Best Business Insurance for Biotech and Life Science Firms in 2026 (Top 10 Companies)

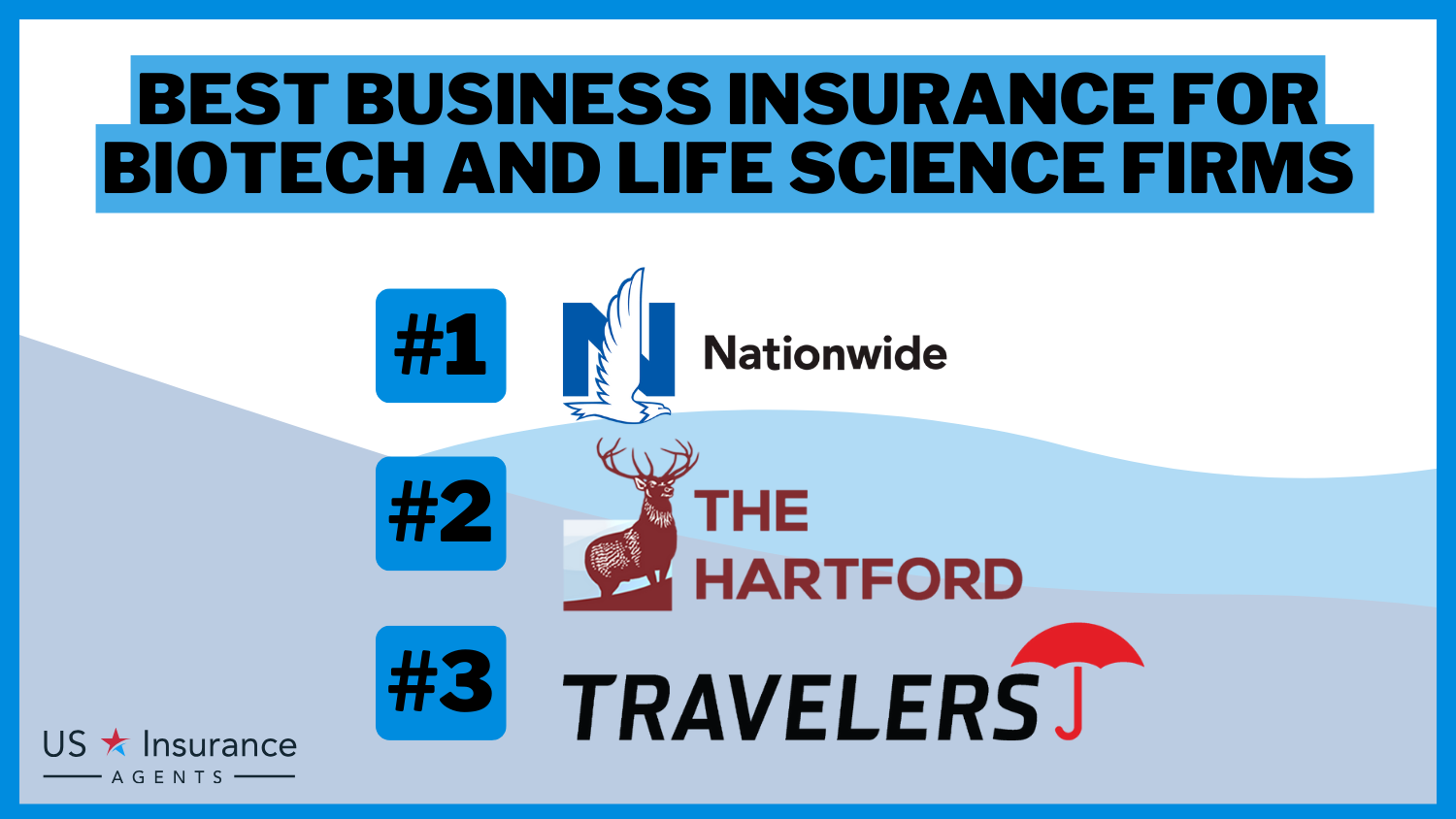

Nationwide, The Hartford, and Travelers offer the best business insurance for biotech and life science firms, providing comprehensive coverage and financial stability. Save up to 15% on premiums with tailored solutions to safeguard assets and mitigate industry-specific risks. Explore now for tailored protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristine Lee is a licensed insurance agent and one of The Zebra’s in-house content strategists. With a background in copywriting, she covers the ins and outs of the home and car insurance industries. She has been a contributor to numerous publications focused on the nuances of insurance, including on The Points Guy.

Kristine Lee

Updated February 2025

Company Facts

Full Coverage for Science Firms

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Science Firms

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Science Firms

A.M. Best Rating

Complaint Level

Pros & Cons

Nationwide emerges as the top pick among the best business insurance for biotech and life science firms, closely followed by The Hartford and Travelers. Offering discounts of up to 15%, these insurers provide comprehensive coverage, financial stability, and specialized solutions tailored to the unique risks faced by biotech and life science firms.

From liability protection to cybersecurity and portable equipment coverage, explore their offerings to safeguard your assets and mitigate industry-specific risks effectively. Enter your ZIP code above to get started on comparing business insurance quotes.

Our Top 10 Company Picks: Best Business Insurance for Biotech and Life Science Firms

| Company | Rank | Biosafety Discount | Lab Equipment Bundle Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Specialized Insurance | Nationwide | |

| #2 | 12% | 8% | Business Interuption Coverage | The Hartford |

| #3 | 10% | 8% | Bundling Policies | Travelers | |

| #4 | 10% | 5% | Safe-Driving Discounts | Progressive | |

| #5 | 15% | 8% | Local Agents | State Farm | |

| #6 | 8% | 5% | Big Discounts | Allstate | |

| #7 | 12% | 9% | Customizable Policies | Liberty Mutual | |

| #8 | 10% | 6% | Add-on Coverages | Farmers | |

| #9 | 10% | 7% | Budgeting Tools | American Family | |

| #10 | 8% | 5% | Usage Discount | Hiscox |

Ensure the continuity and resilience of your business operations by leveraging the expertise and support of these leading insurance providers.

- Nationwide, The Hartford, and Travelers are the best biotech & life science insurers

- Get up to 15% discounts for tailored coverage against industry risks

- Coverage includes liability, cybersecurity, and portable equipment

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mitigating Risks: Life Science Liability Insurance for Biotech and Life Science Firms

Life science liability insurance is indispensable for biotech firms, offering comprehensive coverage against a range of potential liabilities. This insurance includes general liability, protecting against claims related to bodily injury or property damage caused by a company’s products or operations.

Product liability coverage ensures protection from claims arising from injuries or damages caused by biotech products, crucial given their potential impacts on health and the environment. Furthermore, Human clinical trials liability coverage addresses risks associated with conducting clinical trials, safeguarding against claims stemming from trial-related injuries or adverse events.

Chris Abrams Licensed Insurance Agent

Errors and omissions coverage adds another layer of protection, guarding against claims resulting from errors, negligence, or failure to perform professional services. With this insurance in place, biotech companies can navigate their industry’s unique challenges with confidence, focusing on research, innovation, and growth. Find additional information in “Commercial Insurance: A Complete Guide”

Protecting Your Business: Cyber Insurance for Biotech and Life Science Firms

In the digital age, cyber threats pose a significant risk to businesses, including those in the biotech and life sciences industry. Cyber insurance is essential coverage that helps protect your business from the financial and reputational damages caused by cyber-attacks. Here are key points to consider:

- Comprehensive Coverage: Cyber insurance provides financial protection against various cyber risks, including data breaches, hacking, ransomware attacks, and unauthorized access to sensitive information.

- Data Breach Expenses: These cover the costs associated with managing a data breach, including forensic investigations, notifying affected individuals, credit monitoring services, and legal expenses.

- Business Interruption: Cyber insurance can help compensate for the financial losses incurred due to business interruption caused by a cyber attack, including downtime, loss of productivity, and revenue loss.

- Third-Party Claims: If your business faces liability claims from third parties due to a cyber incident, such as a customer suing you for a data breach, cyber insurance can provide coverage for legal defense costs and potential settlements.

- Cyber Extortion: In the event of a ransomware attack or cyber extortion, cyber insurance can cover ransom payments, negotiation expenses, and professional assistance to resolve the situation.

- Cyber Risk Assessment: Some insurers offer proactive cyber risk assessments to help identify vulnerabilities in your IT systems, implement preventive measures, and reduce the likelihood of cyber incidents.

Cyber insurance is vital for protecting biotech and life sciences firms in our digital age, covering data breaches, business interruptions, and third-party claims. Additionally, insurers may provide proactive cyber risk assessments to bolster defenses. Access further resources in “Home Learning: Computer Programming Resources” to enrich your knowledge.

Safeguarding Your Portable Equipment: Insurance for Biotech and Life Science Firms

Portable equipment insurance provides essential coverage for the valuable equipment that is crucial to the operations of biotech and life sciences businesses. Here are key points to understand about this type of insurance:

- Accidental Loss and Damage: Portable equipment insurance offers protection against accidental loss or damage to portable equipment such as phones, laptops, and tools. It ensures that if any of these items are lost, stolen, or damaged, you can quickly recover or replace them without significant financial burden.

- Coverage for Various Scenarios: Whether it’s a laptop damaged during a lab experiment or a phone lost during a business travel, this insurance covers a wide range of scenarios. It provides financial reimbursement for the repair or replacement of your essential equipment, allowing you to resume operations smoothly.

- Protection Against Business Interruption: If your portable equipment becomes unusable due to damage or loss, it can disrupt your business operations. Portable equipment insurance can include coverage for business interruption, compensating for the income lost during the period of equipment unavailability.

- Customizable Policies: Insurance providers understand that each biotech or life sciences business has unique equipment needs. Portable equipment insurance policies can be tailored to fit your specific requirements, ensuring that the coverage aligns with the value and nature of your portable assets.

- Peace of Mind: By having Portable equipment insurance, you gain peace of mind knowing that your essential equipment is protected. In case of unforeseen incidents, you can swiftly recover and continue your work without significant financial setbacks.

Having portable equipment insurance is a vital component of a comprehensive insurance strategy for biotech and life sciences businesses. It safeguards your portable assets and helps mitigate potential disruptions, allowing you to focus on advancing your important work.

When insuring biotech and life science firms, it’s crucial to compare rates for comprehensive coverage at manageable costs. Standout companies offering competitive monthly rates include Nationwide, The Hartford, Progressive, State Farm, Allstate, Liberty Mutual, Farmers, American Family, and Hiscox.

Biotech and Life Science Firms Business Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$290 $560

$310 $600

$300 $590

$350 $650

$330 $620

$300 $600

$270 $520

$310 $580

$280 $550

$320 $600

Monthly premiums range from $270 to $350 for minimum coverage and $520 to $650 for full coverage. Choosing the right insurer ensures adequate protection against potential risks while maintaining financial stability. Delve into “How can I pay my Nationwide insurance premium?” for a comprehensive view.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Corporate Travel Insurance for Biotech and Life Science Firms

Corporate travel insurance is a vital consideration for biotech and life science firms, given the frequent need for business travel within these industries. With the inherent risks associated with travel, having adequate coverage is essential to safeguard employees and mitigate financial liabilities.

This type of insurance offers several key benefits. Firstly, it provides medical expense coverage, reimbursing employees for medical costs incurred during business trips due to illness or injury. Additionally, it offers protection against trip cancellation or interruption, reimbursing prepaid travel expenses in unforeseen circumstances.

Lost luggage coverage ensures reimbursement for lost or stolen luggage and its contents, while delayed travel coverage covers additional expenses caused by travel delays. Moreover, Corporate Travel Insurance typically includes emergency assistance services, offering access to round-the-clock support for travel-related emergencies, medical issues, or legal assistance.

By investing in Corporate Travel Insurance, companies ensure that their employees can focus on their work without worrying about potential travel mishaps, fostering peace of mind and productivity during business trips.

Ensuring Office Protection: Office Package Insurance for Biotech and Life Science Firms

Office package insurance is a comprehensive insurance package specifically designed for office-based biotech and life sciences businesses. It offers a wide range of coverage to protect your physical assets, operations, and liabilities. Here are some key features:

- Property Damage Coverage: Protects your office space, furniture, equipment, and other physical assets against damage caused by events like fire, theft, or natural disasters. Explore “Does Nationwide homeowners insurance cover fire damage?” to learn more.

- Business Interruption Coverage: Provides financial assistance if your business operations are temporarily disrupted due to covered events, helping you cover ongoing expenses and mitigate financial losses.

- Burglary Coverage: Offers protection against theft or burglary of valuable items within your office premises, such as computers, laboratory equipment, or sensitive data.

- Glass Breakage Coverage: Covers the repair or replacement costs of glass windows or doors in case of accidental breakage.

- Public Liability Coverage: Safeguards your business against claims of property damage or bodily injury caused to third parties within your office premises.

- Electronic Equipment Breakdown Coverage: Provides coverage for the repair or replacement of electronic equipment, such as servers or laboratory instruments, in the event of breakdowns.

Having an office package insurance policy in place ensures that your office-based biotech or life sciences business is adequately protected against various risks, allowing you to focus on your core operations with peace of mind.

Securing Your Biotech and Life Science Cargo: Goods In Transit Insurance

In the operation of biotech or life sciences businesses, where the safe and efficient transportation of goods is paramount, goods in transit insurance is a vital consideration. This coverage not only shields against risks like loss, damage, or theft during transit but also extends its protective reach to encompass the dynamic landscape of biotech operations.

Particularly in industries where the transportation of sensitive biological materials or pharmaceuticals is commonplace, goods in transit insurance serves as a crucial component of risk management. This insurance safeguards against potential losses arising from unforeseen events, providing a safety net for businesses navigating the complexities of biotech logistics.

Whether goods are being transported domestically within Australia or across international borders, the inclusion of biotech insurance within goods in transit policies ensures comprehensive coverage tailored to the unique needs of the industry.

By securing this specialized insurance, biotech, and life sciences businesses can navigate transportation challenges with confidence, knowing that their valuable assets are protected against the diverse array of risks inherent in their operations. Further explore “Cars, Trains, Planes, and More – Transportation Vehicles in the U.S.” for insights.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Real-Life Examples of Biotech and Life Science Firms

Explore how tailored insurance solutions supported biotech and life science firms in real-life scenarios. From lab contamination to cybersecurity breaches, these case studies reveal how specialized coverage safeguarded companies and their operations.

- Case Study #1– Biotech Innovations Corp – Laboratory Contamination Incident: Biotech Innovations Corp faced a laboratory contamination incident, threatening research integrity. Nationwide’s property and liability insurance swiftly supported cleanup and legal claims, ensuring a rapid recovery and protecting the company’s reputation.

- Case Study #2– Biopharma Solutions Ltd – Facility Fire and Business Interruption: A facility fire disrupted Biopharma Solutions Ltd’s operations. The Hartford’s business interruption coverage provided compensation, enabling the company to recover swiftly and maintain investor confidence.

- Case Study #3– Genesecure Technologies – Cybersecurity Breach: Genesecure Technologies suffered a cyber attack on sensitive genetic data. Travelers’ cyber insurance minimized financial and reputational damage, facilitating enhanced security measures and data protection.

- Case Study #4– Biotech Logistics Company – Goods In Transit Insurance: A biotech logistics company faced a shipment damage issue. Goods In Transit Insurance compensated for the loss, enabling the company to maintain its reputation for reliable transportation services.

Overall: Comprehensive Protection for Your Biotech and Life Sciences Business

Frequently Asked Questions

How can biotechnology companies secure comprehensive insurance coverage?

Biotechnology companies should prioritize insurance coverage such as life science liability insurance, cyber insurance, and portable equipment insurance to safeguard against industry-specific risks.

What is the significance of biotechnology companies insurance?

Biotechnology insurance, also known as life sciences insurance, provides specialized coverage tailored to the unique risks faced by biotech firms. It includes protection against liabilities, cyber threats, and equipment damage crucial for the continuity of operations.

Compare personalized quotes for commercial insurance by entering your ZIP code into our free comparison tool below.

Why is life science liability insurance crucial for biotechnology companies?

Life science liability insurance offers comprehensive coverage against various risks, including laboratory accidents and product-related liabilities. It ensures financial protection for cleanup efforts and legal defense, safeguarding the company’s reputation and stability.

What role does cyber insurance play in protecting biotechnology companies?

Cyber insurance is vital for biotechnology companies to mitigate the financial and reputational damages caused by cyber attacks. It provides support for forensic investigations, legal consultations, and notification of affected parties, helping companies navigate the complexities of cybersecurity.

Expand your knowledge with “How To Get Free Insurance Quotes Online“

How does portable equipment insurance contribute to the resilience of biotechnology firms?

Portable equipment insurance safeguards valuable equipment crucial to biotechnology operations, providing financial support in case of damage or theft. This coverage helps mitigate potential disruptions, allowing firms to focus on their research and innovation.

What is life sciences transit insurance, and why is it important for biotech businesses?

Life sciences transit insurance offers protection for the safe transportation of sensitive biological materials or pharmaceuticals, addressing the risks associated with transit. It ensures comprehensive coverage tailored to the unique needs of biotech logistics, safeguarding valuable assets during transportation.

How can biotechnology companies ensure adequate coverage for business interruption?

Biotechnology companies can ensure adequate coverage for business interruption by investing in specialized insurance policies such as Office Package Insurance and Business Interruption Coverage. These policies provide compensation for lost income and extra expenses incurred during restoration periods, helping firms recover swiftly from disruptions.

What factors should biotech firms consider when selecting insurance providers?

Biotech firms should consider factors such as coverage options, financial stability of the insurance provider, claims processing efficiency, and industry-specific expertise when selecting insurance providers. It’s essential to choose insurers that understand the unique risks faced by biotech companies and offer tailored solutions.

Find out more about “Your Insurance Agent’s Role in the Claims Process” to enhance your understanding.

How can biotechnology companies protect against liabilities arising from clinical trials?

Biotechnology companies can protect against liabilities arising from clinical trials by securing insurance coverage such as clinical trials liability insurance. This coverage safeguards against claims resulting from trial-related injuries or adverse events, ensuring financial protection during research activities.

What measures can biotech firms take to enhance cybersecurity and reduce cyber insurance risks?

Biotech firms can enhance cybersecurity and reduce cyber insurance risks by implementing robust security protocols, conducting regular risk assessments, providing employee training on cybersecurity best practices, and investing in advanced threat detection technologies. These measures help mitigate the likelihood and impact of cyber attacks, reducing reliance on cyber insurance coverage.

To find cheap business insurance, enter your ZIP code into our free quote comparison tool below and get covered today.

What is biotech and life sciences industry?

What are core coverage options for biotech companies?

What is the difference between biotech and life science industry?

What is the best type of life insurance?

How much does insurance for biotech companies cost?

Why is insurance for biotech organizations Important?

What is clinical trials insurance?

What types of biotech companies need insurance?

What are recommended policies for biotech companies?

What is insurance guide for biotechnology companies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.