Minnesota Car Insurance Requirements for 2026 (What MN Law Mandates)

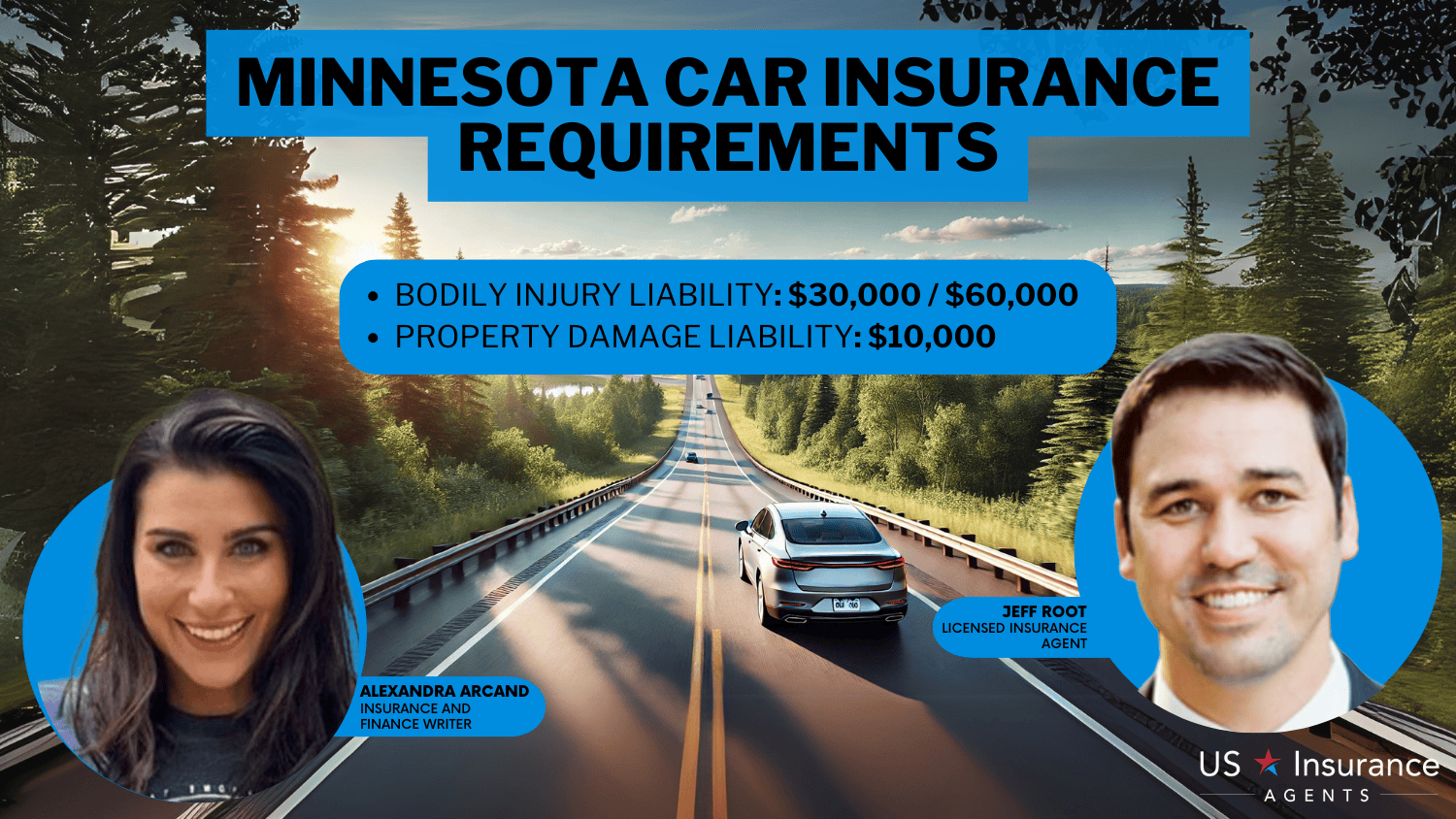

Minnesota car insurance requirements are 30/60/10, which means drivers are required by law to maintain a minimum of $30,000 per person and $60,000 per accident for BIL, and $10,000 for PDL. Minnesota car insurance options are affordable, with rates starting as low as $27 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated August 2025

Minnesota car insurance requirements mandate minimum coverage limits of 30/60/10, including $30,000 for bodily injury per person, $60,000 per accident, and $10,000 for property damage.

With rates starting as low as $27 per month, companies like State Farm, USAA, and Nationwide offer affordable options to help drivers stay compliant and protected. These essential coverages safeguard you and others on the road, ensuring financial security in case of an accident.

Minnesota Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $10,000 per accident |

Compare car insurance quotes from leading providers in your area to secure coverage at the most competitive rates. Understanding your options is key to staying protected and legal, whether you’re looking for basic liability or additional coverage.

Start saving today with the cheapest insurance providers in Minnesota. See if you’re getting the best deal on car insurance by entering your ZIP code here.

- Minnesota car insurance requirements mandate 30/60/10 coverage for all drivers

- State Farm offers the cheapest rates for MN drivers, starting at just $27 per month

- Failing to meet MN requirements can result in fines or license suspension

Minnesota Car Insurance Requirements & What They Cover

Minnesota auto insurance laws mandate all personal vehicles meet specific liability insurance coverage requirements to ensure financial protection for drivers and others on the road.

The Minnesota minimum auto insurance coverage includes bodily injury liability of $30,000 per person and $60,000 per accident, as well as property damage liability of $10,000 per accident. These MN car insurance requirements are designed to cover medical expenses, lost wages, and property damage resulting from accidents.

For drivers using rental vehicles, the Minnesota rental car insurance law requires that they meet the same liability limits as personal vehicles. Understanding the MN auto insurance laws and Minnesota auto insurance minimum coverage is essential to comply with state regulations and avoid penalties.

To learn more about what is the minimum car insurance in Minnesota, read our comprehensive Minnesota auto insurance guide to explore coverage options and ensure compliance with Minnesota insurance requirements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Minnesota

Finding the cheapest car insurance in Minnesota is crucial for meeting Minnesota auto insurance requirements while staying within budget. State Farm offers the most affordable option, with rates starting at just $27 per month for minimum car insurance in Minnesota, covering the state’s required 30/60/10 liability limits.

18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Minnesota

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Minnesota

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Minnesota

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsUSAA follows closely as the second cheapest, with rates at $28 per month, but it’s available only to military members and their families.

Nationwide rounds out the top three, providing Minnesota minimum auto insurance for $35 per month. These options make it easier for drivers to comply with MN auto insurance requirements and Minnesota state minimum car insurance laws without overspending.

Minnesota Minimum Coverage Monthly Rates by City

| City | Rates |

|---|---|

| Bloomington | $80 |

| Brooklyn Park | $82 |

| Burnsville | $73 |

| Coon Rapids | $72 |

| Duluth | $78 |

| Eagan | $75 |

| Eden Prairie | $74 |

| Mankato | $70 |

| Maple Grove | $77 |

| Minneapolis | $85 |

| Moorhead | $69 |

| Plymouth | $79 |

| Rochester | $76 |

| St. Paul | $83 |

| Woodbury | $81 |

Insurance rates can vary based on location, so it’s essential to understand how cities affect premiums. For example, monthly rates for Minnesota minimum car insurance requirements average $85 in Minneapolis, $80 in Bloomington, and $70 in Mankato.

With roadside assistance on your Nationwide auto policy, help is available 24 hours a day, from towing and jump starts to flat tires and gas delivery.

Learn more: https://t.co/tBb1GsBprs pic.twitter.com/LC5uPHCAgk

— Nationwide (@Nationwide) December 23, 2024

MN car insurance laws and local factors, such as traffic density and accident rates, contribute to these differences. Comparing quotes ensures that drivers in every city meet Minnesota auto insurance law standards and secure coverage that aligns with auto insurance requirements in Minnesota.

Use a comprehensive comparison tool to find the best rates while staying compliant with Minnesota state minimum auto insurance regulations.

Read more: Cheapest Car Insurance in Minnesota

Other Coverage Options to Consider in Minnesota

While meeting Minnesota auto insurance requirements is mandatory, adding optional coverage can provide enhanced protection for your vehicle and finances. Beyond the state’s minimum car insurance in Minnesota, here are additional coverage options to consider:

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Uninsured/underinsured motorist insurance coverage protects you if you’re in an accident caused by a driver with insufficient or no insurance.

- Personal Injury Protection (PIP): Personal injury protection covers medical expenses, lost wages, and other costs regardless of fault, ensuring comprehensive care after an accident.

- Collision Coverage: Collision car insurance pays for damages to your vehicle after an accident, regardless of fault, ensuring repairs or replacement costs are covered.

- Comprehensive Coverage: Comprehensive coverage covers non-accident-related damages, such as theft, vandalism, or natural disasters, protecting your car from unexpected incidents.

Including these options alongside your Minnesota state minimum car insurance can fill coverage gaps and protect against out-of-pocket expenses. To ensure you’re adequately covered, review your needs and compare quotes for the best options that meet Minnesota auto insurance laws and provide peace of mind.

Penalties for Driving Without Auto Insurance in Minnesota

Driving without car insurance in Minnesota comes with serious consequences. You could face fines of up to $1,000, have your license suspended for up to 12 months, or even have your vehicle impounded until you can show proof of insurance.

Penalties for Driving Without Auto Insurance in Minnesota

| Penalty Type | Details |

|---|---|

| Fines | Up to $1,000 per offense |

| License Suspension | Driver’s license may be suspended for up to 12 months |

| Vehicle Impoundment | Vehicle may be impounded until proof of insurance is provided |

| SR-22 Filing | Mandatory SR-22 filing required to reinstate license |

| Misdemeanor Charge | Considered a misdemeanor with potential for additional legal consequences |

| Community Service | May be ordered as part of the penalty |

| Higher Future Insurance Premiums | Insurance premiums may increase significantly after the violation |

You may also need to file an SR-22 form to get your license back, which can lead to much higher insurance rates. Repeat violations within 10 years can result in even harsher penalties, like jail time of up to 90 days and additional fines.

Kristine Lee Licensed Insurance Agent

Some drivers may also be required to do community service. Staying insured with at least the Minnesota state minimum car insurance helps you avoid these penalties and keeps you legally on the road.

Read more: Best Minnesota Car Insurance Discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Minnesota Car Insurance

Complying with Minnesota car insurance requirements is essential to protect yourself, your vehicle, and others on the road (Read more: Most Stolen Cars in Minnesota).

By understanding the state’s minimum coverage limits, exploring affordable options like State Farm’s $27 per month rates, and considering additional coverage like PIP and uninsured motorist protection, drivers can ensure they are both legally compliant and financially secure. Avoiding penalties such as fines, license suspension, or higher premiums is another key reason to maintain the required coverage.

Whether you’re selecting basic liability or exploring optional add-ons, comparing quotes and understanding your needs is the best way to stay covered and save money in Minnesota. Our free online comparison tool allows you to compare cheap car insurance quotes instantly. Just enter your ZIP code to get started.

Frequently Asked Questions

What is the minimum car insurance in Minnesota?

The minimum car insurance in Minnesota includes 30/60/10 liability coverage, $40,000 in Personal Injury Protection (PIP), and uninsured/underinsured motorist coverage equal to the liability limits.

What are Minnesota car insurance requirements?

Minnesota requires all drivers to carry liability coverage of 30/60/10, which includes $30,000 for bodily injury per person, $60,000 per accident, and $10,000 for property damage. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

What are the penalties for driving without insurance in Minnesota?

Penalties include fines up to $1,000, license suspension for up to 12 months, vehicle impoundment, mandatory SR-22 filing, and potential misdemeanor charges.

Read more: Best Car Insurance for Drivers with Speeding Tickets in Minnesota

What is the cheapest car insurance in Minnesota?

State Farm offers the cheapest car insurance in Minnesota, with rates starting at $27 per month. USAA and Nationwide are also affordable options at $28 per month and $35 per month, respectively.

Are uninsured and underinsured motorist coverages required in Minnesota?

Yes, Minnesota law requires uninsured and underinsured motorist coverages to protect against accidents caused by drivers with little or no insurance.

What does Personal Injury Protection (PIP) cover in Minnesota?

PIP covers medical expenses, lost wages, and other related costs, regardless of fault, up to a minimum of $40,000 per person.

Do Minnesota car insurance laws apply to rental cars?

Yes, Minnesota rental car insurance law requires the same liability coverage limits of 30/60/10 as for personal vehicles. Supplemental coverage may also be required by the rental company.

Read more: Best Car Insurance for Rental Reimbursement Coverage

How do car insurance rates vary by city in Minnesota?

Rates vary based on location. For example, the average monthly cost is $85 in Minneapolis, $80 in Bloomington, and $70 in Mankato due to factors like traffic density and accident rates.

Can I avoid higher premiums after an uninsured driving penalty?

To avoid high premiums, consider shopping around for quotes, maintaining continuous coverage, and completing an SR-22 filing if required. Find cheap car insurance quotes by entering your ZIP code here.

What additional coverage options should Minnesota drivers consider?

Collision and comprehensive coverage are valuable car insurance types that protect against damage to your car from accidents, theft, or natural disasters, filling the gaps left by basic liability insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.