Best Business Insurance for Social Media Influencers in 2026 (Top 10 Companies)

The best business insurance for social media influencers are Progressive, State Farm, and Nationwide offering competitive average monthly rates and enticing discounts of up to 20%. With tailored coverage plans, social media influencers can safeguard their businesses effectively.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Chris Tepedino is a feature writer that has written extensively about home, life, and car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. ...

Chris Tepedino

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated February 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Social Media Influencers

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Social Media Influencers

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Social Media Influencers

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsExplore the pros and cons of each provider to find the perfect balance between coverage and affordability. With insights on specific data rates and factors influencing cost considerations, influencers can make informed decisions to protect their businesses effectively.

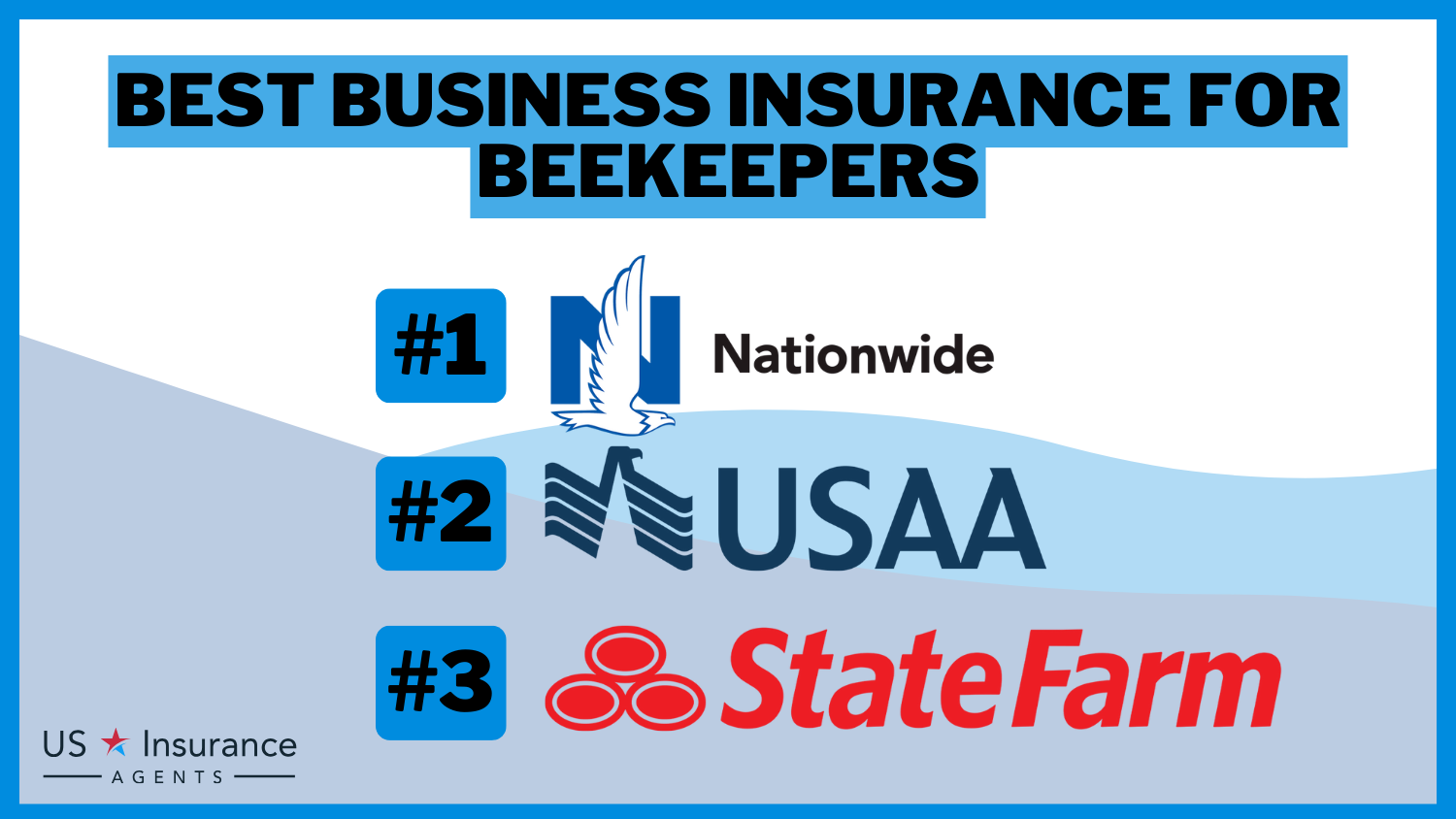

Our Top 10 Company Picks: Best Business Insurance for Social Media Influencers

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | 20% | Broad Coverage | Progressive | |

| #2 | 15% | 15% | Personalized Service | State Farm | |

| #3 | 20% | 18% | Brand Reputation | Nationwide |

| #4 | 22% | 22% | Customized Policies | Travelers | |

| #5 | 17% | 17% | Technology Integration | Liberty Mutual |

| #6 | 25% | 25% | Specialized Coverage | Hiscox |

| #7 | 16% | 16% | Reputation for Service | Allstate | |

| #8 | 19% | 19% | Local Presence | Auto-Owners | |

| #9 | 21% | 21% | High-Value Coverage | Chubb | |

| #10 | 14% | 14% | Variety of Coverages | Farmers |

Don’t miss out on securing your success in the dynamic world of social media influencing. Enter your ZIP code above to get started on comparing business insurance quotes.

#1 – Progressive: Top Overall Pick

Pros

- Broad Coverage: Progressive insurance review & ratings reveal a broad array of coverage options tailored to diverse business requirements.

- Competitive Discounts: Discounts of up to 18% provide cost savings for influencers.

- Additional Savings Opportunities: An extra discount of up to 20%, enhancing affordability..

Cons

- Limited Personalization: Coverage options may lack some personalized aspects.

- Complex Policies: The extensive range of coverage can lead to complex policy structures.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm excels in providing tailored insurance solutions.

- Competitive Discounts: Up to 15% discount enhances affordability.

- Strong Reputation: State Farm insurance review & ratings highlight dependable and customer-oriented service.

Cons

- Moderate Discounts: The percentage may be slightly lower compared to some competitors.

- Limited Technology Integration: State Farm’s technology integration may not be as advanced as some others.

#3 – Nationwide: Best for Brand Reputation

Pros

- Brand Reputation: Nationwide insurance review & ratings showcase a robust brand that inspires confidence among influencers.

- Generous Discounts: Discounts of up to 20% offer significant cost savings.

- Digital Presence: Nationwide leverages technology for a seamless customer experience.

Cons

- Slightly Higher Premiums: Despite discounts, premiums may be slightly higher.

- Less Specialized Coverage: Coverage options may not be as specialized as some competitors.

#4 – Travelers: Best for Tailored Policies

Pros

- Customized Policies: Travelers tailors policies to meet unique influencer needs.

- High Discounts: Up to 22% discounts provide substantial cost savings.

- Innovative Technology: Travelers insurance review & ratings emphasize modern technology to enhance the insurance process.

Cons

- Less Local Presence: Limited local presence compared to some competitors.

- Complex Application Process: Customization may lead to a more complex application process.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Technology Integration

Pros

- Technology Integration: Liberty Mutual excels in integrating technology.

- Competitive Discounts: Up to 17% discounts provide cost-effective solutions.

- Quick Claim Processing: Liberty mutual review & ratings boast efficient and quick claims processing.

Cons

- Moderate Coverage Customization: Level of customization in coverage options may be moderate.

- Limited Local Presence: Local presence may be less extensive compared to some competitors.

#6 – Hiscox: Best for Specialized Expertise

Pros

- Specialized Coverage: Hiscox offers highly specialized comprehensive coverage for unique risks.

- High Discounts: Up to 25% discounts provide significant cost savings.

- Flexible Policies: Allows influencers to adapt coverage to specific needs.

Cons

- Higher Premiums: Despite discounts, specialized coverage may result in higher premiums.

- Limited Variety in Coverage: Coverage options may be limited compared to some competitors.

#7 – Allstate: Best for Service Excellence

Pros

- Reputation for Service: Allstate has a strong reputation for excellent service.

- Competitive Discounts: Up to 16% discounts make it an affordable choice.

- Diverse Coverage Options: Allstate insurance review & ratings highlight variety of coverage options.

Cons

- Moderate Brand Recognition: Brand recognition may be slightly less widespread.

- Limited Personalization: The level of personalization in policies may be moderate.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Localized Support

Pros

- Local Presence: Auto-Owners boasts a strong local presence.

- Competitive Discounts: Up to 19% discounts offer cost-effective solutions.

- Customized Coverage: Auto-Owners insurance review & ratings enunciates coverage customization for influencers

Cons

- Limited Technological Features: May have fewer advanced technological features.

- Slightly Less Variety: While customizable, coverage options may be slightly less varied.

#9 – Chubb: Best for Premium Coverage

Pros

- High-Value Coverage: Chubb specializes in providing high-value coverage.

- Generous Discounts: Offers up to 21% discounts for affordable premium coverage.

- Personalized Risk Management: Chubb insurance review & ratings boast excellence in personalized risk management.

Cons

- Higher Premiums: Premiums for high-value coverage may be higher.

- Specialized Focus: Coverage may be less versatile for a broader range of influencers.

#10 – Farmers: Best for Diverse Offerings

Pros

- Variety of Coverages: Farmers offers a diverse range of coverage options.

- Cost-Effective Solutions: Up to 14% discounts provide affordable insurance.

- Local Agents: Farmers insurance review & ratings underscore access to local agents ensuring personalized support to influencers.

Cons

- Moderate Technological Integration: Technological integration may be moderate.

- Slightly Limited Specialization: Coverage may be slightly less specialized compared to certain providers.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Essential Business Insurance Coverage for Social Media Influencers

When it comes to protecting your business, social media influencer insurance coverage is crucial. Here are the key types of insurance coverage to consider:

- General Liability Insurance: Covers injuries or property damage that occur during your business activities.

- Media Liability Insurance: Protects against claims of defamation, copyright infringement, or other content-related issues.

- Business Owner’s Policy (BOP): Combines general liability and property insurance into a comprehensive package.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages if employees are injured on the job.

- Cyber Liability Insurance: Provides financial protection in case of data breaches or cyberattacks.

- Commercial Auto Insurance: Commercial auto insurance covers accidents involving vehicles used for your influencer business.

Remember, the types of coverage you need may vary based on your specific business operations and risk exposure. Consult with insurance professionals to determine the most suitable combination of coverage for your social media influencer business.

Navigating the Costs: Factors to Consider for Social Media Influencers’ Business Insurance

When it comes to business insurance for social media influencers, understanding the cost considerations is crucial for finding the right coverage that fits your budget. Several factors can influence the cost of insurance influencers business. Here are some key cost considerations to keep in mind:

- Business Size: The size of your influencer business can impact insurance costs, with smaller independent influencers typically paying less than larger businesses.

- Coverage Needs: The types and amount of insurance coverage you require will affect premiums. Consider the specific risks associated with your influencer activities and tailor your coverage accordingly.

- Risk Exposure: Your level of risk exposure, including collaborations, employees, and business-owned vehicles, can influence insurance costs.

- Deductibles and Coverage Limits: The deductibles and coverage limits you choose will impact the cost of insurance. Higher deductibles can lower premiums but require more out-of-pocket expenses in case of a claim.

- Insurance Providers: Rates can vary among insurance providers, so it’s essential to compare quotes from multiple insurers to find the most cost-effective options.

By considering these cost factors and finding the right balance between coverage and affordability, you can protect your influencer business without straining your budget.

Social Media Influencers Business Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $100 | $200 | |

| $110 | $220 | |

| $120 | $240 | |

| $115 | $230 | |

| $105 | $210 |

| $125 | $250 |

| $105 | $210 |

| $95 | $190 | |

| $100 | $200 | |

| $110 | $220 |

Additionally, seeking advice from insurance professionals specializing in influencer coverage can offer valuable insights tailored to your specific needs.

Ty Stewart Licensed Insurance Agent

Remember to compare rates from different insurance providers to ensure you get the best coverage at the most competitive price. Taking the time to assess your needs and explore your options can ultimately save you money and provide peace of mind as you continue to grow your influencer brand.

Insure Your Influence: Obtaining Business Insurance for Social Media Influencers

Obtaining the right social media insurance coverage for influencers is crucial for the protection and longevity of your business. Here are the six steps to follow when seeking business insurance:

- Assess your needs. Determine the specific insurance needs of your business based on the nature of your content and the potential risks involved.

- Research providers. Look for reputable insurance providers that specialize in business insurance for social media influencers.

- Seek professional help. Consult with insurance professionals who understand the unique challenges of influencers. They can guide you in selecting the appropriate coverage for your business.

- Compare quotes. Request quotes from multiple providers to compare rates and coverage options. You may obtain insurance quotes online.

- Review and purchase. Carefully review the quotes and coverage details. Once you find the right policy, complete the necessary paperwork and make the purchase.

- Regularly review. As your business grows and changes, periodically review and update your insurance coverage to ensure it remains aligned with your needs.

By following these steps and working with insurance professionals who understand the unique needs of social media influencers, you can obtain the right insurance coverage to protect your business from potential risks and setbacks.

Don’t leave your success to chance – invest in comprehensive business insurance tailored to your specific needs and continue to thrive in the dynamic world of social media influencing.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Real-Life Scenarios of Business Insurance for Social Media Influencers

Do I need insurance as a content creator? As social media influencers navigate the dynamic landscape of online content creation, having the right insurance coverage is paramount. Explore these case studies illustrating how different types of insurance for content creators or influencers protect them from various risks and ensure the longevity of their businesses.

- Case Study # 1 – General Liability Insurance: Sarah hosted a meet-up where a guest slipped and got injured. Her general liability insurance covered the medical expenses and legal costs, shielding her from financial loss and reputational damage.

- Case Study #2 – Media Liability Insurance: Jake faced a legal notice claiming copyright infringement. His media liability insurance covered legal defense costs and potential damages, allowing him to continue creating content without legal worries.

- Case Study #3 – Business Owner’s Policy: Emily experienced vandalism resulting in stolen equipment. Her business owner’s policy covered the stolen equipment and repair damages swiftly, ensuring minimal disruption to her operations.

- Case Study #4 – Workers’ Compensation Insurance: Mark’s hired assistant got injured during a video shoot. His workers’ compensation insurance covered medical expenses and lost wages, fulfilling his legal obligations and safeguarding his business.

- Case Study #5 – Cyber Liability Insurance: Sophie suffered a cyberattack leading to a data breach. Her cyber liability insurance covered costs of data breach notifications, credit monitoring, and potential legal claims, aiding her business recovery process.

In each of these scenarios, business insurance played a pivotal role in mitigating risks and ensuring the uninterrupted growth of social media influencers’ businesses. Whether it’s protecting against third-party injuries, copyright claims, property damage, employee injuries, or cyberattacks, the right insurance coverage provides peace of mind.

Kristine Lee Licensed Insurance Agent

It will enable influencers to focus on creating engaging content for their audience. Don’t leave your success to chance—invest in comprehensive business insurance tailored to your specific needs and continue thriving in the dynamic world of social media influencing. Explore “How Social Media Could Impact Your Insurance” as an influencer or content creator.

Summing Up: Shield Your Social Media Business With the Right Insurance Coverage

In the fast-paced world of social media influencing, protecting your business is essential. The best business insurance includes the necessary coverage to mitigate risks and ensure financial security. From general liability insurance to media liability insurance, workers’ compensation insurance to cyber liability insurance, there are various types of coverage to suit your needs.

By assessing your insurance requirements, working with reputable providers, and obtaining the right coverage, you can focus on creating content and connecting with your audience, knowing that you are protected. Don’t leave your social media business vulnerable—prioritize its longevity and success with the right insurance coverage today.

Our free quote tool below makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

Frequently Asked Questions

What types of insurance coverage are essential for social media influencers?

Social media influencer insurance should consider various types, including general liability insurance, media liability, business owner’s policy, workers’ compensation, and cyber liability insurance. These coverages help protect against different risks such as third-party injuries, copyright infringement claims, property damage, employee injuries, and cyberattacks.

How do I determine the cost of business insurance for my influencer business?

The cost of business insurance for social media influencers depends on factors such as the type and amount of coverage needed, business operations, revenue, and the influencer’s risk profile. Factors like the influencer’s industry, content type, and audience size can also impact insurance costs. To obtain an accurate estimate, it’s recommended to compare quotes from different insurance providers.

Protect your business today by entering your ZIP code below into our comparison tool for free commercial insurance quotes.

Can business insurance help protect against copyright infringement claims for influencer content?

Yes, certain types of insurance, such as media liability insurance, can provide coverage for copyright infringement claims. This coverage helps influencers with legal defense costs and potential damages arising from claims related to the unauthorized use of copyrighted material in their content.

What is errors and omissions insurance for influencers?

E&O insurance, also known as errors and omissions insurance, provides protection for professionals like influencers in the event of mistakes leading to harm for another party. For instance, if an influencer is found responsible for causing harm to a third party, and the affected party can quantify the damages monetarily.

Discover our “Professional Liability (Errors & Omissions) Insurance” for more information.

How do I become an insurance influencer?

To succeed in insurance influencer marketing, tailor campaigns to fit each stage of the customer journey, unleash creativity for impact, diversify content creation, and add a personal touch to influencer campaigns.

How can insurance protect social media influencers in case of a cyberattack?

Cyber liability insurance is designed to protect social media influencers in the event of a cyberattack. This coverage helps cover the costs associated with data breaches, including expenses for notifying affected parties, providing credit monitoring services, and addressing potential legal claims. It plays a crucial role in safeguarding the influencer’s reputation and aiding in the recovery from a cyber incident.

What qualifies you as an influencer?

An influencer is defined as an individual who commands a devoted and above-average social media audience. Brands often compensate influencers for generating and sharing promotional content.

Discover further details on our “Best Business Insurance for YouTubers (Top 10 Companies)“.

How do I start an influencer business?

To ensure a successful influencer journey, complete basic business tasks, identify your niche, understand your audience, create your influencer brand, develop your content strategy, optimize your online presence, select your channels wisely, and post unique content regularly.

How do I get an influencer license?

To acquire an influencer license. You must provide specific documents. These include a completed application form, the deed or tenancy contract, a copy of the influencer’s passport and visa page, ID, and a copy of the trade license.

What is the best niche for influencer?

The most profitable influencer niches include sustainable living and eco-friendly products, home fitness and wellness, mental health advocacy, gourmet home cooking, personal finance and investment, remote work and productivity tools, indie beauty and skincare, and pet care and animal wellness.

Find out about best coverage for pets on our “Most Affordable Pet Insurance“.

Is influencer marketing paid or owned?

What is influencer licensing?

Do I need an agent as an influencer?

How do I start a social media influencer account?

How much does it cost to license an influencer?

How is social media used in insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.