Allstate vs. Travelers Homeowners Insurance in 2026 (Side-by-Side Review)

Allstate and Travelers differ in the critical areas of homeowners' insurance. Allstate is well known for its excellent customer service, and its average premium is $61 per month, a little higher than the starting rate of $37 per month by Travelers. Both companies offer home insurance to suit various needs.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated November 2024

11,640 reviews

11,640 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsAllstate vs. Travelers homeowners insurance compares Allstate’s local agent support and $61/month average rate to Travelers’ $37/month affordable pricing and diverse coverage options.

Allstate Insurance Company excels in personalized service through its agents, while Travelers Indemnity Company offers lower costs and flexible home insurance coverage. Allstate customers seeking tailored advice benefit from local agents, while budget-conscious homeowners find value in Travelers’ insurance coverage, especially what a typical homeowners insurance policy covers.

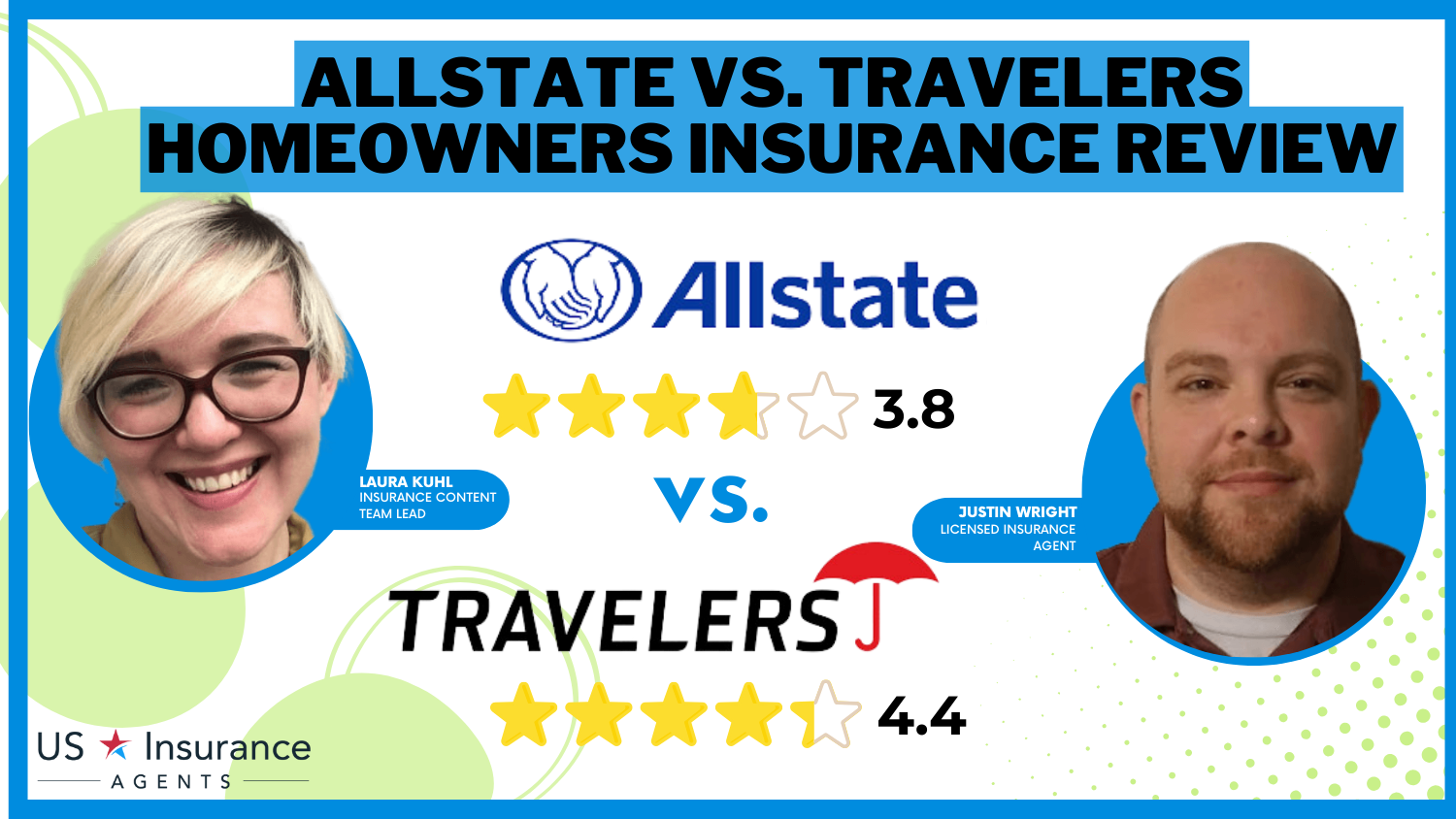

Allstate vs. Travelers Homeowners Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.0 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.4 | 4.3 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.2 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 4.1 |

| Savings Potential | 3.8 | 4.3 |

| Allstate Review | Travelers Review |

Allstate quotes may be pricey, though. Travelers need more local resources. Drivers should review the cost-effective initiatives of the Travelers Institute or alternative services through the Allstate Foundation. Multiple quotes will yield the optimal result for homeowners.

Enter your ZIP code above into our free comparison tool for the best cheap home insurance available today.

- Allstate provides additional coverage for valuable personal items

- Travelers’ quotes start at $37/month, offering affordable rates

- Allstate gives up to 25% off premiums with bundled policies

Coverage Costs: Comparing Allstate and Travelers Homeowners Insurance

Travelers score 4.3/5 for coverage cost, which would be cheaper, especially for younger drivers or those with more pristine driving records. Allstate is very pricey, but Travelers is more affordable, with coverage starting at a minimum of $37 per month.

Allstate vs. Travelers Full Coverage Homeowners Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $230 | $210 |

| Age: 16 Male | $245 | $220 |

| Age: 30 Female | $190 | $175 |

| Age: 30 Male | $200 | $185 |

| Age: 45 Female | $175 | $160 |

| Age: 45 Male | $180 | $165 |

| Age: 60 Female | $160 | $150 |

| Age: 60 Male | $165 | $155 |

The price gap will vary depending on location, driving history, and age. However, Travelers is an excellent choice for those who are mindful of their purse but still need considerable protection. It would help if you got insurance quotes online from both providers to find the best rates.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Homeowners Insurance Coverage Options: Allstate vs. Travelers

The two firms in the industry are Allstate (5.0/5) and Travelers (5.0/5), which broadly and widely offer a wide range of homeowners’ insurance cover options. Each company provides several different plans to fit the numerous needs of clients. Both companies offer full coverage, minimum coverage, comprehensive, and gap insurance with various add-ons, such as SR-22 filings.

Optional Allstate customization offers options for homeowners who want more targeted protection. Travelers offer similar flexibility with basic needs and additional advanced options such as roof replacement coverage. Comprehensive coverage is what? This covers the risks such as fire, theft, and vandalism, with both companies rated high due to customization flexibility.

Discount Opportunities: Allstate vs. Travelers Homeowners Insurance

Allstate (5.0/5) and Travelers (5.0/5) offer discounts to reduce premiums. Allstate provides 25% off for bundling home and auto, while Travelers offers up to 20% off with multi-policy bundles. Can I get a multi-policy discount on my life insurance policy? Both offer discounts when bundling life insurance.

Allstate vs Traveler’s Landlord Insurance

byu/jjmags37 inInsurance

Both organizations also offer discounts for home safety features like burglar alarms and fire sprinklers, for which homeowners can qualify and enjoy reduced rates. These discounts help clients acquire suitable, affordable homeowners’ insurance around their needs. Compare quotes from the top insurance companies.

Company Overview

Before comparing Allstate and Travelers homeowners insurance about options, prices, and discounts, let’s take a brief background glimpse of each company’s history.

Allstate: A Brief History

The company was founded in 1931 in Sears, Roebuck & Co. Inc., during the Great Depression. Allstate became known for its short-term underwriting success and expanded beyond auto insurance to include homeowners’ and life insurance. What is affordable coverage? Allstate offers budget-friendly options to meet customers’ diverse needs.

The diversification placed Allstate at the top of the US list, ahead of the other top insurance companies. Commitment to financial stability has become one of the pillars of Allstate’s success. It managed its resources and investments well to be one of the companies that consistently weathered economic storms with policyholders’ security.

Allstate is financially sound and known for its outstanding customer service, focusing on customer satisfaction. The company is at the pinnacle in claims handling and personalized counseling and offers many homeowners’ coverage options. Of course, basic policies provide:

- Minimum protection.

- Comprehensive policies protecting against other risks.

- Everything in between for the myriad needs of various homeowners.

Firstly, Allstate informs its customers quickly about access to support and advice nationwide through an extensive agent network. Whether discussing the details of a policy, obtaining advice on risk management, or even seeking assistance with a claim, Allstate’s agents are just a step away.

Travelers: A Brief History

Travelers was established in 1853 as the St. Paul Fire & Marine Insurance Company to provide protection and security to individuals and businesses against various disasters. It has evolved into one of the nation’s largest insurance companies with an established reputation for and the ability to meet the financial strength of policyholders’ obligations even in hard times.

Travelers provide home coverage alternatives depending upon the needs of various homeowners because each house is unique. Its policies encompass property damage and liability protection to ensure the homeowners. Its claim handling is also an attribute to be respected.

The company aims to reduce stress during claims by providing consolable support through trained professionals. Technology has combined into Travelers’ services, including online policy management and mobile apps. Travelers’ home insurance reviews reflect high customer satisfaction with these digital tools and claims process.

Travelers also take responsibility for helping homeowners understand and mitigate risks. Protecting properties during such events becomes not only a means of risk management but also a safety and awareness promotional tool for homeowners.

Thus, Allstate and Travelers have profound experience in the insurance industry. These companies stress financial stability, comprehensive coverage, and outstanding customer service so that homeowners can be confident in these options.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Feedback: Allstate vs. Travelers Homeowners Insurance

Customer ratings of Allstate (4.0 out of 5) Comment on a solid reputation with excellent customer service and a user-friendly mobile app, but premiums can still be higher, especially for those with less-than-perfect records with Travelers Rating—4.1/5.

Heidi Mertlich Licensed Insurance Agent

Travelers are honored for affordable pricing and more streamlined claims processes. Travelers vs. CSAA insurance group renters insurance shows that while both offer solid coverage, some customers find the latter’s response to customer service disappointing, and specific coverage exclusions could be more appealing. Both tend to have good overall scores, but each should consider its pros and cons when deciding which better meets their needs.

Business Reputation: Allstate vs. Travelers Homeowners Insurance

Allstate Overall: 4.0/5 Using the available independent review scores from J.D. Power and the BBB, Allstate tends to have good ratings. Still, the complaint ratio is worse than that of Travelers, according to the NAIC.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Travelers

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 860 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 76/100 Good Customer Feedback |

|

| Score: 1.45 More Complaints Than Avg. | Score: 1.12 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

It can be understood as a problem in terms of customer satisfaction despite the large number of policy offers. Conversely, Travelers traditionally score very high on different sources in this industry, like J.D. Power, A.M. Best, and Consumer Reports, maintaining 4.5/5 scores.

A lower complaint ratio, higher claims handling rankings, and customer satisfaction make Travelers the reliable homeowners’ insurance provider. Both companies are well-established, but Travelers has a better general business reputation than Allstate. Travelers is also known for offering the best renters insurance for military personnel.

Allstate Pros & Cons

Pros:

- Comprehensive Coverage: Allstate offers several options, including added coverage for specific needs.

- Customer Service: Excellent customer service and reputation for doing more than what is required to help customers.

- Financial Stability: Allstate is committed to monetary stability to rid the economy of turmoil and fulfill its commitments to policyholders.

Cons:

- Pricing: Though competitive, Allstate pricing may fluctuate, and the only way to obtain an accurate quote is to contact an agent.

- No Online Quotes: This might not be as convenient for the self-service users.

- Optional Coverages: The optional coverages may sometimes add to the cost of the overall policy. See more in our article, “Allstate Insurance Review.“

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travelers Pros & Cons

Pros:

- Competitive Pricing: Travelers benefit from competitive pricing, which serves customers with cost-effective coverage.

- Claims Handling: Known for effective claims handling, focusing on making the process smooth and relatively stress-free.

- Technology Integration: Leverages technological advancement; for instance, there are online applications and tools for providing efficient customer service.

Cons:

- Limited Local Agents: While Travelers have a robust online presence, some places can restricted to local areas.

- Notable History: While Travelers has a long history, it may not have the same brand recognition as Allstate for some consumers. Elevate your knowledge with our “Travelers Insurance Review.“

- Discount Availability: Discounts may vary, and not all homeowners may qualify for the same savings, impacting overall affordability.

Choosing Between Allstate and Travelers for Your Homeowners Insurance Needs

Allstate and Travelers are known homeowner insurance companies offering expansive cover options, affordable prices, and discounts that will allow you to save on your premiums. The comparison between the two companies should depend on what you need, how much you can spend, and what is relevant to you.

Comprehensive research of both companies, including a “Farmers vs. Erie Homeowners Insurance Review” with quotes, will power you with information to make the right decision so that you can best cover your needs under homeowner’s insurance.

Get affordable home insurance quotes based on your requirements. Input your ZIP code using our free comparison tool below to get instant quotes from top insurance providers.

Frequently Asked Questions

How does Allstate vs. Travelers compare in terms of coverage and pricing?

Allstate quotes start at $61, emphasizing vital customer service and electronic add-ons on coverage. Compared to Allstate, Travelers’ insurance is an option starting at $37 per month. It is famous for flexible personal property coverage and expansive discounts, which will attract price-conscious homeowners.

What are the main differences between Travelers vs. Allstate for homeowners insurance?

Travelers emphasize affordability and discounts, while Allstate prioritizes specialized coverage options, including electronics and home systems protection. Both offer customizable plans, but Travelers often appeals to homeowners seeking lower premiums.

Which provider offers better value: Allstate vs. Travelers home insurance?

Travelers provide better value for those seeking affordable monthly premiums and straightforward coverage. Allstate may be a better fit for customers needing extensive add-ons or higher coverage limits for personal property. Obtain a more nuanced perspective with our “Farmers vs. American Family Homeowners Insurance Review.”

What do customers say in Travelers homeowners insurance reviews?

Travelers’ home insurance reviews earn praise for their affordable rates, starting at $37 per month, and user-friendly policy management tools. However, some reviews mention claims processes could be quicker. To compare home insurance rates, input your ZIP code below to avoid overpaying.

What insights can you find in Allstate homeowners insurance reviews?

Allstate home insurance reviews highlight vital customer service and specialized coverage options, such as electronic protection, but some customers note higher premiums than competitors like Travelers.

How does Allstate vs. 21st Century compare for homeowners insurance?

Allstate offers a broader range of homeowners insurance options and superior customer service compared to the 21st Century, which primarily focuses on auto insurance and lacks comprehensive home coverage plans. Discover what lies beyond with our “21st Century Insurance Review.”

What coverage options are available with Travelers home insurance?

Traveler’s home insurance includes personal property, liability, and optional add-ons like flood coverage. Its competitive pricing makes it a strong choice for budget-conscious homeowners.

What does Allstate homeowner insurance include in its policies?

It has wide-ranging coverages for homes, such as dwelling, liability, add-ons for electronic appliances, and protection for the house’s electrical systems.

Does Allstate insurance for electronics provide comprehensive protection?

Yes, electronics protection offered by Allstate can include repairs and replacement or any damages incurred to electronic equipment at the house. For additional information, see “Does Allstate homeowners insurance cover appliances?”

What do Allstate and Travel insurance reviews reveal about its policies?

Allstate travel and insurance reviews commend its trip cancellation and interruption benefits, while Allstate homeowners insurance reviews highlight its robust coverage options and customer service. When comparing Travelers vs. Allstate home insurance, both suggest comparing coverage limits with specialized insurers for better value.

How does Allstate and Travelers insurance address homeowners’ specific needs?

Which provider is better for homeowners insurance: The General vs. Travelers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.