Cheap Chevrolet Suburban 1500 Car Insurance in 2026 (Top 10 Companies for Savings!)

Discover the top picks for cheap Chevrolet Suburban 1500 car insurance: USAA, Erie, and AAA offer the most affordable rates, starting as low as $81 monthly. These companies lead due to their exceptional coverage options, superior customer service, and comprehensive policies tailored for Suburban owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated November 2024

Company Facts

Min. Coverage for Chevrolet Suburban 1500

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Suburban 1500

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Suburban 1500

A.M. Best Rating

Complaint Level

Pros & Cons

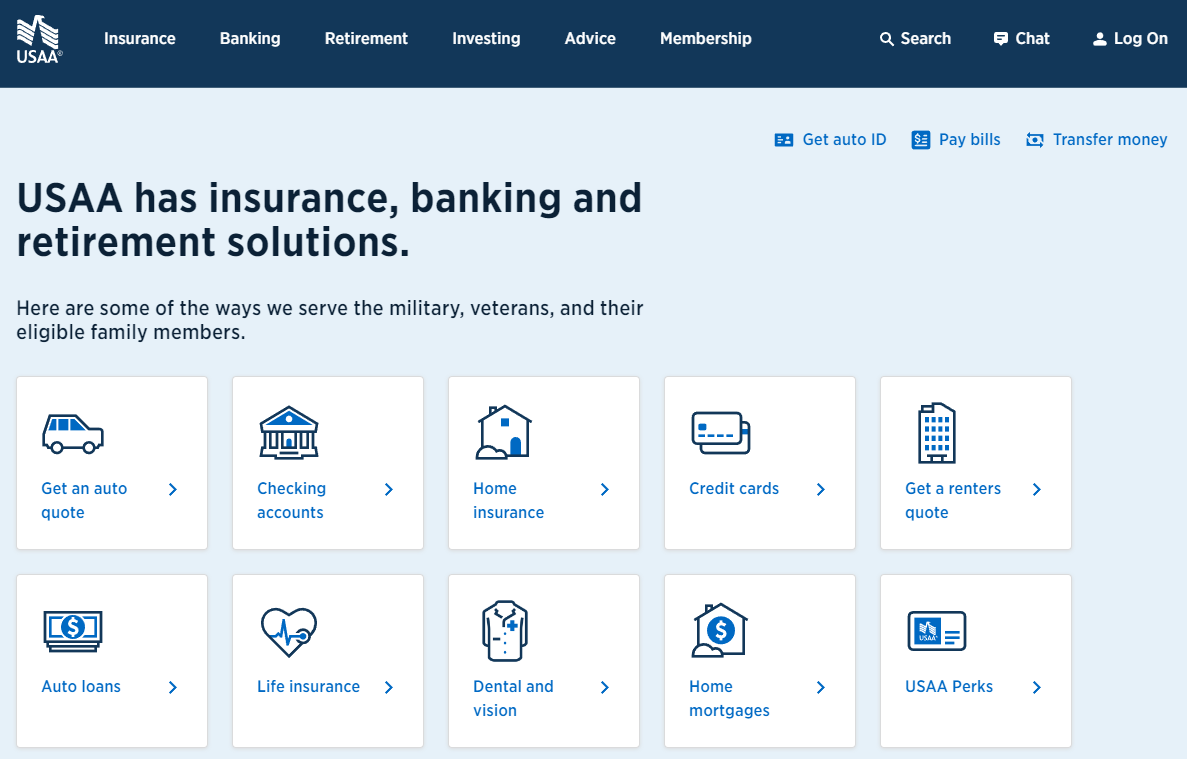

The top picks for cheap Chevrolet Suburban 1500 car insurance are USAA, Erie, and AAA, renowned for offering competitive rates and robust coverage options.

These providers stand out by blending affordability with comprehensive benefits, ensuring that Suburban owners receive value and peace of mind. Their dedication to customer satisfaction and flexibility in policy customization helps drivers secure the necessary protection without breaking the bank. Learn more in our “Cheap Chevrolet Suburban Car Insurance.”

Our Top 10 Company Picks: Cheap Chevrolet Suburban 1500 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $81 A++ Military Savings USAA

#2 $86 A+ Industry Experience Erie

#3 $94 A Roadside Assistance AAA

#4 $102 A 24/7 Support Liberty Mutual

#5 $109 A+ Exclusive Benefits The Hartford

#6 $115 B Filing Claims State Farm

#7 $121 A Small Businesses Farmers

#8 $126 A++ Multi-Policy Savings Travelers

#9 $129 A+ Family Plans Nationwide

#10 $135 A+ UBI Discount Progressive

Whether you’re looking for liability coverage or a full suite of insurance services, these companies provide reliable solutions tailored to the unique needs of Chevrolet Suburban 1500 owners.

Understanding how insurance works can feel complicated, but finding affordable rates doesn’t have to be. Enter your ZIP code above for the best insurance rates possible.

- USAA is the top pick for cheap Chevrolet Suburban 1500 car insurance

- Tailored policies address the specific coverage needs of Suburban owners

- Specialized discounts are available for Suburban safety features

#1 – USAA: Top Overall Pick

Pros

- Military Focus: USAA provides tailored services and discounts specifically for military members and their families.

- High Customer Satisfaction: USAA consistently scores high in customer service and claims satisfaction.

- Competitive Rates: Offers some of the lowest rates in the industry for those who qualify. See more details on our USAA insurance review & ratings.

Cons

- Limited Eligibility: USAA services are only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer local offices compared to other national insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for Industry Experience

Pros

- Personalized Service: Known for a personal touch with local agents. More information is available about this provider in our Erie insurance review & ratings.

- Rate Lock Feature: Erie offers a rate lock feature that ensures your premium stays the same year to year.

- Full Replacement Coverage: Provides new car replacement without depreciation for qualifying vehicles.

Cons

- Limited Availability: Erie insurance is not available in all states.

- No Online Claims: Claims must be handled through an agent, not online.

#3 – AAA: Best for Roadside Assistance

Pros

- Comprehensive Roadside Assistance: Renowned for offering one of the best roadside assistance programs.

- Bundle Discounts: Discounts available when bundling auto insurance with other types of coverage.

- Wide Acceptance: AAA offers a variety of insurance products that cater to a broad demographic. Read up on the “AAA Insurance Review & Ratings” for more information.

Cons

- Membership Required: Must purchase a AAA membership to access insurance products.

- Variable Customer Service: Service quality can vary significantly between different regional clubs.

#4 – Liberty Mutual: Best for 24/7 Support

Pros

- Extensive Coverage Options: Offers a wide array of coverage choices, including accident forgiveness.

- 24/7 Customer Support: Round-the-clock customer service for claims and inquiries.

- Online Tools: Comprehensive set of online tools for policy management and claims. Check out insurance savings in our complete Liberty Mutual car insurance review & ratings.

Cons

- Higher Premiums: Can be more expensive than competitors for some policyholders.

- Inconsistent Customer Reviews: Customer satisfaction can vary depending on the region.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Exclusive Benefits

Pros

- Specialized Packages for Seniors: Offers advantages for AARP members, including lifetime renewability.

- RecoverCare Benefit: Provides unique benefits like in-home help following an accident.

- 12-Month Rate Protection: Gives customers annual policy rate consistency. Discover more about offerings in our The Hartford insurance review & ratings.

Cons

- AARP Membership Required for Best Benefits: Best rates and benefits are only available to AARP members.

- Limited Appeal for Younger Drivers: Benefits geared more towards older adults.

#6 – State Farm: Best for Filing Claims

Pros

- Efficient Claim Processing: Known for a smooth, efficient claims process. Access comprehensive insights into our State Farm car insurance review & ratings.

- Wide Network: Largest auto insurer in the U.S. with extensive agent network.

- Multiple Discounts: Offers several discount opportunities including safe driver discounts.

Cons

- Higher Rates for Some: Rates can be higher for customers without multiple policies.

- Varied Customer Experience: Experience can vary greatly depending on the agent.

#7 – Farmers: Best for Small Businesses

Pros

- Customized Policies: Specializes in policies tailored for small businesses. Delve into our evaluation of Farmers car insurance review & ratings.

- Risk Management Services: Offers services and resources to help businesses manage risks.

- Fleet Discounts: Discounts available for businesses with multiple vehicles.

Cons

- Higher Cost: Generally more expensive than some competitors.

- Complex Policies: Policies can be complex and require thorough understanding.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Multi-Policy Savings

Pros

- Multiple Policy Discount: Significant discounts for customers who bundle multiple policies.

- Customizable Coverage Options: Offers a wide range of customizable coverage options.

- Gap Coverage: Provides gap insurance for auto leases and loans. Unlock details in our Travelers insurance review & ratings.

Cons

- Strict Underwriting: Not all applicants may qualify for their best rates.

- Customer Service Variability: Some customers report less-than-ideal service experiences.

#9 – Nationwide: Best for Family Plans

Pros

- Family Discounts: Offers discounts for families with multiple drivers or vehicles.

- SmartRide Program: A usage-based program that rewards safe driving. Discover insights in our Nationwide insurance review & ratings.

- Accident Forgiveness: Includes accident forgiveness to prevent rates from increasing after a first accident.

Cons

- Pricey for High-Risk Drivers: More expensive for drivers with poor records.

- Inconsistency in Claims Process: Some users report variability in the claims process.

#10 – Progressive: Best for UBI Discount

Pros

- Snapshot Program: Offers discounts through their usage-based insurance program, Snapshot.

- Name Your Price Tool: Helps customers find a policy that fits their budget. If you want to learn more about the company, head to our Progressive car insurance review & ratings.

- Strong Online Presence: Excellent digital tools for managing policies and filing claims.

Cons

- Variable Rates Post-Snapshot: Rates can increase significantly after the initial Snapshot period.

- Mixed Customer Reviews: Some dissatisfaction with claims and customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

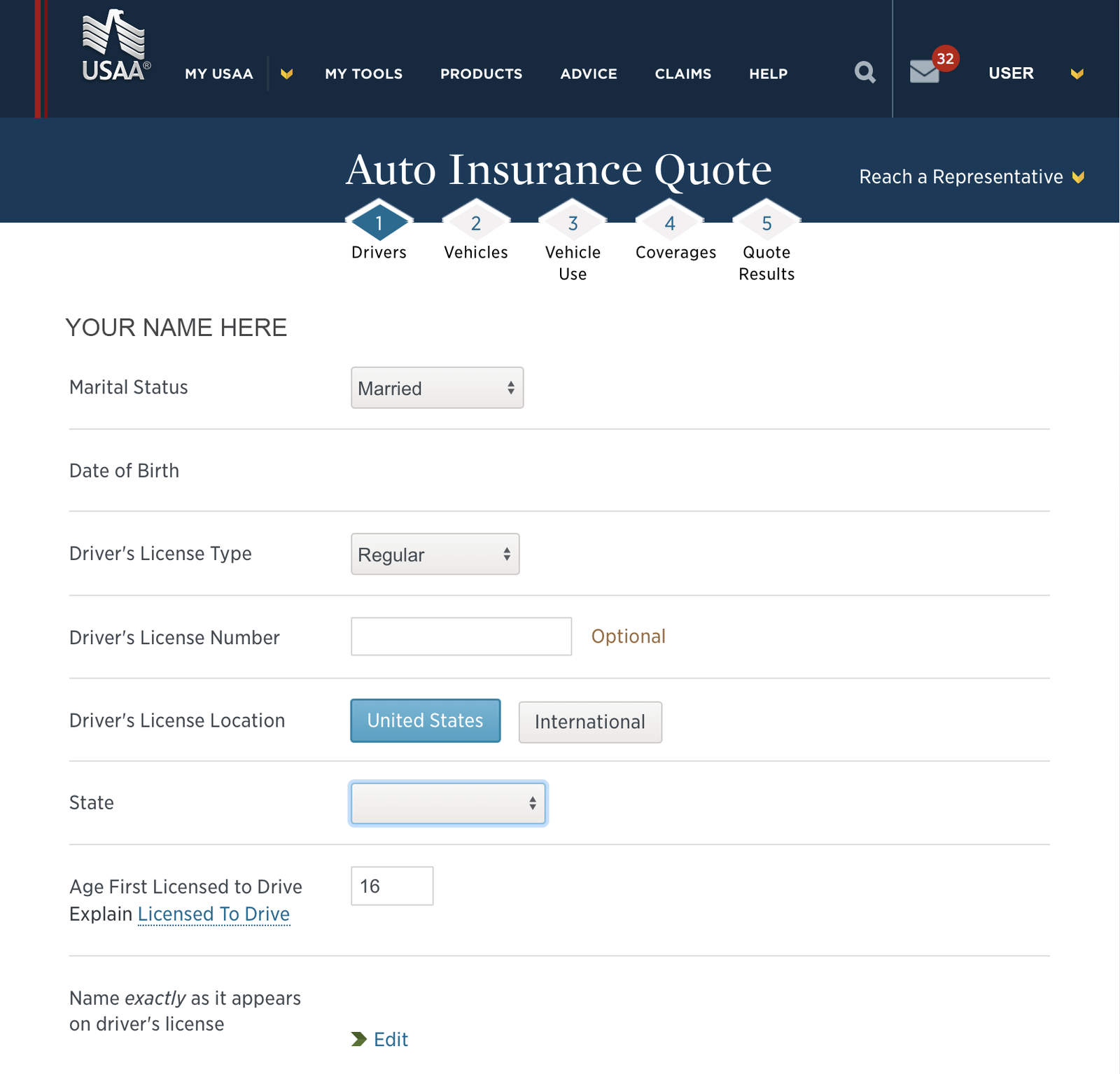

Chevrolet Suburban 1500 Insurance Rates: Provider Comparison

The table below details the monthly car insurance rates for a Chevrolet Suburban 1500, comparing minimum and full coverage across various providers. This information is crucial for owners of this vehicle to understand the financial implications of their insurance choices.

Chevrolet Suburban 1500 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $94 $155

Erie $86 $149

Farmers $121 $186

Liberty Mutual $102 $163

Nationwide $129 $206

Progressive $135 $215

State Farm $115 $179

The Hartford $109 $170

Travelers $126 $193

USAA $81 $136

When it comes to insuring a Chevrolet Suburban 1500, the rates vary significantly between providers and coverage levels. For instance, USAA offers the most competitive rates with minimum coverage starting at $81 and full coverage at $136 per month, making it an attractive option for those seeking comprehensive protection at a lower cost.

On the higher end, Progressive presents a full coverage rate at $215 monthly, which is considerably more expensive. This discrepancy highlights the importance of comparing insurance offers based on what coverage level suits your needs and budget. For those prioritizing basic protection, AAA and Erie offer relatively affordable options at $94 and $86 for minimum coverage, respectively.

Meanwhile, those who desire more comprehensive coverage may find Erie’s $149 and Liberty Mutual’s $163 monthly for full coverage as reasonable middle-ground options. See more details on our “Full Coverage Car Insurance: A Complete Guide.”

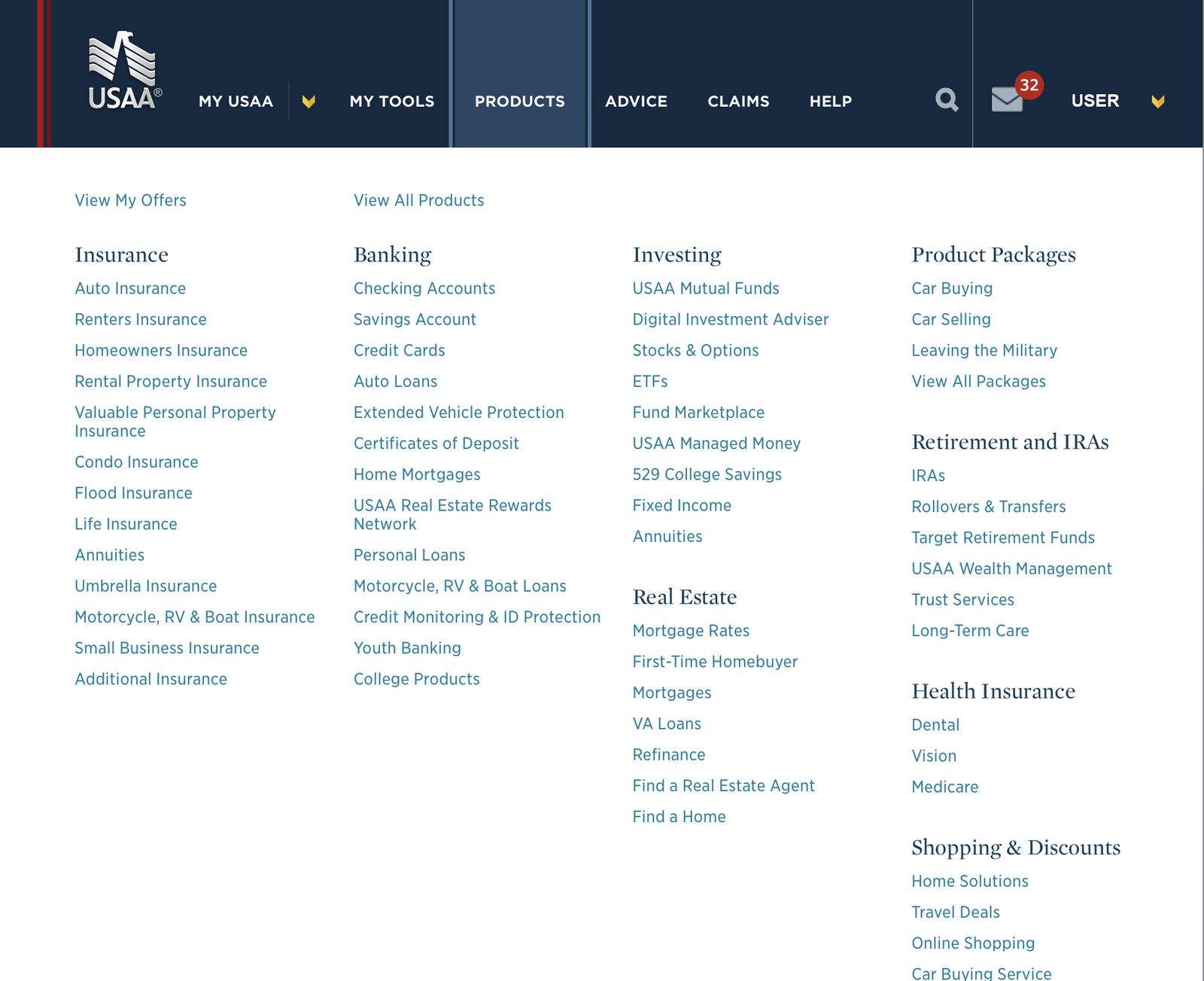

Factors That Influence the Cost of Chevrolet Suburban 1500 Car Insurance

Several key factors affect the cost of insuring your Chevrolet Suburban 1500. The make and model of your vehicle play a significant role, as well as your driving record and location. Check out insurance savings in our complete “Car Driving Safety Guide for Teens and Parents.”

Additionally, insurance companies consider factors such as age, gender, marital status, and credit score when determining premiums. By understanding these influences, you can gain insights into potential cost savings. Another important factor that can influence the cost of insuring your Chevrolet Suburban 1500 is the level of coverage you choose.

Insurance companies offer different types of coverage options, such as liability, collision, and comprehensive coverage. The more comprehensive the coverage, the higher the premium is likely to be. It’s important to carefully consider your coverage needs and budget when selecting the right insurance policy for your Chevrolet Suburban 1500.

Understanding the Basics of Car Insurance for the Chevrolet Suburban 1500

When getting car insurance for your Chevrolet Suburban 1500, it’s crucial to comprehend the fundamentals. Liability coverage is typically required by law and protects you from potential financial loss if you cause an accident. Comprehensive and collision coverage options provide additional protection for your vehicle. Familiarize yourself with the various policy types and coverage limits to select the right one for your needs.

Additionally, it’s important to consider the deductible when choosing car insurance for your Chevrolet Suburban 1500. The deductible is the amount you will have to pay out of pocket before your insurance coverage kicks in. A higher deductible can lower your insurance premium, but it also means you will have to pay more in the event of a claim.

On the other hand, a lower deductible may result in a higher premium but can provide more financial protection in case of an accident. Consider your budget and risk tolerance when deciding on the deductible amount for your car insurance policy. Discover more about offerings in our “Lesser Known Car Insurance Discounts.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Rates for the Chevrolet Suburban 1500

Comparing car insurance rates is an essential step in finding the best deal for your Chevrolet Suburban 1500. By requesting quotes from multiple insurers, you can identify the most competitive rates available. Keep in mind that rates can vary significantly based on your personal circumstances and the coverage options you choose. Take the time to compare rates to ensure you’re getting the most value for your money.

When comparing car insurance rates for the Chevrolet Suburban 1500, it’s important to consider factors beyond just the price. Look for insurers that offer comprehensive coverage, excellent customer service, and a strong reputation for handling claims efficiently.

Laura Walker Former Licensed Agent

Additionally, take into account any discounts or special offers that may be available to you, such as safe driver discounts or bundling your car insurance with other policies. By considering these factors alongside the rates, you can make a well-informed decision and secure the best insurance coverage for your Chevrolet Suburban 1500. Access comprehensive insights into our “Does your car insurance rate go up the more cars you have?”

Tips for Finding Affordable Car Insurance for Your Chevrolet Suburban 1500

If you’re looking to save money on your Chevrolet Suburban 1500 insurance, consider these helpful tips:

- Bundle your car insurance with other policies, such as homeowner’s insurance, for potential discounts.

- Opt for a higher deductible to lower your monthly premiums.

- Maintain a good credit score to qualify for better rates.

- Take advantage of discounts offered by insurers, such as safe driver or multi-car discounts.

Additionally, it’s important to regularly review your car insurance coverage to ensure you have the appropriate level of protection for your Chevrolet Suburban 1500. As your vehicle ages, you may consider adjusting your coverage to reflect its current value. This can help prevent overpaying for coverage you no longer need. Delve into our evaluation of “Best Car Insurance by Vehicle.”

It’s also a good idea to compare quotes from multiple insurance providers to ensure you’re getting the best rate possible. By taking these steps, you can find affordable car insurance that meets your needs and budget.

The Average Cost of Insuring a Chevrolet Suburban 1500

It’s essential to have realistic expectations regarding the average cost of insuring a Chevrolet Suburban 1500. The actual cost varies depending on several factors, including your location, driving record, and coverage preferences. On average, you can expect to pay between $1,200 and $1,800 per year for car insurance for a Chevrolet Suburban 1500.

However, it’s important to note that these figures are just averages and can vary significantly. Factors such as your age, gender, and credit score can also impact the cost of insuring a Chevrolet Suburban 1500. Additionally, the level of coverage you choose, such as liability-only or comprehensive coverage, will also affect the overall cost.

It’s always recommended to shop around and compare quotes from different insurance providers to ensure you’re getting the best rate for your specific circumstances. Unlock details in our “How To Get Free Insurance Quotes Online.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Coverage Options for Your Chevrolet Suburban 1500

When selecting coverage options for your Chevrolet Suburban 1500, you can choose from a range of options to suit your needs. In addition to liability coverage, comprehensive and collision coverage provide additional protection. Consider factors such as the age and condition of your vehicle, your personal risk tolerance, and your budget when determining the appropriate coverage.

Comprehensive coverage is an option that provides protection for your Chevrolet Suburban 1500 against non-collision related incidents. This can include damage from natural disasters, theft, vandalism, and falling objects. It is especially beneficial if you live in an area prone to severe weather or have concerns about theft.

Collision coverage, on the other hand, covers damage to your Chevrolet Suburban 1500 resulting from a collision with another vehicle or object. This can help cover the cost of repairs or even replacement if your vehicle is deemed a total loss. It is particularly important if you frequently drive in high-traffic areas or have concerns about accidents. Discover insights in our “How much insurance coverage do I need?”

How to Lower Your Car Insurance Premiums for the Chevrolet Suburban 1500

If you’re looking to lower your car insurance premiums for your Chevrolet Suburban 1500, try implementing the following strategies:

- Take a defensive driving course to demonstrate responsible driving habits.

- Drive fewer miles annually to qualify for low-mileage discounts.

- Improve your credit score by paying bills on time and reducing outstanding debts.

- Consider opting for a higher deductible, assuming you can afford the potential out-of-pocket costs.

Another strategy to lower your car insurance premiums for the Chevrolet Suburban 1500 is to install anti-theft devices such as car alarms or tracking systems. These devices can help reduce the risk of theft and may qualify you for discounts on your insurance. Learn more in our “Anti Theft System Car Insurance Discount.”

Additionally, maintaining a clean driving record is crucial in keeping your car insurance premiums low. Avoiding traffic violations and accidents can help demonstrate to insurance companies that you are a responsible driver, which may result in lower rates.

Common Mistakes to Avoid When Insuring Your Chevrolet Suburban 1500

When purchasing car insurance for your Chevrolet Suburban 1500, avoid these common mistakes:

- Overlooking the importance of comparing rates from multiple insurers.

- Underinsuring your vehicle, leaving yourself vulnerable to financial loss in case of an accident.

- Failure to disclose accurate information about your driving record or modifications made to your vehicle.

Securing the right insurance for your Chevrolet Suburban 1500 requires diligence in comparing rates, ensuring adequate coverage, and being transparent about your driving history and any vehicle modifications.

Jeff Root Licensed Life Insurance Agent

By avoiding these common pitfalls, you can protect yourself against potential financial hardships and enjoy greater peace of mind. See more details on our “Car and Homeowners Insurance Coverage That Can Be a Waste of Money.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Proper Coverage Limits for Your Chevrolet Suburban 1500

It’s crucial to ensure your Chevrolet Suburban 1500 has adequate coverage limits. Insufficient coverage may result in out-of-pocket expenses in the event of an accident.

Consider factors such as the value of your vehicle, potential medical expenses, and the cost of property damage when determining your coverage limits. Check out insurance savings in our complete “Does it make more sense to increase my car insurance limits or buy an umbrella policy?”

How to Choose the Right Deductible for Your Chevrolet Suburban 1500 Car Insurance

Choosing the right deductible for your Chevrolet Suburban 1500 car insurance involves finding a balance between your monthly premiums and potential out-of-pocket costs. Discover more about offerings in our “What is the difference between a deductible and a premium in car insurance?”

Opting for a higher deductible usually lowers your premium, but it also means you will have to pay more in case of a claim. Evaluate your financial situation and ability to absorb unexpected expenses when selecting a deductible.

Understanding the Role of Your Driving Record in Determining Insurance Costs for the Chevrolet Suburban 1500

Your driving record has a significant impact on your insurance costs for the Chevrolet Suburban 1500. Traffic violations, accidents, and claims can increase your premiums.

Maintaining a clean driving record by obeying traffic laws and practicing safe driving habits can help keep insurance costs in check. Access comprehensive insights into our “Traffic School Can Lower Your Car Insurance Rates.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Savings Opportunities for Insuring a Chevrolet Suburban 1500

Insurance companies often offer various discounts and savings opportunities for insuring a Chevrolet Suburban 1500. These may include discounts for safe driving, bundling multiple policies, low mileage, or having certain safety features installed in your vehicle. Explore these options to maximize your potential savings. Delve into our evaluation of “Best Safety Features Car Insurance Discounts.”

The Impact of Location on Your Chevrolet Suburban 1500 Car Insurance Rates

Where you live plays a significant role in determining your Chevrolet Suburban 1500 car insurance rates. Different areas have varying levels of risk, such as higher accident rates or higher rates of auto theft. Urban areas and densely populated regions generally have higher insurance rates compared to rural areas. Unlock details in our “Is car theft covered by car insurance?”

Tips for Comparing Quotes and Getting the Best Deal on Chevrolet Suburban 1500 Car Insurance

When comparing quotes for Chevrolet Suburban 1500 car insurance, keep these tips in mind:

- Ensure you’re comparing the same coverage options and limits.

- Look beyond the price and consider the reputation and customer service of the insurer.

- Inquire about any available discounts or special offers.

- Consider consulting with an independent insurance agent who can provide personalized advice and guide you through the selection process.

In your quest to find the best Chevrolet Suburban 1500 car insurance, always compare equivalent coverage levels and investigate each insurer’s reputation and customer service capabilities.

Additionally, take advantage of any discounts and consider the guidance of an independent insurance agent to tailor your policy perfectly to your needs. Discover insights in our “Best Car Insurance.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explaining Comprehensive and Collision Coverage Options for the Chevrolet Suburban 1500

Comprehensive and collision coverage options provide additional protection for your Chevrolet Suburban 1500.

Comprehensive coverage protects against damage caused by non-accident-related incidents, such as theft, vandalism, or severe weather. Collision coverage covers damage resulting from accidents with other vehicles or objects. While these coverages are optional, they provide valuable peace of mind. Learn more in our “Collision vs. Comprehensive Car Insurance.”

Factors That May Affect the Cost of Insuring a Used or New Chevrolet Suburban 1500

Insuring a used or new Chevrolet Suburban 1500 may have different cost implications. Newer vehicles generally have higher replacement costs, which can impact insurance rates.

Additionally, the condition and value of a used vehicle, as well as its safety features and mileage, may affect insurance costs. Be sure to consider these factors when insuring your Chevrolet Suburban 1500. See more details on our “Low Mileage Car Insurance Discount.”

Important Considerations When Selecting an Insurer for Your Chevrolet Suburban 1500

When selecting an insurer for your Chevrolet Suburban 1500, consider the following:

- Financial stability of the insurer to ensure they can fulfill their obligations in case of a claim.

- Customer reviews and reputation for quality service.

- Accessibility and convenience of customer support.

- Availability of additional benefits or coverage options that align with your needs.

In choosing an insurer for your Chevrolet Suburban 1500, it’s crucial to assess the financial stability of the company, ensuring they have the means to meet claims reliably.

Additionally, consider customer reviews and the availability of robust support services and tailored coverage options, which will greatly enhance your satisfaction and security with your insurance choice. Check out insurance savings in our complete “What age do you get cheap car insurance?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Modifications or Customizations Can Impact Your Car Insurance Premiums on a Chevrolet Suburban 1500

Modifications or customizations made to your Chevrolet Suburban 1500 can impact your car insurance premiums. Insurers will take into account any changes that could affect the value or safety of your vehicle.

It’s essential to inform your insurer about any modifications to ensure you have the appropriate coverage in case of an accident. Discover more about offerings in our “Can I get car insurance for a car that is modified or customized?”

Understanding How Credit Score Can Affect Your Car Insurance Rates for a Chevrolet Suburban 1500

Your credit score can affect your car insurance rates for a Chevrolet Suburban 1500. Insurers often consider credit history as a factor when determining premiums. Maintaining a good credit score demonstrates financial responsibility and may qualify you for lower insurance rates. It’s important to regularly monitor and improve your credit score to potentially save on insurance costs.

We hope this guide has provided you with valuable insights into the cost of car insurance for the Chevrolet Suburban 1500. By understanding the various factors that influence insurance costs and utilizing the tips provided, you can secure affordable and comprehensive coverage for your Chevrolet Suburban 1500. Access comprehensive insights into our “What is included in comprehensive car insurance?”

Melanie Musson Published Insurance Expert

Remember to periodically review your insurance coverage to ensure it meets your evolving needs. Safe and happy driving.

See which companies have the cheapest rates for you by entering your ZIP code in our free comparison tool below.

Frequently Asked Questions

What factors affect the cost of Chevrolet Suburban 1500 car insurance?

The cost of Chevrolet Suburban 1500 car insurance can be influenced by various factors such as the driver’s age, driving history, location, coverage options, deductible amount, and the insurance company’s policies.

For additional details, explore our comprehensive resource titled “Best Safe Driver Car Insurance Discounts.”

Are Chevrolet Suburban 1500 cars expensive to insure?

Insurance costs for Chevrolet Suburban 1500 cars can vary depending on several factors. However, due to its size, power, and potential repair costs, insurance rates for this vehicle may be higher compared to smaller, less expensive cars.

Is it possible to find affordable insurance for a Chevrolet Suburban 1500?

Yes, it is possible to find affordable insurance for a Chevrolet Suburban 1500. By comparing quotes from different insurance providers, adjusting coverage options, and considering discounts, you can potentially find a policy that fits your budget.

Do safety features affect the cost of insuring a Chevrolet Suburban 1500?

Yes, safety features can impact the cost of insuring a Chevrolet Suburban 1500. Vehicles equipped with advanced safety features such as anti-lock brakes, airbags, stability control, and anti-theft systems may qualify for discounts, which can help lower insurance premiums.

Can the location where I live affect the cost of insuring a Chevrolet Suburban 1500?

Yes, the location where you live can affect the cost of insuring a Chevrolet Suburban 1500. Factors such as crime rates, population density, and the likelihood of accidents or theft in your area.

To find out more, explore our guide titled “Car Accidents: What to do in Worst Case Scenarios.”

What is the cheapest way to get full coverage insurance?

State Farm offers the lowest full coverage rates for teens, seniors, drivers with a speeding ticket, and those with an at-fault accident. Progressive presents the most affordable full coverage for drivers who have a DUI. For young drivers aged 20-25, GEICO is the cheapest option.

Who is cheaper, Geico or Progressive?

These auto insurers offer competitive pricing, with rates typically below the national average for various driver profiles. In a direct comparison, Geico often emerges as the more affordable option on a monthly basis.

Why is my full coverage insurance so expensive?

Several key elements determine your monthly insurance payments, including your deductible, vehicle type, driving history, claims record, daily commuting distance, credit rating, previous insurance payment history, where you live, age, gender, and any additional features included in your policy.

How do I get around high insurance rates?

Here are nine strategies to decrease your monthly auto insurance expenses: Shop around for the best rates; before purchasing a vehicle, compare the insurance prices; opt for higher deductibles to reduce premiums; consider lowering coverage on older vehicles; bundle your homeowners and auto insurance for discounts; keep a good credit history to possibly lower rates; utilize discounts for low mileage; and inquire about group insurance options that may be available through your employer or associations.

To learn more, explore our comprehensive resource on “Can I bundle my car insurance with other policies?”

What is the least expensive form of insurance coverage?

Term life insurance is the most affordable type of life insurance policy, while the cost of whole life insurance can be considerably more each month.

Enter your ZIP code below in our free tool to start seeing quotes today.

Who is offering cheapest car insurance?

What cars are hard to insure?

Does credit score affect car insurance?

Is insurance cheaper if your car is paid off?

At what point is full coverage not worth it?

Can you negotiate insurance rates?

Do Chevy engines last?

Is $200 a month a lot for car insurance?

How to save in car insurance?

What percentage of your income should go to insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.