks: Best Car Insurance for Dentists

| Company | Rank | Multi-Policy Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Personalized Service | State Farm | |

| #2 | 15% | 13% | Military Savings | USAA | |

| #3 | 18% | 30% | Tech-Savvy Drivers | Progressive | |

| #4 | 21% | 25% | Comprehensive Coverage | Allstate | |

| #5 | 13% | 23% | Family Protection | Nationwide |

| #6 | 28% | 25% | Tailored Policies | Liberty Mutual |

| #7 | 22% | 19% | Bundled Coverage | Farmers | |

| #8 | 18% | 20% | High-Quality Coverage | Travelers | |

| #9 | 12% | 17% | Customer Loyalty | American Family |

| #10 | 15% | 25% | Digital Convenience | Esurance |

This article guides dentists through the process of selecting the right provider while highlighting the best multi-policy car insurance discounts available.

By comparing top insurers and specialized benefits, dentists can make informed decisions that protect both their personal and professional interests.

- Dentists can get up to 12% off when registered to autopay

- Clean driving records significantly lower rates for dentists

- USAA offers the lowest rate for drivers with a DUI

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool today.

#1 – State Farm: Top Pick Overall

Pros

- Reputation: State Farm is widely recognized for its excellent reputation in providing personalized service to customers.

- Discounts: Offering both multi-policy discounts for dentists and safe driver discounts. See details in our State Farm insurance review.

- Customer Satisfaction: A low complaint level indicates high customer satisfaction with State Farm’s services.

Cons

- Premiums: State Farm might charge a little more for insurance than some other companies, but they also give special help and care just for you.

- Limited Military Savings: State Farm does not offer specific auto insurance discounts for military personnel.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Exclusive to Military Members: USAA auto insurance ratings reflect its focus on military savings, which is ideal for military personnel and dentists in the armed forces.

- Low Rates: USAA car insurance for dentists offers competitive rates, which can provide potential savings for its members (Read More: USAA Insurance Review).

- Strong Customer Satisfaction: USAA ranks high for satisfaction and claims service for those who qualify for USAA car insurance, including dentists who are also military personnel and their families.

Cons

- Membership Requirement:USAA insurance, dental, and automobile coverage is exclusive to dentists, military personnel, and their families, limiting who is eligible.

- Coverage Restrictions:There may be some restrictions on specialized auto insurance for dentists.

#3 – Progressive: Best for Tech-Savvy Drivers

Pros

- Innovative Technology: Digital tools help dentists take care of insurance matters more easily. This saves them time and helps everything go smoothly.

- A.M. Best Rating: Progressive car insurance for dentists has an A rating, so they’re financially solid.

- Flexible Coverage: Progressive offers a range of coverage options, catering to the diverse needs of dentists and drivers.

Cons

- Customer Service Ratings: Some dentists’ customers report varied experiences with Progressive car insurance customer service (Read More: Progressive Insurance Review).

- Higher Premiums for Some: Because Progressive focuses on technology, it could result in higher premiums for dentist drivers who hold fast to the old-fashioned coverage plans.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage: Allstate is reputed for offering extensive coverage plans and providing complete protection to dentists.

- A.M. Best Rating: With an A+ rating, Allstate exhibits strong financial stability for dentist policyholders. Find out more in our Allstate insurance review.

- Customizable Policies: Allows policy customization to fit individual needs and preferences, including those of dentists.

Cons

- Premium Costs: Allstate’s full coverage usually costs more than the basic plans, which might affect dentists’ premiums.

- Inconsistent Service Experiences: Some dentists have noticed that Allstate’s customer service and claims handling can be a bit inconsistent at times.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Family Protection

Pros

- Family-Oriented Coverage: Nationwide is all about taking care of your family and your dentist, with coverage options that fit your needs.

- Generous Multi-Policy Discount: Nationwide gives dentists a 13% discount if they bundle multiple policies together.

- Customizable Plans: Nationwide provides customizable plans, allowing customers to customize auto insurance for dentists to their family’s needs.

Cons

- Limited Discounts: Certain discount programs for military personnel and dentists are unavailable. See details in our Nationwide insurance review.

- Lacking in Tech: In many aspects, online tools for high-tech dentists are behind the times when compared to those offered by competitors.

#6 – Liberty Mutual: Best for Tailored Policies

Pros

- Professional Group Discounts: Liberty Mutual recognizes dentists as low-risk professionals and offers exclusive discounts for medical and dental practitioners.

- Gap Coverage Protection: Liberty Mutual pays the difference between what you’re paying on your car loan and its actual cash value if your vehicle is a total loss.

- 24/7 Claims Assistance: Liberty Mutual offers 24/7 claims assistance services for dentists who work outside standard business hours.

Cons

- Mixed Customer Reviews: Some dentists report mixed experiences with Liberty Mutual’s customer service and claims process. Learn more in our Liberty Mutual review.

- Potentially Higher Premiums: The focus on tailored policies may lead to higher premium costs for some dentists.

#7 – Farmers: Best for Bundled Coverage

Pros

- Generous Bundling Discount: Farmers offers a 22% discount for bundling dental and auto insurance, helping dentists save significantly.

- Diverse Insurance Products: Farmers offers a variety of insurance products, including high-liability car insurance for dentists. Bundling policies is easy for added convenience.

- Personalized Service: Farmers build strong agent-customer relationships through personalized service for dentists.

Cons

- Limited Availability: As indicated in our Farmers insurance review, access is not the same everywhere. Some dentists are not able to access it.

- Higher Individual Premiums: Bundling saves money, but dentists may pay more for stand-alone auto coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for High-Quality Coverage

Pros

- Convenient Mobile App: Travelers has a solid mobile app that lets dentists handle their car insurance quickly.

- High-Quality Coverage: Travelers allows dentists to choose various coverage levels that align with their professional requirements (Read More: Travelers Insurance Review).

- Professional Security: Travelers is focused on providing solid coverage solutions for the unique risks and liability problems of dental professionals.

Cons

- Customer Service Ratings: Some dentists report varied experiences with Travelers’ customer service, indicating room for improvement.

- Potentially Higher Premiums: Focusing on thorough coverage can raise dentists’ premiums. They might pay more than some rivals.

#9 – American Family: Best for Customer Loyalty

Pros

- Strong Claims Support: Their A rating from A.M. Best means dentists can trust American Family to pay auto claims reliably when accidents happen.

- Flexible Auto Coverage: American Family lets dentists customize their car insurance without buying unnecessary add-ons that don’t match their professional driving needs.

- Loyalty Rewards Program: American Family offers up to 12% off for dentists who stick with them over time. Find out more in our American Family insurance review.

Cons

- Limited Geographic Presence: American Family’s availability is limited to certain regions, potentially excluding dentists in other areas.

- May Lack Some Discounts: While offering customer loyalty discounts, American Family may not have as many discount options for dentists as some competitors.

#10 – Esurance: Best for Digital Convenience

Pros

- Digital Convenience: Esurance is known for its user-friendly digital platform, providing convenience in managing policies and claims for dentists.

- Quick and Easy Quotes: Esurance is praised for its quick and straightforward online quote process, saving dentists time.

- A.M. Best Rating: Our Esurance insurance review highlights its A+ financial rating, and Esurance customer service adds to its strong reputation.

Cons

- May not Suit Everyone: Esurance’s focus on digital convenience may not be ideal for dentists who prefer traditional interaction with agents.

- Limited Personalized Service: Some customers note less personalized service than traditional insurers, but easy access to the Esurance claims phone number helps streamline support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Rates for Dentists

As a dentist, finding the right car insurance means balancing comprehensive coverage with affordable rates. Your profession often qualifies you for better pricing since insurers view dental professionals as lower-risk drivers.

The table below compares monthly rates from ten leading insurance companies, showing both basic and full coverage options to help you make an informed decision.

Dentist Car Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $120 | $250 | |

| $110 | $220 |

| $100 | $200 | |

| $115 | $230 | |

| $130 | $260 |

| $110 | $220 |

| $100 | $200 | |

| $120 | $250 | |

| $115 | $230 | |

| $100 | $190 |

USAA is a good bargain for military dental professionals, with some of the lowest rates available – just $100 per month for minimum coverage and $190 for full coverage.

Jeff Root Licensed Life Insurance Agent

Dentists should compare the different providers’ prices for basic and full coverage car insurance so they can choose the best coverage for their needs, preferences, and budget.

Read More: What is minimum essential coverage?

The Unique Car Insurance Needs of Dentists

As a dentist, don’t just shop for the cheapest car insurance. Your profession creates unique driving risks that standard policies might not cover. Most dentists drive between office locations, hospitals, and conferences regularly.

If you use your car for work trips, make sure your policy covers business use – not just personal driving. Many basic auto policies exclude work-related accidents, leaving you exposed when traveling between patients or to professional meetings.

In addition to the typical considerations when choosing car insurance, dentists should also carefully evaluate their liability insurance coverage needs. Given your profession’s responsibilities, it’s vital to have enough liability coverage to protect against lawsuits or claims from any accidents while driving.

Factors to Consider When Choosing Car Insurance for Dentists

Your profession imposes unique demands on your insurance, so you’ll have to do more than examine the numbers to determine what each firm truly offers.

Another significant consideration is the coverage options that the insurance company offers. Dentists should prioritize comprehensive coverage that protects against a wide range of risks, including theft, vandalism, natural disasters, and accidents.

Additionally, having coverage for medical payments and uninsured/underinsured motorists is vital to safeguard both yourself and your passengers.

Insurance companies often provide discounts and perks for having multiple coverage types. Bundling simplifies management and may save you money over time.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Find Affordable Car Insurance for Dentists

While comprehensive coverage is essential, it’s also important to consider affordability when choosing car insurance as a dentist. The cost of insurance varies depending on various factors, such as your location, driving history, and the type of vehicle you drive.

Chris Abrams LICENSED INSURANCE AGENT

This can significantly reduce the average car insurance cost per month for dental professionals. See the table below with the most popular car insurance companies for dentists:

Dentist Car Insurance Full Coverage Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 |

| $163 | $208 | $257 | $298 | |

| $198 | $247 | $282 | $275 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

If you’ve got a history of traffic tickets, accidents, or DUIs, your insurance costs are probably going to go up. Insurance companies view individuals with a poor driving record as higher-risk policyholders, which results in higher rates.

It’s important to note that the specific impact of your driving record on insurance rates may vary depending on the insurance provider and your location.

Read More: How long does a DUI stay on your record?

To effectively manage car insurance costs per month, see the tips below, designed specifically for dentists.

- Balance Coverage and Affordability: While comprehensive coverage is vital, dentists should also consider budget-friendly options when selecting car insurance.

- Costs Vary by Profile: Factors like location, driving history, and vehicle type significantly impact insurance rates.

- Compare Multiple Quotes: Shopping around for dentists’ car insurance from at least three motor insurance companies helps identify the best value.

- Look for Dentist-Specific Discounts: Some insurers offer car insurance with a dentist discount or specially tailored car insurance quotes for dentists due to the profession’s low-risk profile.

- Potential Savings: Exploring these options can help dentists secure reliable coverage at a lower cost.

By understanding your unique needs and comparing offers from top auto insurance companies, dentists can secure affordable coverage without sacrificing quality protection.

Common Mistakes to Avoid When Buying Car Insurance as a Dentist

When buying car insurance as a dentist, don’t just select the lowest-priced plan; instead, carefully examine the coverage limits and read the policy details thoroughly. It’s essential to understand your insurance company’s terms and exclusions to ensure adequate protection and adherence to state regulations.

Car Insurance Minimum Coverage Requirements by State

| State | Coverage Limits | Required Coverages |

|---|---|---|

| Alabama | 25/50/25 | Bodily injury liability and property damage liability |

| Alaska | 50/100/25 | Bodily injury liability and property damage liability |

| Arizona | 15/30/10 | Bodily injury liability and property damage liability |

| Arkansas | 25/50/25 | Bodily injury liability, property damage liability and personal injury protection |

| California | 15/30/5 | Bodily injury liability and property damage liability |

| Colorado | 25/50/15 | Bodily injury liability and property damage liability |

| Connecticut | 25/50/20 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Delaware | 25/50/10 | Bodily injury liability, property damage liability and personal injury protection |

| Florida | 10/20/10 | Property damage liability and personal injury protection |

| Georgia | 25/50/25 | Bodily injury liability and property damage liability |

| Hawaii | 20/40/10 | Bodily injury liability, property damage liability and personal injury protection |

| Idaho | 25/50/15 | Bodily injury liability and property damage liability |

| Illinois | 25/50/20 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Indiana | 25/50/25 | Bodily injury liability and property damage liability |

| Iowa | 20/40/15 | Bodily injury liability and property damage liability |

| Kansas | 25/50/25 | Bodily injury liability, property damage liability and personal injury protection |

| Kentucky | 25/50/25 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Louisiana | 15/30/25 | Bodily injury liability and property damage liability |

| Maine | 50/100/25 | Bodily injury liability, property damage liability, uninsured/underinsured motorist coverage and medical payments coverage |

| Maryland | 30/60/15 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Massachusetts | 20/40/5 | Bodily injury liability, property damage liability and personal injury protection |

| Michigan | 20/40/10 | Bodily injury liability, property damage liability and personal injury protection |

| Minnesota | 30/60/10 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Mississippi | 25/50/25 | Bodily injury liability and property damage liability |

| Missouri | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Montana | 25/50/20 | Bodily injury liability and property damage liability |

| Nebraska | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Nevada | 25/50/20 | Bodily injury liability and property damage liability |

| New Hampshire | NA | Financial responsibility (coverage unspecified, may vary by state) |

| New Jersey | 15/30/5 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| New Mexico | 25/50/10 | Bodily injury liability and property damage liability |

| New York | 25/50/10 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| North Carolina | 30/60/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| North Dakota | 25/50/25 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Ohio | 25/50/25 | Bodily injury liability and property damage liability |

| Oklahoma | 25/50/25 | Bodily injury liability and property damage liability |

| Oregon | 25/50/20 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Pennsylvania | 15/30/5 | Bodily injury liability, property damage liability and personal injury protection |

| Rhode Island | 25/50/25 | Bodily injury liability and property damage liability |

| South Carolina | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| South Dakota | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Tennessee | 25/50/15 | Bodily injury liability and property damage liability |

| Texas | 30/60/25 | Bodily injury liability, property damage liability and personal injury protection |

| Utah | 25/65/15 | Bodily injury liability, property damage liability and personal injury protection |

| Vermont | 25/50/10 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Virginia | 25/50/20 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Washington, D.C. | 25/50/10 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| West Virginia | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Wisconsin | 25/50/10 | Bodily injury liability, property damage liability, uninsured/underinsured motorist coverage and medical payments coverage |

| Wyoming | 25/50/20 | Bodily injury liability and property damage liability |

Finally, do not under- or over insure your automobile by considering your risk tolerance, finances, and vehicle value to find an appropriate coverage level. Always compare car insurance quotes to ensure the best balance.

Essential Car Insurance Coverage for Dentists

If you’re wondering, “What does car insurance cover?” your policy should include sufficient liability coverage to safeguard you financially in case of accidents or claims. Liability coverage has two key parts:

- Bodily Injury Liability: Covers medical expenses, pain, and lost wages of others if you’re at fault.

- Property Damage Liability: Pays for repairs or replacement of others’ property.

To find the best coverage, consult an insurance agent experienced with dental professionals who can tailor liability limits and additional protections offered by insurance companies. See the table below:

Car Insurance Coverage Add-On for Dentists

| Insurance Company | Gap Insurance | Rideshare | Roadside Assistance | New Car Replacement | Custom Equipment |

|---|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ❌ | ✅ | |

| ❌ | ✅ | ✅ | ❌ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

Understanding your options helps you choose the right protection for commuting, traveling between offices, and professional events. Learn how the right coverage can safeguard your personal and professional life.

Car Insurance Coverage Options Every Dentist Should Have

What is the best auto insurance for dental professionals? When it comes to car insurance coverage for dentists, several options are essential to ensure comprehensive protection. These coverage options go beyond the state-mandated minimums, providing additional peace of mind.

- Uninsured and Underinsured Motorist Protection: This coverage protects you financially if you’re in an accident with an uninsured or underinsured driver, ensuring you’re not left covering the costs due to their lack of coverage.

- Medical Payments Coverage: This coverage helps pay for medical expenses after an accident, no matter who’s at fault. For dental professionals, it’s a key layer of financial protection against high treatment costs.

- Review Rental Car Coverage: Dentists often rely on their vehicles for work, and rental car coverage provides a temporary replacement after an accident, helping you maintain your professional responsibilities without interruption.

As a dentist, you may rely on a vehicle for your work. If your car is involved in an accident and requires repairs, having rental car coverage can ensure that you have a temporary replacement vehicle, allowing you to continue your professional obligations uninterrupted.

Read More: Best Car Insurance for Medical Payments Coverage

Tips for Saving Money on Car Insurance Premiums as a Dentist

As a dentist, you can save on car insurance premiums without sacrificing coverage by using a few key strategies. Maintaining a clean driving record often leads to lower rates, while increasing your deductible can reduce your premiums.

Special Car Insurance Discounts and Offers

When shopping for car insurance, dentists should explore special discounts and offers available exclusively for individuals in the dental profession. Several insurance companies recognize that dentists generally belong to a low-risk category and provide professional association discounts on car insurance tailored for them.

One common discount is the “professional affinity discount,” offered to individuals who belong to specific professional organizations or associations. Below are the common discounts offered by top insurance companies to dentists:

Car Insurance Discounts for Dentists From Top Provider

| Company | Bundling | AutoPay | Good Driver | UBI | New Car |

|---|---|---|---|---|---|

| 25% | 9% | 25% | 30% | 10% | |

| 25% | 4% | 25% | 30% | 15% |

| 10% | 5% | 20% | 20% | 10% | |

| 20% | 5% | 30% | 30% | 12% | |

| 25% | 15% | 20% | 30% | 8% |

| 20% | 10% | 40% | 40% | 15% |

| 10% | 12% | 30% | $231/yr | 10% | |

| 17% | 13% | 25% | 30% | 15% | |

| 5% | 6% | 10% | 20% | 8% | |

| 13% | 6% | 30% | 30% | 10% |

Insurers often reward dentists who complete defensive driving or risk management courses with meaningful discounts, recognizing their commitment to staying safe on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Financial Stability of Car Insurance Companies for Dentists

When choosing a car insurance provider, it’s important to evaluate the financial stability and reputation of the company.

Kristine Lee LICENSED INSURANCE AGENT

One way to assess the financial stability of an insurance company is to review its A.M. Best rating. A.M. Best is an independent agency that evaluates the financial strength of insurance providers. Look for companies with high ratings, as this indicates their ability to meet their financial obligations, including paying claims.

Overall, it’s essential to choose an insurance company that not only offers competitive rates but also consistently provides reliable and efficient service when you need it most.

Read more: A.M. Best Ratings Explained

How to File a Car Insurance Claim as a Dentist

In the unfortunate event of an accident, it’s essential for dentists to know how to navigate the car insurance claim process effectively. Filing a claim can seem overwhelming, but following a step-by-step guide can help ensure a smoother experience:

- Collect Information: At the scene of the accident, gather contact details of all parties involved, including their insurance information.

- Contact Your Insurance Company: Report the accident to your insurer as soon as possible. Provide them with the gathered information and a detailed account of the incident. They may assign an adjuster to investigate further.

- Provide Documentation: Be ready to supply your insurance company with any documentation they request, such as police reports, photos of the accident scene, and medical records if injuries occur.

Throughout the process, be proactive in communicating with your insurance company and promptly respond to any requests or inquiries.

Read more: What documentation do I need to file a car insurance claim with Progressive?

3 Case Studies: Comprehensive Car Insurance for Dentists

Choosing the right insurance provider can be crucial for professionals like dentists, who have specific needs and unique circumstances.

- Case Study #1 – Personalized Excellence With State Farm: Dr. Sarah Evans, a busy dentist, discovered the best car insurance for dentists through State Farm’s personalized service approach.

- Case Study #2 – Military-Focused Savings With USAA: Captain James Miller, a military dentist, found the best car insurance for dentists through USAA’s specialized military program.

- Case Study #3 – Tech-Savvy Innovation With Progressive: Dr. Emily Chen, a tech-savvy dentist, sought an insurance provider that aligned with her innovative preferences. Progressive, known for its tech-driven approach, provided a user-friendly experience. Dr. Chen secured minimum coverage for $100. The full coverage car insurance price for dentists was $200.

These case studies highlight how dentists can benefit from working with insurance providers that cater to their unique needs. By selecting the right provider, dentists can ensure comprehensive protection and peace of mind in both their professional and personal lives.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Car Insurance Providers Tailored for Dentists

When it comes to choosing the best and cheapest car insurance companies for dentists, these insurers understand the unique needs and challenges that dentists face and have customized their policies accordingly.

One such company is State Farm. This leading insurer offers tailored car insurance policies designed specifically for dentists, combining trusted service with personalized coverage options. Their policies include not only standard coverage but also additional protection that addresses the unique risks associated with the dental profession.

It’s true, everybody. Insurance is, in fact, a sport. @CP3 pic.twitter.com/4L2PUvl2Ss

— State Farm (@StateFarm) October 12, 2018

Other top providers include USAA, which serves military-affiliated dental professionals with specialized coverage at competitive rates, and Progressive, which caters to tech-savvy dentists through innovative digital tools and comprehensive protection.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

What is 30/60/25 coverage?

30/60/25 coverage means $30,000 bodily injury per person, $60,000 per accident, and $25,000 for property damage. While meeting some state minimums, dentists should consider higher limits to protect their assets and professional responsibilities from potential lawsuits.

How much is full coverage insurance a month for dentists?

Dentists can expect to pay between $190-$260 monthly for full coverage. USAA offers the lowest rates at $190 a month for full coverage, while Liberty Mutual is on the higher end at $260 a month. State Farm and Allstate both average around $250 a month for comprehensive protection.

Which type of car insurance is best for dentists who travel between multiple offices?

Dentists with multiple practices need comprehensive coverage with strong liability, uninsured motorists, and rental protection, covering both personal and professional use with higher liability limits.

Read More: Uninsured/Underinsured Motorist Insurance Coverage

Who has the best and cheapest car insurance for dental professionals?

The best car insurance varies by situation. USAA offers the lowest rates for military members, while Progressive and Esurance provide competitive rates for non-military dentists, starting at a minimum of $100 and $200 for full coverage.

Who is the number 1 auto insurer in the U.S. for dentists?

The top auto insurer in the U.S. for dentists is State Farm. It ranks #1 and is best known for its personalized service, offering a 10% multi-policy discount and a 15% safe driver discount.

Read More: Best Safe Driver Car Insurance Discounts

How does a dentist’s driving record impact their insurance rates?

A dentist’s driving record greatly affects insurance costs. Clean records can mean rates from $84 to $248 per month for full coverage. One ticket can raise rates by $30–80, an accident by $50–150, and a DUI increases premiums significantly, though Progressive offers competitive DUI rates around $200 per month.

Read More: How does the insurance company determine my premium?

How do safety features and defensive driving courses impact insurance rates for dentists?

Dentists should promptly file claims by gathering info, contacting insurers, and providing documentation. Insurers like State Farm and USAA offer fast, 24/7 service. USAA dental insurance reviews emphasize their reliable customer support for quick claim resolution.

Do dentists qualify for professional discounts on car insurance?

Yes, many insurers offer dentists 5-15% professional discounts, recognizing them as low-risk drivers. Additional savings are available through dental association memberships.

What happens if I use my personal vehicle for dental practice business?

You’ll need business use coverage since personal policies exclude work-related accidents. Consider commercial auto insurance or business use endorsements for protection.

Should dentists consider higher liability limits than standard coverage?

Yes, experts recommend $500,000-$1 million limits to protect against potential lawsuits. The minimal extra cost provides significant financial protection for your assets. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.