Best Business Insurance for Alarm Companies in 2026 (Top 10 Providers)

Travelers, Nationwide, and Progressive offer the best business insurance for alarm companies, with minimum rates starting as low as $130/month. These companies excel in coverage and affordability, ensuring optimal protection for alarm businesses, and making them stand out among competitors.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated February 2025

1,734 reviews

1,734 reviewsCompany Facts

Full Coverage for Alarm Companies

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Alarm Companies

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Alarm Companies

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsTravelers, Nationwide, and Progressive offer the best business insurance for alarm companies. With comprehensive coverage and stellar customer service, these providers offer tailored protection for alarm businesses.

Alarm contractors play a crucial role in providing security solutions for individuals and businesses. However, the nature of their work exposes them to various risks and liabilities. To safeguard their businesses, alarm contractors need to have appropriate insurance coverage in place.

Our Top 10 Picks: Best Business Insurance for Alarm Companies

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 13% | 15% | Tailored Coverage | Travelers | |

| #2 | 20% | 15% | Business Programs | Nationwide |

| #3 | 10% | 31% | Customizable Policies | Progressive | |

| #4 | 15% | 30% | Competitive Rates | State Farm | |

| #5 | 25% | 22% | Local Agents | Allstate | |

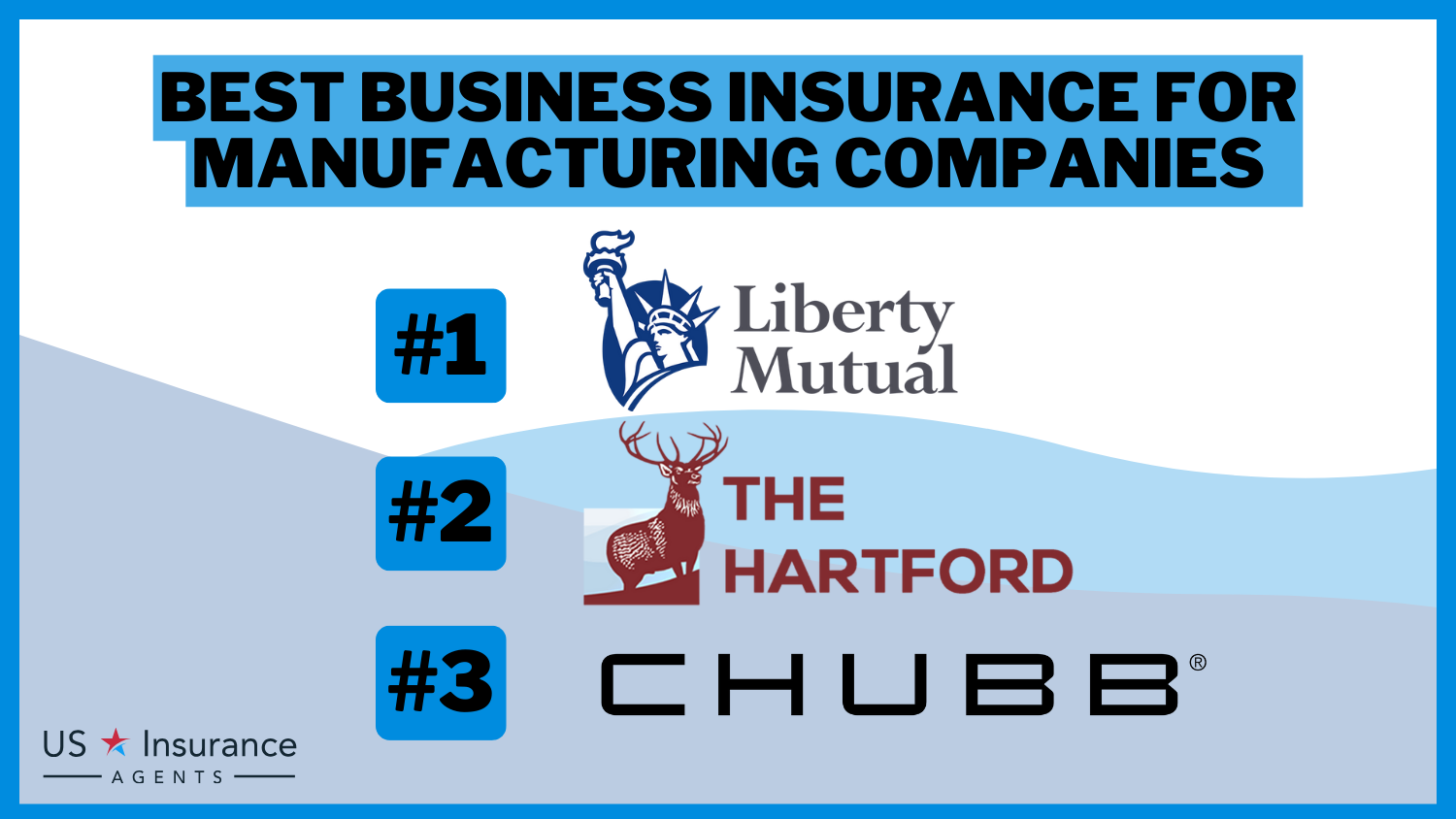

| #6 | 25% | 30% | Various Discounts | Liberty Mutual | |

| #7 | 5% | 15% | Bundling Policies | Farmers | |

| #8 | 5% | 20% | Big Discounts | The Hartford |

| #9 | 10% | 10% | High-Risk Savings | Chubb | |

| #10 | 29% | 20% | Customer Service | American Family |

We’ll delve into the suggested varieties of alarm contractors business insurance, explore additional coverage alternatives, and underscore the significance of risk engineering.

Continue reading to grasp the ways in which business insurance can safeguard both alarm contractors and their clients. Enter your ZIP code above to find the cheapest coverage for your business.

#1 – Travelers: Top Overall Pick

Pros

- Tailored Coverage: Travelers insurance review and ratings offers customizable coverage options to meet individual needs.

- Competitive Discounts: Provides significant discounts, allowing customers to save on premiums.

- Wide Range of Options: Offers diverse coverage options catering to various travel and insurance needs.

- Strong Financial Stability: Known for its financial strength and stability, ensuring reliability for policyholders.

- Excellent Customer Service: Praised for its responsive and helpful customer service team, offering support throughout the insurance process.

Cons

- Potentially Higher Premiums: Some customers may find their premiums comparatively higher than other insurers.

- Limited Local Agents: Availability of local agents may vary depending on the region, impacting personalized service.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Business Program

Pros

- Specialized Business Programs: Offers tailored insurance programs designed specifically for businesses.

- Nationwide Network: Nationwide insurance review & ratings boasts a widespread network of agents, providing accessibility and convenience for customers.

- Strong Reputation: Known for its reliable service and comprehensive coverage options in the business insurance sector.

- Flexible Policy Options: Provides customizable policies to suit the unique needs of different businesses.

- Variety of Discounts: Offers various discounts to help businesses save on insurance premiums.

Cons

- Claims Process Length: Some policyholders reported longer processing times for claims.

- Potentially Higher Rates: Premiums might be relatively higher compared to some competitors.

#3 – Progressive: Best for Customizable Policies

Pros

- Customizable Policy: Offers highly customizable policies, allowing customers to tailor coverage to their specific needs.

- Innovative Technology: Utilizes cutting-edge technology to streamline the insurance process, making it more convenient for customers.

- Competitive Rates: Provides competitive rates, ensuring affordability for a wide range of customers.

- Extensive Discounts: Offers various discounts, including safe driver and multi-policy discounts, helping customers save on premiums.

- Strong Online Presence: Progressive insurance review & ratings is known for its user-friendly website and mobile app, providing easy access to policy information and claims.

Cons

- Customer Service Variability: Some customers report mixed reviews regarding customer service experiences.

- Limited Local Agents: Face-to-face interaction might be limited due to fewer physical locations.

#4 – State Farm: Best for Competitive Rates

Pros

- Competitive Rates: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm insurance review & ratings provides a substantial discount for low-mileage usage.

- Wide Coverage Options: Offers various coverage options tailored for different business needs.

- Strong Financial Stability: Known for its financial strength and stability, providing peace of mind to policyholders.

- Extensive Agent Network: Boasts a large network of local agents, offering personalized service and support.

Cons

- Potentially Higher Rates: Rates might be relatively higher compared to some competitors.

- Limited Online Quotes: Some find the online quoting process less streamlined compared to other insurers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Local Agents

Pros

- Extensive Agent Network: Boasts a large network of local agents, providing personalized service and support.

- Community Involvement: Actively involved in local communities, building trust and rapport with customers.

- Diverse Coverage Options: Offers a wide range of coverage options, catering to various insurance needs.

- User-Friendly Technology: Utilizes user-friendly technology, such as the Allstate mobile app, for convenient policy management.

- Strong Financial Stability: Allstate insurance review & ratings is known for its financial strength and stability, ensuring reliability for policyholders.

Cons

- Potentially Higher Premiums: Some customers may find their rates relatively higher compared to other insurers.

- Limited Local Agents: Availability of local agents might vary, affecting personalized service.

#6 – Liberty Mutual: Best for Various Discounts

Pros

- Wide Range of Discounts: Liberty Mutual review & ratings offers various discounts, including multi-policy, safe driver, and home safety discounts, helping customers save on premiums.

- Customizable Coverage Options: Provides flexibility in coverage options, allowing customers to tailor policies to their specific needs.

- Strong Financial Stability: Known for its financial strength and stability, providing assurance to policyholders.

- Nationwide Presence: Boasts a widespread network of agents across the country, offering accessibility and personalized service.

- Innovative Tools and Resources: Provides user-friendly online tools and resources for easy policy management and claims processing.

Cons

- Mixed Customer Service Reviews: Some customers report varied experiences with customer service.

- Potentially Complex Claims Process: Claims processing might be perceived as more complex by some policyholders.

#7 – Farmers: Best for Bundling Policies

Pros

- Significant Bundling Discounts: Offers substantial discounts for bundling multiple insurance policies, helping customers save on premiums.

- Diverse Coverage Options: Farmers insurance review & ratings provides a wide range of coverage options tailored to different insurance needs, from auto to home to life insurance.

- Strong Agent Support: Boasts a network of knowledgeable and supportive agents, offering personalized guidance and assistance.

- Enhanced Coverage Features: Offers additional coverage features and options, such as identity theft protection and roadside assistance.

- Reputation for Reliability: Known for its reliability and stability in the insurance industry, providing peace of mind to policyholders.

Cons

- Higher Premiums: Some customers may find their rates relatively higher compared to competitors.

- Claims Processing Time: Complaints about delays in claims processing have been reported by some policyholders.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Big Discounts

Pros

- Big Discounts: The Hartford insurance review & ratings offers substantial discounts for various factors, including safe driving, bundled policies, and loyalty, helping customers save on premiums.

- Specialized Coverage Options: Provides specialized insurance solutions for specific industries and professions, offering tailored coverage.

- Strong Financial Stability: Known for its financial strength and stability, providing reassurance to policyholders.

- Dedicated Customer Service: Offers responsive and knowledgeable customer service, with specialized support for business insurance needs.

- Enhanced Coverage Features: Provides additional coverage options and features to enhance protection, such as equipment breakdown coverage and business income coverage.

Cons

- Limited Personal Insurance Options: Focuses more on commercial insurance, with fewer personal insurance offerings.

- Potentially Higher Rates: Some policyholders may find their premiums comparatively higher.

#9 – Chubb: Best for High-Risk Savings

Pros

- High-Risk Savings: Offers tailored insurance solutions for high-risk individuals or businesses, providing comprehensive coverage.

- Personalized Service: Provides personalized assistance and guidance from experienced agents, ensuring individualized attention.

- Strong Financial Backing: Backed by a solid financial foundation, offering stability and reliability to policyholders.

- Customizable Policies: Chubb insurance review & ratings offers flexible policy options, allowing customers to tailor coverage to their specific needs and risk profiles.

- Reputation for Excellence: Known for its exceptional service and expertise in handling high-risk insurance scenarios.

Cons

- Higher Premiums: Known for premium pricing due to its focus on high-value coverage.

- Limited Availability: May not be as widely available in all regions compared to other insurers.

#10 – American Family: Best for Customer Service

Pros

- Responsive Customer Service: American Family insurance review & ratings provides responsive and helpful customer service through online channels, including live chat and email support.

- User-Friendly Online Platform: Offers a convenient and intuitive online platform for policy management, claims filing, and account access.

- Digital Tools and Resources: Provides a range of digital tools and resources to assist customers in understanding their policies and managing their insurance needs.

- Competitive Rates: Offers competitive rates and discounts, ensuring affordability for customers.

- Wide Range of coverage Options: Offers diverse coverage options to meet various insurance needs, from auto and home to life and business insurance.

Cons

- Potentially Higher Rates: Some customers may find their rates relatively higher compared to competitors.

- Limited Online Tools: Online tools and apps for policy management might be perceived as less advanced compared to other insurers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Business Insurance Coverage for Alarm Companies

Alarm companies face unique risks and liabilities, highlighting the need for proper insurance. It’s crucial for them to secure suitable coverage to protect their business, employees, and clients. Alarm company insurance typically includes coverage for general liability, property damage, and professional liability.

Additionally, alarm companies may need specialized coverage for equipment breakdown, cyber liability, and errors and omissions. Working with an insurance provider experienced in the security industry can help alarm companies tailor their insurance policies to meet their specific needs and mitigate potential risks.

Melanie Musson Published Insurance Expert

Property coverage is vital for safeguarding assets from risks like fire or theft, while workers’ compensation insurance covers medical expenses, disability benefits, and lost wages for employees, shielding the business from potential lawsuits. Commercial auto coverage is essential for protecting vehicles and drivers during transportation or on-site services.

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential to mitigate claims arising from professional service errors or negligence. Additionally, umbrella and excess liability coverage offer supplementary protection beyond primary liability policies, ensuring adequate coverage for catastrophic events or high-value claims.

By obtaining these recommended insurance coverages, alarm contractors can operate with confidence, knowing that they are protected against potential risks and liabilities. It is important to consult with an experienced insurance professional to assess the specific needs of the alarm contractor business and tailor the insurance coverage accordingly.

Additional Business Coverage for Alarm Companies

In addition to the recommended coverage options mentioned earlier, alarm contractors can consider the following additional solutions to further protect their businesses and manage specific risks:

- Property in Transit: Alarm contractors often transport valuable equipment to job sites. Property in transit coverage protects against theft, damage, or loss of equipment while it is being transported. This coverage ensures that the equipment is adequately protected throughout the transportation process.

- Inland Marine Coverage: Designed to protect movable property that may not fall under traditional property coverage. For alarm contractors, this coverage can provide protection for specialized equipment, such as alarms, cameras, and monitoring systems. It covers loss or damage to these items while in transit, at job sites, or in temporary storage.

- Theft of Client Property / Third-Party Crime Coverage: Alarm contractors are entrusted with the security of their client’s properties. Theft of client property or third-party crime coverage helps protect against such situations by offering coverage for stolen client property or damages caused by criminal acts.

- Management Liability Coverage: Management liability coverage, also known as directors and officers (D&O) insurance, is crucial for alarm contractors with a management team or board of directors. It provides protection against claims related to mismanagement, breach of fiduciary duty, or wrongful acts committed by company executives.

- Data Breach Coverage: With the increasing reliance on technology and data management systems, alarm contractors face the risk of data breaches and cyberattacks. Data breach coverage helps protect against the financial consequences of a data breach, including the costs of notifying affected individuals, providing credit monitoring services, legal expenses, and potential lawsuits.

- Cyber Security Coverage: It goes beyond data breaches and focuses on protecting alarm contractors from a wide range of cyber risks. It provides coverage for various cyber incidents, including hacking, malware attacks, and denial-of-service attacks.

- Representations and Warranties Coverage (R&W): It is particularly relevant for alarm contractors involved in mergers, acquisitions, or other business transactions. It protects against financial losses resulting from breaches of representations and warranties made during the transaction.

- Computer-Based Crimes or Cyber-extortion Insurance: It poses significant threats to alarm contractors. This type of coverage helps protect against losses resulting from cyber-extortion attempts, such as ransomware attacks. It covers expenses associated with negotiating and paying ransom demands, as well as any resulting business interruption costs.

- Risk Engineering: By partnering with risk engineering experts, alarm contractors can identify vulnerabilities, develop risk management strategies, and enhance their overall operations. This proactive approach can help minimize accidents, property damage, and liability claims, ultimately protecting the contractor’s reputation and financial stability.

- Multinational Coverage: This coverage addresses the unique risks and legal requirements associated with conducting business abroad. It ensures compliance with local regulations, provides protection against foreign liabilities, and helps manage the complexities of global operations.

By considering these additional coverage options, such as additional solutions for alarm contractors, alarm contractors can enhance their risk management strategies and ensure comprehensive protection for their businesses.

Ensuring insurance coverage is vital for alarm contractors, yet it’s equally advantageous to remain abreast of industry standards and available resources, especially in the realm of business insurance. Several avenues can provide additional insights. To gain further insights, read our “Best Business Insurance: A Complete Guide“.

First, one can visit the official website of the alarm contractor industry association to access news, updates, and various resources pertinent to business insurance coverage and requirements.

Second, exploring the website of the pertinent government agency responsible for overseeing alarm contractor regulations offers guidance and compliance information, including aspects related to business insurance obligations.

Lastly, accessing trade publications dedicated to the security industry provides valuable insights, trends, and expert opinions on business insurance options, coverage considerations, and risk management strategies to further enhance knowledge and expertise in the field.

Comparative Analysis of Insurance Providers for Alarm Companies

Understanding the specific coverage rates offered by insurance providers is crucial for alarm companies seeking comprehensive protection. By analyzing the rates provided by different insurers, businesses can make informed decisions tailored to their budgetary constraints and coverage needs.

Alarm Companies Business Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $134 | $300 | |

| $141 | $297 | |

| $140 | $294 | |

| $154 | $330 | |

| $122 | $365 |

| $138 | $300 |

| $133 | $296 | |

| $129 | $261 | |

| $140 | $293 |

| $130 | $266 |

In assessing the coverage rates offered by various insurance providers, it’s imperative for alarm companies to consider several factors. These include the average monthly rates for good drivers, A.M. Best ratings indicating financial stability and performance, as well as the complaint levels associated with each insurer. To learn more, read our guide on A.M. Best ratings explained.

Travelers, Nationwide, and Progressive emerge as standout options, offering competitive rates averaging around $120 per month for good drivers. Additionally, their strong A.M. Best ratings signify reliable financial backing, instilling confidence in their ability to fulfill policy obligations.

Moreover, their low complaint levels suggest a commitment to customer satisfaction, further reinforcing their credibility as top choices for alarm company insurance. However, it’s essential for businesses to thoroughly review and compare coverage rates from multiple providers to ensure they secure the most suitable and cost-effective insurance solutions for their specific requirements.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Real-Life Examples of Insurance Used by Alarm Companies

Unveil real-life scenarios where insurance plays a pivotal role in safeguarding both the operations and reputation of alarm service providers. From liability protection to employee coverage and professional liability safeguards, these stories underscore the indispensable role insurance plays in mitigating risks and ensuring business continuity.

- Case Study #1 – Liability Insurance in Action: During installation, a respected alarm company damages artwork at a client’s office. Luckily, their insurance covers restoration costs, avoiding financial strain and preserving client trust.

- Case Study #2 – Employee Insurance for Workplace Injuries: An operator at a 24/7 alarm services provider suffers a severe back injury, necessitating surgery and rehab, causing an extended absence. Workers’ comp covers medical bills, lost wages, and rehab, protecting the company from legal issues and ensuring business continuity.

- Case Study #3 – Insurance for Professional Liability: A commercial security system installer faces a flaw causing financial losses for a client, who alleges service inadequacy. Professional liability insurance covers legal fees and settlements, protecting the company’s reputation and finances.

An alarm company dealing with advanced security systems experiences a data breach where a cybercriminal gains access to their client database, compromising sensitive information. Swift action is taken, including client notifications and offering credit monitoring services.

Chris Abrams Licensed Insurance Agent

Thanks to their data breach coverage, the company manages notification costs, credit monitoring, and potential legal liabilities, aiding in client trust recovery and business continuity.

In Review: Business Insurance for Alarm Companies

Insurance plays a crucial role in safeguarding alarm contractors from the various risks inherent in their industry. Understanding the recommended coverage for alarm contractors is paramount to ensuring comprehensive protection for both the business and its assets.

Additional coverage options such as professional liability, data breach coverage, and management liability coverage provide further protection against specific risks. Alarm contractors should also consider risk engineering services to proactively manage risks and minimize potential losses.

By understanding the recommended coverage options and exploring additional solutions, alarm contractors can ensure the continuity of their business operations and the security of their client’s assets. Compare personalized quotes for commercial insurance by entering your ZIP code into our free comparison tool below.

Read more: Best Business Insurance for Contractors

Frequently Asked Questions

Are there case studies demonstrating the necessity of insurance for alarm companies?

Yes, case studies illustrate the importance of various insurance types. For instance, general liability coverage helped an alarm company cover costs when accidentally damaging client property, showcasing the practical benefits of insurance in real-world scenarios.

Enter your ZIP code below to get started on comparing business insurance quotes.

What’s the role of risk engineering services for alarm contractors?

Risk engineering services aid alarm contractors in proactively managing risks, minimizing potential losses, and ensuring the continuity of business operations. These services help tailor insurance coverage to address specific business needs and potential liabilities.

How do insurance providers determine the rates for alarm contractors?

Insurance providers assess various factors when determining rates for alarm contractors, including the size and scope of the business, the types of services offered, the location of operations, past claims history, and the level of coverage required. Rates may vary based on these factors and the insurer’s underwriting criteria.

Find affordable options for commercial insurance by entering your ZIP code below into our free comparison tool.

What types of insurance are essential for alarm contractors?

Alarm contractors require various types of insurance coverage to protect their businesses. Essential coverage includes general liability insurance, property coverage, workers’ compensation insurance, and commercial auto coverage.

To gain further insights, navigate to “Commercial Auto Insurance: A Complete Guide“.

How can alarm contractors manage risks beyond basic coverage?

Alarm contractors can enhance their risk management by considering additional coverage options like data breach coverage, which assists in managing notification costs, credit monitoring, and potential legal liabilities after a security breach.

Can alarm contractors customize their insurance coverage to suit their specific business needs?

Yes, alarm contractors can customize their insurance coverage to address their unique risks and requirements. Working with an experienced insurance professional allows them to tailor their coverage accordingly, ensuring comprehensive protection for their business operations.

How often should alarm contractors review and update their insurance coverage?

Alarm contractors should review their insurance coverage annually or whenever there are significant changes to their business operations, services offered, or risk profile. It’s important to ensure that insurance coverage remains adequate and up-to-date to effectively protect the business against potential risks and liabilities.

What are some additional solutions beyond basic insurance coverage that alarm contractors can consider?

In addition to basic insurance coverage, alarm contractors can explore additional solutions such as professional liability insurance, data breach coverage, management liability coverage, and risk engineering services. These options provide further protection against specific risks and help manage liabilities effectively.

Delve deeper into this topic by exploring “Liability Insurance: A Complete Guide“.

Is a home security system a good investment?

While the initial cost may give pause, the long-term benefits of a home security system are undeniable. From deterring potential intruders to providing round-the-clock surveillance, the value it brings to your home far exceeds the investment.

Are there any industry-specific resources or best practices that alarm contractors should be aware of?

Are alarm systems effective?

Why is professional liability insurance important for alarm contractors?

What are the 3 main types of alarms?

Is Ring better than CCTV?

Can Ring systems be hacked?

How many types of home security systems are there?

What is the best type of smoke alarm?

What kind of company is alarm com?

How many alarm sensors do I need?

What is the most common type of alarm system?

What are the three types of security system?

How much is a simple alarm system?

Why not to use Ring as security?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.