Best Business Insurance for Bed & Breakfasts in 2026 (Top 10 Companies Ranked)

Nationwide, Progressive, and State Farm provide the best business insurance for bed & breakfasts, offering comprehensive coverage with starting rate at $50/month. Safeguard your venture with the trusted protection and reliability of these industry-leading providers to protect your bed & breakfast business.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated March 2025

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Bed & Breakfasts

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Bed & Breakfasts

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Bed & Breakfasts

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe top pick overall for the best business insurance for bed & breakfasts is Nationwide, Progressive, and State Farm. With comprehensive coverage starting rate at $50/month, Nationwide distinguishes for competitive rates, making it one of the best insurance companies for B&B owners.

This guide empowers informed decisions, uncovering tailored coverage options and competitive rates to fortify your business for success.

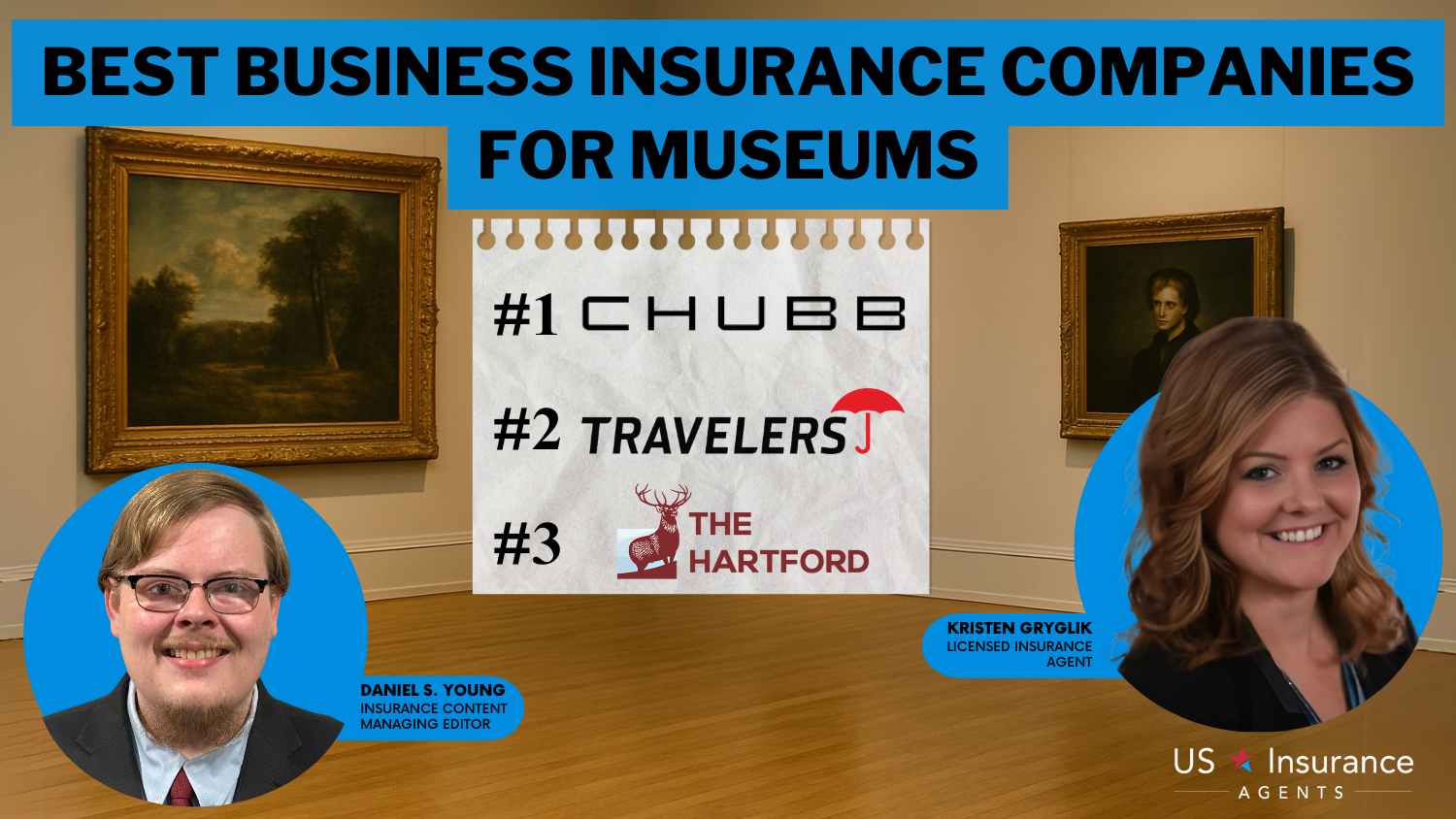

Our Top 10 Company Picks: Best Business Insurance for Bed & Breakfasts

| Company | Rank | Max Multi-Policy Discount | Max Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 10% | Usage Discount | Nationwide |

| #2 | 5% | 30% | Online Convenience | Progressive | |

| #3 | 17% | 10% | Many Discounts | State Farm | |

| #4 | 5% | 5% | Deductible Reduction | Hartford |

| #5 | 10% | 10% | Accident Forgiveness | Travelers | |

| #6 | 25% | 10% | Customizable Polices | Liberty Mutual |

| #7 | 25% | 30% | Add-on Coverages | Allstate | |

| #8 | 5% | 10% | Student Savings | Farmers | |

| #9 | 29% | 10% | Policy Options | American Family | |

| #10 | 25% | 10% | 24/7 Support | Erie |

Securing the right insurance is vital for safeguarding your investment and ensuring the lasting success of your bed & breakfast business.

Explore the offerings from these reputable providers to secure the peace of mind you need. Enter your ZIP code into our quote comparison tool above to secure cheaper insurance rates for your business.

#1 – Nationwide: Top Overall Pick

Pros

- Tailored Coverage: Nationwide is recognized for providing tailored coverage specifically designed for the unique needs of bed & breakfast businesses, ensuring comprehensive protection. Discover insights in our Nationwide insurance review & ratings for further details.

- Competitive Rates: With a low average monthly rate for good drivers and a high A.M. Best Rating of A+, Nationwide offers competitive rates that make it an attractive option for budget-conscious bed & breakfast owners.

- Usage Discount: Nationwide offers a usage discount, making it a suitable choice for businesses with varying occupancy levels, providing flexibility in coverage.

Cons

- Limited Online Convenience: Some users may find that Nationwide lacks the online convenience offered by other providers, potentially making the management of policies less streamlined.

- Moderate Multi-Policy Discount: While Nationwide provides a multi-policy discount of up to 25%, it may not be as high as some other competitors, potentially impacting overall cost savings.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive stands out for its online convenience, making it easy for bed & breakfast owners to manage their policies efficiently through digital platforms. Unlock details in the Progressive insurance review & ratings to get additional insights.

- High Low-Mileage Discount: With a substantial low-mileage discount of up to 30%, Progressive is an excellent choice for businesses that prioritize reduced mileage and operational costs.

- Competitive Rates: Progressive offers competitive average monthly rates for good drivers, ensuring that businesses can benefit from cost-effective coverage.

Cons

- Limited Multi-Policy Discount: Progressive provides a multi-policy discount of up to 5%, which may be lower than what some businesses might find with other insurance providers.

- Average A.M. Best Rating: While Progressive has a respectable A.M. Best Rating of A, it falls short of the A+ ratings offered by some competitors, potentially influencing the perceived financial strength.

#3 – State Farm: Best for Many Discounts

Pros

- Many Discounts: State Farm is recognized for offering many discounts, including a multi-policy discount of up to 17%, making it appealing for businesses seeking various ways to save on insurance costs.

- Low Average Monthly Rate: With a low average monthly rate for good drivers, State Farm provides cost-effective coverage without compromising on service quality.

- Low Complaint Level: State Farm maintains a low complaint level, indicating a high level of customer satisfaction and reliability in handling insurance-related concerns. Delve into the evaluation of State Farm insurance review & ratings for a comprehensive overview.

Cons

- Limited Online Convenience: Similar to Nationwide, State Farm may not offer the same level of online convenience as some other providers, which could be a drawback for those who prefer digital management.

- Moderate Multi-Policy Discount: While State Farm offers a multi-policy discount, it may not be as high as some competitors, potentially impacting the overall affordability for businesses bundling policies.

#4 – The Hartford: Best for Deductible Reduction

Pros

- Deductible Reduction: Hartford is best known for its deductible reduction feature, providing businesses with the opportunity to lower their out-of-pocket expenses in the event of a claim. Access comprehensive insights in the review of The Hartford insurance review & ratings.

- Stable Multi-Policy Discount: Hartford offers a multi-policy discount of up to 5%, providing some cost-saving benefits for businesses bundling their insurance policies.

- Reputation for Stability: With a presence in the insurance industry, Hartford has established a reputation for stability, which can instill confidence in bed & breakfast owners seeking a reliable insurance partner.

Cons

- Limited Discounts: Hartford may have fewer discounts compared to some competitors, potentially limiting the avenues for businesses to maximize savings on their insurance premiums.

- Average Low-Mileage Discount: While some competitors offer higher low-mileage discounts, Hartford’s offering of up to 5% might be considered moderate, especially for businesses with a focus on reducing mileage.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers stands out with its accident forgiveness feature, providing businesses with the reassurance that a single claim won’t significantly impact their future insurance costs.

- Competitive Multi-Policy Discount: Travelers offers a multi-policy discount of up to 10%, providing businesses with the opportunity to save on overall insurance costs when bundling policies. Discover more about discounts in our Travelers insurance review & ratings to discover more information.

- Flexible Low-Mileage Discount: With a low-mileage discount range of 5% – 10%, Travelers caters to businesses with varying mileage needs, offering flexibility in cost savings.

Cons

- Average A.M. Best Rating: While Travelers maintains a respectable A.M. Best Rating, businesses may note that some competitors boast higher ratings, potentially influencing perceptions of financial strength.

- Policy Customization Limitations: Travelers’ policy customization options may be perceived as less extensive compared to certain competitors, potentially limiting businesses seeking highly tailored coverage.

#6 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: Liberty Mutual shines in offering customizable policies, allowing Bed & Breakfast owners to tailor coverage to their specific needs, addressing various property-related risks.

- High Multi-Policy Discount: With a multi-policy discount of up to 25%, Liberty Mutual provides businesses with significant cost-saving opportunities when bundling multiple insurance policies. Check out insurance savings in the comprehensive Liberty Mutual review & ratings.

- Competitive Low-Mileage Discount: Liberty Mutual offers a low-mileage discount of up to 10%, providing businesses with competitive rates for reduced mileage.

Cons

- Average A.M. Best Rating: While Liberty Mutual maintains a solid A.M. Best Rating, it falls short of the A+ ratings offered by some competitors, potentially influencing perceptions of financial strength.

- Potential for Higher Rates: Some businesses may find that Liberty Mutual’s average monthly rates for good drivers are slightly higher compared to certain competitors, impacting overall affordability.

#7 – Allstate: Best for Add-on Coverages

Pros

- Add-On Coverages: Allstate stands out for its extensive add-on coverages, allowing businesses to enhance their protection with additional features tailored to their specific needs. Read up on our Allstate insurance review & ratings for in-depth analysis.

- High Multi-Policy Discount: Allstate offers a multi-policy discount of up to 25%, providing businesses with significant cost-saving benefits when bundling various insurance policies.

- Online Convenience: Allstate provides a high level of online convenience, making it easy for Bed & Breakfast owners to manage their policies and access information through digital platforms.

Cons

- Average A.M. Best Rating: While Allstate maintains a solid A.M. Best Rating, it falls short of the A+ ratings offered by some competitors, potentially influencing perceptions of financial strength.

- Potential for Higher Rates: Some businesses may find that Allstate’s average monthly rates for good drivers are slightly higher compared to certain competitors, impacting overall affordability.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Student Savings

Pros

- Student Savings: Farmers is recognized for its student savings feature, making it an attractive option for Bed & Breakfast owners with student employees, potentially reducing insurance costs.

- Policy Options: Farmers offers a variety of policy options, providing businesses with flexibility in choosing coverage that aligns with their specific needs and preferences. More information is available about this provider in our Farmers insurance ieview & iatings.

- Reputation for Customer Support: Farmers has a reputation for providing reliable customer support, ensuring that businesses can get assistance when needed.

Cons

- Moderate Multi-Policy Discount: While Farmers provides a multi-policy discount, it may not be as high as some competitors, potentially impacting overall cost savings for businesses bundling policies.

- Average Low-Mileage Discount: The low-mileage discount offered by Farmers, ranging from 5% – 10%, may be perceived as average, especially compared to competitors with higher discounts.

#9 – American Family: Best for Policy Options

Pros

- Policy Options: American Family is known for offering a wide range of policy options, allowing businesses to customize coverage based on their specific needs and preferences. See details in our American Family insurance review & ratings for a thorough examination.

- High Multi-Policy Discount: With a multi-policy discount of up to 29%, American Family provides businesses with significant cost-saving opportunities when bundling various insurance policies.

- Flexible Low-Mileage Discount: American Family offers a low-mileage discount ranging from 5% – 10%, providing businesses with flexibility in managing their operational costs.

Cons

- Average A.M. Best Rating: While American Family maintains a solid A.M. Best Rating, it falls short of the A+ ratings offered by some competitors, potentially influencing perceptions of financial strength.

- Potential for Higher Rates: Some businesses may find that American Family’s average monthly rates for good drivers are slightly higher compared to certain competitors, impacting overall affordability.

#10 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie insurance review & ratings highlights providers’s commitment to 24/7 support, ensuring bed & breakfast owners can access assistance and information whenever needed.

- High Multi-Policy Discount: Erie offers a multi-policy discount of up to 25%, providing businesses with significant cost-saving benefits when bundling various insurance policies.

- Flexible Low-Mileage Discount: Erie provides a low-mileage discount ranging from 5% – 10%, offering businesses flexibility in managing their operational costs.

Cons

- Limited Online Convenience: Some users may find that Erie lacks the same level of online convenience offered by other providers, potentially impacting the ease of policy management.

- Average A.M. Best Rating: While Erie maintains a solid A.M. Best Rating, it falls short of the A+ ratings offered by some competitors, potentially influencing perceptions of financial strength.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Insurance Options to Protect Your Bed and Breakfast Business

When it comes to insuring your bed and breakfast, it’s important to choose the right insurance policies that provide comprehensive coverage for your unique business needs. While general liability insurance is the most crucial policy, there are other types of insurance that are often necessary to ensure optimal protection. Let’s explore the best insurance options for your bed and breakfast:

- General Liability Insurance: It is the foundation of insurance coverage for bed and breakfasts. It provides protection against third-party claims of bodily injury, property damage, and personal injury. This coverage is essential because accidents can happen, and guests or visitors may hold your business responsible.

- Commercial Property Insurance: It safeguards your physical assets from various perils such as fire, theft, vandalism, or natural disasters. It covers the cost of repairing or replacing your building, furnishings, equipment, and inventory in the event of covered damage or loss.

- Product Liability Insurance: As a bed and breakfast, you may offer products or services to your guests, such as meals, snacks, or amenities. Product liability insurance is crucial to protect your business in case a guest claims that a product or service you provided caused them harm.

- Workers’ Compensation Insurance: If your bed and breakfast employs staff members, workers’ compensation insurance is typically required by law in most states. This coverage provides benefits to employees who suffer work-related injuries or illnesses. It covers medical expenses, lost wages, rehabilitation costs, and disability or death benefits.

- Commercial Auto Insurance: If you use vehicles for business purposes, such as transporting guests, making deliveries, or running errands, commercial auto insurance is essential. This coverage protects your vehicles, drivers, and others on the road in case of accidents. It provides coverage for property damage, bodily injury, and medical expenses.

Other coverage options for your bed and breakfast include Cyber Liability Insurance, which protects against data breaches and cyber risks. Umbrella Insurance extends liability coverage beyond primary policies, offering increased protection. Employment Practices Liability Insurance (EPLI) covers claims related to employment issues. Liquor Liability Insurance protects against alcohol-related incidents if your B&B serves alcohol.

To determine the most suitable insurance coverage for your bed and breakfast, it’s recommended to consult with an experienced insurance agent or broker who can assess your specific needs and tailor a policy that provides the right level of protection. The table below displays monthly insurance rates for bed and breakfast businesses categorized by coverage type, varying from minimum to full coverage.

Bed and Breakfasts Business Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $48 | $275 | |

| $53 | $290 | |

| $57 | $315 |

| $54 | $305 | |

| $62 | $340 |

| $50 | $300 |

| $55 | $310 | |

| $52 | $285 | |

| $60 | $330 |

| $58 | $320 |

Nationwide offers competitive rates starting at $50 for minimum coverage and $300 for full coverage, providing affordability and comprehensive protection. State Farm and Allstate also present competitive options at $52 and $48 for minimum coverage, respectively. This data showcases the monthly insurance rates for bed and breakfast businesses, allowing them to balance cost-effectiveness with the necessary coverage level.

Choosing the Right Business Insurance Providers for Bed & Breakfasts

When searching for business coverage for your bed and breakfast, you’ll typically find two primary types of insurance providers: Independent Insurance Agents/Brokers and Direct Insurance Companies.

Independent agents/brokers offer diverse coverage options from multiple insurers, providing personalized guidance and expertise. To learn more about this topic, explore additional articles comparing Buying Insurance from Independent Insurance Brokers vs. Direct Writers. They help evaluate your needs, gather quotes, and compare policies.

Direct insurance companies sell policies directly to customers without intermediaries, often through online platforms for convenient access and management of coverage. Both options have their advantages: independent agents offer personalized support and assistance with claims, while direct companies provide accessibility and online management capabilities.

Both independent agents/brokers and direct insurance companies have their advantages. Independent agents can offer personalized guidance and expertise, helping you navigate the complex insurance landscape. They can also provide ongoing support and assistance with claims. On the other hand, direct insurance companies offer convenience and accessibility, allowing you to manage your coverage online at your convenience.

Jeff Root Licensed Life Insurance Agent

Ultimately, the choice between an independent agent/broker and a direct insurance company depends on your preferences, comfort level with technology, and the level of guidance you require in selecting and managing your bed and breakfast insurance coverage.

Discover the Perfect Coverage for Your Bed and Breakfast

Finding the right insurance coverage for your bed and breakfast is essential to protect your business from potential risks and liabilities. Here are the seven steps to help you find the coverage you need:

- Assess risks. Begin by identifying the specific risks associated with your bed and breakfast. Consider factors such as the size of your property, the number of guests you accommodate, the services you offer (e.g., meals, events), and any potential hazards or vulnerabilities. This assessment will help you determine the types and amount of coverage you require.

- Research insurance providers. Look for reputable insurance providers that specialize in business insurance or have experience insuring bed and breakfast establishments. Explore their websites, read customer reviews, and evaluate their reputation, financial stability, and claims handling process. This research will help you narrow down your options to reliable and trustworthy insurance companies.

- Get quotes. Contact several insurance providers to request quotes for the coverage you need. Provide them with accurate and detailed information about your bed and breakfast, including its size, location, services, number of employees, and any unique aspects. By obtaining multiple quotes, you can compare coverage options, policy limits, deductibles, and premiums to find the most suitable and affordable insurance package.

- Understand policy coverage: Carefully review the coverage details and policy documents provided by each insurance provider. Pay attention to the specific risks and perils covered, exclusions, limits, and any additional endorsements or optional coverages available. Make sure the policies align with your bed and breakfast’s specific needs and provide adequate protection for potential risks.

- Consider bundling policies. Some insurance companies offer package policies or business owner’s policies (BOPs) that combine multiple coverages into a single, comprehensive plan. Bundling your insurance policies can often result in cost savings and simplifies the management of your coverage.

- Seek professional advice. If you’re unsure about the specific insurance needs of your bed and breakfast or need guidance in navigating the insurance market, consider consulting an experienced insurance agent or broker. They can provide expert advice, assess your risks, customize coverage options, and help you make informed decisions about your insurance needs.

- Review and update regularly. As your bed and breakfast evolves, regularly review your insurance coverage to ensure it aligns with any changes in your operations, property value, or services offered. Stay in touch with your insurance provider or agent to discuss updates, modifications, or additional coverages that may be necessary to protect your business adequately.

By following these steps, you can find the coverage you need for your bed and breakfast, ensuring peace of mind and financial protection. Obtaining an online quote for bed and breakfast insurance offers convenience and efficiency. By providing basic information about their establishment, owners can quickly receive tailored quotes from multiple insurance providers.

This streamlined process saves time and allows for easy comparison of rates and coverage options, empowering owners to make informed decisions to protect their ventures effectively. Leveraging online quoting tools simplifies the insurance bed and breakfast procurement process, enabling bed and breakfast businesses to secure the necessary coverage with ease and confidence.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Decoding the Price of General Liability Insurance for Bed and Breakfasts

The cost of general liability insurance for a bed and breakfast can vary depending on several factors. Here’s some information to help you understand the cost considerations:

- Business Size and Revenue: The size of your bed and breakfast, including the number of rooms, guests you accommodate, and your annual revenue, can impact the cost of insurance. A larger business with more guests and higher revenue may have higher premiums compared to a smaller establishment.

- Location: The geographic location of your bed and breakfast plays a role in determining bed and breakfast insurance costs. Factors such as the state, city, crime rates, and weather patterns in your area can influence insurance premiums. Locations with higher risks or more frequent claims may have higher insurance costs.

- Coverage Limits: The coverage limits you choose for your general liability insurance policy will affect the cost. Higher coverage limits provide greater protection but may result in higher premiums. It’s important to evaluate your business’s specific risks and liabilities to determine the appropriate coverage limits for your bed and breakfast.

- Deductible Amount: The deductible is the amount you’re responsible for paying out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, but it also means you’ll have a higher financial responsibility in the event of a claim.

- Claims History: Insurance companies consider your claims history when determining premiums. If you have a history of frequent claims or high-value claims, it may lead to higher insurance costs. On the other hand, a clean claims history may result in lower premiums.

- Risk Management Practices: Demonstrating good risk management practices, such as implementing safety measures, conducting regular inspections, and maintaining proper documentation, can help lower insurance costs. Insurance companies often offer discounts or incentives for businesses that actively manage and mitigate risks.

- Additional Coverage: If you require additional coverages, such as commercial property insurance, product liability insurance, or workers’ compensation insurance, the overall cost of your insurance package will increase.

On average, bed and breakfasts in America spend between $350 to $700 per year for $1 million in general liability coverage. However, it’s important to note that this is just an average range, and your actual premium may vary based on the factors mentioned above. For more detailed information on Commercial General Liability (CGL) Insurance, refer to our comprehensive guide.

To get an accurate cost estimate, it’s best to reach out to insurance providers directly and request personalized quotes based on your bed and breakfast’s specific details and coverage needs. By comparing quotes from multiple insurers, you can find the most competitive rates while ensuring adequate coverage for your business.

Critical Insurance Types for Bed and Breakfast Businesses

In addition to general liability insurance, bed and breakfast establishments should consider several other types of insurance to ensure comprehensive coverage and protect their business against various risks. These additional coverages provide enhanced protection and include commercial property insurance, business interruption insurance, workers’ compensation insurance, commercial auto insurance, and umbrella insurance.

It’s crucial to assess the specific risks and needs of your bed and breakfast to determine the appropriate coverage types and limits for your business. Consulting with an insurance professional specializing in hospitality insurance can offer valuable insights and assistance in tailoring an insurance package to meet your specific requirements.

Covered Scenarios: General Liability Insurance for Bed and Breakfasts

General liability insurance for a bed and breakfast provides coverage for a variety of situations that may lead to claims or lawsuits. Here are some common scenarios where general liability insurance can offer protection:

- Slip and Fall Accidents: If a guest or visitor slips, trips, or falls on your premises and suffers injuries, general liability insurance can cover their medical expenses, exploring how a medical discount plan can effectively lower your healthcare expenses, including hospital bills, doctor’s fees, and medication costs.

- Property Damage: Accidental damage to someone else’s property can occur within your bed and breakfast premises. For instance, if a guest’s personal belongings are damaged due to a fire or water leak caused by your negligence, general liability insurance can help cover the cost of repairing or replacing the damaged items.

- Personal Injury Claims: General liability insurance can provide coverage for personal injury claims arising from non-physical harm, such as defamation, libel, or slander. If a guest alleges that your business made false statements about them, leading to damage to their reputation, general liability insurance can help cover legal fees and potential settlements.

- Food-Related Illnesses: If a guest becomes ill due to food poisoning or allergic reactions caused by the food served at your bed and breakfast, general liability insurance can help cover medical expenses, legal costs, and any settlements or judgments resulting from a lawsuit.

- Advertising Liability: General liability insurance can provide coverage for claims of false advertising, copyright infringement, or misleading marketing practices. If a competitor accuses your bed and breakfast of using their copyrighted material without permission or making false claims about your services, it can help cover legal costs associated with defending against such claims.

- Damage to Rented Premises: If you rent a property for your bed and breakfast and accidentally cause damage to the rented premises, such as damaging walls or fixtures, general liability insurance can help cover the cost of repairs.

It’s important to note that general liability insurance has limits and exclusions. It’s crucial to review your policy carefully to understand the specific coverages, exclusions, and limits that apply to your bed and breakfast. Additionally, it’s recommended to consult with an insurance professional or agent who can provide guidance tailored to your business’s unique needs and risks.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Safeguard Your Bed & Breakfast Business With Insurance

In addition to obtaining the necessary insurance coverage, there are several additional steps you can take to further protect your bed and breakfast business. These measures can help mitigate risks, improve safety, and enhance the overall security of your establishment. Consider implementing the following:

- Establish clear safety policies and procedures. Develop comprehensive safety policies and procedures for your bed and breakfast, covering areas such as guest safety, employee safety, emergency protocols, and maintenance guidelines. Train your staff on these policies and regularly review and update them to ensure they reflect current best practices.

- Conduct regular inspections and maintenance. Perform routine inspections of your property, including guest rooms, common areas, and outdoor spaces, to identify and address any potential hazards or maintenance issues promptly. Regular maintenance helps prevent accidents and reduces the risk of property damage or guest injuries.

- Implement security measures. Install security systems, including surveillance cameras, alarms, and secure locks, to deter theft, vandalism, and unauthorized access. Consider providing guests with secure storage options for their valuables, such as in-room safes or lockers, to minimize the risk of theft incidents.

- Maintain adequate lighting. Ensure that all areas of your bed and breakfast property are well-lit, both indoors and outdoors. Sufficient lighting helps prevent accidents, deters criminal activity, and creates a safe and welcoming environment for guests and staff.

- Train staff on safety and security. Provide comprehensive training to your employees on safety protocols, emergency procedures, and customer service practices. Educate them about potential risks and empower them to identify and address safety concerns promptly. Encourage open communication and create a culture of safety awareness throughout your organization.

- Regularly review and update insurance coverage. Periodically review your insurance policies regularly to match your bed and breakfast’s evolving needs. Consult with an insurance professional for any necessary adjustments or additional coverage. For further details on updating insurance, see article titled “How often should I review and update my car insurance coverage?“

By implementing these additional steps, you can demonstrate your commitment to the safety and well-being of your guests, protect your business from potential liabilities, and enhance the overall guest experience at your bed and breakfast.

Case Studies: Illustrating Insurance Scenarios for Bed & Breakfasts

Delve into real-life scenarios showcasing the pivotal role of insurance for bed & breakfast businesses. These case studies vividly illustrate how diverse insurance coverage options have shielded establishments from unforeseen events, guaranteeing not only guest satisfaction but also financial stability.

- Case Study #1 – General Liability Insurance: At Sunrise Inn, a guest slipped on a wet floor, fracturing an arm. General liability insurance covered medical costs and legal claims, ensuring guest well-being and financial security.

- Case Study #2 – Commercial Property Insurance: Cottage Retreat suffered severe storm damage, including to its roof and interior. Commercial property insurance covered repair costs, facilitating swift recovery.

- Case Study #3 – Workers’ Compensation Insurance: Harmony Haven experienced an employee slip in the kitchen, resulting in a back injury. Workers’ compensation insurance covered medical treatment and lost wages, protecting both employee and business.

- Case Study #4 – Commercial Auto Insurance: Tranquil Retreat’s shuttle van was involved in an accident. Commercial auto insurance covered repairs, medical expenses, and liability claims, providing peace of mind.

These case studies vividly demonstrate the invaluable role insurance plays in safeguarding bed & breakfast establishments. By witnessing how different types of coverage have shielded businesses from unforeseen events, owners are empowered to make informed decisions about their insurance needs.

Laura Walker Former Licensed Agent

With comprehensive protection in place, bed & breakfasts can thrive with confidence, knowing they are prepared for whatever challenges may arise. As you continue your journey in the hospitality industry, remember that investing in the right insurance coverage is an essential step towards ensuring the long-term success and sustainability of your business.

In Review: Exploring the Best Insurance Options for Your Bed and Breakfast Business

Insurance coverage, such as general liability, commercial property, workers’ compensation, and commercial auto insurance, provides a solid foundation of financial protection. These policies help cover liabilities, property damage, injuries, and other unforeseen circumstances that can occur within the hospitality industry.

In addition to insurance, implementing safety measures, conducting regular inspections, and training your staff on safety protocols further enhance the security and well-being of your guests and employees. By prioritizing safety, maintaining your property, and implementing robust security measures, you can create a welcoming environment for guests while reducing potential risks.

Remember to regularly review and update your insurance coverage to align with the evolving needs of your bed and breakfast. Consulting with insurance professionals who specialize in the hospitality industry, can provide valuable guidance and ensure that your coverage adequately protects your business. (Read more: How To Get Free Insurance Quotes Online)

By combining comprehensive insurance coverage with proactive risk management practices, you can safeguard your bed and breakfast, foster a positive guest experience, and position your business for long-term success in the dynamic world of hospitality. Enter your ZIP code below to get started on comparing business insurance quotes.

Frequently Asked Questions

Why is securing insurance coverage for a Bed & Breakfast important?

Insurance coverage for a Bed & Breakfast is crucial as it provides financial protection against potential risks and liabilities. Whether it’s injuries to guests, property damage, or legal claims, the right insurance policies can safeguard your business and ensure its long-term stability.

To delve deeper into personal injury protection insurance, explore our comprehensive guide on “Personal Injury Protection (PIP) Insurance: A Complete Guide“.

How can I choose the best insurance provider for my Bed & Breakfast?

Choosing the right insurance provider involves thorough research and comparison. Evaluate factors such as coverage rates, options, discounts, and reviews. Our content highlights insights on top providers like Nationwide, Progressive, and State Farm, aiding you in making informed decisions for your hospitality venture.

Compare personalized quotes for commercial insurance by entering your ZIP code into our free comparison tool below.

What are the essential insurance policies for a Bed & Breakfast?

General liability insurance is crucial for a Bed & Breakfast, but additional coverage like commercial property insurance, workers’ compensation, and commercial auto insurance may also be necessary. Consulting with an experienced insurance agent or broker helps tailor a policy that provides the right level of protection for your specific needs. To learn more about insurance agents or brokers, check out our related articles on:

How much does general liability insurance cost for a Bed & Breakfast?

The cost of general liability insurance for a Bed & Breakfast varies based on factors such as location, size, and specific coverage needs. On average, Bed & Breakfasts in America spend between $350 to $700 per year for $1 million in general liability coverage. However, getting personalized quotes from insurance providers is essential for accurate cost estimates.

What scenarios does general liability insurance for Bed & Breakfasts cover?

General liability insurance for Bed & Breakfasts covers various scenarios, including slip-and-fall incidents, property damage caused by guests, or legal claims arising from accidents. However, it’s crucial to review policy details, limits, and exclusions to fully understand the extent of coverage for your specific business insurance.

How much does insurance cost for a bed and breakfast?

The average cost of insurance for a bed and breakfast varies depending on factors like location, size, and coverage needs. Rates can range from $350 to $700 per year for general liability coverage.

What are some bed and breakfast insurance companies?

There are several bed and breakfast insurance companies available, including Nationwide, Progressive, State Farm, and others that offer tailored insurance solutions for B&Bs.

What kind of insurance does a bed and breakfast need?

A bed and breakfast insurance policy typically covers general liability, property damage, loss of income due to business interruption, and liability for guest injuries.

Explore our detailed guide on “Restaurant & Bar Business Insurance: A Complete Guide” to learn more about insurance coverage for other types of businesses.

Are there specialized insurance programs for bed and breakfasts?

Yes, there are bed and breakfast insurance programs specifically designed to meet the unique needs of bed and breakfast establishments, offering tailored coverage options.

How do bed and breakfast insurance rates vary?

Bed and breakfast insurance rates can vary based on factors such as location, size, amenities offered, and claims history.

Do I need insurance for my bed and breakfast if I don’t have employees?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.