| City | Rates |

|---|---|

| Alexandria | $66 |

| Arlington | $68 |

| Chesapeake | $60 |

| Hampton | $58 |

| Newport News | $57 |

| Norfolk | $64 |

| Richmond | $65 |

| Roanoke | $55 |

| Virginia Beach | $62 |

| Williamsburg | $59 |

Virginia Car Insurance Requirements in 2026 (Minimum Coverage in VA)

Virginia car insurance requirements mandate 30/60/20 in liability coverage—$30,000 for bodily injury per person, $60,000 per accident, and $20,000 for property damage. Drivers can find affordable Virginia car insurance, with monthly rates starting as low as $25.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated August 2025

Virginia car insurance requirements mandate 30/60/20 liability coverage: $30,000 for bodily injury per person, $60,000 per accident, and $20,000 for property damage.

These limits ensure drivers can cover basic injury and damage costs in an at-fault accident. Drivers must also carry uninsured/underinsured motorist coverage with the same minimums.

Virginia Car Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $20,000 per accident |

It also covers penalties for noncompliance and options, such as paying a $500 UMV fee if you choose not to opt out of traditional coverage.

- Virginia requires 30/60/20 liability plus UI/UIM coverage

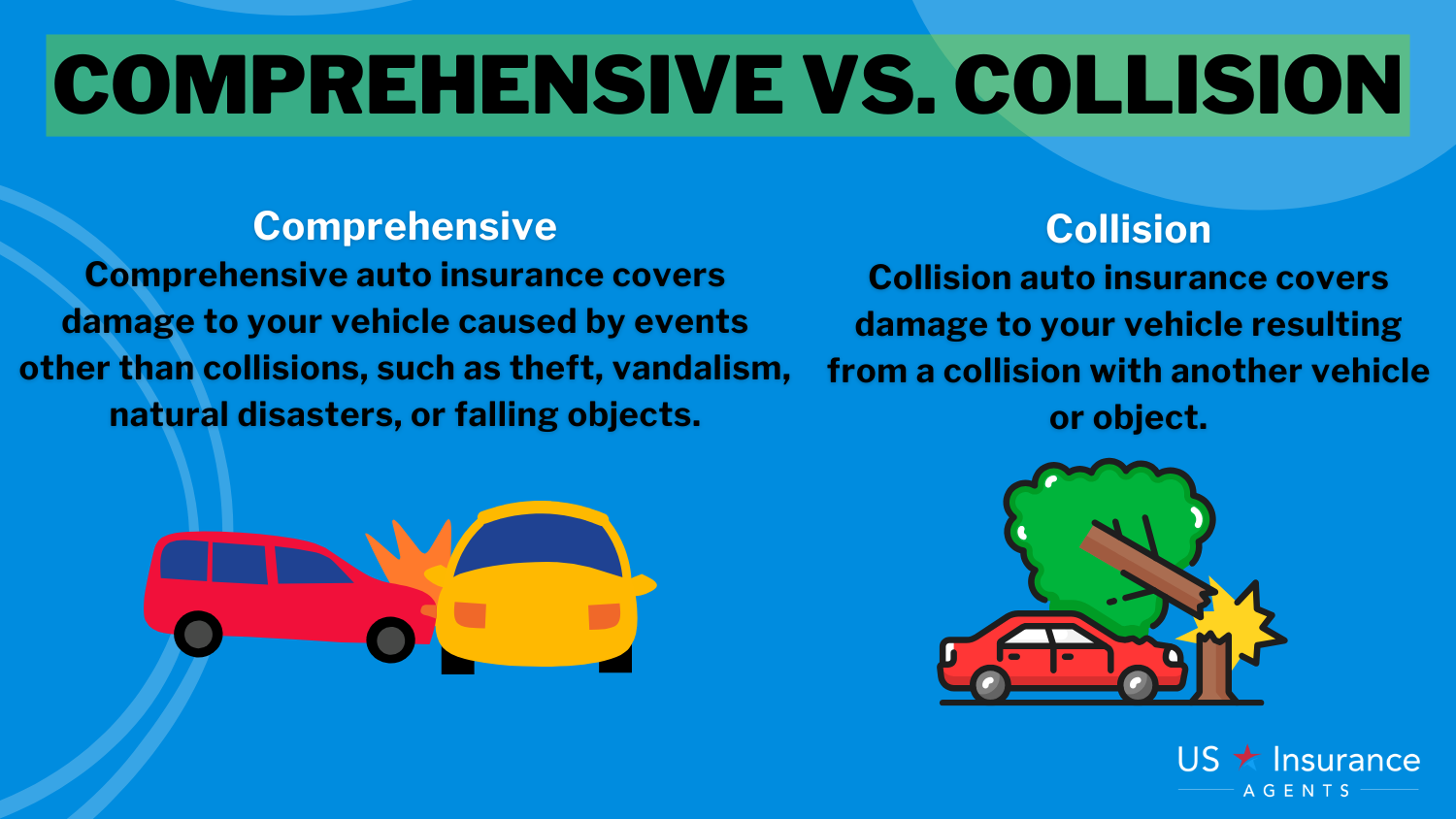

- Collision and comprehensive coverage also cover vehicle damage

- Proof of insurance is required; violations may lead to $500 fees and SR-22 filings

To get the best Virginia car insurance, enter your ZIP code and compare the most affordable options near you. Rates vary, so the best way to meet Virginia car insurance requirements is to compare multiple rates.

Virginia Minimum Coverage Requirements & What They Cover

Virginia requires the following minimum liability coverage:

- $25,000/$50,000 for bodily injury

- $20,000 for property damage

Also required:

- $25,000 / $50,000 for uninsured/underinsured bodily injury

- $20,000 for uninsured/underinsured property damage

Additional insurance coverage can include:

- Comprehensive and collision coverage

Comprehensive and collision insurance covers repairs or replacement if your vehicle is damaged.

Collision car insurance applies to accident-related damage. Comprehensive coverage covers non-collision events, such as fire or theft.

Kristine Lee Licensed Insurance Agent

Coverage is recommended even if your car isn’t on Virginia’s list of most stolen vehicles.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance Options in VA

The cheapest car insurance in Virginia is offered by USAA, Progressive, and State Farm, with rates starting at $18 per month.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Virginia

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Virginia

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe lowest rates are usually for minimum liability insurance policies that meet Virginia’s 30/60/20 limits. Car insurance discounts, driving history, and coverage choices affect your final premium. The table below shows monthly minimum coverage car insurance rates by city in Virginia.

Roanoke has the cheapest minimum coverage rate in Virginia at $55 per month.

Car Insurance Monthly Rates in Virginia by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $237 | $238 | $174 | $165 | $174 | $165 | $174 | $165 | |

| $144 | $170 | $131 | $132 | $131 | $132 | $131 | $132 | |

| $203 | $212 | $160 | $160 | $160 | $160 | $160 | $160 | |

| $154 | $161 | $154 | $161 | $115 | $111 | $115 | $111 | |

| $227 | $261 | $203 | $206 | $203 | $206 | $203 | $206 |

| $161 | $177 | $136 | $137 | $136 | $137 | $136 | $137 |

| $135 | $139 | $135 | $139 | $102 | $97 | $102 | $97 | |

| $122 | $141 | $101 | $101 | $101 | $101 | $101 | $101 | |

| $129 | $140 | $116 | $117 | $116 | $117 | $116 | $117 | |

| $97 | $107 | $70 | $69 | $70 | $69 | $70 | $69 |

Rates may vary depending on age and gender, with younger drivers and males typically paying more for coverage.

The table below outlines monthly car insurance rates in Virginia based on provider and driving record.

Car Insurance Monthly Rates in Virginia by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $168 | $217 | $270 | $246 | |

| $135 | $157 | $204 | $224 | |

| $163 | $203 | $232 | $227 | |

| $113 | $113 | $176 | $310 | |

| $211 | $257 | $285 | $380 |

| $140 | $169 | $140 | $246 |

| $99 | $132 | $166 | $132 | |

| $103 | $113 | $122 | $113 | |

| $120 | $163 | $168 | $250 | |

| $71 | $84 | $98 | $131 |

Rates may vary depending on each provider’s policies and the driver’s record, including any history of violations or accidents.

Consequences of Driving Without Insurance in Virginia

Failure to meet Virginia car insurance requirements or show proof of insurance results in penalties and fees.

If you are unable to show proof of insurance, you can face the following penalties:

- Suspended registration

- Statutory fee of $500 and reinstatement fees

- Requirement to submit an SR-22 for 3 years

Learn how to find the best car insurance companies and avoid penalties in Virginia for not having proof of insurance.

Proof of Insurance and Financial Responsibility

Proof of insurance and financial responsibility:

- Get a standard liability car insurance policy

- Pay a $500 Uninsured Motor Vehicle (UMV) fee (valid 12 months, no coverage)

- Other options apply only to non-consumer vehicles

Need to meet Virginia car insurance requirements? Proof of insurance isn’t enough—you’re also responsible for covering costs if you’re at fault.

Check Reddit’s tip: Google “independent insurance agency Richmond, VA,” read reviews, and call a few. You’ll deal with agents more than the insurance companies.

Each agency offers different rates. Don’t settle—compare options and make sure your coverage meets Virginia car insurance laws and financial responsibility requirements.

Required Documentation

To provide proof of insurance, you can provide one of the following:

- Insurance ID Card

- Evidence of currently paid UMV

Check USAA’s website to upload proof of insurance or access your digital ID card.

Keep it available when driving, registering, or after an accident.

You must maintain proof of insurance and financial responsibility and present it:

- When asked by a police officer

- When registering your vehicle

- After an accident

- Anytime you are operating a vehicle

Chris Abrams Licensed Insurance Agent

Meeting Virginia car insurance requirements for uninsured motorist coverage means carrying at least 30/60/20 liability limits and matching uninsured motorist coverage.

Compare rates by ZIP code to find the best rates. Optional coverage, like collision and comprehensive, can offer added protection. Maintain proof of insurance to avoid fines, fees, and license issues.

Get the minimum car insurance coverage in Virginia to drive legally by entering your ZIP code into our free quote comparison tool.

Virginia Insurance Agents

Virginia Beach Car Insurance | Norfolk Car Insurance | Chesapeake Car Insurance | Richmond Car Insurance | Newport News Car Insurance | Alexandria Car Insurance | Hampton Car Insurance | Roanoke Car Insurance | Portsmouth Car Insurance | Suffolk Car Insurance | Lynchburg Car Insurance | Harrisonburg Car Insurance | Leesburg Car Insurance | Charlottesville Car Insurance | Blacksburg Car Insurance | Danville Car Insurance | Manassas Car Insurance | Petersburg Car Insurance

Frequently Asked Questions

What are the minimum car insurance requirements in Virginia?

Virginia mandates 30/60/20 liability coverage: $30,000 per person, $60,000 per accident for bodily injury, and $20,000 for property damage.

Is uninsured/underinsured motorist coverage required in Virginia?

Yes, Virginia requires uninsured/underinsured motorist coverage with the same minimum limits as minimum VA car insurance coverage.

Can I use car insurance from another state in the state of Virginia?

No, Virginia residents must have car insurance that meets the state’s minimum coverage requirements.

What is the Uninsured Motor Vehicle (UMV) fee in Virginia?

Drivers can pay a $500 annual UMV fee to drive legally without insurance, but it does not offer any coverage.

What are the penalties for driving without insurance in Virginia?

Penalties for not meeting Virginia car insurance requirements for SR-22 include a $500 fine, suspended registration, and a three-year requirement to file an SR-22.

Is personal injury protection (PIP) required in Virginia?

No, PIP is not required in Virginia, but drivers may opt for medical payments coverage for additional protection.

How can I provide proof of insurance in the state of Virginia?

Drivers can pay a $500 annual UMV fee to drive legally without insurance, but it does not provide any coverage, as per Virginia’s car insurance requirements for the UMV fee.

Can my car insurance policy be canceled in the state of Virginia?

Yes, insurers can cancel policies for reasons such as nonpayment or fraud, provided they give the policyholder prior notice.

How do I file a complaint against my car insurance company in Virginia?

You can file a complaint with the Virginia Bureau of Insurance for investigation and resolution.

What optional coverages are available in the state of Virginia?

Optional coverages include collision, comprehensive, medical payments, and rental reimbursement. No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.