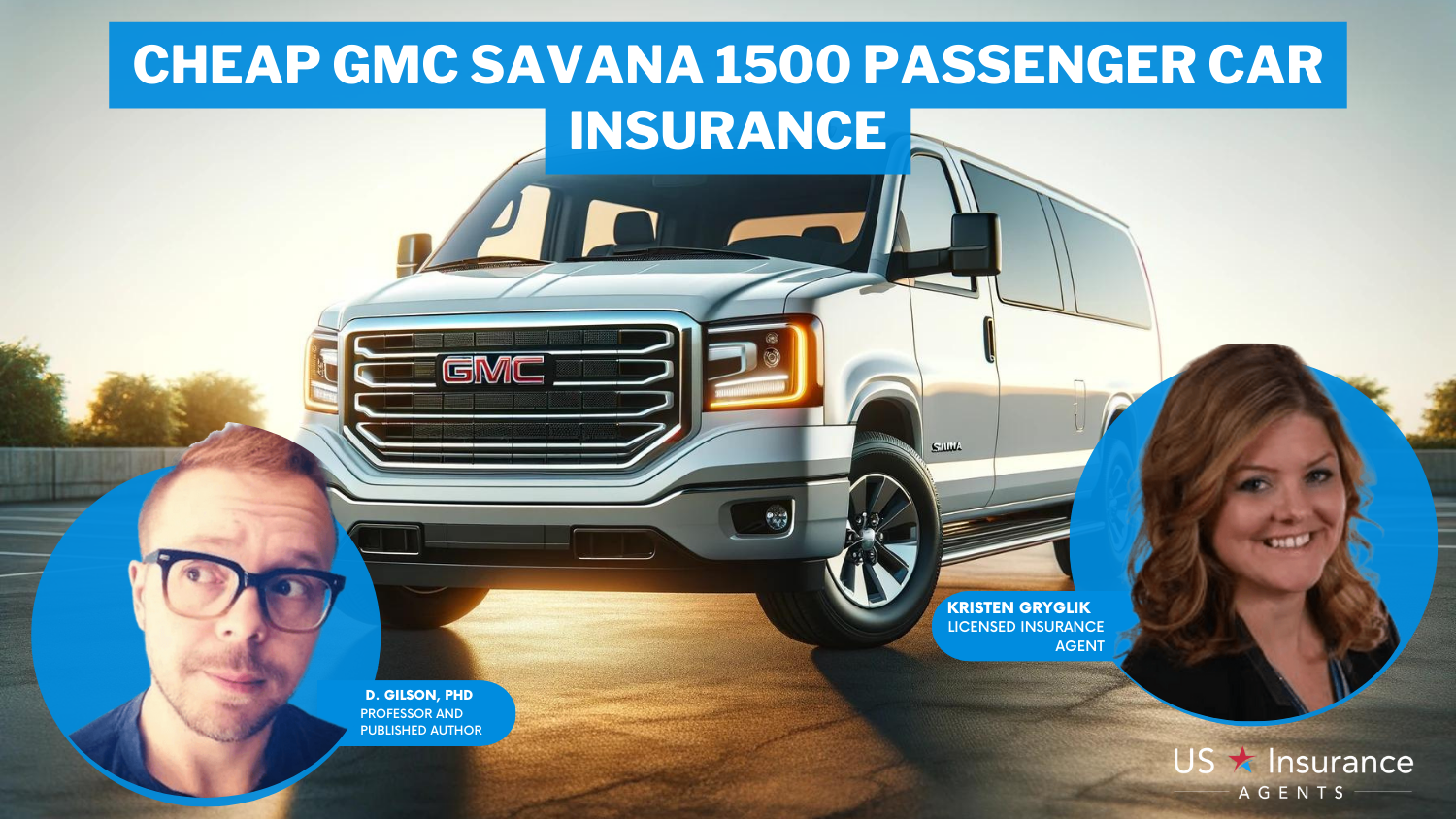

Cheap GMC Savana 1500 Passenger Car Insurance in 2026 (Top 10 Low-Cost Companies)

State Farm, Nationwide, and Progressive stand out as the top picks overall and also offer cheap GMC Savana 1500 Passenger car insurance. Offering the lowest rates, starting at just $48 per month, these companies provide competitive prices, strong customer service, and robust coverage options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated January 2025

Company Facts

Min. Coverage for GMC Savana 1500 Passenger

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for GMC Savana 1500 Passenger

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for GMC Savana 1500 Passenger

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Nationwide, and Progressive emerge as the top providers for cheap GMC Savana 1500 Passenger car insurance, offering rates starting at just $48 per month.

This article delves into the strengths and weaknesses of each company, highlighting their competitive pricing, extensive coverage options, and customer service ratings. See if you’re getting the best deal on car insurance by entering your ZIP code above.

Our Top 10 Company Picks: Cheap GMC Savana 1500 Passenger Car Insurance

| Company | Rank | Monthly Rates | A M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $48 | B | Agency Network | State Farm | |

| #2 | $50 | A+ | SmartRide Program | Nationwide |

| #3 | $52 | A+ | Tight Budgets | Progressive | |

| #4 | $53 | A++ | Military Benefits | USAA | |

| #5 | $55 | A | Claims Service | American Family | |

| #6 | $57 | A | Discount Variety | Farmers | |

| #7 | $60 | A++ | Specialized Coverage | Travelers | |

| #8 | $62 | A+ | Local Agents | Allstate | |

| #9 | $65 | A | Policy Options | Liberty Mutual |

| #10 | $68 | A+ | Organization Discount | The Hartford |

State Farm stands out as the best overall choice due to its combination of affordability, strong financial stability, and personalized service. Discover how these insurers compare and find the best coverage for your needs.

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers competitive rates for insuring the GMC Savana 1500.

- Strong Financial Stability: The company demonstrates strong financial stability, providing reassurance to policyholders.

- Good Customer Service Reputation: The company is known for its good customer service reputation, as highlighted in the State Farm insurance review & ratings.

Cons

- Limited Coverage Options: Fewer customizable coverage options compared to some competitors.

- Higher Premiums for Young Drivers: Typically charges higher premiums for younger or inexperienced drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Multi-policy discounts

Pros

- Offers Discounts: Nationwide provides discounts that can make coverage more affordable.

- Vanishing Deductible: Nationwide’s Vanishing Deductible program can be beneficial for policyholders.

- On Your Side Review: Annual policy review to ensure you have the best coverage.

Cons

- Higher Rates: Rates may be higher compared to some regional insurers, as noted in the Nationwide insurance review & ratings.

- Limited Availability: There is limited availability of local agents in some areas.

#3 – Progressive: Best for Innovative pricing tools

Pros

- Variety of Discounts: Progressive offers a variety of discounts, potentially reducing premiums.

- Digital Tools: The company provides easy online tools for quote comparison.

- Customize Coverage: Progressive offers good options for customizing coverage, according to Progressive insurance review & ratings.

Cons

- Higher Premium: Premiums may be higher for certain driver profiles.

- Customer Service: Mixed reviews on customer service experiences.

#4 – USAA: Best for Lower rates for military

Pros

- High Customer Satisfaction: USAA is known for excellent customer service and member satisfaction.

- Competitive Rates: The company offers competitive rates for military members and their families.

- Comprehensive Coverage: USAA provides comprehensive coverage options, as noted in the USAA insurance review & ratings.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families.

- Limited Local Offices: There are limited physical branch locations for in-person service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Customizable policies

Pros

- Offers Various Discounts: American Family offers various discounts that can lower premiums.

- Financial Stability: The company has strong financial stability.

- Customer Service: American Family provides a personalized customer service experience.

Cons

- Higher Rates: Rates may not be as competitive in some regions, as mentioned in the American Family insurance review & ratings.

- Mixed Customer Reviews: Varied feedback on customer service experiences

#6 – Farmers: Best for Customizable coverage

Pros

- Customizable Coverage: Farmers offers customizable coverage options, as highlighted in the Farmers insurance review & ratings.

- Access to Agents: The company provides access to local agents for personalized service.

- Comprehensive Coverage Options: Offers a wide range of coverage options.

Cons

- Higher Rates: Rates may be higher compared to some competitors.

- Customer Service: There are mixed customer service reviews in some regions.

#7 – Travelers: Best for Competitive rates

Pros

- Competitive Pricing: Travelers offers competitive pricing for certain driver profiles.

- Extensive Coverage Options: The company provides a wide range of coverage options.

- Safe Driver Discounts: Discounts for maintaining a clean driving record, as mentioned in the Travelers insurance review & ratings.

Cons

- Limited Agents: There is limited availability of local agents.

- Online Quote: The online quote process may not be as user-friendly as others.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Multiple discount

Pros

- Digital Tools: Name Your Price® tool helps find affordable coverage.

- Multiple Discount: The company offers multiple discount opportunities.

- Customer Service: Allstate has a strong customer service reputation.

Cons

- Higher Premium: Premiums may be higher compared to some competitors.

- Limited Discounts: There are limited discounts specifically tailored for the GMC Savana 1500, according to Allstate insurance review & ratings.

#9 – Liberty Mutual: Best for Extensive coverage

Pros

- Customizable Coverage: Liberty Mutual offers customizable coverage options.

- Various Discounts: Offers multiple discounts, including for safety features and bundling policies.

- Financial Stability: Liberty Mutual has strong financial stability, as noted in the Liberty Mutual review & ratings.

Cons

- Higher Premiums: Higher premiums for certain driver profiles.

- Mixed Customer Service Reviews: Experiences with customer service and claims handling can be inconsistent.

#10 – The Hartford: Best for Specialized coverage

Pros

- Specialized Coverage: The Hartford offers specialized coverage options for business use of vehicles like the GMC Savana.

- AARP Member Discounts: The company provides AARP member discounts, as highlighted in the The Hartford insurance review & ratings.

- Good Claims Handling Reputation: The Hartford has a good claims handling reputation.

Cons

- Limited Availability: Limited availability compared to larger insurers.

- Rates for Non-AARP Members: Rates may be higher for non-AARP members.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Determine The Cost of GMC Savana 1500 Passenger Car Insurance

Insurance providers take several factors into account when calculating the cost of GMC Savana 1500 Passenger car insurance. These factors include:

- The Driver’s age and Gender: Younger drivers and male drivers often have higher insurance rates compared to older drivers and female drivers due to statistical risk factors.

- Driving Record: Your driving history, including accidents, traffic violations, and claims, can impact your insurance premiums. A clean driving record generally leads to lower rates.

- Location: The area where you reside or regularly drive influences your insurance rates. Urban areas with higher traffic congestion and crime rates may have higher premiums compared to rural areas.

- Annual Mileage: The average number of miles you drive each year can affect your insurance rates. Higher mileage generally implies more time on the road and a potentially higher risk of accidents.

- Credit History: In some states, insurance companies consider your credit score when determining your rates. Maintaining good credit can help you secure lower insurance premiums.

- Vehicle Make and Model: The specific make and model of your GMC Savana 1500 Passenger car can impact your insurance rates. Cars with higher market values or those that are more expensive to repair or replace may have higher premiums.

- Coverage Options: The type and level of coverage you choose for your GMC Savana 1500 Passenger car insurance can affect the cost. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, may result in higher premiums compared to basic liability insurance coverage.

In conclusion, understanding the factors that determine the cost of insurance for your GMC Savana 1500 Passenger Car can help you make informed decisions and potentially save money.

Scott W. Johnson Licensed Insurance Agent

By considering elements such as the vehicle’s safety features, your driving history, geographic location, and the level of coverage you choose, you can better anticipate your insurance expenses and select a policy that fits your needs and budget. Stay proactive and regularly review your insurance options to ensure you’re getting the best possible rate for your GMC Savana 1500.

Exploring the Average Insurance Rates for GMC Savana 1500 Passenger

The average insurance rates for GMC Savana 1500 Passenger can vary depending on the aforementioned factors and the specific coverage options you choose. On average, insuring a GMC Savana 1500 Passenger may cost around $100 to $133 per month. However, these rates are just estimates and can fluctuate based on individual circumstances.

It is important to note that insurance rates for the GMC Savana 1500 Passenger can also be influenced by other factors such as the driver’s age, driving history, and location. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums. Expand your understanding with our thorough “Insurance Quotes Online” overview.

Additionally, the location where the vehicle is primarily driven and parked can impact insurance rates, with urban areas typically having higher rates due to increased risk of theft and accidents. Therefore, it is advisable to contact insurance providers and obtain personalized quotes to get a more accurate estimate of the insurance costs for your specific circumstances.

GMC Savana 1500 Passenger Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $62 | $130 |

| American Family | $55 | $120 |

| Farmers | $57 | $122 |

| Liberty Mutual | $65 | $135 |

| Nationwide | $50 | $110 |

| Progressive | $52 | $115 |

| State Farm | $48 | $105 |

| The Hartford | $68 | $140 |

| Travelers | $60 | $125 |

| USAA | $53 | $117 |

Understanding the Coverage Options for GMC Savana 1500 Passenger Car Insurance

When obtaining car insurance for your GMC Savana 1500 Passenger, it is crucial to understand the coverage options available. These typically include:

- Liability Coverage: This coverage pays for injuries and property damage caused by you in an accident. It is usually required by law.

- Collision Coverage: Collision coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive coverage provides protection against damages to your GMC Savana 1500 Passenger that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage: Medical payments coverage helps cover medical expenses for you and your passengers in the event of an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough coverage to pay for the damages.

It is important to note that the coverage options mentioned above may vary depending on the insurance provider and the specific policy you choose for your GMC Savana 1500 Passenger. It is recommended to carefully review the terms and conditions of each coverage option before making a decision.

In addition to the coverage options mentioned, some car insurance policies may offer additional add-ons or endorsements that you can consider for your GMC Savana 1500 Passenger. These may include:

- Rental Car Reimbursement: This coverage helps cover the cost of a rental car while your GMC Savana 1500 Passenger is being repaired after an accident.

- Roadside Assistance: Roadside assistance provides services such as towing, battery jump-start, flat tire change, and fuel delivery in case your vehicle breaks down.

- Gap Insurance: Gap insurance covers the difference between the actual cash value of your GMC Savana 1500 Passenger and the amount you owe on your auto loan or lease in the event of a total loss.

It is advisable to discuss these additional coverage options with your insurance agent or provider to determine if they are suitable for your specific needs and budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Lower Your GMC Savana 1500 Passenger Car Insurance Premiums

Here are some tips to help you lower your GMC Savana 1500 Passenger car insurance premiums:

- Compare Quotes: Obtain multiple quotes from different insurance providers to find the best rates and coverage options for your vehicle.

- Bundle Your Policies: Consider bundling your GMC Savana 1500 Passenger insurance with other insurance policies, such as homeowners or renters insurance, as this can often lead to discounts.

- Take Advantage of Discounts: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for completing defensive driving courses.

- Consider Raising Deductibles: Increasing your deductibles can lower your premiums; however, make sure you can afford the higher out-of-pocket expenses in case of a claim.

- Drive Safely: Maintaining a clean driving record and avoiding accidents and traffic violations can help prevent your premiums from increasing.

Additionally, considering higher deductibles and regularly reviewing your coverage options can further help in managing costs. With these strategies, you can ensure that you have reliable and affordable insurance coverage tailored to your specific needs.

Comparing Insurance Quotes for GMC Savana 1500 Passenger From Different Providers

When looking for car insurance for your GMC Savana 1500 Passenger, it is beneficial to compare quotes from various insurance providers. This allows you to assess different coverage options, benefits, and prices.

Online insurance comparison tools can help simplify this process, allowing you to make an informed decision and find the best policy for your needs. Discover our comprehensive guide to “Compare Car Insurance Quotes” for additional insights.

Insurance Costs for a New vs. Used GMC Savana 1500 Passenger

The cost of insuring a used or new GMC Savana 1500 Passenger can differ. Generally, insuring a used vehicle tends to be cheaper due to the vehicle’s depreciation value. However, insurance premiums are influenced by various factors, including the condition of the vehicle, its safety features, and the driver’s history.

It is important to obtain quotes for both used and new GMC Savana 1500 Passenger vehicles to compare the insurance costs effectively. For further details, check out our in-depth “Cheapest Car Insurance Companies” article.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact of Your Driving Record on GMC Savana 1500 Passenger Car Insurance Rates

Your driving record plays a significant role in determining the cost of GMC Savana 1500 Passenger car insurance. Insurance providers consider your history of accidents, traffic violations, and claims to assess your level of risk.

Drivers with clean records typically receive lower insurance rates, as they demonstrate a lower likelihood of being involved in accidents. On the other hand, drivers with a history of accidents or violations may experience higher premiums. Expand your understanding with our thorough “Best Car Insurance Discounts to Ask for” overview.

How Does the Location Affect the Cost of Insuring a GMC Savana 1500 Passenger?

Your location has a direct impact on your GMC Savana 1500 Passenger car insurance rates. Insurance providers consider the crime rate, population density, and traffic conditions of your area. Urban areas with higher crime rates and more traffic congestion generally have higher insurance premiums compared to rural areas.

Additionally, areas prone to extreme weather events may also have higher insurance rates due to the increased risk of vehicle damage. For more information, explore our informative “Defensive Driving Courses Can Lower Your Car Insurance Rates” page.

Explaining Comprehensive and Collision Coverage for GMC Savana 1500 Passenger Car Insurance

Comprehensive and collision coverage are two essential components of GMC Savana 1500 Passenger car insurance.

- Comprehensive Coverage: Comprehensive coverage provides protection against damages to your GMC Savana 1500 Passenger that are not caused by a collision. This can include theft, vandalism, fire, natural disasters, and falling objects.

- Collision Coverage: Collision coverage helps pay for repairs or replacement of your GMC Savana 1500 Passenger if it is damaged in a collision with another vehicle or object, regardless of fault. This coverage is particularly useful for accidents where there may not be another party at fault.

By knowing the benefits and limitations of each type of coverage, you can make informed decisions to ensure your vehicle is well-protected in any situation. This knowledge empowers you to choose the right insurance policy, providing peace of mind and financial security on the road. Explore our detailed analysis on “Collision vs. Comprehensive Car Insurance” for additional information.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Deductibles and Limits for GMC Savana 1500 Passenger Insurance

When purchasing GMC Savana 1500 Passenger insurance, it is important to consider the deductibles and limits of your policy.

- Deductibles: A deductible is the amount you must pay out-of-pocket before your insurance coverage applies. Choosing a higher deductible can lower your premiums, but be sure to choose an amount that you can comfortably afford in case of a claim.

- Limits: Insurance policies have limits, which are the maximum amounts an insurance company will pay for a covered claim. It is crucial to select appropriate limits for your GMC Savana 1500 Passenger insurance to ensure adequate coverage in the event of an accident.

By understanding these aspects, you can customize your policy to fit your financial situation and driving habits, providing peace of mind and financial security.

Regularly reviewing and adjusting your deductibles and limits as needed will help maintain optimal coverage for your GMC Savana 1500 Passenger. Get more insights by reading our expert “Full Coverage Car Insurance: A Complete Guide” advice.

Tips for Finding Affordable yet Reliable Insurance for Your GMC Savana 1500 Passenger

When searching for affordable yet reliable insurance for your GMC Savana 1500 Passenger, it’s essential to start by researching multiple insurance providers. Take the time to compare rates and customer service quality to identify companies that offer the best value. This comparison can help you find competitive rates without compromising on the level of service you receive.

Reading customer reviews is another crucial step. Online reviews can provide valuable insights into the experiences of other GMC Savana 1500 Passenger owners with various insurance companies. These firsthand accounts can highlight potential issues and advantages, helping you make a more informed decision. For more information, explore our informative “Car Insurance: A Complete Guide” page.

Additionally, don’t hesitate to ask for recommendations from friends, family, or local automobile associations. They can point you toward reputable insurance providers based on their experiences.

Furthermore, working with an insurance agent can be highly beneficial. Agents can guide you through the process, offer personalized advice, and assist in making decisions that best suit your needs and budget for your GMC Savana 1500 Passenger.

Exploring Discounts and Savings Options for Insuring a GMC Savana 1500 Passenger

Insurance providers often offer various discounts and savings options to help reduce the cost of insuring a GMC Savana 1500 Passenger. These discounts can include:

- Safe Driver Discounts: Insurance companies may provide discounts for maintaining a clean driving record without any accidents or traffic violations.

- Multi-Policy Discounts: If you have multiple insurance policies with the same provider, such as home and auto insurance, you may receive a discount.

- Good Student Discounts: Students with good grades may be eligible for discounts on their GMC Savana 1500 Passenger car insurance.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can often lead to discounted insurance rates.

Additionally, installing anti-theft devices and maintaining a good credit score can further enhance your savings. Understanding and utilizing these options not only helps you save money but also ensures you get the best possible coverage for your vehicle. Read our extensive guide on “Best Car Insurance Discounts to Ask for in” for more knowledge.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Maintaining Good Credit When Insuring a GMC Savana 1500 Passenger

Insurance companies often consider your credit history when calculating your insurance premiums. Maintaining a good credit score demonstrates financial responsibility and can help you secure lower insurance rates.

Schimri Yoyo Licensed Agent & Financial Advisor

It is important to pay bills on time, keep credit card balances low, and monitor your credit report regularly for accuracy. Dive deeper into “How does the insurance company determine my premium?” with our complete resource.

Common Mistakes to Avoid When Purchasing Car Insurance for a GMC Savana 1500 Passenger

When purchasing car insurance for your GMC Savana 1500 Passenger, it is crucial to avoid common mistakes that may result in inadequate coverage or higher premiums. Here are some mistakes to watch out for:

- Choosing the Minimum Required Coverage: Opting for the minimum required coverage may save you money upfront, but it could leave you with insufficient coverage in case of an accident.

- Not Shopping Around for Quotes: Failing to compare quotes from different insurance providers may result in higher premiums or missing out on potential discounts. For more information, explore our informative “How To Get Free Insurance Quotes Online” page.

- Forgetting to Update Your Policy: Ensure that you keep your insurance provider informed of any changes to your GMC Savana 1500 Passenger, such as modifications or additional drivers.

- Not Reviewing Your Policy Regularly: As your circumstances change, it is important to review your car insurance policy periodically to ensure it still meets your needs.

When calculating how much GMC Savana 1500 Passenger car insurance will cost, it is important to consider all the variables mentioned above. By understanding the factors that affect insurance rates and employing the tips provided, you can find affordable and reliable coverage for your GMC Savana 1500 Passenger while ensuring adequate protection on the road. Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

What is the cheapest GMC Savana car insurance?

The cheapest GMC Savana car insurance can vary based on factors like location, driving history, and the insurance company. Comparing quotes can help find the best rates.

How much does GMC Savana car insurance cost?

GMC Savana car insurance cost depends on various factors such as the driver’s age, driving record, location, and the specific model of the vehicle.

How can I compare GMC Savana car insurance quotes?

To compare GMC Savana car insurance quotes, you can use online comparison tools, contact insurance agents, or visit insurance company websites for personalized quotes.

For further details, check out our in-depth “Free Insurance Comparison” article.

Which are the best car insurance companies for GMC Savana?

The best car insurance companies for GMC Savana offer competitive rates, good customer service, and comprehensive coverage options. Some top companies include Geico, State Farm, and Progressive.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What coverage options are available for car insurance for GMC Savana?

Coverage options for car insurance for GMC Savana include liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage.

What is the GMC Savana insurance cost by model year?

GMC Savana insurance cost by model year can vary, with newer models typically costing more to insure due to higher replacement and repair costs.

Get more insights by reading our expert “Lesser Known Car Insurance Discounts for ” advice.

Where can I find GMC Savana insurance information by year?

GMC Savana insurance information by year can be found on insurance company websites, automotive forums, and dedicated insurance comparison sites.

Are GMC Savanas expensive to insure?

Whether GMC Savanas are expensive to insure depends on factors like the driver’s profile and the vehicle’s model year. Generally, they are moderately priced compared to other vehicles.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What is the GMC Savana insurance cost for young drivers?

GMC Savana insurance cost for young drivers tends to be higher due to their lack of driving experience and higher risk of accidents.

Learn more by visiting our detailed “What age do you get cheap car insurance?” section.

What factors affect GMC Savana insurance rates?

Factors affecting GMC Savana insurance rates include the driver’s age, driving history, location, credit score, and the vehicle’s safety features and model year.

What is the GMC Savana insurance cost for senior drivers?

What is the GMC Savana insurance cost for drivers with violations?

How can I find the cheapest car insurance for GMC Savana with a speeding ticket?

How can I get the cheapest car insurance for GMC Savana after an accident?

What is the cheapest car insurance for GMC Savana with a DUI record?

Where can I find the cheapest car insurance for GMC Savana with driving violations?

What are some tips for lowering car insurance costs for my GMC Savana?

Are GMC trucks expensive to insure?

Why are trucks expensive to insure?

How does credit score affect car insurance rates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.