Nebraska Car Insurance Requirements for 2026 (Your Guide to NE Coverage)

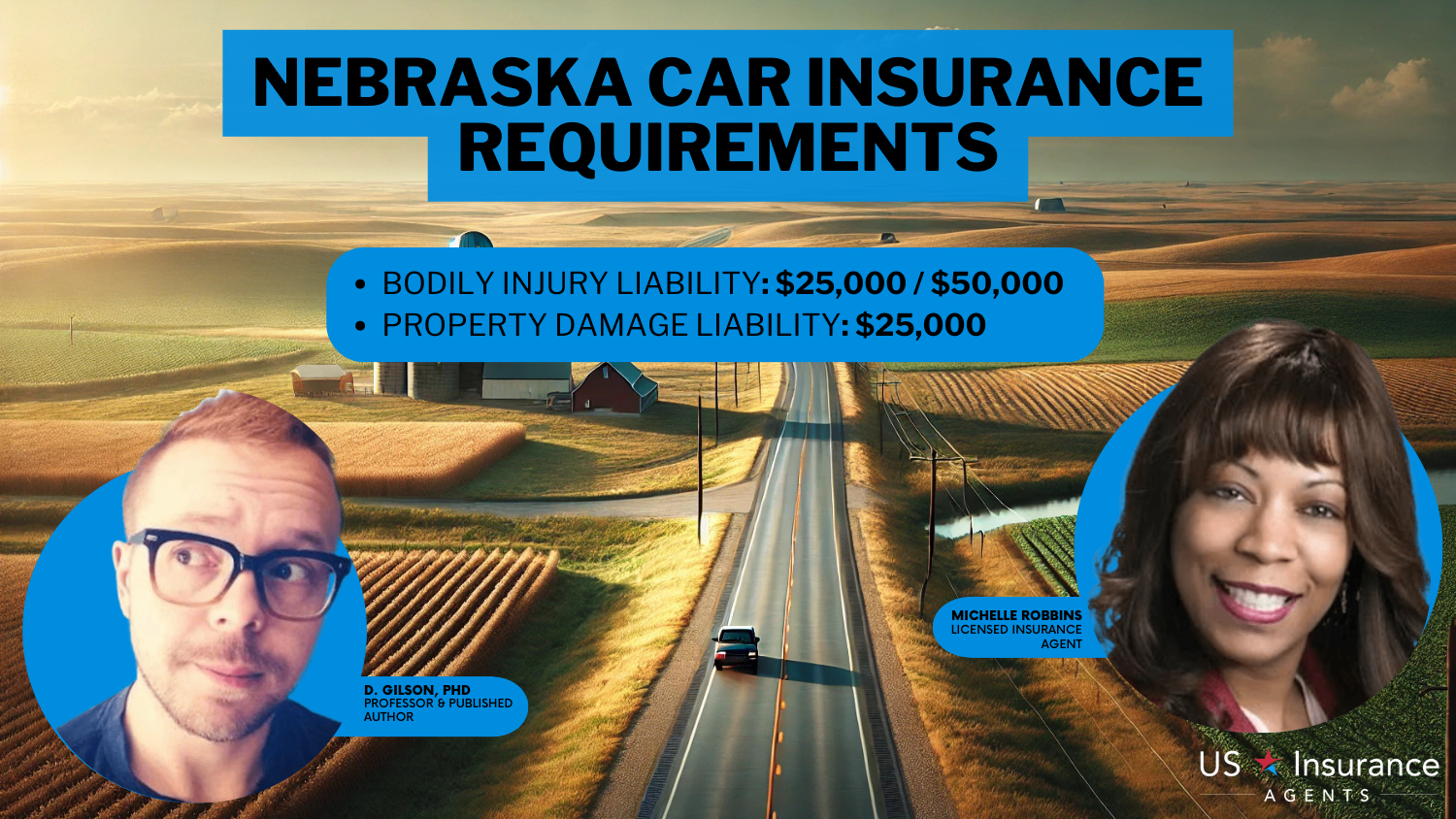

Nebraska car insurance requirements mandate that all drivers obtain specific minimum coverage. Nebraska's minimum auto insurance requirement includes 25/50/25 of property damage and bodily injury coverage, starting at only $15 monthly. Learn more about car insurance in Nebraska in our comprehensive resource.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated August 2025

Nebraska car insurance requirements mandate that all drivers obtain specific minimum coverage through liability insurance per the state requirements for financial protection in accidents.

Each vehicle owner in Nebraska must maintain a bodily injury liability policy of a minimum of $25,000 for individual injuries and a maximum of $50,000 for accidents while also buying at least $25,000 for property damages.

Nebraska Car Minimum Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

If you’re a driver in Nebraska, understanding the state’s car insurance regulations is crucial to ensure you’re adequately protected on the road. In this article, we cover a range of key topics, including the minimum liability coverage limits mandated by Nebraska law, additional optional coverages to consider, factors that influence insurance rates.

Whether you’re a new driver or a long-time resident, our goal is to equip you with the knowledge you need to make informed decisions about your car insurance. Take the next step towards securing the right coverage for your needs by entering your ZIP code. Compare rates from top insurance providers and drive with confidence.

Nebraska Minimum Coverage Requirements & What They Cover

Nebraska state legislation requires local drivers to maintain insurance coverage at the minimum limit. Nebraska drivers must maintain three core car insurance components as their minimum coverage requirement.

- Bodily Injury Liability: This will cover medical treatment expenses and wage compensation when you cause collisions.

- Property Damage Liability: This coverage pays for damages to another person’s property.

- Underinsured/Underinsured Motorist Coverage: You are protected when another driver without insurance causes an accident with you.

These coverage types help drivers handle accident-related costs without paying everything out of pocket. Having at least the minimum required Nebraska auto insurance keeps you legal on the road and protects you financially.

Driving without Nebraska car insurance could face fines, license suspension, or other penalties. Choosing the right Nebraska car coverage ensures you’re protected.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Nebraska

The best car insurance in Nebraska requires potential customers to obtain price quotes from different providers. Insurance providers based in the state provide reduced rates to customers who practice safe driving while bundling various policies and maintaining credit scores above their minimum requirements.

Company Facts

Min. Coverage in Nebraska

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Nebraska

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Nebraska

A.M. Best

Complaint Level

Pros & Cons

Online platforms provide convenient access to multiple provider car insurance quotes, which enable you to locate the best affordable plan suitable for your needs. These online platforms enable customers to understand their coverage options, rates, and car insurance discounts, which helps them find the right provider for their insurance needs.

Penalties for Driving Without Insurance

Driving in Nebraska without insurance violates the legislation and carries major penalties. If caught, operating without insurance will result in financial penalties that do not exceed $500. Your driving abilities and vehicle registration access will be suspended permanently. Looking for the best car insurance Nebraska offers can help you avoid these risks and protect you legally.

Legal driving and vehicle usage rights will also be revoked. After insurance verification becomes necessary for a specified period, you must file an SR-22 document to recover your driver’s license and vehicle registration, which incurs additional expenses, including inconvenience.

Nebraska Penalties for Driving Without Insurance

| Offense | Penalty |

|---|---|

| First Offense | License & registration suspension (up to 6 months), $50 reinstatement fee, SR-22 for 3 years, fine up to $500 |

| Second Offense | Longer suspension, higher fees, SR-22 for 3 years, increased fines |

| Additional Violations | Higher fines, longer suspensions, possible vehicle impoundment, higher insurance rates |

The state of Nebraska mandates drivers always to keep their auto insurance at the required minimum because failing to do so produces serious consequences. Consumer protection through state insurance laws allows you to enjoy road safety protection with the additional benefit of avoiding serious consequences.

Is an unregistered car covered by car insurance? This is an important question because driving without proper registration and insurance can lead to even more issues. State laws are in place to protect drivers and ensure safety on the road.

Other Coverage Options to Consider in Nebraska

State law requires all Nebraska drivers to have sufficient liability coverage, but purchasing added policies gives them extra financial protection. Additional insurance coverages exist, which you should consider adding to your policy.

Nebraska Car Min. Coverage Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Alliance | $55 |

| Auburn | $52 |

| Beatrice | $50 |

| Bellevue | $54 |

| Chadron | $54 |

| Columbus | $50 |

| Crete | $57 |

| Fremont | $51 |

| Grand Island | $52 |

| Hastings | $48 |

| Kearney | $49 |

| La Vista | $55 |

| Lexington | $49 |

| Lincoln | $50 |

| McCook | $56 |

| Norfolk | $51 |

| North Platte | $52 |

| Omaha | $49 |

| Papillion | $53 |

| Plattsmouth | $54 |

| Ralston | $56 |

| Scottsbluff | $50 |

| South Sioux City | $54 |

Under Collision Coverage, your auto insurance provides financial support to repair damages from accidents even when you are not the responsible party, thus creating confidence during car accidents.

This coverage type provides complete protection for your car in cases of theft or vandalism and natural disasters, including hail and floods. Medical Payments Coverage protects your medical costs after accidents, even if the collision was not your fault, thus relieving you of healthcare expenses.

Kristine Lee Licensed Insurance Agent

Roadside assistance coverage assists with breakdowns, flat tires, and emergency towing to prevent road standings. The various car insurance add-ons empower drivers to increase their security by protecting their vehicles and themselves against diverse potential dangers.

Required Coverage

If you own a car in Nebraska, you need to have certain types of insurance. This insurance helps cover costs if you have an accident. All personal vehicles in Nebraska require the following liability coverage requirements:

- Bodily Injury

- Property Damage

- Comprehensive and Collision Coverage

- Uninsured / Underinsured Motorist Coverage

Collision covers repairs or replacement of your vehicle after it’s been in an accident. Comprehensive covers damages resulting for non-collision incidents such as your vehicle being broken into or a fire. A list of the most stolen vehicles in Nebraska can give you an immediate idea if your car is in danger of being stolen and make this coverage even more useful. Each coverage has a deductible that must first be paid before receiving compensation.

Bundlé and savé your way with the Personal Price Plan®. pic.twitter.com/Y5w8kZ5hxi

— State Farm (@StateFarm) October 1, 2024

Uninsured or underinsured motorist coverage pays out when the at-fault party either doesn’t have insurance, doesn’t have enough coverage, or is a hit-and-run driver. Even though the state requires drivers to maintain insurance, not everyone does, making this coverage recommended.

Proof of Insurance and Financial Responsibility

In Nebraska, drivers must show proof of insurance and financial responsibility to operate a vehicle legally. This ensures that there is a way to cover the costs if an accident happens. There are a few ways to meet this requirement:

- Get a standard liability car insurance policy

- Self-insurance – must have more than 25 vehicles insured

- A cash deposit of $75,000 with the State Treasurer

- Surety bond with a company licensed by the state

These options give drivers flexibility in meeting the state’s insurance requirements. Most people choose a standard insurance policy because it is the easiest and most common way to comply with the law. You could face fines, license suspension, or other penalties without proof of financial responsibility.

Required Documentation

You must provide certain documents to prove you have the required insurance. These documents show that you meet Nebraska’s financial responsibility laws. You can use one of the following:

- Insurance ID card

- Certificate of self-insurance

- Certificate of cash bond

- Proof of surety bond

Driving without proof of insurance can lead to serious trouble. If you are stopped by the police or get into an accident, you must show that you have coverage. Keeping proof of insurance with you can help you avoid fines and other penalties. It’s important to always have proof of insurance with you. You must show it in the following situations:

- When asked by a police officer

- After an accident

- When registering your vehicle

- Anytime you drive your vehicle

Keeping proof of insurance on hand helps you avoid fines and other penalties. It also ensures you’re prepared for an accident or traffic stop. Many people carry a physical copy in their car and a digital copy on their phone for convenience.

Read More: How do I get car insurance on a vehicle without a valid driver’s license?

Failure to Maintain Financial Responsibility Penalties

If you drive without insurance in Nebraska, you could face serious consequences. The law requires all drivers to have proof of financial responsibility. If you cannot provide it when needed, you may face the following penalties:

- Fines up to $500

- Suspension of your license and registration

- The requirement to file an SR-22

- Applicable reinstatement fees

These penalties can be costly and inconvenient. Getting your license and registration reinstated takes time and money. To avoid these issues, always keep your insurance up to date and carry proof of coverage whenever you drive.

Learn More: Types of Car Insurance Coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Stay Protected and Drive Legally With Nebraska Car Insurance

In the article we have discussed Nebraska car insurance requirements. Nebraska car insurance rules are made to protect drivers on the road. The law is there to make sure you have enough coverage in case there is an accident. You need to ask yourself how much car insurance do I need? Well, the rule of thumb for most states is 25/50/25.

Nebraska Insurance Agents

Omaha Car Insurance | Lincoln Car Insurance | Bellevue Car Insurance | Grand Island Car Insurance | Kearney Car Insurance | Fremont Car Insurance | Hastings Car Insurance | Norfolk Car Insurance | North Platte Car Insurance | Columbus Car Insurance | Papillion Car Insurance | Madison Car Insurance | Mccook Car Insurance

Frequently Asked Questions

What is the minimum car insurance coverage required in Nebraska?

In Nebraska, the minimum car insurance coverage required is liability insurance, which includes bodily injury liability and property damage liability. The limits for this coverage are 25/50/25, which means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage.

What is bodily injury liability insurance?

Bodily injury liability insurance covers the cost of damages or injuries you may cause to others in an at-fault accident. According to Nebraska auto insurance laws, bodily injury insurance coverage pays for medical bills, lost wages, and other expenses that may come about.

Understanding Nebraska auto liability insurance is suitable for drivers, as it ensures you’re meeting state requirements. Checking a Nebraska auto insurance guide can help you choose the right coverage to stay compliant and protected.

What is collision coverage?

Collision car insurance coverage is an optional coverage that pays for repairs or replacement of your own vehicle if it is damaged in a collision with another vehicle or object. It steps in when your car gets damaged in a crash. This type of protection can save you money when repair bills are high. Not everyone needs collision coverage, but many drivers choose it for extra help when unexpected accidents occur.

What is property damage liability insurance?

Property damage liability insurance pays for damage you cause to someone else’s property in an accident. It covers the cost of repairs or replacement. Nebraska car insurance laws require drivers to have this coverage to stay legal on the road.

Meeting the Nebraska car insurance requirements helps protect you from out-of-pocket costs. The state sets Nebraska auto insurance requirements to ensure all drivers have basic protection. Having at least the minimum car insurance in Nebraska keeps you covered in case of an accident.

Is liability insurance enough coverage for my car?

Liability insurance is the minimum coverage required by law in Nebraska. However, it may not be enough coverage for all situations. You may want to consider additional coverage, such as collision coverage or comprehensive coverage, to protect your own vehicle in case of an accident, theft, or other damage.

What is comprehensive coverage?

Comprehensive car insurance coverage is an optional insurance coverage that pays for damages to your vehicle caused by non-collision events, such as theft, vandalism, weather, or animals. Find the best comprehensive car insurance quotes by entering your ZIP code into our free comparison tool today.

Are there any other types of car insurance that I should consider?

Yes, there are other types of car insurance you might need. These include uninsured/underinsured motorist coverage, medical payments coverage, and roadside assistance.

They offer extra protection if you’re in an accident or need help on the road. If you have SR-22 insurance in North Platte, NE, you may also need additional coverage to meet state rules.

Understanding Nebraska’s minimum insurance requirements can help you choose the right policy. Having the right car insurance in Nebraska keeps you covered. Driving without insurance in Nebraska can lead to serious penalties, so it’s important to stay insured.

What happens if I don’t have car insurance in Nebraska?

Driving without car insurance in Nebraska is against the law. It can lead to fines, license suspension, or even jail time. Laws for Nebraska car insurance require all drivers to have coverage to avoid these penalties. If you cause an accident without insurance, you may have to pay for damages and injuries out of pocket.

Nebraska car liability insurance helps cover these costs and keeps you protected. Meeting the Nebraska minimum auto insurance requirements is necessary to stay legal. Understanding Nebraska insurance requirements can prevent financial trouble.

Having at least the Nebraska state minimum auto insurance ensures you are covered in case of an accident.

What are the requirements for car insurance in Nebraska?

Drivers operating vehicles within Nebraska must maintain at least two essential insurance coverages that safeguard them and their passengers while on the roads. Every Nebraska driver must maintain bodily injury liability coverage that pays out $25,000 per individual injured in their accidents while providing a total of $50,000 for multiple injuries.

All motorists in Nebraska must carry property damage liability protection of at least $25,000 to pay for losses that accrue to another person’s property when they cause an accident. Nebraska requires uninsured motorist bodily injury coverage, providing $25,000 per person and $50,000 per accident to defend you when hit by an uninsured motorist.

Each state requires a specific amount of basic car insurance to help drivers handle the expenses from accidents they create, yet further coverage types can assist in fully protecting them during severe incidents.

Learn More: Commercial General Liability Insurance

What is the penalty for driving without insurance in Nebraska?

Driving without insurance in Nebraska sanctions you as a Class II misdemeanor, which demands severe corresponding fines. Law enforcement will impose a base penalty of $50 on escapable offenders but the amount may rise based on specific conditions. The suspension of your driver’s license begins immediately after insurance coverage verification becomes required before you can resume legal driving.

The filing process of an SR-22 certificate becomes mandatory after an incident to prove your insurance coverage. With the mandatory requirement of SR-22 documents for license reinstatement, you must bear both high monetary costs and inconvenience since most insurers require this filing for several years.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.