Best Insurance for CBD Businesses in 2026 (Top 10 Companies)

Explore the best insurance for CBD businesses with Progressive, State Farm, and Allstate. Delight in the peace of mind that comes with comprehensive coverage, and a generous 15% discount. These benefits ensure that your CBD venture is focus on growing your business without worrying about insurance concerns.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated February 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for CBD Businesses

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for CBD Businesses

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage for CBD Businesses

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsProgressive, State Farm, and Allstate emerge as the leading choices for the best insurance for CBD businesses, providing a comprehensive coverage and tailored policies and a substantial 15% discount.

Delve into our comprehensive guide to reveal critical aspects such as product liability protection, cyber insurance, and regulatory compliance to shield your CBD venture effectively.

Our Top 10 Company Picks: Best Insurance for CBD Businesses

| Company | Rank | Multi-Policy Discount | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 30% | Customized Coverage | Progressive | |

| #2 | 17% | 25% | Personalized Service | State Farm | |

| #3 | 25% | 20% | Enhanced Protection | Allstate | |

| #4 | 20% | 25% | Industry Expertise | Nationwide |

| #5 | 15% | 10% | Comprehensive Policies | Farmers | |

| #6 | 25% | 20% | Strong Financials | Liberty Mutual |

| #7 | 12% | 23% | Flexible Options | Travelers | |

| #8 | 20% | 15% | Specialized Coverage | The Hartford |

| #9 | 20% | 22% | Industry Knowledge | American Family | |

| #10 | 15% | 18% | Global Reach | AIG |

With expert recommendations and competitive rates from trusted insurers, fortify your business against potential risks and pave the way for a thriving future in the CBD industry.

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

- Competitive rates and a 15% discount available with Progressive

- Specialized policies addressing product liability and cyber risks

- Comprehensive coverage tailored for CBD businesses’ unique risks

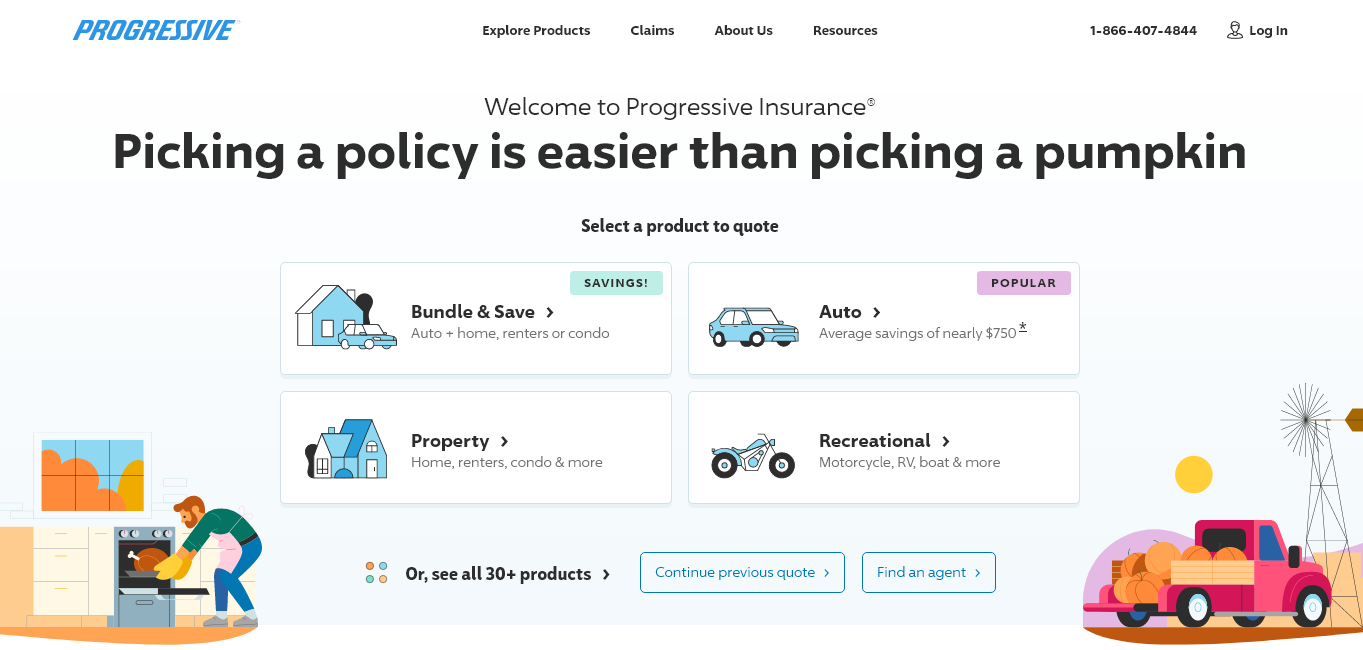

#1 – Progressive: Top Overall Pick

Pros

- Customized Coverage: Progressive offers a high level of customization, allowing customers to tailor their insurance coverage to their specific needs.

- Safe Driver Discount: The company provides a substantial safe driver discount of up to 30%, incentivizing and rewarding safe driving habits.

- Multi-Policy Discount: Progressive insurance review & ratings highlight the opportunity for customers to save through a multi-policy discount of up to 15%, incentivizing the bundling of multiple insurance policies for added cost-effectiveness.

Cons

- Limited Multi-Policy Discount: While there is a multi-policy discount, it is not as high as some competitors, potentially making it less attractive for customers looking to bundle multiple policies.

- May not be Cost-Effective for Some Drivers: Depending on individual circumstances, the customized coverage may result in higher premiums compared to more standardized plans.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm insurance review & ratings highlight the company’s reputation for personalized service, offering clients a dedicated agent who caters to their individual insurance requirements.

- Safe Driver Discount: Offers a competitive safe driver discount of up to 25%, encouraging and rewarding safe driving habits.

- Multi-Policy Discount: Provides a multi-policy discount of up to 17%, promoting savings for customers who bundle multiple policies.

Cons

- May Lack Customization: The emphasis on personalized service may mean that the company’s policies are less flexible and customizable compared to some competitors.

- Possibly Higher Premiums: While personalized service is a benefit, it may come at a cost, potentially resulting in higher premiums for some policyholders.

#3 – Allstate: Best for Enhanced Protection

Pros

- Enhanced Protection: Allstate emphasizes enhanced protection, appealing to customers seeking comprehensive coverage for a variety of risks.

- Safe Driver Discount: The Allstate insurance review & ratings highlight a beneficial incentive, granting a safe driver discount of up to 20%, as a means to encourage and acknowledge responsible driving behaviors.

- Multi-Policy Discount: Allstate provides a multi-policy discount of up to 25%, encouraging customers to bundle multiple insurance policies.

Cons

- Potentially Higher Premiums: The focus on enhanced protection may result in higher premiums compared to companies that offer more basic coverage options.

- Limited safe Driver Discount: While a safe driver discount is offered, it may not be as substantial as some competitors, potentially offering fewer savings for safe drivers.

#4 – Nationwide: Best for Industry Expertise

Pros

- Industry Expertise: Nationwide is known for its industry expertise, making it an appealing choice for customers who value a company with deep knowledge of the insurance sector.

- Safe Driver Discount: The Nationwide insurance review & ratings showcases an enticing safe driver incentive, providing a competitive discount of up to 25% to encourage and acknowledge responsible driving behavior.

- Multi-Policy Discount: Nationwide provides a multi-policy discount of up to 20%, encouraging customers to bundle multiple insurance policies.

Cons

- Possibly Higher Premiums: The emphasis on industry expertise and comprehensive coverage may result in higher premiums compared to companies with more basic policies.

- May Lack Customization: Nationwide’s focus on industry expertise may mean that its policies are less customizable for customers with unique needs.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Comprehensive Policies

Pros:

- Comprehensive Policies: Farmers is recognized for offering comprehensive policies, appealing to customers who want coverage for a wide range of risks.

- Safe Driver Discount: Provides a safe driver discount of up to 10%, incentivizing and rewarding safe driving habits.

- Multi-Policy Discount: Farmers insurance review & ratings highlight a potential saving opportunity with a multi-policy discount of up to 15%, incentivizing customers to combine various insurance policies for greater affordability.

Cons

- Potentially Limited Safe Driver Discount: The safe driver discount offered by Farmers is relatively lower compared to some competitors, providing less incentive for safe driving.

- May Have Higher Premiums for Comprehensive Coverage: While comprehensive policies are a strength, they may come at a higher cost compared to more basic coverage options.

#6 – Liberty Mutual: Best for Strong Financials

Pros

- Strong Financials: Liberty Mutual boasts strong financial stability, providing reassurance to customers about the company’s ability to fulfill its obligations.

- Safe Driver Discount: Liberty Mutual insurance review & ratings highlights a significant incentive for safe driving, providing a discount of up to 20% to policyholders who demonstrate safe driving behaviors, thereby encouraging and recognizing responsible driving practices.

- Multi-Policy Discount: Liberty Mutual provides a multi-policy discount of up to 25%, encouraging customers to bundle multiple insurance policies.

Cons

- Possibly Higher Premiums: The strong financials and comprehensive coverage options may result in higher premiums compared to companies with more basic plans.

- Limited Global Reach: While strong domestically, Liberty Mutual’s global reach may be more limited compared to some international competitors.

#7 – Travelers: Best for Best Insurance for CBD Businesses

Pros

- Flexible Options: Travelers stands out for offering flexible insurance options, catering to customers who value versatility in their coverage.

- Safe Driver Discount: The Travelers insurance review & ratings highlights a compelling incentive with a competitive safe driver discount of up to 23%, promoting and incentivizing responsible driving behavior.

- Multi-Policy Discount: Travelers offers a multi-policy discount of up to 12%, promoting savings for customers who bundle multiple insurance policies.

Cons

- Possibly Higher Premiums for Flexibility: The flexibility in options may come at a cost, potentially resulting in higher premiums for customers who desire more customized coverage.

- May not be Ideal for Those Seeking Industry Expertise: Travelers’ strength in flexibility may mean it lacks the specialized industry knowledge that some customers prioritize.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Specialized Coverage

Pros

- Specialized Coverage: The Hartford is known for offering specialized coverage, making it a suitable choice for customers with unique insurance needs.

- Safe Driver Discount: The Hartford insurance review & ratings showcase the company’s tailored coverage options, demonstrating their commitment to providing customized protection for drivers who prioritize safety on the road.

- Multi-Policy Discount: The Hartford provides a multi-policy discount of up to 20%, encouraging customers to bundle multiple insurance policies.

Cons

- Possibly Limited Customization: While specialized coverage is a strength, The Hartford’s policies may have limited customization compared to companies with more flexible options.

- May Lack Global Reach: The Hartford’s focus on specialized coverage may mean it has a more limited global reach compared to some international competitors.

#9 – American Family: Best for Industry Knowledge

Pros

- Industry Knowledge: American Family is recognized for its industry knowledge, appealing to customers who prioritize a company with a deep understanding of the insurance sector.

- Safe Driver Discount: American Family insurance review & ratings showcases the company’s tailored coverage options for safe drivers, with a discount of up to 22%, demonstrating their commitment to rewarding and encouraging safe driving practices.

- Multi-Policy Discount: American Family offers a multi-policy discount of up to 20%, encouraging customers to bundle multiple insurance policies.

Cons

- Possibly Higher Premiums for Industry Knowledge: The emphasis on industry knowledge and comprehensive coverage may result in higher premiums compared to companies with more basic policies.

- May Lack Global Reach: American Family’s focus on industry knowledge may mean it has a more limited global reach compared to some international competitors.

#10 – AIG: Best for Global Reach

Pros

- Global Reach: AIG stands out for its global reach, making it an ideal choice for customers who value an insurance provider with an international presence.

- Safe Driver Discount: AIG insurance review & ratings showcase a significant incentive for safe driving behaviors with an opportunity for a generous discount of up to 18%, encouraging and recognizing responsible driving practices.

- Multi-Policy Discount: AIG provides a multi-policy discount of up to 15%, encouraging customers to bundle multiple insurance policies.

Cons:

- May Have Higher Premiums for Global Reach: The international presence and global reach of AIG may come at a cost, potentially resulting in higher premiums compared to more localized competitors.

- Limited Emphasis on Industry Expertise: AIG’s focus on global reach may mean it has a less specialized understanding of specific industries compared to some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Product Liability Claims: Essential for CBD Insurance

CBD businesses operate in a high-risk industry, property insurance and product liability claims are a real possibility. For a comprehensive overview, explore our detailed resource titled “Universal Property Insurance.” The passage of the 2018 Farm Bill added to the confusion surrounding CBD’s legal status, leading some to falsely believe that CBD products can be shipped to any state without repercussions.

Jeff Root Licensed Life Insurance Agent

However, the FDA maintains its authority to regulate all CBD products, even those derived from hemp. With existing federal restrictions and the industry’s uncertain legal landscape, CBD businesses must prioritize obtaining CBD product liability insurance to protect themselves from potential legal and financial pitfalls.

CBD Product Liability: Understanding the Risks and Responsibilities

CBD product liability insurance is essential for businesses operating in the CBD and hemp industries. It functions similarly to regular product liability insurance, providing coverage when a consumer alleges harm or injury from a faulty product.

CBD Business Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $150 | $300 | |

| $120 | $250 | |

| $140 | $280 | |

| $160 | $320 | |

| $130 | $270 |

| $150 | $290 |

| $140 | $280 | |

| $130 | $260 | |

| $160 | $310 |

| $150 | $300 |

In the case of CBD businesses, product liability insurance shields suppliers, producers, and manufacturers from potential claims and their associated costs. Given the rapid expansion of the CBD industry, the need for product liability coverage has become increasingly important.

Here are some types of insurances that are commonly recommended for CBD businesses:

- Product Liability Insurance: This insurance protects CBD businesses from claims related to product defects, injuries, or illnesses caused by their products. It covers legal expenses, medical costs, and potential settlements.

- General Liability Insurance: This insurance provides coverage for third-party claims of bodily injury, property damage, or personal injury. It protects businesses from accidents that may occur on their premises or as a result of their operations.

Property insurance protects the physical assets of CBD businesses, including buildings, equipment, inventory, and supplies, against damages caused by fire, theft, vandalism, or other covered events, with cyber liability insurance it covers CBD businesses sensitive customer information.

While cyber liability insurance helps protect against data breaches, hacking, or other cyber incidents. If a CBD business has employees, workers’ compensation insurance is usually required. It provides coverage for medical expenses and lost wages if an employee is injured or becomes ill while on the job.

- Business Interruption Insurance: This insurance compensates CBD businesses for lost income and extra expenses in case of disruptions to their operations, such as fire, natural disasters, or other covered events.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects CBD businesses against claims of negligence, mistakes, or inadequate advice or services provided by professionals in the industry.

It’s important to note that insurance needs may vary depending on the specific nature of a CBD business.

It’s advisable to consult with an insurance professional to determine the most suitable coverage for your particular situation.

Important Product Claims CBD Companies Must Anticipate

CBD companies should be aware of potential product claims that can arise due to the lack of FDA approval for most CBD products. These claims can lead to legal consequences and reputational damage. Four common product claims that CBD businesses should be prepared for are:

- Ingestible Products: CBD affects individuals differently, and claiming a one-size-fits-all approach can be risky. Adding CBD to ingestible food products is not allowed without authorization, as it could be seen as adding prescription drugs to food products.

Topical products like cosmetic products are gaining popularity, claims about their therapeutic benefits should be avoided until supported by clinical trials. Making unproven health claims for topical CBD solutions can lead to legal issues. To gain profound insights, consult our extensive guide titled “Individual Health Insurance: A Complete Guide.”

Medical claims can dissuade individuals from seeking professional medical treatments. Despite CBD’s potential benefits, companies should refrain from making medical claims to avoid penalties from the FDA.

- Legal Disputes: CBD products derived from marijuana, which is federally illegal, should be clearly labeled as derived from legal hemp to avoid legal disputes. The discrepancy between federal and state laws regarding cannabis can lead to complex legal issues that businesses should be prepared for.

Navigating potential product claims is crucial for CBD companies. Stay vigilant to avoid legal consequences and protect your reputation.

By adhering to FDA regulations, refraining from unproven health claims, and ensuring clear labeling, you can mitigate risks and thrive in the CBD industry.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Business Insurance for CBD Businesses

CBD businesses can face various risks and liabilities, making it essential for them to have adequate insurance coverage. Here are three case studies that demonstrate how different types of insurance can be utilized by CBD businesses to protect themselves:

- Case Study #1 – Product Recall: A batch of CBD-infused skincare products is found to be contaminated, prompting a product recall. Product liability insurance covers the costs of the recall process, protecting the CBD business from financial losses and reputational damage while ensuring consumer safety.

- Case Study #2 – Cybersecurity Breach: Hackers gain unauthorized access to the CBD business’s customer database, compromising sensitive information. Cyber liability insurance steps in to cover expenses related to data breach notification, forensic investigations, and legal fees, safeguarding the business from financial losses and maintaining customer trust amid cybersecurity threats.

- Case Study #3 – Regulatory Compliance: The FDA issues warnings to a CBD business for making unapproved health claims about its products. The business’s errors and omissions (E&O) insurance provides coverage for legal defense costs and settlements, ensuring compliance with regulations and protecting the company from the financial consequences of regulatory violations.

Allstate’s policy covered the water damage restoration costs, providing financial support for the property’s recovery. The comprehensive coverage from Allstate facilitated a seamless restoration process for Urban Realty Group.

Ty Stewart Licensed Life Insurance Agent

The insurance support ensured that the property damage was addressed promptly, minimizing business interruptions, and safeguarding the real estate firm’s assets.

Round Up: The Importance of Insurance In CBD Business

In conclusion, business insurance for CBD businesses is essential for mitigating risks and protecting the company’s financial stability. Given the unique nature of the CBD industry and the regulatory challenges it faces, having the right insurance coverage is crucial. CBD businesses should consider several types of insurance to address specific risks and liabilities.

By securing these types of insurance, CBD businesses can operate with confidence, knowing that they have financial protection against a range of risks and liabilities. Consulting with an insurance professional who specializes in the CBD industry can help ensure that the coverage adequately addresses the unique needs of the business.

Protect your business today by entering your ZIP code below into our comparison tool for free commercial insurance quotes.

Frequently Asked Questions

What are the key considerations when selecting business insurance for CBD companies?

The key considerations when selecting business insurance for CBD companies include understanding the specific risks associated with the industry, such as product liability and regulatory compliance, and ensuring that the insurance coverage is tailored to address these risks effectively.

What are the essential considerations when selecting CBD retail insurance to protect your business?

When selecting CBD retail insurance, consider coverage for product liability, property damage, and cyber liability, ensuring compliance and financial stability. Tailor policies to address unique risks and seek guidance from industry professionals.

Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

What are the essential considerations when selecting business insurance for CBD ventures?

For CBD businesses, securing the right insurance is crucial. Connect with a CBD insurance agent or broker for tailored CBD-based insurance coverage. They understand your unique needs and can provide comprehensive protection for your CBD business.

To gain in-depth knowledge, consult our comprehensive resource titled “Insurance Agents.”

What are the key considerations when seeking CBD insurance in Vermont?

The key considerations when seeking CBD insurance in Vermont include understanding state regulations, assessing business risks, and obtaining comprehensive coverage tailored to the specific needs of CBD businesses operating in the state.

Does CBD insurance cover legal expenses related to regulatory compliance issues?

Yes, CBD insurance often includes coverage for legal expenses associated with regulatory compliance matters, such as FDA regulations or state licensing requirements, helping businesses navigate complex legal challenges effectively.

What are the key considerations for obtaining CBD insurance in Connecticut?

When seeking CBD insurance coverage in Connecticut, it’s crucial to explore reputable CBD insurance carriers that offer comprehensive services tailored to your business’s needs. These carriers provide specialized CBD product insurance services, ensuring adequate coverage for various aspects of your CBD business operations.

By partnering with trusted CBD insurance services, businesses can mitigate risks and protect their ventures effectively, all while securing competitive premium rates.

For a comprehensive analysis, refer to our detailed guide titled “How does the insurance company determine my premium?.”

Can CBD insurance protect my business from claims of false advertising or misleading marketing?

Yes, CBD insurance policies may include coverage for claims of false advertising or misleading marketing practices, providing financial protection in the event of lawsuits or regulatory investigations related to marketing claims.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

What steps can take to minimize insurance premiums for my CBD business?

To minimize insurance premiums, consider implementing risk management practices, such as ensuring product quality control, maintaining a safe work environment, and implementing cybersecurity measures to reduce the likelihood of claims.

What are the key considerations when obtaining commercial liability insurance for industrial hemp operations?

The CBD product liability insurance cost varies based on factors like product type and coverage limits. Insurance for CBD companies should include coverage for ingestible CBD products, ensuring protection against potential claims. Hemp business insurance offers comprehensive coverage for various risks associated with operating in the hemp industry.

For a thorough understanding, refer to our detailed analysis titled “Liability Insurance.”

Does CBD insurance provide coverage for loss of income or business interruption?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.