Best Business Insurance for Home Tutors in 2026 (Top 10 Companies)

Travelers, Chubb, and The Hartford offer the best business insurance for home tutors with competitive rates, starting as low as $50 per month. Protect your tutoring business with specialized coverage tailored to your needs, ensuring comprehensive protection for your students, property, and liabilities.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated February 2025

Company Facts

Full Coverage for Home Tutors

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Home Tutors

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Home Tutors

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best business insurance for home tutors are Travelers, Chubb, and The Hartford. These companies excel in providing competitive rates and comprehensive coverage tailored to the unique needs of tutoring businesses.

In catering to tutoring businesses, Travelers understands the unique needs, such as health insurance for tutors. Their customizable policies enable home tutors to manage risks effectively, safeguarding their well-being while delivering quality educational services.

Our Top 10 Company Picks: Best Business Insurance for Home Tutors

| Company | Rank | Multi-Policy Discount | Education Industry Discount | Best For | See Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 8% | Customizable Coverage | Travelers | |

| #2 | 15% | 10% | Tailored Coverage | Chubb | |

| #3 | 14% | 9% | Specialized Coverage | The Hartford |

| #4 | 13% | 8% | Add-on Coverages | Liberty Mutual |

| #5 | 12% | 7% | Bundling Policies | Nationwide |

| #6 | 13% | 8% | Online Convenience | Progressive | |

| #7 | 11% | 6% | Local Agents | Farmers | |

| #8 | 14% | 9% | Safe-Driving Discounts | Allstate | |

| #9 | 12% | 7% | Student Savings | Markel | |

| #10 | 10% | 5% | Customizable Policies | American Family |

With a strong emphasis on delivering value, these insurers enable home tutors to select coverage options that align seamlessly with their business requirements, establishing them as the preferred choices in the industry.

Enter your ZIP code belowto get started on comparing business insurance quotes.

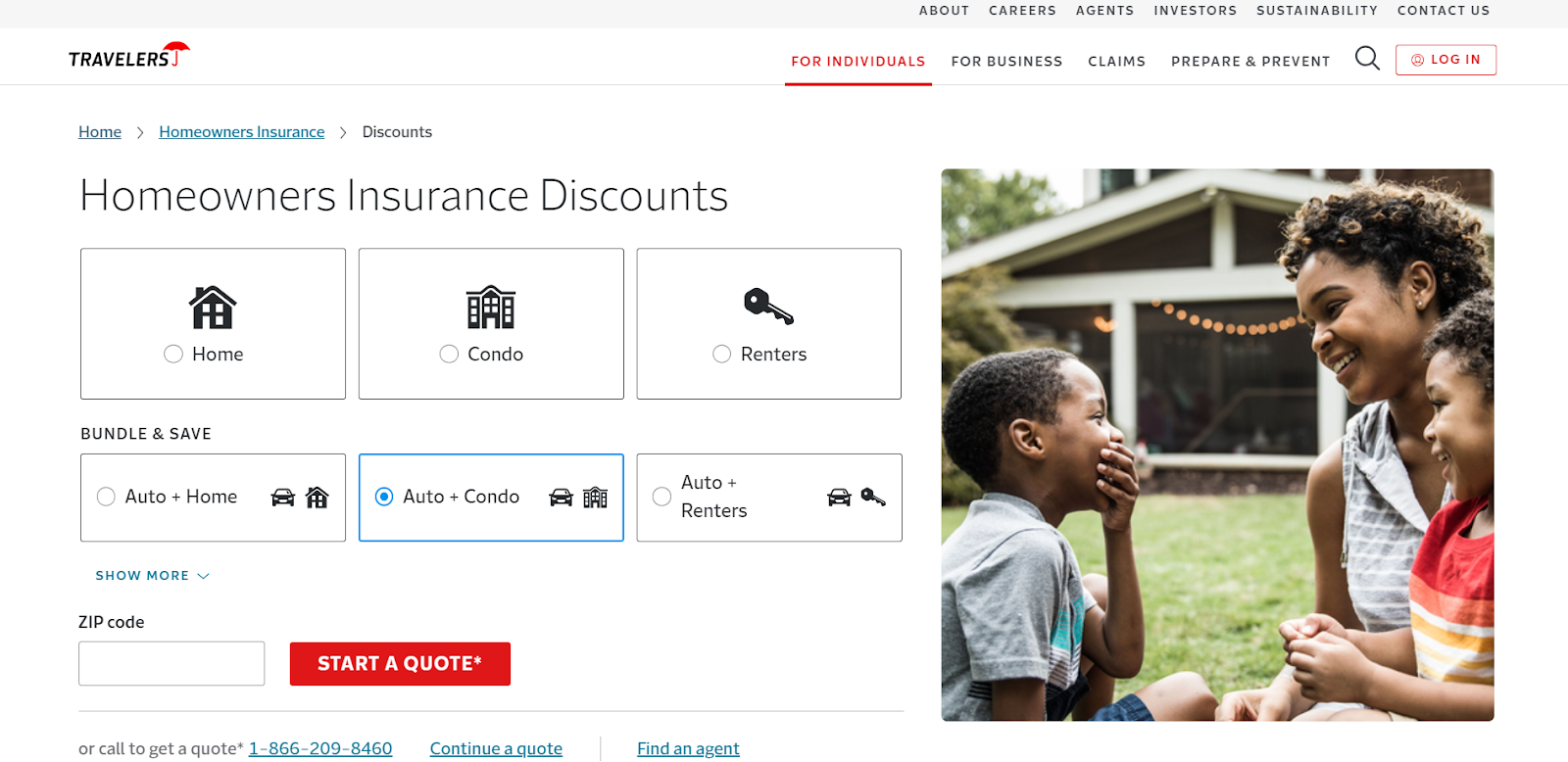

#1 – Travelers: Top Overall Pick

Pros

- Industry Experience: Long-standing history in the insurance industry.

- Comprehensive Coverage: Offers a wide range of coverage options.

- Financial Stability: Our Travelers insurance review & ratings show the company is highly regarded for its financial strength, ensuring reliable coverage.

Cons

- Cost: Perceived as relatively more expensive by some.

- Limited Online Presence: Online tools and resources may be less robust.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Chubb: Best for Global Solutions

Pros

- Highly Customizable Policies: Offers highly customizable insurance solutions.

- Global Presence: Chubb insurance review & ratings showcase the company’s comprehensive coverage and support for international operations.

- Risk Engineering Services: Offers risk engineering services for proactive risk management.

Cons

- Premium Pricing: Policies may be perceived as premium-priced.

- Limited Online Presence: Online resources and tools may be less user-friendly.

#3 – The Hartford: Best for Specialized Excellence

Pros

- Specialized Industry Focus: Known for expertise in providing insurance solutions for specific industries.

- Customer Service: Our The Hartford insurance review & ratings show the company is highly regarded for its customer service.

- Risk Management Resources: Offers tools and resources for effective risk management.

Cons

- Coverage Limitations: Some businesses may find limitations in certain coverage options.

- Availability: Coverage options and specific policies may not be available in all locations.

#4 – Liberty Mutual: Best for Extensive Coverage

Pros

- Extensive Coverage Options: Offers a wide range of coverage options for various business needs.

- Digital Tools: Our Liberty Mutual insurance review & ratings reveal user-friendly online tools for policy management and claims.

- Discount Programs: Offers various discount programs that can help businesses save on premiums.

Cons

- Pricing: Some customers may find Liberty Mutual’s pricing to be on the higher side.

- Claims Processing Time: Complaints about claims processing time may exist.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Versatile Protection

Pros

- Versatile Coverage: Our Nationwide insurance review & ratings offer a comprehensive analysis of the company’s diverse insurance products tailored to various business types.

- Risk Management Services: Provides resources to help businesses manage and mitigate risks.

- Online Account Management: User-friendly online tools for policy management and information.

Cons

- Pricing: Some businesses may find Nationwide’s premiums relatively higher.

- Policy Customization: Limited flexibility in customizing policies compared to some competitors.

#6 – Progressive: Best for Digital Experience

Pros

- Competitive Pricing: Known for offering competitive pricing on insurance policies.

- Digital Tools: User-friendly online tools for obtaining quotes and managing policies.

- Discount Programs: Numerous discount programs are available for businesses, along with a comprehensive analysis of Progressive insurance review & ratings.

Cons

- Limited Industry Specialization: May not have as much industry specialization as some competitors.

- Customer Service: Some customers may express concerns about customer service.

#7 – Farmers: Best for Diverse Coverage

Pros

- Diverse Coverage Options: Provides a wide range of insurance coverage options for businesses.

- Local Agent Network: Our Farmers insurance review & ratings highlight the company’s extensive network of local agents, providing personalized service to customers.

- Discount Programs: Offers various discount programs to help businesses save on premiums.

Cons

- Pricing: Some businesses may find Farmers’ premiums to be on the higher side.

- Claims Handling: Mixed reviews regarding the efficiency of the claims handling process.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Comprehensive Choices

Pros

- Multiple Coverage Options: Offers various coverage options to cater to different business needs.

- Local Agents: Has a network of local agents for personalized assistance and advice.

- Digital Tools: Our Allstate insurance review & ratings showcase user-friendly online tools for policy management and claims, highlighting the company’s commitment to customer satisfaction.

Cons

- Premium Pricing: Some businesses may find Allstate’s premiums relatively higher.

- Claims Processing Time: Complaints about claims processing time may exist.

#9 – Markel: Best for Specialized Solutions

Pros

- Specialized Coverage: Known for providing specialized insurance solutions for niche markets.

- Risk Management Services: Offers risk management services to help businesses mitigate risks.

- Flexible Policies: Markel insurance review & ratings highlight its flexibility in customizing policies to meet unique business needs.

Cons

- Limited Industry Reach: May not provide coverage for all industries, focusing on specific niches.

- Online Presence: Online tools and resources may not be as advanced compared to larger insurers.

#10 – American Family: Best for Diverse Options

Pros

- Diverse Coverage Options: Offers a variety of coverage options to meet different business needs.

- Local Agents: Ensuring an optimal American Family insurance review & ratings experience, we maintain a network of local agents for personalized service and support.

- Discount Programs: Provides various discount programs to help businesses manage costs.

Cons

- Pricing: Some businesses may find American Family’s premiums relatively higher.

- Claims Processing: Mixed reviews about the efficiency of the claims processing system.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home Tutor Business Insurance: Essential to Protect Students and Tutors

Tutors have unique needs when it comes to insurance coverage due to the nature of their work and the potential risks involved. Here are some key points explaining why tutors need insurance:

- Student Expectations: Tutors are entrusted with the task of preparing students for important exams that can significantly impact their future. With high client expectations, there is a risk of lawsuits if students feel dissatisfied with their results. Insurance provides a safety net by covering legal expenses that may arise from such situations.

- Legal Protection: Tutors may face allegations of negligence, mistakes, or oversights during their tutoring sessions. These allegations can lead to lawsuits, and the legal costs involved can be substantial. Insurance helps tutors protect themselves from the financial burden of legal expenses and ensures they can mount a proper defense.

- Medical Expenses: Accidents can happen during tutoring sessions, resulting in injuries to students or tutors themselves. Insurance coverage can help with the costs of medical bills, ensuring that tutors are not personally responsible for covering these expenses.

- Unexpected Costs: Running a tutoring business comes with various unforeseen costs, such as property damage, theft, or accidents. Insurance provides financial protection against these unexpected events, helping tutors recover and continue their business operations without significant financial setbacks.

- Business Continuity: In the event of a major incident or disaster, such as a fire or natural disaster, insurance can provide the necessary funds to help tutors rebuild their business and resume operations.

In summary, insurance is essential for tutors, offering protection from lawsuits, covering medical expenses, and ensuring business continuity. It provides peace of mind and financial security, allowing tutors to focus on delivering excellent educational services without worrying about potential risks.

Jeff Root Licensed Life Insurance Agent

Business insurance for home tutors is crucial, protecting against legal liabilities, covering medical expenses, and unforeseen costs. With comprehensive coverage, tutors safeguard their students, livelihoods, and peace of mind. Investing in insurance allows tutors to focus on delivering educational services without concerns about potential risks. Securing the right insurance is essential for the tutoring business.

Essential Insurance Coverage for Home Tutors

To adequately protect their business, tutors should consider the following types of insurance coverage:

- Business Owner’s Policy (BOP): An affordable option that combines commercial property insurance and general liability coverage, suitable for small tutoring businesses.

- General Liability Insurance: Covers basic third-party risks, such as accidental damage to a student’s property during a tutoring session. Often required for commercial leases.

- Professional Liability Insurance: Also known as errors and omissions insurance (E&O), this policy covers legal costs if a tutor is sued for negligence, mistakes, or oversights.

- Workers’ Compensation Insurance: Most states require workers’ compensation for tutoring businesses with employees. It also protects sole proprietors from work-related injury costs that health insurance might not cover.

- Commercial Car Insurance: Commercial car insurance provides financial protection when tutors use their vehicles for business purposes. Car liability insurance requirements differ by state.

- Cyber Liability Insurance: Recommended for businesses handling sensitive information, such as credit card numbers. Helps tutors recover from data breaches and cyberattacks.

Safeguard your tutoring business with essential insurance coverage tailored to your needs. From general liability to professional indemnity, these policies provide vital protection against potential risks and liabilities, ensuring peace of mind as you focus on delivering quality educational services to your students.

Home Tutors Business Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$55 $76

$57 $78

$58 $80

$54 $76

$56 $78

$56 $76

$53 $73

$57 $79

$52 $72

$55 $75

Finding the right insurance coverage for your home tutoring business is crucial for protecting your livelihood. With competitive monthly rates from reputable insurers like Travelers, Chubb, and The Hartford, you can secure comprehensive coverage that meets your needs without breaking the bank. Explore your options and safeguard your business with confidence.

Securing Insurance for Your Home Tutoring Business: A Simple Three-Step Process

Acquiring insurance for your tutoring services is a straightforward process. Follow these three steps:

- Prepare Your Business Information: Gather basic details about your business, such as revenue and the number of employees.

- Complete the Application: Fill out the online application form, providing the necessary information about your tutoring business.

- Consult an Insurance Professional: After submitting your application, an insurance professional will review your information and provide advice tailored to your specific insurance needs.

Ensuring the security of your home tutoring business through insurance is not just a smart choice; it’s a fundamental step towards safeguarding your professional endeavors. By following this simple three-step process, you can navigate the intricacies of insurance acquisition with ease.

Remember, your business’s protection is paramount, and consulting with a licensed insurance professional can provide invaluable insights tailored to your specific needs. Embrace the peace of mind that comes with comprehensive coverage, and focus on what truly matters: providing exceptional educational services to your students.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Highlighting Business Insurance for Home Tutors

Demonstrating Insurance Benefits for Home Tutors Insurance plays a crucial role in safeguarding home tutoring businesses against unexpected liabilities and accidents. Through four illustrative case studies, observe how various types of coverage provide financial security and peace of mind for tutors.

- Case Study #1 – General Liability Protection: Sarah’s tutoring session results in significant damage to expensive electronic equipment when a student accidentally knocks it over. Thanks to Sarah’s general liability insurance, the policy covers the repair or replacement costs, saving her from financial burden.

- Case Study #2 – Professional Liability Coverage: John, a private tutor, faces a lawsuit threat after a student accuses him of providing incorrect information during a session, resulting in poor exam performance. Fortunately, John’s professional liability insurance covers legal costs, protecting his reputation and finances.

- Case Study #3 – Worker’s Compensation Security: Maria’s assistant suffers a severe injury while working for her tutoring business, necessitating medical treatment and wage replacement. Worker’s compensation insurance covers these expenses, preventing Maria from personal liability and potential lawsuits.

- Case Study #4 – Commercial Auto Assurance: David, using his personal vehicle for tutoring sessions, gets into a car accident, resulting in damage to both vehicles. David’s commercial car insurance covers repair costs, sparing him from financial consequences.

These case studies highlight the importance of different types of insurance for home tutors. General liability insurance protects against property damage during tutoring sessions, professional liability insurance safeguards tutors from claims of negligence, workers’ compensation insurance provides coverage for work-related injuries, and commercial car insurance offers financial protection.

Melanie Musson Published Insurance Expert

Having the appropriate insurance coverage ensures that home tutors can focus on providing excellent educational services while being prepared for unforeseen events.

Protect Your Tutoring Business With a Commercial Policy

Tutors must prioritize insurance coverage to safeguard their businesses, protecting themselves, clients, and businesses from lawsuits, costs, and risks. With insurance, they shield themselves from legal expenses, medical bills, and unforeseen costs, including professional liability insurance (errors and omissions insurance).

Relevant insurance types include general liability for third-party risks, professional liability for legal costs due to negligence, workers’ compensation for employees, and commercial auto and cyber liability for accidents and data breaches. Insurance costs vary based on factors like business size and coverage.

While acquiring insurance is straightforward online, consulting licensed professionals is advisable for tailored advice. Careful consideration and comparison ensure adequate protection, providing peace of mind and allowing tutors to focus on delivering excellent educational services.

Our free comparison tool makes it easy to stick to your business insurance budget – enter your ZIP code below to get started.

Frequently Asked Questions

What types of insurance are available for tutoring businesses?

There are various types of insurance available for tutoring businesses, including liability insurance for tutoring business, professional liability insurance (such as Allstate errors and omissions insurance), workers’ compensation insurance, and commercial auto insurance.

Do tutors need insurance?

Yes, business insurance for tutors, including home tutor insurance and insurance for private tutors, is essential for private tutors to protect themselves and their businesses from potential risks and liabilities.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Best Business Insurance: A Complete Guide,” available for your reference.

What does liability insurance for tutors cover?

Liability insurance for tutors typically covers third-party claims of bodily injury or property damage occurring during tutoring sessions, protecting tutors from potential lawsuits.

What is private tutor insurance?

Private tutor insurance refers to insurance coverage specifically tailored to the needs of individual tutors, providing protection against various risks associated with their profession.

Compare your rideshare insurance options by entering your ZIP code into our free quote tool below.

Is business insurance necessary for tutoring at home?

Yes, insurance for tutoring at home, including insurance needed for tutoring business, is crucial to protect against potential liabilities and accidents that may occur on the premises.

For a thorough analysis, consult our guide, “Liability Insurance: A Complete Guide,” covering all aspects pertinent to tutoring businesses.

Are there discounts available for tutor insurance?

Some insurance providers may offer discounts or special rates for tutoring businesses, especially if they have a clean claims history or bundle multiple policies together. It’s advisable to compare insurance quotes to find the best deal for your tutoring business.

What is the cost of insurance for tutoring businesses?

The cost of insurance for tutoring businesses varies depending on factors such as business size, revenue, location, and the specific coverage needed. Independent tutors may pay lower premiums compared to larger tutoring companies.

What insurance is needed for a tutoring business?

A tutoring business may require several types of insurance, including private tutoring business insurance, liability insurance for tutoring business, professional liability insurance, and possibly workers’ compensation insurance, depending on the business’s size and structure.

To gain thorough knowledge, consult our detailed resource titled “Liability Insurance: A Complete Guide” for valuable insights and guidance.

Does insurance for tutoring businesses cover cyber liability?

Some insurance policies for tutoring businesses may include coverage for cyber liability, protecting against data breaches and cyberattacks that may compromise sensitive information.

Find affordable options for commercial insurance by entering your ZIP code below into our free comparison tool.

How can I get insurance for my tutoring business?

You can obtain insurance for your tutoring business by contacting insurance providers directly, comparing quotes online, or consulting with insurance agents specializing in small businesses or professional services.

For a comprehensive analysis, refer to our detailed guide titled “How To Get Free Insurance Quotes Online” to delve deeper into securing the best coverage for your home tutoring business.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.